Abstract

This paper uses 39 monthly time series of the financial market observed from January 2000 to April 2017 to estimate a financial conditions index (FCI) for South Africa. The empirical technique used is a dynamic factor model with time-varying factor loadings proposed by Koop and Korobilis (Eur Econ Rev 71(C):101–116, 2014) based on the principal component analysis and the Kalman smoother. In addition, we estimate a time-varying parameter factor-augmented vector autoregressive (TVP-FAVAR) model, which includes, in addition to the FCI, two observed macroeconomic variables. The results show the ability of the estimated FCI to predict risks in the financial market emanating from both the domestic market and the global market. Furthermore, the TVP-FAVAR model outperforms the constant-loading factor-augmented vector autoregressive model and the traditional vector autoregressive model in the out-of-sample forecasting of the inflation rate and the real gross domestic product growth rate. Finally, tighter financial conditions contract the real economy and are deflationary at the same time. Importantly, the responses of macroeconomic variables are asymmetric and vary over time.

Similar content being viewed by others

Notes

See Claessens and Kose (2017) for a detailed literature review on macro-financial linkages.

The US TED spread is the difference between the LIBOR and the 90-days Treasury bill rate.

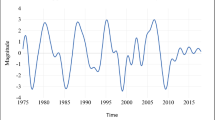

For robustness, we purge the FCI of economic activity using industrial production growth as a proxy for GDP. The two FCIs trend together throughout the sample. Moreover, we find a very high correlation coefficient of 99.22% between the two FCIs. A graphical representation comparing the two FCIs is given in “Appendix”.

See columns 4 and 5 of Table 1.

The tabulated results are available upon request.

To avoid sidetracking readers with a separate section describing the implementation of quantile regression, we instead refer them to the recent work of Adrian et al. (2019), which we follow closely.

More precisely, see Figure 3.2 panel 3.

References

Adrian T, Boyarchenko N, Giannone D (2019) Vulnerable growth. Am Econ Rev 109(4):1263–89

Allen L, Bali TG, Tang Y (2012) Does systemic risk in the financial sector predict future economic downturns? Rev Financ Stud 25(10):3000–3036

Arregui N, Elekdag S, Gelos R, Lafarguette R, Seneviratne D (2018) Can countries manage their financial conditions amid globalization? IMF Working Paper WP/18/15

Bai J, Ng S (2002) Determining the number of factors in approximate factor models. Econometrica 70(1):191–221

Balcilar M, Thompson K, Gupta R, Van Eyden R (2016) Testing the asymmetric effects of financial conditions in South Africa: a nonlinear vector autoregression approach. J Int Financ Mark Inst Money 43:30–43

Bańbura M, Giannone D, Reichlin L (2011) Nowcasting. In: Clements MP, Hendry DF (eds) The Oxford handbook on economic forecasting, vol 2. Oxford University Press, Oxford, pp 193–224

Bańbura M, Modugno M (2014) Maximum likelihood estimation of factor models on datasets with arbitrary pattern of missing data. J Appl Econom 29(1):133–160

Banerjee A, Marcellino M, Masten I (2008) Forecasting macroeconomic variables using diffusion indexes in short samples with structural change. Economics Working Papers ECO2008/17, European University Institute

Barkbu B, Eichengreen B, Mody A (2012) Financial crises and the multilateral response: what the historical record shows. J Int Econ 88(2):422–435

Bates BJ, Plagborg-Møller M, Stock JH, Watson MW (2013) Consistent factor estimation in dynamic factor models with structural instability. J Econom 177(2):289–304

Bernanke BS (1983) Non-monetary effects of the financial crisis in the propagation of the great depression

Bernanke BS, Lown CS, Friedman BM (1991) The credit crunch. Brook Pap Econ Activ 1991(2):205–247

Bicchetti D, Neto D (2017) Monitoring financial stability in emerging and frontier markets. UNCTAD Discussion Papers

Brave S, Butters R (2011) Monitoring financial stability: a financial conditions index approach. Econ Perspect 35(1):22

Brunnermeier MK, Sannikov Y (2014) A macroeconomic model with a financial sector. Am Econ Rev 104(2):379–421

Chavleishvili S, Manganelli S (2019) Forecasting and stress testing with quantile vector autoregression. ECB Working Paper

Claessens S, Kose A (2017) Macroeconomic implications of financial imperfections: a survey. BIS Working Papers (677)

Cogley T, Sargent TJ (2005) Drifts and volatilities: monetary policies and outcomes in the post WWII US. Rev Econ Dyn 8(2):262–302

Del Negro M, Otrok C (2008) Dynamic factor models with time-varying parameters: measuring changes in international business cycles. FRB of New York Staff Report (326)

Diamond DW, Dybvig PH (1983) Bank runs, deposit insurance, and liquidity. J Polit Econ 91(3):401–419

Doz C, Giannone D, Reichlin L (2011) A two-step estimator for large approximate dynamic factor models based on Kalman filtering. J Econom 164(1):188–205

Doz C, Giannone D, Reichlin L (2012) A quasi-maximum likelihood approach for large, approximate dynamic factor models. Rev Econ Stat 94(4):1014–1024

Dubey P, Geanakoplos J, Shubik M (2005) Default and punishment in general equilibrium 1. Econometrica 73(1):1–37

Evans M (2005) Where are we now? Real-time estimates of the macroeconomy. Int J Central Bank 1(2):127–175

Gauthier C, Graham C, Liu Y (2004) Financial conditions indices for Canada. Technical report, Bank of Canada Working paper

Giannone D, Reichlin L, Small D (2008) Nowcasting: the real-time informational content of macroeconomic data. J Monet Econ 55(4):665–676

Giglio S, Kelly B, Pruitt S (2016) Systemic risk and the macroeconomy: an empirical evaluation. J Financ Econ 119(3):457–471

Goodhart CAE, Hofmann B (2001) Asset prices, financial conditions and the transmission of monetary policy. Proceedings (Mar)

Gumata N, Klein N, Ndou E (2012) A financial conditions index for South Africa. IMF Working Paper WP/12/196

Hakkio CS, Keeton WR (2009) Financial stress: what is it, how can it be measured, and why does it matter? Econ Rev 94(2):5

Hatzius J, Hooper P, Mishkin FS, Schoenholtz KL, Watson MW (2010) Financial conditions indexes: a fresh look after the financial crisis. NBER Working Papers 16150, National Bureau of Economic Research, Inc

He Z, Krishnamurthy A (2019) A macroeconomic framework for quantifying systemic risk. Am Econ J Macroecon 11(4):1–37

IMF (2017a) IMF global financial stability report: getting the policy mix right, Chapter 3. Technical report, International Monetary Fund, pp 83–108

IMF (2017b) IMF global financial stability report October 2017: is growth at risk?, Chapter 3. Technical report, International Monetary Fund, pp 91–118

Kabundi A, Nel E, Ruch F (2016) Nowcasting real GDP growth in South Africa. SARB Working Paper (16/01)

Kabundi A, Rapapali M (2019) The transmission of monetary policy in South Africa before and after the global financial crisis. S Afr J Econ 87(4):464–489

Kindleberger CP, Aliber RZ (2000) Manias, panics and crashes: a history of financial crises. Wiley, New York

Koop G, Korobilis D (2012) Forecasting inflation using dynamic model averaging. Int Econ Rev 53(3):867–886

Koop G, Korobilis D (2013) Large time-varying parameter vars. J Econom 177(2):185–198

Koop G, Korobilis D (2014) A new index of financial conditions. Eur Econ Rev 71(C):101–116

Lorenzoni G (2008) Inefficient credit booms. Rev Econ Stud 75(3):809–833

Loria F, Matthes C, Zhang D (2019) Assessing macroeconomic tail risk. Federal Reserve Bank of Richmond Working Paper 19–10

Mariano RS, Murasawa Y (2003) A new coincident index of business cycles based on monthly and quarterly series. J Appl Econom 18(4):427–443

Matheson TD (2012) Financial conditions indexes for the United States and Euro area. Econ Lett 115(3):441–446

Mendoza EG (2002) Credit, prices, and crashes: business cycles with a sudden stop. In: Edwards S, Frankel J (eds) Preventing currency crises in emerging markets. University of Chicago Press, Chicago, NBER, pp 335–392

Miglietta A, Venditti F (2019) An indicator of macro-financial stress for Italy. Bank of Italy Occasional Paper (497)

Oet MV, Bianco T, Gramlich D, Ong SJ (2012) Financial stress index: a lens for supervising the financial system. Federal Reserve Bank of Cleveland Policy Discussion Paper (12/37)

Primiceri GE (2005) Time varying structural vector autoregressions and monetary policy. Rev Econ Stud 72(3):821–852

Quintana JM, West M (1988) Time series analysis of compositional data. Bayesian Stat 3:747–756

Reinhart CM, Rogoff KS (2009) This time is different: eight centuries of financial folly. Princeton University Press, Cambridge

Samuelson P (1966) Science and stocks. Newsweek, September 19:92

Schularick M, Taylor AM (2012) Credit booms gone bust: monetary policy, leverage cycles, and financial crises, 1870–2008. Am Econ Rev 102(2):1029–61

Swiston AJ (2008) A U.S. financial conditions index; putting credit where credit is due. IMF Working Papers 08/161, International Monetary Fund

Thompson K, Van Eyden R, Gupta R (2015) Identifying an index of financial conditions for South Africa. Stud Econ Finance 32(2):256–274

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The views expressed in this paper are those of the author(s) and do not necessarily represent those of the World Bank Group, the South African Reserve Bank, and its affiliated policy. The authors would like to thank the editor of Empirical Economics, Robert Kunst, and three anonymous referees for their constructive comments and suggestions. This paper was written, while Alain Kabundi was affiliated with the South African Reserve Bank.

Appendix

Appendix

See Fig. 12.

List of variables

No. | Description | Definition | Frequency | Transformation | Source |

|---|---|---|---|---|---|

Credit market | |||||

1 | All monetary institutions | Credit (Total loans and advances) extended to the domestic private sector | D | 5 | S |

2 | R186 10.5% (2026)—Government stock | Government stock | D | 2 | S |

3 | Yield Market: Eskom bonds and T-bill | Eskom bonds—91-day Treasury bill | D | 1 | S |

4 | Yield Market: 0–3-year government bond and T-bill | 0–3-year government bond—91-day Treasury bill | D | 1 | S |

5 | Yield Market: 3–5-year government bond and T-bill | 3–5-year government bond—91-day Treasury bill | D | 1 | S |

6 | Yield Market: 5–10-year government bond and T-bill | 5–10-year government bond—91-day Treasury bill | D | 1 | S |

7 | Yield Market: Long-term government bond and T-bill | Long-term government bond—91-day Treasury bill | D | 1 | S |

8 | Secondary Market: JSE All Bond yield | JSE All Bond yield | D | 2 | S |

9 | Differential between repurchase rate and T-bill | Differential between repurchase rate—91-day Treasury Bill | D | 1 | S |

10 | Margin between prime rate and 3-month Negotiable certificates of deposits (NCDs) | Prime rate—3-month NCD’s | D | 1 | S |

11 | Margin between 3-month NCD’s and Reserve Bank debentures | 3-month NCD—Reserve Bank debentures | D | 1 | S |

FX market | |||||

12 | South African (SA) rand against US dollar (ZAR) | Exchange rate: SA rand against US dollar | D | 5 | S |

13 | Nominal effective exchange rate of the rand—20 trading partners: Effective Jan. 2010—Trade in manufactured goods | Nominal effective exchange rate of the rand | D | 5 | S |

14 | FX crash | \(FXcrash_{t}=\frac{x_{t}}{\max \left[ x_{t}\in \left( x_{t-i}|i=1,\ldots ,12\right) \right] }\) | D | 1 | S |

Real estate market | |||||

15 | South Africa: ABSA House Price Index (SA, 2000=100) | House Price Index as calculated by commercial bank ABSA | M | 5 | S |

16 | FNB house prices | House prices as calculated by First National Bank | M | 5 | S |

Foreign market | |||||

17 | US 3-month LIBOR | 3-month LIBOR of the USA | D | 2 | B |

18 | US 90-day T-bill rate | 90-day Treasury bill rate of the USA | D | 2 | B |

19 | TED (US) | 3-month LIBOR—US 90-day Treasury bill rate | D | 1 | B |

20 | VIX | CBOE Volatility Index | D | 1 | B |

21 | S&P 500 stock in gold index | S&P 500 stock in gold index | D | 5 | B |

22 | Oil price in US dollars (Brent crude) | Price of Brent Crude oil in US dollars | D | 5 | B |

23 | Gold price—London (US dollar) | Gold price | D | 5 | B |

24 | Global total return index | Global total return index | D | 5 | B |

Funding market | |||||

25 | Negotiable certificates of deposits (NCDs): 3 months | 3-month NCDs | D | 2 | S |

26 | Negotiable certificates of deposits (NCDs): 6 months | 6-month NCDs | D | 2 | S |

27 | Negotiable certificates of deposits (NCDs): 12 months | 12-month NCDs | D | 2 | S |

28 | Prime overdraft rate and T-bill | Prime overdraft rate—91-day Treasury bill | D | 1 | S |

29 | Interbank funds and T-bill | Interbank funds—91-day Treasury bill | D | 1 | S |

30 | Bank rate and average and fixed repo rate | Bank rate/fixed repo rate | D | 2 | S |

31 | TED (SA) | 3-month JIBOR—SA 91-day Treasury bill rate | D | 1 | A |

32 | Financial beta | \(\beta _{\mathrm{fin}}=\frac{{\hbox {cov}}\left( r_{\mathrm{fin},t}|_{t-1}^{t},r_{\mathrm{JSE},t}|_{t-1}^{t}\right) }{{\hbox {var}}\left( r_{\mathrm{JSE},t}|_{t-1}^{t}\right) }\) | D | 1 | A |

33 | Bank beta | \(\beta _{\mathrm{bank}}=\frac{{\hbox {cov}}\left( r_{\mathrm{bank},t}|_{t-1}^{t},r_{\mathrm{JSE},t}|_{t-1}^{t}\right) }{{\hbox {var}}\left( r_{\mathrm{JSE},t}|_{t-1}^{t}\right) } \) | D | 1 | A |

Equity market | |||||

34 | Stock crash | \({\hbox {Stockcrash}}_{t}=\frac{x_{t}}{\max \left[ x_{t}\in \left( x_{t-i}|i=1,\ldots ,12\right) \right] }\) | D | 1 | A |

35 | All-Share (J203) Price Index | All-Share Price Index | D | 5 | S |

36 | Financials (J580) Price Index | Financials Price Index | D | 5 | S |

37 | Banks (J835) Price Index | Banks Price Index | D | 5 | S |

38 | All-Share total return (J203T) Price Index | All-Share total return Price Index | D | 5 | S |

39 | General Mining (J154) Price Index | General Mining Price Index | D | 5 | S |

Macroeconomic activity | |||||

1 | GDP | Nowcast of GDP growth | M | 1 | A |

2 | Inflation | Year-on-year change in consumer prices | M | 1 | S |

3 | Industrial production growth | Year-on-year change in industrial production | M | 1 | W |

X | Prime overdraft rate | Benchmark rate at which private banks lend out to the public. | M | 1 | S |

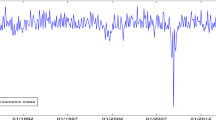

Baseline FCI and FCI using industrial production growth. The figure represents our baseline FCI constructed using our nowcast GDP (FCI) and the FCI constructed using industrial production growth (FCI_IP). Since the FCIs are standardised, values above 0 indicate stress in the financial market, while those below represent an ease of financial tensions. The FCIs have a high correlation coefficient of 99.22%

Rights and permissions

About this article

Cite this article

Kabundi, A., Mbelu, A. Estimating a time-varying financial conditions index for South Africa. Empir Econ 60, 1817–1844 (2021). https://doi.org/10.1007/s00181-020-01844-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-020-01844-0