Abstract

New evidence in the literature on trade effects of the euro often reports different estimates. In this paper, I investigate the impact of trade data, instead of methodology, on the estimation of the key coefficient. In particular, I apply both the log-linearized least squares (OLS) estimator and the Poisson pseudo-maximum likelihood (PPML) estimator to the structural gravity model and compare these estimates by using trade data from two of the most widely used sources (IMF DOTS and UN Comtrade) and by varying samples. One surprising result is that the OLS estimator yields coefficients of the euro with opposite signs for the two data sources, when a sample covering all countries is applied. It is as expected that the PPML estimator is much less sensitive to sample size than the OLS estimator, taking a data source as given. However, the variation in estimates caused by data sources and sampling is consistent for both estimators. It indicates that both estimators are not free from the measurement error issue. More findings include: (1) the discrepancy in OLS estimates derived for the two datasets persists across samples, but the magnitude varies; (2) the magnitude of the discrepancy in PPML estimates from the two datasets is more stable to sampling; (3) both OLS and PPML estimators are sensitive to sample compositions for a given sample size.

Similar content being viewed by others

Notes

To be more specific, I investigate the trade effects of the adoption of the euro by European union countries. For convenience, I still use “European Monetary Union” (EMU) to describe such an adoption, even though the EMU has a broader scope beyond only adopting the common currency: https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/economic-and-monetary-union/what-economic-and-monetary-union-emu_en.

Many studies (Larch et al. 2018; Mika and Zymek 2018, among others) have analyzed the robustness of coefficients across samples. However, most of their focus is to study the performance of a given estimator, taking trade data being perfect as given. Furthermore, they do not vary samples in more extended ways as in this paper.

Regarding trade data imperfection, there are more papers which investigate the trade data asymmetry issue. That is, exporters and importers report different trade data for the same trade flow. For example, Shaar (2017) constructs an index to measure the consistency of bilateral trade statistics of both trade partners using the 1962–2013 Comtrade data. She points out that trade data improve over time for most countries, and that countries are generally more aware of the origin of their imports than they are aware of the destination of their exports. Ferrantino et al. (2012) make use of the asymmetry to analyze tax evasion behavior of Chinese exporters.

There are other data sources on international trade which employ different methodologies to compile data, such as the BACI developed by the CEPII and the Atlas of Economic Complexity (AEC) maintained by the Center for International Development at Harvard University. However, those compiled datasets often use DOTS or Comtrade as their sources and vary by methodologies. If we compare discrepancies in estimates for CEPII and AEC, we might introduce additional bias caused by data compilation methodologies. More importantly, a comparison of estimates from DOTS and Comtrade is adequate for the purpose of this paper, to highlight the impact of measurement errors in trade data on empirical results.

The investigation is not exhaustive. For example, there are unexpected inconsistency in trade data between DOTS and Comtrade, which can be cross-checked with national data more easily. As expressed by Markhonko (2014), “...The blame should be not only on those users who jump to the conclusions before making sufficient effort to understand the nature of the data, but on the producers of official trade statistics as well who, apparently, do not do enough to explain the meaning of the data, their advantages as well as their limitations” (p. 5). My investigation of the two datasets is aimed to be feedback from the user’s side of those datasets.

Please see Rose and Stanley (2005) for a meta-analysis of earlier studies on the trade effects of currency unions. Havránek (2010) reviews more recent studies. Looking at the number of studies which quantify trade effects of currency unions, it might not be exaggerated to say that the trade effects of currency unions or of the European Monetary Union are an “over researched” topic.

In a recent study, Bergin and Lin (2012) employ UN Comtrade data to study the dynamic trade effects of currency unions. However, the results from Bergin and Lin (2012) are not comparable with those from other studies, since the former focuses on the two trade margins, instead of the overall trade value.

For example, Bannister et al. (2017) assess trade data quality for Lao P.D.R. The authors find that trade data between Lao P.D.R. and different trade partners for different products may be more or less misreported. They also notice that different national statistics departments in Lao P.D.R. report very different trade data.

For example, Eurostat regularly publishes quality reports on European statistics on international trade in goods, e.g., https://ec.europa.eu/eurostat/web/products-statistical-working-papers/-/KS-TC-15-002. Head et al. (2010) fix some errors in DOTS database. Different international organizations also corporate with each other to improve the quality of trade statistics, e.g., https://wits.worldbank.org/wits/wits/witshelp/content/data_retrieval/T/Intro/B2.Imports_Exports_and_Mirror.htm. Studies such as Ferrantino et al. (2012) investigate the reasons, such as tax evasion, for the difference in trade statistics reported by importers or exporters. Escaith (2015) discusses the birth, past and future of trade statistics.

Please see the User guide on European statistics on international trade in goods, 2016 edition, p. 43: User guide on European statistics on international trade in goods—2016 edition.

For example, a joint note of OECD and WTO, Trade in value-added: concepts, methodologies and challenges (2012), mentions that “conventional trade statistics may give a misleading perspective of the importance of trade to economic growth and income.” (p. 1)

Please see: https://comtrade.un.org/db/help/uReadMeFirst.aspx.

As noted by Marini et al. (2018), “Annual data reported to the UN COMTRADE database are used for those countries that do not report to the IMF.” However, it is not clear how accurate the statement is in the practice of DOTS. In the cleaned dataset for this paper, there are still 42,116 observations missing in DOTS but non-missing in Comtrade.

Those countries are Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovak Republic, Slovenia, Spain, Sweden and the United Kingdom. Due to a statistic reason, Belgium and Luxembourg are treated as one unit. The second section of “Appendix B” provides a brief description of those countries’ population, GDP and trade patterns.

In this section, I do not control other gravity variables including common language, common history of colonies, free trade agreements. The main reason is to keep as many observations as possible. The change in coefficients of the euro caused by the omission is negligible. Table 16 presents results when no other gravity variable is included, as compared to benchmark results in Table 4.

Similarly, I conduct the analysis when the percentile of both gap measures are defined at country pair level. That is, the threshold is defined within each country pair. The results are available upon request.

I estimate the effects by using Comtrade data as well. The main conclusion does not change, and the result is available upon request.

It is worth noting that only over 100 out of 1000 PPML coefficients are statistically significant for each sample size. However, it does not affect the argument. Figures of the distribution of the significant coefficients are available upon request.

In addition, I also conducted analysis on the distribution of estimates of the euro across samples which are restricted by the rank of other selected indicators including the average distance from EU countries, the percentile of import share, GDP per capital, GINI index, adult literacy rate, arable land in 2010. The results are available upon request. Ideally, this line of analysis can identify how each individual country affects the estimates.

It would be better to use data from Eurostat for those observation, but Eurostat uses euro as the measurement currency, which is not consistent with dollar used for observations of other countries.

You can bulk download directly from: http://data.imf.org/?sk=9D6028D4-F14A-464C-A2F2-59B2CD424B85 and the World Integrated Trade Solution (WITS), maintained by the World Bank, but the data is compiled by UN Comtrade: https://comtrade.un.org/.

The FOB price is export value reported by exporters, while the CIF price is reported by importers.

References

Alesina A, Barro RJ (2001) Dollarization. Am Econ Rev 91(2):381–385

Alesina A, Barro RJ (2002) Currency unions. Q J Econ 117(2):409–436

Alesina A, Barro RJ, Tenreyro S (2002) Optimal currency areas. NBER Macroecon Annu 17:301–345

Anderson JE, Van Wincoop E (2003) Gravity with gravitas: a solution to the border puzzle. Am Econ Rev 93(1):170–192

Bacchetta P, Van Wincoop E (2005) A theory of the currency denomination of international trade. J Int Econ 67(2):295–319

Baldwin R (2006) The euro’s trade effects. Working paper series 594, European Central Bank

Baldwin RE, Nino VD (2006) Euros and zeros: the common currency effect on trade in new goods. Technical report, National Bureau of Economic Research

Baldwin R, Taglioni D (2007) Trade effects of the euro: a comparison of estimators. J Econ Integr 780–818. ECB working paper No. 446

Baldwin R, Skudelny F, Taglioni D (2005) Trade effects of the euro evidence from sectoral data. Working paper series 446, European Central Bank

Bannister MGJ, Ghazanchyan MM, Bikoi TP (2017) LAO PDR: assessing the quality of trade statistics. International Monetary Fund, Washington, D.C

Berger H, Nitsch V (2008) Zooming out: the trade effect of the euro in historical perspective. J Int Money Finance 27(8):1244–1260

Bergin PR, Lin C-Y (2012) The dynamic effects of a currency union on trade. J Int Econ 87(2):191–204

Borowski J et al (2004) A report on the costs and benefits of Poland’s adoption of the euro. Technical report, National Bank of Poland

Bun MJ, Klaassen FJ (2007) The euro effect on trade is not as large as commonly thought. Oxf Bull Econ Stat 69(4):473–496

Campbell DL (2013) Estimating the impact of currency unions on trade: solving the Glick and Rose puzzle. World Econ 36(10):1278–1293

Cavallo A, Neiman B, Rigobon R (2015) The price impact of joining a currency union: evidence from Latvia. IMF Econ Rev 63(2):281–297

Chen N, Novy D (2018) Currency unions, trade, and heterogeneity. Technical report, CESifo working paper

Correia S (2015) Singletons, cluster-robust standard errors and fixed effects: a bad mix. Technical note, Duke University

deHaan E, Lawrence A, Litjens R (2018) Measurement error in dependent variables. Technical report, National Bureau of Economic Research

De Nardis S, De Santis R (2008) The single currency’s effects on Eurozone sectoral trade: Winners and losers? Economics-e-journal discussion paper 1–34

De Sousa J (2012) The currency union effect on trade is decreasing over time. Econ Lett 117(3):917–920

Donaldson D (2015) The gains from market integration. Annu Rev Econ 7(1):619–647

Eicher TS, Henn C (2011) One money, one market: a revised benchmark. Rev Int Econ 19(3):419–435

Escaith H (2015) Past and present issues in trade statistics. Revue de l’OFCE 4:37–51

Faruqee MH (2004) Measuring the trade effects of EMU. Number 4-154. International Monetary Fund, Washington, D.C

Feenstra RC, Lipsey RE, Bowen HP (1997) World trade flows, 1970–1992, with production and tariff data. Technical report, National Bureau of Economic Research

Fernandes A (2006) Trade dynamics and the euro effects: sector and country estimates. University of Essex and IPVC, Colchester

Ferrantino MJ, Liu X, Wang Z (2012) Evasion behaviors of exporters and importers: evidence from the US–China trade data discrepancy. J Int Econ 86(1):141–157

Flam H, Nordström H (2006) Trade volume effects of the euro: aggregate and sector estimates. Working paper

Frankel J (2010) The estimated trade effects of the euro: Why are they below those from historical monetary unions among smaller countries? In: Europe and the euro. University of Chicago Press, pp 169–212

Frankel JA, Rose AK (1998) The endogenity of the optimum currency area criteria. Econ J 108(449):1009–1025

Frankel J, Rose A (2002) An estimate of the effect of common currencies on trade and income. Q J Econ 117(2):437–466

Glick R, Rose AK (2002) Does a currency union affect trade? The time-series evidence. Eur Econ Rev 46(6):1125–1151

Glick R, Rose AK (2016) Currency unions and trade: a post-EMU reassessment. Eur Econ Rev 87:78–91

Gopinath G, Kalemli-Özcan Ş, Karabarbounis L, Villegas-Sanchez C (2017) Capital allocation and productivity in south Europe. Q J Econ 132(4):1915–1967

Greene WH (2012) Econometric analysis, 7th edn. Pearson Education, London

Guimaraes P, Portugal P et al (2010) A simple feasible procedure to fit models with high-dimensional fixed effects. Stata J 10(4):628

Gujarati DN (2009) Basic econometrics. Tata McGraw-Hill Education, New York City

Guolo A (2008) Robust techniques for measurement error correction: a review. Stat Methods Med Res 17(6):555–580

Havránek T (2010) Rose effect and the euro: Is the magic gone? Rev World Econ 146(2):241–261

Head K, Mayer T (2014) Gravity equations: workhorse, toolkit, and cookbook. In: Gopinath G, Helpman E, Rogoff K (eds) Handbook of international economics, vol 4. Elsevier, pp 131–195

Head K, Mayer T, Ries J (2010) The erosion of colonial trade linkages after independence. J Int Econ 81(1):1–14

Hu Y, Wansbeek T (2017) Measurement error models: editors’ introduction. J Econ 200(2):151–153

Larch M, Wanner J, Yotov YV, Zylkin T (2018) Currency unions and trade: a PPML re-assessment with high-dimensional fixed effects. Oxf Bull Econ Stat 81:487

Marini M, Dippelsman RJ, Stanger M (2018) New estimates for direction of trade statistics. IMF working paper no. 18/16

Markhonko V (2014) Asymmetries in official international trade statistics and analysis of globalization. In: International conference on the measurement of international trade and economic globalization, Aguascalientes, Mexico

Micco A, Stein E, Ordoñez G (2003) The currency union effect on trade: early evidence from EMU. Econ Policy 18(37):315–356

Mika A, Zymek R (2018) Friends without benefits? New EMU members and the ‘Euro Effect’ on trade. J Int Money Finance 83:75–92

Nitsch V (2002) Honey, I shrunk the currency union effect on trade. World Econ 25(4):457–474

Nitsch V (2013) Make or break: the varying trade effects of the euro. Reg Trade Monet Integr West Afr Eur 6:87–98

Rose AK (2000) One money, one market: the effect of common currencies on trade. Econ Policy 15(30):08–45

Rose AK, Stanley TD (2005) A meta-analysis of the effect of common currencies on international trade. J Econ Surv 19(3):347–365

Shaar K (2017) International trade data quality index. MPRA Paper No. 81572

Silva JS, Tenreyro S (2006) The log of gravity. Rev Econ Stat 88(4):641–658

Silva JS, Tenreyro S (2010) Currency unions in prospect and retrospect. Annu Rev Econ 2(1):51–74

Subramanian A, Wei S-J (2007) The WTO promotes trade, strongly but unevenly. J Int Econ 72(1):151–175

Timini J (2018) Currency unions and heterogeneous trade effects: the case of the Latin monetary union. Eur Rev Econ Hist 22:322

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I am grateful to Volker Nitsch, Sebastian Schuler, Lennart Kraft, participants in the Brown Bag Seminar of the Chair of International Economics in Darmstadt University of Technology and the Chair of Econometrics in Goethe University Frankfurt, and participants in the 6th Ph.D. Meeting in Economics in Thessaloniki 2018, the Dynamics, Economic Growth, and International Trade Conference in Moscow 2018, the European Trade Study Group in Warsaw 2018, the 21st Göttinger Workshop in 2019 for their helpful comments. I also thank the Chair of International Economics of Technische Universität Darmstadt, and the Faculty of Economics and Business Administration for the funding of my attendance to the above-mentioned workshops and conferences. All remaining errors are my own.

Appendices

Appendix A: Data preparation and summary statistics

The raw data for the period of 1992–2015 are downloaded from the official websites of both datasets, the Direction of Trade StatisticsFootnote 22 and the UN Comtrade. Unless indicated otherwise, I use the import data reported by importers to mirror the export data of exporters, which is reported at the CIF (cost, insurance, freight) price. After excluding trade unit defined at more aggregated level like “World,” “Euro Area,” “Africa” or “Special Categories,” etc., the DOTS raw data cover 216 exporters, 215 importers while the Comtrade covers 251 exporters, 204 importers for the mirrored export data.

To prepare for the final dataset, I first rename countries with different names in the two datasets. Then, I drop observations for countries/territories pairs covered only by one dataset. Table 7 lists those countries/territories and the mean of export when the corresponding countries are the exporter. Figure 6 shows the share of export of the dropped observations to the total export for Comtrade.

During the period of 1992–2015, a few countries have experienced unification or independence. In the third step, I process the statistics for those countries. Table 8 presents the summary statistics for the observations of them. Following Glick and Rose (2016) and Mika and Zymek (2018), I treat Belgium and Luxembourg as one unit, as there were no separate statistics for them before 1997. Similarly, I aggregate Serbia, Rep. of and Montenegro into one unit, as they were only not in one union until 1996. For simplicity, I drop observations if one trade partner is Czechslovakia. From 1993 on, the statistics are reported separately for Czech Republic and Slovakia.

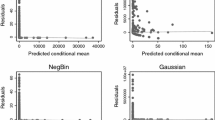

Figure 7 presents total export values contained by the two datasets, both in FOB (Freight on Board) and CIF (Cost, Insurance and Freight)Footnote 23 prices. As CIF price is usually higher than the corresponding FOB price, we should expect a higher value of exports measured by CIF price than that measured by FOB, no matter in which dataset. However, we only see this gap in Comtrade. Moreover, exports measured by CIF and FOB in DOTS are almost identical, both of which have been slightly more than CIF exports in Comtrade since 2002. It might be due to the projection procedure for statistics in DOTS while not in Comtrade. And there is very likely to be an overestimate of export value reported by exporters (FOB) in DOTS (Tables 9, 10, 11; Figs. 7, 8, 9, 10, 11, 12).

Countries most frequently reported trade data with high relative gaps. Note High relative gap means that this gap measure is bigger than 1, different from the threshold in Table 10. The frequency is calculated at country level for the year of 2015. It is the number of observations that a given country, as importers, reported with high relative gaps. To save space, countries with frequency less than 4 are not included in the figure. These countries include Cameroon, United Kingdom, Azerbaijan, Macao, Paraguay, Serbia and Montenegro, Algeria, Australia, Brazil, China, Egypt, Georgia, Guatemala, India, Israel, Japan, Peru, Uruguay, Zambia. In total, there are 956 observations with high relative gap in their trade statistics for DOTS and Comtrade

Countries most frequently reported trade data with high absolute gaps. Note High absolute gap means that this gap measure is bigger than 1 billion US dollars, different from the threshold in Table 10. The frequency is calculated at country level for the year of 2015. It is the number of observations that a given country, as importers, reported with high absolute gaps. Denmark, Italy, Japan, Lao PDR, Oman, Russian Federation, Sudan, Sweden, Zimbabwe also reported trade statistics with absolute gap more than 1 billion US dollars in 2015, but only for one trade flow

Top 30 countries with the highest ratio of frequencies reported trade data with high relative gaps. Note “Ratio of frequencies” is the ratio of frequency with high relative gaps as defined in Fig. 8 to total number of observations that a country reported as importers in 2015

Top 30 countries with the highest ratio of frequencies reported trade data with high absolute gaps. Note “Ratio of frequencies” is the ratio of frequency with high absolute gaps as defined in Fig. 9 to total number of observations that a country reported as importers in 2015

Number of observations with high gaps in trade data across time. Note The left y-axis displays the number of observations with high relative or absolute gaps in trade data. The right y-axis displays the number of those observations as a share of total number of observations for a given year. High relative gap means that this gap measure is bigger than 10. High absolute gap means that this gap measure is bigger than 464 millions US$

Appendix B: A description of EU countries

See Tables 12, 13 and Fig. 13.

The ratio of export to emu initial members. Note Export share is the ratio of export value to 11 EMU initial members to total export of each country. “Followers” refers to EU countries which joined EMU after 1999. This group includes Greece, Slovakia, Slovenia, Estonia, Cyprus and Malta (ranked by the nominal GDP in 2016, the same in the following). The 11 EMU “initial member” countries are Germany, France, Italy, Spain, Netherlands, Belgium, Austria, Ireland, Finland, Portugal, Luxembourg. Belgium and Luxembourg are treated as one unit, as there is no data for the separate countries before 1999. “Non-EMU” countries include the rest of EU countries. As Lithuania and Latvia joined EMU only in 2014 and 2015, I group them into Non-EMU. The export share for EMU initial members is slightly overestimated since the denominator does not include the export to itself

Appendix C: Supplement materials

See Tables 14, 15, 16, 17 and Figs. 14, 15, 16, 17.

Ratio of export among EMU initial members to export among EU countries. Note The 11 EMU “initial member” countries are Germany, France, Italy, Spain, Netherlands, Belgium, Austria, Ireland, Finland, Portugal, Luxembourg. Belgium and Luxembourg are treated as one unit, as there is no separate data for the two countries before 1999

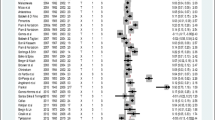

Distribution of the key coefficient over sample sizes: OLS, DOTS. Note “Size 1” means that except for 28 EU countries, extra 20 randomly selected countries from the rest of world are included as exporters or importers. Size 2–6 adds 20 more randomly selected countries gradually than the number of countries in the correspondingly previous sample. To get the distribution for each sample size, I implement the selection process for 1000 times for each size

Distribution of discrepancy in OLS estimates over sample sizes. Note The discrepancy is constructed from OLS estimates derived for DOTS minus those for Comtrade for each random draw of a sample. “Size 1” means that except for 28 EU countries, extra 20 randomly selected countries from the rest of world are included as exporters or importers. Size 2–6 adds 20 more randomly selected countries gradually than the number of countries in the correspondingly previous sample. To get the distribution for each sample size, I implement the selection process for 1000 times for each size

Rights and permissions

About this article

Cite this article

Hou, J. Revisiting the trade effects of the euro: data sources and various samples. Empir Econ 59, 2731–2777 (2020). https://doi.org/10.1007/s00181-019-01742-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01742-0