Abstract

At the zero lower bound, the dynamic Nelson–Siegel (DNS) model and even the Svensson generalization of the model have trouble in fitting the short maturity yields and fail to grasp the characteristics of the Japanese government bonds (JGBs) yield curve. During the zero interest rate policy regime, the short end of the yield curve is flat and yields corresponding to various maturities have asymmetric movements. Therefore, closely related generalized versions of Nelson–Siegel model—with and without no-arbitrage restriction (GAFNS and GDNS)—that have two slopes and curvatures factors are considered and compared empirically in terms of in-sample fit as well as out-of-sample forecasts with the standard Nelson–Siegel model—with and without no-arbitrage restriction (AFNS and DNS). The affine-based models provide a more attractive fit of the yield curve than their counterpart DNS-based models. Both extended models are capable to restrict the estimated rates from becoming negative at the short end of the curve and distill the JGBs term structure of interest rate quite well. The affine-based extended model leads to a better in-sample fit than the simple GDNS model. In terms of out-of-sample accuracy, both non-affine models outperform the affine models at least for 1- and 6-month horizons. The out-of-sample predictability of the GDNS for the 1- and 6-month-ahead forecasts is superior to the GAFNS for all maturities, and for longer horizons, i.e., 12-month-ahead, the former is still compatible to the latter, particularly for short- and medium-term maturities.

Similar content being viewed by others

Notes

For example, on February 17, 2009, the 7-year interest rate becomes relatively low compared with the 6-year and 8-year rates (Kikuchi and Shintani 2012). Detail description of these features of JGBs yield curve is given in Ullah et al. (2015), Ullah (2017), Kim and Singleton (2012), Dai and Singleton (2000), and Kikuchi and Shintani (2012).

The parameter \( \lambda \) in Nelson-Siegel spot rate function specifies the location of the hump or the U-shape on the yield curve. The small values of \( \lambda \) which have rapid decay in regressors, tend to fit low maturities interest rates quite well and larger values of \( \lambda \) lead to more appropriate fit of longer maturities spot rates.

The model with two slope factors (as in Bjork and Christensen 1999) or two curvatures (such as in Svensson 1995) may also serve the purpose of fitting curves with special shapes, such as twists, but Christensen et al. (2009) shows that the model, which accounts for two slope and curvature factors simultaneously, outperforms the standard Bjork and Christensen (1999) and Svensson (1995) models. Secondly, the models with either two slopes or two curvatures cannot be derived in the affine framework (for detail see Christensen et al. 2009).

Moreover, Diebold and Li (2006) find that the time series of estimated factors of Nelson–Siegel model are highly persistent, which implies that these can be modeled as AR(1) or VAR(1). Using the Japanese market data Ullah et al. (2013) find that the three latent factors of yield curve are highly persistent and VAR(1) specification is more appropriate than the AR(1) and random walk specifications.

The estimate of slope factor \( \beta_{2t} \) is negative in DNS and AFNS models because of having positively sloped yield curves in entire sample.

Ullah et al. (2015) shows that the GDNS outperforms the standard DNS in terms of in-sample fit as well as out-of-sample forecasts across all maturities in the Japanese bond market.

References

Ang A, Piazzesi M (2003) A no-arbitrage vector autoregression of term structure dynamics with macroeconomic and latent variables. J Monetary Econ 50(4):745–787

Bjork T, Christensen BJ (1999) Interest rate dynamics and consistent forward rate curves. Math Finance 9:323–348

Bliss RR (1997) Testing term structure estimation methods. Adv Futures Opt Res 9:197–231

Christensen JHE (2015) A regime-switching model of the yield curve at the zero bound. Federal Reserve Bank of San Francisco Working Paper 2013-34. http://www.frbsf.org/economic-research/publications/working-papers/wp2013-34.pdf

Christensen JHE, Diebold FX, Rudebusch GD (2009) An arbitrage-free generalized Nelson–Siegel term structure model. Econ J 12:33–64

Christensen JHE, Diebold FX, Rudebusch GD (2011) The affine arbitrage-free class of Nelson–Siegel term structure models. J Econom 164:4–20

Dai Q, Singleton KJ (2000) Specification analysis of affine term structure models. J Finance 55:1943–1978

Diebold FX, Li C (2006) Forecasting the term structure of government bond yields. J Econom 130:337–364

Duffie D, Kan R (1996) A yield-factor model of interest rates. Math Finance 6(4):379–406

Duffiee GR (2000) Term premia and interest rates forecasts in affine models. J Finance 57:405–443

Fama E, Bliss R (1987) The information in long-maturity forward rates. Am Econ Rev 77:680–692

Favero CA, Niu L, Sala L (2012) Term structure forecasting: no-arbitrage restrictions versus large information set. J Forecast 31(2):124–156

Gimeno R, Marques JM (2009) Extraction of financial market expectations about inflation and interest rates from a liquid market. Working paper 0906, Banco de Espanha

Hamilton JD (1994) State-space models. In: Engle RF, McFadden DL (eds) Handbook of econometrics. Elsevier, Amsterdam, pp 3041–3080

Hansen PR, Lunde A, Nason JM (2005) A test for superior predictive ability. Econometrica 23:365–380

Hansen PR, Lunde A, Nason JM (2011) The model confidence set. Econometrica 79:453–497

Harvey AC (1989) Forecasting structural time series models and the Kalman filter. Cambridge University Press, Cambridge

Kikuchi K, Shintani K (2012) Comparative analysis of zero coupon yield curve estimation methods using JGB price data. Monetary Econ Stud 30:75–122

Kim D, Singleton K (2012) Term structure models and the zero bound: an empirical investigation of Japanese yields. J Econom 170(1):32–49

Litterman R, Scheinkman JA (1991) Common factors affecting bond returns. J Fixed Income 1(1):62–74

Moench E (2008) Forecasting the yield curve in a data-rich environment: a no-arbitrage factor-augmented VAR approach. J Econom 146(1):26–43

Nelson CR, Siegel AF (1987) Parsimonious modeling of yield curves. J Bus 60:473–489

Svensson LEO (1995) Estimating forward interest rates with the extended Nelson–Siegel method. Sver Riksbank Q Rev 3:13–26

Ullah W (2017) Term structure forecasting in affine framework with time-varying volatility. Stat Methods Appl 26:453–483

Ullah W, Tsukuda Y, Matsuda Y (2013) Term structure forecasting of government bond yields with latent and macroeconomic factors: do macroeconomic factors imply better out-of-sample forecasts? J Forecast 32:702–723

Ullah W, Matsuda Y, Tsukuda Y (2015) Generalized Nelson–Siegel term structure model: do the second slope and curvature factors improve the in-sample fit and out-of-sample forecast? J Appl Stat 42(4):876–904

Welch G, Bishop G (2006) An introduction to the Kalman filter. Department of Computer Science, University of North Carolina, Chapel Hill

Acknowledgements

We would like to thank the anonymous referees and the Editor for making useful comments to improve this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix-I

1.1 Principal component analysis of the JGBs yields

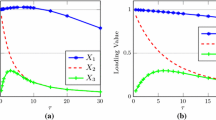

Consider the JGB zero rates with maturities of 3, 6, 9, 12, 15, 18, 21, 24, 30, 36, 48, 60, 72, 84, 96, 108, 120, 180, 240 and 300 months (20 maturities) from January 1996 through December 2013, the principal component analysis is carried out and the results are reported in Table 11 and Fig. 5. Table 11 reports the eigenvectors that correspond to the first five principal components of the sample. Figure 5 displays the scatter plot of loadings of first five principal components against maturity.

Appendix-II

2.1 Coefficients and latent variable in the general state-space form

In the statistical formulation of the models in Sect. 2.3, the matrices and vectors for the state and observations equations should be considered as follows. In the state-space framework (23–25) for GDNS, the matrices can be defined as:

while for the GAFNS model the matrices and vectors can be written as:

In both models, the matrix \( \varOmega \) is assumed to be diagonal for computational traceability, while the covariance matrix \( \varSigma_{v} \) is considered non-diagonal.

Appendix-III

3.1 Data description

We consider JGB yields with maturities of 3, 6, 9, 12, 15, 18, 21, 24, 30, 36, 48, 60, 72, 84, 96, 108, 120, 180, 240 and 300 months. The yields are derived from bid/ask average price quotes, from January 1996 through December 2013, using the Fama and Bliss (1987) methodology.

Table 12 provides summary statistics for the dataset. For each maturity, we report mean, standard deviation, minimum, maximum, skewness, kurtosis, and autocorrelation coefficients at various displacements. The summary statistics reveal that the average yield curve is upward sloping. Unconditional volatility increases by maturity and yields for all maturities are persistent; however, relatively short rates persistency is higher than those of the long rates.

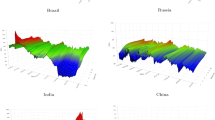

In addition to the findings in Table 12, we see few interesting characteristics in Fig. 6, which plots cross section of yields over time. The first noticeable fact is that long-term yields vary significantly over time. Second, the short rates are almost zero during the prolonged period except with a little rise in late 2006 and early 2007 that causes a fall in the slope of the curves. Moreover, when short rates are stuck at zero, the long end seems more volatile than the short end of the curves.

Rights and permissions

About this article

Cite this article

Ullah, W. The arbitrage-free generalized Nelson–Siegel term structure model: Does a good in-sample fit imply better out-of-sample forecasts?. Empir Econ 59, 1243–1284 (2020). https://doi.org/10.1007/s00181-019-01710-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01710-8