Abstract

Existing estimates of the public/private wage gap allow for possible sorting of individuals into one sector, but they rely on parametric assumptions that may introduce substantial bias in the parameter of interest. Solutions are semi- and nonparametric approaches. For Italy, the latter methods yield a gap of approximately 20%, whereas the bias from parametric assumptions is as large as 10%.

Similar content being viewed by others

Notes

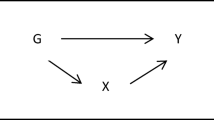

In this note, we assume the existence of an exclusion restriction. However, this is not strictly required in the fully parametric model.

For illustrative purposes, we provide formal intuition on the size of the bias of the Heckman two-step estimator in “Appendix A.”

Newey (2009) considers power series and splines for the second stage (denoted by \(\left\{ \cdot \right\} _{k=1}^{K}\)), and some semiparametric methods to estimate the first stage. For a more transparent comparison to Das et al. (2003), we use power series in the wage equation and the linear probability model in the selection equation.

For a review on sample selection estimators, see Vella (1998).

The test takes the form of two inequalities that are necessary to identify a Local Average Treatment Effect (Imbens and Angrist 1994): \(P[y,D=1|Z=0] \le P[y,D=1|Z=1]\) and \(P[y,D=0|Z=1] \le P[y,D=0|Z=0]\). If any of the two inequalities is violated, the validity of the instrument is falsified. In the latter case, the test is not informative about which of the two assumptions fails.

As a further check in favor of the validity of the instrument, we estimate the model with IV using a more parsimonious and plausibly exogenous set of controls and then add them progressively: Under the maintained assumption of constant treatment effect, finding stable results would be additional evidence in favor of the validity of the instrument and the method(s) in general; if there is instability in the estimated effect, nothing can be said. Controlling only for age education and year, the wage differential is slightly above 30% (Table 6); as soon as we add the job position, it marginally decreases to 28%, where it remains no matter what variables we add.

Note that the top and bottom 1% of the sample is trimmed in the estimation of the semi- and nonparametric estimators to guarantee that the propensity score estimates are strictly inside the unit interval.

The conditions are those of the IV for local average treatment effect (Imbens and Angrist 1994), as well as bounded outcome, rank similarity, and first-order stochastic dominance.

The exact meaning of “large” is an individual choice of the researcher that should trade off the benefits from a simpler communication and the costs from unduly restrictive assumptions.

The relevance of the instrument is less important for partial than for point identification, because the set is valid for the entire population rather than for compliers only; see Chen et al. (2017) for a thorough discussion.

References

Arabmazar A, Schmidt P (1982) An investigation of the robustness of the tobit estimator to non-normality. Econometrica 50(4):1055–1063

Bhattacharya J, Shaikh AM, Vytlacil E (2008) Treatment effect bounds under monotonicity assumptions: an application to Swan-Ganz catheterization. Am Econ Rev 98(2):351–56

Bhattacharya J, Shaikh AM, Vytlacil E (2012) Treatment effect bounds: an application to SwanGanz catheterization. J Econom 168(2):223–243

Bound J, Jaeger D, Baker R (1995) Problems with instrumental variable estimation when the correlation between the instruments and the endogenous explanatory variable is weak. J Am Stat Assoc 90:443–450

Brunello G, Dustmann C (1997) Le retribuzioni nei settori pubblico e privato in Italia e in Germania: un paragone basato su dati microeconomici. In: Dell’Aringa C (ed) Rapporto ARAN sulle retribuzioni. ARAN, Franco Angeli

Card D (1999) The causal effect of education on earnings. In: Ashenfelter O, Card D (eds) Handbook of labor economics, volume 3 of handbook of labor economics. Elsevier, New York, pp 1801–1863

Chen X, Flores CA, Flores-Lagunes A (2017) Going beyond LATE: bounding average treatment effects of job corps training. J Hum Resour (forthcoming)

Das M, Newey WK, Vella F (2003) Nonparametric estimation of sample selection models. Rev Econ Stud 70(1):33–58

Depalo D (2018) Identification issues in the public/private wage gap with an application to Italy. J Appl Econom 33(3):435–456

Depalo D, Giordano R (2011) The public–private pay gap: a robust quantile approach. Giornale degli Economisti 70(1):25–64

Dustmann C, van Soest A (1998) Public and private sector wages of male workers in Germany. Eur Econ Rev 42(8):1417–1441

Heckman JJ (1979) Sample selection bias as a specification error. Econom Econom Soc 47(1):153–61

Heckman JJ, Vytlacil EJ (2007) Econometric evaluation of social programs, Part I: causal models, structural models and econometric policy evaluation. In: Heckman J, Leamer E (eds) Handbook of econometrics, volume 6 of handbook of econometrics. Elsevier, New York

Imbens GW, Angrist JD (1994) Identification and estimation of local average treatment effects. Econometrica 62(2):467–75

Imbens GW, Rubin DB (1997) Estimating outcome distributions for compliers in instrumental variables models. Rev Econ Stud 64(4):555–574

Lausěv J (2014) What has 20 years of publicprivate pay gap literature told us? Eastern european transitioning vs. developed economies. J Econ Surv 28(3):516–550

Lucifora C, Meurs D (2006) The public sector pay gap in France, Great Britain and Italy. Rev Income Wealth 52(1):43–59

Maddala GS (1983) Limited-dependent and qualitative variables in econometrics. Cambridge University Press, Cambridge

Mourifié I, Wan Y (2017) Testing local average treatment effect assumptions. Rev Econ Stat 99(2):305–313

Newey WK (1999) Consistency of two-step sample selection estimators despite misspecification of distribution. Econ Lett 63(2):129–132

Newey WK (2009) Two-step series estimation of sample selection models. Econom J 12:S217–S229

Nijman T, Verbeek M (1992) Nonresponse in panel data: the impact on estimates of a life cycle consumption function. J Appl Econom 7(3):243–257

Puhani P (2000) The Heckman correction for sample selection and its critique. J Econ Surv 14(1):53–68

Vella F (1998) Estimating models with sample selection bias: a survey. J Hum Resour 33(1):127–169

Vytlacil E (2002) Independence, monotonicity, and latent index models: an equivalence result. Econometrica 70(1):331–341

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank two anonymous referees for their constructive comments. All errors are our responsibilities. Replication files and additional results will be available at the Webpage: http://sites.google.com/site/domdepalo/ The views expressed in this paper are those of the authors and do not imply any responsibility of the Bank of Italy.

Appendices

Appendix A: Asymptotic bias from parametric assumptions

Let the true model be given by Eqs. 1–3 and the true distribution of \(\varepsilon _{ji}\) be unknown for \(j=\left\{ 0,1\right\} \). Define \(\theta _{j}\equiv \left( \beta _{j},\xi _{j}\right) \) and \(\omega _{ji}\equiv \left( x_{i}',\lambda _{j}\left( z_{i}\right) \right) '\), where \(\lambda _{j}\left( z_{i}\right) \) is the correction term (\(\lambda _{0}\left( z_{i}\right) =\frac{\phi \left( z_{i}'\gamma \right) }{1-\Phi \left( z_{i}'\gamma \right) }\) and \(\lambda _{1}\left( z_{i}\right) =\frac{\phi \left( z_{i}'\gamma \right) }{\Phi \left( z_{i}'\gamma \right) }\)). It is possible to rewrite the outcome equation as \(y_{ji}=\omega _{ji}'\theta +u_{ji}\), where \(u_{ji}=\varepsilon _{ji}-\xi _{j}\lambda _{j}\left( z_{i}\right) \), which is a zero-mean error term. Hence, it can be interpreted in terms of the Heckman two-step estimator. The probability limit of this estimator is given by:

Even though the mean regression model is correctly specified, \(\beta _{j}\) may suffer from an asymptotic bias equal to:

Hence, the severity of the bias is proportional to \({\mathbb {E}}\left[ \omega _{ji}{\mathbb {E}}\left( \varepsilon _{ji}|d_{i}=j,z_{i}\right) \right. \left. -\omega _{ji}\xi _{j}\lambda _{j}\left( z_{i}\right) \right] \), which equals 0 only under normality (if an exogenous and relevant instrument exists).

Appendix B: Additional table (available on the website)

See Table 6.

Rights and permissions

About this article

Cite this article

Depalo, D., Pereda-Fernández, S. Consistent estimates of the public/private wage gap. Empir Econ 58, 2937–2947 (2020). https://doi.org/10.1007/s00181-018-1592-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1592-7