Abstract

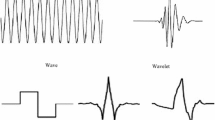

We use wavelet analysis to study the relationship between the yield curve and macroeconomic indicators in Canada. We rely on the Nelson–Siegel approach to model the zero-coupon yield curve and use the Kalman filter to estimate its time-varying factors: the level, the slope and the curvature. Apart from establishing a bidirectional yield–macro relation, the paper broadens the existing literature by exploring the link between the monetary policy and the yield curve. We reached several conclusions. First, the monetary policy variable, the bank rate, affects mainly short-run interest rates. Arguably, the main driver for economic activity is the long-run interest rate (instead of the short run), suggesting that monetary policy is mostly ineffective. Second, we concluded that concerning the inflation rate, the Bank of Canada is very proactive. Third, regarding the unemployment rate, we found that both the slope and the curvature are leading indicators for the long-run evolution of unemployment. Finally, our results suggest that the industrial production index leads the yield curve factors and not the other way.

Similar content being viewed by others

Notes

Typically, the empirical measure for the slope is: \(\mathrm{Slope}_{t}=y_{t}(3)-y_{t}(120)\). Therefore, a negative value for the slope means that the interest rate is increasing with the maturity.

Data downloaded from http://www.bankofcanada.ca/rates/interest-rates/bond-yield-curves/ on September 22, 2016.

There is well-known bias regarding the estimation of the wavelet coefficients at the lowest scale levels. For that reason, we implement the correction proposed by the Liu et al. (2007).

References

Aguiar-Conraria L, Soares MJ (2011) Business cycle synchronization and the Euro: a wavelet analysis. J Macroecon 33:477–489

Aguiar-Conraria L, Soares MJ (2014) The continuous wavelet transform: moving beyond uni and bivariate analysis. J Econ Surv 28(2):344–375

Aguiar-Conraria L, Magalhães PC, Soares MJ (2012a) Cycles in politics: wavelet analysis of political time series. Am J Polit Sci 56:500–518

Aguiar-Conraria L, Martins MM, Soares MJ (2012b) The yield curve and the macro-economy across time and frequencies. J Econ Dyn Control 36(12):1950–1970

Aguiar-Conraria L, Magalhães PC, Soares MJ (2013) The nationalization of electoral cycles in the United States: a wavelet analysis. Public Choice 156:387–408

Ang A, Piazzesi M (2003) A no-arbitrage vector autoregression of term structure dynamics with macroeconomic and latent variables. J Monet Econ 50:745–787

Benati L, Goodhart C (2008) Investigating time-variation in the marginal predictive power of the yield spread. J Econ Dyn Control 32(4):1236–1272

Berens P (2009) CircStat: a MATLAB toolbox for circular statistics. J Stat Softw 31(10):1–21

Booth L, Georgopoulos G, Hejazi W (2007) What drives provincial-Canada yield spreads? Can J Econ 40:1008–1032

Cazelles B, Chavez M, de Magny GC, Guégan J-F, Hales S (2007) Time-dependent spectral analysis of epidemiological time-series with wavelets. J R Soc Interface 4:625–636

Cook T, Hahn T (1989) The effect of changes in the Federal funds rate target on market interest rates in the 1970s. J Monet Econ 24(9):331–351

Dewachter H, Lyrio M (2006) Macroeconomic factors in the term structure of interest rates. J Money Credit Bank 38(1):119–140

Diebold FX, Li C (2006) Forecasting the term structure of government bond yields. J Econ 130(2):337–364

Diebold FX, Rudebusch GD (2013) Yield curve modeling and forecasting: the dynamic Nelson–Siegel approach. Princeton University Press, Princeton

Diebold FX, Rudebusch GD, Aruoba SB (2006) The macroeconomy and the yield curve: a dynamic latent factor approach. J Econ 131(1):309–338

Edelberg W, Marshall DE (1996) Monetary policy shocks and long-term interest rates. Econ Perspect 20:2–17

Estrella A, Hardouvelis GA (1991) The term structure as a predictor of real economic activity. J Finance 46:555–576

Evans CL, Marshall DE (2007) Economic determinants of the mominal treasury yield curve. J Monet Econ 54:1986–2003

Gallegati M, Ramsey J, Semmler W (2014) Interest rate spreads and output: a time scale decomposition analysis using wavelets. Comput Stat Data Anal 76:283–290

Garcia R, Luger R (2007) The Canadian macroeconomy and the yield curve: an equilibrium based approach? Can J Econ/Revue canadienne d’économique 40(2):561–583

Geiger F (2011) The yield curve and financial risk premia. In: Implications for monetary policy, economics macroeconomics/monetary economics/growth lecture notes in economics and mathematical systems, vol 465. Springer, Berlin

Goupillaud P, Grossman A, Morlet J (1984) Cycle-octave and related transforms in seismic signal analysis. Geoexploration 23:85–102

Hao L, Ng EC (2011) Predicting Canadian recessions using dynamic probit modelling approaches. Can J Econ/Revue canadienne d’économique 44(4):1297–1330

Hejazi W, Lai H, Yang X (2000) The expectations hypothesis, term premia, and the Canadian term structure of interest rates. Can J Econ/Revue canadienne d’économique 33(1):133–148

Kozicki S, Tinsley PA (2001) Shifting endpoints in the term structure of interest rates. J Monet Econ 47:613–652

Lange RH (2013) The Canadian macroeconomy and the yield curve: a dynamic latent factor approach. Int Rev Econ Finance 27:261–274

Liu Y, San Liang X, Weisberg RH (2007) Rectification of the bias in the wavelet power spectrum. J Atmos Ocean Technol 24:2093–2102

Maraun D, Kurths J, Holschneider M (2007) Nonstationary Gaussian processes in wavelet domain: synthesis, estimation, and significance testing. Phys Rev E 75(1):016707

Moneta F (2005) Does the yield spread predict recessions in the Euro area? Int Finance 8(2):263–301

Murray J (2013) Monetary policy decision making at the Bank of Canada. Bank Can Rev 2013(Autumn):1–9

Nelson C, Siegel A (1987) Parsimonious modeling of yield curves. J Bus 60:473–489

Rudebusch GD, Wu T (2008) A macro-finance model of the term structure, monetary policy, and the economy. Econ J 118:906–926

Taylor JB (1993) Discretion versus policy rules in practice. In: Carnegie-Rochester conference series on public policy, vol 39(1), pp 195–214

Torrence C, Compo G (1998) A practical guide to wavelet analysis. Bull Am Meteorol Soc 79:61–78

Wu T (2002) Monetary policy and the slope factors in empirical term structure estimations. Federal Reserve Bank of San Francisco Working Paper 02-07

Zar JH (1996) Biostatistical analysis, 3rd edn. Prentice-Hall, Upper Saddle River

Acknowledgements

The research unit of Aguiar-Conraria and Soares receives funding from COMPETE Reference No. POCI-01-0145-FEDER-006683, with the FCT/MEC’s (Funda ção para a Ciência e a Tecnologia, I.P.) financial support through national funding and by the ERDF through the Operational Programme on “Competitiveness and Internationalization—COMPETE 2020 under the PT2020 Partnership Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Human and animal rights

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

This work was carried out within the funding with COMPETE Reference No. POCI-01-0145-FEDER-006683, with the FCT/MEC’s (Fundação para a Ciência e a Tecnologia, I.P.) financial support through national funding and by the ERDF through the Operational Programme on “Competitiveness and Internationalization—COMPETE 2020 under the PT2020 Partnership Agreement.

Rights and permissions

About this article

Cite this article

Ojo, M.O., Aguiar-Conraria, L. & Soares, M.J. A time–frequency analysis of the Canadian macroeconomy and the yield curve. Empir Econ 58, 2333–2351 (2020). https://doi.org/10.1007/s00181-018-1580-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1580-y

Keywords

- Term structure

- Yield curve

- Macroeconomic variables

- Wavelet power spectrum

- Wavelet coherency

- Wavelet phase difference