Abstract

We use a unique data set from Finnish and Swedish horse race betting markets to explain the favorite-longshot bias. The data set includes a complete set of odds for exotic markets. We use the exotic market odds in conjunction with the win market odds and find convincing support for the misperceptions explanation of the favorite-longshot bias rather than the risk-love explanation. Furthermore, our data provide evidence of a specific type of failure to reduce compound lotteries. Namely, it seems that bettors do not assess the exotic market events as simple lotteries but instead consider the race for the first place and the race for the second place in a sequential form.

Similar content being viewed by others

Notes

Snowberg and Wolfers (2008) explicitly use this characterization.

In both countries, the monopolies face minor competition from internet betting sites that operate abroad.

For example, trifecta betting does not take place in all races.

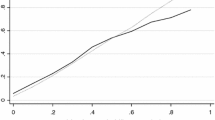

We fit nonparametric as well as parametric constant absolute risk aversion utility functions by using the likelihood-based approach of Jullien and Salanie (2000) for both markets. The results display significantly (\( p < 0.0001 \) for parametric estimates) different utility functions across the markets.

We also fit a parametric Prelec weighting function for both markets by using the likelihood-based approach of Jullien and Salanie (2000). The estimates display significant (\( p < 0.0001 \)) nonlinearity in both markets. The weighting functions are also significantly (\( p < 0.0001 \)) different across the markets.

It is a well-known fact that the Harville formula is biased. This bias occurs because there tends to be more entropy in the race for second place than for first place. This makes favorites who fail to win less likely to finish second than implied by the Harville formula (see Stern 1990).

References

Ali MM (1977) Probability and utility estimates for racetrack bettors. J Polit Econ 85:803–815

Barberis NC (2013) Thirty years of prospect theory in economics: a review and assessment. J Econ Perspect 27(1):173–196

Camerer CF, Ho TH (1994) Violations of the betweenness axiom and nonlinearity in probability. J Risk Uncertain 8:167–196

Cleveland WS, Devlin SJ (1988) Locally weighted regression: an approach to regression analysis by local fitting. J Am Stat Assoc 83:596–610

Cleveland WS, Devlin SJ, Grosse E (1988) Regression by local fitting: methods, properties, and computational algorithms. J Econom 35(1):87–114

Gandhi A (2007) Rational expectations at the racetrack: testing expected utility using prediction market prices. University of Wisconsin, Maddison

Griffith RM (1949) Odds adjustments by American horse-race bettors. Am J Psychol 62(2):290–294

Harville DA (1973) Assigning probabilities to the outcomes of multi-entry competitions. J Am Stat Assoc 68:312–316

Jullien B, Salanie B (2000) Estimating preferences under risk: the case of racetrack bettors. J Polit Econ 108(3):503–530

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47:263–292

Ottaviani M, Sorensen PN (2008) The favorite-longshot bias: an overview of the main explanations. In: Hausch DB, Ziemba WT (eds) Handbook of sports and lottery markets. North-Holland, Amsterdam, pp 83–101

Ottaviani M, Sorensen PN (2010) Noise, information, and the favorite-longshot bias in parimutuel predictions. Am Econ J Microecon 2(1):58–85

Snowberg E, Wolfers J (2008) examining explanations of a market anomaly: preferences or perceptions. In: Hausch DB, Ziemba WT (eds) Handbook of sports and lottery markets. North-Holland, Amsterdam, pp 103–136

Snowberg E, Wolfers J (2010) Explaining the favorite-long shot bias: is it risk-love or misperceptions. J Polit Econ 118(4):723–746

Sobel RS, Raines ST (2003) An examination of the empirical derivatives of the favorite-longshot bias in racetrack betting. Appl Econ 35:371–385

Sobel RS, Ryan ME (2008) Unifying the favorite-longshot bias with other market anomalies. In: Hausch DB, Ziemba WT (eds) Handbook of sports and lottery markets. North-Holland, Amsterdam, pp 137–160

Stern H (1990) Models for distributions on permutations. J Am Stat Assoc 85(410):558–564

Thaler RH, Ziemba WT (1988) Anomalies: parimutuel betting markets: racetrack and lotteries. J Econ Perspect 2(2):161–174

Weitzman M (1965) Utility analysis and group behavior: an empirical study. J Polit Econ 73:18–26

Acknowledgements

We thank the anonymous referees for their useful suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Koivuranta, M., Korhonen, M. Misperception explains favorite-longshot bias: evidence from the Finnish and Swedish harness horse race markets. Empir Econ 57, 2149–2160 (2019). https://doi.org/10.1007/s00181-018-1538-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1538-0