Abstract

This paper investigates political pressure from incumbent Presidents and Congress on US monetary policy during the period that Greenspan was the chairman of the Federal Reserve. We propose an expectations-augmented Taylor rule in which we replace realized values with expectations, and use the unemployment gap instead of the output gap. We apply a state-space framework that allows the use of mixed frequency data. Our findings suggest that the Federal Reserve under Greenspan did not create election driven cycles, but also did not strictly follow the Taylor rule. The deviations from the Taylor rule are not driven by partisan politics, but are rooted in the expected economic conditions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since the breakdown of the Bretton Woods system, a trend towards more independence of central banks is observed. Also the success of the independent Bundesbank led to the belief that independence of the central bank is a useful device to maintain price stability. Furthermore, the Maastricht Treaty requires that having an independent central bank is a condition for entering the Economic and Monetary Union. Also for former socialist countries, an independent central bank is a good start for a well-functioning market economy. However, policy makers and politicians could have other objectives. This will be discussed in detail in Sect. 2.

In this paper, we focus on the period August 1987 until and including January 2006 in which the Federal Reserve (Fed) was chaired by Greenspan. This period is chosen because Taylor (1993) argues that monetary policy accurately describes monetary policy since 1987, and because in the period after 2006 monetary policy is strongly affected by the Global Financial Crisis. Some authors argue that Greenspan, and also other central bankers, departed from a strict or rules-based monetary policy rule because of favourable or less favourable economic circumstances (see Friedman 2006). Other authors are more critical. Taylor (2009) argues that Greenspan kept rates too low for too long leading to the housing bubble. In the same vain, Cargill and O’Driscoll (2012) argue that interest rates lower than predicted by the Taylor rule contributed to the run-up of real estate prices, the burst of the US bubble economy, and the subsequent international financial crisis in late 2008 and early 2009. Also more recently, central banks are subject to political pressure, because to resolve the global financial crisis pressure increased on central banks to shift to an activist policy to support fiscal imbalances and prop up troubled financial institutions. In an economic symposium to honour Alan Greenspan’s service, conference participants disagreed about the extent to which monetary policy in the Greenspan era could be characterized by a simple rule (Kahn 2005). This paper contributes to this discussion.

This paper investigates whether political pressure from the Presidency and the Congress has had an effect on monetary policy in the USA in the period August 1987 until and including January 2006. Cargill and O’Driscoll (2013) conclude that Fed’s emphasis on the short run inevitably subjects them to political pressure. We contribute to the literature by developing an expectations-augmented Taylor rule and test the two main theoretical findings of political influence on macroeconomic policy that originated with Nordhaus (1975) and Hibbs (1987). These political economy models will be reviewed in the next section. Our main contribution is that we also look at the implications of the balance of power in Congress on monetary policy. If Fed’s policy is affected by political parties, then we would expect that a Republican Presidency is more inflation averse as it is often argued (see the next section). We expect this to hold, or even be stronger if both the President is a Republican and Republicans have a majority in the Senate and the House of Representatives. Our hypothesis is that if the political party of the President has control over Congress, then his or her political influence on policymakers is high. We present the econometric model of the Taylor rule in Sect. 3. In this section, we also discuss how we test our hypotheses related to political pressure. The data are presented in Sect. 4. In Sect. 5, we present the results and test whether the Fed is subject to political pressure. We complete the paper with our main conclusion in Sect. 6.

2 Literature review

The time inconsistency, or dynamic inconsistency, problem is the main theoretical driver of central bank independence. Time inconsistency occurs when a present plan is optimal for a future period but is actually suboptimal when the future period starts. The most prominent models of the dynamic inconsistency approach, which are based on game theory, are from Kydland and Prescott (1977) and Barro and Gordon (1983). Their conclusion is that the dynamic inconsistency problem leads to a bias towards higher inflation. As a result, Rogoff (1985) concludes that the central bank’s objective function should reflect stronger inflation aversion than the objective function of the society. In other words, society is better off by appointing a conservative central banker who has an objective function that deviates from the social welfare function. This makes central bank independence theoretically a preferred option (Taylor 2013). We refer to Hayo and Hefeker (2002) for a critical review of the literature.

In this paper, we focus on political pressure on monetary and fiscal authorities. Barro and Gordon (1983) argue that when monetary rules are in place, every period the policy maker is tempted to cheat on the monetary rules in order to benefit from inflation shocks. A politician wants to engage in monetary policy and fiscal policy in order to satisfy his own or his constituents’ preferences instead of choosing the optimal solution for society as a whole. One of the possible arguments for choosing a suboptimal solution is mentioned by Nordhaus (1975), who argues that politicians only care about staying in the office. Kiewiet and Rivers (1984) find a relationship between the actual economic performance and upcoming elections. The authors claim that voters are more likely to support the incumbent party when the economic situation is more favourable. Consequently, politicians might try to influence the behaviour of the central bank. The main assumption of Nordhaus’ (1975) model is that voters are not forward looking and do not have any memory and therefore can be systematically fooled. Nordhaus’ (1975) model led to the creation of a political business cycle, where the incumbent reduces unemployment before the elections, by stimulating the economy, and will fight inflation right after the elections by causing a recession. Although the outcomes of this model became quite famous, the main critique is based on the assumption that voters are not rational. However, even with rational voters Cukierman and Meltzer (1986) and Rogoff and Sibert (1988) arrived at similar conclusions. In Rogoff and Sibert (1988), the incomplete information of voters on the competence of policy makers causes the cycle, while in Cukierman and Meltzer (1986) policymakers and voters have different information about shocks. However, in many econometric studies on political business cycles, such as Alesina et al. (1997) and Faust and Irons (1999), there is little support for increasing economic activity prior to elections in the USA (see Drazen 2001 for a review).

There is also a different view on why politicians would like to deviate from the optimal solution. Hibbs (1987) argues that there are ideological differences between parties, which lead to partisan politics creating macroeconomic cycles. For the USA, his main assumption was that Democratic voters are poor and labourers, while the Republican voters are rich and capitalists. In addition, he claims that expansionary fiscal and monetary policy will lead to income redistribution from the rich to the poor. Therefore, Hibbs concludes that the Democrats would be more tolerant to higher inflation rates, while the Republicans would be more inflation averse. Alesina (1987) models the partisan approach of Hibbs (1987) in a rational world, where elections create uncertainty because the rational economic agents do not know which party will win. As a result, this model predicts only differences at the beginning of the term in office of the new party. In the case of the USA, it predicts that if the Republicans win the election, there will be low money growth and a recession while economic growth and high money growth will be observed when the Democrats win the election. Alesina and Sachs (1988) empirically confirm the findings of Alesina (1987).

Although the election driven monetary cycles give mixed results, there is more positive empirical evidence for the partisan theory. Chappell et al. (1993) find that the Presidents exerted their partisan’s influences in the Presidential appointments with the Federal Open Market Committee (FOMC). Democrats’ appointees of the FOMC are less strict when it comes to monetary policy compared to Republicans. Moreover, Chappell and Keech (1986) find that money growth is systematically higher under Democratic Presidents, which implies that Democrats seem to care less about inflation. Furthermore, Caporale and Grier (1998) state that with Republican Presidents there is significantly tighter monetary policy. In accordance with Caporale and Grier (1998), Corder (2006) claims that with a backward-looking Taylor rule the Fed is more an inflation fighter with Republicans in the White House. Based on the empirical studies, it seems that the President has partisan influence on Fed decision-making. In this paper, we take a novel approach since we do not only consider the political affiliation of the President but also consider the balance of power in Congress which we argue increases the influence of the President on policy makers.

3 Economic model

3.1 The expectations-augmented Taylor rule

To test the political monetary cycle theory and the partisan theory, we use a modified Taylor rule model for Fed’s behaviour. The rationale behind the standard rule is that when the inflation exceeds its target or when the output gap is positive, the nominal interest rate has to be increased in order to reduce inflationary pressure. If the opposite occurs, the rule recommends a lower nominal short-term interest rate in order to stimulate consumption and investment.

Although Taylor (1993) shows that the rule describes the federal funds rate quite accurate in the period 1987–1992, there are some arguments why the original rule might not accurately describe the behaviour of a central bank. First of all, the two main objectives of the Fed, referred to as the FOMC’s dual mandate, are full employment and price stability. Therefore, the output gap might be less relevant for the Fed than the unemployment gap (see also Orphanides 2002; Mehra and Sawhney 2010). However, there is no consensus about what the output measure should be (see Check 2015). Secondly, Svensson (2003) states that even if the central bank’s objective is to stabilize inflation and output a simple Taylor rule will be suboptimal. The reason is that the impact of interest rate changes on inflation and output (or unemployment) comes with a lag. Therefore, Svensson (2003) argues that the value of the instrument has to be set consistently with the inflation target and output forecasts allowing the use of judgement and what he calls extra-model information. In other words, the central bank’s behaviour should be forward looking. Indeed, forecasts have always played an important role in monetary policy decisions as Greenspan explains in his semiannual Testimony before the Committee on Banking and Financial Services, for the US House of Representatives (July 22, 1999). Besides this theoretical argument, there is also a practical argument, namely that actual inflation and output are not known when the Fed sets its federal funds rate target, only estimates are available. As a result, the rule should be based on expected values instead of the realized values. Moreover, the series for actual inflation, output, and unemployment are frequently adjusted as better estimates become available. Using expected values based on surveys implies that we use sequential information sets that are actually available as history unfolds (real-time data, see also Mehra and Minton 2007; Mehra and Sawhney 2010). Orphanides (2001) concludes that “...analysis of monetary policy rules based on data other than what is available to policy makers in real time may be difficult to interpret...” [Orphanides 2001 p 984]. Finally, a well-observed behaviour of the Fed is commonly known as interest rate smoothing. Interest rate smoothing reduces the variability of interest rate changes. Following Sack and Wieland (2000), the main reasons for interest rate smoothing are to avoid measurement errors in real-time data of key macroeconomic variables, reduce uncertainty about outcomes of relevant structural parameters, and facilitate the forward looking expectations of agents in the market. Woodford (1999) claims that interest rate smoothing is a condition for optimal monetary policy. Although interest rate smoothing is widely accepted, the standard Taylor rule does not allow for this. Partial adjustment models that are often applied to model interest rate smoothing have the drawback of serially correlated errors that bias the least squares standard errors. To avoid this, we model interest rate smoothing in our expectations-augmented Taylor rule by applying Generalized Least Squares with first-order autocorrelation coefficient \(\rho \):

Here, \(i_t \) represents the nominal short-term interest rate, \(\pi _t\) is the inflation rate, \(\pi ^{*}\) is the (fixed) target level of the inflation rate, \(u_t \) is the unemployment rate, \(u_t^*\) is the natural unemployment rate. \(E_{t}\) denotes expectations available at time t, and \(\varepsilon _{t}\) is a random error term. The inflation target of the Fed will be assumed to be 2% over the entire period. This assumption is in accordance with Taylor (1993). We add dummy variables and interaction terms of these dummy variables with the inflation term and the unemployment gap to test the political pressure theories of Hibbs (1987) and Nordhaus (1975).

The expectations with regard to the inflation rate and the unemployment rate are available to the Fed before the Fed takes a decision on the interest rate. We assume that the interest rate the Fed sets at time t is not affecting expectations about future rates of inflation and unemployment. Despite the fact that the Fed recently offers guidance for large, complex bank holding companies we do not think reverse causation is an issue in the sample period we use.

3.2 Political pressure

We test the political monetary cycle theory and the partisan theory by adding dummy variables and interaction terms that reflect these theories (this will be discussed below):

If the dummy \(D_{t}\) takes the value 0, Eq. (2) reduces to Eq. (1), and \(\alpha =\alpha _{0}\) and \(\beta =\beta _{0}\). The coefficients \(\alpha _{1}\) and \(\beta _{1}\) measure the impact of the dummy variables on the dependent variable: if the dummy \(D_{t}\) takes the value 1, the effect of expected deviation of the inflation rate from its fixed target and the expected unemployment gap on the federal funds rate is \(\alpha =\alpha _{0} + \alpha _{1}\) and \(\beta =\beta _{0} + \beta _{1}\), respectively. We use different dummy variables to test the different theories.

As already mentioned before, the political monetary cycle is based on the concept of an economic boost before the election and a recession after the election with no difference with respect to the partisan affiliation of the incumbent. In order to test this theory, we construct two election (0, 1) dummies: a p-months before-election dummy (\(B_{p})\) and a p-months after-election dummy (\(A_{p})\). The length of the before-election and after-election periods p is three to nine months. In the next section, we discuss how we construct the dummy variables in detail. Following the theory, an economic boost before the election would let the Fed react less to inflation and more to the unemployment gap. On the other hand, after the elections the Fed should be less responsive to the unemployment gap and be more inflation averse.

To test the partisan theory, we construct a partisan-dummy P with the value of 1 when a Democrat President is in the office while it will be 0 when a Republican President is in charge. Also we construct dummies for democratic control in the US Senate (S), democratic control in the House of Representatives (H), democratic control in Congress (C), and democratic control in Congress together with a democratic President in office (\(D\times C)\). The partisan theory describes that Republicans are more inflation avers while the Democrats care more about unemployment. Our tests will reveal whether there is significant pressure of the incumbent on the Fed to change their behaviour towards the federal funds rate. The partisan theory indicates that Republicans are more inflation avers while the Democrats care more about unemployment. However, when the Fed is completely independent from the White House, both theories should be rejected.

4 Data

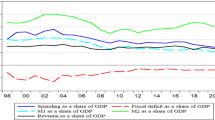

We are analysing political pressure for the period August 1987 until and including January 2006. In this period, the Fed was led by Alan Greenspan. When we discuss the results in the next section, we also extend the sample period to include the period in which Volcker was Chairman of the Fed. Table 4 in Appendix 1 gives a description of the time series used in this paper. The effective federal funds rate is from the Board of Governors of the Federal Reserve System. These are annualized monthly averages based on daily figures. The survey of the University of Michigan has been used to obtain the expected yearly inflation rate for every month. The expected 12-month ahead inflation rate is less volatile than the actual annual inflation rate as is shown in Fig. 1.

The quarterly expected unemployment rate is from a survey of professional forecasters of the Federal Bank of Philadelphia. Figure 2 reveals that the expected 4-quarter ahead forecast of unemployment underestimates the peaks and troughs in the actual unemployment rate. These peaks and troughs in the actual unemployment rate for the USA correspond closely to the peaks (July 1990 and March 2001) and troughs (March 1991 and November 2001) in the US business cycle as dated by the National Bureau of Economic Research.

Instead of assuming a constant natural unemployment rate of for instance 6%, we use the Hodrick–Prescott filter because the Fed might target a different rate under different economic circumstances. The quarterly expected unemployment rate is decomposed in a monthly trend component, which we interpret as the expected natural rate of unemployment, and a cyclical component using a state-space approach of the Hodrick–Prescott filter using a wider sample (July 1954 until and including June 2013) to avoid the end-point bias. We denote by the expected unemployment gap the difference between the median 4-quarter ahead forecast and the smoothed monthly trend component from the Hodrick–Prescott filter. Finally, the target level of the inflation is set at 2% annually, and the expected inflation gap is defined as the median expected price change in the next 12 months minus 2.

In our analysis, we focus on the Greenspan era: August 1987 until January 2006. In this period, there were five elections with 8 years of Democrats (Clinton administrations, February 1993–January 2001) and 10.5 years of Republicans in the office (Reagan, February 1981–January 1989; G.H.W. Bush, February 1989–January 1993; and G.W. Bush, February 2001–January 2009). Table 1 shows the balance of power between Congress and the President. The balance of power in Congress in this period shifted from Democrats to Republicans at the end of 1994 with a short interruption in the Senate in the period June 2001–December 2002. Only during the \(103{\mathrm{rd}}\), the \(108{\mathrm{th}}\), and the \(109{\mathrm{th}}\) Congress did the incumbent President have full support from both the Senate and the House of Representatives. In the periods January 1987–December 1992 and January 1995–December 2000, the President faced a Congress from the other party. In the periods January 1987–December 1992, January 1995–December 2000, and June 2001–December 2002, a situation that may be called a “hung” Congress or Government—where the Senate, the House of Representatives, or Presidency are not dominated by a single party—occurs.

To test the political pressure hypotheses, we construct dummy variables. The dummy variable P has a value of 1 in the months in which the Democrats are in office and zeroes for Republicans. Furthermore, we constructed two (0, 1) election dummy variables: \(B_{p}\) and \(A_{p}\) have ones p months before, respectively, after the elections, and 0 elsewhere. The length p for the lags and leads is 3, 6, and 9 months.

5 Results and discussion

The base model presented in Eq. (2) is estimated using maximum likelihood. We set the coefficients at initial values, although the results are not sensitive to the choice of initial values. The first-order autocorrelation coefficient is initially chosen close to the first-order autocorrelation coefficient of the federal funds rate (0.9). The initial value for the nominal target interest rate of 4% is based on a real interest rate of 2 and 2% inflation. The estimation results of the base model for the period August 1987–January 2006 are shown in the first column of Table 2. In Appendix 2, we show the results including the period in which Volcker was Chairman of the Fed under Presidents Carter and Reagan.

Table 2 shows that in the base model for the period August 1987–January 2006 the weights in the Taylor rule are as expected. The coefficient \(\alpha \) that measures the reaction of the Fed to deviations of expected inflation from its target value is 0.25 (p value = 0.004) which is significantly lower than 0.5 (p value = 0.004) that Taylor (1993) proposes. The coefficient \(\beta \) that measures the reaction of the Fed to deviations in the expected unemployment gap is \(-0.57\) (p value = 0.049). Note that in the Volcker–Greenspan period the coefficient for the expected inflation gap is not significantly different from zero at the usual levels of significance (see Table 5 in Appendix 2).

In this section, we test the existence of the political monetary cycle and partisan affiliation for the period in which Greenspan served as Chairman of the Fed of the USA from August 1987 to January 2006 using Eq. (2). We add election dummies (before and after elections dummies with different leads and lags) to test for election cycles. Table 2 shows that including election dummies with leads and lags of 3, 6, or 9 months does not affect these results of the base model since none of the coefficients for the dummy variables and the interaction terms differ from zero at the usual levels of significance. We conclude that there is no support for election driven cycles in the Taylor rule in the period August 1987 to January 2006. If we apply the model to the period from August 1979 to January 2006, we find some evidence for election driven cycles (see Table 5 in Appendix 2). Six months before elections the Fed attaches a higher weight to reducing unemployment, while six months after elections emphasis is on reducing inflation.

To find evidence for a partisan effect, we add dummies for political affiliation of the incumbent President and the power balance in Congress as in Eq. (2). Table 3 only shows the coefficients for the deviation of expected inflation to the target inflation rate (\(\alpha \)) and the coefficient for the expected unemployment gap (\(\beta \)). We can conclude that in our expectations-augmented Taylor rule there are deviations from rules-based monetary policy (see Friedman (2006)). More specifically, from Table 3 we conclude that

-

(i)

In the base model (Table 3, Row a), the Taylor rule was followed with the weight on expected unemployment being twice as high as the weight in expected inflation. This resembles the result of Corder (2006) for the Greenspan period. Corder (2006) reports similarly sized coefficients, but he uses the output gap.

-

(ii)

Under a Republican President (Table 3, Row b), the coefficients of the Taylor rule are the same as in the base model. However, the coefficient of the expected unemployment gap is not significant at 10%. Under a Democratic President, the weights on both the expected inflation gap and the expected unemployment gap are statistically not different from zero at the usual levels of significance. This result favours the hypothesis that Republicans are more inflation avers.

-

(iii)

In a Democratic controlled Congress (Table 3, Row c), which occurs in period January 1987–December 1994, emphasis was predominantly on reducing inflation, whereas in a non-Democratic controlled Congress emphasis shifted to reducing unemployment. The latter is also observed in a Republican controlled Congress (Table 3, Row d). These conflicting results from a partisan point of view can be explained by differences in the economic situation.

-

(iv)

When the Republicans faced a minority in either the Senate or the House of Representatives (Table 3, Row d), emphasis was on reducing inflation as in the Democratic controlled Congress (Table 3, Row c).

-

(v)

In periods in which the Democrats had full control in Congress (Table 3, Row e), the results are similar to those with a Democratic President in office: both coefficients do not differ from zero at the usual levels of significance. In the short period that Democrats were in full control, from January 1993 to January 1995, expected inflation was fairly stable and unemployment was expected to fall.

-

(vi)

Interestingly, and perhaps surprisingly, in the period from January 2001 until December 2006 (with a short interruption in 2001) in which Republicans had full control (defined as a situation where the President is of the same party as the majority in Congress) the weight on the expected unemployment is high and significantly negative (Table 3, Row f). In this period, unemployment was expected to rise while inflation was low. This result indicates that it is the differences in economic situations that matters for the design of monetary policy rather than political affiliation (cf. Friedman 2006).

-

(vii)

With a “hung” Congress (Table 3, Row g), where the President, the majority in the Senate and in the House of Representative are not all from the same party, preference is given to reducing inflation. If there is no hung Congress, the outcomes resemble those of full Republican control with a strong emphasis on reducing unemployment.

Our main conclusion is that we find conflicting results if we compare periods with a Democratic President and a Republican President, and periods with Republican control of Congress and Democratic control of Congress. We conclude that these differences are not explained by different political points of view. The main conclusion is that monetary policy under Greenspan is discretionary and based on the actual and expected economic conditions rather than being based on a fixed rule. The conclusions are less ambiguous if we include the Volcker period in our analysis. For the extended period, we observe that a Democratic Presidency or a Democratic Congress more closely follows the prescription of the Taylor rule (see Table 6 in Appendix 2).

There are some limitations of our study. First of all, the inflation target of 2% of the Fed may not be always representing the actual target. Secondly, there may be omitted variables such as financial stress indicators, which are not taken in account in the model explicitly.

6 Conclusion

In order to test political pressure on monetary policy, the Fed’s reaction function is modelled for the period August 1987–January 2006 by an expectations-augmented Taylor rule specification.

We deviate from the standard Taylor rule in three aspects. Firstly, motivated by the Fed’s dual mandate (full employment and price stability) we replace the output gap in the Taylor rule with the unemployment gap. Secondly, the Taylor rule is forward looking since we use expected values for inflation and unemployment. Finally, we allow for interest rate smoothing. This expectations-augmented Taylor rule is estimated for the period August 1987–January 2006, and we test two political macroeconomic theories. The first is to test for evidence of an election driven monetary cycle in the Taylor rule, and the second is whether partisan affiliation of the President and Congress matters.

We found no evidence for an opportunistic election driven cycles because election dummies with various leads and lags are statistically not significant. Also, we did not find evidence of an effect of partisan affiliation. When a Republican President is in office, emphasis was on reducing inflation as theory suggests, but in a Republican controlled Congress focus was on reducing unemployment. The same result was found if the President is Republican and Republicans face a majority in Congress. In these periods, in the 2000s the economic situation was more turbulent. This seems to confirm the conclusion by Friedman (2006) that the Fed under Greenspan departed from a strict policy rule because of less favourable, economic conditions. Furthermore, we show that the Fed has been less inflation avers and less unemployment avers when a Democrat President is in office. On the other hand, we show that in a Democratic controlled Congress (January 1987–December 1994) emphasis was predominantly on reducing inflation. To explain these results, which are not consistent with partisan theories, again we conclude that it is the economic situation that drives our results. This observation is in line with Kahn’s (2005) statement that “...Greenspan’s approach to monetary policy was described as discretionary, flexible, and based on a deep understanding of economic data and business conditions...”

References

Alesina A (1987) Macroeconomic policy in a two-party system as a repeated game. Q J Econ 102(3):651–678

Alesina A, Sachs J (1988) Political parties and the business cycle in the United States, 1948–1984. J Money Credit Bank 20(1):63–82

Alesina A, Roubini N, Cohen GD (1997) Political cycles and the macroeconomy. The MIT Press, Cambridge

Barro R, Gordon D (1983) Rules, discretion and reputation in a model of monetary policy. J Monet Econ 12(1):101–121

Caporale T, Grier KB (1998) A political model of monetary policy with application to the real fed funds rate. J Law Econ 41(2):409–428

Cargill TF, O’Driscoll GP (2012) Measuring central bank independence, policy implications, and federal reserve independence. Paper presented at the American Economic Association

Cargill TF, O’Driscoll GP (2013) Federal reserve independence: reality or myth? Cato J 33(3):417–435

Chappell HW, Keech W (1986) Party differences in macroeconomic policies and outcomes. Am Econ Rev 76(2):71–74

Chappell HW, Havrilesky TM, McGregor RR (1993) Partisan monetary policies: presidential influence through the power of appointment. Q J Econ 108(1):185–218

Check A (2015) Interest rate rules in practice: the Taylor rule or a tailor-made rule? Job market paper, 9 Nov 2015 (unpublished)

Corder JK (2006) Partisan politics and fed policy choices: a Taylor rule approach. Paper presented at the annual meeting of the Midwest Political Science Association, Palmer House Hilton, Chicago, Illinois, 20 Apr, 2006

Cukierman A, Meltzer AH (1986) A theory of ambiguity, credibility, and inflation under discretion and asymmetric information. Econometrica 54(5):1099–1128

Drazen A (2001) The political business cycle after 25 years. In: Bernanke BS, Rogoff K (eds) NBER Macroeconomics annual 2000, vol 15., The MIT PressCambridge, MA, pp 75–138

Faust J, Irons J (1999) Money, politics and the post-war business cycle. J Monetary Econ 43(1):61–89

Friedman BM (2006) The Greenspan era: discretion, rather than rules. Am Econ Rev 96(2):174–177

Hayo B, Hefeker C (2002) Reconsidering central bank dependence. Eur J Polit Econ 18(4):653–674

Hibbs D (1987) The American political economy: macroeconomics and electoral politics. Harvard University Press, Cambridge

Kahn GA (2005) The Greenspan era: lessons for the future-a summary of the bank’s 2005 economic symposium. Econ Rev 2005(QIV):35–45

Kiewiet DR, Rivers D (1984) A retrospective on retrospective voting. Polit Behav 6(4):369–393

Kydland FE, Prescott EC (1977) Rules rather than discretion: the inconsistency of optimal plans. J Polit Econ 85(3):473–491

Mehra YP, Minton BD (2007) A Taylor rule and the Greenspan era. Econ Q 93(3):229–250

Mehra YP, Sawhney B (2010) Inflation measure, Taylor rules, and the Greenspan-Bernanke years. Econ Q 96(2):123–151

Nordhaus WD (1975) The political business cycle. Rev Econ Stud 42(2):169–190

Orphanides A (2001) Monetary policy rules based on real-time data. Am Econ Rev 91(4):964–985

Orphanides A (2002) Monetary policy rules and the great inflation. Am Econ Rev 92(2):115–120

Rogoff K (1985) The optimal degree of commitment to an intermediate monetary target. Q J Econ 100(4):1169–1189

Rogoff K, Sibert S (1988) Elections and macroeconomic policy cycles. Rev Econ Stud 55(1):1–16

Sack B, Wieland V (2000) Interest-rate smoothing and optimal monetary policy: a review of recent empirical evidence. J Econ Bus 52(1 and 2):205–228

Svensson LEO (2003) What is wrong with Taylor rules? Using judgment in monetary policy through targeting rules. J Econ Lit 41(2):426–477

Taylor JB (1993) Discretion versus policy rules in practice. Carnegie Rochester Conf Ser 39(1):195–214

Taylor JB (2009) Getting off track: how government actions and interventions caused, prolonged, and worsened the financial crisis. Hoover Institute Press, Stanford University, Washington

Taylor JB (2013) The effectiveness of central bank independence vs. policy rules. Bus Econ 48(3):155–162

Woodford M (1999) Optimal monetary policy inertia , vol 67. Manch School, University of Manchester, pp 1–35

Acknowledgements

We thank Jan Hessel Veurink for cooperating on an earlier version of this paper. Comments by anonymous referees are gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Data: definitions and sources

See Table 4.

Appendix 2: Results for the period August 1979–January 2006

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Kuper, G.H. The powers that are: central bank independence in the Greenspan era. Empir Econ 54, 485–499 (2018). https://doi.org/10.1007/s00181-016-1225-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1225-y