Abstract

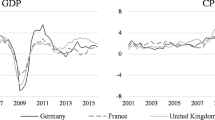

This paper proposes the use of Bayesian model averaging (BMA) as an alternative tool to forecast GDP relative to simple bridge models and factor models. BMA is a computationally feasible method that allows us to explore the model space even in the presence of a large set of candidate predictors. We test the performance of BMA in now-casting by means of a recursive experiment for the euro area and the three largest countries. This method allows flexibility in selecting the information set month by month. We find that BMA-based forecasts produce smaller forecast errors than standard bridge model when forecasting GDP in Germany, France and Italy. At the same time, it also performs as well as medium-scale factor models when forecasting Eurozone GDP.

Similar content being viewed by others

Notes

Based on the methodology used and illustrated in the paper, the computation of a forecast requires just a few minutes.

In the latest version of the program, the largest possible model is itself the result of a pre-screening process that erases from the information set the irrelevant variables using a loose significance level.

In the website of PcGets (http://www.pcgive.com/pcgets/), Hendry and Krolzig refute this critique stating that “a unique outcome results, with the property that it is congruent and undominated, resolving any ’path dependence’ critique: since PcGets ensures a unique outcome, the path does not matter”.

As emphasized by Diron (2008) for euro area real GDP, the pseudo real-time exercise produces reliable assessments of the forecasting models under analysis.

For the sake of simplicity, we decided to consider the second month of the quarter as it is the one in which national accounting data are released. In general, we believe that this represents the typical structure of the edge of the data in each month, where industrial production and other real data are updated two or three months behind the current month and survey-based data and financial data are up to date.

The current quarter now-cast in the first month takes as unknown the GDP growth in the previous quarter and uses the back-casted value.

A possible exception to this result is the OECD CLI, which is sometimes ex-post revised in order to improve its performance, as it is common for composite coincident and leading indexes. Empirically, the worse real-time than in-sample or pseudo real-time forecasting performance of CLIs was emphasized by Diebold and Rudebusch (1991). More recently, Lahiri and Yang (2015) also found that the replacement of M2 with the Leading Credit Index in the Leading Economic Indicator (LEI) produced by the Conference Board improved its forecasting performance.

The inclusion probabilities series not reported are available upon request.

For the sake of completeness, we also used composite PMI, retrieving no improvements in the model forecast accuracy relative to the model with only its manufacturing counterpart.

See, e.g., Andreou et al. (2011).

We set the VAR in the frequency common to all variables included. The reduction of the monthly variables to quarterly frequency is done via quarterly averaging.

The housing sector in Germany has shown wide fluctuations due to particularly uncommon weather conditions in some periods of the sample considered, which have caused large swings in GDP q–o–q growth.

Recently Hendry and Hubrich (2011) have shown that using disaggregated forecast may be less accurate than forecasting directly the aggregate through lagged aggregate information or using disaggregate information in direct model.

The model is fed with industrial production, new orders index, retail sales, extra EMU exports, consumers’ confidence index, economic sentiment indicator for euro area and IFO business confidence indicator for Germany. All variables used in the factor models were also employed in the BMA bridge models.

References

Andreou E, Ghysels E, Kourtellos A (2011) Forecasting with mixed-frequency data. In Clements M, Hendry D (eds) Oxford Handbook of Economic Forecasting, pp 225–245

Baffigi A, Golinelli R, Parigi G (2004) Bridge models to forecast the Euro area GDP. Int J Forecast 20(3):447–460

Bates JM, Granger CWJ (1969) The combination of forecasts. Oper Res Quart 20:451–468

Bernanke BS, Boivin J (2003) Monetary policy in a data-rich environment. J Monet Econ 50:525–546

Bulligan G, Golinelli R, Parigi G (2010) Forecasting monthly industrial production in realtime: from single equations to factor-based models. Empir Econ 39(2):303–336

Camacho M, Perez-Quiros G (2010) Introducing the EURO-STING: short term indicator of euro area growth. J Appl Econom 25(4):663–694

Diebold FX, Rudebusch GD (1991) Forecasting output with the composite leading index: a real time analysis. J Am Stat Assoc 86:603–610

Diron M (2008) Short-term forecasts of Euro Area real GDP growth. An assessment of real-time performance based on vintage data. J Forecast 27(5):371–390

Estrella A, Mishkin FS (1996) The Yield curve as a predictor of U.S. recessions. Curr Issue Econ Finance 2(7):1–6

Fernandez C, Ley E, Steel MFJ (2001a) Model uncertainty in cross-country growth regressions. J Appl Econom 16(5):563–576

Fernandez C, Ley E, Steel MFJ (2001b) Benchmark priors for Bayesian model averaging. J Econom 100:381–427

Fornari F, Lemke W (2010) Predicting recessions probabilities with financial variables over multiple horizons, European Central Bank Working Paper series, No. 1255

Ghysels E, Sinko A, Valkanov R (2007) MIDAS regressions: further results and new directions. Econom Rev 26(1):53–90

Golinelli R, Parigi G (2007) The use of monthly indicators to forecast quarterly GDP in the short run: an application to G7 countries. J Forecast 26:77–94

Golinelli R, Parigi G (2008) Real-time squared: a real-time data-set for real-time GDP forecasting. Int J Forecast 24:368–385

Granger C, Timmermann A (1999) Data mining with local specification uncertainty: a discussion of Hoover and Perez. Econom J 2:220–225

Hendry D, Hubrich K (2011) Combining disaggregate forecasts or combining disaggregate information to forecast aggregate. J Bus Econ Stat 29(2):216–227

Hendry DF, Krolzig HM (1999) Improving on “Data Mining Reconsidered” by K.D. Hoover and S.J. Perez. Econom J 2:202–219

Hoeting JA, Madigan D, Raftery AE, Volinsky CT (1999) Bayesian model averaging: a tutorial. Stat Sci 14(4):382–417

Hoogerheide L, Kleijn R, Ravazzolo F, Van Dijk HK, Verbeek M (2010) Forecast accuracy and economic gains from Bayesian model averaging using time-varying weights. J Forecast 29:251–269

Ivanova D, Lahiri K, Seitz F (2000) Interest rate spreads as predictors of German inflation and business cycle. Int J Forecast 16(1):39–58

Kinal T, Lahiri K (1984) A note on selection of regressors. Int Econ Rev 25(3):625–629

Klein LR, Sojo E (1989) Combinations of high and low frequency data in macroeconometric models. In: Klein LR, Marquez J (eds) Economics in theory and practice: an eclectic approach. Kluver, Dordrecht

Koop G (2003) Bayesian econometrics. Wiley, New York

Lahiri K (1996) Interest rate spreads as predictors of business cycles in statistical methods in finance. In: Maddala GS, Rao CR (eds) Handbook of statistics, vol 14. North Holland, Amsterdam, pp 297–315

Lahiri K, Monokroussos G (2013) Nowcasting US GDP: the role of ISM business surveys. Int J Forecast 29(4):644–658

Lahiri K, Yang L (2015) Further analysis of the conference board’s new Leading Economic Index. Int J Forecast 31(2):446–453

Lahiri K, Monokroussos G, Zhao Y (2016) Forecasting consumption: the role of consumer confidence in real time with many predictors. J Appl Econom 31(7):1254–1275

Madigan D, York J, Allard D (1995) Bayesian graphical models for discrete data. Int Stat Rev 63(2):215–232

Min C, Zellner A (1993) Bayesian and non-Bayesian methods for combining models and forecasts with application to forecasting international growth rates. J Econom 56:89–118

Palm FC, Zellner A (1992) To Combine or not to Combine? Issues of combining forecasts. J Forecast 11:687–701

Schumacher C, Breitung J (2008) Real-time forecasting of German GDP based on large factor model with monthly and quarterly data. Int J Forecast 24:386–398

Stock JH, Watson MW (2004) Combination forecasts of output growth in a seven-country data set. J Forecast 23:405–430

Zellner A (1986) On assessing prior distributions and Bayesian regression analysis with g-prior distributions. In: Goel PK, Zellner A (eds) Bayesian inference and decision techniques: essays in honour of bruno de finetti. North-Holland, Amsterdam

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank the Editor Badi Baltagi, an Associate Editor, a Referee, Antonio Bassanetti, Guido Bulligan, Michele Caivano, Silvia Fabiani, Dimitris Korobillis, Giulio Nicoletti, Mario Porqueddu, Roberto Sabbatini, Fabrizio Venditti and Francesco Zollino for helpful comments on a previous version. All remaining errors are our own responsibility.

Rights and permissions

About this article

Cite this article

Bencivelli, L., Marcellino, M. & Moretti, G. Forecasting economic activity by Bayesian bridge model averaging. Empir Econ 53, 21–40 (2017). https://doi.org/10.1007/s00181-016-1199-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1199-9