Abstract

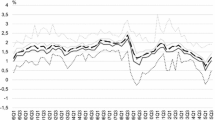

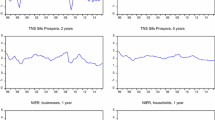

We investigate whether combining forecasts from surveys of expectations is a helpful empirical strategy for forecasting inflation in Brazil. We employ the FGV–IBRE Economic Tendency Survey, which consists of monthly qualitative information from approximately 2000 consumers since 2006, and also the Focus Survey of the Central Bank of Brazil, with daily forecasts since 1999 from roughly 250 professional forecasters. Natural candidates to win a forecast competition in the literature of surveys of expectations are the (consensus) cross-sectional average forecasts (AF). We first show that these forecasts are a bias-ridden version of the conditional expectation of inflation using the no-bias tests proposed in Issler and Lima (J Econom 152(2):153–164, 2009) and Gaglianone and Issler (Microfounded forecasting, 2015). The results reveal interesting data features: Consumers systematically overestimate inflation (by 2.01 p.p., on average), whereas market agents underestimate it (by 0.68 p.p. over the same sample). Next, we employ a pseudo out-of-sample analysis to evaluate different forecasting methods: the AR(1) model, the Granger and Ramanathan (J Forecast 3:197–204, 1984) forecast combination (GR) technique, a Phillips-curve based method, the Capistrán and Timmermann (J Bus Econ Stat 27:428–440, 2009) combination method, the consensus forecast (AF), the bias-corrected average forecast (BCAF), and the extended BCAF. Results reveal that: (i) the MSE of the AR(1) model is higher compared to the GR (and usually lower compared to the AF); and (ii) the extended BCAF is more accurate than the BCAF, which, in turn, dominates the AF. This validates the view that the bias corrections are a useful device for forecasting using surveys. The Phillips-curve based method has a median performance in terms of MSE, and the Capistrán and Timmermann (2009) combination method fares slightly worse.

Similar content being viewed by others

Notes

Prior to that, Palm and Zellner (1992) also employ a two-way decomposition to discuss forecast combination in a Bayesian and a non-Bayesian setup. But, the main focus of their paper is not on panel-data techniques, but on the usefulness of a Bayesian approach to forecasting.

One could impose additional restrictions across coefficients \(\overline{k^{h} }\) and \(\overline{\beta ^{h}}\) using the term structure of forecasts. Given stationarity of \(y_{t}\): \(y_{t}=\varepsilon _{t}+\psi _{1}\varepsilon _{t-1}+\cdots +\psi _{h-1}\varepsilon _{t-h+1}+\psi _{h}\varepsilon _{t-h}+\cdots ,\) which gives: \(\mathbb {E}_{t-\left( h-1\right) }(y_{t})= \mathbb {E}_{t-h}(y_{t})+\psi _{h-1}\varepsilon _{t-\left( h-1\right) },\) \( h=1,2,\ldots ,H,\) showing that the expectation revision \(\mathbb {E} _{t-\left( h-1\right) }(y_{t})-\mathbb {E}_{t-h}(y_{t})\) is unforecastable using information up to \(t-h\). In a GMM context, this implies additional moment restrictions across horizons if we substitute \(\mathbb {E} _{t-h}(y_{t}) \) by \(\frac{1}{N}\sum \nolimits _{i=1}^{N}\frac{f_{i,t}^{h}- \overline{k^{h}}}{\overline{\beta ^{h}}}\) and \(\mathbb {E}_{t-\left( h-1\right) }(y_{t})\) by \(\frac{1}{N}\sum \nolimits _{i=1}^{N}\frac{ f_{i,t}^{h-1}-\overline{k^{h-1}}}{\overline{\beta ^{h-1}}}\). Notice that, for large enough N, we can approximate reasonably well these conditional expectations using these averages, as proposed in Gaglianone–Issler. They did not consider these additional restrictions into GMM estimation, but that could certainly be exploited in the future.

We thank an anonymous referee for pointing this out to us.

See consumer survey: methodological features (April 2013), available at http://portalibre.fgv.br.

With this criterium, we excluded 349 observations of a total of 164,479.

The Focus survey is widely used in Brazil, and its excellence has been internationally recognized. In 2010, the survey received the Certificate of Innovation Statistics, due to a second place in the II Regional Award for Innovation in Statistics in Latin America and Caribbean, offered by the World Bank.

Since the survey had a small cross-sectional coverage (small N) in its first years, we only considered post-2003 data.

The “iterative” procedure of Hansen et al. (1996) is employed in the GMM estimation, and the initial weight matrix is the identity.

The Hodrick-Prescott (HP) filtered output gap is computed from the log real monthly GDP (IBRE/FGV).

The adopted set of instruments is slightly modified for the lower education groups (cons_educ_1_3) and the market forecasts (focus_day10; focus_day15).

The output gap is based on the seasonally adjusted IBC-BR index of economic activity. The Hodrick–Prescott (HP) filter is employed to generate the output gap in a recursive estimation scheme, that is, we re-construct the entire output gap series for each new observation added to the estimation sample along the out-of-sample exercise (and then re-estimate the Phillips curve to construct new h-step ahead forecasts). This way, we perform a “pseudo” real-time PC-forecast (based on the last available vintage of the IBC-BR).

The h-step ahead forecasts are constructed using an iterated procedure, which is trivial in the case of the AR model. In the case of the PC and h >1, we use the previous PC-forecast (from \(h-1\)), random walk forecasts for the expected and imported inflation rates and the AR(1) forecast for the output gap (autoregressive coefficient of 0.95, based on in-sample estimations).

For example, an asymmetric loss function (e.g., lin-lin) could reflect the forecaster’s different weighting scheme of positive forecast errors vis-à-vis the negative ones. In this setup, a non-trivial forecast bias may arise, for instance, reflecting the asymmetric loss function (instead of lack of rationality). For further details, see Batchelor (2007) which presents several arguments consistent with forecasters having a nonquadratic loss function.

In each test, with disaggregated data (individual OLS regressions), we only considered survey participants with more than 20 available forecasts.

We leave the rationality tests for market forecasters for future research, since the focus here is on leveraging the consumer data for forecasting purposes.

Results in Table 7 reveal that there might be some useful information (for forecasting purposes) embodied in the consumer consensus forecast. Also, in forming the consensuses, one might consider, for instance, taking into account only those rational consumers when forming a “filtered-consensus” forecast, avoiding mixing information from the non-rational forecasters. We leave this for future research.

Regarding income level 1, the % of rational consumers jumps from 30 % (at \(\tau =0.3\)) to 62 % (at \(\tau =0.7\)).

References

Ang A, Bekaert G, Wei M (2007) Do macro variables, asset markets or surveys forecast inflation better? J Monet Econ 54:1163–1212

Baltagi BH (2013) Panel Data Forecasting. In: Elliott G, Timmermann A (eds) Handbook of economic forecasting, vol 2. Elsevier, New York, pp 995–1024

Batchelor R (2007) Bias in macroeconomic forecasts. Int J Forecast 23:189–203

Bates JM, Granger CWJ (1969) The combination of forecasts. Oper Res Q 20:309–325

Capistrán C, Timmermann A (2009) Forecast combination with entry and exit of experts. J Bus Econ Stat 27:428–440

Carvalho FA, Minella A (2012) Survey forecasts in Brazil: a prismatic assessment of epidemiology, performance, and determinants. J Int Money Finance 31(6):1371–1391

Christoffersen PF, Diebold FX (1997) Optimal prediction under asymmetric loss. Econ Theory 13:808–817

Clark TE, West KD (2007) Approximately normal tests for equal predictive accuracy in nested models. J Econom 138:291–311

Coibion O, Gorodnichenko Y (2012) What can survey forecasts tell us about information rigidities? J Polit Econ 120:116–159

Cordeiro YAC, Gaglianone WP, Issler JV (2015) Inattention in individual expectations. Working paper no. 395, Central Bank of Brazil

Davies A, Lahiri K (1995) A new framework for analyzing survey forecasts using three-dimensional panel data. J Econom 68:205–227

Diebold FX, Mariano RS (1995) Comparing predictive accuracy. J Bus Econ Stat 13:253–263

Elliott G, Komunjer I, Timmermann A (2008) Biases in macroeconomic forecasts: irrationality or asymmetric loss? J Eur Econ Assoc 6(1):122–157

Elliott G, Timmermann A (2004) Optimal forecast combinations under general loss functions and forecast error distributions. J Econom 122:47–79

Faust J, Wright JH (2013) Forecasting inflation. Handbook of economic forecasting, vol 2A, Chap 1, pp 3–56. Ed. Elsevier B.V

Gaglianone WP, Giacomini R, Issler JV, Skreta V (2016) Incentive-driven inattention. Getulio Vargas Foundation, Mimeo

Gaglianone WP, Issler JV (2015) Microfounded forecasting. Ensaios Econômicos EPGE no. 766, Getulio Vargas Foundation

Gaglianone WP, Lima LR (2012) Constructing density forecasts from quantile regressions. J Money Credit Bank 44(8):1589–1607

Gaglianone WP, Lima LR (2014) Constructing optimal density forecasts from point forecast combinations. J Appl Econom 29(5):736–757

Gaglianone WP, Lima LR, Linton O, Smith DR (2011) Evaluating value-at-risk models via quantile regression. J Bus Econ Stat 29(1):150–160

Genre V, Kenny G, Meyler A, Timmermann A (2013) Combining expert forecasts: can anything beat the simple average? Int J Forecast 29:108–121

Granger CWJ (1969) Prediction with a generalized cost of error function. Oper Res Q 20(2):199–207

Granger CWJ, Ramanathan R (1984) Improved methods of combining forecasting. J Forecast 3:197–204

Hansen LP (1982) Large sample properties of generalized method of moments estimators. Econometrica 50:1029–1054

Hansen LP, Heaton J, Yaron A (1996) Finite-sample properties of some alternative GMM estimators. J Bus Econ Stat 14:262–280

Issler JV, Lima LR (2009) A panel data approach to economic forecasting: the bias-corrected average forecast. J Econom 152(2):153–164

Lahiri K, Peng H, Sheng X (2015) Measuring uncertainty of a combined forecast and some tests for forecaster heterogeneity. CESifo working paper no. 5468

Marques ABC (2013) Central Bank of Brazil’s market expectations system: a tool for monetary policy. Bank for International Settlements, vol 36 of IFC Bulletins, pp 304–324

Mincer JA, Zarnowitz V (1969) The evaluation of economic forecasts. In: Mincer Jacob (ed) Econmic forecasts and expectations. National Bureau of Economic Research, New York

Palm FC, Zellner A (1992) To combine or not to combine? Issues of combining forecasts. J Forecast 11(8):687–701

Patton AJ, Timmermann A (2007) Testing forecast optimality under unknown loss. J Am Stat Assoc 102(480):1172–1184

Phillips PCB, Moon HR (1999) Linear regression limit theory for nonstationary panel data. Econometrica 67:1057–1111

Stock J, Watson M (2002a) Macroeconomic forecasting using diffusion indexes. J Bus Econ Stat 20:147–162

Stock J, Watson M (2002b) Forecasting using principal components from a large number of predictors. J Am Stat Assoc 97(460):1167–1179

Stock J, Watson M (2006) Forecasting with many predictors. In: Elliott G, Granger CWJ, Timmermann A (eds) Handbook of economic forecasting. North-Holland, Amsterdam, pp 515–554

Stock J, Watson M (2009) Phillips curve inflation forecasts. In: Fuhrer Jeffrey, Kodrzycki Yolanda, Little Jane, Olivei Giovanni (eds) Understanding inflation and the implications for monetary policy. MIT Press, Cambridge

Timmermann A (2006) Forecast combinations. In: Elliott G, Granger CWJ, Timmermann A (eds) Handbook of economic forecasting. North-Holland, Amsterdam, pp 135–196

West K (1996) Asymptotic inference about predictive ability. Econometrica 64:1067–1084

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors thank the editor Badi H. Baltagi, the anonymous referee and the seminar participants of the XVIII Annual Inflation Targeting Seminar of the Banco Central do Brasil for the helpful comments and suggestions. The views expressed in the paper are those of the authors and do not necessarily reflect those of the Banco Central do Brasil (BCB) or of Getulio Vargas Foundation (FGV). We are also grateful to the Investor Relations and Special Studies Department (Gerin) of the BCB and to the Brazilian Institute of Economics (IBRE) of the FGV for kindly providing the data used in this paper. The collection and manipulation of data from the Market Expectations System of the BCB is conducted exclusively by the staff of the BCB. Gaglianone, Issler and Matos gratefully acknowledge the support from CNPq, FAPERJ, INCT and FGV on different grants. The excellent research assistance given by Francisco Luis Lima, Marcia Waleria Machado and Andrea Virgínia Machado are gratefully acknowledged.

Appendix

Appendix

In the Appendix, Tables 8–11, we provide complementary empirical evidence supporting some of the results presented in the text.

Rights and permissions

About this article

Cite this article

Gaglianone, W.P., Issler, J.V. & Matos, S.M. Applying a microfounded-forecasting approach to predict Brazilian inflation. Empir Econ 53, 137–163 (2017). https://doi.org/10.1007/s00181-016-1163-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1163-8