Abstract

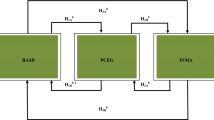

This paper examines the causal relationships between insurance market activities, economic growth, financial depth, and government consumption expenditure. We utilize a panel vector autoregressive model to test Granger causality for 18 middle-income countries over 1980–2012—a group that has not been previously studied in this literature. The results show a robust long-run economic relationship between insurance market activities, economic growth, financial depth, and government consumption expenditure. Moreover, in the short run, we find bidirectional causality between financial depth and economic growth, between financial depth and government consumption expenditure, and between insurance market activities and government consumption expenditure. Unidirectional causality exists from insurance market activities to economic growth, from financial depth to insurance market activities, and from government consumption expenditure to economic growth.

Similar content being viewed by others

Notes

Financial depth, measured as the ratio of broad money supply to gross domestic product, is one of many possible measures of financial development.

The importance of insurance market business is not only limited to risk absorption, allocation and transfer but also the mobilization of funds for use by financial markets to induce investment and growth (see, for instance, Alhassan and Fiador 2014).

Our study uses different levels of insurance market activities, both by density and premiums (see below).

Most of what we have learned relates to banking systems and securities markets, with insurance receiving only a passing review. Nevertheless, while insurance, banking and securities markets are interrelated, insurance market satisfy or perform somewhat different economic functions than do other financial services and in turn require particular conditions to succeed and to make a full economic contribution (Brainard 2008).

Beck and Demirguc-Kunt (2009) find that life and non-life insurance penetration increases with the income level of the country. This trend is much stronger with life insurance as it is more income elastic than non-life (business) insurance. Hence, a consideration of financial depth of a nation is likely an important consideration for research.

Outreville (2013) summarizes the macroeconomic factors that drive the insurance market; they include economic factors, demographic factors, social and cultural factors, and institutional and market structure factors. However, our study is mostly restricted to economic and institutional and market structure factors. Specifically, we include the three specific factors: economic growth, financial depth and government consumption expenditure. The inclusion of these three factors is mostly due to their relative importance in our selected countries.

We cover two different aspects of insurance market activities: insurance penetration and insurance density, both for life and non-life. The choice of these two broad insurance indicators is determined by the following factors: broad coverage of this sector, data availability and previous use in various studies. It should be noted that there are likely to be different effects on economic growth from life and non-life insurance markets given that these two types of insurance indicators protect households and corporations from different kinds of risk (Liu et al. 2014b).

A detailed description of the construction of a composite index such as this, using principal component analysis, is available in Pradhan et al. (2014a).

MACED are used to denote financial depth and government consumption expenditure.

Various studies have paid attention to the linkage between insurance activity and economic growth, along with many different econometric models. However, there are a variety of conflicting results among the studies (see, for instance, Lee et al. 2013a, b; Pradhan et al. 2015b). The present study aims to add clarity to these conflicting results.

The samples were selected on the basis of the data available for insurance market activities, economic growth, financial depth and government consumption expenditure, consistently for all countries over the time period from 1980 to 2012.

The geographic coverage of these studies is limited to richer countries or regions such as the USA, Germany, France, Switzerland, Japan and the OECD group of countries (Eling and Luhnen 2010). See also the next footnote.

To our knowledge, there are only two studies in the context of countries with low incomes: Alhassan and Fiador (2014) for Ghana and Pan et al. (2012)for China. The latter justifies the importance of the insurance market activities and its link to economic growth in the low- and middle- income provinces of China. See also Pradhan et al. (2016) for a panel study of ARF countries.

INSAC is used for LINSD, NINSD, TINSD, LINSP, NINSP, TINSP and INSCO (see Table 2 for a summary of these variables).

Broad money supply is used as a proxy for financial depth.

As commented earlier, insurance market activities are LINSD, NINSD, TINSD, LINSP, NINSP, TINSP and INSCO, used one at a time (see Table 2).

See the estimated coefficients of the ECTs in the first row of each of the seven different models.

VECM is referred to as vector error-correction modeling.

Macroeconomic determinants refer to both financial depth and government consumption expenditure.

The supply-leading hypothesis contends that insurance market activities are a necessary precondition for economic growth, but economic growth is not a necessary precondition for insurance market activities.

The two unique findings are: their direct unidirectional causality to economic growth and indirect bidirectional causality to both insurance market activities and its counterpart (financial depth/ government consumption expenditure).

References

Adams M, Andersson J, Andersson L, Lindmark M (2009) Commercial banking, insurance and economic growth in Sweden between 1830 and 1998. Account Bus Financ Hist 19:21–38

Alhassan AL, Fiador V (2014) Insurance-growth nexus in Ghana: an autoregressive distributed lag bounds cointegration approach. Rev Dev Finance 4:83–96

Altunbas Y, Thornton J (2013) Deposit insurance and private capital inflows: further evidence. J Int Financ Mark Inst Money 27:243–247

Andersson LA, Eriksson L, Lindmark M (2010) Life insurance and income growth: the case of Sweden 1830–1950. Scand Econ Hist Rev 58(3):203–219

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment fluctuations. Rev Econ Stud 58(2):277–297

Arena M (2008) Does insurance market activity promote economic growth? A cross-country study for industrialized and developing countries. J Risk Insur 75(4):921–946

Azman-Saini WNW, Smith P (2011) Finance and growth: new evidence on the role of insurance. S Afr J Econ 79(2):111–127

Beck T, Demirguc-Kunt A (2009) Financial institutions and markets across countries and over time-data and analysis. The World Bank, Washington

Beck T, Webb I (2003) Economic, demographic, and institutional determinants of life insurance consumption across countries. World Bank Econ Rev 17(1):51–88

Beenstock M, Dickinson G, Khajuria S (1986) The determination of life premiums: an international cross-section analysis 1970–1981. Insur Math Econ 5(1):616–634

Bernoth K, Pick A (2011) Forecasting the fragility of the banking and insurance sectors. J Bank Finance 35(4):807–818

Brainard L (2008) What is the role of insurance in economic development? Zurich Government and Industry Affairs Thought Leadership Series Paper, No. 2, pp. 1–13

Chaiechi T (2012) Financial development shocks and contemporaneous feedback effect on key macroeconomic indicators: a post Keynesian time series analysis. Econ Model 29(2):487–501

Chang C, Lee C (2012) Non-linearity between life insurance and economic development: a revisited approach. Geneva Risk Insur Rev 37(2):223–257

Chang T, Cheng SC, Pan G, Wu TP (2013) Does globalization affect the insurance markets? Bootstrap panel Granger causality test. Econ Model 33(1):254–260

Chang T, Lee CC, Chang CH (2014) Does insurance activity promote economic growth? Further evidence based on bootstrap panel Granger causality test. Eur J Finance 20(12):1187–1210

Chen PF, Lee CC, Lee CF (2012) How does the development of life insurance market affect economic growth? Some international evidence. J Int Dev 24(7):865–893

Chen SS, Cheng SC, Pan G, Wu TP (2013) The relationship between globalization and insurance activities: a panel data analysis. Jpn World Econ 28(3):151–157

Ching K, Kogid M, Furuoka F (2010) Causal relation between life insurance funds and economic growth evidence from Malaysia. ASEAN Econ Bull 27(2):185–199

Choi I (2001) Unit root tests for panel data. J Int Money Finance 20(2):249–272

Cristea M, Marcu N, Carstina S (2014) The relationship between insurance and economic growth in Romania compared to the main results in Europe—a theoretical and empirical analysis. Procedia Econ Finance 8:226–235

Curak M, Loncar S, Poposki K (2009) Insurance sector development and economic growth in transition countries. Int Res J Finance Econ 34(3):29–41

Eling M, Luhnen M (2010) Efficiency in the international insurance industry: a cross- country comparison. J Bank Insur 34(7):1497–1509

Eller M, Haiss P, Steiner K (2006) Foreign direct investment in the financial sector and economic growth in Central and Eastern Europe: the crucial role of the efficiency channel. Emerg Mark Rev 7(4):300–319

Engle RF, Granger CWJ (1987) Cointegration and error correction: representation, estimation and testing. Econometrica 55(2):251–276

Enz R (2000) The S-curve relation between per-capita income and insurance penetration. Geneva Pap Risk Insur Issues Pract 25(3):396–406

Ewing BT, Riggs K, Ewing KL (2007) Time series analysis of a predator–prey system: application of VAR and generalized impulse response function. Ecol Econ 60(3):605–612

Fink G, Haiss P, Kirchner H (2005) Die FinanzierungüberAnleihenemissionen und ZusammenhängezumWirtschaftswachstum. Kredit und Kapital 38(3):351–375

Garcia MTM (2012) Determinants of the property-liability insurance market: evidence from Portugal. J Econ Stud 39(4):2012

Guo F, Huang YS (2013) Identifying permanent and transitory risks in the Chinese property insurance market. N Am J Econ Finance 26:689–704

Guochen P, Wei SC (2012) The relationship between insurance development and economic growth: a cross-region study for China. Paper presented at 2012 China International Conference on Insurance and Risk Management, held at Qingdao, during July 18–21, 2012

Haiss PR, Sumegi K (2008) The relationship between insurance and economic growth in Europe: A theoretical and empirical analysis. Empirica 35(4):405–431

Han L, Li D, Moshirian F, Tian L (2010) Insurance development and economic growth. Geneva Pap Risk Insur 35(2):183–199

Hasan I, Tucci CL (2010) The innovation-economic growth nexus: global evidence. Res Policy 39(10):1264–1276

Hofman K, Primack A, Keusch G, Htynkow S (2005) Addressing the growing burden of trauma and injury in low- and middle-income countries. Am J Public Health 95(1):13–17

Holtz-Eakin D, Newey W, Rosen HS (1988) Estimating vector auto regressions with panel data. Econometrica 56(6):1371–1395

Horng MS, Chang YW, Wu TY (2012) Does insurance demand or financial development promote economic growth? Evidence from Taiwan. Applied Economics Letters 19(2):105–111

Hsueh S, Hu Y, Tu C (2013) Economic growth and financial development in Asian countries: a bootstrap panel granger causality analysis. Econ Model 32:294–301

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115(1):53–74

IMF (2005) Indicators of financial structure, development, and soundness. Chapter 2. http://www.imf.org/external/pubs/ft/fsa/eng/pdf/ch02.pdf

Jung WS (1986) Financial development and economic growth: international evidence. Econ Dev Cult Change 34(2):336–346

Kao C (1999) Spurious regression and residual based tests for cointegration in panel data. Econometrics 90(1):1–44

Kar M, Nazlioglu S, Agir H (2011) Financial development and economic growth nexus in the MENA countries: bootstrap panel Granger causality analysis. Econ Model 28(1–2):685–693

King RG, Levine R (1993) Finance and growth: Schumpeter might be right. Q J Econ 108(3):713–737

Kugler M, Ofoghi R (2005) Does insurance promote economic growth? Evidence from the UK. Paper presented at the Money Macro and Finance (MMF) Research Group Conference, United Kingdom

Laytin AD, Kumar V, Juillard CJ, Sarang B, Lashoher A, Roy N, Dicker RA (2015) Choice of injury scoring system in low- and middle-income countries: lessons from Mumbai. Injury 46(12):2491–2497

Lee CC, Huang WL, Yin CH (2013a) The dynamics interactions among the stock, bond, and insurance markets. N Am J Econ Finance 26(3):28–52

Lee CC, Lee CC, Chiu YB (2013b) The link between life insurance activities and economic growth: some new evidence. J Int Money Finance 32(3):405–427

Lee CC (2011) Does insurance matter for growth: empirical evidence from OECD countries. BE J Macroecon 11(1):1–26

Lee CC (2013) Insurance and real output: the key role of banking activities. Macroecon Dyn 17(2):235–260

Lee CC, Chiu YB (2012) The impact of real income on insurance penetration: evidence from panel data. Int Rev Econ Finance 21(1):246–260

Lee CC, Chang CP, Chen PF (2012) Further evidence on property–casualty insurance premiums: do multiple breaks and country characteristics matter? Jpn World Econ 24(3):215–226

Lee SJ, Kwon SI, Chung SY (2010) Determinants of household demand for insurance: the case of Korea. Geneva Pap Risk Insur Issues Pract 35(1):82–91

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econom 108(1):1–24

Levine R (1997) Financial development and economic growth: views and agenda. J Econ Lit 35(20):688–726

Levine R (2003) More on finance and growth: more finance, more growth? Federal Reserve Bank of St. Louis. Review 85(6):31–46

Levine R (2005) Finance and growth: theory and evidence. In: Aghion P, Durlauf S (eds) Handbook of economic growth. Elsevier Science, Amsterdam

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality analysis and causes. J Monet Econ 46(1):31–77

Liu CC, Chiu YB (2012) The impact of real income on insurance premiums: evidence from panel data. Int Rev Econ Finance 21(1):246–260

Liu GC, Lee CC (2014) Insurance activities and banking credit causal nexus: evidence from China. Appl Econ Lett 21(9):626–630

Liu G, He L, Yue Y, Wang J (2014) The linkage between insurance activity and banking credit: some evidence from dynamics analysis. N Am J Econ Finance 29(3):239–265

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and new sample test. Oxf Bull Econ Stat 61(S1):631–652

Marques LM, Fuinhas JA, Marques AC (2013) Does the stock market cause economic growth? Portuguese evidence of economic regime change. Econ Model 32:316–324

McKinnon RI (1973) Money and capital in economic development. The Brookings Institution, Washington

Menyah K, Nazlioglu S, Wolde-Rufael Y (2014) Financial development, trade openness and economic growth in African countries: new insights from a panel causality approach. Econ Model 37(2):2014

Moshirian F (1999) Sources of growth in international insurance services. J Multinatl Financ Manag 9:177–194

Nektarios M (2010) A growth theory for the insurance industry. Risk Manag Insur Rev 13(1):45–60

Njegomir V, Stojic D (2010) Does insurance promote economic growth: the evidence from Ex-Yugoslavia region? Econ Thought Pract 19:31–48

Odhiambo NM (2008) Financial depth, savings and economic growth in Kenya: a dynamic causal linkage. Econ Model 25(4):704–713

Odhiambo NM (2009) Finance-growth-poverty nexus in South Africa: a dynamic causality linkage. J Socio Econ 38:320–325

Outreville FJ (1990) The economic significance of insurance markets in developing countries. J Risk Insur 57(3):487–498

Outreville FJ (1996) Life insurance markets in developing countries. J Risk Insur 63(2):263–278

Outreville FJ (2013) The relationship between insurance and economic development: 85 empirical papers for a review of the literature. Risk Manag Insur Rev 16(1):71–122

Pagano M (1993) Financial markets and growth: an overview. Eur Econ Rev 37(2–3):613–622

Pan G, Chang H, Su C (2012) Regional differences in development of life insurance markets in China. Emerg Mark Rev 13(4):548–558

Park H, Borde SF, Choi Y (2002) Determinants of insurance pervasiveness: a cross-national analysis. Int Bus Rev 11:79–96

Patrick H (1966) Financial development and economic growth in underdeveloped countries. Econ Dev Cult Change 14(2):174–189

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61:653–670

Pedroni P (2001) Purchasing power parity tests in cointegrated panels. Rev Econ Stat 83(4):727–731

Pradhan RP, Arvin MB, Norman NR (2015) Insurance development and the finance-growth nexus: evidence from 34 OECD countries. J Multinatl Financ Manag 31:1–22

Pradhan RP, Arvin MB, Norman NR, Hall JH (2014a) Causal nexus between economic growth, banking sector development, stock market development and other macroeconomic variables: the case of ASEAN countries. Rev Finan Econ 23(4):155–173

Pradhan RP, Arvin MB, Norman NR, Hall JH (2014b) The dynamics of banking sector and stock market maturity and the performance of asian economies. J Econ Adm Sci 30(1):16–44

Pradhan RP, Arvin MB, Norman NR, Nair M, Hall JH (2016) Insurance penetration and economic growth nexus: cross-country evidence from ASEAN. Res Int Bus Finance 36:447–458

Pradhan RP, Tripathy S, Pandey S, Bele SK (2014c) Banking sector development and economic growth in ARF countries: the role of stock markets. J Macroecon Finance Emerg Mark Econ 7(2):1–22

Rajan R, Zingales L (1998) Finance dependence and growth. Am Econ Rev 88(3):559–586

Samargandi N, Fidrmuc J, Ghosh S (2015) Is the relationship between financial development and economic growth monotonic? Evidence from a sample of middle-income countries. World Dev 68:66–81

Schumpeter JA (1911) The theory of economic development. Harvard University Press, Cambridge

Shaw ES (1973) Financial deepening in economic development. Oxford University Press, New York

Sigma Economic Research & Consulting (various years). World Insurance, Zurich: Switzerland

Skipper HD, Kwon WJ (2007) Risk management and insurance: perspectives in a global economy. Blackwell, Oxford

Soo HH (1996) Life insurance and economic growth: theoretical and empirical investigation. Doctoral Dissertation, University of Nebraska, Lincoln

Vadlamannati KC (2008) Do insurance sector growth and reforms affect economic development? Empirical evidence from India. J Appl Econ Res 2(1):43–86

Ward D, Zubruegg R (2000) Does insurance promote economic growth? Evidence from OECD countries. J Risk Insur 67(4):489–506

Wasow B, Hill RD (1986) Determinants of insurance penetration: a cross-country analysis. In: Wasow B, Hill RD (eds) Insurance industry in economic development. New York University Press, New York, pp 160–176

Webb IP, Grace MF, Skipper HD (2005) The effect of banking and insurance on the growth of capital and output. SBS Revista De Termas Financieros 2(2):1–32

Wolde-Rufael Y (2009) Re-examining the financial development and economic growth nexus in Kenya. Econ Model 26(6):1140–1146

Acknowledgments

An earlier version of this paper was presented at the 21st International Conference on Computing in Economics and Finance (CEF), Taipei, Taiwan, June 20–22, 2015. We thank the conference participants for helpful comments. We are also grateful to an anonymous referee of this journal for many constructive comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: Panel data unit root test

Appendix: Panel data unit root test

The aim of the unit root test is to ascertain the order of integration of the variables, which is where they attain stationarity. This is a primary requirement for conducting cointegration and Granger causality test. This study uses two different panel unit root tests for determining the order of integration where the time series variable attains stationarity. These include: LLC (Levine-Lin-Chu: Levine et al. 2002) and IPS (Im-Pesaran-Shin: Im et al. 2003). Together LLC and IPS have been deployed on the principles of the conventional augmented Dickey-Fuller (ADF) test. While LLC allows for heterogeneity of the intercepts across members of the panel, IPS allows for heterogeneity in intercepts as well as in the slope coefficients. Both LLC and IPS are applied by averaging individual ADF t-statistics across cross-sectional units.

The test follows the estimation of the following equation:

where \(i = 1, 2{\ldots }.{N}; {t} = 1, 2{\ldots }. {T}; {Y}_{{it}}\) is the series for country i in the panel over period t; \({p}_{{i}}\) is the number of lags selected for the ADF regression; \(\Delta \) is the first difference filter (I–L); and \(\varepsilon _{{ it}}\) are independently and normally distributed random variables for all i and t with zero means and finite heterogeneous variances \((\sigma _{{i}}^{2})\).

LLC considers the coefficients of the autoregressive term as homogenous across all individuals, i.e., \(\gamma _{\mathrm{i}}=\gamma \forall i\). The LLC tests the null hypothesis that each individual in the panel has integrated time series, i.e., \(H_{0}\): \(\gamma _{{i}}=\gamma = 0 \forall i\) against an alternative \(H_{A}: \gamma _{\mathrm{i}}=\gamma < 0 \forall i\). LLC considers pooling the cross-sectional time series data, and the test is based on the following t-statistics:

where \(\gamma \) is restricted by being kept identical across regions under both the null and alternative hypotheses.

It is clear that the null hypothesis of the LLC test is very restrictive and the IPS test relaxes this assumption by allowing \(\gamma \) to vary across i under the alternative hypothesis. Hence, the null hypothesis of the IPS test is \({H}_{0}{:} \gamma _{i} = 0 \forall i\), while the alternative hypothesis is that at least one of the individual series in the panel is stationary, i.e., alternative \({H}_{A}: \gamma _{i}< 0 \forall i\). The alternative hypothesis simply implies that \(\gamma _{i}\) differs across countries.

Due to heterogeneity, each equation is estimated separately by the ordinary least squares technique and the test statistics are obtained as averages of the test statistics for each equation.

The IPS t-bar statistic is simply defined as the average of the individual Dickey-Fuller \(\tau \) statistics. This is as follows:

Assuming that the cross sections are independent, IPS test uses the mean-group approach and obtains \(\tau _{\mathrm{i}}\) and then proposes the use of the standardized t-bar statistic as shown below.

where \(E\left( {\bar{{t}}} \right) \) and \(var\left( {\bar{{t}}} \right) \) represents the mean and variance of each \(\tau \) statistic, respectively. They are generated by simulations and are tabulated in IPS (1997). The statistic \(\bar{{Z}}\) converges to a standard normal distribution as N and T stand to infinitely large and we can compute the significance level in a simple way (see, for instance, Im et al. 2003).

Rights and permissions

About this article

Cite this article

Pradhan, R.P., Arvin, M.B., Bahmani, S. et al. Insurance–growth nexus and macroeconomic determinants: evidence from middle-income countries. Empir Econ 52, 1337–1366 (2017). https://doi.org/10.1007/s00181-016-1111-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1111-7

Keywords

- Insurance market activities

- Economic growth

- Financial depth

- Government consumption expenditure

- Middle-income countries