Abstract

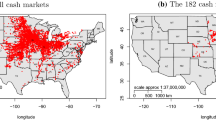

This study investigates dynamic relationships among US corn cash prices for the years 2006–2011. Using daily data from 182 markets in seven Midwestern states, an error correction model is estimated and directed acyclic graphs characterize the contemporaneous causal relationships among prices from different states. Empirical results based on the PC algorithm show that three states, Iowa, Ohio, and Minnesota, dominate corn cash prices. Four potential causal paths among the three states also are identified. Given that physical flows of grain are different at different times of the year, the data are divided into storage periods and harvest periods, and a VAR in differences is adopted to model the price relationships. While Iowa and Ohio continue to dominate corn prices during the storage period, the causal flows are mixed during the harvest period. An application of the LiNGAM algorithm refines the results relative to those derived from the PC algorithm and reveals that Iowa, the leading corn-producing state, is the only state that dominates pricing over the crop year.

Similar content being viewed by others

Notes

As an important issue for empirical research, investigations of lagged causality among price series considered in the current study are ongoing but are not discussed in detail because of this paper’s focuses on contemporaneous causal orderings.

In this study, \(p=7\) and \(X_{t}=\left( \begin{array}{ccccccc} X_{1,t}&X_{2,t}&X_{3,t}&X_{4,t}&X_{5,t}&X_{6,t}&X_{7,t} \end{array} \right) ^{\prime }\) where \(X_{1,t}\), \(X_{2,t}\), \(X_{3,t}\), \(X_{4,t}\), \(X_{5,t}\), \(X_{6,t}\) and \(X_{7,t}\) correspond to price series of IA, IL, IN, OH, MN, NE, and KS, respectively.

A brief discussion is given in “Appendix 2”.

Possible structural breaks in the long-run relationship among these series are examined with Hansen and Johansen’s (1999) recursive cointegration method, which can reveal the (in)stability of the identified cointegration relationship. Figure 3 shows the normalized trace test statistics calculated at each data point between March 9, 2006 (point 46) and March 24, 2011 (point 1316). The first 45 data points ranging from January 3, 2006 to March 8, 2006, are used as the base period. As shown in Fig. 3, the test statistics are scaled by the 5 % critical values. Therefore, we can reject the null hypothesis at a data point if its corresponding entry in the figure is greater than 1. It is obvious that we have at least one and almost never more than one cointegration vector, especially for the R-representation. In sum, the recursive cointegration analysis confirms that the ECM with one lag is an appropriate specification.

The 5 and 10 % significance levels result in an identical decision about edge inclusion and causal flow assignment. The 1 % significance level results in an identical decision about edge inclusion as, but a different decision about causal flow assignment from, the 5 and 10 % significance levels. Spirtes et al. (2000) have stated: “In order for the method to converge to correct decisions with probability 1, the significance level used in making decisions should decrease as the sample size increases, and the use of higher significance levels (e.g., 0.2 at sample sizes less than 100, and 0.1 at sample sizes between 100 and 300) may improve performance at small sample sizes.” Yang and Bessler (2004) have compared the significance levels at 1 and 0.1 % for a system of 9 variables with a sample size of 1800. Ramsey (2010) has adopted the significance level at 0.1 % for simulation exercises on various graphs, including one with 10 nodes, 20 edges, and a sample size of 1000, and another one with the same numbers of nodes and edges, and a sample size of 5000. For our sample size being 1316, the 1 % significance level seems appropriate.

The edge between IL and OH can be removed by conditioning on IA, IN, and KS because the associated p value for this correlation is 0.3920, rather strongly suggesting that this edge should be removed. The edge between OH and MN can be removed by conditioning on IA and IN because the associated p value for this correlation is 0.0337. The edge between OH and NE can be removed by conditioning on IA, IN, and KS because the associated p value for this correlation is 0.2009. The edge between IA and IN can be removed by conditioning on IL, OH, and MN because the associated p value for this correlation is 0.0962. The edge between IN and KS can also be removed by conditioning on IL, OH, and MN because the associated p value for this correlation is 0.0173.

In Fig. 6, the triple OH–KS–MN is directed as \(\hbox {OH}\rightarrow \hbox {KS}\leftarrow \hbox {MN}\) because the edge between OH and MN is removed by conditioning IA and IN. In other words, KS is not in the sepset of OH and MN. Had the arrows gone from KS to OH and MN, i.e., KS was a common cause of OH and MN, then OH and MN would be unconditionally correlated, and we would have had to depend on the first-order conditional correlation between OH and MN, conditioning on KS, to remove the edge between OH and MN. The same logic works if the path was \(\hbox {OH}\rightarrow \hbox {KS}\rightarrow \hbox {MN}\), a causal chain. However, KS is not in the sepset of OH and MN. Hence, the inverted fork \(\hbox {OH}\rightarrow \hbox {KS}\leftarrow \hbox {MN}\) applies. Similarly, the triples IA–NE–IN and IN–NE–KS are directed as \(\hbox {IA}\rightarrow \hbox {NE}\leftarrow \hbox {IN}\) and \(\hbox {IN} \rightarrow \hbox {NE}\leftarrow \hbox {KS}\), respectively, because the edges between IA and IN, and IN and KS are removed by conditioning on IL, OH, and MN, and NE is not in the sepsets of IA and IN, or IN and KS. The triple OH-KS-IL is directed as \(\hbox {OH}\rightarrow \hbox {KS}\rightarrow \hbox {IL}\), because \(\hbox {OH}\rightarrow \hbox {KS}\), KS and IL are adjacent, OH and IL are not adjacent, and there is no arrowhead at KS because KS is in the sepset of OH and IL and we do not have an inverted fork. The tuple MN–NE is directed as \(\hbox {MN}\rightarrow \hbox {NE}\) because there is a directed path from MN to NE, i.e., \(\hbox {MN}\rightarrow \hbox {KS}\rightarrow \hbox {NE}\), and an edge between them. Similarly, the tuple MN–IL is directed as \(\hbox {MN}\rightarrow \hbox {IL}\) because there is a directed path from MN to IL, i.e., \(\hbox {MN}\rightarrow \hbox {KS}\rightarrow \hbox {IL}\), and an edge between them. The tuple IL-NE is directed as \(\hbox {IL}\rightarrow \hbox {NE}\) because otherwise IL was a common effect of NE and KS, and the edge between them would be removed. Similarly, tuple IL–IN is directed as \(\hbox {IL}\rightarrow \hbox {IN}\) because otherwise IL was a common effect of IN and MN, and the edge between them would be removed. The tuple MN–IN is directed as \(\hbox {MN}\rightarrow \hbox {IN}\) because there is a directed path from MN to IN, i.e., \(\hbox {MN}\rightarrow \hbox {IL}\rightarrow \hbox {IN}\), and an edge between them.

Omitted variables such as corn cash prices of other states and the futures prices may affect the causal ordering of the seven states under study. Modeling efforts to take account of omitted variables in assigning causal orderings among economic variables are underway in the literature. (See for example, Bryant et al. 2009).

Other detailed numerical results not provided here are available upon request.

For Category 1, MN is the most exogenous state because it accounts for over 98 % of its own price variation at all horizons. The second most exogenous state is OH with over 87 % price variation accounted for by itself at all horizons, and the rest almost accounted for by MN. For each of the remaining five states (IA, IL, IN, NE, and KS), almost all price variation is explained by OH and MN together at all horizons except for a small portion explained by itself. The influence of OH decreases over the time while that of MN increases. States except OH and MN may have statistically, but not economically, significant explanatory power against price variation of other states. For example, for Case 1, at Day 30, the explanatory power of IL against price variation of IN is statistically significant, but not economically significant. The impulse responses of IA, IL, IN, NE, and KS to shocks in MN and OH are rather persistent. A one standard deviation shock in MN generates responses of around seven (five) standard deviations in IA, IL, and NE (IN and KS). The initial responses (response) of IL, NE, and KS (IA/IN) to a one standard deviation shock in OH are (is) around two (three/four) standard deviations, and then they (it) decline(s) to one (one/three) at Day 30. While MN and OH almost do not respond to shocks in other states, each of them has persistent responses of around one standard deviation to its own shock.

Discussion about innovation accounting analysis for Categories 2, 3, and 4 is similar and is omitted to save space.

Detailed numerical results not provided here are available upon request. Yang et al. (2000) found similar empirical results when they investigated the LOP among developed and developing countries.

The storage period is when corn is usually planted in the fields, and the harvest period is when corn harvest usually occurs.

Detailed numerical results not provided here are available upon request.

Detailed innovation accounting analysis for the store and harvest period is available upon request.

References

Awokuse T (2007) Market reforms, spatial price dynamics, and China’s rice market integration: a causal analysis with directed acyclic graphs. J Agric Resour Econ 32:58–76

Awokuse T, Bessler D (2003) Vector autoregressions, policy analysis, and directed acyclic graphs: an application to the US economy. J Appl Econ 6:1–24

Balcombe K, Bailey A, Brooks J (2007) Threshold effects in price transmission: the case of Brazilian wheat, maize, and soya price. Am J Agric Econ 89:308–323

Bernanke B (1986) Alternative explanations of the money-income correlation. Carnegie-Rochester Conf Ser Pub Policy 25:49–99

Bessler D, Akleman D (1998) Farm prices, retail prices, and directed graphs: results for pork and beef. Am J Agric Econ 80:1144–1149

Bessler D, Yang J, Wongcharupan M (2003) Price dynamics in the international wheat market: modeling with error correction and directed acyclic graphs. J Reg Sci 43:1–33

Bryant H, Bessler D, Haigh M (2009) Disproving causal relationships using observational data. Oxf Bull Econ Stat 71:357–374

Bülmann P, van de Geer S (2011) Statistics for high-dimensional data: methods, theory and applications. Springer, New York

Demiralp S, Hoover K (2003) Searching for the causal structure of a vector autoregression. Oxf Bull Econ Stat 65:745–767

Diamandis P, Georgoutsos D, Kouretas G (2000) The monetary model in the presence of I(2) components: long-run relationships, short-run dynamics and forecasting of the Greek drachma. J Int Money Finance 19:917–941

Dickey D, Fuller W (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49:1057–1072

Doan T (1996) User’s manual: RATS 4.0. Estima, Illinois

Enders W (2010) Applied econometric time series. Wiley, New Jersey

Engle R, Granger C (1987) Co-integration and error correction: representation, estimation and testing. Econometrica 55:251–276

Goodwin B, Piggott N (2001) Spatial market integration in the presence of threshold effects. Am J Agric Econ 83:302–317

Greb F, von Cramon-Taubadel S, Krivobokova T, Munk A (2013) The estimation of threshold models in price transmission analysis. Am J Agric Econ 95:900–916

Haigh M, Bessler D (2004) Causality and price discovery: an application of directed acyclic graphs. J Bus 77:1099–1121

Hansen H, Johansen S (1999) Some tests for parameter constancy in cointegrated VAR-models. Econom J 2:306–333

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254

Johansen S (1991) Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 59:1551–1580

Kalisch M, Bülmann P (2007) Estimating high-dimensional directed acyclic graphs with the PC-algorithm. J Mach Learn Res 8:613–636

Kuiper W, Lutz C, van Tilburg A (1999) Testing for the law of one price and identifying price-leading markets: an application to corn markets in Benin. J Reg Sci 39:713–738

Kwiatkowski D, Phillips P, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: how sure are we that economic time series have a unit root? J Econom 54:159–178

Lai P, Bessler D (2015) Price discovery between carbonated soft drink manufacturers and retailers: a disaggregate analysis with PC and LiNGAM algorithms. J Appl Econ 18:173–197

Li S, Thurman W (2013) Grain transport on the Mississippi River and Spatial Corn Basis. Selected paper prepared for presentation at the Southern Agricultural Economics Association SAEA annual meeting, Orlando, Florida, 35 February 2013

Lutkepohl H (2006) New introduction to multiple time series analysis. Springer, New York

Lutkepohl H, Reimers H (1992) Impulse response analysis of cointegrated systems. J Econ Dyn Control 16:53–78

Lutz C, van Tilburg A, van der Kamp B (1995) The process of short- and long-term price integration in the Benin maize market. Eur Rev Agric Econ 22:191–212

Moneta A, Entner D, Hoyer P, Coad A (2013) Causal inference by independent component analysis: theory and applications. Oxf Bull Econ Stat 75:705–730

National Agricultural Statistics Service (1997) Usual planting and harvesting dates for US field crops. http://usda.mannlib.cornell.edu/usda/nass/planting//1990s/1997/planting-12-05-1997. Accessed 20 Feb 2015

National Agricultural Statistics Service (2010) Field crops usual planting and harvesting dates. http://usda.mannlib.cornell.edu/usda/current/planting/planting-10-29-2010. Accessed 20 Feb 2015

National Corn Growers Association (2015) World of corn 2015. http://www.worldofcorn.com/pdf/WOC-2015. Accessed 17 Oct 2015

Orden D, Fisher L (1993) Financial deregulation and the dynamics of money, prices, and output in New Zealand and Australia. J Money Credit Bank 25:273–292

Osterwald-Lenum M (1992) A note with quantiles of the asymptotic distribution of the maximum likelihood cointegration rank statistics. Oxf Bull Econ Stat 54:461–472

Phillips P (1998) Impulse response and forecast error variance asymptotics in nonstationary VARs. J Econom 83:21–56

Phillips P, Perron P (1988) Testing for a unit root in time series regression. Biometrica 75:335–346

Ramsey J (2010) Bootstrapping the PC and CPC algorithms to improve search accuracy. Paper 101, Department of Philosophy, Carnegie Mellon University

Richardson T, Spirtes P (1999) Automated discovery of linear feedback models. In: Glymour C, Cooper G (eds) Computation, causation, and discovery. MIT/AAAI Press, Cambridge

Sephton P (2003) Spatial market arbitrage and threshold cointegration. Am J Agric Econ 85:1041–1046

Shalizi C (2013) Advanced data analysis from an elementary point of view. http://www.stat.cmu.edu/~cshalizi/ADAfaEPoV/ADAfaEPoV. Accessed 20 Feb 2015

Shimizu S, Hoyer P, Hyvärinen A, Kerminen A (2006) A linear non-Gaussian acyclic model for causal discovery. J Mach Learn Res 7:2003–2030

Sims C (1980) Macroeconomics and reality. Econometrica 48:1–48

Spirtes P, Glymour C, Scheines R (2000) Causation, prediction, and search. MIT Press, Boston

Swanson N, Granger C (1997) Impulse response functions based on a causal approach to residual orthogonalization in vector autoregressions. J Am Stat Assoc 92:357–367

Whittaker J (1990) Graphical models in applied multivariate statistics. Wiley, Chichester

Yang J (2003) Market segmentation and information asymmetry in Chinese stock markets: a VAR analysis. Financ Rev 38:591–609

Yang J, Bessler D (2004) The international price transmission in stock index futures markets. Econ Inq 42:370–386

Yang J, Bessler D, Leatham D (2000) The law of one price: developed and developing country market integration. J Agric Appl Econ 32:429–440

Yang J, Bessler D, Leatham D (2001) Asset storability and price discovery in commodity futures markets: a new look. J Futures Mark 21:279–300

Yang J, Yang Z, Zhou Y (2012) Intraday price discovery and volatility transmission in stock index and stock index futures markets: evidence from China. J Future Mark 32:99–121

Acknowledgments

The author acknowledges Kevin McNew and Geograin, Inc of Bozeman, Montana for generously providing the data used in the analysis in this paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Three possible cases of Equation (1)

Three possible cases for Eq. (1) of interest are: (a) if \(\Pi \) has full rank p, \(X_{t}\) is stationary in levels and a VAR in levels should be adopted, i.e., \(X_{t}=\mu +\sum _{i=1}^{k}\Pi _{i}X_{t-i}+e_{t}\), where \(\Pi _{1}=\Gamma _{1}+\Pi +I_{p}\), \(\Pi _{i}=\Gamma _{i}-\Gamma _{i-1}\) for \(i=2,\ldots ,k-1\), and \(\Pi _{k}=-\Gamma _{k-1}\); (b) if \(\Pi \) has zero rank (\(\Pi =\mathbf {0}\)), it does not contain long-term information and a VAR in differences should be adopted, i.e., \(\Delta X_{t}=\mu +\sum _{i=1}^{k-1} \Gamma _{i}\Delta X_{t-i}+e_{t}\), for \(X_{t}\) being I(1) and not cointegrated; (c) if \(\Pi \) has rank \(r\in [1,p-1]\) for \(X_{t}\) being I(1), i.e., \(X_{t}\) has r linearly independent cointegrating vector(s) and \(p-r\) common stochastic trend(s), it can be written as \(\Pi =\alpha \beta ^{\prime }\), where \(\alpha \) and \(\beta \) are \(p\times r\) matrices with rank r, and \(\beta ^{\prime }X_{t}\thicksim I(0)\) is stationary. \(\Pi \) is the long-run impact matrix, and \(\Gamma _{i}\) for \(i=1,\ldots ,k-1\) are the short-run impact matrices. The rows of \(\beta ^{\prime }\) constitute a basis for the r cointegrating vectors and the elements of \(\alpha \) apportion the effect of the cointegrating vectors to the evolution of \(\Delta X_{t}\). Equation (1) thus can be written as \(\Delta X_{t}=\mu +\alpha \beta ^{\prime }X_{t-1} +\sum _{i=1}^{k-1}\Gamma _{i}\Delta X_{t-i}+e_{t}\). Because for any \(r\times r\) non-singular matrix M, we have \(\alpha \beta ^{\prime }=(\alpha M)(M^{-1} \beta ^{\prime })=(\alpha M)[\beta (M^{-1})^{\prime }]^{\prime }=\alpha ^{\Delta }\beta ^{\Delta }\), the factorization \(\Pi =\alpha \beta ^{\prime }\) is not unique and only identifies the space spanned by the cointegrating relations. Further restrictions on the model are needed to establish the uniqueness of \(\alpha \) and \(\beta \).

Appendix 2: Cholesky decomposition

We can consider a p-variable structural VAR model which is expressed as:

where k is the lag order and \(A_{i}\)’s are \(p\times p\) matrices of coefficient parameters. We can normalize the variance-covariance matrix of the structural shocks such that \(E(v_{t}v_{t}^{{\prime }})\equiv \Sigma _{v}=I_{p}\) without a loss of generality if the diagonal elements of matrix A are unrestricted. The corresponding reduced-form of Eq. (8) is represented as:

if we let \(B_{i}=A^{-1}A_{i}\) for \(i=1,2,\ldots ,k\). As a weighted average of the structural shocks, the reduced-form shocks can be written as:

Equation (10) has been estimated by writing it as an ECM. To reveal the relative effect of each variable, we need the response of \(X_{t}\) to the structural innovation \(v_{t}\) and hence require the recovery of the elements of matrix \(A^{-1}\) from reduced-form parameters, which can be accomplished by solving \(\frac{p(p+1)}{2}\) equations using the information from the variance and covariance matrix of the reduced-form residuals \(e_{t}\)’s, i.e., \(\Sigma _{e}=A^{-1}A^{-1^{\prime }}\). Due to symmetry of \(\Sigma _{e}\), it is obvious that at most \(\frac{p(p+1)}{2}\) unknowns in matrix \(A^{-1}\) can be uniquely identified. If we use a Cholesky decomposition, \(A^{-1}\) is a lower triangular matrix. However, the problem with this method is that it makes sense only if the causal chain used, which may be unrealistic, is accepted by the underlying model.

Rights and permissions

About this article

Cite this article

Xu, X. Contemporaneous causal orderings of US corn cash prices through directed acyclic graphs. Empir Econ 52, 731–758 (2017). https://doi.org/10.1007/s00181-016-1094-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1094-4