Abstract

We examine the impact of financial reforms on efficient reallocation of capital within and between sectors in South Africa using firm-level panel data for the period 1991–2008. The measure of efficient allocation of capital is based on the Tobin’s Q. We find that financial reforms are associated with improvements in within-sector, but not between-sector allocation of capital. These results imply that for South Africa to unleash the potential for take-off that is often associated with reallocation of resources from the primitive to modern sectors, reforms that focus beyond the financial sector are necessary. While more research is necessary to determine what would fully constitute such additional reforms, our analysis shows that reforms that improve the quality of economic institutions may be a step in the right the direction.

Similar content being viewed by others

Notes

Another approach, followed in Hsieh and Klenow (2009) is to look at the impact of policy distortions on allocative efficiency as measured by industry-level TFP dispersions. Our paper has some similarity in spirit to theirs, given the single-country approach is applied in the context of the estimations. Hseih and Klenow, however, undertake a comparative analysis of three countries—US, India and China, with the US as a benchmark for measuring the potential gains from allocative efficiency in the latter two countries.

To compute the “within” and “between” components we draw on the literature on decomposition of inequality indices. A survey of this literature is presented in Shorrocks and Wan (2005). An elaborate discussion relating to how we empirically measure these two concepts is provided in Sect. 3.3 and the “Appendix”.

Abiad et al. (2008) consider firm-level data for a panel of five emerging markets, namely: India, Jordan, Korea, Malaysia, and Thailand. Based on their regressions, there is some evidence to suggest that the beneficial effects of liberalization in case of some countries in their sample (Korea and Malaysia) are much larger than in the case of the others (India, Jordan and Thailand).

For a summary of financial policies (restrictions and reforms) in South Africa between 1960 and 2007, see Chinzara et al. (2012).

Porta et al. (1997, 1998) postulate that good legal systems which enforce private property rights, support private contractual arrangements and protect the legal rights of investors, enhance investment. Galindo et al. (2007) attempt to test this hypothesis, but due to data constraints resort to comparing the countries that use English Common Law to those that do not. They find that countries with an English Common Law have better investor protection than those with other forms of law.

The literature suggests that corruption may “grease the wheels” and speed up economic activity if the bureaucratic system is inefficient.

The discussion here closely follows Abiad et al. (2008).

Note that variability may also emanate from productivity shocks and other factors. However, we control for these in the empirical analysis to follow.

However, it is possible to draw implications for non-listed firms from our findings as they are even more financially constrained than listed companies (Abiad et al. 2008).

Hennessy (2004) suggests measurement errors arising due to underinvestment as a result of debt overhang. If highly leveraged firms are more likely to default, their managers will invest less than is optimal, since being taken over by creditors in the event of default is also very likely. Debt overhang therefore creates an additional discrepancy between average and marginal Q which is controlled for using the Li/Ai terms in (6).

Note that Abiad et al use four measures of dispersion, namely the Theil Index, the mean log deviation, the coefficient of variation and the Gini Index. Given that the Gini Index is not a decomposable measure of dispersion (see Bourguignon 1979), we consider only the former three indices. However, in the interest of a succinct presentation, we report regressions only for the Theil Index and the coefficient of variation. Results for the mean log deviation, which yield very similar results, are available upon request.

See Dunteman (1989).

Although the retail and wholesale trade essentially fall under the services sector, we choose to classify them separately because we believe that the Tobin Q’s of firms in the former sector are likely to have different dynamics compared to other firms in the services sector. This is because firms in the retail and wholesale trade sector often have low capital intensity and high sales turnover than other firms in the services sector.

The comparison of the RE and FE estimates based on non-robust standard errors using the Hausman test suggest that the estimates are not systematically and statistically different. However, it is important to note that in all our estimations, we use robust standard errors, which renders the Hausman test unnecessary.

We use the Stata module xtabond2 discussed in Roodman (2009) for our estimations.

In the interest of a succinct presentation, we do not report the results for the FE model. However, the coefficients are very close to those of the RE model.

We also ran regressions based on the mean log deviation and the results remain robust. In fact the results based on the mean log deviation were quite similar to those based on the coefficient of variation.

We thank an anonymous referee for this suggestion. For a discussion of the approach, see McKinnon (2008).

Another interpretation, similar in vein to the development economics literature, is that in the transitional stages resource allocation occurs largely from primary to secondary sectors, which in our context are respectively represented by Mining and Manufacturing.

To be specific, and as mentioned earlier, we estimated regressions based on all of these measures but in the interest of brevity have chosen to present results based of the Theil Index and the coefficient of variation. However, results for the mean log deviation are very similar and available upon request.

References

Abel A, Eberly J (1994) A unified model of investment under uncertainty. Am Econ Rev 84:1369–1384

Abiad A, Oomes N, Ueda K (2008) The quality effect: does financial liberalisation improve the allocation of capital. J Dev Econ 87:270–282

Acemoglu D, Johnson S, Robinson J (2005) Institutions as the fundamental cause of long-run growth. In: Aghion P, Durlauf S (eds) Handbook of economic growth. Elsevier, Amsterdam

Aidt TS (2003) Economic analysis of corruption: a survey. Econ J 113:632–652

Almeida H, Wolfenzon D (2005) The effect of external finance on the equilibrium allocation of capital. J Financ Econ 75:133–164

Ang J, McKibbin W (2007) Financial liberalization, financial sector development and growth: evidence from Malaysia. J Dev Econ 84:215–233

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Beck PJ, Maher MW (1986) A comparison of bribery and bidding in thin markets. Econ Lett 20:1–5

Blanchard O, Rhee C, Summers L (1993) The stock market, profit, and investment. Q J Econ 108(1):115–136

Bourguignon F (1979) Decomposable income inequality measures. Econometrica 47(4):901–920

Carmignani F, Chowdhury A (2007) Does financial openness promote economic integration? Discussion Paper No. 4. United Nations Economic Commission for Europe

Chari A, Henry PB (2004) Is the invisible hand discerning or indiscriminate? Investment and stock prices in the aftermath of capital account liberalizations. NBER Working Paper No. 10318

Chenery HB, Syrquin M (1975) Patterns of development, 1950–1970. Oxford University Press, London

Chinn MD, Ito H (2008) A new measure of financial openness. J Comp Policy Anal 10(3):307–320

Chinzara Z, Lahiri R, Chen ET (2012) Financial globalization and the sectoral reallocation of capital in South Africa. School of Economics and Finance Discussion Papers and Working Papers Series, 286, Queensland University of Technology

Clark C (1940) The conditions of economic progress, 3rd edn. Macmillan, London

Cortuk O, Singh N (2011) Structural change and growth in India. Econ Lett 110(3):178–181

Demetriades PO, Luintel KB (2001) Financial restraint in the South Korea miracle. J Dev Econ 64:459–479

Devereux MB, Smith GW (1994) International risk sharing and economic growth. Int Econ Rev 53(2):363–384

Dunteman GH (1989) Principal components analysis. In: Lewis-Beck MS (ed) Quantitative applications in the social sciences. SAGE Publications, Inc

Fan S, Zhang X, Robinson S (2003) Structural change and economic growth in China. Rev Dev Econ 7(3):360–377

Galindo A, Schiantarelli F, Weiss A (2007) Does financial liberalization improve the allocation of investment? Micro evidence from developing countries. J Dev Econ 83:562–587

Gertler M, Rose A (1994) Finance, public policy, and growth. In: Caprio G, Atiyas I, Hanson J (eds) Financial reform: theory and experience. Cambridge University Press, New York

Hayashi F (1982) Tobin’s marginal q and average q: a neoclassical interpretation. Econometrica 50:213–224

Hennessy CA (2004) Tobin’s q, debt overhang, and investment. J Finance 59(4):1717–1742

Hsieh C, Klenow PJ (2009) Misallocation and manufacturing TFP in China and India. Q J Econ 124(4):1403–1447

Henry BP (2007) Capital account liberalisation: theory, evidence, and speculation. J Econ Lit 45(4):887–935

Ito H (2006) Financial development and financial liberalization in Asia: thresholds, institutions and the sequence of liberalization. N Am J Econ Finance 17(3):303–327

Jovanovic B, Rousseau P (2002) The Q-theory of mergers. Am Econ Rev 92(2):198–204

Kose MA, Prasad ES, Rogoff K, Wei S (2009) Financial globalization: a reappraisal. IMF Staff Papers 56(1):8–62

Kuznets S (1966) Modern economic growth. Yale University Press, New Haven

Laeven L (2003) Does financial liberalization reduce financing constraints? Financ Manag 32(1):5–34

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (1997) Legal determinants of external finance. J Finance 52:1131–1150

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (1998) Law and finance. J Polit Econ 106:1113–1155

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46:31–77

Levine R (2005) Finance and growth: theory and evidence. In: Aghion P, Durlauf S (eds) Handbook of economic growth. Elsevier Science, The Netherlands

Lloyd T, Morrissey O, Osei R (1998) The problem of pooling in panel data analysis for developing countries: the case of aid and trade relationships. CREDIT Research Paper, University of Nottingham, UK

Loayza N, Rancière R (2006) Financial development, financial fragility, and growth. J Money Credit Bank 38(4):1051–1076

Lien DHD (1986) A note on competitive bribery games. Econ Lett 22:337–41

Lucas RE (1967) Adjustment costs and the theory of supply. J Polit Econ 75(4):321–334

Lui FT (1995) An equilibrium queuing model of bribery. J Polit Econ 93(4):760–81

Maddala GS (1999) On the use of panel data methods with cross-country data. Ann Econ Stat 55/56:429–448

McKinnon DP (2008) An introduction to statistical mediation analysis. Erlbaum, New York

McKinnon RI (1973) Money and capital in economic development. The Brookings Institution, Washington

Montiel P, Reinhart C (1999) Do capital controls and macroeconomic policies influence the volumeand composition of capital flows? Evidence from the 1990s. J Int Money Finance 18(4):619–635

Obstfeld M (1994) Risk-taking, global diversification, and growth. Am Econ Rev 84:1310–1329

Pagés C (2010) The age of productivity. Inter-American Development Bank, Washington

Phelan C (1995) Repeated moral hazard and one-sided commitment. J Econ Theory 66(2):488–506

Prasad A, Rogoff K, Wei S, Kose MA (2004) Financial gobalization, growth and volatility in developing countries. NBER Working Paper Series, No. 10942

Roodman D (2009) How to do xtabond2: an introduction to difference and system GMM in Stata. Stata J 9(1):86–136

Shaw ES (1973) Financial deepening in economic development. Oxford University Press, New York

Shorrocks A, Wan G (2005) Spatial decomposition of inequality. J Econ Geogr 5:59–81

Smith G, Dyakova A (2014) African stock markets: efficiency and relative predictability. S Afr J Econ 82(2):258–275

Tang D (2006) The effect of financial development on economic growth: evidence from the APEC countries, 1981–2000. Appl Econ 38:1889–1904

The Africa report (2013) Top 200 banks 2013. Online. Available: http://www.theafricareport.com/Top-200-Banks/top-200-banks-2013.html. Accessed 26 Jan 2014

Timmer CP (1988) The agricultural transformation. In: Chenery H, Srinivasan TN (eds) Handbook of development economics, volume 1, chapter 8. Elsevier, Amsterdam, pp 275–331

Tobin J (1969) A general equilibrium approach to monetary theory. J Money Credit Bank 1(1):15–29

World Bank (2015) World development indicators. The World Bank. http://data.worldbank.org/products/wdi

Wurgler J (2000) Financial markets and the allocation of capital. J Financ Econ 58:187–214

Yartey AO (2008) The determinants of stock market development in emerging economies: Is South Africa different? IMF Working Paper No. 08/32. The International Monetary Fund

Yogo M (2004) Estimating the elasticity of intertemporal substitution when instruments are weak. Rev Econ Stat 86(3):797–810

Zhang D, Wu T, Chang T, Lee C (2013) Revisiting the efficient market hypothesis for African countries: panel Surkss test with a fourier function. S Afr J Econ 80(3):287–299

Author information

Authors and Affiliations

Corresponding author

Appendix: Measures of dispersion of Tobin’s Q and their decomposition

Appendix: Measures of dispersion of Tobin’s Q and their decomposition

As discussed in Sect. 3 of the paper, our approach to studying Q-dispersion at the inter-sector vs intra-sector level is to look at a combination of two sectors, and analyze the dispersion of Q that arises due to dispersion “within” each sector of that particular two-sector combination, and that which occurs due to the dispersion “between” the two sectors. Our measures of dispersion are essentially measures of inequality, and as such their decomposition follows analogous measures of decomposition in the literature on inequality indices. For a detailed discussion of this literature, in addition to a more elaborate derivation of these measures of decomposition, see Shorrocks and Wan (2005). In the following discussion, we have closely followed the approach in that paper, applied in the context of the Tobin’s Q rather than income levels. We consider the decomposition of three of the four measures considered in Abiad et al. (2008), namely the mean log deviation, the Theil Index, and the coefficient of variation.Footnote 24

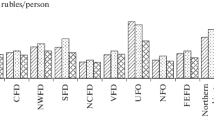

Since we consider four sectors—namely manufacturing (1), mining (2), retail (3) and services (4), we have six combinations to consider, which are {1,2}, {1,3}, {1,4}, {2,3}, {2,4} and {3,4}. Let these combinations be indexed by c, where c = {1,2}, {1,3}, {1,4}, {2,3}, {2,4}, {3,4}. Let firms in each sector combination be indexed by i, and let \(n_c\) be the number of firms in sector combination c. As mentioned above, our first three measures of Q-dispersion for each of these sector combinations are special cases of the Generalized Entropy Index below:

Here the adjusted Q for each firm in each subsector of the combination c is computed as in Eq. (7) in Sect. 3, and the above summation is over the pooled adjusted Qs of both sectors. The mean of this pooled set of adjusted Qs is given by \(\mu _c\). We consider the cases \(\alpha =0,\;1,\;2\), which respectively represent the mean log deviation, the Theil Index and half of the square of the coefficient of variation, specifically expressed as:

We can analogously compute the above indices for each subsector within each combination c; for the notation it is simply a matter of switching c with s, where s represents the sectors 1, 2, 3, 4, and \(\hbox {n}_{s}\) and \(\mu _{s}\) the corresponding number of firms in sector and the sectoral mean respectively. Also, the corresponding measures of dispersion for the sectors are given by \(E_s (\alpha )\)where \(s=1,2,3,4\) and \(\alpha =0,1,2\).

Now consider the combination c={1,2}. The decomposition of the above measures of dispersion into “within” and “between” components for this combination is given by:

In the equations above, the two terms on the right-hand side following the second equality are the within and between components of the three measures discussed above. We can calculate the corresponding decompositions for the other sector combinations in an analogous manner. Note also that we can easily extract the sectoral contribution from the within-sector term, given the within-sector term is simply the weighted sum of the sectoral indices of dispersion. For example, consider the percentage contribution of sector 1 (denoted \(\hbox {PC1}_{\{1, 2\}})\) to the within component of (15). This contribution would be expressed as:

Rights and permissions

About this article

Cite this article

Chinzara, Z., Lahiri, R. & Chen, E.T. Financial liberalization and sectoral reallocation of capital in South Africa. Empir Econ 52, 309–356 (2017). https://doi.org/10.1007/s00181-016-1070-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1070-z

Keywords

- Financial liberalization

- Within-sector/between-sector reallocation of capital

- Efficient capital allocation

- Economic development

- Tobin’s Q