Abstract

Private wealth holdings are likely to become an increasingly important determinant in the job exit decision of elderly workers. Net wealth may correlate with worker’s characteristics that also determine the exit out of a job. It is therefore important to include a rich set of observed characteristics in an empirical model for retirement in order to measure the (marginal) effect of wealth on the job exit rate. But even with a rich set of regressors, the question remains whether there are time-invariant unobservable worker’s characteristics that affect both net wealth and the job exit rate. We specify a simultaneous equations model for job exit transitions with multiple destinations, net wealth, and the initial labour market state. The job exit rates and the net wealth equation contain random effects. We allow for correlation between the random effects of job exit and net wealth, and the initial labour market state. As instruments for wealth, we use survey information that measures ‘shocks’, like shocks to the household’s financial situation during the previous year. Results show an upward bias in the effect of net liquid wealth on retirement, but a small bias and a positive causal effect if net total wealth (including housing equity and mortgage debt) is used. Both measures of wealth show a significant positive effect on retirement. For an average individual with age 58, an increase in net liquid wealth by 64,000 euros, or in net total wealth by 110,000 euros, raises the exit rate into retirement by 1 % point.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

While population ageing puts current pension systems under financial strain, older cohorts accumulate more private wealth than their predecessors until just a couple of decades ago. Private wealth becomes an increasingly important financial resource for the retired compared to social security wealth. Pension arrangements become more flexible owing to institutional and financial innovation. It therefore becomes increasingly important to know whether the private wealth holdings of households influence the flow out of work of elderly workers.

Economic models (such as Kingston 2000) assign a positive impact of the level of private wealth holdings on the flow out of work. French (2005) and Gustman and Steinmeier (2005) estimate structural models of retirement based on the life-cycle framework, including wealth accumulation.Footnote 1 Van Ooijen et al. (2010) empirically analysed the relationship between wealth and subjective information on planned retirement with data from the DNB household survey (DHS), finding a small but significant impact. Bloemen (2011) empirically analyses the impact of the private wealth level of households on the job exit rate of elderly male workers in the Netherlands. The analysis shows that workers with higher levels of net wealth have higher retirement probabilities. The analysis was carried out with a rich set of regressors and includes a sensitivity analysis of the results, such as the use of different measures of net wealth, incorporating nonlinear wealth effects, checking for the impact of possible outliers in net wealth, and varying the flexibility of the age pattern. Results appeared robust. However, throughout the analysis the maintained assumption is that, after controlling for all the observable regressors, there is no correlation in unobservables between the level of net wealth and the job exit rate.

In this study, we analyse the role of unobservables in estimating the impact of wealth on retirement outcomes. As we will see, both job exit rates and wealth exhibit strong time-persistent individual- specific effects. As long as these random effects in wealth and job exit rates are uncorrelated, a regression framework, as was carried out in Bloemen (2011) to analyse the impact of wealth on job exit rates, remains valid and even desirable because of its simplicity. However, to relax the maintained assumption, we need a different modelling framework. This modelling framework needs, first, to incorporate correlation in time-invariant unobservables between job exit rates and private wealth. Second, we need to find instruments for private wealth. It is difficult to find suitable instruments, as the (limited amount of) literature on instrumenting wealth addresses diverse topics and is not very conclusive in suggesting possible instruments. Third, a model framework that allows for random effects also requires correction for selection into the sample, since the analysis of job exit naturally applies to the employed. Our aim is to set up a model framework that allows us to decompose the total effect of private wealth into a causal effect and an effect that is channelled through correlation in time-invariant unobservables. In the end, we will be able to present elasticities of the total effect, the causal effect, and the bias due to correlation in unobservables.

Before setting up such a model framework, we discuss the various a priori reasons for correlation in unobservables between the level of net wealth and the event of job exit. First, planned behaviour of households may play a role. Workers with a strong preference to retire early may have accumulated savings throughout their working life in anticipation of the early retirement. For such workers, we expect to see a positive relation between the level of net wealth and retirement, but this is not a causal effect of net wealth on retirement. If this mechanism of correlation in unobservables prevails, we expect an upward bias in the estimated effect of wealth on retirement if we do not incorporate such correlation in the estimation. Next, as pointed out by Bloemen (2002), the level of net wealth may be correlated with (favourable) worker’s characteristics that also influence job attachment, lay-off rates, and the attractiveness of pension schedules. Neglecting unobservable correlation is expected to bias downward the estimated impact of wealth on job exit, which may be particularly important for job exit states like unemployment and disability. Finally, there may be observable variables that are not observed in our data that can affect both the level of net wealth and the exit out of a job. For instance, in the data we do not observe details of individual pension arrangements.

In the analysis, we use data for the Netherlands from the Socio-Economic Panel (SEP). We study the impact of wealth on job exit rates of elderly workers, distinguishing ‘retirement’ and ‘unemployment’ and ‘disability’Footnote 2 as states of destination. We make this distinction since wealth a priori affects job exit rates to different states of destination differently if ‘choice’ and ‘restriction’ play different roles. In the analysis, two different net wealth measures are used. The first is ‘net liquid wealth’, and the second, ‘net total wealth’ adds the value of the house and subtracts the outstanding mortgage debt.

It is extremely difficult to find suitable instruments, since many individual characteristics are potentially correlated with unobservables in wealth, being a stock variable at the end of the working life. Since we are looking for instruments that are uncorrelated with a random, time-persistent, individual effect, suitable candidates can be variables that are somehow related to shocks in the business cycle or at the individual level. Our survey contains some indicators that are also generally used for constructing measures of ‘consumer confidence’. For instance, we have subjective information on the individual’s perception of the income development of the household in the past 12 months. The indicators are highly correlated with movements of the business cycle. They may represent shocks, or expectations about future shocks, to the household’s financial situation that are unplanned and out of control of the household. These variables are shown to have predictive power for the level of wealth. To test whether they also provide valid exclusion restrictions, we exploit the availability of multiple instrumental variables, and apart from estimating the basic model variant that excludes all of the instruments from the job exit rates, we estimate for each instrumental variable a model variant in which we drop the exclusion restriction and include the instrument in the job exit rates. This way we can test the validity of the exclusion restrictions. None of the exclusion restrictions is rejected.

Results show that the total effect of wealth which adds up both the causal effect and the bias is quite similar to results obtained by Bloemen (2011) using a much simpler regression framework without unobservables.Footnote 3 It shows a positive and significant effect of both measures of private wealth on exit into retirement while no significant effect is found for exit into unemployment or disability. But with the present model framework we are able to decompose the total effect into a causal effect and a bias. Decomposing the total effect into a causal effect and a bias, we find that the sign of the bias is in accordance with the expectation spelled out above: the bias is positive (upward) for exit into retirement and negative (downward) for exit into unemployment and disability. For net liquid wealth a correlation in unobservables with job exit is found, but the bias is not estimated precisely, whereas the causal effect is significant neither. Thus, it remains hard to assign the total effect either to a causal effect or to a bias. For net total wealth (including housing equity and mortgage debt), correlation in unobservables is smaller and not significant. For net total wealth, a positive causal effect on retirement remains, while for exit into unemployment and disability a positive causal effect appears, once the downward bias has been corrected for. One possible explanation for the more pronounced effect of net total wealth on retirement is that net total wealth contains more variation than net liquid wealth.Footnote 4 Another explanation may lay in the nature of housing equity and mortgage debt itself. A higher outstanding mortgage debt may provide an additional incentive to stay on the job.

In Sect. 2, we present the data that are used in the analysis. Section 3 presents the model. Section 4 presents the results of the estimation of the model. The final section concludes.

2 The data

We use data from the Dutch Socio-Economic Panel collected by Statistics Netherlands (SEP) for the years 1995 through 2002.Footnote 5 Survey waves are available on a yearly basis and refer to the month of May in each year. For the construction of our data on job exit transitions, we select employed individuals who are observed in at least two consecutive survey waves, such that we can observe changes in the labour market state from one year to another. Our model includes initial conditions for the labour market state requiring observations on non-employed individuals. The first year of observation will be used in the estimation of the initial condition for both the employed and non-employed individuals. We selected male individuals appearing in any of the survey waves in 1995 through 2001 in the age range of 48 through 64 reporting to be employed. We use the subsequent wave to check the labour market state of the same individuals in the next year.Footnote 6 The upperbound of 64 was chosen since the usual retirement age in the Netherlands is 65.

Our main outcome variable is job exit, but since net wealth has a potentially different impact on different states of destination (see the discussion in Sect. 3.1) we split up job exit by state of destination. To distinguish states of destination, we use a specific question from the survey.Footnote 7 Respondents that left their job are asked to report the reason for their job exit from a list of possibilities. The most important reasons for job exit listed are being fired, end of contract, shutdown of firm, illness/disability, early retirement/living of one’s investments,Footnote 8 pensioned, remaining (not specified any further).

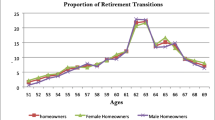

Pooling the (pairs) of waves with information on job exits results in 3711 pooled (worker-year) observations on 1113 different workers. For the 3711 pooled observations of 1113 different individuals, we have tracked the labour market state the next year: 208 (5.6 %) of them are observed not to have a job the next year. We merged states of destination into categories ‘retired’,Footnote 9 ‘unemployed’Footnote 10 and ‘disability’. The percentages of job exiters exiting by these channels are 72.1, 15.9, and 12.0, respectively (see Table 5).

Selecting observations for the estimation of the initial conditions (selection into the sample by the first year someone is observed in the survey) results in 572 and 1187 observations for non-employed and employed individuals, respectively. Note that we use more observations on workers in the estimation of the initial conditions, since we use less regressors, and consequently, the requirements for observability are less stringent. Adding the observations for the initial conditions and the transitions together, we use observations on 1759 different individuals and 4357 individuals-years.

Sample statistics for the sample of job exiters are in Tables 3 (continuous and count variables) and 4 (dummy indicators). For the initial conditions, sample statistics can be found in Tables 1 and 2. The background characteristics for job exiters come from the year before the (potential) transition: if we use year \(t+1\) to determine whether someone exited, the variables are from year t.Footnote 11

The longitudinal data set of the Socio-Economic Panel (SEP)Footnote 12 provides aggregate measures of assets and debts. The aggregate measures are computed by aggregating information on several asset and debt categories. The value of total liquid assets is obtained by Statistics Netherlands by aggregating the amounts on the current accounts and savings accounts, bonds, stocks, money lent, value of jewellery, antiques, and cars.Footnote 13 Total debts (excluding the value of mortgage debt outstanding) are obtained by aggregating personal loans at banks and credit institutions, loans to finance purchases, and remaining (including money borrowed from family and friends). Net liquid wealth is computed by the difference between liquid assets and total debts. An alternative measure of net wealth can be obtained by incorporating the value of the house and the mortgage debt. By adding the value of the house and subtracting the value of the mortgage debt from the value of net liquid wealth defined above, we obtain this alternative measure of net wealth, which we will refer to as net total wealth.

Survey respondents are asked to provide information on separate income components. This way we can construct a measure of non-labour income. Some of these income components are related to income out of assets and are likely to be correlated with the net wealth. We therefore construct two measures of non-labour income. The first is non-labour income obtained from assets. This includes interest, dividend, and annuity payments. In the estimation of the model, we do not include the level of this variable, since it can be argued to be correlated with the random effect in wealth. The other non-labour income variable consists of income obtained from family and friends, income obtained from renting rooms, income out of alimony payments, and housing benefits.

In Table 1, we find that the non-employed, within the age range from 48 through 64, are on average older and less wealthy than the employed. The final column of Table 1 reports the results of a pairwise comparison of the means of the two groups. The difference in age is significant, while the (on average younger) employed also have a significantly higher number of children living in the household. The difference in means between the employed and the non-employed for net liquid wealth is not significant, but the employed have, on average, a higher net total wealth than the non-employed. We also find that the spouse is employed less often, and if she is employed, her earnings are lower.

We use indicators for the level of education ranging from primary education (level 1) to university (level 5). In addition, we use indicators for the sector that respondents have been educated for, including technical, economic/administrative, general, and services. These sectors can be observed for both the employed and the non-employed.

There are more lower-educated and less higher-educated individuals among the non-employed (Table 2). The percentage of married men is lower among the non-employed, whereas the percentages of single, divorced, and widowed men all are higher.

For the job exiters (Tables 3, 4), the mean value of net liquid wealth is 62,782 guilders, whereas the median is 24,878. Net total wealth has a mean 282,224 and a median value of 199,209. The average monthly wage income is 4729 guilders. The value of the monthly wage is important not only because it measures current earnings, but in the Netherlands, pension benefit systems are typically of the defined benefit type and the future pension benefits are directly based on the final earnings.Footnote 14

In the Netherlands, the employee pension schedules are organized by collective bargaining agreements at the sector level. Replacement rates and age of eligibility to early retirement benefits vary by sector. The survey contains detailed information on the industrial sector of workers. Given the number of transitions observed, we have aggregated information on industrial sectors in 12 categories. In addition, we use indicators for the sector that respondents have been educated for. In the empirical analysis, we estimate our base specification with these broad sectors, and we do a sensitivity analysis with the more detailed industry dummies.

The survey contains limited information on participation in pension schemes. Each respondent is asked to report whether he participates in an employee pension scheme. Table 4 shows that this is the case for 89.8 % of the respondents, whereas 1.8 % does not know the answer to this question. Usually, the pension premium is withheld automatically from the salary by default. However, 4.1 % of the individuals claim to pay a pension premium directly. For these individuals, information is collected on the premium contribution paid: the average contribution is 253 guilders. In 73.8 % of the cases, the employer contributes to the payment of the premium, according to the survey respondents (Table 5).

Some individuals participate in an individual pension scheme, initiated by themselves. The motives for participating in an individual pension scheme can be quite diverse and are not recorded in the survey. We can imagine that poor employee pension schemes or many job changes in the past may add to the participation in individual pension schemes, but an alternative motive may come from high-income people who have more financial means to invest in individual pension schemes. In any case, someone participating in an individual pension scheme has a certain awareness of his financial situation after retirement, and including information on participation in individual pension schemes in the job exit rate may proxy this awareness as well as the ‘true’ impact of the pension scheme itself. We see that 15.6 % of the respondents participate in an individual pension scheme. The sample average of the monthly contribution is 407 guilders.

We have included some other properties of the job. We see that 32.0 % of the respondents characterize themselves as a civil servant. Early retirement schemes of civil servants are known to be more generous and widespread than for workers in the private sector. At this age, most workers (96.0 %) have a ‘permanent’ job.

The survey contains subjective measures of the health status of individuals. Survey respondents are asked ‘how, in general, is your health condition?’ They select one answer out of the following 5 possibilities: ‘very good’, ‘good’, ‘reasonable’, ‘bad’, and ‘very bad’. A majority of 61.4 % answers to be in good health, while 17.3 % report to be in very good health, and 19.7 % call their health reasonable. A minority reports their health to be bad (1.5 %) or very bad (0.08 %). In the model, we will merge these two categories of bad health and use it as the reference class.

3 The model

3.1 The job exit rate: theoretical background

Blundell et al. (1997) and Bloemen (2007) show that net wealth enters the job exit probability in a life-cycle model that allows for consumption, wealth accumulation and savings, the trade-off between retirement and work, and uncertainty in the availability of jobs. The choice to exit the job or to stay is based on comparing the levels of the value functions associated with the alternatives.Footnote 15 Let \(V_t(A_t,y_{t};d_{t+1})\) denote the value of choosing labour market state \(d_{t+1}\) at the end of period t (\(d_t = 1\) indicating employment and \(d_t = 0\) indicating retirement) for someone employed at the beginning of period t (\(d_t = 1\)). \(A_t\) denotes the level of net wealth at the beginning of period t, and \(y_{t}\) is the income in the current job that enters the function since it affects the level of pension benefits in typical defined benefit plans (see the model formulation in Bloemen 2007). The worker decides to exit the job if \(V_t(A_t,y_{t};0) > V_t(A_t,y_{t};1)\). The labour market state affects the value function since it affects the accumulation of pension wealth, the eligibility to retirement benefits, the level of income, and it has a direct effect on utility. The probabilityFootnote 16 that the worker decides to leave the job is

Under some regularity conditions, the probability of exiting the job in a period t, conditional on the level of wealth at the beginning of the period, is increasing in the level of wealth. We may want to extend the model with job exit due to demand side shocks. If uncertainty in the availability of jobs is expressed by an exogenous lay-off rate \(\delta _t\), then the probability that the worker exits the job in year t, conditional on being employed at time t, can be expressed asFootnote 17

The expression for the job exit rate (2) shows that according to economic theory net wealth enters the job exit rate by the choice to exit the job and not by the lay-off rate \(\delta _t\). For this reason, we will make a distinction between different exit routes in the empirical analysis and distinguish retirement from alternative reasons for job exit, like unemployment and disability. Kapteyn and De Vos (1998) argued that alternative exit routes for elderly workers, like unemployment and disability, are financially attractive, and job exit by these routes may occur in good harmony between the worker and the employer. Therefore, choice may not be completely absent as a factor determining the job exit by any of these routes, and net wealth may affect the exit rate.

Accordingly, we specify an empirical model for (2), controlling for observable and unobservable characteristics to isolate the causal effect of wealth, and distinguishing different states of destination.

3.2 The empirical model

Our empirical model describes transitions out of work into different destinations, along with model equations for net wealth and the initial labour market state.

We use a multinomial logit model to analyse the impact of net wealth on the job exit rate. To have a reasonable number of observations in each state of destination, we made a combined exit route unemployment/disability. This combined exit route represents job exit through other reasons than retirement. It represents job exits induced by restrictions in either labour market conditions or health status. We are aware that job exit for these reasons may contain a choice element, as discussed above, but for ease of terminology we will label this exit route ‘involuntary job exit’ in the sequel. An implicit assumption of the multinomial logit model is Independence of Irrelevant Alternatives (IIA). A practical implication for this assumption is that the two exit routes that we distinguish, ‘involuntary exits’ and ‘retirement’, should not be (too close) substitutes to each other. The reason why we make a distinction between these two exit routes in the first place is that we a priori expect that our variable of interest has a different impact on job exit in these different directions, because one direction is more governed by choice while the other follows from health and unemployment shocks. Moreover, eligibility conditions for exit in either direction are not the same. In the model below, we also include random effects, and after averaging over random effects, IIA in its pure form does not hold anymore (only conditional on the random effect).

For an individual i selected in the sample in period t and whose labour market state we keep track of in period \(t+1\), we have three possible values for the outcome variable \(d_{it}\): staying employed (E), retirement (R), and involuntary job exit (I). The state of employment is our base category, such that the probabilities we specify below are job exit probabilities. If \(x_{it}\) is a vector of explanatory variables, we specify the probability of job exit to state J as

with \(\beta _J, J = R, I\) the parameter vectors measuring the impact of the explanatory variables \(x_{it}\) on the probability of job exit to state J. The level of net wealth at the beginning of period t, \(A_{it}\), is included among the regressors \(x_{it}\). In (3), \(\alpha _i\) represents the unobserved individual-specific variation in job exit rates. We include one individual-specific random effect \(\alpha _i\), irrespective of the state of destination, as we typically observe only one realized exit route for the job exiters in our sample. The impact of the random effect on job exit is measured by \(\gamma _R\) and \(\gamma _I\), depending on the state of destination.Footnote 18 Since (3) is a nonlinear model, it suffers from the incidental parameter problem (Neyman and Scott 1948; Greene 2004) if \(\alpha _i\) were treated as a fixed effect.

Next, we formulate an equation for the level of net wealth. Since the empirical distribution of net wealth is highly skewed, Burbidge et al. (1988) propose to use the inverse hyperbolic sine transformation to transform the level of net wealth. The inverse hyperbolic sine transformation \(g(A_{it},\theta )\) on net wealth \(A_{it}\) is

with \(\theta \) a parameter.Footnote 19 The transformation (4) has some convenient properties:

-

If \(\theta \) tends to zero, then \(g(A_{it},\theta )\) tends to \(A_{it}\).

-

\(\hbox {Sign}(g(A_{it},\theta )) = \hbox {Sign}(A_{it})\).

-

\(g(A_{it},\theta )\) is monotonically increasing in \(A_{it}\).

-

\(g(A_{it},\theta )\) is symmetric in \(\theta \), so we can restrict \(\theta \ge 0\) without loss of generality.

The equation for net wealth now becomes

The net wealth equation contains an individual-specific random effect \(\omega _i\) and an idiosyncratic error \(u_{it}\). We do not wish to interpret the equation for net wealth as a structural, behavioural equation for wealth.Footnote 20 The functionality of the net wealth equation is to allow for correlation in unobservables between job exits and net wealth.Footnote 21

Supposing that we observe individual i for periods \(t=0\) through T, Eqs. (3) and (5) constitute a simultaneous dynamic panel data model with random effects. The random effects \(\alpha _i\) in the job exit rate and \(\omega _i\) in the wealth equation are allowed to be correlated. For period \(t=0\), Eq. (3) cannot be specified as it requires the labour market state \(d_{i,-1}\) and wealth level \(A_{i,-1}\) in period \(t=-1\). If there were no random effects in the model, we could safely ignore the likelihood contribution for labour market state \(d_{i0}\) and use the job exit probabilities for periods \(t=1\) through T. Since we include a random effect selectivity into employment at \(t=0\) becomes an issue, and we need to specify an initial condition for the labour market state \(d_{i0}\) at \(t=0\). Bhargava and Sargan (1983) advocate the use of simultaneous equations estimators in the context of linear dynamic random effects models and discuss the initial condition problem. Wooldridge (2005) provides solutions for the initial condition problem in nonlinear dynamic panel data models with random effects, and our model fits in this class of models. According to Wooldridge (2005), we formulate an equation for the labour market state \(d_{i0}\), conditional on the random effect. This equation does not contain \(d_{i,-1}\) (as it is not observed), so it is an equation for the labour market state as opposed to Eq. (3) which specifies a transition probability. Because we are estimating transition probabilities for the employed, this initial condition has the interpretation of a selection equation: its estimation requires data on non-employed individuals, not selected into the sample for transitions. The equation naturally also does not include the unobserved \(A_{i,-1}\), but, conform Wooldridge (2005), the initial condition contains correlation with the random effect \(\omega _i\) in the wealth equation (as well as with the random effect \(\alpha _i\) in the job exit equation), so this way selectivity into a labour market state related to wealth holdings is incorporated in the model.

The equation for the initial labour market state \(d_{i0}\), with \(d_{i0} = 1\) if individual i, selected in the sample in period \(t=0\), is employed and \(d_{i0} = 0\) if individual i is not employed, is

with \(m_{i0}\) the explanatory variables, \(\eta \) the parameter vector that measures the impact of the explanatory variables on the labour market state, and \(\epsilon _{i0}\) the error term that is allowed to be correlated with \(\alpha _i\) and \(\omega _i\). Wooldridge (2005) suggests the inclusion of the same exogenous variablesFootnote 22 in \(m_{i0}\) as in the job exit rate for \(t=1\). However, some of the variables in the job exit rate are specific to the state of employment (like job characteristics) and are not observable for the non-employed.

To allow for correlation in the unobservables \(\alpha _i\), \(\omega _i\), and \(\epsilon _{it}\), we assume they follow a joint normal distribution, independently and identically distributed across individuals:

The formulated model allows for correlation in unobservables between net wealth, as a regressor included in \(x_{it}\) in (3), and the unobservables \(\alpha _i\). The remaining regressors are assumed to be uncorrelated with the unobservables in the exit rates. Moreover, we assume that the regressors \(z_{it}\) in the wealth equation and \(m_{it}\) in the initial condition are uncorrelated with \(\alpha _i, \omega _i, \epsilon _{it}, u_{it}\) and the errors governing (3). Conform Wooldridge (2005), we first specify likelihood contributions for individual i for periods \(t=0\) through T conditional on the random effects (\(\alpha _i,\omega _i\)) using (7), after which we integrate over the random effects. Details are shown in ‘Appendix 1’.

Having introduced the technical specification, it is important to discuss the interpretation of the unobserved time-invariant variables \(\alpha _i\) and \(\omega _i\) and address the underlying assumptions.

First, the time-invariant individual-specific variable \(\alpha _i\) may represent unobserved individual-specific preferences concerning the trade-off between leisure and consumption, which from a life-cycle perspective influences the individual’s preference for pursuing a career job and the level of job attachment and work effort. Through this channel, the job exit probability (or, reversely, the staying-on probability) is influenced. Moreover, the individual’s preference for retiring earlier is affected directly through preference for leisure.

The time-invariant variable \(\omega _i\) in wealth may come from individual-specific preferences that affect wealth accumulation, such as the rate of time preference and the degree of risk aversion. Individuals with a lower rate of time preference assign a higher weight to future outcomes, which affects their propensity to accumulate wealth, whereas risk-averse types have a stronger precautionary savings motive. Reversely, a high rate of time preference can be associated with a low ability to plan and to accumulate sufficient wealth.

Unobserved factors \(\alpha _i\) and \(\omega _i\) that, respectively, influence the exit from the labour force and the wealth level are potentially correlated. Workers with a low rate of time preference who lack the patience to accumulate wealth may also lack the ability to stay in a career job and therefore have higher job exit rates. Not correcting for correlation in unobserved factors would potentially bias downward the impact of wealth on job exit. Since individuals with such unfavourable personal characteristics may be more likely to exit the labour via unemployment or disability, we think that this downward bias especially shows up in the impact of wealth on job exit in these directions. If individuals have a life-time preference for retiring early, their wealth accumulation may have been set accordingly. This mechanism would mainly affect the impact of wealth on the retirement exit route and leads to an upward bias. Moreover, the rate of time preference, affecting the individual’s ability to plan and save, also affects the individual’s ability to plan retirement age.

In this framework, we allow for correlation in the unobservable individual-specific and time-invariant variable in wealth and the job exit rate, but we make the assumption that the remaining explanatory variables are uncorrelated with these unobservables. Nevertheless, some of these variables are also part of a life-cycle framework. For instance, the level of education is usually set at the beginning of working life, but the choice for education may very well be made under consideration of similar leisure and consumption trade-offs. If someone with a high preference for life-cycle consumption chooses to invest in a high degree of education before entering the labour force, this affects the accumulation of wealth during working life and also the attachment to the job. However, in this study we treat educational attainment as predetermined, as we only look at job exit near the end of working life. Another variable that we assume to be uncorrelated with the random effects is marital status and family composition. These are variables that also may be part of a life-cycle plan, as family composition will interact with job attachment, while also savings motives are likely to be affected by family composition (think, for instance, of the bequest motive). These are issues that are not explicitly incorporated in the current approach.Footnote 23 Thus, to the extent that the random effects and the independent variables are correlated, the results in Sect. 4 need to be interpreted with caution.

3.3 Instrumenting wealth

We need instruments that predict wealth, but do not affect job exit rates independently from wealth. In our model, the random effect is the main source of correlation between wealth and job exit rates. Thus, to instrument net wealth, we need to include variables in \(z_{it}\) in the wealth Eq. (5) that are uncorrelated with the unobservables in this equation. Such variables are extremely hard to find. There are some examples known in the literature studying wealth in different contexts. Carroll and Samwick (1998) instrumented wealth with occupation, education, and industry, in a study of precautionary savings. Bover (2006) uses geographical variation in housing prices and inheritance information about real estate properties, in a study of wealth effects on consumption, with an emphasis on housing wealth. Dvornak and Kohler (2007) study the impact of housing wealth and stock market wealth on consumption expenditures and use first and second income lags as instruments. If we think that it is plausible that the main source of correlation between unobservables in exit rates and wealth is individual-specific random effects, a guideline to look for suitable candidates is to search for variables that are somehow related to business cycle shocks. Such variables can affect wealth in a specific period, but have little impact on the planned stock level of wealth resulting from unobserved leisure-consumption trade-offs and preferences for (early) retirement.

Our survey contains some indicators that are also generally used, for instance, by Statistics Netherlands, for constructing measures of ‘consumer confidence’. The survey respondents get subjective questions about their financial situation. In a first question, they are asked to classify the development of the financial situation of their household in the past 12 months. There are five possible classifications: obviously improved; somewhat improved; remained the same; somewhat deteriorated; obviously deteriorated. A second question is more specifically related to their income: survey respondents are asked to classify the development of their income in the past 12 months into one of the same five classifications. It seems plausible that information obtained by these types of survey questions largely represents exogenous financial shocks that are not necessarily correlated with the unobserved, time-persistent effect that affects the accumulation of wealth over the life cycle. In a different question respondents are asked: ‘Do you believe it is a favourable time now to make large expenditures?’ Respondents can answer by choosing any of the following three classes: it is a favourable time; neither favourable nor unfavourable time; it is an unfavourable time. It is plausible that the response to this survey question correlates with the level of net wealth, which actually is a desirable property for an instrumental variable (see later). But in order to use this information as an instrument, we need to assume that there is no unobserved variable that drives both the accumulation of wealth and the response to this question about purchase opportunities at a specific point in time. Since we have several instrumental variables in our data, we are able to test for the exclusion restrictions statistically. In Sect. 4, we present estimates for the basic model that imposes exclusion restrictions for all the instrumental variables, but for each instrumental variable separately we will also relax the exclusion restriction by including the instrument in the job exit rates and re-estimating the model. Since our method of estimation is maximum likelihood of the equation system for job exit rates and wealth, this way we can compute the likelihood ratio test statistic to test whether the exclusion restriction for the instrument is valid. Results are presented in Sect. 4 and show that none of the exclusion restrictions are rejected. Thus, we test the validity of the exclusion restrictions, irrespective of whether the underlying channel runs via time-invariant unobservables or time-varying unobservables.

The previous three survey questions are also used by Statistics Netherlands to construct an index of ‘consumer confidence’, as an indicator of the business cycle. Usually, the answers to these questions show a large variation across the business cycle. They represent ‘shocks’ in the household’s financial situation and the perception of the individual about the developments in the economy.

Another question that is asked to survey respondents is ‘How well are you able to make ends meet with your total (household) income?’ Respondents can answer by choosing any of the following six classes: very difficult; difficult; somewhat difficult; somewhat easy; easy; very easy. We think that, a priori, it is far less plausible to assume that there are no unobservable variables that drive both the accumulation of net wealth and the ability of a household to make ends meet. Those who are clumsy in dealing with financial matters may very well both experience a low accumulation of net wealth across the life cycle and problems in making ends meet. Note that the phrasing of the survey question also does not, unlike the previous three question, contain a specific time dimension or period context that make it plausible that this information represents shocks. However, on the other hand, the outcome may also be related to household’s financial restrictions that are exogenous to the household. It is unlikely that a poor ability of households to make ends meet is a situation that is strongly persistent across the life cycle, and the outcome of the survey question may also expose variation with shocks and business cycle fluctuations. But also for this instrumental variable, we can test for the exclusion restriction. In the empirical implementation, we will use this latter instrument more as a robustness check and estimate the model both with and without this additional information as an instrument for net wealth. It turns out that results are robust with respect to the inclusion of this instrument. The bottom part of Table 11 shows that the aggregate survey information of the instrumental variables covaries with the business cycle indicators (consumer confidence and an index for stock prices), which is consistent with the assumption that these variables capture shocks.

With first-stage regressionsFootnote 24 for wealth, F statistics were computed for testing whether the indicators add anything to the explanation of wealth. We included the same right-hand side variables as we will use in the estimation of the random effects model (see later). We constructed dummy variables corresponding to the information in Table 11: for the questions referring to the income and the financial situation in the past 12 month, we included four dummy variables for both in the regression; for the question about the time to make large expenditures, we included two dummy variables; for the question how well the household manages to make ends meet, we also included four dummy variables, since we merged the categories ‘very difficult’ and ‘difficult’. We first did a first-stage OLS regression including only the variables that are most likely to be related to shocks, i.e. the information about income and financial situation in the past 12 months, and whether it is a favourable time to make large expenditures. We did the analysis both for net financial wealth and for net total wealth (including the value of the house and the mortgage debt outstanding). In the text below, we report numbers in brackets for the latter concept of net wealth. The F statistic for testing the null hypothesis whether the 10 coefficients associated with these variables are jointly zero is 18.1 (24.4). With a p value \( < 0.00\), this indicates that the null hypotheses is rejected and the dummy indicators do add to the explanation of wealth. Including the variables increased the R-squared of the regression by 0.03 (0.03), which is not a very large addition. This can be viewed both as good and as bad news. It is good news for the interpretation of our instruments as shock variables: in general, explaining a stock variable with shock variables leads to a low R-squared. The small addition to the R-squared makes it less likely that our indicators may be correlated with the random effect. The flip side is that a small explanatory power of the instruments may make it harder to identify the causal effect of net wealth on job exit from the effect that is running through the unobservable random effect: this can result in relatively high standard errors of the coefficients of interest. Next, we have, in addition to these instruments, also added the information on how well the household is able to make ends meet. This leads to an F statistic of 718.0 (52.8), whereas the R-squared further increases with 0.07 (0.07), meaning that now the total set of 14 variables explain an additional 0.10 (0.10) of the R-squared.

4 Results

The parameter estimates of the multinomial logit model are presented in Sect. 4.1. In a multinomial logit model, the parameters of the choice probabilities measure the relative change in the choice probability as a result of a change in the explanatory variables. To gain more insight in the size of the wealth effect, we present computations of the marginal effects of wealth on the exit rates in Sect. 4.3. In this section, we also present a decomposition of the total effect of wealth into a causal effect and a ‘bias’. We present this decomposition both in terms of marginal effects and in terms of elasticities. Section 4.2 presents the outcomes of the tests for the exclusion restrictions.

4.1 Parameter estimates

The model Eqs. (3), (5), and (6) with the covariance structure in (7) have been estimated simultaneously by simulated maximum likelihood using 60 replications to simulate the integration over unobserved random effects. ‘Appendix 1’ shows the details of the likelihood function.

We have done the analysis with two measures of net wealth. The first measure we refer to as ‘net liquid wealth’. It is defined in the data section. The second measure adds the value of the house and subtracts the amount of the mortgage debt outstanding, and we refer to it as ‘net total wealth’ in the sequel. Table 6 displays the estimation results for net liquid wealth, while Table 7 shows the results for net total wealth. As instruments for wealth, we have included the indicators for income development and financial situation in the past 12 months and the indicators for the feeling whether it is a good time to make large expenditures. We have also estimated the model with an extended set of instruments, adding the indicators for how well the household is able to ‘make ends meet’. We do not show estimation results of the latter results in any tables, but we report on the outcomes in the sequel.

We start by discussing the results obtained with net liquid wealth. Table 6a shows the parameter estimates of involuntary job exits. In the left columns, we show restricted estimation results, obtained by setting all correlations in the random effects between job exits, wealth, and initial labour market state equal to zero. The right columns show the estimates that allow for an unrestricted correlation in the unobserved random effects. Theoretical considerations in Sect. 3.1 suggest that involuntary job exits are mainly led by demand side factors and health status and are not the (direct) result of choice. The estimates in Table 6a are in accordance with that view. Net wealth has a positive but insignificant effect on involuntary job exits, irrespective of whether or not we allow for correlation in unobservables. The parameter \(\gamma _{I}\) measures the impact of the random effect \(\alpha _i\) on the job exit rate (see the expression for the job exit rates in (3)). We see that the parameter \(\gamma _{I}\) is significantly different from zero. This indicates that there are time-invariant unobservable factors that make workers that exit involuntarily different from workers that stay on the job during the sample period. As discussed before, workers that exit may have unfavourable characteristics, like a lower productivity possibly, that make them more likely to end up in the state of unemployment or disability. To see whether the random effects affecting involuntary job exit are correlated with the random effects in wealth and initial conditions, we check the estimates of the correlation coefficients corresponding to (7), shown in Table 6e. There is a negative correlation between the random effect in wealth and the random effect of job exits (see coefficient \(\rho _{\alpha \omega }\)). Together with the positive coefficient \(\gamma _I\), this implies a negative correlation between time-invariant unobservables in wealth and involuntary job exits. This also explains the somewhat higher coefficient for the causal effect of wealth on involuntary job exits in the right columns of Table 6a, once we allow for this negative correlation in unobservables. Apparently, there are negative unobserved time-invariant worker’s characteristics that go together with lower wealth levels and a higher probability of involuntary job exit. We may think of lower job attachment attitude and low productivity. But in total, this negative correlation is not so strong, since the estimates both with and without allowing for correlation in random effects show an insignificant positive causal effect of wealth on involuntary job exit.

In the estimation, we have separated non-labour income obtained from assets from non-labour income obtained from other resources (see discussion in the data section). In the job exit probabilities, we include non-labour income from other resources in levels, while we include the first difference of non-labour income from assets, to difference out any possible random effects, as an instrument. To avoid endogeneity issues, we have not included non-labour income in the wealth equation. We include a lagged level of non-labour income from other resources in the initial labour market state.

Looking at the parameter estimates of the involuntary job exit rate in Table 6a, we see that having a permanent job reduces involuntary job exits. Also the subjective health indicators add to the explanation of the involuntary job exit rate. Workers with a very good health have a significantly lower involuntary job exit rate than workers in bad health (the reference group). The same holds for workers in good health and reasonable health. We also see that the size of the coefficients of the health indicator increases monotonically if health status decreases. We see a negative effect of marital status on involuntary job exits. Further sensitivity analysis with information on the spouse’s labour market state and the earnings of the spouse (not shown in the table) showed that this effect is caused by workers with an employed spouse: workers with an employed spouse have a lower probability to exit involuntarily. Class endogamy and polarization may be an explanation for this phenomenon.

Table 6b contains the estimates of the job exit rate into retirement. Here we see a difference in the coefficient of wealth, depending on whether or not we allow for correlation in random effects between wealth and the job exit probability. If we restrict correlations in unobservables to zero, net liquid wealth has a positive significant effect on the job exit rate into (early) retirement (with a p level of 0.06).

If we allow for correlation, the coefficient of wealth gets somewhat smaller and gets more imprecise. Parameter \(\gamma _R\) learns us something about the impact of random effects on job exit into retirement. We see that it is negative and significant at the 10 % level once we allow for correlation in random effects. The negative value of \(\gamma _R\), together with the negative correlation \(\rho _{\alpha \omega }\) (Table 6e), shows that there is a positive correlation in unobservables between wealth and job exit into retirement. Apparently, there are unobserved individual worker effects that go together with both higher wealth levels and a higher job exit probability into retirement. Once we allow for correlation in unobservables between wealth and job exit into retirement, we cannot detect a significant positive ‘causal’ effect of wealth on retirement anymore (interpreting the coefficient of wealth in the job exit probability as the ‘causal’ effect). As a robustness check, we also estimated the model with an extended set of instruments, adding information about how well households are able to ‘make ends meet’. This information adds more to the R-squared in the exploratory first-stage wealth regression. The a priori fear was that this information may more likely be correlated with the random effect in wealth. In that case, the use of this instrument will bias upward (away from zero) the causal effect. We estimated the three equations random effects model including this additional instrument in the wealth equation. However, we found little difference with the results shown in Table 6: the coefficient of wealth in the probability of job exit into retirement remained insignificant at the 10 % level, while the correlation in random effects between job exits and wealth remained significant at the 10 % level.

Looking at the parameter estimates of the observable characteristics affecting the job exit into retirement, we see that the job exit rate increases with age. The level of education has an impact here. The coefficients are not all significant, but show that workers with lower levels of education have higher job exit rates into retirement. This may reflect preferences, but also job properties (jobs for higher educated may be more interesting). Workers with a permanent job also have a higher exit rate into retirement, which reflects eligibility to (early) retirement schemes of workers with a permanent contract. We do not find significant effects of the health indicators. This does not mean that health does not influence the job exit rate by retirement at all. There is an indirect effect: involuntary job exit rates are higher for workers with lower health status, so once an involuntary exit has been realized due to poor health, no exit into retirement can take place, since the different exit routes are competing risks. But in comparing job exiters into retirement with job stayers, no impact of health is found. The information on pension premiums shows no significant effect on the exit rate on retirement.

Table 6c contains the estimates of the net wealth Eq. (5). The instrumental variables included in the wealth regression are all significant, as we already reported before from the exploratory first-stage regressions with OLS (Sect. 3.3). The level of wealth is lower, the worse is the development of the financial situation in the past 12 months. At first sight, it seems counterintuitive that wealth levels are higher the worse is the income development in the past 12 months. In exploratory regressions, we found out that the variable actually measures differences between the financial situation in the past 12 months and the income development in the past 12 months: these variables are highly correlated, but ‘income’ generally shows larger shocks than the ‘financial situation’. Households whose income increases, but whose financial situation increases less, do worse than households whose income increases, and whose financial situation increases as well.

The level of net liquid wealth increases with age and with the level of education. Net liquid wealth differs with the marital status of the worker. Divorced men have the lowest level of net wealth. For single and widowed men, we do not find much difference. We see a monotonically increasing pattern in the year dummies: there remain time effects, even though we include the indicators from Table 6 that are highly correlated with the business cycle.

Table 6d contains the results for the initial labour market state, while Table 6e shows the correlation coefficients \(\rho _{\alpha \epsilon }\) and \(\rho _{\omega \epsilon }\) of the unobservables in the initial state with the exit rates and wealth, respectively. The estimates of the correlation coefficients are small and close to zero, and not significant, suggesting that selectivity into non-employment based on unobservables that correlate with wealth and job exits does not seem to be very relevant here. Indeed, job exit rates before the age of 48 are still very small, and the results in Table 6d show that health, age, and having a low education level are important observed characteristics explaining selection into (non)-employment.

Throughout the discussion, we have already referred to Table 6e, showing us the parameter estimates of the covariance matrix in (7). For ease of interpretation, we have reparametrized the covariances into their corresponding correlation coefficients. What remains to be noted from this table is that random effects play an important role in the explanation of the level of net wealth, as shown by the parameter estimate \(\sigma _{\omega }\). The correlation across time periods in the net wealth level, due to the random effect, is \(\sigma _{\omega }^2/(\sigma _{\omega }^2 + \sigma _{\nu }^2)\) and takes the value 0.64. This shows that there is a lot of household-specific correlation in the net wealth level that cannot be explained by the observable characteristics that appear in the net wealth equation.Footnote 25

We see some interesting differences between the results with the alternative measure of net total wealth (Table 7) and the results obtained with net liquid wealth (Table 6).Footnote 26 Table 7a shows that once we allow for correlations in unobservables, the coefficient estimate of wealth in the probability of involuntary job exit becomes significant at the 10 % level. We again see that the coefficient \(\gamma _I\) is positive and significant, showing that time-persistent unobservable effect plays a role in the involuntary job exit rate. Table 7d tells us something about the correlations in unobservables between the job exit rates, wealth, and initial conditions. We see that for net total wealth, the correlations with the initial condition are more important. Between wealth and the initial condition, we see a positive and significant correlation coefficient. This correlation is possibly due to a relationship between employment status and home-ownership, as we did not find such correlation for net liquid wealth. The estimate for the correlation between initial employment and involuntary job exit is negative, but not very precise. The same holds for the correlation between wealth and the involuntary job exit.

Results for the job exit rate into retirement show a positive and significant effect of net total wealth, which becomes somewhat less precise once we allow for correlations in unobservables, but still it is significant at the 10 % level. The parameter estimate of \(\gamma _R\) is negative but insignificant. The latter suggest that job exiters into retirement are, in terms of unobservables, comparable to job stayers.

Results for the wealth equation (Table 7c) show comparable effects as before: wealth decreases with education level and increases with health. The separate coefficients of the instrumental dummies are not always significant for all response classes, but recall from the exploratory first-stage regressions that also here the F statistics reveal joint significance. Also for net total wealth, we have estimated the model with the extended set of instruments, which add more to the explanation of the wealth level, but there were no qualitative differences in the outcomes.

Table 7d shows the complete results for the covariance structure. The correlation across time in unobservables for net total wealth, \(\sigma _{\omega }^2/(\sigma _{\omega }^2 + \sigma _{\nu }^2)\), is 0.85, which shows a higher persistence in net total wealth that is assigned to unobservables compared to net liquid wealth. This reflects both the relatively large value of housing equity and mortgage debt and the relatively illiquid nature of housing equity.

4.2 Testing the exclusion restrictions

Exploiting the fact that we have multiple instruments, we test the exclusion restrictions. For each instrumental variable, we re-estimate the model, including the instrument in the job exit rates, and we compute the likelihood ratio test statistic. As an example, consider the instrumental variable derived from the survey question whether it is the right time to make large expenditures. The survey information was transformed into dummy indicators for the outcomes ‘favourable’ and ‘neither favourable, nor unfavourable’, so we add these two dummy variables to the two job exit probabilities, implying that we need to test whether the corresponding four coefficients are jointly zero. We test this by computing the likelihood ratio test statistic and comparing it to critical values of the Chi-squared distribution with 4 degrees of freedom. For the exclusion restrictions to be valid, they should not show a separate impact on the exit rates. By including a set of instruments in the exit rates, while maintaining the exclusion restrictions for the remaining instruments, we can test whether they have a separate impact on the exit rates. The principle of the test is similar to an overidentifying restrictions or Sargan test, where the availability of multiple instrumental variables is exploited. An important caveat of these type of tests is that, while for one set of instruments the exclusion restrictions are being tested, the assumption is maintained that the remaining instruments are valid. We try to deal with this as best as possible by circulating the role of the instruments in the tests, and testing for each set of instruments the overidentifying restrictions.

Tests are performed both for the model variant with net liquid wealth and for the model variant with net total wealth. Table 8 shows the test statistics for each instrumental variable. It also shows the relevant number of degrees of freedom and the corresponding critical values of the Chi-squared distribution at the 10 and the 5 % levels. For all the instruments, the value of the likelihood ratio test statistic is below the critical value, both at the 5 and at the 10 % levels.Footnote 27 Thus, the exclusion restrictions are not rejected.

4.3 Decomposition into ‘causal effect’ and ‘bias’: marginal effects and elasticities

Section 4.1 presented the parameters estimates, and the parameter estimates of multinomial choice probabilities are related to the relative change in probabilities due to a change in the variable. In this section, we gain further insight in the sensitivity of the job exit rates with respect to the level of wealth, by both computing the marginal effects of wealth on exit rates and by evaluating elasticities. Both the marginal effect and the elasticities are based on the derivative of the exit rate with respect to the level of wealth. In ‘Appendix 2’, we show in (18) that we can decompose the derivative of the exit probability with respect to wealth into a causal effect and a bias. In ‘Appendix 2’, we show that the derivative consists of three terms: the first term corresponds to the causal effect and the second and third term to the bias. The latter two terms represent the effect of wealth on job exits that arises because of correlation in the random effects between job exits and wealth and initial conditions. The expression measuring this effect is zero if these correlation coefficients are restricted to zero. Adding up of the two effects gives the total effect, which may be interpreted as the effect of wealth on job exit that we get if we ignore the distinction between the causal effect and the effect that arises due to correlation through unobservables (the bias).

Table 9 shows the marginal effects of wealth. We have evaluated the marginal effects for a worker of the age of 58. At the age of 58, most workers have not yet reached the eligibility age for early retirement,Footnote 28 but are old enough to consider retirement, so especially for this group it is interesting to analyse to what extent a different wealth level can induce them to retire earlier.

The values of the remaining explanatory variables are set to their sample means. To compare the order of magnitude of the impact of wealth on the job exit probabilities, we also present the marginal effect for other variables. We show marginal effects for age, education, health, having a permanent job, and the absence of children in the household.

The upper part of Table 9 shows the marginal effects on the involuntary exit rate, while the lower part shows job exits due to retirement. The left two columns show the results for net liquid wealth, while the results for net total wealth are shown in the columns at the right side.

In accordance with the estimation results in Tables 6a and 7a, no significant causal effect of wealth is found on the involuntary exit rates. The impact is also small in magnitude. It is interesting to see that the bias effect of wealth on involuntary job exits is negative. This is consistent with the story that a higher level of wealth may proxy for favourable personal characteristics, making it less likely that the workers exit by the involuntary exit route. The opposite signs in bias and causal effect make the total effect negative. Having opposite signs for bias and causal effect may be a reason why it is difficult to find accurate estimates of wealth on involuntary exits. The table shows the bigger (negative) effects of a better health and having a permanent job on involuntary exits.

For the retirement exit rate, we find both for net liquid wealth and for net total wealth a positive and significant total effect, but results differ if we look at the decomposition. For net liquid wealth, we see that it is difficult to distinguish the causal effect from the bias on job exit into retirement. The total effect is positive and significant, but the causal effect and the bias are roughly of equal size. To interpret the magnitude of the causal effect, we may do a simple back-of-the-envelope calculation to answer the question how big an increase in net liquid wealth we need to raise the retirement rate by 1 % point: we approximately need an increase in wealth by 0.01/0.00071 (in units of 10,000 guilders) which corresponds to an increase in wealth by roughly 64,000 euros. This is a large number, but falls well within the sample variation that we reported in Table 1.Footnote 29

For net total wealth, the bias is much smaller compared to the causal effect, and the causal effect is more precisely estimated. Doing a similar calculation for the magnitude of the causal effect of net total wealth on the retirement rate, to get an increase in the retirement rate by 1 % point, we roughly need an increase in net total wealth by 0.01/0.00040 (in units of 10,000 guilders) corresponding to an increase in net liquid wealth by roughly 110,000 euros, which is a large number but at the same time a number that is well within the limits of the sample variation. This order of magnitude can easily measure the difference between someone with a below average valued house, and someone with a more expensive house.

For some other covariates, we find bigger effects: we find an increasing impact of age, and individuals with university level of education are more likely to stay on the job longer. It matters whether there are no children in the household anymore, and workers with a regular, permanent job are more likely to make use of the retirement exit route. Health does not have much impact on exit by retirement anymore.

Table 9 shows the absolute changes in the exit probability due to changes in wealth. Another way of exposing the impact of wealth is by computing elasticities. The upper part of Table 10 displays the elasticities for net liquid wealth. Standard errors are in brackets. Conform the findings for the marginal effects, the elasticity for the causal effect of net liquid wealth on job exit is not significant for either exit route. The same holds for the elasticity for the unobservable correlation. For job exits into retirement, the elasticity of the effect of net liquid wealth running through the unobservables is just somewhat larger than the causal effect. Interestingly, adding the two effects together shows a positive and significant association between net liquid wealth and the transition into retirement. This indicates that there is a negative correlation between the estimates of the separate parts, which leads to a smaller standard error for the sum. The value of the elasticity of the total effect is comparable to results obtained by Bloemen (2011), who ignores the role of unobservables. The results show that it is difficult to empirically disentangle the total effect, which is estimated precisely, into the causal effect and the bias which are both estimated imprecisely. Note, though, that the separate coefficients in Table 6 seemed to indicate that the impact of net liquid wealth running through unobservables is somewhat more important than the causal impact. For the involuntary job exit, we see a negative value of the elasticity of the net liquid wealth effect running through the unobservables, which is quite a bit larger than the causal effect. For both the total effect and the causal effect and the bias, the elasticities of the involuntary job exit probabilities with respect to net liquid wealth are estimated imprecisely, such that we cannot conclude that there is any impact of wealth on involuntary job exit.Footnote 30

The lower part of Table 10 shows the results for net total wealth. For this measure of wealth, we find a causal elasticity for the probability of exit into retirement of 0.15, which is estimated significantly at the 10 % level. There is also a positive value assigned to elasticity job exit due to unobservables (the bias), but this is much smaller than the causal effect, and not significant. The value of the total elasticity is 0.18 and significant at the 5 % level, somewhat larger than the estimated elasticity for the causal effect, but taking the standard errors into consideration, we would not make a large mistake here if the distinction between causal effects and effects running through unobservables were ignored. The value of this total elasticity is again quite close to the value obtained in Bloemen (2011), ignoring correlation in unobservables. Interestingly, for the causal elasticity of the involuntary job exit probability with respect to net total wealth we find a value of 0.13, which is significant at the 10 % level. The effect of unobservables is negative, and the estimated total elasticity is quite close to zero.Footnote 31

5 Conclusions

We analysed the effect of private wealth on job exit at older age. We constructed a model framework that allows us to decompose the total effect of private wealth into a causal effect and an effect that is channelled through correlation in time-invariant unobservables, the bias. Our model is a simultaneous dynamic panel data model with random effects, with equations for job exit into several destinations, net wealth, and an initial condition. We instrument wealth with survey information that varies with business cycle shocks, and we perform statistical tests for the exclusion restrictions, exploiting the fact that we have multiple instrumental variables. The exclusion restrictions are not rejected by the test. We present results using net liquid wealth and net total wealth (excluding the value of the house and the outstanding mortgage debt). Results are robust if an extended set of instrumental variables is used.

Results for the total effect, adding up the causal effect and the bias, are close to results obtained in a study by Bloemen (2011), which is completely based on observable regressors and ignores potential correlation in unobservables. The total effect shows a positive and significant impact of wealth into retirement, and no effect of wealth on involuntary job exit, for both measures of net wealth. However, for net liquid wealth estimation results reveal a correlation between unobservables in exit rates and net wealth, and the total effect is biased upward for retirement and downward for involuntary job exits. The decomposition of the elasticity into a causal effect and a bias shows that we get a precise estimate neither for the causal effect nor for the bias.

For net total wealth, the causal effect on retirement is positive, while correlation in unobservables between job exit rates and net total wealth is not detected. One possible explanation for the more pronounced effect of net total wealth on retirement is that net total wealth contains more variation than net liquid wealth. Another explanation may lay in the nature of housing equity and mortgage debt itself. A higher outstanding mortgage debt may provide an additional incentive to stay on the job. Housing wealth is illiquid in the short run and can be made liquid only by selling the house. In this respect, housing wealth is closer to pension wealth, which is also illiquid and only becomes available upon eligibility in the shape of income provision (As opposed to pension wealth, it may be possibly to borrow against housing equity.).

Computation of marginal effects revealed that we need fairly large increases in wealth levels to find an ‘economically significant’ impact on retirement rates (of, say, 1 % point), but on the other hand those increases are well within the sample variation. For an average individual with age 58, we computed that if net liquid wealth is increased by 64,000 euros, or net total wealth by 110,000 euros, the exit rate into retirement can be raised by 1 % point. Once pension systems become more flexible in terms of eligibility and the choice of the retirement age, net wealth may become an increasingly important factor in the choice to retire, and policy makers should be aware that policy measures to induce workers to stay on the job and retire later may be partially offset for workers with a sufficiently high net (total) wealth level. However, from a point of view of public finance, that should not be a problem if retiring earlier is accounted for in an actuarially fair way.

Notes

Labelled as ‘involuntary’ job exit later on.

However, in the present analysis some additional variables are added. Particularly interesting is the inclusion of subjective indicators for health status.

In particular, there are relative few elderly workers with financial (non-mortgage) debt.

The SEP originates from 1984. Only from 1987 on information about wealth holdings was collected. In 1990 a reform of the SEP took place, having a major impact on the collection of income data (from net to gross), the frequency of the data collection (from every 6 months to annually), and the month of data collection. Only from 1995 on survey questions remained relatively stable, and in particular, for our purpose we use a survey question on an extensive range of reasons for job exit that was included from that year. In 2002, the SEP survey stopped existing.

An important condition is that information on the same individual is present in the next wave. Individuals that are subject to attrition of any kind are dropped from the data. This requires the assumption that unobserved factors in the attrition process are uncorrelated with unobservables in the determination of the labour market state. Van den Berg and Lindeboom (1998) (and a couple of other studies by the same authors) address the issue of attrition in panel data in the context of the estimation of labour market transition models, motivating that workers experiencing labour market transitions are more likely to leave a panel survey. Here we have not corrected for attrition bias.

This survey question is available from 1995, which is an important reason why we start our analysis in this particular year.

In Dutch: ‘rentenieren’.

‘Retired’ includes job exit for the reason of ‘early retirement/living of one’s investments’, ‘pensioned’, and ‘remaining’. Note that the retirement categories are self-reported and that we cannot distinguish whether someone goes on early retirement according to the narrow definition of the early retirement system, or whether someone decides to live on interest. Moreover, the category ‘pensioned’ is also recorded by some job exiters younger than 60, so it can indicate that the reported ‘being pensioned’ may also include early retirement in the narrow sense. There is a category ‘remaining’ which does not further specify the reason for job exit. The respondents could also report job exit for reasons like ‘marriage’, ‘taking care of the children’, and ‘taking care of a family member’, but none of the respondents in our subsample reported any of these categories as the reason for their job exit. The category ‘remaining’ does not include these types of reasons for job exit, and since the categories that survey respondents may choose from are pretty exhaustive, it seems likely that it refers to job quits, rather than job exit due to restrictions or involuntary reasons like unemployment or disability. Since quits represent a choice, we decided to include it in the category retirement. The category include 5.8 % of the job exiters. A sensitivity analysis with the multinomial logit model showed that the coefficients of wealth are hardly affected by reassigning those observations to the other exit route.

Job exit for the reasons of being fired, termination of contract, and shutdown of a firm.

For instance, if we select an employed individual in the age range 48–64 in the year 1995, we use the wave in 1996 to check whether a job exit took place and use information on net wealth, marital status, pension scheme participation, etc., from the May 1995 wave. However, since information on income refers to the previous fiscal year, we use income information from the May 1996 wave, which refers to the calendar year (January–December) 1995. Since the survey in May 1996 collects information on the wage income earned in 1995 and also on the number of months worked in that year, we can determine the monthly earnings of each individual in the year 1995, which is assigned to the monthly wage income earned in May 1995. In the estimation, we make use of some ‘lagged’ income components from the May 1995 wave, which refers to the year 1994. This example is for the years 1995–1996, but the same holds for any other pairs 1996–1997 through 2001–2002. Self-employed individuals are excluded: the survey does not apply the questions on wealth to the self-employed. In the waves of 1995 through 2001, information on income in the previous fiscal year is expressed in guilders. In the year 2002, the information on income has been collected in euros. We have converted this information in euros to guilders by multiplying the amount by 2.20371 which is the euros to guilder exchange rate.

The SEP is provided in both a compact longitudinal form and more extensive wave by wave. Both variants are available to us, so any choice made in selecting the sample are not led by limitations of the longitudinal data. We only use the longitudinal data to obtain the aggregate wealth variable according to the definition set by Statistics Netherlands.

Not every household has possessions in each category. Money in current and savings account is most common. Jewellery and antiques apply to few households only. In this paper, we only consider aggregate wealth and not the relation between portfolio composition and retirement.