Abstract

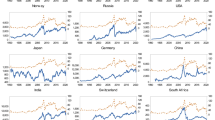

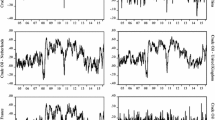

In this paper, we investigate volatility spillovers and dynamic correlations between crude oil and stock markets using GARCH-class models. We focus on the dynamic relationships of seven major oil-exporting countries and nine oil-importing countries. Our main findings based on in-sample and out-of-sample evidence suggest that the volatility spillovers and dynamic correlations between global crude oil market and a country’s stock market depend on the net position of oil imports and exports of this country in the world market. In addition, crude oil risk can be better hedged by investing in stocks of oil-exporting countries than in those of oil-importing countries.

Similar content being viewed by others

Notes

It is known that more complex models always have more parameters to be estimated, and therefore, they always have greater estimation errors in the process of out-of-sample forecasting (see, e.g., Jorion 1992; DeMiguel et al. 2009). Due to the existence of estimation error, it is not necessary that multivariate GARCH models generate more accurate forecasts than simple univariate ones.

The acronym comes from synthesized work on multivariate GARCH models by Baba, Engle, Kraft, and Kroner. Unlike the VEC model of Bollerslev et al. (1988), the BEKK model does not need to impose strong restrictions on the parameters to ensure the positivity of variance and covariance matrix, \(\hbox {H}_{\mathrm{t}}\).

It may be argued that in prior to model the volatility relationships, we should model the return relationships. For example, Aloui and Jammazi (2009) consider the stylized fact that stock returns react asymmetrically to changes in price of crude oil, depending on whether stock markets are in bullish or bearish phases (also see the references therein). Actually, we find that if we do so, we can obtain the similar results with those in Table 1. As our main interest is volatility comovement rather than return comovement and also for the purpose of reducing the burden of estimating and forecasting, we assume that the conditional mean is a constant following Koopman et al. (2005) and Wang and Wu (2012a, b).

We also calculate the conditional correlations using BEKK models. They are similar to the correlations from DCC models. To save space, we do not report these correlations but they are available upon request.

To save space, we only give the probabilities of regime 1. The probabilities of regime 2 is equal to 1 minus those of regime 1.

According to Engle (2002) and Caporin and McAleer (2012), the DCC and CCC parameters can be estimated using a two-step method, the first step being univariate model estimates for each series and the second step being the correlation estimates. Based on the two-step method, the volatility forecasts obtained from the CCC and the DCC model are equivalent to those from the univariate GARCH model. The only difference is the correlation term. Thus, in this paper, the performances of the CCC and the DCC models are not evaluated in the sense of volatility forecasting.

Here, we thank an anonymous referee for this suggestion.

References

Akram QF (2004) Oil prices and exchange rates: Norwegian evidence. Econom J 7:476–504

Aloui C, Jammazi R (2009) The effects of crude oil shocks on stock market shifts behavior: a regime switching approach. Energy Econ 31:789–799

Amano RA, van Norden S (1998) Oil prices and the rise and fall of the US real exchange rate. J Int Money Finance 17:299–316

Apergis N, Miller SM (2009) Do structural oil-market shocks affect stock prices? Energy Econ 31:569–575

Arouri MEH (2011) Does crude oil move stock markets in Europe? a sector investigation. Econ Model 28:1716–1725

Arouri MEH, Lahiani A, Nguyen DK (2011) Return and volatility transmission between world oil prices and stock markets of GCC countries. Econ Model 28:1815–1825

Arouri MEH, Jouini J, Nguyen DK (2012) On the impacts of oil price fluctuations on European equity markets: volatility spillover and hedging effectiveness. Energy Econ 34:611–617

Ashley R, Granger CWJ, Schmalensee R (1980) Advertising and aggregate consumption: an analysis of causality. Econometrica 48:1149–1167

Baillie RT, Myers R (1991) Bivariate GARCH estimation of the optimal commodity futures hedge. J Appl Econom 6:109–124

Barsky RB, Kilian L (2004) Oil and macroeconomy since the 1970s. J Econ Perspect 18:115–134

Billio M, Caporin M (2005) Multivariate Markov switching dynamic conditional correlation GARCH representations for contagion analysis. Stat Methods Appl 14:145–161

Bjørnland HC (2009) Oil price shocks and stock market booms in an oil-exporting country. Scott J Polit Econ 56:232–254

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econom 31:307–327

Bollerslev T (1990) Modelling the coherence in short-run nominal exchange rate: a multivariate generalized ARCH approach. Rev Econ Stat 72:498–505

Bollerslev T, Wooldridge JM (1992) Quasi-maximum likelihood estimation and inference in dynamic models with time-varying covariances. Econom Rev 11:143–172

Bollerslev T, Engle RF, Nelson D (1994) ARCH models. In: Engle RF, McFadden DL (eds) Handbook of econometrics, vol. IV. Elsevier Science B.V, Amsterdam, pp 2961–3038

Bollerslev T, Engle RF, Wooldridge JM (1988) A capital asset model with time-varying covariances. J Polit Econ 96:116–131

Caporin M, McAleer M (2012) Do we really need both BEKK and DCC? a tale of two covariance models. J Econ Surv 26:736–751

Chang C-L, McAleer M, Tansuchat R (2010) Analyzing and forecasting volatility spillovers, asymmetries and hedging in major oil markets. Energy Econ 32:1445–1455

Chang C-L, McAleer M, Tansuchat R (2011) Crude oil hedging strategies using dynamic multivariate GARCH. Energy Econ 33:912–923

Chen S-S (2009) Oil price pass-through into inflation. Energy Econ 31:126–133

DeMiguel V, Garlappi L, Nogales F, Uppal R (2009) a generalized approach to portfolio optimization: improving performance by constraining portfolio norms. Manage Sci 55:798–812

Diebold FX, Lopez JA (1996) Forecast evaluation and combination. In: Maddala GS, Rao CR (eds) Handbook of statistics: statistical methods in finance, vol. 14. North-Holland, Amsterdam, pp 241–268

Elder J, Serletis A (2010) Oil price uncertainty. J Money Credit Bank 42:1137–1159

Engle RF (1982) Autoregressive conditional heteroskedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50:987–1007

Engle RF (2002) Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J Bus Econ Stat 20:339–350

Engle RF, Kroner KF (1995) Multivariate simultaneous generalized ARCH. Econ Theory 11:122–150

Fan Y, Xu J-H (2011) What has driven oil prices since 2000? a structural change perspective. Energy Econ 33:1082–1094

Ferderer JP (1996) Oil price volatility and the macroeconomy. J Macroecon 18:1–26

Filis G, Degiannakis S, Foros C (2011) Dynamic correlation between stock market and oil prices: the case of oil-importing and oil-exporting countries. Int Rev Financ Anal 20:152–164

Hamilton JD (1983) Oil and the macroeconomy since World War II. J Polit Econ 91:228–248

Hamilton JD (1996) This is what happened to the oil price–macroeconomy relationship. J Monet Econ 38:215–220

Hamilton JD (2003) What is an oil shock? J Econom 113:363–398

Hamilton JD (2008) Macroeconomics and ARCH. NBER working paper 14151

Hamilton JD (2009) Understanding crude oil prices. Energy J 30:179–206

Hansen PR (2005) A test for superior predictive ability. J Bus Econ Stat 23:365–380

Hansen PR, Lunde A (2006) Consistent ranking of volatility models. J Econom 131:97–121

Inoue A, Kilian L (2004) In-sample or out-of-sample tests of predictability: Which one should we use? Econom Rev 23:371–402

Johnson LL (1960) The theory of hedging and speculation in commodity futures. Rev Econ Stud 27:139–151

Jorion P (1992) Portfolio optimization in practice. Financ Anal J 48:68–74

Jung H, Park C (2011) Stock market reaction to oil price shocks: a comparison between an oil-exporting economy and an oil-importing economy. J Econ Theory Econom 22:1–29

Kilian L (2009) Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am Econ Rev 99:1053–1069

Kilian L, Park C (2009) The impact of oil price shocks on the U.S. stock market. Int Econ Rev 50:1267–1287

Koopman SJ, Jungbacker B, Hol E (2005) Forecasting daily variability of the S&P 100 stock index using historical, realized and implied volatility measurements. J Empir Finance 12:445–475

Ku Y-H, Chen H-C, Chen K-H (2007) On the application of the dynamic conditional correlation model in the estimating optimal time-varying hedge ratios. Appl Econ Lett 14:503–509

LeBlanc M, Chinn MD (2004) Do high oil prices presage inflation? Bus Econ 39:38–48

Ljung M, Box G (1978) On a measure of lack of fit in time series models. Biometrika 65:297–303

Lopez JA (2001) Evaluation of predictive accuracy of volatility models. J Forecast 20:87–109

Malik F, Hammoudeh S (2007) Shock and volatility transmission in the oil, US and Gulf equity markets. Int Rev Econ Finance 16:357–368

Nomikos NK, Pouliasis PK (2011) Forecasting petroleum futures markets volatility: the role of regimes and market conditions. Energy Econ 33:321–337

Park J, Ratti RA (2008) Oil price shocks and stock markets in the U.S. and 13 European countries. Energy Econ 30:2587–2608

Patton AJ (2011) Volatility forecast comparison using imperfect volatility proxies. J Econ 160:246–256

Politis DN, Romano JP (1994) The stationary bootstrap. J Am Stat Assoc 89:1303–1313

Sadorsky P (1999) Oil price shocks and stock market activity. Energy Econ 21:449–469

Sadorsky P (2012) Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Econ 34:248–255

Sadorsky P (2014) Modeling volatility and correlations between emerging market stock prices and the prices of copper, oil and wheat. Energy Econ 43:72–81

Wang Y, Wu C (2012a) Energy prices and exchange rates of the U.S. dollar: further evidence from linear and nonlinear causality analysis. Econ Model 29:2289–2297

Wang Y, Wu C (2012b) Forecasting energy market volatility using GARCH models: Can multivariate models beat univariate models? Energy Econ 34:2167–2181

Wang Y, Wu C, Yang L (2013) Oil price shocks and stock market activities: evidence from oil-importing and oil-exporting countries. J Comp Econ 41:1220–1239

Wei C (2003) Energy, the stock market, and the putty-clay investment model. Am Econ Rev 93:311–323

Acknowledgments

We would like to thank the editor, Robert Kunst, and two referees for making many constructive and useful comments and suggestions that helped us to improve the paper. The suggested additional analyses and changes proved to be important in making our findings more comprehensive, convincing, and better understood. This paper is supported by the National Science Foundation of China (No. 71401077).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wang, Y., Liu, L. Crude oil and world stock markets: volatility spillovers, dynamic correlations, and hedging. Empir Econ 50, 1481–1509 (2016). https://doi.org/10.1007/s00181-015-0983-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-015-0983-2