Abstract

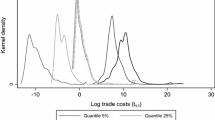

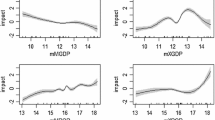

This paper assesses whether the sensitivity of bilateral trade volumes to various trade cost factors is constant or varies across countries. It utilizes a random coefficient model and analyzes a cross-sectional sample of bilateral trade data for 96 countries in 2005. We expect the elasticity of trade to vary particularly with bilateral distance and bilateral tariffs due to measurement error about these factors. Indeed, the variability of coefficients is significant for these trade cost measures. The results indicate that the elasticity of trade with respect to tariffs in different countries varies relatively more than that with respect to distance. This is consistent with there being a host of sources of measurement error about bilateral tariffs (due to strategic or non-strategic mis-reporting; the potential inappropriateness of the weighting of disaggregated tariffs; etc.).

Similar content being viewed by others

Notes

With as many parameters \(\eta _{ij}\) as country pairs, \(\eta _{ij}\) is not identified and is captured in the random error term \(\epsilon _{ij}\).

In a perfectly symmetric data set without any missing observations, the number of observations would be \(96\times 95 / 2 = 4560\). We assume that missing observations do not induce bias (i.e., there is no sample selection). Indeed, the paper by Egger et al. (2011) suggests that gravity models which condition on country-specific effects (as we do by tetradic differencing) do unlikely display sample selection bias, and two-part models can be used for the analysis with zeros. In that sense, we focus on the second part of a two-part gravity model.

For the present paper, we employed the xtmixed routine of Stata. This package is designed to fit nested models, when observations from one group (e.g., country pairs) are nested within larger groups (e.g., continents). xtmixed can further be adapted to evaluate crossed models as required here, where groups are in fact not hierarchical but horizontal or crossed (e.g., exporting by importing countries).

We have done so but suppress the respective results for the sake of brevity.

References

Anderson JE, Wincoop E (2003) Gravity with gravitas: a solution to the border puzzle. Am Econ Rev 93(1):170–192

Anderson JE, Wincoop E (2004) Trade costs. J Econ Lit 42(3):691–751

Baltagi BH, Egger PH, Pfaffermayr M (2014) Panel data gravity models of international trade. In: Baltagi BH (ed) The Oxford handbook of panel data, Chapter 20. Oxford University Press, New York

Cameron AC, Gelbach JH, Miller DL (2006) Robust inference with multi-way clustering. Technical report, NBER technical working paper 327

Egger PH, Nigai S (2014) Structural gravity with dummies only. Constrained ANOVA-type estimation of gravity panel data models. Technical report, CEPR discussion paper, forthcoming

Egger PH, Larch M, Staub KE, Winkelmann R (2011) The trade effects of endogenous preferential trade agreements. Am Econ J Econ Policy 3(3):113–143

Engel C, Rogers JH (1996) How wide is the border? Am Econ Rev 86(5):1112–1125

Fisman R, Wei S-J (2004) Tax rates and tax evasion: evidence from “missing imports” in china. J Polit Econ 112(2):471–500

Head K, Mayer T (2014) Gravity equations: workhorse, toolkit, and cookbook. In: Gopinath G, Helpman E, Rogoff KR (eds) Handbook of international economics, Chapter 3, vol 4. North Holland, Amsterdam

Hillberry R, Hummels D (2008) Trade responses to geographic frictions: a decomposition using micro-data. Eur Econ Rev 52(3):527–550

Melitz J, Toubal F (2014) Native language, spoken language, translation and trade. J Int Econ 93(2):351–363

Pinheiro JC, Bates DM (2000) Mixed-effects models in S and S-PLUS. Springer, New York

Rousslang DJ, To T (1993) Domestic trade and transportation costs as barriers to international trade. Can J Econ 26(1):208–221

StataCorp (2013) Stata multilevel mixed-effects reference manual. StataCorp, College Station

Acknowledgments

The authors acknowledge financial support from the Czech Science Foundation, Grant Number P402/12/0982.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Egger, P., Průša, J. The determinants of trade costs: a random coefficient approach. Empir Econ 50, 51–58 (2016). https://doi.org/10.1007/s00181-015-0954-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-015-0954-7