Abstract

This study empirically investigates the link between fiscal policy and the current account in Nigeria. Given the enormous influence of the oil revenue on Nigeria’s economy, the study separates the effects of oil on the fiscal balance and the current account balance. In line with existing literature, the causal link between the fiscal balance and current account takes into consideration the contemporaneous effects on the current account balance brought about by exchange-rate fluctuations, the growth in GDP, and the growth in money supply. The models are estimated using time-series data from 1970 to 2012, using the Johansen estimation techniques. The results from the estimation results reveal the existence of a positive and stable relationship between government budget surplus and the current account balance in the overall economy. In the non-oil segment, on the other hand, there is evidence of a twin-deficit, a fact which has been blurred by proceeds from the oil revenue. The unequivocal conclusion is that the country remains over-reliant on the revenue generated by oil; also, the proceeds from oil have not yet trickled down to the rest of the economy.

Similar content being viewed by others

Notes

The structural government budget surpluses (cyclically adjusted budget surplus) adopted in this study are seen as the most accurate reflections of government fiscal policy. Potential GDP is therefore the appropriate scaling factor (Collignon 2010). Potential GDP is estimated using the Hodrick–Prescott (HP) filter technique. This technique has been widely accepted as a robust estimate of the potential level of GDP and it is important

to note that the potential output measured in this study does not represent output that could be produced under full employment conditions, but rather it is viewed as the maximum output that can be produced without causing any inflationary pressures (Okun 1962; De Masi 1997; Klein 2011).

The analysis in this study includes an examination of the suspicion that there is multicollinearity between government budget surplus and government expenditure. In fact, however, the two variables correlation coefficient has the value of \(-0.4\), suggesting a weak correlation estimate. This is again confirmed from the autocorrelation test of the VAR shown in Table 5 in Appendix 3.

The disaggregation method adopted in this study differs from that of Liuksila et al. (1994), who assessed fiscal sustainability within a permanent income framework.

To check the validity of this estimation, a Granger causality test was performed. The results revealed a bi-directional causality between government expenditure and oil revenue, supporting the fiscal synchronisation hypothesis. In addition, a test for a long-run relationship, using Johansen (1988), indicated one cointegrating vector in the VAR.

Since the slope of the curves is expected not to be constant over the years, the recursive estimates of the regressions were estimated and used in generating the expenditure arising from the oil and cyclical fiscal balance.

All the diagnostic tests performed are explained in Table Appendix 3.

References

Abbas SM, Ali J, Bouhga-Hagbe AJ, Fatás A, Mauro P, Velloso RC (2010) Fiscal policy and the current account. IMF Working Paper No. WP/10/121, Washington DC: International Monetary Fund

Abiad AD, Leigh D, Mody A (2009) Financial integration, capital mobility, and income convergence. Econ Policy 24(58):241–305

Akanbi OA (2011) The macroeconomic determinants of technological progress in Nigeria’. S Afr J Econ Manag Sci 14(3):1–16

Arezki R, Hasanov F (2009) Global imbalances and petrodollars. IMF Working Paper No. 89, Washington DC: International Monetary Fund

Barro RJ (1989) The Ricardian approach to budget deficits. J Econ Perspect 3(2):37–54

Baxter M (1995) International trade and business cycles. In: Grossmann GM, Rogoff K (eds) Handbook of international economics, vol 3. North-Holland, Amsterdam, pp 1801–1864

BBVA Research (2012) Spain economic outlook: first quarter. BBVA, Madrid

Beetsma RM, Klaassen F, Giuliodori M (2008) The effects of public spending shocks on trade balances and budget deficits in the European Union. J Eur Econ Assoc 6(2–3):414–423

Beidas-Strom S, Cashin P (2011) Are Middle Eastern current account imbalances excessive? IMF Working Paper No. 195, Washington DC: International Monetary Fund

Bems R, Filho I (2009) The current account and precautionary savings for exporters of exhaustible resources. IMF Working Paper No. 33, Washington DC: International Monetary Fund

Chete LN (2001) Explaining current account behavior in Nigeria. Niger J Econ Soc Stud 43(2):25–40

Chinn MD, Prasad ES (2003) Medium-term determinants of current accounts in industrial and developing countries: an empirical exploration. J Int Econ 59:47–76

Collignon S (2010) Fiscal policy rules and sustainability of public debt in Europe, Recon Online Working Paper, No. 28

Corsetti G, Muller GJ (2006) Budget deficits and current accounts: openness and fiscal persistence. Econ Policy 21(48):597–638

De Masi P (1997) IMF estimates of potential output: theory and practice. Staff Studies for the World Economic Outlook, International Monetary Fund, Washington

Egwaikhide F (1997) Effects of budget deficit on the current account balance in Nigeria: A simulation exercise. AERC Research Paper No. 70

Egwaikhide F, Oyeranti O, Ayodele O, Tchokote J (2002) Causality between budget deficit and the current account balance in African countries. West Afr J Monet Econ Integr 2(2):10–41

Endegnanew Y, Amo-Yartey C, Turn-Jones T (2012) Fiscal policy and the current account: are microstates different? IMF Working Paper No. 12/51, Washington DC: International Monetary Fund

Enders W (2004) Applied econometric time series, 2nd edn. Wiley, New York

Engle R, Granger C (1987) Cointegration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Fasano U, Wang Q (2002) Testing the relationship between government spending and revenue: Evidence from GCC countries. IMF Working Paper, No. 02/201, Washington DC: International Monetary Fund

Frenkel JA, Razin A (1996) Fiscal policies and growth in the world economy. MIT Press, Cambridge

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with application to the demand for money. Oxf Bull Econ Stat 52:169–210

Khalid AM, Guan TW (1999) Causality tests of budget and current account deficits: cross-country comparisons. Empir Econ 24:389–402

Klein N (2011) Measuring the potential output of South Africa. International Monetary Fund, African Department, No. 11/3

Liuksila C, Garcia A, Bassett S (1994) Fiscal policy sustainability in oil-producing countries. IMF Working Paper, No. 94/137, Washington DC: International Monetary Fund

Mohammadi H (2004) Budget deficits and the current account balance: New evidence from panel data. J Econ Finance 28(1):39–45

Morsy H (2009) Current account determinants for oil-exporting countries. IMF Working Paper No. 28, Washington DC: International Monetary Fund

Mundell RA (1960) The monetary dynamics of international adjustment under fixed and flexible exchange rates. Q J Econ 74(2):227–257

Okojie CE (2005) Capital flows and current account sustainability in Nigeria. ESPD/NRP/05

Okun A (1962) Potential GNP: its measurement and significance. 1962 In: Proceedings of the Business and Economic Statistics Section of the American Statistical Association, pp 1–7

Olumuyiwa A (2008) The size and sustainability of Nigerian current account deficit. IMF Working Paper No. 81, Washington DC: International Monetary Fund

Said S, Dickey D (1984) Testing for unit roots in autoregressive-moving average models with unknown order. Biometrical 71:599–607

Salter WA (1959) Internal and external balance: the role of price and expenditure effects. Econ Rec 35:226–238

Takebe M, York R (2011) External sustainability of oil-producing sub-Saharan African countries. IMF Working Paper No. 207, Washington DC: International Monetary Fund

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Data analysis

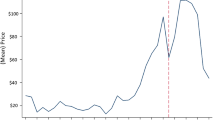

Figure 3 reveals some important facts about the government expenditure pattern over the years in the Nigerian economy. In the majority of years up to 1999, government expenditure resulting from oil revenue was substantially higher than that resulting from other factors. This picture has changed over the last decade, however, with many government spending decisions being driven mainly by factors other than the amount of oil revenue accrued by the economy. In the years 1978 and 1979, for instance, government spending decisions were entirely motivated by revenue from oil stream.

From Fig. 4, the estimated curve in the total economy shows that, for every 20 percentage point change in output gap, the fiscal balance changed by approximately 2 percentage points (translating into a slope of 0.1) over the period 1970–2012 (Panel A). This reveals that very weak counter-cyclical fiscal policy actions were adopted in most of these years.

Taking out the effect of oil, fiscal policy actions in Nigeria remained counter-cyclical in nature over the entire period (Panel B), but had a much more pronounced effect. In the non-oil segment, the estimated curve shows that, for every 20 percentage point change in output gap, the fiscal balance changed by approximately 3.2 percentage points (translating into a slope of 0.16) over the period 1970 to 2012.

Appendix 2: Stationarity tests (order of integration) results

Appendix 3: Reduced-form VAR diagnostic tests

All the roots have modulus less than one and lie inside the unit circle. Table 5 shows other diagnostics tests for the VAR. The VAR passed all the diagnostic tests, revealing a well-specified model.

Appendix 4

See Fig. 5

Rights and permissions

About this article

Cite this article

Akanbi, O.A. Fiscal policy and current account in an oil-rich economy: the case of Nigeria. Empir Econ 48, 1563–1585 (2015). https://doi.org/10.1007/s00181-014-0838-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-014-0838-2