Abstract

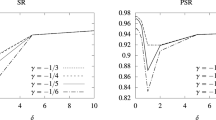

This paper studies the behavior of recently proposed bootstrap tests for the null hypothesis of stationarity when the data are generated under the alternative hypothesis of a unit root. Using Monte Carlo experiments and empirical examples, it is shown that the power of these tests critically depends on the type of bootstrap employed. Specifically, while tests based on the stationary bootstrap have power functions that are increasing with respect to sample size, those based on the sieve bootstrap have non-monotonic power functions. We argue that this difference arises from the fact that the latter procedure does not impose the null hypothesis when generating the bootstrap samples while the former ensures that the bootstrap samples are stationary, conditional on the original data. Our results therefore suggest that while both forms of bootstrap are effective at providing improved distributional approximations under the null hypothesis, it is important to pay careful attention to the particular type of bootstrap being employed when attempting to distinguish between the unit root and stationarity hypotheses as the choice of bootstrap can have crucial implications for the power of the resulting tests.

Similar content being viewed by others

Notes

The optimal choice is defined as the one that minimizes the mean squared error (to an appropriate order) of the variance estimate of the sample mean under the null hypothesis of stationarity.

The qualitative features of the results are not sensitive to the number of Monte Carlo replications or the number of bootstrap replications. For instance, using 10,000 Monte Carlo replications with 999 bootstrap replications or 10,000 Monte Carlo replications with 1,999 replications gave results very similar to those reported in the paper.

Given the large extent of size distortions associated with the asymptotic KPSS tests, the rejection frequencies for these tests are adjusted for size.

We thank an anonymous referee for pointing this out.

The full set of results is available upon request.

The exceptions to the 1957Q1 start date are Austria (1970Q1) and Japan (1966Q4). The exceptions to the 2000Q1 end date are Ireland (1998Q4) and Japan (1999Q3).

References

Andrews DWK (1991) Heteroskedasticity and autocorrelation consistent covariance matrix estimation. Econometrica 59:817–858

Andrews DWK, Chen HY (1994) Approximately median-unbiased estimation of autoregressive models. J Bus Econ Stat 12:187–204

Basawa IV, Mallik AK, McCormick WP, Reeves JH, Taylor RL (1991a) Bootstrapping unstable first-order autoregressive processes. Ann Stat 19:1098–1101

Basawa IV, Mallik AK, McCormick WP, Reeves JH, Taylor RL (1991b) Bootstrap test of significance and sequential bootstrap estimation for unstable first order autoregressive processes. Commun Stat Theory Methods 20:1015–1026

Bühlmann P (1997) Sieve bootstrap for time series. Bernoulli 3:123–148

Caner M, Kilian L (2001) Size distortions of tests of the null hypothesis of stationarity: evidence and implications for the PPP debate. J Int Money Financ 20:639–657

Chang Y, Park JY (2003) A sieve bootstrap for the test of a unit root. J Time Ser Anal 24:379–400

Cooray A (2003) The fisher effect: a survey. Singap Econ Rev 48:135–150

Datta S (1996) On asymptotic properties of bootstrap for AR(1) processes. J Stat Plan Inference 53:361–374

Davidson R, MacKinnon JG (2004) Econometric theory and methods. Oxford University Press, New York

Dickey D, Fuller WA (1979) Distribution of the estimators for autocorrelated time series with a unit root. J Am Stat Assoc 74:427–431

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Ferretti N, Romo J (1996) Unit root bootstrap tests for AR(1) models. Biometrika 83:849–860

Horowitz JL (2001) The bootstrap. In: Handbook of Econometrics, vol 5. pp 3159–3227

Inoue A, Kilian L (2002) Bootstrapping autoregressive processes with possible unit roots. Econometrica 70:377–391

Koustas Z, Serletis A (1999) On the fisher effect. J Monet Econ 44:105–130

Koop G, Steel MFJ (1994) A decision-theoretic analysis of the unit-root hypothesis using mixtures of elliptical models. J Bus Econ Stat 12:95–107

Kuo BS, Tsong CC (2005) Bootstrap inference for stationarity. Helsinki Center for Economic Research, Discussion Paper No. 50

Kurozumi E (2002) Testing for stationarity with a break. J Econom 108:63–99

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: how sure are we that economic time series have a unit root? J Econom 54:159–178

Lai KS (2008) The puzzling unit root in the real interest rate and its inconsistency with intertemporal consumption behavior. J Int Money Financ 27:140–155

Leybourne SJ, McCabe BPM (1994) A consistent test for a unit root. J Bus Econ Stat 12:157–166

Nelson CR, Plosser CR (1982) Trends and random walks in macroeconomic time series: some evidence and implications. J Monet Econ 10:139–162

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69:1519–1554

Palm FC, Smeekes S, Urbain JP (2008) Bootstrap unit root tests: comparisons and extensions. J Time Ser Anal 29:371–401

Paparoditis E, Politis DN (2003) Residual-based block bootstrap for unit root testing. Econometrica 71:813–855

Paparoditis E, Politis DN (2005) Bootstrapping unit root tests for autoregressive time series. J Am Stat Assoc 100:545–553

Park JY (2002) An invariance principle for sieve bootstrap in time series. Econom Theory 18:469–490

Parker C, Paparoditis E, Politis DN (2006) Unit root testing via the stationary bootstrap. J Econom 133:601–638

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346

Phillips PCB, Xiao Z (1998) A primer on unit root testing. J Econ Surv 12:423–469

Politis DN, Romano JP (1994) The stationary bootstrap. J Am Stat Assoc 89:1303–1313

Politis DN, White H (2004) Automatic block-length selection for the dependent bootstrap. Econom Rev 23:53–70

Psaradakis Z (2003) A sieve bootstrap test for stationarity. Stat Probab Lett 62:263–272

Psaradakis Z (2006) Blockwise bootstrap testing for stationarity. Stat Probab Lett 76:562–570

Rapach DE, Weber CE (2004) Are real interest rates really nonstationary? New evidence from tests with good size and power. J Macroecon 26:409–430

Rose AK (1988) Is the real interest rate stable? J Financ 43:1095–1112

Said SE, Dickey DA (1984) Testing for unit roots in autoregressive-moving average models of unknown order. Biometrika 71:599–607

Schotman P, van Dijk HK (1991) On bayesian routes to unit roots. J Appl Econom 6:387–401

Shephard NG, Harvey AC (1990) On the probability of estimating a deterministic component in the local level model. J Time Ser Anal 11:339–347

Swensen AR (2003a) Bootstrapping unit root tests for integrated processes. J Time Ser Anal 24:99–126

Swensen AR (2003b) A note on the power of bootstrap unit root tests. Econom Theory 19:32–48

Acknowledgments

We are grateful to two anonymous referees whose comments and suggestions helped improve the paper. We are solely responsible for any errors.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gulesserian, S.G., Kejriwal, M. On the power of bootstrap tests for stationarity: a Monte Carlo comparison. Empir Econ 46, 973–998 (2014). https://doi.org/10.1007/s00181-013-0711-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-013-0711-8