Abstract

This paper focuses on a procedure to test for structural changes in the first two moments of a time series, when no information about the process driving the breaks is available. We model the series as a finite-order auto-regressive process plus an orthogonal Bernstein polynomial to capture heterogeneity. Testing for the null of time-invariance is then achieved by testing the order of the polynomial, using either an information criterion, or a restriction test. The procedure is an omnibus test in the sense that it covers both the pure discrete structural changes and some continuous changes models. To some extent, our paper can be seen as an extension of Heracleous et al. (Econom Rev 27:363–384, 2008).

Similar content being viewed by others

References

Akaike H (1974) Stochastic theory of minimal realization. IEEE Trans Automat Contr 667–674

Altissimo F, Corradi V (2003) Strong rules for detecting the number of breaks in a time series. J Econom 117:207–244

Andrews WK (1993) Tests for parameter instability and structural change with unknown change point. Econometrica 61:821–856

Andrews WK, Ploberger W (1994) Optimal tests when a nuisance parameter is present only under the alternative. Econometrica 62:1383–1414

Bai J (1999) Likelihood ratio tests for multiple structural changes. J Econom 91:299–323

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66:47–78

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Econom 18:1–22

Baek C, Pipiras V (2011) Statistical tests for changes in mean against long-range dependence. J Time Ser Anal 33:131–151

Berkes I, Horvath L, Kokozka P, Shao Q-M (2006) On discriminating between long-range dependence and changes in mean. Ann Stat 34:1140–1165

Brown RL, Durbin J, Evans M (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc 37:149–192

Charfeddine L, Guégan D (2011) Which is the best model for the US inflation rate : a structural changes model or a long memory process? IUP J Appl Econ 1:5–25

Davidson R, MacKinnon JG (2004) Econometric theory and methods. Oxford University Press, Oxford

Engle RF, Smith AD (1999) Stochastic permanent breaks. Rev Econ Stat 81:553–574

Guégan D (2010) Non-stationary samples and meta-distribution. In: Basu A, Samanta T, SenGupta A (eds), ISI Platinium Jubilee Volume, Statistical sciences and interdisciplinary research, ICSPRAR World Scientific Review

Hansen BE (2000) Testing for structural changes in conditional models. J Econom 97:93–115

Heracleous MS, Koutris A, Spanos A (2008) Testing for nonstationarity using maximum entropy resampling: a misspecification testing perspective. Econom Rev 27:363–384

Granger C, Starica C (2005) Nonstationarities in stock returns. Rev Econ Stat 87:503–522

MacNeill IB (1978) Properties of sequences of partial sums of polynomial regression residuals with applications to tests for change of regression at unknown times. Ann Stat 6:422–433

McQuarrie ADR, Tsai C-L (1998) Regression and time series model selection. World Scientific, Singapore

Nyblom J (1989) Testing for the constancy of parameters over time. J Am Stat Assoc 84:223–230

Perron P (1989) The great crash, the oil price shock and the unit root hypothesis. Econometrica 57: 1361–1401

Perron P (1991) A test for changes in a polynomial trend function for a dynamic time series. Research Memorandum No. 363. Econometric Research Program. Princeton University, Princeton

Perron P (2005) Dealing with structural breaks. In: Palgrave handbook of econometrics vol 1: econometric theory

Author information

Authors and Affiliations

Corresponding author

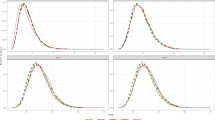

Appendix: Results of Monte-Carlo simulations

Appendix: Results of Monte-Carlo simulations

See Tables 1, 2, 3, 4, 5, 6 and 7

Rights and permissions

About this article

Cite this article

Guégan, D., de Peretti, P. An omnibus test to detect time-heterogeneity in time series. Comput Stat 28, 1225–1239 (2013). https://doi.org/10.1007/s00180-012-0356-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00180-012-0356-7