Abstract

The objective of this paper is to compare the economic resilience of industries and regions along the last four decades, which include the three last major crises for the advanced countries (90s, Great Recession in 2007 and recent COVID-19 pandemic). Productive structure and sectoral specialization are introduced as explaining factor for the different regional behaviors. For this purpose, we estimate both resilience and specialization indices based on employment data. To analyze the relationship between specialization and resilience, a cross-sectional descriptive analysis is complemented by a panel data model that includes some controls. Finally, a regional shift-share analysis contributes to exert some other regional effects affecting economic resilience. The results of this research show some continuities and other significant changes in the regional impact of crises from one to the next. Although there are other effects to have played a role, results show economic specialization is found to have exerted influence on the recovery of certain regions during this period. Recovery periods differ from each crisis and the results might be affected for this dimensionality limitation. Due to the characteristics of the database, the study includes only six sectors. However, general results are generalizable to other regions as the response of employment growth to crises is similar in many advanced regions and specialization patterns does not significantly differ among regions. The paper carries a structural long-term comparison between the last major crises for Spanish regions, which clearly differentiates one from another in their causes and effects. We introduce specialization to explain the different regional resilience patterns. Methodologically, we estimate both sectoral and regional resilience indices for these three crises and relate this resilience to specialization and other explaining factors.

Similar content being viewed by others

1 Introduction

How deep recessions impact across regions (and cities) within nations is an important issue in the specialized literature. There has traditionally been interest in regional disparities and different regional responses to crises from Kuznets (1955) or Alonso (1969) to Lucas (2000) and, more recently, Barrios and Strobl (2005). The concern regarding the matter has been exacerbated in recent times due to the outbreak of the COVID-19 pandemic (Gong et al. 2020). To provide effective recommendations to regional economic and policy stakeholders in response to future similar shocks, it is imperative to conduct a thorough analysis of successful strategies and enhanced responses to previous adverse shocks (Martin et al. 2015).

The concept of regional resilience, as posited by Martin and Sunley (2015), has been the subject of considerable scholarly discourse in recent times, with the aim of elucidating the dissimilarities and reactions of regions to crises (Christopherson et al. 2010; Evenhuis 2017; Martin 2018; Lazzeroni 2019; Bristow and Healy 2020; Gong and Hassink 2017; Simonen et al. 2020).Footnote 1 The idea of resilience describes how well systems bounce back from shocks or develop new capacities to handle upcoming shocks (Wilson 2018).

The literature on regional resilience has underlined the relevance of a good number of factors to explain resilience capacities. Di Caro and Fratesi (2018a, b) pointed out that the variation in resilience among different regions may be attributed to a confluence of various economic, social, and institutional factors. Several explanatory factors have also been identified in the literature, including human capital (Giannakis and Bruggeman 2020), knowledge systems (Filipetti et al. 2019), territorial capital (Fratesi and Perucca 2018), innovation capacities (Bristow and Healy 2018; McCann and Soete 2020), regional labor market characteristics (Angulo et al. 2018), industrial relatedness (Cainelli et al. 2019), and regional competitiveness (Fratesi and Rodriguez-Pose 2016). Institutional issues (Hu and Hassink 2017), quality of government (Ezcurra and Rios 2019), national redistribution system (Djikstra et al. 2015), and the role of public sector (Martin 2012) have also been assessed.

Among these various explaining factors, productive structure and specialization arise as a key one in recent times. Regional economic structures influence regional resilience in the different stages (Brown and Greenbaum 2016). Cuadrado Roura and Maroto (2016), Martin and Sunley (2020), and Delgado-Bello et al. (2021) have proposed the use of structural changes and productive specialization as explanatory factors for the Great Recession.

This study embraces the perspective of this previous research and expands upon their comparative discoveries to encompass the latest COVID-19-related crisis, as well as the preceding crise that occurred during the 1990s and the mid-2000s. While previous works focused only on the conjunctural role of productive specialization after a particular crisis,Footnote 2 we use a long-time comparative analysis with three different crises to open out the literature on regional resilience and productive structure.

The comparison of the specialization–resilience relationship over a long period of time that includes three crises is the essential point of the paper. Differences in this connection should expect due to the structural changes of the industrial mix of the regions but also due to the specific characteristics and causes of each crisis—mainly relevant in the case of the COVID-19 pandemic. Other factors that may modulate how specialization affects economic resilience, such as different policies applied to recover from each crisis or changes in the labor market institutions. This justifies why we use a regional shift-share analysis to complement the specialization–resilience relationship.

To understand the different results expected for each crisis, it is imperative to highlight some characteristics of the three crises under examination, as well as the assessment of their respective regional trends. The first of these crises covered from 1992 to 1997 and had a dominant national character,Footnote 3 but also exhibited a global dimension, as evidenced by the bursting of Japan's real estate bubble in 1990, the protracted impact of oil prices, inflation, and other related factors. The economic recuperation started in the middle of 1995, but it was not until 1997 that the crisis could be deemed as resolved.Footnote 4 The second crisis started at the end of 2007 and had an international character, and its financial/pecuniary origin is widely recognized. It is also well known that the impact of this Great Recession was particularly pronounced in some countries, as Italy, Greece, Ireland, and Spain.Footnote 5 It was not until the year 2014 that the national economy started a period of gradual recovery, which persisted until the end of 2019. Finally, the third crisis can be attributed almost exclusively to the outbreak of the COVID pandemic in early 2020.Footnote 6

As it could be expected, the three crises had different regional impacts (Fig. 1)Footnote 7 that we try to rationalize by emphasizing the pivotal role played by productive specialization and structural changes.

Considering this motivation, the aim of this paper is to clarify the variations in economic resilience among regions after the three crises experienced by the Spanish economy over the past thirty years, with a focus on the role exerted by the productive specialization and structural changes. This study evaluates the research hypothesis as follows: While the impacts of shocks may vary across sectors and regions, and the paths of convergence or divergence may differ, regions that demonstrate resilience show similar specialization patterns across all shocks.

The main hypothesis is that the role of productive structure has been, and structurally continues to be, significant in revealing the differential responses of regions to crises. It seems clear that the number of factors that may explain resilience capacities of regions is not simple. Nevertheless, our outcomes permit us to validate the hypothesis that productive structures have had and continue to have a clear impact on regional resilience, particularly when a longer period is observed and some different crises have happened, as in the case object of our analysis. In fact, our focus covers a rather long period, more than thirty years, and the three crises occurred in such period, which will be evaluated for their respective sectoral and regional resilience indices. Subsequently, the resilience patterns will be related to specialization indices, and the impact of structural changes will be incorporated through a regional shift-share analysis.

This work provides three contributions that may have a significant value. Firstly, it contributes to the existing body of literature on regional resilience, underlying the role of regional productive structures to confront the effects of three rather different economic crisis (one of dominant national character, the second of a clear international profile, and the third due to an unexpected pandemic process). Second, this study also undertakes a comparative analysis examining their correlation with the function of productive specialization. And third, from a methodological point of view, we have extended the usual approach simultaneously applying resilience indices for both regional and sectoral aspects to better understanding some coincidences and disparities of regional resilience along more than the three decades of the case study.

Although the interest of the study has been justified in the previous lines, there are some limitations that may be introduced to be cautious with the results here presented. First, there is a data limitation as sectoral disaggregation covers only six main industries as we describe in Sect. 2. Secondly, as we clarify in Sect. 3, we estimate the resilience and specialization indices in terms of employment—as it behaves homogenously across similar regions and lag further to recover from crises than output—and define the resilience as the recovery from a crisis (not the decline as in Martin et al. 2016). Despite these limitations, in our opinion, the findings present in the relationship between specialization and regional resilience (Sect. 4) and the cyclical responses and long-run structural changes in regions (Sect. 5) have the potential to be extrapolated to analogous regions and areas, given that typical specialization trends and their associations with resilience are discernible across developed regions, as we discuss in Sect. 6.

2 Data and methodology

The RegData-Sect used in this study was sourced from FEDEA database,Footnote 8 which allows access to extensive time-series data on gross value added and occupational trends across six sectors for all Spanish autonomous communities. The level of sectoral disaggregation is limited (six sectors), which constitutes a limitation when delving into elucidations on productive organization and specialization. Any case, the data exhibited are consistent with prior historical regional data, as evidenced by the BBVA Foundation's series and previous comparative studies.Footnote 9 This source of data aligns with the Regional AccountsFootnote 10 that have been provided by the Spanish National Institute of Statistics (INE). The estimation of value added at constant prices has been conducted through the utilization of chain volume indices, in conjunction with the value added at current prices as supplied by the INE.

2.1 Sectoral and regional resilience indicators

To explain the described differences in terms of regional falls and resilience, we propose a novel method for the quantitative estimation of regional resilience indices, encompassing both regional and sectoral resilience indices. Although previous works, such as Martin et al. (2016) used similar resilience indices, we adopt the formulation introduced by Hu et al. (2022), but originally used to compare not only the degree of resilience between different regions but also at different time periods and different sectoral activities (see Tables A.1-A.3 in the Appendix for the extended results of the resilience indices for these three axes). Notwithstanding the seemingly uncomplicated nature of the indices’ formulation, they exhibit a heightened capacity for explanation.

Several methodologies and indicators have been employed in the literature to measure regional economic resilience empirically (Doran and Fingleton 2016). We explored the economic resilience of Spanish regions in terms of employment growth rates,Footnote 11 like the work of Lagravinese (2015) and Faggian et al. (2018). The rationale for focusing on employment growth is related to the persistent effects of economic crisis on employment compared with the effects on output. Employment typically returns to pre-crisis levels with a longer lag than output, thus better reflecting crisis’ social impact (Reinhart and Rogoff 2009). Our analysis focused on the second feature of regional resilience, namely the recovery phases.

By constructing a counterfactual function, we can compare the actual change in the regional variable, generally employment or value added, with the expected change in said variable. Equation 1 represents the mathematical formula utilized to calculate the anticipated alteration:

where ξ0ri is the change in the value of sector i (N is the total number of industries) in region r at starting time 0, the base year; and \(\overline{{\xi }_{n}^{T}}\) is the change rate of the country average in T time (Martin et al. 2016). Finally, our resilience index RI can be expressed as Eq. 2:

where ‘recovery’ in Eq. 2 refers to the period when the region r recovers from a crisis.Footnote 12 This is another difference from our estimates related to those by Martin et al. (2016) who used the contraction or decline periods to estimate their indices. Our resilience approach measures recovery dimension of the resilience but not resistance one, so this limitation dimensionality (Martin 2012) must be taken into account.

2.2 Specialization indices

Then, the productive specialization analysis carried out was based on the generally used specialization coefficients (Cuadrado Roura and Maroto 2016), which compared the relative weight of a sector within a region with the percentage participation of that sector on a national level. A generic expression of this index would be Eq. 3:

where i is the sector in question, r the regional indicator, and ξ the analyzed variable calculated in terms of a specific year t. This SIirt is always positive. When it exceeds the unit value, we can confirm that region r shows specialization in sector i for year t. The indicators in question were calculated using the variable of employment, with a segregation based on the various NUTS2 regions of Spain.

2.3 Regression model

Once the aggregate indicators of resilience and specialization will be computed, we try to uncover some of the reasons explaining the quite remarkable differences existing among the regions in the analysis.

As in other similar papers such as Villaverde and Maza (2020), we choose to utilize pre-crisis periodFootnote 13 averages for all the explanatory variables in the model specified in Sect. 3.3 to address potential endogeneity issues in some of them.Footnote 14 Furthermore, even though we first decided to include a few more variables in the model to help explain the resilience level, we ultimately decided to remove them because they did not significantly improve the model's goodness of fit; in other words, we selected the variables that best describe the data (forward variable selection processFootnote 15).

Bearing these considerations in mind, we firstly estimate the following panel data model for the resilience index (RIrt) by ordinary least squares (OLS) as in Eq. (4):

where i denotes the region under consideration, j is the industrial sector (j = 6), and t the year.

As the aim of this model is to relate specialization indices to regional resilience, the dependent variable will be the annual resilience RIrt for each region during the post-crisis period (T = 1 according to the formulation of Eq. 1). This index measures the recovery power of each region each year after the decline period. As for the explanatory variables finally included in the model, some comments about data sources, metrics, definitions, and expected signs are mandatory and are included in Table 1.

2.4 Regional shift-share analysis

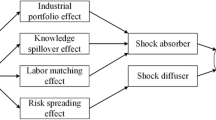

At last, additional supplementary examination of structural modifications and their impacts on local durability culminates in a regional shift-share analysis originally proposed by Dunn (1960). Regional resilience depends on specialization patterns but also on other structural changes. This approach allows us to highlight the role of industry mix—which differs from one crisis to other—and other regional factors on shaping regional responses to crises. This analysis complements the previous relationship between resilience and specialization and is other of contributions of the paper.

The methodology employed (Esteban 2000) involves the multisectoral decomposition of regional growth pertaining to a particular variable, such as sectoral employment, which serves to establish specialization patterns, using a multiplicative model (Cuadrado Roura and Maroto 2016). Each index or effect may exceed unity (if the region has expanded beyond the national average) or fall below unity (if otherwise). The mathematical expression is represented by Eqs. 5 and 6:

where ξ represents the employment levels, i represents N (N = 6) productive sectors, r corresponds to the regions (r = 17) considered, and T and 0 are the final and base reference years, respectively.

Equation 5 elucidates that the national component (NS) quantifies the proportion of the overall growth in each sector or region that can be attributed to the aggregate growth of the country under consideration during the analyzed time frame. The structural component (IM) serves to identify the productive sectors of a given region that exhibit a growth rate either above or below the national average. Hence, a region exhibiting a proportion surpassing the mean for dynamic sectors is expected to experience a relatively higher rate of growth in comparison with a region where low-growth sectors prevail. The aggregate of NS and IM represents the anticipated expansion for a particular industry i within a given region r. The regional competitive advantage (RS) is defined as the disparity between actual and anticipated growth. The aforementioned metric gauges the competitive edge of a particular industry i within a given region r, thereby facilitating the identification of the foremost sectors (i.e., those that experience a growth rate exceeding the national average) vis-à-vis the relatively sluggish sectors (i.e., those that exhibit a growth rate lower than the national average) in the same region r. Equation 6 defines the aggregate regional effect (RE) as the sum of the structural and regional components (IM + RS).

3 Explaining relationship between regional resilience and specialization

As anticipated, the main objective of this paper is to elucidate the regional resilience by examining the productive specialization. Secondly, attempts to exhibit shared characteristics among the preceding three crises. To establish a correlation between regional resilience and productive specialization during such three crises, the initial step involves the computation of regional resilience indicators for the above-mentioned time frames.

As previously mentioned, it is possible to calculate resilience indices for both regions and economic sectors based on the available disaggregation of the database. The national case sectoral estimates are presented in Table 2 and the specific sectoral–regional indices are shown in Tables A.1-A.3 in the Appendix.

The information presented in Table 2 shows interesting findings in terms of sectoral resilience for the Spanish regions. Primary activities and manufacturing present worse recoveries from the three crises than the aggregate economy in terms of employment growth. Since the primary sector has experienced a decline in their shares of employment, their negative recovery indices are less significant in the recent times. On the contrary, although manufacturing employment shares have been stable during these decades, the recovery resilience indices are negative and increasing from one crisis to the next one. Energy and construction show inverse patterns. Employment growth in energy industries recovered better after the Great Recession, which intensively and negatively affected to construction. However, employment in construction activities has been a source of recovery in the 90 s and the recent COVID-19 pandemic. Finally, services show, in general, positive resilience indices against all crises. Employment in service activities has recovered faster than the rest of industries during the recessions of these last decades in Spanish regions. In the COVID-19, non-market services showed better recovery in employment shares than market services. Reasoning is twofold. On one side, due to the general face-to-face interactions between market service providers and consumers and the negative effects which provoked the movement restrictions during some months. On the other, side, since the 1990s, public administration and other public services, including health and education, have demonstrated positive resilience, mainly due to the stability derived from their public and non-market character and the public investment in employment in recession periods.

Regional disparities may have been hidden by aggregate estimates in Table 2. The maps presented in Fig. 2 illustrate the indices of regional resilience in terms of employment growth. This allows a better comparative analysis between different crises.

In the crisis of the 1990s, the Balearic and Canary Islands exhibited positive resilience (1.50 and 0.94, respectively), showing a better recovery in terms of employment than other regions. Murcia, Madrid, Valencia, Andalusia, Catalonia, and Navarre also show positive, but lower, indices (0.49, 0.27, 0.21, 0.21, 0.17, and 0.16, respectively). Conversely, the Cantabrian regions, Castilla y León, and Extremadura have shown the poorest recoveries to the crisis, as evidenced by their negative indicators. The impact of the second crisis (started in 2007) on regional economies was comparatively much more severe than the 1990s. We observe lower recovery indices in all regions than in the previous crisis. Positive resilience indices have been assessed exclusively for Madrid (0.27), La Rioja (0.17), Basque Country (0.13), Balearic Islands (0.12), Catalonia (0.05), and Navarre (0.01). Results show that, in line with those by Cuadrado Roura and Maroto (2016) or Villaverde and Maza (2020), richer regions recovered faster than the poorer during this period, although the recovery period analyzed is shorter (only 2 years) the mapping of resilience indicators after the COVID-19 pandemic reveals a more uniform figure. Positive indices are lower than in previous crises, but negative ones are more intense. All regions experienced an immediate adverse impact in terms of employment, albeit certain regions exhibited positive recoveries between 2019 and 2021.

The first conclusion is three distinct situations yield comparable outcomes. Regions that exhibit positive resilience comprehend the Mediterranean regions, islandic territories, Madrid, the Basque Country, and Navarre. Cantabrian regions and several other internal regions of intermediate size, namely Aragon, Extremadura, and Castilla y León, exhibit negative recoveries from the crises. Regions that presented high levels of resilience showed a more rapid and effective recovery in the aftermath of disruptive events.

There could be various reasons accounting for this scenario, such as industrial structure, labor market conditions, financial and governance arrangements, and, finally, agency and decision-making (Martin et al. 2016). However, institutional dimensions—labor market, arrangements, and decision-making—have more related to long-run growth rather to responses to crises (Rodriguez-Pose 2013). This issue motivates us to focus on industrial specialization to explain regional resilience patterns. Furthermore, the topic of regional economic structure has garnered fresh attention and discussion over the last few years, as we resumed in the introduction of the paper. Basically, the main concern is whether specialization enhances or detracts from regional resilience and which sectoral specialization is more related to better recoveries from crises at a regional level. Certain industries such as manufacturing, mining, energy, and construction are observed to be more susceptible to fluctuations in business cycles compared to service sectors, as noted by Maroto (2012). According to De Groot et al. (2006), if a region possesses a higher proportion of industries that are more susceptible to the business cycle than the average, it can be anticipated that they will be considerably impacted during a recession, all other factors remaining constant.

The previous descriptive analysis in Table 2 and Fig. 2 will be complemented by a regression analysis that includes some controls, following the model described in Eq. (4) in Sect. 2.3. The estimation results comparing the three scenarios of crises are displayed in Table 3.

As is evident, there is no statistically significant relationship between per capita income and unemployment rates. In the first scenario, this outcome is expected, but in the second, it is shocking.Footnote 16 The effect of human capital is not different from cero. It seems that in recovery period the amount of skilled labor force is not playing a key role in creating employment. Just the opposite happens with exports. This suggests that more open regions take advantage over the recovery period in terms of employment. Di Caro (2017) also found this positive effect. Population density shows different results according to the period analyzed. It shows a clear negative effect in the COVID-19 crisis but a positive in both previous periods of recession. Finally, accessibility shows a positive effect during all crises, following results by Giannakis and Bruggeman (2017).

The analysis of the relationship between specialization and regional resilience in Table 3 shows differences between industries but similarities in the effects between crises. The model suggests that there exists a positive and robust relation between recoverability resilience in terms of employment and specialization in services, mostly in market activities. These findings suggest that areas with higher levels of service specialization in employment are more resilient to economic shocks. Specialization in construction also shows a positive effect for the crisis in the 90 s and the last pandemic, but negative for the Great Recession. The relationship turns negative when regions are specialized in manufacturing, energy, and primary sectors. This may suggest that the regions labor specialized in these sectors were not well prepared to recover from the crises here analyzed. These results are aligned with those found by Angulo et al. (2018).

4 Explaining the regional resilience to recent crises: industry-mix and structural changes

The preceding results show the significance of the productive structure in determining the resilience of Spanish regions to various crises encountered over the past thirty years, as evidenced by the observed specialization patterns. Nevertheless, there could be additional impacts associated with the productive framework that contribute to this phenomenon.

After analyzing the relationship between sectoral specialization and regional resilience, this section will focus on the effects of structural changes and industry mix in the different recovery patterns displayed by the regions after different crises. We use the regional shift-share described in Sect. 2.4 for this aim. The justification of this approach is to complement the descriptive and econometric approach analyzed in Sect. 3. Regional shift-share allows us to introduce not only specialization but industry-mix changes too (IM) and other factors that may affect regional recoveries from crises—which will be included in the residual component of the regional growth in the shift-share analysis (RS).

The structural component of regional growth (IM) for all three periods is displayed in Fig. 3, and the regional component of the regional employment growth (RS) is shown in Figure A.1 in the Appendix. We have developed a comparative analysis of scenarios before and after the crisis.

Structural changes by regions, regional shift-share analysis. (IM component in Eq. 6, in terms of employment).

The aftermath of the 1990s crisis resulted in significant structural changes in two archipelago regions (the Balearic and the Çanary Ils.), Madrid, the Basque Country, and the Mediterranean axis. The structural effects persist even in the aftermath of the crisis, as evidenced by the best performance of these regions in comparison with others. These results are like those described in Fig. 2 as these are the more resilient regions during all the period analyzed.

During the Great Recession, the structural impacts were particularly pronounced regions such as the Baleares and the Canary Islands, Madrid, and other resilient areas exhibited a greater structural component. This suggests that regions which changed more their industry mix and adapted to the impact are those which recovered faster during this period. On the opposite, regions where recovery was slower are those where industry-mix changes were less. This image is very similar—although the resilient regions differ—during the recent COVID-19 crisis. Regions that exhibit greater capacity to withstand and recover from disruptive events are characterized by a higher degree of structural transformation during the preceding period leading up to the impact.

5 Conclusions and further research

Understanding long-term patterns of uneven regional development hence requires an understanding of regional cyclical resistance and recoverability. The aim of this paper was to extend the empirical framework of previous works by Cuadrado Roura and Maroto (2016) or Martin et al. (2016) who related the regional resilience to productive structure and industrial specialization during the Great Recession of 2007. We extend their research and compare the crises raised during the last three decades in the developed regions, including not only the Great Recession but also those during the 90 s and the recent COVID-19 pandemic. It is important to highlight the significant differences between these shocks we assessed in the introduction of the paper. These differences, both in their causes and the implications on the industry-mix and structural changes, imply differences in the results and motivate the purpose of this work.

The contribution of this work, in addition to extend the empirical period of analysis to the three recent major crises, is twofold. First, we complement the cross-sectional descriptive analysis of the relationship between specialization and resilience with a deeper understanding of some of the explaining factors of this relationship using a panel data model that includes some controls. Secondly, we use the methodology introduced in previous literature to compare not only the resilience—in terms of recoverability—between different regions but also at different time periods and different economic sectors.

The case study we consider, the Spanish regions, shows a singular scenario for analyzing regional resilience. The economic downturns have had a significant impact of Spanish regions, particularly within the context of the European Union. However, the specialization patterns—mainly characterized in the recent times by a deindustrialization–tertiarization process—are very close to other advanced regions. Additionally, the behavior of the variable of our analysis—employment—is also very similar in most regions during the negative shocks. These two facts allow us to generalize most of the findings in this work to other regions and areas in developed countries.

The findings of this research show some continuities and other significant changes in the regional impact of crises from one to the next. Although there may be other effects to have played a role we did not explore in this case, results show economic specialization is found to have exerted influence on the recovery resilience of certain regions during all crises analyzed. Those regions specialized in services show positive patterns of resilience while those specialized in manufacturing—sector where employment suffers more during the decline periods—show negative figures. Specialization in construction shows different effects throughout the years. While it presents a positive relationship during the last 90 s and in the recent COVID-19, it is negative during the Great Recession. Primary and energy activities, where employment shares are very low in the recent times, do not show a significative effect on the regional resilience.

Another interesting result of the work is to underline that the role of specialization in the regional resilience is structural and not conjunctural. It remains during all crises analyzed. Additionally, not only specialization differently affects regional resilience but deeper structural changes before the shocks allow regions to faster and better recover from them. Regions with a higher structural component in the shift-share we employ are those more resilient during all crises. Previous changes in the industry mix—moving employment resources from manufacturing or primary activities to some services—may help regions to face downturns with less difficulties. This shift-share analysis also allows to introduce some other likely regional effects—as a residual of the calculation—through the regional components of the aggregate growth (Figure A.1 of the Appendix). For instance, the central government, for example, launched some contracyclical measures, as subsidies to employees working in sectors particularly damaged by the pandemia due to the fall of demand, i.e., some subsectors of market services (commerce, hotels and restaurants, personal services, etc.), as well as manufacturing activities (textile, machinery and equipment, chemistry, cars, …). The aim of such measures was to avoid unemployment increase. Likewise, some regional governments launched social subsidies as well as economic policy measures to stabilize employment and the activity level during the hardest months of the pandemic’ impact on the activity levels.

Finally, despite the contribution of the paper to the literature of regional resilience, it is important to acknowledge certain limitations that warrant attention. First, we already clarified that the low sectoral disaggregation of the database may hide some interesting patterns. For example, certain advanced manufacturing activities and the knowledge intensive business services may help regions to recover from crises and develop better (Di Meglio et al. 2018). However, the positive effect of services in general may hide that some activities intensive in labor, such as tourism, wholesale, transport and some other public services, act as barriers to regional resilience (Maroto 2023). Database also limits the regional disaggregation to NUTS-2. Considering more disaggregated units might help to deep into the explanatory factors of the relationship between productive structure and regional resilience. Second, the relationship between specialization and regional resilience may be affected by spatial spillovers from one region to another. Introducing these spatial effects in our model would be an interesting future work. All these open possibilities of additional analysis on the effects of policy measures against crisis and the effects on regional resilience, as Martin et al. (2016) suggested.

Notes

The authors suggest consulting Martin (2016), Bristow et al. (2014), Capello et al. (2015) or Sensier et al. (2016), or examining the special issues on regional resilience in academic journals such as Annals of Regional Science (2018) or Cambridge Journal of Regions, Economy, and Society (2010 and 2016), for a deeper introduction to the concept of economic resilience, and Fröhlich and Hassink (2018) for a recent bibliometric analysis.

The rate of unemployment experienced an increase from 16% in 1990 to 24% in 1993 and 1994, resulting in a total of 3.6 million individuals unemployed. Simultaneously, there was a decline in profits and investments, while the public debt escalated to 70% of the Gross Domestic Product (GDP) and the overall public deficit surged to 7.2% of the GDP. Several internal factors played a role in this outcome. The economic growth rate was adversely affected by budgetary imbalances, a prolonged drought, and a decline in the real estate sector, resulting in a growth rate of merely 0.9% in 1992 and a contraction of -1.5% in 1993. In response to the economic situation, the government implemented various some stabilizing measures including two currency devaluations, reductions in public expenditures, privatization of public enterprises, restructuring of Social Security finances, and the applications of a restrictive monetary policy.

As the growth rate escalated to 3.9% and the unemployment rate declined between 3 and 4 points but with relevant sectoral differences.

In the Spanish economy it led to a series of significant consequences. These included the collapse of the real estate market, which had been actively promoted since the early 2000s., a severe crisis in the banking and financial sector, a sharp decline in domestic demand that had experienced robust growth between 2000 and 2007, a reduction in exports, tourism, and other service-related activities, and, over all a severe crisis in the banking and financial sector. The GDP experienced a significant fall of -3.9% in the year 2009, followed by a modest recuperation in 2010 and a new subsequently drop in 2012 to attain a negative -3% of GDP in 2012. In addition, it is necessary to consider the negative impact resulting from the implementation of highly stringent measures imposed by the European Commission, the ECB, and the IMF, which were intended to promote stability but have also had a clear recessionary effect: The unemployment rate experienced, for example, a significant increase from 8.2% in 2007 to 26.9% in 2013.

This required the implementation of stringent measures to confine individuals, resulting in a cessation of economic activity. Consequently, there was a significant decline in production, as evidenced by a growth rate fall of − 11.3%. The recovery started to be a reality comprehensively apprehended by the second half of 2021, resulting in a growth rate of 5.5%, which has been replicated in the current year of 2022.

As shown by Fig. 1, the regional convergence process observed in the Spanish economy since the 1970s experienced a significant deceleration, coinciding with the crises that occurred in the 1990s and from 2007 on. The presence of U-shaped curves both prior to and following the crises indicates that the disparities between regions have clearly changed. This change was particularly since regions with higher per capita income have resisted better the crisis compared to the poorest ones. Notwithstanding the recent COVID-19 crisis, the trajectory of convergence observed since 2014 remains unaltered, with certain some less developed regions, such as Extremadura, Galicia, and Castilla-La Mancha, experiencing comparatively lesser degrees of hardship during this period. Conversely, regions with higher economic prosperity, including but not limited to the Basque Country, Madrid, Catalonia, as well as the Baleares Ils., exhibit more unfavourable outcomes after 2019.

https://fedea.net/datos-economia-regional-y-urbana/. Published in 2023.

Such as a high number of regional analysis, as in Cuadrado & Maroto (2016) and many other researchers.

A complementary analysis of the resilience in terms of output (gross value added) has been carried out too. In the paper we only show the results according to resilience in terms of employment growth but the one in terms of output has been used for a robustness check.

This supposes other limitation of this work that we would want to clarify. Recovery years differ from each crisis, so different impacts on the results among the three crises should be cautiously taken. This is even clearer in the last COVID crisis as the recovery period (2019–2021) used in the study is much shorter than that of previous crises.

Pre-crisis periods involve 1971–1993 for the first crisis, 2000–2007 for the Great Recession, and, finally, 2014–2019 for the COVID-19.

The use of variables constant in time in the model avoids the estimation of individual fixed effects for each region. However, these differential regional behaviours may be observed through the other techniques applied in the paper.

We also tried with patents as a proxy for innovation (Bristow and Healy 2017), a proxy for social capital in line with the reasoning of Storper (2005) and Fratesi and Perucca (2018), net migration rates, the openness degree as an alternative to exports, and GDP as an alternative to per capita GDP. As we are analysing this issue at the regional level, we did not consider any measure of the degree of autonomy; in any case, Hernandez Salmeron and Usabiaga (2017) show that, using the Spanish regions as the case study, political decentralisation does not significantly affect the regional economic performance.

One explanation could be that because the regions, like the Spanish provinces of Villaverde and Maza (2020), have a history of experiencing relatively high unemployment rates even during economic booms, their rise during the recession has not had a significant impact on employment performance.

References

Alonso W (1969) Urban and regional imbalances in economic developments. Econ Dev Cult Change 17:1–14

Angulo MJ, Mur F, Trivez FJ (2018) Measuring resilience to economic shocks: an application to Spain. Ann Reg Sci 60:349–373

Barrios S, Strobl E (2005) The dynamics of regional inequalities. European Economy—Economic Papers 2008–2015, 229, Directorate General Economic and Financial Affairs (DG ECFIN), European Commission

Briguglio L, Cordina G, Farrugia N, Vella S (2009) Economic Vulnerability and Resilience: Concepts and Mesurements. Oxf Dev Stud 37(3):229–247

Bristow G, Healy A, Norris L, Wink R, Kirchner L, Koch F, Speda D, Kafkalas G, Kakderi C, Espenberg K, Varblane U (2014) ECR2 Economic Crisis: Resilience of Regions. [Research Report] ESPON | Inspire Policy Making with Territorial Evidence; University of Cardiff. ffhal-03168559

Bristow G, Healy A (2017) Innovation and Regional Economic Resilience: An Exploratory Analysis. Annals of Regional Science 60(2):265–284

Bristow G, Healy A (2017) Innovation and Regional Economic Resilience: An Exploratory Analysis. Annals of Regional Science 60(2):265–284

Bristow G, Healy A (2020) Introduction to the handbook on regional economic resilience. In: Bristow G, Healy A (eds) Handbook on regional economic resilience. Edward Elgar, Cheltenham, pp 1–8

Brown L, Greenbaum RT (2016) The role of industrial diversity in economic resilience: an empirical examination across 35 years. Urban Stud 54:1347–1366

Cainelli G, Ganau R, Modica M (2019) Industrial relatedness and regional resilience in the European Union. Pap Reg Sci 98:755–778

Capello R, Caraglui A, Fratesi U (2015) Spatial heterogeneity in the costs of the economic crisis in Europe: Are cities sources of regional resilience? J Econ Geogr 15:951–972

Christopherson S, Michie J, Tyler P (2010) Regional resilience: theoretical and empirical perspectives. Camb J Reg Econ Soc 3:3–10

Cuadrado Roura JR, Maroto A (2016) Unbalanced regional resilience to the economic crisis in Spain: a tale of specialization and productivity. Camb J Reg Econ Soc 9:153–178

Davies S (2011) Regional resilience in the 2008–2010 downturn: comparative evidence from European countries Cambridge. J Reg Econ Soc 4(3):369–382. https://doi.org/10.1093/cjres/rsr019

De Groot HLF, Nahuis R, Tang PJG (2006) The institutional determinants of labour market performance: comparing the Anglo-Saxon model and a European style alternative. In: Mitchell W, Muysken J, van Veen T (eds) Growth and Cohesion in the European Union. Edward Elgar, Cheltenham, pp 157–179

Delgado-Bello C, Maroto A, Atienza M (2021) Resilience and economic structure: the case of the Chilean regions during the Asian crises and the Great Recession of 2008. Pap Reg Sci 102(1):31–51

Di Caro P, Fratesi U (2018a) Regional determinants of economic resilience. Ann Reg Sci 60:235–240

Di Caro P, Fratesi U (2018b) Regional determinants of economic resilience. Ann Reg Sci 60:235–240

Di Meglio G, Gallego J, Maroto A, Savona M (2018) Services in developing economies: the deindustrialization debate in perspective. Dev Change 49(6):1495–1525

DiCaro P (2017) Testing and explaining economic resilience with an application to Italian regions. Pap Reg Sci 96(1):93–113

Dijkstra L, Garcilazo E, McCann P (2015) The effects of the global financial crisis on European regions and cities. J Econ Geogr 15(5):935–949

Doran J, Fingleton B (2016) Employment resilience in Europe and the 2008 economic crisis: insights from micro-level data. Reg Stud 50(4):644–656

Dunn ES (1960) A statistical and analytical technique for regional analysis. Pap Proc Reg Sci Assoc 6:97–112

Esteban J (2000) Regional convergence in Europe and the industry mix: a shift-share analysis. Reg Sci Urban Econ 30(3):353–364

Evenhuis E (2017) New directions in researching regional economic resilience and adaptation. Geogr Compass 11:1–15

Ezcurra R, Ríos V (2019) Quality of government and regional resilience in the European Union. Evidence from the Great Recession. Pap Reg Sci 98:1267–1290

Faggian A, Gemmiti R, Jaquet T, Santini I (2018) Regional economic resilience: the experience of the Italian local labor systems. Ann Reg Sci 60(2):393–410

Filippetti A, Guy F, Iammarino S (2019) Regional disparities in the effect of training on employment. Reg Stud 53:217–230

Fratesi U, Perucca G (2018) Territorial capital and the resilience of European regions. Ann Reg Sci 60:241–264

Fratesi U, Rodríguez-Pose A (2016) The crisis and regional employment in Europe. What role for sheltered economies? Camb J Reg Econ Soc 9(1):33–57

Fröhlich K, Hassink R (2018) Regional resilience: A stretched concept? Eur Plan Stud 26:1763–1778

Giannakis E, Bruggeman A (2017) Determinants of regional resilience to economic crisis: a European perspective. Eur Plan Stud 25(8):1394–1415. https://doi.org/10.1080/09654313.2017.1319464

Giannakis E, Bruggeman A (2020) Regional disparities in economic resilience in the European Union across the urban-rural divide. Reg Stud 54(9):1200–1213

Gong H, Hassink R (2017) Regional resilience: the critique revisited. In: Vorley T, Williams N (eds) Creating resilient economies: entrepreneurship, growth and development in uncertain times. Edward Elgar, Cheltenham, pp 206–216

Gong H, Hassink R, Tan J, Huang D (2020) Regional resilience in times of a pandemic crisis: the case of COVID-19 in China. Tijdschr Econ Soc Geogr 111(3):497–512

Hernandez-Salmeron M, Usabiaga C (2017) Regional growth and convergence in Spain: Is the decentralisation model important? Acta Oecon 67(3):389–412

Hu X, Hassink R (2017) Exploring adaptation and adaptability in uneven economic resilience: a tale of two Chinese mining regions. Camb J Reg Econ Soc 10(3):527–541

Hu X, Li L, Dong K (2022) What matters for regional economic resilience amid COVID-19? Evidence from cities in Northeast China. Cities 120:103440

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

Lagravinese R (2015) Economic crisis and rising gaps north-south: evidence from the Italian regions. Camb J Reg Econ Soc 8(2):331–342

Lazzeroni M (2019) Industrial decline and resilience in small towns: evidence from three European case studies. Tijdschr Econ Soc Geogr 111:182–195

Lucas RE (2000) Some macroeconomics for the 21st century. J Econ Perspect 14(1):159–168

Maroto A (2023) Ctrl+supr versus shift+comp. Industrialization and business services as engine of economic growth. In: Tsounis N, Vlachvei A (eds) Advances in empirical economic research. Proceedings in Business and Economics, Springer

Martin R (2012) Regional economic resilience, hysteresis, and recessionary shocks. J Econ Geogr 12:1–32

Martin RL (2018) Shocking aspects of regional development: towards an economic geography of resilience. In: Clark G, Gertler M, Feldman MP, Wójcik D (eds) The new Oxford handbook of economic geography. Oxford University Press, Oxford, pp 839–864

Martin R, Sunley P (2015) On the notion of regional economic resilience: conceptualization and explanation. J Econ Geogr 15:1–42

Martin R, Sunley P (2020) Regional economic resilience: evolution and evaluation. In: Bristow G, Healy A (eds) Handbook of regional economic resilience. Edward Elgar, Cheltenham-Northampton, pp 10–35

Martin R, Sunley P, Tyler P (2015) Local growth evolutions: recession, resilience, and recovery. Camb J Reg Econ Soc 8:141–148

Martin R, Sunley P, Gardiner B, Tyler P (2016) How regions react to recesions. Resilience and the role of economic structures. Reg Stud 50(4):561–585

Maroto A (2012) Productivity in the services sector: conventional and current explanations. Serv Ind J 32(5):719–746. https://doi.org/10.1080/02642069.2010.531266

McCann P, Soete L (2020) Place-based innovation for sustainability. Publications Office of the European Union, European Commission, Brussels

Palaskas T, Psycharis Y, Rovolis A, Stoforos C (2015) The asymmetrical impact of the economic crisis on unemployment and welfare in Greek urban economies. J Econ Geogr 15(5):973–1007

Reinhart C, Rogoff K (2009) The aftermath of financial crises. Am Econ Rev Pap Proc 99(2):466–472

Ríos V, Gianmoena L, Iraizoz B, Pascual P, Rapún M, Ubago Y (2017) The determinants of regional resilience in Spain during the Great Recession. In: (Mancha, T. Dir): Política económica, economía regional y servicios. 299–322 Thomson-Reuters

Rodriguez-Pose A (2013) Do institutions matter for regional development? Reg Stud 47(7):1034–1047

Sensier M, Bristow G, Healy A (2016) Measuring regional economic resilience across Europe: operationalising a complex concept. Spat Econ Anal 11(2):1–44

Simonen J, Herala J, Svento R (2020) Creative Destruction and creative resilience: restructuring of the Nokia dominated high-tech sector in the Oulu region. Reg Sci Policy Pract 12:931–954

Storper M (2005) Society, community and economic development. Stud Comp Int Dev 39(4):30–57

Villaverde J, Maza A (2020) The economic resilience for Spanish provinces: From recession to recovery. Acta Oeconomica 70(2):195–213

Wilson GA (2018) “Constructive tensions” in resilience research: Critical reflections from a human geography perspective. Geogr J 184(1):89–99. https://doi.org/10.1111/geoj.12232

Xiao J, Boschma R, Andersson M (2018) Resilience in the European Union: the effect of the 2008 crisis on the ability of regions in Europe to develop new industrial specializations. Ind Corp Change 27:15–47

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables

4,

5,

6,

7,

8,

9 and Fig.

4.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sánchez, A.M., Cuadrado-Roura, J.R. Sectoral–regional resilience and productive specialization: a comparison among the last three crises. Ann Reg Sci (2024). https://doi.org/10.1007/s00168-024-01261-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s00168-024-01261-6