Abstract

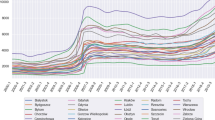

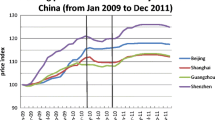

House prices in China have increased greatly in recent decades, and the dynamics seem to vary across cities. It is rational to assume that urban housing prices converge to different equilibria and form club convergence (i.e., subgroups). Empirical evidence on the existence of club convergence is limited, however, as is evidence on the underlying mechanisms. Therefore, the aim of the present study was to 1) detect club convergence in housing prices across Chinese regions over the period 2006–17 and 2) examine the determinants influencing club formation. A log t test in combination with a clustering algorithm was used to assess club formation. The results showed that regional housing prices face heterogeneous dynamics, providing some evidence of housing market segmentation. Four convergence clubs of Chinese regions with different convergence levels were identified. Ordered logit model showed that population growth, income, and housing regulation are among the drivers of club formation. The results also indicated that being in a different Chinese city-tier and differences in urban healthcare affect housing market club membership. The findings are supportive for policymakers to coordinate balanced regional housing development across China.

Similar content being viewed by others

Notes

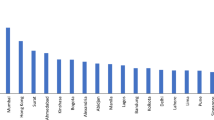

Areas in the east show significantly higher house prices than those in central or western China and cities being ranked high in Chinese city-tier have higher housing prices and growth.

To circumvent spurious dynamic relations in a traditional HP filter, Hamilton (2018) proposed using an OLS regression of variable g on a constant and the p lag term of g (the value p depends on the date type). The fitted values are used as an estimate of the latent cyclical component.

For house price index data, when the first time of the observation is set as the base year, one trend component will appear for the calculated data because of the influence of the same initial condition.

5 We discarded a fraction (v = 0.2) of the time series in terms of the size (T = 95, > 50). Setting v = 0.22, 0.24, 0.26 and 0.30 was used to check for robustness.

References

Abbott A, Vita GD (2012) Pairwise convergence of district-level house prices in London. Urban Stud 49(4):721–740

Abbott A, Vita GD (2013) Testing for long-run convergence across regional house prices in the UK: a pairwise approach. Appl Econ 45(10):1227–1238

Alexander C, Barrow M (1994) Seasonality and cointegration of regional house prices in the UK. Urban Stud 31(10):1667–1689

Apergis N, Payne JE (2012) Convergence in US house prices by state: evidence from the club convergence and clustering procedure. Lett Spat Resour Sci 5(2):103–111

Apergis N, Simo-Kengne BD, Gupta R (2015) Convergence in provincial-level South African house prices: evidence from the club convergence and clustering procedure. Rev of Urban Reg Dev Stud 27(1):2–17

Awaworyi Churchill S, Inekwe J, Ivanovski K (2018) House price convergence: evidence from Australian cities. Econ Lett 170:88–90. https://doi.org/10.1016/j.econlet.2018.06.004

Barro RJ, Sala-i-Martin X (1992) Convergence. J Polit Econ 100(2):223–251

Barros CP, Gil-Alana LA, Payne JE (2012) Comovements among U.S. State housing prices: evidence from fractional cointegration. Econ Model 29(3):936–942. https://doi.org/10.1016/j.econmod.2012.02.006

Baumol WJ (1986) Productivity growth, convergence, and welfare: What the long-run data show. The American Economic Review 1072–1085

Blanco F, Martín V, Vazquez G (2016) Regional house price convergence in Spain during the housing boom. Urban Stud 53(4):775–798

Carlino GA, Mills LO (1993) Are US regional incomes converging?: A time series analysis. J Monet Econ 32(2):335–346

Chenery HB, Robinson S, Syrquin M, Feder S (1986) Industrialization and growth: Citeseer

Cook S (2003) The convergence of regional house prices in the UK. Urban Stud 40(11):2285–2294

Cook S (2005) Detecting long-run relationships in regional house prices in the UK. Int Rev Appl Econ 19(1):107–118

Cook S (2012) β-convergence and the cyclical dynamics of UK regional house prices. Urban Stud 49(1):203–218

Du K (2017) Econometric convergence test and club clustering using Stata. Stata J 17(4):882–900

Gong Y, Hu J, Boelhouwer PJ (2016) Spatial interrelations of Chinese housing markets: Spatial causality, convergence and diffusion. Reg Sci Urban Econ 59:103–117

Gray D (2018) Convergence and divergence in British housing space. Reg Stud 52(7):901–910. https://doi.org/10.1080/00343404.2017.1360480

Grigoryeva I, Ley D (2019) The price ripple effect in the Vancouver housing market. Urban Geogr 40(8):1168–1190. https://doi.org/10.1080/02723638.2019.1567202

Hamilton JD (2018) Why you should never use the Hodrick-Prescott filter. Rev Econ Stat 100(5):831–843

Hodrick RJ, Prescott EC (1997) Postwar US business cycles: an empirical investigation. J Money Credit Bank 29(1):1–16

Holly S, Hashem Pesaran M, Yamagata T (2011) The spatial and temporal diffusion of house prices in the UK. J Urban Econ 69(1):2–23. https://doi.org/10.1016/j.jue.2010.08.002

Holmes MJ, Grimes A (2008) Is there long-run convergence among regional house prices in the UK? Urban Stud 45(8):1531–1544

Holmes MJ, Otero J, Panagiotidis T (2011) Investigating regional house price convergence in the United States: Evidence from a pair-wise approach. Econ Model 28(6):2369–2376

Holmes MJ, Otero J, Panagiotidis T (2017) A pair-wise analysis of intra-city price convergence within the Paris housing market. J Real Estate Financ Econ 54(1):1–16

Holmes MJ, Otero J, Panagiotidis T (2018) Climbing the property ladder: an analysis of market integration in London property prices. Urban Stud 55(12):2660–2681

Holmes MJ, Otero J, Panagiotidis T (2019) Property heterogeneity and convergence club formation among local house prices. J Hous Econ 43:1–13. https://doi.org/10.1016/j.jhe.2018.09.002

Kim YS, Rous JJ (2012) House price convergence: evidence from US state and metropolitan area panels. J Hous Econ 21(2):169–186. https://doi.org/10.1016/j.jhe.2012.01.002

Lee CC, Chien MS (2011) Empirical modelling of regional house prices and the ripple effect. Urban Stud 48(10):2029–2047. https://doi.org/10.1177/0042098010385257

Lee CC, Lee CC, Chiang SH (2016) Ripple effect and regional house prices dynamics in China. Int J Strateg Prop Manag 20(4):397–408

Liu T-Y, Su C-W, Chang H-L, Chu C-C (2018) Convergence of regional housing prices in China. J Urban Plan Dev 144(2):04018015

Mao G (2016) Do regional house prices converge or diverge in China? China Econ J 9(2):154–166. https://doi.org/10.1080/17538963.2016.1164493

McKelvey RD, Zavoina W (1975) A statistical model for the analysis of ordinal level dependent variables. J Math Sociol 4(1):103–120

Meen G (1999) Regional house prices and the ripple effect: a new interpretation. Hous Stud 14(6):733–753

Meen G (2002) The time-series behavior of house prices: a transatlantic divide? J Hous Econ 11(1):1–23

Meen G (2016) Spatial housing economics: a survey. Urban Stud 53(10):1987–2003

Montagnoli A, Nagayasu J (2015) UK house price convergence clubs and spillovers. J Hous Econ 30:50–58

Montañés A, Olmos L (2013) Convergence in US house prices. Econ Lett 121(2):152–155. https://doi.org/10.1016/j.econlet.2013.07.021

Phillips PC, Sul D (2007) Transition modeling and econometric convergence tests. Econometrica 75(6):1771–1855

Phillips PC, Sul D (2009) Economic transition and growth. J Appl Economet 24(7):1153–1185

Quah D (1992) International patterns of growth: I. Persistence in Cross-country Disparities, Unpublished manuscript, London School of Economics

Rong Z, Wang W, Gong Q (2016) Housing price appreciation, investment opportunity, and firm innovation: evidence from China. J Hous Econ 33:34–58

Rostow WW (1980) Why the poor get richer and the rich slow down: Essays in the Marshallian long period: Springer

Schnurbus J, Haupt H, Meier V (2017) Economic transition and growth: a replication. J Appl Economet 32(5):1039–1042

Tsai I-C (2018a) House price convergence in euro zone and non-euro zone countries. Econ Syst 42(2):269–281

Tsai IC (2018b) Housing price convergence, transportation infrastructure and dynamic regional population relocation. Habitat Int 79:61–73. https://doi.org/10.1016/j.habitatint.2018.07.004

Wen H, Tao Y (2015) Polycentric urban structure and housing price in the transitional China: evidence from Hangzhou. Habitat Int 46:138–146. https://doi.org/10.1016/j.habitatint.2014.11.006

Young AT, Higgins MJ, Levy D (2008) Sigma convergence versus beta convergence: evidence from US county-level data. J Money, Credit, Bank 40(5):1083–1093

Zhang D, Fan G-Z (2019) Regional spillover and rising connectedness in China’s urban housing prices. Reg Stud. https://doi.org/10.1080/00343404.2018.1490011

Zhang F, Morley B (2014) The convergence of regional house prices in China. Appl Econ Lett 21(3):205–208

Zhang H, Li L, Hui EC-M, Li V (2016) Comparisons of the relations between housing prices and the macroeconomy in China’s first-, second- and third-tier cities. Habitat Int 57:24–42. https://doi.org/10.1016/j.habitatint.2016.06.008

Zhang L, Hui EC, Wen H (2017) The regional house prices in China: ripple effect or differentiation. Habitat Int 67:118–128. https://doi.org/10.1016/j.habitatint.2017.07.006

Funding

This study was funded by China Scholarship Council (CSC) [No. 201906840014]. The authors would also like to Dr Yuan Feng, Dr Martijn Smit, and Dr Jinlong Gao for their constructive comments on the earliy and revised draft of this work.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Rights and permissions

About this article

Cite this article

Cai, Y., Zhu, Y. & Helbich, M. Club convergence of regional housing prices in China: evidence from 70 major Cities. Ann Reg Sci 69, 33–55 (2022). https://doi.org/10.1007/s00168-021-01107-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-021-01107-5