Abstract

We analyze a stylized creative region’s economy. There are two goods (consumption and creative capital) and creative class members differ in their income generating abilities. The distribution of abilities in the creative class population is such that the median ability is less than the average ability. There is a proportional income tax rate and all tax revenues are redistributed to the creative class members by the regional authority (RA) with a uniform, lump-sum transfer. In this setting, we perform four tasks. First, we determine the tax rate that maximizes the lump-sum transfer. Second, we show that income equality requires the tax rate to equal unity and that the poorest creative class member is better off with a lower tax rate and hence more inequality. Third, given the \(ith\) creative class member’s preference over the tax rate and the transfer, we ascertain the tax rate that will be chosen by majority voting. Finally, we discuss the connection between increasing inequality and the majority chosen tax rate.

Similar content being viewed by others

Notes

It should be noted that in his 2018 book titled The New Urban Crisis, Florida agrees that the influx of the creative class into cities has often given rise to economic inequality and, as such, he suggests some ways in which this inequality problem might be addressed. See Batabyal (2018) for a critical review of this book.

Go to https://www.bloomberg.com/news/articles/2019-08-27/the-changing-geography-of-america-s-creative-class for a more detailed corroboration of this claim. Accessed on 7 April 2021.

Go to https://www.thebalance.com/cities-that-levy-income-taxes-3193246 for additional details on this point. Accessed on 7 April 2021.

We suppose that the time period during which the events described in our model are unfolding is sufficiently long and hence there are no limits of any kind on the supply of either consumption or creative capital. Put differently, our focus here is on interior solutions for all the pertinent decision variables. If the time period were not long enough and there were limits on the supply of either consumption or creative capital then our subsequent analysis would have to be modified to explicitly account for the possibility of corner solutions for one or more of the decision variables of interest.

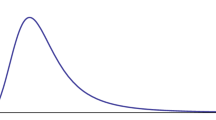

When the median is less than the mean, this tells us that the probability distribution function of interest is positively skewed or, put differently, that there are outliers in the high end of the distribution. When it comes to the study of income distributions, there is a lot of empirical evidence—see Chiripanhura (2011)—which shows that such distributions are frequently characterized by the presence of a large number of poor and middle-class households with a small number of very wealthy households. In other words, the median household income is typically less than the mean household income. The \({\alpha }_{i}{^{\prime}}s\) in our model refer to the income generating ability of the individual creative class members. Therefore, given the prior empirical evidence, we contend that it makes sense to think of the distribution of these income generating abilities in a way so that the median ability level is less than the mean ability level.

Given the two possible interpretations of our stylized region stated in the first paragraph of this section, the RA can be thought of as either the Mayor of a city like San Francisco or as the Governor of a state such as California. That said, for the purpose of our analysis in this paper, it is understood that a Mayor makes decisions with his or her city council and that a Governor makes decisions in consultation with the state legislature.

We concentrate on majority voting because this is one of the most common voting systems in democracies. That said, although voters do not, as a rule, determine tax rates directly, in elections at the state and sub-state levels, there is a connection between taxes and voting. Go to https://vhd.overseasvotefoundation.org/index.php?/ovf/Knowledgebase/Article/View/512/10/is-there-a-link-between-voting-and-taxes for additional details on this point. In addition, through ballot initiatives, voters often do vote directly on a variety of issues including taxes. For instance, in the 2020 election in the United States, voters in 17 states had a direct say on a variety of taxes. See https://www.kiplinger.com/taxes/state-tax/601555/election-2020-states-with-tax-questions-on-the-ballot for a more detailed corroboration of this point. Both sites accessed on 8 April 2021.

See Hindriks and Myles (2013, pp. 157–159) for a textbook exposition of the median voter theorem.

See Hindriks and Myles (2013, p. 354) for a textbook discussion of the single crossing property.

We acknowledge that voters care not only about the tax rate but also about “the group benefits that emerge from the RA’s spending of the tax money.” That said, the reader should note that we have already modeled this point in Eq. (11) and by specifying in Sect. 2 that the RA redistributes the tax revenues to the creative class members with a uniform, lump-sum transfer \(g>0.\) In fact, we think the above point is an important one and that is why Sect. 3 is devoted to determining how to maximize this lump-sum transfer.

References

Arribas-Bel D, Kourtit K, Nijkamp P (2015) The sociocultural sources of urban buzz. Environ Plan C 33:1–17

Batabyal AA (2017) A note on optimal income redistribution in a creative region. Reg Sci Inquiry 9:39–44

Batabyal AA (2018) Review of The New Urban Crisis by Richard Florida. Reg Stud 52:310–311

Batabyal AA, Beladi H (2018) Artists, engineers, and aspects of economic growth in a creative region. Econ Model 71:214–219

Batabyal AA, Nijkamp P (2016) Creative capital in production, inefficiency, and inequality: a theoretical analysis. Int Rev Econ Financ 45:553–558

Chiripanhura B (2011) Median and mean income analyses. Econ Labour Market Rev 5:45–63

Donegan M, Lowe N (2008) Inequality in the creative city: is there still a place for ‘old- fashioned’ institutions? Econ Dev Q 22:46–62

Florida R (2002) The rse of the creative class. Basic Books, New York, NY

Florida R (2005) The flight of the creative class. Harper Business, New York, NY

Florida R (2018) The new urban crisis. Basic Books, New York, NY

Florida R, Mellander C, Stolarick K (2008) Inside the black box of regional development—human capital, the creative class, and tolerance. J Econ Geogr 8:615–649

Hindriks J, Myles GD (2013) Intermediate public economics, 2nd edn. MIT Press, Cambridge, MA

Kane K, Hipp JR (2019) Rising inequality and neighborhood mixing in US metro areas. Reg Stud 53:1680–1695

Leslie D, Catungal JP (2012) Social justice and the creative city: class, gender, and racial inequalities. Geogr Compass 6:111–122

Peck J (2005) Struggling with the creative class. Int J Urban Reg Res 29:740–770

Reese LA, Sands G (2008) Creative class and economic prosperity: old nostrums, better packaging? Econ Dev Q 22:3–7

Siemiatycki E (2013) A smooth ride? From industrial to creative urbanism in Oshawa, Ontario. Int J Urban Reg Res 37:1766–1784

Tiebout C (1956) A pure theory of local expenditures. J Polit Econ 64:416–424

Acknowledgements

I thank the Editor-in-Chief Martin Andersson and an anonymous reviewer for their helpful comments on a previous version of this paper. In addition, I acknowledge financial support from the Gosnell endowment at RIT. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.