Abstract

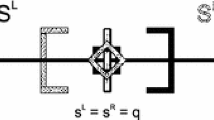

This paper analyzes the location equilibrium in two intersecting circular markets where two identical firms engage in Cournot competition. It is shown that each of the two intersection points occupied by one of the firms is the unique fully symmetric location equilibrium and also the social optimum, which is neither maximal nor minimal differentiation. The intuition of our result is that by each firm locating at each of the intersection points, firms can minimize their transport costs and partially avoid competition, compared with both locating at one of the intersection points. Our finding coincides with the real-world phenomenon that transport hubs may attract the presence of more firms.

Similar content being viewed by others

Notes

Transportation hubs have also received much attention in the transport geography literature. For instance, Hesse and Rodrigue (2004) mentioned that transport hubs are becoming more and more important and are attracting various distribution centers to locate nearby in the USA and Europe. Such transportation hubs are emerging along the Ohio River Valley in the USA and Benelux and the Netherlands in Europe.

There are few economic papers discussing competition along intersecting roads (markets). If we also consider some atypical market configurations in the literature, then there are more studies. For example, Braid (1989) analyzed spatial retail competition along intersecting roadways (two, three, or four ways). Retailers choose their locations in the first stage and engage in price competition in the second stage. He showed that there is no subgame perfect equilibrium in this model. Chen and Riordan (2007) developed the spokes model for nonlocalized spatial competition among oligopoly firms. Their spokes model was employed later by Caminal and Granero (2012), Germano and Meier (2013), and Buechel and Reggiani (2014). Moreover, a network structure with many nodes has been analyzed in Pinto et al. (2016), where they showed that firms prefer to be located at those network nodes with multiple exits. Other network structures for oligopoly competition can be found in Buechel and Roehl (2015), Hoernig et al. (2012), and Wang and Wang (2018).

Our two intersecting circular markets can also be applied to the case of conurbation, where two or more nearby cities may come to overlap as cities grow, such as Dallas–Fort Worth in the USA.

The intuition of the result in Pal (1998) has been further explained in Yu and Lai (2003, p. 573), where they described the “natural location effect” as a firm choosing the best location without considering the existence of its rival. Obviously, this effect is nil in a circular market. They also described the “strategic location effect” as a firm moving as far as possible from the rival’s location, which we identify here to avoid competition.

For the analysis of spatial location choices, we believe that a setting of Cournot competition is better than a setting of Bertrand competition. This is because the competition in a Bertrand setting might be too strong and may encounter an undercutting problem leading to no location equilibrium, while Cournot competition is much milder and can escape from the undercutting trap.

For example, in the steamboat age, St. Louis was developed as an important inland city, because it was located at the intersection of the Mississippi River and the Missouri River.

For example, in Taipei metropolitan area, the government is now constructing a three-(intersecting)-circular and three-linear subway system with many intersections to make it easy for travelers to transfer.

If an \([x_1,y_2]\) pair is symmetric on one of the central east–west and the central north–south lines, then we defined it as semi-symmetric locations. For example, \([x_1,y_2]=[\frac{1}{4},\frac{1}{4}]\) is a semi-symmetric location pair, because it is only symmetric on the central north–south line; \([x_1,y_2]=[\frac{s}{2},1-\frac{s}{2}]\) is also a semi-symmetric location pair, because it is only symmetric on the central east–west line.

One of the referees asked whether \(x_1\in [0,\frac{1}{2}]\) and \(y_2=1-x_1\in [\frac{1}{2},1]\) (say, \([x_1,y_2]=[\frac{1}{4},\frac{3}{4}]\)) could be a equilibrium location pair. First, the pair \([x_1,y_2]=[\frac{1}{4},\frac{3}{4}]\) is neither fully symmetric nor semi-symmetric by our definition but symmetric on the linkage line of \(x=\frac{1}{4}\) and \(y=\frac{3}{4}\), while the line’s exact direction depends on the value of s. Second, we have proved that \([x_1,y_2]=[\frac{1}{4},\frac{3}{4}]\) is not an equilibrium location pair. Please see the proof in Appendix 3.

Although (\(x_1=0\), \(y_2=0\)) are fully symmetric locations, it is not an equilibrium location pair. Detailed proof is listed in Appendix 1.

More related explanation can be found in Yu and Lai (2003, p. 573). In contrast, the middle point of a linear market has a cost advantage for firms to serve the whole market, and this advantage is strong enough to dominate the effect of competition avoidance mentioned above, and thus we can see that firms agglomerate at the market center in Anderson and Neven (1991).

It is obvious that \([x_1,y_2]=[1/2,1/2]\) can avoid competition between firms. However, \([x_1,y_2]=[1/2,1/2]\) cannot be a location equilibrium, because the transportation cost is not minimized (see Appendix 2 for details).

The result that transportation hubs reduce competition comes from our setting that there exist two intersection points between two circular markets, and firms strategically choose to locate on separated intersection points to reduce competition. If there is only one transportation hub (\(s=0\)), then there exists no incentive to choose separated locations to avoid competition. In this case, the competition at the transportation hub is greater than at other locations.

One of the referees asked whether \([x_1,y_2]=[s,s]\) (or \([1-s,1-s]\)) might (also) be an equilibrium location. First, this location pattern is not fully symmetric in our definition and is excluded from our previous analysis. Second, we can show that \([x_1,y_2]=[s,s]\) (or \([1-s,1-s]\)) is not an equilibrium (see Appendix 4), because it will be dominated by \([x_1,y_2]=[s,1-s]\). Therefore, Proposition 1 is confirmed again.

Many thanks to one of the referees for pointing out this situation.

For example, given parameters \(a=2\), \(b=1\), \(t=1\), and \(s=1/32\), our equilibrium locations are valid when \(\lambda <32\). In other words, our equilibrium locations are quite robust. In fact, when \(a=2\), \(b=1\) and \(t=1\), all \(\lambda \le 14\) yield the same equilibrium as ours, no matter the value of s.

Similar calculations can prove that \([x_1,y_2]=[0,0]\) and \([x_1,y_2]=[1/2,1/2]\) are both local minimums in social welfare. Detailed calculations are available upon request to the authors. In fact, by considerable numerical calculation, this local maximum is also the unique global maximum.

Colombo (2016) showed that when \(c=0\), the equilibrium quantity is not well defined. Therefore, \(c>0\) is necessary.

Note that the consumer surplus under a hyperbolic demand function has no closed-form solution, so the corresponding welfare analysis cannot proceed.

References

Anderson SP, Neven D (1991) Cournot competition yields spatial agglomeration. Int Econ Rev 32:793–808

Braid RM (1989) Retail competition along intersecting roadways. Reg Sci Urb Econ 19:107–112

Buechel B, Roehl N (2015) Robust equilibria in location games. Eur J Oper Res 240:505–517

Caminal R, Granero LM (2012) Multi-product firms and product variety. Economica 79:303–328

Chen Y, Riordan MH (2007) Price and variety in the spokes model. Econ J 117:897–921

Colombo S (2016) Location choices with a non-linear demand function. Pap Reg Sci 95:215–226

Germano F, Meier M (2013) Concentration and self-censorship in commercial media. J Public Econ 97:117–130

Guo WC, Lai FC (2015) Spatial Cournot competition in a linear–circular market. Ann Reg Sci 54:819–834

Gupta B, Lai FC, Pal D, Sarkar J, Yu CM (2004) Where to locate in a circular city? Int J Ind Organ 22:759–782

Hamilton J, Thisse JF, Weskamp A (1989) Bertrand vs. Cournot in a model of location choice. Reg Sci Urb Econ 19:87–102

Hesse M, Rodrigue JP (2004) The transport geography of logistics and freight distribution. J Trans Geogr 12:171–184

Hoernig S, Jay S, Neumann KH, Peitz M, Pluckebaum T, Vogelsang I (2012) The impact of different fibre access network technologies on cost, competition and welfare. Telecom Policy 36:96–112

Matsumura T, Matsushima N (2012) Spatial Cournot competition and transportation costs in a circular city. Ann Reg Sci 48:33–44

Matsumura T, Shimizu D (2006) Cournot and Bertrand in shipping models with circular markets. Pap Reg Sci 85:585–598

Matsushima N (2001) Cournot competition and spatial agglomeration revisited. Econ Lett 73:175–177

Matsushima N, Matsumura T (2003) Mixed oligopoly and spatial agglomeration. Can J Econ 36:62–87

Pal D (1998) Does Cournot competition yield spatial agglomeration? Econ Lett 60:49–53

Pal D, Sarkar J (2006) Spatial Cournot competition among multi-plant firms in a circular city. South Econ J 73:246–258

Pinto AA, Almeida JP, Parreira T (2016) Local market structure in a Hotelling town. J Dyn Games 3:75–100

Reggiani C (2014) Spatial price discrimination in the spokes model. J Econ Manag Strat 23:628–649

Shimizu D (2002) Product differentiation in spatial Cournot markets. Econ Lett 76:317–322

Shimizu D, Matsumura T (2003) Equilibria for circular spatial Cournot markets. Econ Bull 18:1–9

Sun CH (2010) Spatial Cournot competition in a circular city with directional delivery constraints. Ann Reg Sci 45:273–289

Wang T, Wang R (2018) A network-city model of spatial competition. Econ Lett 170:168–170

Yu CM (2007) Price and quantity competition yield the same location equilibria in a circular market. Pap Reg Sci 86:643–655

Yu CM, Lai FC (2003) Cournot competition in spatial markets: some further results. Pap Reg Sci 82:569–580

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

1.1 Appendix 1: The proof that \([x_1,y_2]=[0,0]\) is not an equilibrium

Given \(x_1=0\), \(y_2\in [0,\delta ]\), and \(\delta \) is small, we can show that it is profitable for firm 2 to deviate from \(y_2=0\). The domestic market for both firms can be divided into six segments ([0, s], [s, 1 / 2], \([1/2,y_2+1/2]\), \([y_2+1/2,1-s]\), \([1-s,1-y_2]\), \([1-y_2,1]\)), and the nondomestic market can also be divided into six segments (\([0,y_2]\), \([y_2,s]\), [s, 1 / 2], \([1/2,y_2+1/2]\), \([y_2+1/2,1-s]\), \([1-s,1]\)) as shown in Fig. 9. The profits for firm 1 and firm 2 at a location point x on market X are

Solving \(\partial \pi _1^X/\partial q_1^X=0\) and \(\partial \pi _2^X/\partial q_2^X=0\) simultaneously yields \(q_1^X\) and \(q_2^X\). The profits for firm 1 and firm 2 at a location y on market Y are

Solving \(\partial \pi _1^Y/\partial q_1^Y=0\) and \(\partial \pi _2^Y/\partial q_2^Y=0\) simultaneously yields \(q_1^Y\) and \(q_2^Y\).

After some calculations, given \(x_1=0\), the total profit for firm 2 is

since

which is monotonically increasing in \(y_2\), because \(a>2t\) and \(s\le 1/4\). In other words, given \(x_1=0\), firm 2 will choose \(y_2=\delta \) when \(y_2\in [0,\delta ]\). Therefore, \([x_1,y_2]=[0,0]\) cannot be an equilibrium.

1.2 Appendix 2: The proof that \([x_1,y_2]=[1/2,1/2]\) is not an equilibrium

Given \(x_1=1/2\), \(y_2\in [1/2-\delta ,1/2]\), and \(\delta \) is small, we can show that it is profitable for firm 2 to deviate from \(y_2=1/2\). The domestic market for both firms can be divided into six segments, and the nondomestic market can also be divided into six segments for further calculations as shown in Fig. 10. The profits for firm 1 and firm 2 at a location point x on market X are the same as Eqs. (24) and (25).

After some calculations and given \(x_1=1/2\), the total profit of firm 2 is

Since

In other words, given \(x_1=1/2\), firm 2 will choose \(y_2=1/2-\delta \) when \(y_2\in [1/2-\delta ,1/2]\). Therefore, \([x_1,y_2]=[1/2,1/2]\) cannot be an equilibrium.

1.3 Appendix 3: The proof that \([x_1,y_2]=[1/4,3/4]\) is not an equilibrium

Given \(x_1=1/4\) and \(y_2\in [3/4,1-s]\), we can show that it is profitable for firm 2 to deviate from \(y_2=3/4\). The X market can be divided into six segments ([0, s], [s, 1 / 4], \([1/4,1/2-s]\), \([1/2-s,3/4]\), \([3/4,1-s]\), \([1-s,1]\)), and the Y market can also be divided into six segments ([0, s], \([s,y_2-1/2]\), \([y_2-1/2,s+1/2]\), \([s+1/2,y_2]\), \([y_2,1-s]\), \([1-s,1]\)) as shown in Fig. 11. The profits for firm 1 and firm 2 at a location point x on market X are

Solving \(\partial \pi _1^X/\partial q_1^X=0\) and \(\partial \pi _2^X/\partial q_2^X=0\) simultaneously yields \(q_1^X\) and \(q_2^X\). The profits for firm 1 and firm 2 at a location y on market Y are

Solving \(\partial \pi _1^Y/\partial q_1^Y=0\) and \(\partial \pi _2^Y/\partial q_2^Y=0\) simultaneously yields \(q_1^Y\) and \(q_2^Y\).

After some calculations, given \(x_1=1/4\), the total profit for firm 2 is

which is monotonically increasing in \(y_2\), since \(\frac{\partial ^2\Pi _2}{\partial y_2^2} =\frac{4t^2(4y_2-4s-1)}{9b}>0\) by the assumptions \(s\le 1/4\) and \(y_2\ge 3/4\). Given \(\left. \frac{\partial \Pi _2}{\partial y_2}\right| _{y_2=\frac{3}{4}}=\frac{t(8a-7t+16ts(1+s))}{18b}>0\), firm 2 will choose \(y_2=1-s\) when \(y_2\in [3/4,1-s]\). Therefore, \([x_1,y_2]=[1/4,3/4]\) cannot be an equilibrium.

1.4 Appendix 4: The proof that \([x_1,y_2]=[s,s]\) is not an equilibrium

Given \(x_1=s\) and \(y_2\in [s,s+\delta ]\), where \(\delta \) is not large, we can show that firm 2 will choose \(y_2^*=s\). Similarly, given \(x_1=s\) and \(y_2\in [0,s]\), we can also show that firm 2 will choose \(y_2^*=s\). Given \(x_1=s\) and \(y_2=s\), we have \(\Pi _2 =\frac{t^2+12a^2-6ta}{54b}\). Comparing this with the profit of firm 2 in Proposition 1, we have \(\Pi _2(x_1=s,y_2=1-s) -\Pi _2(x_1=s,y_2=s)=\frac{16t^2s^2(3-8s)}{27b}>0\). Therefore, each firm locating at each of the intersecting points dominates the local solutions [s, s] or \([1-s,1-s]\) that both firms agglomerate at one intersecting point.