Abstract

This paper explores the patterns of innovation and collaboration by using unique regional survey data on more than 600 Swedish firms. The data also include the smallest firms, which have been largely neglected in the existing literature on innovations. In the context of collaboration, however, small firms are of particular interest because external interactions and joint projects can be expected to play a very central role in innovation processes in firms where internal resources are very limited. The results show that the probability of innovation is higher among collaborating firms, yet not all types of collaborations matter. Extra-regional collaborations appear as most important in promoting firm innovation, and collaboration seems to be most favourable when the partners involved have some organizational or knowledge relatedness. Small firms, in particular, seem to gain from such extra-regional linkages.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the last 25 years, a path of literature has evolved on innovation and collaborations within regional innovation networks, showing that the local economic milieu plays an important role in stimulating firm innovation (Asheim and Isaksen 2002; Moodysson et al. 2008; Simmie 2003; Trippl 2011). Innovation is a process where different types of knowledge and competencies are combined. Through participation in different types of knowledge networks, firms can access various kinds of knowledge and information. Through such interactions, small firms can bring together similar innovation capacities as those present in large firms. Although large firms carry out more innovations in absolute number, innovation activities are observed also in small firms (Ebersberger and Herstad 2012; Gagliardi et al. 2013).

A large body of literature focuses on the role of proximity for knowledge exchange and find that knowledge networks tend to be geographically bounded (e.g. Anselin et al. 1997; Asheim and Isaksen 2002). Recent literature shows that the spatial aspects of knowledge exchange and formation of knowledge networks appear to be more complex than what previously have been indicated (Boschma 2005). The perspectives of proximity are therefore broadened to non-spatial dimensions relating to cognitive, organizational, institutional and social adjacency (Boschma 2005; Boschma and Frenken 2010; Ponds et al. 2007).

This paper explores the patterns of innovation and collaborations using unique firm-level survey data. These survey data include information about innovations and collaborations in 636 firms with at least one employee in the county of Jönköping, located in the southern part of Sweden. This county consists of 13 municipalities, and 11 of these are characterized as rural. Nevertheless, the county has a strategically good location in the middle of a triangle with the three Swedish metropolitan regions in the corners, and the region hosts a large number of small- and medium-sized manufacturing firms. The survey data collected from firms in this region consider all types of collaborations, not only those relating directly to innovation projects, and include information about type of collaborators and their geographical location. Moreover, the data cover firms in all size classes and include also the smallest firms, which are largely neglected in the literature on firm innovation.

The purpose of the paper is to explore the patterns of firm collaboration with regard to the type of collaborator and its geographical location. By quantitative analyses of the relations between collaborations and firm innovation, the paper contributes to previous research in three ways. First, the data include, in contrast to, e.g. the Community Innovation Survey (CIS), also the smallest firms (between 1 and 9 employees). Innovation activities in small firms are largely overlooked in current research, partly due to lack of data. It might be that small firms carry out fewer innovations in absolute numbers, but they are nevertheless important contributors to technological progress and economic renewal (Acs and Audretsch 1988). This paper sheds some light on innovations and collaborations in small firms, proposing that small firms may be as innovative as their larger counterparts if they find relevant partners to collaborate with. The survey data indicate that a substantial fraction of small firms are innovative, although this fraction is somewhat larger for firms with more than 9 employees.

The second contribution of the paper is found in the analysis of spatial and non-spatial dimensions of collaboration patterns. This study considers general collaboration that take place for any purpose and not only collaboration directly related to innovations. These collaborations are scrutinized from a geographical perspective, where intra-regional, extra-regional and international linkages are distinguished. Furthermore, the data allow us to distinguish between intra- and inter-firm collaborations, intra- and inter-industry collaborations and collaborations along vertical and horizontal linkages in the value-added chain. These data allow us to broaden the perspectives of proximity. Hence, this study adds to a rather limited empirical literature analysing non-spatial proximity dimensions of firms’ collaboration patterns and the impact of different types of collaboration on firm innovative performance.

A third contribution of the paper regards the type of region investigated. Most studies on innovation activities focus on (or are unintentionally biased towards) large metropolitan regions, simply because these regions often are the preferred location for R&D activities and also host the predominant part of knowledge-intensive firms. Innovation is, however, a phenomenon that occurs in different types of places. Still, the literature on innovation and innovation networks in regions characterized by structures with low density is not yet very developed.

The results from this study suggest that spatial proximity is not necessarily very relevant for explaining firm-level collaboration patterns. Rather, non-spatial dimensions of proximity seem to be more important in shaping patterns of collaboration. Furthermore, the relationships between innovation and collaborations appear to be similar in small and large firms, with one exception; inter-regional collaborations seem to be particularly important for innovations in small firms.

The paper starts with a review of previous research in fields relating to this study, covering the role of geographical and non-geographical proximity in knowledge sharing as well as the role of small firms in regional innovation performance. Section 3 presents the methodological issues relating to the survey and data collection, followed by Sect. 4 that presents the econometric methodology applied in the quantitative analyses of the survey data. The results from these analyses are presented in Sect. 5, and the outcomes of the study are finally summarized and discussed in Sect. 6.

2 Pooling of resources and innovation in small and large firms

A growing body of empirical studies on firm innovation points to the importance of combining different knowledge sources (Johansson et al. 2015; Almeida and Phene 2012). The dependence on external knowledge may vary across firms, and specifically across firms of varying sizes. Innovation is an activity involving both high costs and high risks and is often the result of the confrontation of different fields of knowledge (Oerlemans and Meeus 2005). As a consequence, large firms appear to be more innovative than small firms as they have both the financial muscles to take larger risks and an internal knowledge pool of sufficient size and scope to develop new ideas.

The role of small firms in economic renewal is, on the other hand, still not very well understood. Schumpeter is one of the first and perhaps one of the most important scholars describing the role of small firms in research and technological progress. Schumpeter argues that small firms show a particular vitality in terms of innovativeness and are therefore the engine of entrepreneurship. In the late 1980s and the early 1990s, a strain of research evolved, arguing that small firms are the engines of renewal, knowledge creation and sharing ideas, just because of their multiplicity (e.g. Gilder 1988; Rogers 1990). The lack of bureaucracy provides them with the freedom in mind and action which allows for far-reaching specialization and an extensive flexibility. In fact, we frequently observe that larger firms prefer to organize innovative activities in the form of small firm spin-offs (Eriksson and Moritz Kuhn 2006).

On an industry level, sectors composed by smaller firms tend to have a more rapid technological change since more ideas come out in daylight to be tested. An industry with fewer, but larges firms tends to have a more rapid rate of technological advances on those innovation attempts that are actually pursued (Cohen and Klepper 1992). Possibly, there is a firm size threshold that matters for innovation performance. As long as the firms under study are of a modest size, there are empirical results, showing that one cannot say that larger firms are more research intensive nor more innovative than their smaller counterparts (Baldwin and Scott 1987; Kamien and Schwartz 1982). The relative innovation advantage between small and large firms is rather determined by market structures and the degree of competitiveness in the industry.

The impediments for innovation related to capital and knowledge access can be reduced through collaboration with other firms and institutes (Preffer and Salancik 1978; Roijakkers and Hagedoorn 2006). Innovation activities can be performed within the firm, in collaboration with other actors, be fully outsourced to external actors, or as a mix of internal and external knowledge (Cantwell and Zhang 2012). Thus, collaboration opens up for the opportunity to pool resources where firms can have complementary roles (Wernerfelt 1984). Since small firms face more limitations with regard to internal resources, external knowledge may be of specific importance for them (Asheim and Isaksen 2002). Yet, Chesbrough (2003) stresses that firms in all size classes have expanded their innovation strategies to not only involve investments in internal R&D but also investments in joint innovation activities with external parties. Several scholars point at collaboration and participation in different types of knowledge networks as a mean of enhancing firms’ innovative capacities (e.g. Saxenian 1990; Freel 2003). This development follows from an increasing competition in the globalized economy, which results in the pressure on firms to produce and innovate faster, and at the same time to reduce R&D costs.

2.1 External knowledge and the geography of knowledge transfers

Firms can access external knowledge from various sources. One is the exchange of goods and services. International commodity trade is a central channel for knowledge and technology diffusion, but local markets for services and labour are even more important for knowledge exchange. This follows from the fact that more complex knowledge stays embedded in the mind of people and requires personal interaction for being transacted. Consequently, local markets for business services have shown of significant importance for mediating knowledge and stimulate innovation and renewal (Johansson et al. 2015). In related research, there are also ample evidences of the importance of multinational firms as disseminators of technologies (e.g. Blomström and Kokko 1998; Keller and Yeaple 2009). Firms that are parts of a larger organizational structure often find useful knowledge sources within its own corporate group, which can be described as a specific kind of knowledge network. Empirical studies have shown that firms within these types of networks are, in fact, more innovative than independent corporations (e.g. Ebersberger and Lööf 2005; Johansson and Lööf 2008).

Irrespective of the type of knowledge transaction, such exchanges are often enhanced by geographical proximity. Physical distances impact on patterns of commodity trade and play an even larger role in the spatial formation of service markets. In such markets, knowledge-intensive services are strongly clustered in space. In fact, R&D activities, knowledge-intensive services and other forms of knowledge demanding production tend to agglomerate in space for a number of reasons, and one of them is the localized nature of knowledge transfers (Acs et al. 1992; Feldman 1994, among others). The exchange of complex knowledge often requires face-to-face interaction in a process of interactive learning. This implies that the costs of acquiring external knowledge through market-based transactions, inter-organizational collaborations or in the form of pure spill over often are larger if the actors involved are located far from each other.

In terms of networking activities, firms can find external knowledge and collaborating partners within and outside their own corporate sphere. This embeddedness of firms in a wider knowledge context does not only depend on the operations of individual firms, organizations and institutions in a country or region but rather on how they interact as parts of a system (Freeman 1995; Gregersen and Johnson 1997). This type of networks for cooperation and knowledge sharing is often referred to as innovation systems (Jaffe 1986; Lundvall 1988). In view of spatial clustering of knowledge-intensive activities and the localized nature of knowledge spillovers, regional innovation systems (RIS) have attracted a lot of interest in the literature but also in the design of innovation policies (Asheim and Isaksen 2002).

2.2 Non-geographical perspectives of knowledge proximity

Besides the geographical location of network participants, proximity in the context of knowledge networks can have a number of non-spatial dimensions. Research in this field is partly founded in the literature on evolutionary economics, which argues that firms tend to innovate within areas of their present cognitive capabilities. This implies that knowledge exchange and collaborations tend to be close or yet complementary in cognitive/technological “space” rather than geographical (Nelson and Winter 1982). External knowledge can be novel to the firm or of complementary character to the present internal knowledge (Mowery and Nathan 1989). In both cases, the knowledge recipients need some sort of absorptive capacity (Cohen and Levinthal 1990). This absorptive capacity principally builds on the existence of common knowledge bases and codes for communication (Boschma 2005; Boschma and Frenken 2010).

Boschma (2005) distinguishes four different non-spatial proximity dimensions: cognitive, organizational, institutional and social proximity. In brief, these dimensions relate to technology and knowledge bases (cognitive proximity), hierarchical structures (organizational proximity), legal frameworks (institutional proximity) and personal relations (social proximity). Boschma argues that the geographical structures for interactive learning cannot be fully understood unless these other dimensions of proximity are also considered. Short geographical distances are neither a necessary nor a sufficient condition for learning. Rather, proximity in space matters for learning because it facilitates the coordination of various activities and individuals. Other proximity dimensions may, however, provide alternative solutions to the problem of coordination. Hence, geographical distances matters because they influence the strength of non-spatial proximity dimension in knowledge networks.

Empirical research shows that organizational and cognitive proximities have significant influences on the formation of knowledge networks and on the innovative performance of firms (Rallet and Torre 1999; Torre and Wallet 2014). Cognitive proximity seems to be of crucial importance for the capacity of firms to assimilate external knowledge, independently of whether such knowledge flows are intentional or unintentional (Oerlemans and Meeus 2005). Organizational proximity, on the other hand, is needed to form effective structures for knowledge sharing. In fact, geographical proximity seems to be of no use if it does not coincide with some sort of organizational relationships (Rallet and Torre 1999).

It is, however, not an easy task to empirically distinguish between different proximity dimensions as these often interact with each other (Boschma and Frenken 2010). For example, social proximity is interlinked with geographical proximity because people most often socialize with people living and working nearby. Organizational and cognitive proximity are interlinked because firms that are technologically adjacent are more likely to form common organizational structures, taking the shape of corporate conglomerates or less rigid network organizations such as industry networks. Organizational proximity is also related to social proximity as personal links are fostered by the type of repetitive contacts that are frequent within corporate groups. Social, cognitive and organizational proximities are all fostered by common knowledge bases and professional ties and relate to the ability to communicate and understand complex pieces of knowledge and information. This ability is enhanced when the parties involved share similar knowledge and technologies, similar problems and common networks including systems of suppliers, customers and competitors (Boschma 2005; Fitjar and Rodríguez-Pose 2013). It is therefore useful to also consider the type of proximity achieved through vertical and horizontal integration. Vertical integration results from linkages between actors operating at different stages in the supply chain, from subcontractors to final seller. Horizontal integration results from relations between competing actors operating at the same stage in the product value chain. These collaborations within supply chains are facilitated by proximity dimensions associated with technological relatedness, repetitive contacts and common codes for communication.

In spite of its’ merits, however, too much proximity can be contra-productive. Noteboom (2000) argues that when cognitive distances are too small interactive learning and innovations are impeded because lack of new perspectives on problems and their solutions. Moreover, variations in knowledge, experiences and skills within organizations and regions are needed to foster new ideas (Jacobs 1969; Frenken et al. 2007; Wixe 2014). Too much cognitive distance, on the other, implies problems of communication. Boschma (2005) suggests that the optimal solution is a geographical clustering of firms endowed with a common knowledge base made up of diverse, but complementary, knowledge resources. These types of clusters are, indeed, often observed as locations with above-average innovation rates. Moreover, regions with a high degree of variety among firms in related industries show strong economic performance (Frenken et al. 2007).

Organizational and technological relatedness may be of particular importance for fostering collaborations involving small firms as these firms often tend to be very specialized. Moreover, the magnitude and influences of collaborations within the value chain may be of specific interest in the context of small firms because larger firms often locate into regional innovation systems for the purpose of exploiting the specialized innovative capacities found among small-scale suppliers. In return, large firms provide these regionalized suppliers with the capital and information needed for their innovation processes (Kristensen and Zeitlin 2005; Dicken 1998). Indeed, large national and multinational firms often play the critical role of competent customers in the innovation process (Eliasson 2003). This symbiotic relationship between small and large firms in the supply chain is particularly interesting for the regional context considered in this paper, a relatively remote region with low density hosting many small- and medium-sized manufacturing firms acting as subcontractors.

3 A survey on firm innovation and collaboration

The present paper is based on a survey on firm innovation and collaborations in the county of Jönköping, located in the southern part of Sweden. Eleven of the 13 municipalities in the county are classified as rural, with a large share of out-commuters to the largest city, Jönköping. Thus, the majority of the county has a low accessibility to larger cities. The county hosts about 4 % of Sweden’s labour force and 4 % of the total population. A bit more than 16 % of the labour force is highly educated, which can be compared to the metropolitan region of Stockholm, where the corresponding share is 28 %. Around 25 % of all workers are employed in some type of manufacturing, and around 20 % are within retail. Many of the smaller firms in this county are subcontractors and business supporters to the manufacturing sector. The agricultural sector accumulates to more than 36 % of the workplaces but only 1 % of all employees.

In 2014, Statistics Sweden presented their results of CIS survey round 2010–2012 (Statistics Sweden 2014). Summarizing these results, one can see that the region of Jönköping is one of the top regions in terms of innovative activities but one of the bottom regions in terms of innovation cooperation. The industrial structure of a county probably shapes the pattern of innovation and firm collaboration, and one may raise the question whether a study on Jönköping is applicable to other regions. Low density of population and economic activity, a large share of manufacturing relatively little access to knowledge and little diversity within the region, is, however, common features of most rural regions. Obviously, these structures imply that rural regions provide a very different local environment for innovation activities compared to urban regions.

3.1 Data collection

The first challenge posed to everyone doing empirical studies on innovation is how to actually define the term innovation. What is a new product and what can be considered as a new process? The Oslo manual is a collaboration between 30 countries on guidelines for collecting and interpreting innovation data and from this, the Community Innovation Survey (CIS) has been devised (OECD 2005). The results from the CIS have, over the years, refined the Oslo manual and revised the definition of the term innovation. Four types of innovations are now distinguished in this manual: product innovations, process innovations, marketing innovations, and organizational innovations. An innovation is thereby defined as “...the implementation of a new or significantly improved (good or service), or process, a new marketing method, or a new organizational method in business practice, workplace organization or external relations..., where the minimum requirement for an innovation is that the product, process, marketing method or organizational method must be new (or significantly improved) to the firm” (OECD 2005). The survey on collaboration and innovation in the county of Jönköping adheres to this definition.

The CIS survey is designed with the ambition to provide information on innovativeness of sectors, different types of innovations and various aspects of innovation development. The CIS questionnaire is sent out to firms with at least ten employees. CIS is constructed in such way that firms can easily be categorized into innovating and non-innovating firms even though the definition behind it is somewhat complex. This has opened up for critiques on the CIS but foremost on various analyses of the results. When postal questionnaires are sent out, the problem is that the respondent is alone responsible of interpreting the definition of what is an innovation. This becomes problematic in the sense that the threshold of what is an innovation can differ between nations but also between sectors and individual firms. A small change may qualify as an innovation from one person’s point of view, while such change is mere routine in the view of someone else (Tether 2001). One can therefore say that the user of the survey result can easily distinguish between innovators and non-innovators, but the respondents of the questionnaires can have a hard time putting themselves into either of the categories.

The survey on which the present paper is based has a number of similarities with the CIS, but is addressed also the smallest firms, with the minimum restriction of one employee. The fact that also the smallest firms were included called for some modification of the survey method in terms of formulation of survey questions and method of data collection. Instead of written postal questionnaires, telephone interviews were made as this method requires less reading from the part of the respondent and allows for some guidance from the part of the interviewer. Also, in telephone interviews, questions must be formulated and posed in a more direct manner than what is necessarily the case in written questionnaires.

The sample of firms that were interviewed were randomly selected form a large sample of 3313 out of a total population of 8151 firms with at least one employee in the county of Jönköping. This sample of firms was delivered by Statistics Sweden and was stratified with respect to firm size. These data also provided us with information about basic firm characteristics such as revenue, number of employees, legal form, industry and age. From this sample, we draw a random subsample of 985 firms, which were contacted for an interview. Six hundred and thirty-six of the firms that were contacted were actually interviewed. Table 8 in the “Appendix” shows the complete sampling process from the original sample of 3300 firms.

3.2 Data exploration

Summarizing the survey responses, Table 1 shows that 69 % of all respondents consider their firm to be innovative in some respect. This figure is 77 % for larger firms (at least 10 employees) and 59 % for smaller firms (between 1 and 9 employees).

Table 2 presents a more detailed description of the interrelations between different types of innovations. Considering all firms, 44 % concentrate on one type of innovation. This figure is slightly lower for larger firms and considerably higher (56 %) for smaller innovative firms. The largest difference can be found for those firms doing all types of innovations (product, service and process), where larger firms are more dominant. The middle part of Table 2 reports the number of innovative firms doing product, service and process innovations, respectively. Service innovations are the most common among small as well as large firms. The bottom part of the table reveals that firms often do the three types of innovations in combination. There seem to be slight tendency to do process innovations in combination with either a product or a service innovation. This is because product and process developments often also require changes and improvements in production processes. This pattern is also found in other studies, e.g. a study by Mairesse and Robin (2012) on innovation activities in French firms. Their results indicate that distinct effects from product and process innovations, respectively, are difficult to disentangle and suggest a general single indicator of innovation instead.

Comparing the responses from our survey with the outcomes of the CIS survey, we find that there are variations across all municipalities in the county, but there are also some variations between the two surveys. This is given in Table 3. On average, our survey gives a higher share of innovative respondents. The discrepancy between the two surveys can be explained by the way the survey is conducted, i.e. the use of telephone interviews instead of a postal questionnaire, or due to the fact that we cover firms in all size classes in a wider set of sectors. In any case, we cannot know for sure which one of the two surveys that gives the most accurate picture of reality but we can observe that the results from both of them show a relatively high degree of innovativeness in the county of Jönköping.

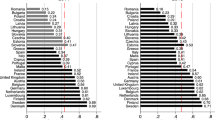

All firms, innovative and non-innovative, were asked with whom they collaborate for developing their businesses, without any strict relation to innovation activities. 472 out of the 636 respondents said that they have collaborated with another firm/organization during the time period in question. Nearly 45 % of these 472 firms have less than 10 employees. Figure 1 presents the collaboration patterns among small and large firms. The firms have answered the question: “which of the following actors has your company collaborated with for the purpose of developing your firm during 2008–2011, and where are these collaborators located?” Multiple answers are allowed, and the vertical axis shows the number of firms in each collaboration category. The left side of the figure shows who they collaborate with; supplier, client and/or competitor. The right-hand side shows where these collaborators are located; within the region, elsewhere in Sweden, or internationally.

Figure 1 indicates that collaborations create vertical linkages, both backward and forward in the value chain. Most of these collaborations take place within Sweden. Among small firms, collaborations outside their own region are more common than within. Horizontal linkages, i.e. collaborations between competing firms, seem to be less pronounced as are collaborations across national borders.

4 Econometric methods

The purpose of this study is to analyse how internal and external knowledge sources relate to firms’ innovation propensity, with specific focus on the influences of firm collaboration. With regard to innovation performance, our prime interest is whether firms are innovative or not. Accordingly, the dependent variable is binary: innovative or not innovative. The most common empirical strategy in this situation is to use a logistic regression model which estimates the logit-transformed probability of the relationships through a maximum likelihood method. In our case, this model is specified as:

where the dependent variable innovative (1 or 0) is incorporated as the probability of it to be 1: \(P_\mathrm{innov}\) . The explanatory variables are grouped into three categories: firm characteristics, local characteristic and collaborations. In Eq. 1, they are expressed as three vectors of predictor groups.

We have to consider the distribution of respondents across different firm size groups and the correlation with firm distribution across different size groups in the whole population. Deviations between the true firm distribution over different size classes and the size distribution of firms in our sample need to be treated by adding sampling weights to reduce biases in the regression estimates. For this purpose, we do a post-stratification with four strata based on firm size groups. Data do not have to be stratified with respect to firms’ geographical location as the sample of respondents reflects the geographical distribution of the total firm population.

The explanatory variables are presented in Table 4. First, we include a dummy variable for firms with less than ten employees. The knowledge and experience within the firm is another key variable, which is here approximated by the share of employees with at least three years of university education. As argued in the theoretical background, internal knowledge often needs to be accompanied with external competences and external interactions can take many forms. Our data reveal two types of external interactions that are not a direct result of collaboration, namely export activities and ownership structures. Knowledge and technology transfers are embedded in trade in goods and services. Moreover, previous research has found that exporters are more likely to invest in R&D because these firms already have a larger market to reap monopoly profits from. Affiliation to a multinational firm gives similar kinds of knowledge and market advantages for what reason we include a dummy variable for forms affiliated to a multinational firm.

Substantial parts of the literature on location and economic agglomeration explain the effects of the local and regional milieu for firm innovativeness. This literature generally emphasizes the role of accessibility to different sources of knowledge. Possible knowledge transfers can be captured in various ways, and a variation of variables has been tried out in the present analysis. Accessibility to knowledge, share of business services and accessibility to knowledge-intensive business services in the surrounding economy are variables that are all correlated with it each other. Hence, the inclusion of one of them in the regression model is enough to capture the effect of the regional milieu. Following results from previous research (e.g. Johansson et al. 2015), we include accessibility to knowledge-intensive business services since this variable reflects the local supply of knowledge mediated in markets for services.

The third set of variables is those describing collaborations. The basic question in this analysis is whether firms collaborate or not. More detailed information on collaboration is derived from two main questions in the survey: with whom does the firm cooperate and where does the firm find collaborating partners? The answers to these questions allow us to distinguish between intra- and inter-firm collaborations and intra- and inter-industry collaborations. Hence, this information can be used to analyse non-spatial dimensions of proximity associated with technological relatedness and organizational structures. Within-industry collaborations are further disentangled with respect to horizontal as well as backward and forward linkages in the supply chain. Turning to the second question about collaboration: where is the collaborator located? The alternative answers contain three geographical levels: within the region where the firm is located, outside this particular region but still within the country, and outside the country. The majority of municipalities in the Jönköping County are rural, and one can therefore expect that firms in this region need to compensate the low density regional milieu with extra-regional collaborations.

In the final step of the empirical analysis, we further investigate the importance of collaboration for stimulating innovations in small firms. For this purpose, we estimate the regression model in specifications that include interaction variables, where the dummy variable for firms with less than 10 employees is interacted with the various collaboration variables. These variables are not given in Table 4 above.

5 Empirical results

The analysis is divided into three steps. Firstly, we examine how the likelihood to be innovative relates to firm characteristics and collaborations. Secondly, we disentangle the patterns of collaboration with respect to type and location of collaborators. Finally, we investigate whether collaborations are of particular importance for fostering innovations in small firms.

Estimation results are presented as odds ratios instead of the estimated coefficients to emphasize the focus on probabilities for firms to be innovative. In our multiple logistic regression, the estimated coefficients for all variables: \(\hat{\beta }_\iota \) (firm variables), \(\hat{\gamma }_\iota \) (region variables) or \(\hat{\delta }_\iota \) (collaboration variables) are related to their conditional odds ratio. The odds ratio of being innovative is defined as the ratios of the probability of innovate over the probability of not innovate.

Following this, we interpret \(\hbox {exp}( {\hat{\beta }_x })\) as an estimate of the odds ratio between the dependent variable and the predictor when the other predicting variables are held constant. The end result of this manipulation is that the odds ratio can be computed by raising e to the power of the logistic coefficient. In other words, the exponential function of the estimated coefficient is the odds ratio associated with a one-unit increase in the predicting variable.

5.1 Firm characteristics, regional characteristics and any type of collaboration

Table 5 presents the estimation results of the first step in the analysis. Five model specifications are estimated with stepwise introduction of explanatory variables. All coefficients from estimations of specification 1 follow prior expectations; being a small firm has a negative effect on the probability of being an innovating firm (an odds ratio below 1), whereas a high share of educated employees has a positive effect, though close to ambivalent (an odds ratio close to 1). Being an exporter increases the probability of being innovative, which supposedly reflects that exporting firms have market access and networks outside the national boundaries, which can be an important source of new knowledge.

Moreover, we expect that ownership structures that involve multinational enterprises influence innovation performance. Being a part of a larger corporate group, with multi-locations, can be advantageous, in particular for smaller firms that have limited internal resources for exploiting new market potentials. The second specification includes the variable reflecting multinational firm ownership, and this variable has the expected innovation probability and is highly robust across all model specifications. Interestingly, the disadvantages of being a small firm seem to disappear when multinational firm ownership is included in the model. This finding supports prior expectations that small firms may very well be innovative but they are dependent on being a part of a larger structure providing them with a wider knowledge network. For small firms, the costs and risks associated with innovation activities can be hard to overcome and being part of a larger corporate group bring opportunities to share costs, knowledge and risks. Moreover, when controlling for multinational firm ownership, the dummy variable for exporting firms has no significant importance. The networks provided by multinational corporate groups appear to give rise to similar, yet stronger, influences on the probability of innovation as participation in international markets.

A number of locational characteristics have been included among the regressors to capture the influences of the local innovative milieu. Independent of variable used in this respect we find no significant correlation between variations in firm innovation probability and variations in the local knowledge environment. As given in Table 5, accessibility to knowledge-intensive businesses (KIBS) is insignificant across all model specifications. This outcome is most likely related to the specific economic structures in the Jönköping region, which are characterized by relatively low density and poor diversity (Wixe and Andersson 2013). There are only two localities in this region that are characterized by urban structures, and KIBS employees are highly concentrated to these two locations. As a result, most respondents of the survey have about equally poor access to KIBS and find other sources of external knowledge.

Despite poor access to knowledge mediated on local markets for labour and services, firms in the county of Jönköping are innovative. This can plausibly be an effect of successful collaborations. This hypothesis is tested in model specification five where accessibility to KIBS is excluded and collaboration (of any type) is included instead. As general as collaboration is identified here, it is highly significant with an odds ratio far above 1. Again, the dummy variable for small firms is insignificant and remains so even if the variables multinational and exporter are excluded (this specification is not given in Table 5). These findings indicate that collaboration of any type and for any purpose is positively related to firm-level innovation.

The estimations in Table 5 are complemented by estimation per innovation type; product, service and process. The overlap between these three innovation types is relatively common (see Table 2). More than half of the innovative firms do more than one innovation type which makes the results, when separated, rather difficult to interpret (c.f. Mairesse and Robin 2012). However, Tables 10, 11 and 12 in “Appendix” present some results which are worth mentioning. Focusing on the probability of doing only product innovations, it is interesting to see that the explanatory variables small firm and exporter become insignificant. In contrast, focusing on service innovations (Table 11 in “Appendix”) small firms appear to have a significant disadvantage, whereas the share of employees with a higher education and being an exporter becomes insignificant. What regards collaboration, separating the three types of innovations, it is only significant in the case of service innovations. These findings are largely in line with the results presented by Mairesse and Robin (2012), which show that the major difference between firms in manufacturing and service sectors is the proportion of firms doing R&D where service sectors host a much smaller share of firms.

5.2 Who do they collaborate with and where are they located?

The results in Table 5 indicate that with respect to firm and regional characteristics, internal knowledge and affiliation to a multinational conglomerate are the only two variables that are positively related to firm innovation. Moreover, collaborations appear to significantly matter for firm-level probability to innovate. The second step of the analysis is to further explore the effects of different types of collaborations.

The survey questions are posed in such way that collaborations can be categorized into different types with regard to type of collaborator and with regard to the geographical location of the collaborator. The first categorization is based on the question: who is the collaborator? A collaborator within the same corporate group can be close in both organizational and cognitive terms. Presumably, this would give advantages due to overlapping knowledge bases, common codes and established channels for regular communication. However, being in the same corporate family does not necessarily imply that all entities are categorized into the same industry.Footnote 1 Firms within the same industry are adjacent because they use similar technologies and operate on related markets and are therefore confronted with similar technological challenges and similar business problems. When firms belong to the same industry, one can thus assume that they have a deeper understanding of each other’s problems and of the processes related to the emergence and development of innovation ideas. Knowledge shared between collaborating partners can be related but also complementary to each other. It is therefore useful to further decompose collaborations with respect to upstream and downstream linkages, as well as horizontal linkages in the supply chain. Furthermore, the geographical patterns of collaborations are explored by the question: where are the collaborators located? The answers to this question allow us to distinguish between intra-regional, extra-regional and international collaborations. This categorization of collaborators into type of firm and its’ location allow us to examine the influences of spatial as well as non-spatial dimensions of proximity on firm-level probability of innovation. Table 6 presents the estimated results from these estimations.

Results from specification 6 and 7 in Table 6 show that the probability of being innovative is positively related to collaborations with firms belonging to the same industry. However, the relationship is substantially stronger when collaborators belong to the same corporate group. Hence, organizational proximity seems to increase the probability of firm-level innovation. When collaborations are subdivided into relations with client, customer and/or competitors, the results from specification 8 suggest that firms collaborating with suppliers and clients have a higher probability of innovation than firms that do not have any backward or forward linkages in their network of collaborators. The effect of client collaboration (forward integration) is slightly larger than collaborating with suppliers (backward integration). This is not a surprising result, given that we know that the region of study hosts a large number of subcontracting firms. We can also see that collaboration with competitors (horizontal integration) does not covariate with firm-level innovation probability. This can be due to lack of relevant competitors, but also the outcome of a strategic choice in a cluster of similar firms, minimizing the risk to expose any innovation ideas to other firms competing in, more or less, the same markets. Whether this result originates from poor opportunities or developed strategies (if not a combination) may very well depend on the regional structure; a rural region may hold fewer opportunities to collaborate compared to an urban region.

The second categorization of collaborations regards their spatial patterns. The results presented in the last column in Table 6 reveal that only one of the geographical variables is significantly correlated with firm probability to innovate and that is inter-regional collaborations. Collaborating with partners outside the firm’s own region seems to enhance the probability of being innovative. Collaboration within the region is not significantly correlated with firm-level innovation probabilities. This finding reflects that external assets relevant for spurring innovations (e.g. knowledge, experiences and risk capital) that firms strive to reach through collaborations are comparably scarce within the Jönköping region. These types of resources are generally abundant in dense regions, which attract highly educated people working in knowledge-intensive and creative industries. Larger cities often function as nodes for innovative activity since they have access to the relevant resources such as R&D institutions, transportation, trade networks and skilled labour. Being located in a rural region with low density may offer only few (if any!) opportunities for collaboration within a short geographical distance. Innovation processes often require very specific inputs: a certain type of knowledge, a specific type of business service or a particular logistic solution. The opportunities to find this in a rural region are small, for what reason firms have to reach beyond regional borders to find relevant collaboration partners. Results from analyses of survey data on innovation and collaboration among firms in Norway show similar result with respect to spatial patterns of collaborations (Fitjar and Rodríguez-Pose 2013). The Norwegian study, however, includes only firms in urban regions, so the findings from that study suggest that inter-regional interactions predominated the spatial collaboration patterns also in more urban regions. Moreover, international collaboration may be more important to firm innovativeness than shown by the results in Table 6, because such collaborations are partly absorbed by the variables reflecting intra-firm structures.

The final step in the analysis regards the relationship between collaborations and innovation in small firms. This is analysed by adding interaction variables that captures the collaboration patterns of firms with less than 9 employees. To investigate whether innovation in small firms is particularly correlated with some specific type of collaboration, we add interaction variables between the variable Small firm and each type of collaboration. They are numbered 5a (from specification 5 in Table 5), 8a–8c (from specification 8 in Table 6) and 9a–9c (from specification 9 in Table 6).

In most cases, the coefficients presented in Table 7 are robust in comparison with those presented in Tables 5 and 6. The interaction variables reflecting collaborations in small firms are insignificant in all specifications but the one capturing extra-regional collaborations. Thus, extra-regional collaborations appear to be of particular importance for innovations in small firms. In almost all of the specifications in Table 7, the variable Small firm shows no significant correlation with firm innovation probability. This variable becomes negative and significant when we interact the variables for small firms and extra-regional collaboration (specification 9b). Hence, it seems like it is the extra-regional collaborations that provides small firms with the capacities needed for successful innovation. These findings further emphasize the positive relationship between extra-regional collaboration and innovation found in Table 6 and suggests that small firms may compensate their internal limitations through network participation and collaborations. None of the other interaction variables show any significant effects, and the remaining collaboration variables have the same sign and significance levels as in Table 5. These results indicate that there are few (if any!) differences between small and large firms with regard to the relationship between different types of collaborations and firms propensity to innovate. In fact, it seems like collaborations may be equally important in fostering innovations in all types of firms in a county characterized by low density and relatively poor access to knowledge within the region.

6 Conclusions

The survey data used in this empirical analysis provide a rich material on innovations in small and large firms and give a general picture of innovation and collaboration patterns in a rural region located at some distance from larger metropolitan cities. The material also allows us to present more detailed “brushstrokes” on how innovative firms act in this setting and identify factors of importance for the probability that a firm is innovative. A general conclusion from this work is that collaborations of any kind, not just those focusing specifically on innovation activities, enhance the probability that a firm is innovative in some respect. Moreover, the empirical results suggest that once small firms get access to a wider network and collaboration partners, these firms can be as innovative as their larger counterparts. In fact, the estimated positive relationship between collaborations and firm-level innovation probability appear to be of similar magnitude for firms in all size classes. However, extra-regional interaction appears to be of particular importance for small firm innovativeness.

Furthermore, our analysis indicates that intra-firm and intra-industry collaborations stimulate firm-level innovation. These findings reflect that proximity associated with organizational structures and technological relatedness facilitates the sharing of knowledge and ideas. Interestingly, collaboration with partners within the own corporate group appear to have a far stronger positive relation to the probability of being innovative than collaborations with firms in the same industry. A part of this effect is probably induced by the predominance of multinational firms in private R&D activities and follows prior expectations. However, the results also support previous research stressing the role of organizational proximity for efficient knowledge transfers and interactive learning.

The study disentangles collaboration in relation to vertical and horizontal linkages in the value-added chain. The latter of these three has no significant effect, but collaboration with suppliers or customers appears to be positively related to firm innovation. Interestingly, the odds ratio for forward linkages is slightly higher than for backward linkages, which supports ideas about how the demand side may stimulate product development and the role of competent customers in innovation networks. Moreover, these types of collaborations appear to be of high relevance for firms in all size classes. The predominant importance of collaborations between firms at different stages in the supply chain supports arguments in previous literature that too much proximity hampers the innovative outcomes of collaborations simply because the collaborating partners are very likeminded. Too much proximity may result in lock-in effects, whereas new ideas rather are stimulated by the confrontation of different perspectives.

Considering the spatial patterns of collaboration, firms in the Jönköping region mostly find their collaborating partners in other regions in Sweden and such inter-regional collaborations seem to of largest relevance for firms’ innovation output. The lack of impact from local collaborators may be a result of the regional structure, whereas the influence of international knowledge flows is partly captured by the firm-level variables reflecting export market participation and multinational firm ownership. In sum, this study provides some evidences that spatial proximity is not necessarily very relevant for explaining firm-level collaboration patterns and how such collaboration associates with probabilities of innovation. Rather, non-spatial dimensions of proximity seem to be more important in shaping patterns of collaboration and innovation. This non-geographical proximity may facilitate the more distant collaborations observed in our survey data, as corporate structures and participation in global value chains are likely to nurture collaborations on inter-regional and international linkages.

A number of questions remain unanswered in this paper. First, innovation activities in small firms need to be further explored, and the importance of different types of collaborations for firms in different size classes is an issue that requires further investigation. A second relevant topic for future research, which cannot be answered by the present survey data, is to what extent the patterns and influences of collaboration relate to regional structure; do firms in dense regions collaborate more since they have access to a larger variety of collaboration partners in the local economy or are collaborations more important for firms in rural areas with limited variety in local economies? These issues need to be further explored in order to understand the generalizability of the results in the present study. Overall, the patterns of collaboration observed among firms in the county of Jönköping are likely to be present in regions (rural/distant from metropolitan areas) that are populated by small firms, where a relatively large fraction mostly act as subcontractors to firms in other regions and countries. Whether similar patterns for spatial interaction are observed also in regions with other types of economic structures is an important question for further research and for regional innovation policy design.

Notes

Same corporate group and same industry are not correlated with each other why they can be controlled for simultaneously in the regression analysis.

References

Acs ZJ, Audretsch DB (1988) Innovation in large and small firms: an empirical analysis. Am Econ Rev 78(4):678–690

Acs ZJ, Audretsch DB, Feldman MP (1992) Real effects of academic research: comment. Am Econ Rev 82(1):363–367

Almeida P, Phene A (2012) Managing knowledge within and outside the multinational corporation. In: Andersson M, Johansson B, Karlsson C, Lööf H (eds) Innovations & growth: from R & D strategies of innovating firms to economy-wide technological change. Oxford University Press, Oxford, pp 21–37

Anselin L, Varga A, Acz Z (1997) Local geographical spillovers between universities research and high technology innovations. J Urban Econ 42:422–488

Asheim B, Isaksen A (2002) Regional innovation systems: the integration of local ‘sticky’ and global ‘ubiquitous’ knowledge. J Technol Transf V27(1):77–86

Baldwin WL, Scott JT (1987) Market structure and technological change. Harwood Publishers, Chur

Blomström M, Kokko A (1998) Multinational corporations and spillovers. J Econ Surv 12(3):247–277

Boschma R (2005) Proximity and innovation: a critical assessment. Reg Stud 39(1):61–74

Boschma R, Frenken K (2010) The spatial evolution of innovation networks: a proximity perspective. In: Boschma R, Martin R (eds) The handbook of evolutionary economic geography. Edward Elgar, Cheltenham

Cantwell J, Zhang F (2012) Knowledge accession strategies and the spatial organisation of R&D. In: Andersson M, Johansson B, Karlsson C, Lööf H (eds) Innovation & growth: from R&D strategies of innovating firms to economy-wide technological change. Oxford University Press, Oxford

Chesbrough HW (2003) Open innovation: the new imperative for creating and profiting from technology. Harvard Business School Press, Boston

Cohen W, Klepper S (1992) The tradeoff between firm size and diversity in the pursuit of technological progress. Small Bus Econ 4(1):1–14

Cohen WM, Levinthal DA (1990) Absorptive capacity: a new perspective on learning and innovation. Adm Sci Q 35(1):128–152

Dicken P (1998) Global shift: transforming the world economy. Paul Chapman, London

Ebersberger B, Herstad SJ (2012) The relationship between international innovation collaboration, intramural R&D and SMEs’ innovation performance: a quantile regression approach. Appl Econ Lett 20(7):626–630

Ebersberger B, Lööf H (2005) Multinational enterprises, spillover, innovation and productivity. Int J Manag Res 4:7–37

Eliasson G (2003) Global economic integration and regional attractors of competence. Ind Innov 10(1):75–102

Eriksson T, Moritz Kuhn J (2006) Firm spin-offs in Denmark 1981–2000—patterns of entry and exit. Int J Ind Organ 24(5):1021–1040

Feldman MP (1994) Knowledge complementarity and innovation. Small Bus Econ 6(5):363–372

Fitjar RD, Rodríguez-Pose A (2013) Firm collaboration and modes of innovation in Norway. Res Policy 42(1):128–138

Freel MS (2003) Sectoral patterns of small firm innovation, networking and proximity. Res Policy 32(5):751–770

Freeman C (1995) The ‘National System of Innovation’ in historical perspective. Camb J Econ 19(1):5–24

Frenken K, van Oort FG, Verburg T (2007) Related variety, unrelated variety and regional economic growth. Reg Stud41(5):685–697

Gagliardi D, Muller P, Glossop E, Caliandro C, Fritsch M, Brtkova G, Ramlogan R (2013) A recovery on the horizon? In: Cox D, Gagliardi D, Monfardini E, Cuvelier S, Vidal D, Laibarra B, Probst L, Schiersch A, Mattes A (eds) Annual report on European SMEs 2012/2013. European Commission

Gilder G (1988) The revitalization of everything: the law of the microcosm. Harv Bus Rev 66(2):49–61

Gregersen B, Johnson B (1997) Learning economies, innovation systems and European integration. Reg Stud 31(5):479–490

Jacobs J (1969) The economy of cities. Vintage, New York

Jaffe AB (1986) Technological opportunity and spillovers of R&D: evidence from firms’ patents, profits and market value. National Bureau of Economic Research. NBER working paper no. W1815

Johansson B, Johansson S, Wallin T (2015) Internal and external knowledge and introduction of export varieties. World Econ 38:629–654

Johansson B, Lööf H (2008) The impact of firm’s R&D strategy on profit and productivity. Working paper series in economics and institutions of innovation

Kamien MI, Schwartz NL (1982) Market structure and innovation. Cambridge University Press, Cambridge

Keller W, Yeaple SR (2009) Multinational enterprises, international trade, and productivity growth: firm-level evidence from the United States. Rev Econ Stat 91(4):821–831

Kristensen PH, Zeitlin J (2005) Local players in global games: the strategic constitution of a multinational corporation. Oxford University Press, Oxford

Lundvall BA (1988) Innovation as an interactive process: from user-producer interaction to the national system of innovation. In: Dosi G, Freeman C, Nelson R, Silverberg G, Soete L (eds) Technical change and economic theory. Pinter, London, pp 349–369

Mairesse J, Robin S (2012) The importance of process and product innovation for produvtivity in french manufacturing and service industries. In: Andersson M, Johansson B, Karlsson C, Lööf H (eds) Innovation & growth-from R&D strategies of innovating firms to economy-wide technological change. Oxford University Press, UK, pp 128–159

Moodysson J, Coenen L, Asheim BT (2008) Explaining spatial patterns of innovation: analytical and synthetic modes of knowledge creation in the Medicon Valley life-science cluster. Environ Plan A 40(5):1040–1056

Mowery DC, Nathan R (1989) Technology and the pursuit of economic growth. Cambridge University Press, New York

Nelson RR, Winter SG (1982) An evolutionary theory of economic change. M.A Harvard University Press, Cambridge

Noteboom B (2000) Learning and innovation in organizations and economies. Oxford University Press, Oxford

OECD/Eurostat (2005) Oslo manual: guidelines for collecting and interpreting innovation data, 3rd edn. The measurement of scientific and technological activities. OECD Publishing, Paris

Oerlemans L, Meeus M (2005) Do organizational and spatial proximity impact on firm performance? Reg Stud 39(1):89–104

Ponds R, Van Oort F, Frenken K (2007) The geographical and institutional proximity of research collaboration*. Pap Reg Sci 86(3):423–443

Preffer J, Salancik G (1978) The external control of organizations: a resource dependence perspective. Harper & Row, New York

Rallet A, Torre A (1999) Is geographical proximity necessary in the innovation networks in the era of global economy? GeoJournal 49(4):373–380

Rogers TJ (1990) Landmark messages from the microcosm. Harv Bus Rev 68:24–30

Roijakkers N, Hagedoorn J (2006) Inter-firm R&D partnering in pharmaceutical biotechnology since 1975: trends, patterns, and networks. Res Policy 35(3):431–446

Saxenian A (1990) Regional networks and the resurgence of silicon valley. Calif Manag Rev 33:89–112

Simmie J (2003) Innovation and urban regions as national and international nodes for the transfer and sharing of knowledge. Reg Stud 37(6):607–620

Statistics Sweden (2014) Regional innovationsstatistik i Sverige 2010–2012

Tether B (2001) Identifying innovation, innovators and innovative behaviours: a critical assessment of the community innovation survey (CIS). CRIC discussion paper

Torre A, Wallet F (2014) Regional development and proximity relations. Edward Elgar, Padstow

Trippl M (2011) Regional innovation systems and knowledge-sourcing activities in traditional industries–evidence from the Vienna food sector. Environ Plan A 43(7):1599

Wernerfelt B (1984) A resource-based view of the firm. Strateg Manag J 5(2):171–180

Wixe S (2014) Firm knowledge, neighborhood diversity and innovation. CESIS working paper series

Wixe S, Andersson M (2013) Which types or relatedness matter in regional growth? Industry, occupation and education. CESIS working paper series, No. 332. https://static.sys.kth.se/itm/wp/cesis/cesiswp332.pdf

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

See Tables 8, 9, 10, 11 and 12.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.