Abstract

After falling for four decades, statutory retirement ages are increasing in most OECD countries. The labor market adjustment to these reforms has not yet been thoroughly investigated by the literature. We draw on a major pension reform that took place in Italy in December 2011 that increased the retirement age by up to six years for some categories of workers. We have access to a unique dataset validated by the Italian social security administration (INPS), which identifies in each private firm, based on an administrative exam of eligibility conditions, how many workers were locked in by the sudden increase in the retirement age, and for how long. We find that firms mostly affected by the lock in are those that were downsizing even before the policy shock. The increase in the retirement age seems to displace more middle-aged workers than young workers. Furthermore, there is not a one-to-one increase in the number of older workers in the firms where some workers were locked in by the reform. We provide tentative explanations for these results, based on the interaction between retirement, employment protection legislation and liquidity constraints of firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

OECD countries are struggling to increase their retirement ages to cope with rapidly ageing populations. Conditions imposed by multilateral organizations in the context of public debt relief programs also impose an increase in the retirement age. For instance, during the Eurozone debt crisis, the memorandum of understanding between the Greek Government and the Troika of creditors (the IMF, the ECB, and the European Commission) asked for a higher retirement age. In Spain, during the execution of the financial sector rescue program in 2012 the Spanish government was induced to carry out a pension reform aimed at slowing down the rise of pension expenditures. In the case of Italy, the ECB letter outlining the conditions for the massive purchase of government bonds in August 2011 asked for a radical pension reform increasing the retirement age in the midst of a major recession.

These reforms meet harsh political opposition even when the increase in the retirement age is temporary, and not only from the workers whose retirement is postponed. Employers oppose the reforms because they close a soft landing scheme widely used in countries with strict employment protection legislation when dealing with redundancies. We document in this paper that there is indeed a negative cross-country correlation between effective age of retirement and strictness of employment protection.

An additional factor driving the opposition to reforms is the widespread belief that an increase in the retirement age would crowd out young workers. This lump-of-labor argument is not new. It has been widely used in the past to justify the introduction of early retirement schemes (see Boldrin et al. (1999)). Such a deeply rooted perception was strengthened in the last decade by the observation of diverging trends in employment rates of older and young workers, notably in the aftermath of reforms increasing the retirement age. For instance, in Southern Europe the decline in youth employment ranged between 34% (Italy) and 57% (Spain) while the employment rate of those aged 55 and more was increasing.

Economic theory provides solid arguments against the idea that the total number of jobs or of working hours is fixed (Walker 2007). Since employment headcounts or hours worked are key endogenous variables, there is no reason to expect that their total number should be fixed. By the same token, the argument that mandatory reductions in working hours or early retirement options are warranted in order to create employment opportunities for those currently not working has no economic basis. This lump-of-labor concept can be shown to be fallacious on the basis of any undergraduate economics textbook. Standard price theory suggests that forced reductions in labor supply will induce wage adjustments offsetting any potential creation of employment opportunities for those currently not working.

However, this argument assumes perfect labor markets, where both wages and employment can freely adjust to changes in the institutional environment. Under more complex (and realistic) institutional configurations, including strict employment protection legislation and wage rigidities, sound economic theory does not rule out trade-offs between employment of young, middle-aged and older workers in the short run, and particularly not under recessions, when the adjustment is carried out mostly along the labor demand schedule.

Most of the empirical work to date testing the lump-of-labor idea has been focusing on the intensive margin of employment, drawing on mandatory workweek reductions. For instance, Hunt (1999) analyzed the reduction of standard working hours enforced in Germany through collective agreements in the period 1984 to 1994, which reduced the standard workweek from 40 to 36 hours. Her main findings are that actual working hours followed standard hours quite closely, and monthly wages were hardly affected by the reduction in working hours because workers through bargaining obtained a sufficient increase in their hourly wages to compensate for the reduction in working hours. As a result, the reductions in standard hours caused employment losses among men. France gave researchers other natural experiments. The standard (mandatory) workweek was reduced from 40 to 39 hours in 1982. Crépon and Kramarz (2002) found that this increased the average wage rate, inducing a decline in total employment. Another French experiment that received considerable attention is the 35-hours work week introduced in 1998 with the deliberate goal of reducing unemployment. Although this time the employment costs were partly mitigated by large state transfers to firms that reduced working time, there was an aggregate destruction of jobs (Estevão and Sá 2008). The lump-of-labor arguments were also falsified by a more recent study on mandatory working hours reductions in Japan and Korea (Lee et al. 2012).

Surprisingly enough, there is fairly little empirical research on the effects of policies operating along the extensive margin, notably increasing the retirement age. Such policy interventions pose conceptually a different problem than reductions in working hours, because they involve potentially intergenerational substitution of workers. Early retirement has stronger interactions with tenure-related wage policies of firms and employment protection legislation. The effects of an increase in retirement age and labor demand are indeed more subtle than a simple exogenous shift in labor supply. This is because most of the individuals involved are already employed and can not be easily fired. Empirically, the effects of discrete changes in retirement age on labor demand for different age groups have only partly been investigated, and mostly by using cross-country comparisons capturing, at best, only the long-run effects of changes in the statutory retirement age.

Retirement is considered by this literature as an irreversible flow from employment to inactivity, while during recessions most of the flows into retirement originate from unemployment, and a non-negligible fraction of retirees continue working after drawing a pension. More importantly, the empirical literature on retirement is typically focused on the labor supply side, and hence ignores trade-offs arising on the demand side, notably in terms of labor costs and intergenerational substitutability of workers.

In this paper we treat pension reforms increasing the retirement age as forced expansions at the firm level.Footnote 1 As noted above, such an expansion will be totally offset by wage adjustment if wages and employment were fully flexible. However, when wages are rigid in the short run, and employment protection laws prevent firms from downsizing their stock of older employees, an unexpected closing of the retirement door leads to a forced retention of older employees, and to a sizeable cost shock for firms. This may have ambiguous short-run effects on labor demand for young, middle-aged and older workers. As our model indicates, forced expansion of old workers at the firm level gives rise to two effects: First, there is a negative scale effect due to decreasing returns to scale, reducing the marginal productivity of workers of all ages. Second, there may be a positive complementarity between workers of different ages, which may tend to increase labor productivity of young and middle-aged workers. Which one of the two forces dominates is an empirical matter.

The core of our contribution is to investigate empirically the impact of an increase in retirement age on labor demand. We take Italy as a case study, as it is a country with strict employment protection legislation and where a major retirement reform took place in December 2011 in the middle of a run on the Italian public debt. Under the pressure of markets and international organizations, Italy suddenly increased the retirement age by up to six years for some categories of workers. This policy change is now known as the “Monti Fornero reform”, and the paper estimates its effect on intergenerational labor demand at the firm level. We have access to a unique dataset from the social security administration (INPS) archives covering 90% of private employment, unambiguously identifying in each private firm the fraction of workers locked in by the sudden increase in the retirement age.

We propose a novel identification strategy that makes it possible to estimate the effects of the lock in of older workers on the intergenerational profile of labor demand. In particular, we isolate the exogenous variation in the share of older workers in a firm, by instrumenting this share by the region, sector and contract-specific mortality rate. Our results indicate that an increase in the number of workers locked in crowds out mostly middle-aged workers, while leaving young workers largely unaffected. We also find that there is not a one-to-one increase in the number of older workers in the firm, as perhaps some of them may find alternative exit routes from employment. The results survive to a variety of robustness checks and holds, although at different intensity, across heterogenous groups (such as temporary or permanent workers, white-collar or blue-collar workers, different sectors).

The paper first presents some facts about the evolution of the retirement age in OECD countries and employment rates of young and older workers. Next, it surveys the existing literature on retirement and labor demand across age groups. Then, in Section 4 a simple model of intergenerational labor demand is provided. Section 5 describes in some details the pension reform that took place in Italy in December 2011. In Section 6 we describe the data and spell out the empirical strategy. Section 7 presents the basic empirical results, carries out robustness checks, and provides a discussion of our results. The final section offers a short summary and suggestions for further research.

2 Retirement age, young and older workers: some facts

Figure 1 shows the average effective age of retirement by gender in OECD countries elicited on the basis of Labor Force Surveys. Until the mid-1990s the actual age of retirement was declining for both women and men. Since the beginning of the new Millenium the opposite trend prevails with a rise of the effective retirement age, which is steeper for women than for men. In about 15 years, the actual age of retirement has increased by almost three years for women and two years for men.

OECD average effective age of retirement, 1970–2017. The figure reports OECD36 averages. For each country, the average effective age of retirement is derived from observed changes in labor force participation rates computed for each cohort of workers (grouped into five-year age classes) aged 40 and over. For some countries, estimates until 1997 rest on interpolations of census data and are therefore less reliable than subsequent data based on labor force surveys. Source: OECD estimates based on the European Labor Force Survey, national labor force surveys and national censuses

This evolution of actual retirement ages is the byproduct of pension reforms that in the last twenty-five years have tightened rules in order to reduce pension outlays. The Social Policy Reforms inventory compiled by the Fondazione Rodolfo Debenedetti (https://www.frdb.org) counted 70 reforms increasing the legal retirement age and 30 decreasing it in the period 1995–2007 in the EU-15. In the previous 15 years (1980–1995) there was instead a majority of reforms reducing the legal retirement age (56 reducing the retirement age and 44 increasing it). The increase in the effective retirement age as mainly obtained by closing early retirement route, rather than by creating stronger incentives to work longer. In other words, workers in most cases had not the option to stick to their pre-reform early retirement plans even at the cost of a lower pension. They were just forced to work longer (or become unemployed while waiting to attain the new retirement age).

The reason why there are always reforms moving in opposite directions is that they meet strong political opposition. This opposition spans beyond the workers directly affected by the increase in the retirement age. Very often it is the employer associations to be opposing (or at least not supporting) the increase in the retirement age even if it should reduce the equilibrium payroll tax, that is, the employer social security contributions required to fully fund public pensions. For instance, Macron was not supported by the MEDEF in the recent reform attempt in France. The most likely explanation for this behavior is that early retirement provides an important soft-landing scheme for employers facing redundancies, notably in the countries with strict employment protection legislation.

Figures 2 and 3 display the cross-country correlation between the effective age of retirement and the strictness of employment protection legislation for the last year for which data are available across OECD countries. There is a negative and statistically significant correlation of − .4 for both women and men.

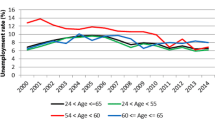

An additional source of opposition to reforms increasing the retirement age is the widespread belief that increasing the retirement age would crowd out young workers. This idea is supported by the observation of diverging trends in employment rates of older and young workers in the EU. An old-in young-out dynamics has been observed in Europe, notably during the Great Recession and the ensuing Euro debt crisis. For the Euro area as a whole, employment in the 15–24 age group declined by almost 17% in the 2007–2013 period. Also in the 25 to 29 age group the percentage employment decline was at two-digit levels. At the other extreme of the age distribution, employment for people in the 55–65 age group increased by approximately 10 percentage points.

Demographic developments played an important role in this context, but cannot account, by themselves, for these dramatic changes in the structure of employment by age groups. Indeed, not only employment levels, but also employment rates of young and senior workers moved in opposite directions since the turn of the Millenium (Fig. 4).

There are a number of possible explanations for these trends. The increase of full-time schooling and educational attainment of the younger population is partly responsible for the decline in youth employment rates. In the case of Italy, for example, OECD data suggest that the share of people in the 25–34 category with tertiary education increased from 16.1% in 2005 to 25.1% in 2015. However, schooling is only a minor part of the story: in Italy some two million of jobs were lost among young workers while employment of older workers increased by some 15 basis points.Footnote 2 An obvious candidate to explain these divergent trends, and one which is very much in the mind of people, is in the reforms that have increased the retirement age.

Are these beliefs misplaced? Do pension reforms increasing the retirement age in the midst of a recession crowd-out youth employment? The next section reviews available evidence on the intergenerational employment effects of reforms increasing the retirement age.

3 The relevant literature

The earliest literature on retirement and the age distribution of employment was based on simple cross-country correlations of macro data. Boldrin et al. (1999) document a negative correlation between effective retirement age and youth unemployment. Dorn and Sousa-Poza (2010) find that generous early retirement provisions give an incentive to firms to encourage more workers to retire early during recessions and circumvent employment protection legislation. Gruber and Wise (2004) and Gruber and Wise (2010) use data from 12 countries covering more than 20 years to estimate the link between the employment rate of workers aged 55 to 64 and the employment or unemployment rate of younger workers (20 to 24 in general). They find no evidence that the increase in the employment of older individuals has a negative impact on the employment of younger individuals. Their estimates rather suggest an inverse relationship where the growth of youth employment happens in parallel to the growth of older workers employment. Munnell and Wu (2013) analyze time series and cross-state variation in employment rates of young and older workers in the US and conclude that there is no evidence that increasing the employment of older persons reduces either the job opportunities or wage rates of younger persons. More recently, Boeri and vanOurs (2020) report a positive cross-country relationship between the employment rates of older workers (aged 55–64) and young workers (aged 15–24) both during the decades in which the retirement age was declining in most countries (1970–1999) and the most recent period witnessing in a number of OECD countries an increase in the retirement age.

These studies have mainly a cross-country design and hence capture long-run associations between youth employment/unemployment and early retirement.

More recently some work has been done in analyzing the impact of pension reforms on youth employment rates in specific countries. In particular, Bingley et al. (2010) examined the effects of the Post Employment Wage (PEW) program which was implemented in Denmark in 1979 and which lowered the retirement age (from 64 to 60) for the long-term unemployed. The program was explicitly intended to favor the hiring of younger workers. They found that after its introduction, the participation rate for the men aged 60 to 64 immediately declined from 80 to 60% while the participation rate of men aged 20 to 24 did not vary until 1989. They examined then the link between these two participation rates in a regression setting with various control variables and found no substitution between young and older workers employment. Borsch-Supan and Schnabel (1998) reached the same conclusion with the reform of the pension system that was enacted in Germany in 1972. This reform introduced a flexible retirement scheme, that is, a reduction of about two years of the normal retirement age (from 65 to 63 for men). The reform was followed by an immediate and dramatic decline in the participation rate of the labor force aged 65 to 63, and also the employment rate of individuals aged 55 to 64 decreased by 7 percentage points over 4 years. All these adjustments were not followed by an increase in the employment of younger workers. Actually, their labor force participation rate declined. A major limitation of these studies is that they are based on aggregate data and fail to identify causal effects.

Reforms increasing the retirement age have been used to characterize the demand for older workers and measure the degree of substitutability between young and older workers. Staubli and Zweimueller (2013) analyzed the effects on employment of older workers of a reform gradually increasing the retirement age from 60 to 62 for men and from 55 to 58.25 for women over a decade or so. They find that the reform delayed retirement, but did not have the expected one-to-one effect on employment of older workers. This is because it induced large inflows into unemployment benefits, and, to a less extent, to disability programs. These spillover effects of the reforms reduced its impact on public expenditures as the savings on pensions were partly offset by increased spending on unemployment benefits and disability programs. Cribb et al. (2014) adopted a difference-in-difference methodology to analyze a 1995 reform in the UK that made the state pension age for women to rise progressively from 60 to 65 over the 2010 to 2020 decade. They found that the employment rate of women aged 60 in 2010 had increased by 10.1 percentage points by 2012, but they also found that the unemployment rate of these women had increased by 1.3 percentage points. Moreover, the employment rate of the male partners had also risen by 4.2 percentage points in the same period, which is at odds with the idea that there is a fixed number of jobs. Lalive and Staubli (2014) looked at a similar experiment in Switzerland where, starting from 1997, the retirement age for women born between 1939 and 1941 was increased by one year and by two years that for women born after 1942. The reform introduced also sanctions for persons leaving employment before the retirement age. They found that the increase in retirement age postponed the exit rate from the labor market by around half a year, but, in contrast with Cribb et al. (2014), they did not find any effect on the labor supply of the women spouse.

A problem of the above studies is that they consider very gradual reforms that can be anticipated by the cohorts of workers affected and their employers. These anticipation effects make it difficult to locate the beginning of the treatment. Reforms increasing the retirement age are indeed generally marginal, involving a very long phasing-in, as they meet very strong political resistance.

These problems are not present in the reform taken as a quasi-experiment in this study. It was carried out in Italy in 2011 in the midst of the Eurozone crisis, and was radical and unexpected. The reform increased overnight the minimum contribution record required to be eligible for early pensions by up to 6 years; old-age pensions were also increased, notably for women, in the public sector, and in self-employment, whose age requirements were increased by up to 3 years. These characteristics of the reform explain why it attracted much interest from researchers. In addition to Boeri et al. (2016), Bertoni and Brunello (2021), Carta et al. (2020), and Bovini and Paradisi (2018) have been using this reform as a case study. Bertoni and Brunello (2021) use labor force survey data at the province level to test whether the increase in the retirement age led to a fall in youth employment. They draw on Census data to instrument the old-age population, and find that older workers crowd out youth employment. Carta et al. (2020) use matched data from a Bank of Italy survey of large firms, balance sheet data and data from the social security administration. They focus only on firms with more than 50 employees and estimate themselves the pension eligibility based on information on the age of workers and on the length of their contribution record (not including additional years purchased by paying contributions for the schooling years). They look at the effects of the exogenous change in the share of older workers in a firm on net employment variation at different age groups. They find positive effects on net employment variations across the other age groups. The study by Bovini and Paradisi (2018) is the one closer to our paper. They use social security (INPS) data to investigate the effect of the pension reform on hiring and firings, and find evidence of crowding out. In particular, they observe that the effect is concentrated on incumbent workers or external hires who share the same occupation group (blue-collar, white-collar or manager) as senior retained employees. They show further that firms only respond in the short run to the increase in the retention rate of senior workers on the cusp of retirement, whereas the change in the residual working life of younger employees does not matter.

Our data are more precise in defining the treatment group, and our identification strategy is novel to this literature. Unlike Bovini and Paradisi (2018), we are also interested in the interplay between retirement rules and employment protection legislation. In presence of convex adjustment costs for labor, firms typically span employment reductions over time. They also operate a freeze of new hirings and attrition as main channels of employment adjustment. This generates a major asymmetry in the generational profile of firms, hence on their exposure to the cost shock associated with an increase in the retirement age. The presence of strict EPL rules force firms to reduce employment mainly by freezing new hires, and hence increasing their share of older workers.

4 The labor demand effects of temporary pension reforms

A representative firm produces with two inputs, a labor composite L and capital K, with a technology represented by a production function \(\tilde F(L,K)\) that is quasi-concave and exhibits constant returns to scale. As we focus on labor demand in the short run, we assume that K is fixed at some level \(\bar {K}\). Hence the production function can be written as \(y=f(L)\equiv \tilde F(L,\bar {K})\). It follows that \(f^{\prime }(L)>0\), \(f^{\prime \prime }(L)<0\). We assume that we can write L = g(N1,N2,N3), where N1,N2 and N3 denote young, middle-age and older workers respectively, and g(N1,N2,N3) is quasi- concave and exhibits constant returns to scale in N1,N2,N3. Finally, define F(N1,N2,N3) ≡ f(g(N1,N2,N3)). It follows that F(N1,N2,N3) is strictly concave in N1,N2,N3. Denote the partial derivatives of F and g with Fi and gi, respectively, i ∈ {1, 2, 3}.

If there are no adjustment costs nor employment protection legislation (EPL), the firm can adjust N1 N2 and N3 freely in each period, and the problem is static.

for i ∈ {1,2,3}. Suppose the measure of workers of each age group i is equal to \(\bar {N}_{i}\). Market clearing then requires that \(N_{i}=\bar {N}_{i}\), i ∈ {1,2,3}, and this determines wages w1, w2 and w3.

We now consider a pension reform that temporarily increases the retirement age. The retirement age of the young and middle-aged workers will not change, and they will retire regularly. At a first glance, this reform is akin to a temporary increase in labor supply. However, the economics of such a pension reform- from the labor market standpoint- is more subtle than a simple exogenous shift in labor supply, since most of the individuals involved are already employed and cannot be easily fired. We thus call a pension reform a forced expansion at the firm level.

The reform temporarily closes the retirement door for a period of time normalized to be one period. We say that the workers are locked in, as they cannot retire as planned. With flexible wages, it follows straightforwardly that the wages of both young and middle-aged workers will adjust so that demand again equals supply. Wages for older workers will certainly fall, while the wages for young and middle-aged workers may fall or increase, as the discussion below highlights.

We argue that a more realistic assumption is that wages are fixed in the period in which the shock occurs. This assumption is key in order to obtain the employment effects that follow. Furthermore, due to EPL, the firm has limited ability to adjust the margin of older workers. This implies that the stock of employed older workers increases as a result of the reform.

We assume that wages are flexible in periods after the reform. Since the reform is for one period only, the wage for older workers will not influence the allocation of resources: it is just a transfer between the firm and the older workers. Furthermore, the fact that wages are flexible in the long run (next period) implies that the firm’s hiring decision of young and middle-aged workers in the reform period in effect is a static maximization problem.

Consider first the effect of an increase in N3 (number of old) for the marginal products of young and middle-aged workers, keeping N1 and N2 fixed. It follows that the marginal product of worker type i, i = 1, 2, increases with Fi3dN3 units. Now

The first term is negative and represents a scale effect: a higher N3 means a higher total labor input L, and as f(L) exhibits negative returns to scale this will reduce the demand for factor i. The second term is positive if N3 and Ni are complements in producing the composite good N, as if g is Cobb Douglas. We refer to this as a complementarity effect. If the complementarity effect is positive, we cannot a priori tell which effect is stronger; the total effect depends on the relative importance of the scale effect and the complementarity effect.Footnote 3

For given w1 and w2, the firm will want to adjust the age structure of the labor force, N1 and N2. At this point the analysis becomes slightly more involved, as a change in N1 (N2) influences the marginal product of N2 (N1). Suppose that N1 and N2 are fully flexible (meaning that there is slack in the labor market if the effect on labor demand is positive). Taking the total derivative of (1) with respect to N3, keeping w1 and w2 constant, gives that

Equation (3) represents our key theoretical prediction on the effect of a temporary retirement reform. A forced expansion of older workers leads to a response of young and middle-aged workers. The first thing to note is that since F is strictly concave, the denominator is strictly positive. Hence the sign of the derivative depends on the sign of the numerator, and ultimately on the sign of the cross derivatives. Suppose first that young and middle-aged are independent, so that F12 = 0. Then, (3) writes

It follows that the effect is positive if and only if Fi3 > 0, i.e., if the complementary effect is stronger than the scale effect. In the general case, the last term in the numerator is strictly positive whenever Fi3 > 0. However, the first term in the numerator may be positive or negative, depending on the sign of F12 and F13. This reflects the effects of a change in N3 on the hiring of the workers of the other age group. For instance, if F12 is negative, and an increase in N3 increases N2, this will have a negative effect on the demand for N1. If, on the other hand, F11, F12, F13, and F23 are all positive, we know that the effect is positive for both young and middle-aged workers.

With flexible employment in the short run, it follows that we can write \({\Delta } N_{i}\approx \frac {dN_{i}}{dN_{3}}{\Delta } N_{3}=\gamma _{i} {\Delta } N_{3}\), where ΔN3 denotes the increase in the number of old employees as a result of the reform. The sign of ΔNi is not pinned down by our theory, as complementarity effects and scale effects go in opposite directions. Hence the effects of the reform on employment of young and middle-aged workers are ultimately an empirical question.Footnote 4

5 The 2011 pension reform in Italy

In the middle of the European sovereign crisis, in November 2011 Mario Monti became Prime Minister of Italy. His Government enacted in December 2011 a bold reform steeply increasing contributory and age requirements to obtain an early retirement or old-age pension. This reform was unanticipated and dictated by the need to restore confidence in Italian public finance after the interest rate on long-term Government bonds had reached an historical peak at 7.56% in the Government auction of November 29, 2011. The sovereign crisis that hit Italy in the Fall of 2011 was both repentine and intense, and the fall of the Berlusconi Government was unlikely to be envisaged by Italian firms. Moreover, it was far from obvious what would happen after the fall of the Berlusconi Government. As the financial crisis unfolded, events took place over a very few days. Giorgio Napolitano, the President of the Italian Republic, appointed Mario Monti as life senator on November 9, 2011. Berlusconi handed his resignation at the President of the Republic on November 12, and Mario Monti received the mandate to form a new Government on November 13. He swiftly put together a technocratic Government that took office on November 16. On December 4, the pension reform was approved, alongside a package of other austerity measures in a rescue package named “Save Italy”. The reform was enacted as a Government decree, hence it became immediately effective. It is now known as the Monti-Fornero reform (Elsa Fornero was the Labor Minister in office in the Monti Government).

The contribution required to be eligible for early pensions was increased by up to 6 years as the previous system of so-called quotas (combining seniority in contributions, and age requirements) was replaced by a pure contribution requirement and gender differences in the normal retirement age were removed. Table 1 provides details as to changes in seniority rules before and after the reform for the public sector. Old-age pensions were also increased, notably for women, in the public sector, and in self-employment, whose age requirements were increased by up to 3 years. All these changes were to be effective one month later, at the beginning of 2012. Under the defined-benefit (or mixed DB-DC) system applied to these cohorts of workers, it is convenient to retire as soon as possible, and hence almost 90 percent of the workers take the retirement route within a year of getting this entitlement. At the same time a DB system discourages workers close to retirement to redice working hours as the pension is computed based on the wages of the last five years. Hence, a worker moving from a full-time to a part-time job would suffer a huge loss in the value of her pension. Employers planning before the reform on the voluntary separation (on the retirement) of a given fraction of their older workforce, found out all of the sudden, in December 2011, that this fraction was lower.

Figure 5 displays four real-world profiles of contributory records as drawn from the INPS archives. The first refers to a private sector employee with several career breaks, say Giulia, who was born in 1951 and was planning to retire in November 2012 and was forced instead to stay until August 2018. The second refers to a worker, say Gianni, with less breaks in career than Giulia. He was born in 1950 and was planning to retire at the age of 62 in December 2012. Nonetheless, he was forced to postpone his retirement plans to September 2017 almost five years after. The third case considers Ludovica, a mostly part-time worker born in 1951 forced to retire in March 2018 rather than in June 2012. The last case considers Giovanni, a worker within the special railroad pension fund, a category of workers who typically enjoy preferential early retirement benefits. As a consequence of the reform, Giovanni was locked in for six years.

Actual contribution histories of selected locked in Workers. All diagrams display, on the vertical axis, the cumulative number of weeks of contribution, and, on the horizontal axis, the year. The dotted vertical line displays the earliest age of retirement before the Monti-Fornero reform, while the continuous vertical line the earliest retirement age under the new rules introduced by the reforms. Contribution histories and earliest retirement options are drawn from actual records in INPS (Italian social security) archives

While increasing drastically the retirement age for the cohorts planning to retire in the following years, the reform kept the flexibility in the retirement age for the cohorts of workers entered in the labor market after 1996 and subject to the new notionally defined contributory (NDC) system. Thus, the increase in the age requirement was bound from the very start to be temporary, allowing for greater flexibility in the retirement age as the cohorts entered in the labor market in 1996 would reach the range of retirement ages allowed by the new system. The purpose of the reform was indeed to “cut the hump” in pension spending associated with the early retirement of the generations still under the DB system.

The reform also involved an acceleration of the transition to the NDC system, forcing every worker to enter the new system on a flow basis. A lower indexation to price inflation of the highest pensions was also introduced temporarily. Overall, the reform was supposed to involve cumulative savings of 80 billion euros between 2012 and 2021 (INPS, 2013), approximately 5 percent of GDP.

As the reform was completely unexpected, some workers were hit particularly hard. Among these were some 100,000 workers who had agreed to leave their job voluntarily in the context of collective bargaining agreements with the understanding that they would soon receive a pension. The Government had to intervene with 8 so-called safeguard measures in the following years to protect such workers. This came at a cumulative cost to date of about 12 billions Euros.

The diverging trends of employment rates of young and older workers, documented in Section 2, are even more marked in Italy than in the rest of the EU. Figure 6 suggests that this divergence predates the Monti-Fornero reform, but the gap widened in the aftermath of the 2011 pension reform.

Finally, in the period covered by data, employment protection legislation in Italy was very strict. In particular, employers in firms with more than 15 employees could be forced to reinstate in the employment ranks employees who had been unfairly laid-off. This regulation applied at all ages, but jurisprudence was particularly protective of older workers. As in many countries with strict employment protection, contractual dualism was widespread with permanent job holders coexisting with fixed-term contract workers, over-represented among young workers.

6 Data and empirical specifications

We draw on data extracted from the Italian social security (INPS) archives, tracking all dependent workers in the private and public sectors as part of the collection of contributions earmarked to pensions and social insurance. The dataset assembled for this analysis tracks all private firms with more than 15 employees when the reform was undertaken that operated without discontinuities in contribution records between 2011 and 2014. The reason why we focus on firms with more than 15 employees is that in Italy, employment protection has a marked discontinuity at the 15 employees threshold: the mandatory reinstatement of workers in case of unfair dismissal applies only above that threshold scale. Thus, firing costs are significantly higher for firms with more than 15 employees.

The unit of observation is the individual employer responsible for the payment of social security contributions to INPS. In most of the cases this unit corresponds to a firm. For the very top large (and multi-plant) firms the identifier may capture plants belonging to the same firm as other units. For each firm we observe the total number of employees, the (one digit) sector of operation, the region, the number of part-time employees, the number of blue- and white-collar workers, and the number of workers on fixed-term contracts. We also have information on the age distribution of employees: the number of employees aged less than 30 and those more than 55. Finally, we know the average wage for the unit as a whole, for young, middle-aged and older workers as well as the average earnings of white-collar and blue-collar workers. Unfortunately data on gross flows (hirings and separations) as well as at the worker-level are not available.

As INPS knows the contribution seniority of each individual worker, we can also establish how many workers in each firm were locked in by the 2011 reform based on their pre-determined contribution record. In particular, the contribution record of all workers who, at the time of the reform, were in the 55 to 64 age group was extracted from the archives and their eligibility to the early retirement prevailing before the Monti-Fornero reform was scrutinized by the same INPS office that certify the beginning of each pension spell. This work identified with precision all workers who had the option to retire in 2013 or 2014 according to the pre-reform rules, but not according to the post-reform rules.

From the stock of locked in workers we excluded the so-called salvaguardati, that is, those workers who were offered the pre-reform regime (in one of the safeguard clauses described in Section 4) as they had already accepted an early retirement plan with the firm. The number of years of increase in the earliest possible retirement age for each worker locked in was also obtained. Thus, for each firm we could establish i) how many workers had been locked in, ii) for how long as well as iii) how many workers were involved in one of the safeguard measures mentioned above.

6.1 Definitions

In each firm we classify workers in three groups based on their age: young, middle-age, and older workers. Young workers are aged less than 30. Older workers are aged more than 55. Middle-age workers are the employees within these two thresholds. If ni,t is total employment in firm i in year t, it follows that in each firm i

We are interested in the net employment variation at the firm level as well as in each age group j within the same firm. Our main outcome is thus

The treatment variable concerns the number of workers locked in in 2011 in each firm. As we also know the duration of the lock in (the number of years for which retirement was postponed), we can also obtain a time-varying measure of lock in, based on the number of workers forced to stay each year after 2011. This measure is used in the panel regressions below. Formally, our baseline treatment is defined as follows

Figure 7 displays the distribution across firms of the treatment. About 3 firms out of 5 with some worker locked in have just one worker in such a condition. The distribution, however, has a long tail: there are also firms with almost 100 workers locked in.

Figure 8 displays the distribution of workers locked in by the duration of the lock in. The mode is between one and two years, but there is a significant fraction of workers locked in for 3 or more years. It was indeed a very radical reform.

Another synthetic treatment measure is provided by the cost shock for the firm, notably the labor costs associated with the fact of having to retain the workers locked in. This cost-shock measure is obtained in the cross-sectional specification by multiplying the number of workers locked in in 2012 by the average yearly wage of the older workers in the firm and the average duration of the lock in. Figure 9 displays the distribution of the cost shock across firms having at least one worker locked in. The mode and the median of the distribution are at a cost of roughly 100,000 euros. The cost shock absorbs up to 15 percent of total labor costs for some firms. One firm out of four affected by the reform experienced an increase in labor costs of about 2.5 percent. Since we are dealing with rather small firms and likely to be liquidity constrained during the financial recession, this confirms that it was a sizeable shock for the average firm involved by the lock in.

Cost shock distribution. The diagram displays the distribution across firms of the cost shock associated with the 2011 reform. The cost shock is measured by multiplying the firm-specific average wage of older workers for the number of workers and years of the lock in. Only firms with at least one worker locked in are considered

As stated above we run regressions exploiting fully the panel structure of the data as well as drawing only on the cross-sectional 2011–2012 variation. In some specifications we also focus only on firms having at least one worker locked in.

6.2 Descriptive statistics

Our panel consists of about 80,000 firms of which about 27,000 were directly involved by the reform in that they had at least one worker locked in by the pension reform. We exclude from our analysis the firms in the top .05 percentile (with more than 1257 employees) which may well not correspond to individual plants for the reasons explained above.

Figure 10 displays average yearly percentage variations in the average size of firms without locked in workers (continuous line) and of firms with at least one worker locked in (dotted line)Footnote 5. The focus is on firms having some positive employment levels throughout the entire period (including the 2008–2011 period). Firms with locked in workers are consistently displaying lower growth rates than firms without workers being locked in. The former type of firm was already downsizing in 2009 in the aftermath of the Great Recession, and after a very mild recovery in 2010 and 2011, experienced dis-employment in all the years following the pension reform (denoted by a vertical bar). Firms without locked in workers were instead, on average, upsizing before the reform and started to destroy jobs in 2012, as the economy experienced a dramatic recession lasting until 2014. The variation in levels is displayed in Fig. 11, and the overall dynamics is very similar.

Total employment. The diagram displays average yearly percentage variations in the average size of firms without locked in workers (continuous line) and of firms with at least one worker locked in (dashed line). The focus is on firms having some positive employment levels throughout the entire period (including the 2008–2011 period)

Total employment, variation in levels. The diagram displays absolute changes in the average size of firms without locked in workers (continuous line) and of firms with at least one worker locked in (dashed line). The focus is on firms having some positive employment levels throughout the entire period (including the 2008–2011 period)

Figure 12 shows percentage changes in average number of young, middle-aged and older workers in firms with at least one worker locked in. The average firm-level stock of young workers declines throughout the entire period. The opposite happens for older workers, while middle-aged workers are declining after the pension reform.

Thus, firms with at least one worker locked in had experienced in the years predating the pension reform an increase in the share of older workers in total employment. In countries with strict employment protection legislation, downsizing is typically achieved mainly by using natural attrition and moderating, if not freezing, new hires. This is in line with Fig. 13 displaying, on the horizontal axis, the percentage total employment variation in our firms, and, on the vertical axis, the share of older workers in each of them. The figure hints at a negative correlation between the two variables: the correlation coefficient is − .002 and is significant at 99 percent.

A higher share of older workers makes firms more vulnerable to reforms temporarily increasing the retirement age, as the Monti-Fornero reform. It is therefore important to analyze how firms characteristics vary depending on the percentage of older workers in firm-level employment. This is done in Table 2 displaying some key characteristics of firms depending on the quintile of the distribution of the share of older workers in total employment. The table suggests that the firms with a lower fraction of older workers have a larger presence of women, a higher share of fixed-term contracts (related to the younger age structure of the firm), pay a lower wage, are more concentrated in expanding sectors (such as information and communication) than in declining sectors (manufacturing and construction). They are also more likely to be located in the stronger regions of the Northern Italy than in the South. The last four rows of the table display the distribution of our outcome variables across the quintiles of older share. The total variation is also decomposed in the different age groups. Firms with a higher share of older workers appear to have been downsizing in 2011–2012 unlike firms with a lower share of older workers. On average, they had in 2012 one worker less than in 2011 and this reduction was achieved almost entirely by cutting the number of middle-aged workers.

6.3 Empirical strategy

Our aim is to estimate γi, the employment effect for young (i = y), middle-aged (i = m) and older workers (i = o) of a forced expansion of older workers at the firm level, and ultimately the effects of the Monti-Fornero reform on employment. A challenge is that we do not observe what the firms would have done in the counter-factual situation with no reform. However, what we do observe is the effect of the number of locked in workers on individual firms’ net hiring of young, middle-age and older workers.

In this section we propose a strategy to identify the coefficient γ in panel and cross-sectional data of firms observed before and after the reform. The year of the reform is 2012. We assume that the reform and hence the presence of locked in workers comes as an unanticipated shock to the firm. However, we are aware of the fact that the share of older workers in 2011, hence the probability to be hit by the reform, is not fully exogenous at the individual firm level. As hinted by the descriptive statistics above, given the strictness of employment protection legislation, firms facing redundancies have been downsizing in the previous years by freezing new hires rather than by laying off workers. This dis-employment strategy clearly leads to an increase in the share of older workers in a firm, hence to a greater exposure to the cost shock associated with the retirement reform. In other words, there is an endogenous selection into the treatment associated with the share of older workers just before the reform took place.

Our identification strategy aims at isolating the exogenous source of variation in the share of older workers in a firm. To this end we control for the share of older workers and we instrument this share by the year, sector, region and contract-specific mortality rate for people aged 55 to 64 in the five years predating the reform. In the regressions where we look at total employment variations (irrespective of the type of contract), the cell-specific mortality rate is obtained by using as weights the firm-specific shares of open-ended and fixed-term contracts. Our identifying assumption is that this cell-specific mortality rate is correlated with the share of older workers in a firm, but not with the outcomes (net firm-level variations in the stock of young. middle-aged, and older workers after 2012).

Summarizing, due to strict employment protection legislation, the age structure of the workforce is endogenous. In particular, as downsizing firms may have more older workers, they are more likely to have workers locked in which would bias our estimates. Once we control for the share of older workers, the number of workers locked in should be exogenously determined by the rules of the pension system. In the absence of EPL, it follows from our model that the size of the firm should not matter for the effects of the reform on employment over and above the direct effect of the number of locked in workers. Hence the fact that size is endogenous will not in itself lead to biased estimates.

7 Regression results

To implement the identification strategy laid out above, we run a two-stage regression. In the first stage we regress the share of older workers in total employment in 2011 in each firm against sector and region dummies as well as the cell-specific average mortality rate of workers aged 55 to 64 in the six years predating the reform, obtained from the INPS archives, i.e.,

where Ds are respectively sector-specific and region-specific dummies. MORTsrc2005 − 2011 are the average mortality rate in year, sector and region between 2005 and 2011Footnote 6. In the second stage we regress the net employment variation against the same set of dummies, our treatment (number of workers locked in or the cost shock measure) and the share of older workers in 2011 instrumented by the mortality rate.

In the panel specification, the estimated equation is as follows:

The cross-sectional estimates consider only the variation between 2011 and 2012. Hence, the subscript t is dropped as we have only one observation per firm:

Table 3 displays the simplest regression, run only over the cross section of firm-level employment variations in the 2011–2012 period. The intergenerational labor adjustment is in line with the panel regression results. The first column reports the first stage results: there is, as expected, a positive correlation between mortality rates and share of older workers in a firm. The coefficient passes the Montiel Olea and Flugher test for weak instruments Olea and Pflueger (2013)Footnote 7.

The second stage results are displayed in columns (2) through (5) for total employment, older workers, young workers and middle-aged workers respectively. The results suggest that an additional worker being locked in involves a reduction in employment levels in the firm of about 0.7 workers. This negative effect is driven by the reduction of the stock of middle-aged workers (− .7) more than by the variation in the stock of young workers (− .2). As expected the number of older workers increases, but there is not a one-by-one increase in the stock of older workers as, presumably some older workers in any event leave the firm (e.g., for alternative exit routes, such as disability benefits). These results are consistent with a greater substitutability between middle-aged and older workers than between older and young workers at the firm level.

Table 4 reports the results of the regression fully exploiting the panel structure of our dataset. The substitutability between older and middle-aged workers is even stronger in this case, as we allow for adjustment in another two years after the shock.

Another way to specify the cross-sectional estimates is in terms of the magnitude of the cost shock, namely the product of the number of workers locked in in 2012 times the average duration of the lock in and the average wage of older workers in 2011. The regressions with the treatment specified as a cost shock are displayed in Table 5. The results suggest that for any extra-cost of about 10,000 Euros involved by the retention of an older worker, about .7 jobs are destroyed. This dis-employment is achieved by reducing the number of middle-aged workers by one unit, the number of young worker by .2 units and by keeping only about one out of two of the older workers locked in in the firm. Thus, once more, it is middle-aged worker who bear most of the cost of the adjustment to the shock.

7.1 Robustness and heterogeneity of the effects

We run three robustness checks

-

1.

we consider only firms with at least one worker locked in;

-

2.

we run a parsimonious regression specification without including controls for the share of older workers, and

-

3.

we run a regression only on firms with positive employment levels over the entire period (continuing firms).

Table 6 runs our baseline panel regression excluding firms without workers locked in. Clearly the number of observations declines substantially with respect to the previous specifications. Results are broadly unchanged. The downsizing is slightly more marked than with the full sample and now we have an almost one-to-one crowding out of middle-aged workers (their coefficient is .9).

The second robustness check involves considering the most parsimonious specification, excluding controls for the share of older workers (Table 7). The first four columns display simple OLS regressions. The next four columns instrument the number of workers locked in with our mortality measure. The OLS results are in line with those of the baseline specification. The second stage IV estimates are less preciseFootnote 8 and generally display larger coefficients than the uninstrumented regressions. But the sign of the coefficients is once more in line with our previous results.

The third robustness check involves considering only firms with some positive employment throughout the entire period (Table 8). We lose about 50,000 observations with respect to the baseline panel specification, but results are broadly unchanged.

The effects of the lock in may well depend on the duration of the lock in, and the characteristics of workers and jobs involved. Thus, we estimated variants of the basic specification in which:

-

1.

We look at the response of open-ended contracts only;

-

2.

We run a regression allowing for separate coefficients depending on the duration of the lock in;

-

3.

We allow for heterogenous effects for blue-collar and white-collar workers, and we consider also adjustments along the intensive margin of hours, by estimating employment variations in terms of full-time equivalents, and

-

4.

We allow for different coefficients by industry.

Table 9 displays the panel regressions run on permanent workers onlyFootnote 9. In other words the dependent variable is defined as the variation in the stock of employees with an open-ended contract. The nature of the adjustment does not change: once more it is middle-aged workers to be mostly affected. The impact of the lock in on total permanent employment is, however, smaller than when we include also temporary workers. It is in particular young workers that now display a lower coefficient with respect to the specification with all workers. Temporary employment is concentrated among young workers, and the employer by not transforming fixed-term at expiration into permanent contracts, can de facto layoff the workers at zero costs. This further confirms the importance of the interplay between employment protection legislation and retirement rules.

Table 10 analyzes the effects of the lock in depending on the duration of the lock in. The total employment effect and the effect for each age group is stronger when we focus on workers with more than two years of lock in than at shorter durations. This is in line with a cost shock interpretation of our results. The only exception is young workers where the coefficient for the shorter lock in duration is slightly larger.

The breakdown between white-collar and blue-collar workers as well as between full-time and part-time workers is not available at yearly frequencies in our dataset. We only have this information in 2008, 2011 and 2014. Table 11 looks at the effects of the lock in on firm-level total employment variation by considering separately blue-collar and white-collar workers (this breakdown is only available for total employment) over the 2011–2014 period. To ease comparisons with total employment variations over the same time period, columns (1), (2) and (3) replicate the basic specification (and the one with permanent workers only) over the same period. All the coefficients are clearly magnified (roughly by a factor of 3) by considering a three-year time period rather than a yearly interval after the shock. The negative employment effects of the lock in appear to be significantly stronger for blue-collar than for white-collar workers. There is not much evidence that firms adjust along the intensive margin: the effect on full-time equivalents (sixth column) is actually weaker than the effect on headcounts (first column).

Finally, Table 12 displays results by sector. Some sectors (agriculture forestry and fishing, real estate and extraterritorial organizations) have a low number of observations and most coefficients are not significant. In the remaining sectors, results are qualitatively consistent with our overall results when the coefficients are statistically significant.

7.2 Discussion

Our results point to rather large effects of the shock on the firm-specific employment levels of young and middle-aged workers. As discussed above, firms with workers locked in had been downsizing even prior to the shock, and also firms without locked in workers reduced firm-level average employment levels after the reform. In other words, the counterfactual employment growth for firms with locked in workers is likely not be zero or positive: they would have reduced employment also in the absence of the retirement shock.

The coefficient for older workers is less than one. This is in line with previous studies (Staubli and Zweimueller (2013)) finding that only a fraction of older workers locked in by a reform increasing the retirement age remain in the firm, as other exit routes, such as disability pensions or bridging schemes to retirement, are typically exploited. Our coefficient for the effects of workers locked in on the employment of older workers is particularly low, .2 in the cross-sectional specification. It is quite likely that in the counterfactual situation, in which the reform had not been introduced, firms with workers locked in would have faced a larger reduction in the number of older workers than other firms, as more older workers would have had retired. Hence, our estimate may well be biased downwards.

We also find consistently across specifications that middle-aged workers are those mostly affected by this additional downsizing induced by the reform. According to our model, this may be explained by substitutability (or weaker complementarity) between older workers and middle-aged workers. There is evidence (Jager and Heining 2019) that coworkers on the same occupation are more substitutable than coworkers in different occupations, and it is plausible that older and middle-age workers have more similar occupations than older workers and young workers. Unfortunately, our data do not include occupations. Furthermore, the same negative shifts in productivities for middle-aged and young workers may give rise to larger employment effects of the former in absolute numbers simply because there are more middle-aged than young workers in most firms.

The relative wages of the different worker groups are also relevant in explaining the concentration of job losses on middle-aged workers. The reform took place in the middle of a deep financial crisis reducing access to credit for many firms. Liquidity constrained firms could have been forced to cut labor cost among the most costly component of their workforce, and one for which dismissal costs are not too large. Figures 14 and 15 provide information on wage tenure profiles in firms with and without workers locked in. The average wage of young workers is consistently lower than the average wage of older workers for all types of firms, as highlighted, inter alia, by regression lines below the bisecting line (dotted line) for both firms with no worker locked in (gray solid line) and at least one worker locked in (black solid line). This is not the case when the focus is on wages of middle-aged vs. older workers: here we have that firms with workers locked in pay middle-aged workers, on average, more than older workers, while the opposite happens for firms with no worker locked in. This seems to be consistent with a condition where older workers are mostly a cost for one type of firms, those downsizing via a hiring freeze and hence having more workers locked in, than for the other type. At the same time, it is clear that labor cost reductions for liquidity constrained firms hit by the forced expansion shock can be better achieved by laying off middle-aged workers than young or older worker not locked in by the reform.

Wage tenure: young vs. middle-aged workers. The diagram displays, on the horizontal axis, the firm-level average wage for young workers in 2011, and, on the vertical axis, the firm-level average wage of middle-aged workers in 2011. Observations with an average wage for middle-aged worker larger than 300,000 Euros (roughly ten times the economy-wide average wage) are not displayed

Wage tenure: middle-aged vs. older workers. The diagram displays, on the horizontal axis, the firm-level average wage for middle-aged workers in 2011, and, on the vertical axis, the firm-level average wage of older workers in 2011. Observations with an average wage for middle-aged worker larger than 300,000 Euros (roughly ten times the economy-wide average wage) are not displayed

Another explanation of our results is in terms of inter-temporal cost-minimization and employment protection. If older workers represent a cost for these firms, then the reform has increased this cost for the firms with workers locked in, inducing them to lay off as many middle-aged workers as possible in order to reduce the number older workers in the future. It is true that the reform is temporary, as it does not involve workers entirely under the new NDC system. However, due to the very long phasing-in of the new pension system in Italy, a significant fraction of middle-aged workers has an important component of their pension defined on the basis of the old system, and hence are still subject to the increase in the retirement age. For an employer it may be preferable to implement this reduction before workers move to permanent contracts and acquire more seniority, thereby increasing the termination costs. In the firms in our sample, having more than 15 employees in 2011, employment protection legislation is a major constraint to layoffs. Figure 16 compares the share of workers with fixed-term contracts among young and middle-aged workers in the firms in our sample. While this “temporary employment” share is clearly larger among young workers, it is still relevant among middle-aged workers (about 2/5 of the temporary employment share for the youngsters). This suggests that there is some scope for low-cost job terminations also among middle-aged workers. Once more the interplay between employment protection and retirement rules seems to be a very important factor behind these results.

Share of fixed-term contracts: middle vs. young. The diagram displays, on the horizontal axis, the firm-level share of fixed-term contracts on total employment among young workers in 2011, and, on the vertical axis, the firm-level share of fixed-term contracts on total employment in 2011 among middle-aged workers

8 Summary and indications for further research

Our paper aims at contributing to the rather scant literature on the effects of reforms increasing the retirement age.

Based on a simple model of labor demand and different age-cohorts of workers as inputs, we show that a pension reform that temporarily increases the retirement age and thereby the number of older workers has two effects on the demand for young and middle-aged workers. First, there is a negative scale effect: due to decreasing returns to scale in production in the short run, a higher number of older workers reduces the marginal product of all workers. Second, there may be a degree of complementarity in production between young, middle-aged and older workers, in which case a higher number of older workers may increase the marginal productivity of young workers. In the short run with wage rigidity, the total effect on the demand for young workers depends on which of the two effects dominates.

The experience of the Italian pension reform in the middle of the 2011 sovereign debt crisis provides a perfect setting for testing the relationship between the lock in of older workers and the potential crowding out of other age groups. The pension reform was unanticipated and repentine, and happened in the middle of a deep recession. We use a unique data set drawn from the Italian social security administration that precisely identifies at the firm level the intensity, and the number of workers locked in by the postponement of their retirement age. The data set covers all private sector firms with more than 15 employees in 2011, and covers the period from 2008 to 2014. The cross sectional variation in the firms’ exposure to the mandatory delay in retirement allows us to estimate the impact of the lock in of older workers on the net hiring of young workers at the firm level. We provide an identification strategy for the effect of a forced retention of older workers on youth labor. Our results suggest that, on average, affected firms display a crowding out effect of middle-aged workers of around − 0.7, implying that for every 3 older workers locked in, firms reduced employment of middle-aged workers by two units. There is also a crowding-out of young workers, but it is less marked than for middle-aged workers: about one worker displaced out of five locked in. Moreover, the reform seems to have increased job destruction among the firms with workers locked in. At face value in the 27,000 firms with locked in workers the increase in the retirement age destroyed approximately .7×.04*70×27,000 = 50,000 jobs, which can be compared to about 126,000 job losses experienced by all private firms in Italy in the 2011–2012 period.

These results point to greater substitutability (or lower complementarity) between middle-aged and older workers. Other factors that could have a played a role in the concentration of the crowding-out on middle-aged workers are the wage-tenure profile and the age profile of temporary employment. Both profiles may have induced firms to concentrate labor cost reductions on middle-aged workers.

In further research, more data, notably having access to financial information on firms, is warranted in order to better understand the underlying mechanism.

The policy implications of our results should be drawn with great caution. Nevertheless, we can make two points. First, reducing the generosity of pensions in the middle of the European sovereign crisis was probably inevitable, despite the severe recession that Southern European economies were experiencing. But this tightening could have been engineered by also including reduced pension levels of those retiring before the normal retirement age rather than imposing such a sudden and steep increase of the retirement age. Second, the retirement age should be as flexible as possible for firms and workers. As far as Italy is concerned, the long-run DC system will ensure a viable and sustainable flexible retirement system. Yet, such a system has a prolonged transition phase. Along this medium-run adjustment to the new system, policy attempts to increase flexibility in retirement in an actuarially neutral fashion should be taken seriously into account.

Notes

We also occasionally refer to forced retentions at the firm level.

A strong reduction of youth employment was predicted by the literature on contractual dualism. For instance, as suggested by Boeri and Garibaldi (2007), the honeymoon of declining youth unemployment following two-tier labor market reforms is followed by youth dis-employment as soon as macroeconomic conditions deteriorate. The literature on contractual dualism (Boeri (2011), Cahuc et al. (2016), and Berton and Garibaldi (2012)), however, fails to explain divergent dynamics of employment rates at the two extremes of the age distribution.

If g is symmetric in N1, N2, and N3, it follows that the complementarity effect is strictly positive when N1 = N2 = N3.

We have analyzed a model with a representative firm, hence the coefficients γi, i = {1, 2, 3} represent average effects. With heterogeneous firms, the firms will have different production technologies Fj, j ∈ J, where J is the set of all firms. Note that (3) still holds for each individual firm, with Fj substituted in for F.

Firms with locked in workers could in principle adjust wages rather than employment. However, due to the centralized and staggered wage bargaining structure, this option was not available for many firms. Unfortunately our data do not cover individual wages, only firm-level average wages which clearly are affected by changes in the composition of the workforce. With the above caveat in mind, we find that the share of firms experiencing a percentage variation in average wages in the [− .05,.05] interval in the 2011-2014 period is about 40% in the set of firms with at least one worker locked in while it is roughly 30% in the other firms

As the mortality rate is also available by contract type (fixed-term vs. open-ended) we obtain a firm-specific mortality rate as a weighted average of the mortality rates for the two types of contracts in their cells, where weights are provided by the firm-specific share of fixed-term or open-ended contracts in total employment.

The F test is 169.4 which is well above the critical 5% value of 37.4

The first stage results are not displayed for brevity. The explanatory power of the mortality variable is lower than when we instrument older workers. This has also to do with the fact that the effect in the first stage can only be estimated over firms with at least one worker locked in rather than over the full sample as in the case of the older workers variable.

The regressions with the net variation of older and middle-aged workers as dependent variables have about 30,000 less observations than the others, as we do not have the breakdown between temporary and permanent contracts for about 5,000 firms.

References

Berton F, Garibaldi P (2012) Workers and firms sorting into temporary jobs. Econ J 122(562):F125–F154. https://doi.org/10.1111/j.1468-0297.2012.2533.x, https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1468-0297.2012.2533.x

Bertoni M, Brunello G (2021) Does delayed retirement affect youth employment? evidence from italian local labour markets. Economic Policy, forthcoming

Bingley P, Datta Gupta N, Pedersen P (2010). In: Gruber J, Wise DA (eds) Social security programs and retirement around the world: The relationship to youth employment. University of Chicago Press, Chicago, pp 99–117

Boeri T (2011) Institutional reforms and dualism in european labor markets. In: Card D, Ashenfelter O (eds) Handbook of Labor Economics

Boeri T, Garibaldi P (2007) Two tier reforms of employment protection: A honeymoon effect?. Economic Journal 17:357–85

Boeri T, Garibaldi P, Moen ER (2016) A clash of generations? increase in retirement age and labor demand for youth. Technical Report, CEPR Discussion Paper No. DP11422

Boeri T, vanOurs J (2020) The economics of imperfect labor markets. Princeton: Princeton University Press, Princeton

Boldrin M, Dolado JJ, Jimeno JF, Peracchi F (1999) The future of pension systems in Europe: A reappraisal. Econ Policy 29:289–323

Borsch-Supan A, Schnabel R (1998) Social security and declining labor-force participation in germany. The American Economic Review 88(2):173–178. http://www.jstor.org/stable/116914

Bovini G, Paradisi M (2018) The transitional labor market consequences of a pension reform. NBER 20th Annual Joint Meeting of the Retirement Research Consortium

Cahuc P, Carlot O, Malherbet F (2016) Explaining the Spread of Temporary Contracts and its Impact on Labor Turnover. The International Economic Review 57(2):533–572

Carta F, D’Amuri F, von Wachter T (2020) Workforce ageing, pension reforms and firm outcomes. NBER Working Paper N. 28407

Crépon B, Kramarz F (2002) Employed 40 hours or not employed 39: Lessons from the 1982 mandatory reduction of the workweek. J Polit Econ 110:1355–1389

Cribb J, Emmerson C, Tetlow G (2014) Labour supply effects of increasing the female state pension age in the uk from age 60 to 62. Technical report, IFS Working Papers, Institute for Fiscal Studies (IFS), London. W14/19. http://hdl.handle.net/10419/101343

Dorn D, Sousa-Poza A (2010) Voluntary and involuntary early retirement: an international analysis. Appl Econ 42:427–43

Estevão M, Sá F (2008) The 35-hour workweek in France: Straightjacket or welfare improvement?. Econ Policy 23:417–463

Gruber J, Wise D (2010) Social security programs and retirement around the world. the relationship to youth employment. Chicago: University of Chicago Press, Chicago

Gruber J, Wise DA (2004) Social security programs and retirement around the world. NBER Books, Cambridge, MA

Hunt J (1999) Has work-sharing worked in Germany?. Q J Econ 114:117–48

Jager S, Heining J (2019) How substitutable are workers? evidence from workers deaths. Technical report, MIT

Lalive R, Staubli S (2014) How does raising women’s full retirement age affect labor supply, income, and mortality? evidence from switzerland. Technical report, report from Joint Meeting of the Retirement Research Consortium. Institute for Fiscal Studies (IFS), London, W14/19. http://hdl.handle.net/10419/101343

Lee J, Kawaguchi D, Hamermesh DS (2012) Aggregate impacts of a gift of time. Am Econ Rev 102(3):612–16. https://doi.org/10.1257/aer.102.3.612, http://www.aeaweb.org/articles?id=10.1257/aer.102.3.612

Munnell A, Wu A (2013) Do older workers squeeze out younger workers. SIEPR Institute for Economic Policy Research

Olea JLM, Pflueger C (2013) A robust test for weak instruments. Journal of Business & Economic Statistics 31(3):358–369. https://doi.org/10.1080/00401706.2013.806694

Staubli S, Zweimueller J (2013) Does raising the early retirement age increase employment of older workers?. J Public Econ 108:17–32

Walker T (2007) Why economists dislike a lump of labor. Rev Soc Econ 65(3):279–291. https://doi.org/10.1080/00346760701635809

Acknowledgements

The authors wish to thank editor Klaus F. Zimmermann and three anonymous referees for comments that greatly improved an initial draft, Alessandro Caiumi for unflagging research assistance and seminar participants in Cyprus, Oslo, London, Milan and Rome for useful comments on initial drafts.

Funding

Open access funding provided by Università Commerciale Luigi Bocconi within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible editor: Klaus F. Zimmermann

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions