Abstract

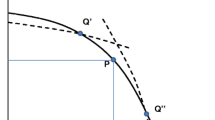

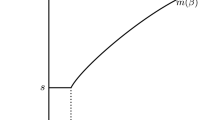

We study the optimal subsidy on prevention against premature death in an economy composed of two-person households, where the survival of the spouse matters, either because of self-oriented coexistence concerns or because of altruism. Under a noncooperative household model, the laissez-faire prevention levels are shown to be lower than the first-best levels, to an extent that is increasing in self-oriented coexistence concerns and decreasing in spousal altruism. The decentralization of the social optimum thus requires a subsidy on prevention depending on the precise type of coexistence concerns. Our results are shown to be globally robust to the introduction of imperfect observability of preferences, life insurance, imperfect marriage matching, and myopia. We conclude by studying the optimal prevention in a cooperative household model with unequal bargaining power.

Similar content being viewed by others

Notes

Balia and Jones (2008) focused on six aspects of lifestyles: smoking, drinking, regular breakfast, sleep patterns, excessive eating, and sporting activities.

The necessity of a large monetary compensation in case of widowhood or widowerhood does not reveal anything about the reasons behind coexistence concerns.

This observation is quite common in public economics. Children concerned with the health (or with the welfare) of their dependent parents can play various strategies to benefit from healthy (or happy) parents without having to serve as a caregiver (see Jousten et al. 2005).

Dependency consists of difficulties to carry out daily activities (washing, eating, etc.).

Following contributions of Becker (1974), Ulph (1988), Konrad and Lommerud (1995), and Chen and Wooley (2001), noncooperative models were applied to various family issues, such as the division of housework (Bragstad 1989), domestic violence (Tauchen et al. 1991), expenditures on children (Del Boca and Flinn 1994), and savings (Browning 2000).

Note that relaxing that assumption would not affect our results.

The length of a period is normalized to 1.

In order to focus on coexistence concerns, we assume that there is no other source of heterogeneity. This implies, among other things, equal resources w for all agents.

See Section 6 for an extension with endogenous probabilities of autonomy.

This is an obvious simplification. See Leroux and Ponthiere (2009) for optimal prevention when agents are not expected utility maximizers.

As usual, the utility of death is normalized to zero.

We exclude the possibility that agents could remarry after the death of a spouse. This would complicate our analysis without providing more insights for the issue at stake.

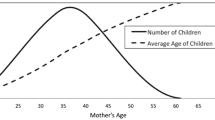

The joint life expectancy is the average period of coexistence for two persons, conditionally on individual vectors of age-specific probabilities of death (see Ponthiere 2007).

Such a perfect sorting could be achieved, for instance, by allowing divorce and remarriage as long as the perfect match has not been found. We relax that assumption in Section 6.

As mentioned in D’Aspremont and Dos Santos Ferreira (2009), a noncooperative couple is “an independent management system in which each spouse keeps his/her own income separate and has responsibility for different items of household expenditure”.

Note that the form of the legislation may also affect how spouses behave within the couple (see Cigno 1991). Here, we abstract from those legal aspects.

We will relax this assumption in Section 7 and see how it changes our results.

Another approach consists in assuming that agent do not internalize the impact of \(h_{i}^{kj}\) on the annuity return (see Becker and Philipson 1998).

This is a direct consequence of our assumptions on preferences and on the annuity market.

This is reinforced by the fact that, in equilibrium, consumptions differ across gender.

As this is well-known, the aggregation of utilities of agents with different preferences makes sense only if individual utilities are interpersonally comparable. One way to achieve this is, as proposed by Mirrlees (1982, pp. 78–80), by means of discussions between agents about utilities. In the rest of this paper, we assume that agents can communicate about their life experiences and reach an agreement as to how their welfare should be included in the social welfare function.

On this, see Jousten et al. (2005).

Note that, in comparison with the laissez-faire, we have a larger prevention at the first best, whatever we fix \(\bar{\alpha}\) to 0 or 1. Indeed, at the first best, counting men or women once or twice does not matter, as long as all agents are counted in the same way.

We still assume that the annuity market is actuarially fair so that \(\tilde{R}_{i}^{kj}=1/\pi _{i}^{kj}\left( h_{i}^{kj}\right) \).

As for decisions concerning prevention, we assume that agents play noncooperatively (no transfers are possible) and cannot agree to lie on their type so as to obtain higher prevention.

It is impossible for a man with \(\Phi _{M}^{c}\) to pretend to be in a type C couple without a woman with \(\Phi _{F}^{c}\) pretending also to be in a type C couple, too.

Full expressions are derived in the Appendix. Assuming α = 1 is convenient to explain the impact of self-selection constraints and does not substantially affect our results.

The reason comes from the difference between the level of altruism set to \( \bar{\alpha}=0\) or 1 in the objective function and the agents’ level of altruism, α considered in the self-selection constraints. Because of this, we would actually find that, in the second-best, type c agents should face positive subsidies on prevention, \(\theta _{M}^{c},\theta _{F}^{c}<0\) (see the Appendix).

Looking at the general expression of \(\theta _{i}^{C}\) in the Appendix, it is not clear whether assuming α < 1 reinforces the subsidization effect due to the existence of incentive constraints or not.

Let us assume a unit tax on the demand for life insurance, ϑ. It should be set such that

$$ -\left( 1+\vartheta \right) u^{\prime }\left( w-h_{M}^{kj}-s_{M}^{kj}\right) +\alpha ^{k}\pi _{F}\left( h_{F}^{kj}\right) u^{\prime }\left( \tilde{R} _{F}^{kj}s_{F}^{kj}\right) <0 $$which ensures that \(a_{i}^{kj}=0.\)

We also assume, for the sake of simplicity, that agents equally misperceive their own survival probability and the one of their spouse.

For the sake of simplicity, we assume here that, although agents are myopic about their survival probability, they correctly estimate the return from annuitized savings, \(\tilde{R}_{i}^{kj}\), so that \(\tilde{R}_{i}^{kj}=1/\pi _{i}\left( h_{i}^{kj}\right) \) as in the baseline case. This is not contradictory: agents may make mistakes about their own survival but know perfectly the survival rate within the whole cohort.

Note that those arguments are not decisive in our context. The Coase Theorem applies only to the extent that bargaining costs are limited. That assumption is strong in the present context, where each spouse may require dictatorship for choices related to their own health (on the grounds of one’s full property of one’s body). This would make household bargaining on health-related choices very difficult. Moreover, marriage is, here, a quite imperfect commitment device, since individual prevention can hardly be monitored at the household level.

We assume here no bargaining costs.

Like in Proposition 2, we cannot, in general, find whether \(h_{F}^{kj}\gtrless h_{M}^{kj}\) as this depends on the levels of \(\left( \varepsilon ,p_{M,}p_{F}\right) \) and on whether \(d_{F}^{kj}\lessgtr d_{M}^{kj}\).

As before, the social planner will set the pure altruism parameter α k to \(\bar{\alpha}=0\) or 1.

The interpretation is symmetric in case of higher bargaining power of the woman.

Hence, at the first-best, intracouple welfare inequalities are smaller than at the laissez-faire.

Note that, due to the unique household budget constraint, those conditions are necessary, but not sufficient, to ensure a perfect redistribution, between wives and husbands, within each couple.

For instance, inter vivos transfers within a family can be interpreted either as a signal revealing the existence of pure altruism or as resulting from family trade in a broader context.

References

Apps PF, Rees R (1988) Taxation and the household. J Public Econ 35:355–369

Apps PF, Rees R (1999) Individual versus joint taxation in models of household production. J Pol Econ 107:178–190

Apps PF, Rees R (2007) The taxation of couples. IZA discussion paper 2910

Balia S, Jones A (2008) Mortality, lifestyles and socio-economic status. J Health Econ 27:1–26

Becker GS (1974) A theory of social interactions. J Pol Econ 82:1063–1093

Becker GS, Philipson T (1998) Old age longevity and mortality contingent claims. J Pol Econ 106:551–573

Besley T (1989) Ex ante evaluation of health states and the provision fo ill-health. Econ J 99:132–146

Blanchflower D, Oswald A (2004) Well-being over time in Britain and the USA. J Public Econ 88:1359–1386

Boskin M, Sheshinski E (1983) Optimal tax treatment of the family: married couples. J Public Econ 20:281–297

Braackmann N (2009) Other-regarding preferences, spousal disability and happiness - evidence from German couples. University of Luneburg working paper 130

Bragstad T (1989) On the significance of standards for the division of work in the household, mimeo, University of Oslo

Browning M (2000) The saving behaviour of a two-person household. Scand J Econ 102:235–251

Cambois E, Clavel A, Romieu I, Robine JM (2008) Trends in disability free life expectancy at age 65 in France: consistent and diverging patterns according to the underlying disability measure. Eur J Ageing 5:287–298

Cigno A (1991) Economics of the family. Clarendon Press and Oxford University Press, Oxford

Cigno A (2012) What’s the use of marriage? Rev Econ Household 10:193–213

Chen Z, Wooley F (2001) A Cournot–Nash model of family decision making. Econ J 111:722–748

Coase R (1960) The problem of social costs. J Law Econ 3:1–44

Contoyannis P, Jones A (2004) Socio-economic status, health and lifestyle. J Health Econ 23:965–995

Cremer H, Lozachmeur JM, Pestieau P (2007) Income taxation of couples and the tax unit choice. CORE discussion paper 2007-13

D’Aspremont C, Dos Santos Ferreira R (2009) Household behavior and individual autonomy. CORE discussion paper 2009-22

Del Boca D, Flinn C (1994) Expenditure decisions of divorced mothers and income composition. J Human Res 29:742–761

Hammond P (1987) Altruism. In: Eatwell J, Milgate M, Newman P (eds) The new palgrave: a dictionary of economics, Macmillan, London, pp. 85–86

Jousten A, Lipszyc B, Marchand M, Pestieau P (2005) Long-term care insurance and optimal taxation for altruistic children. FinanzArch-Public Finance Anal 61:1–18

Kaplan G, Seeman T, Cohen R, Knudsen L, Guralnik J (1987) Mortality among the elderly in the Alameda county study: behavioural and demographic risk factors. Am J Public Health 77:307–312

Kleven HJ, Kreiner CT, Saez E (2006) The optimal income taxation of couples. NBER working paper 12685

Konrad K, Lommerud K (1995) Family policy with non-cooperative families. Scand J Econ 97:581–601

Leroux ML, Ponthiere G (2009) Optimal tax policy and expected longevity: a mean and variance utility approach. Int Tax Public Financ 16:514–537

Leroux ML, Pestieau P, Ponthiere G (2011a) Optimal linear taxation under endogenous longevity. J Popul Econ 24:213–237

Leroux ML, Pestieau P, Ponthiere G (2011b) Longevity, genes and efforts: an optimal taxation approach to prevention. J Health Econ 30:62–76

Mirrlees J (1982) The economic uses of utilitarianism. In: Sen AK, Williams B (eds) Utilitarianism and beyond. Cambridge University Press, Cambridge, pp 63–84

Mullahy J, Portney P (1990) Air pollution, cigarette smoking and the production of respiratory health. J Health Econ 9:193–205

Mullahy J, Sindelar J (1996) Employment, unemployment, and problem drinking. J Health Econ 15:409–434

Needleman L (1976) Valuing other people’s lives. Manch Sch 44:309–342

Pestieau P, Sato M (2008) Long term care: the state, the market and the family. Economica 75:435–454

Ponthiere G (2007) Measuring longevity achievements under welfare interdependencies: a case for joint life expectancy indicators. Soc Indic Res 84:203–230

Tauchen H, Witte A, Long S (1991) Domestic violence: a non-random affair. Int Econ Rev 32:491–511

Ulph D (1988) A general noncooperative Nash model of household behaviour. Mimeo, University of Bristol

Vallin J (2002) Mortalité, sexe et genre. In: Caselli G, Vallin J, Wunsch G (eds) Démographie. Amalyse et Synthèse III: la Mortalité, chap 53, INED, Paris

Acknowledgements

The authors would like to thank Alessandro Cigno, Philippe De Donder, Jacques Drèze, Dirk Van De Gaer, Jean-Marie Lozachmeur, Pierre Pestieau, Erik Schokkaert, two anonymous referees, and the participants of the PET 2010 and LAGV 2010 conferences for their helpful comments on this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Electronic Supplementary Material

Rights and permissions

About this article

Cite this article

Leroux, ML., Ponthière, G. Optimal prevention when coexistence matters. J Popul Econ 26, 1095–1127 (2013). https://doi.org/10.1007/s00148-012-0453-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-012-0453-5