Abstract

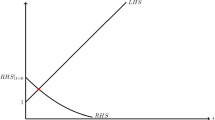

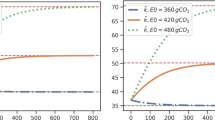

We develop a simple general equilibrium model in the style of Harberger to analyze the distributional effects of the proposed “environment tax” on carbon in Japan. We derive closed-form equations that show how a change in the tax rate affects the economy-wide return to capital, wage, and output prices. The two main features of the economy that determine the sources-side incidence of the tax are the factor intensities of the polluting and nonpolluting industries and the elasticity of substitution in production between polluting inputs and labor or capital. The input that is a better substitute for pollution usually bears a lower burden of the tax than the other input, although we find conditions under which this is not true. If the polluting sector is relatively capital intensive, then capital can bear a higher burden of the tax. Calibrating this model to the Japanese economy, we find a trade-off between these two effects. Polluting industries are more capital intensive, but capital is likely to be a better substitute for pollution than is labor.

Similar content being viewed by others

References

Allen RGD (1938) Mathematical analysis for economists. St. Martin’s, New York

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? American Economic Review 91:877–908

Babiker MH, Metcalf GE, Reilly J (2003) Tax distortions and global climate policy. Journal of Environmental Economics and Management 46:269–287

Cansier D, Krumm R (1997) Air pollution taxation: an empirical survey. Ecological Economics 23:59–70

Claro S (2003) A cross-country estimation of the elasticity of substitution between labor and capital in manufacturing industries. Cuadernos de Economia 40:239–257

DeMooij RA, Bovenberg AL (1998) Environmental taxes, international capital mobility and inefficient tax systems: tax burden vs. tax shifting. International Tax and Public Finance 5:7–39

Fullerton D, Heutel G (2005) The general equilibrium incidence of environmental mandates. Working Paper, University of Texas at Austin

Fullerton D, Heutel G (2007) The general equilibrium incidence of environmental taxes. Journal of Public Economics 91:571–591

Fullerton D, Metcalf GE (2001) Environmental controls, scarcity rents, and pre-existing distortions. Journal of Public Economics 80:249–267

Harberger AC (1962) The incidence of the corporation income tax. Journal of Political Economy 70:215–240

Hayami H, Nakamura M, Yoshioka K (2003) A joint Japan-China research project for reducing pollution in China in the context of the Kyoto Protocol clean development mechanism (CDM): case study of the desulfurized bio-coal briquette experiments in Shenyang and Chendu. Managerial and Decision Economics 24:213–229

Kochi I, Matsuoka S, Memon MA, Shirakawa H (2001) Cost-benefit analysis of the sulfur dioxide emissions control policy in Japan. Environmental Economics and Policy Studies 4:219–233

McLure C (1975) General equilibrium incidence analysis: the Harberger model after ten years. Journal of Public Economics 4:125–161

Metcalf GE (1999) A distributional analysis of green tax reforms. National Tax Journal 52:655–681

Mieszkowski P (1972) The property tax: an excise tax or a profits tax? Journal of Public Economics 1:73–96

Mieszkowski P (1967) On the theory of tax incidence. Journal of Political Economy 75:250–262

Ministry of the Environment (1994) Basic environment plan. http://www.env.go.jp/en/policy/plan/basic/

Park S-J (2004) The double dividend of an environmental tax reform in Japan. Acta Humanistica et Scientifica Universitatis Sangio Kyotiensis, Social Science Series No. 21, Kyoto Sangyo University, pp 137–159

Popp D (2006) International innovation and diffusion of air pollution control technologies: the effects of NOx and SO2 regulations in the U.S., Japan, and Germany. Journal of Environmental Economics and Management 51:46–71

Robison HD (1985) Who pays for industrial pollution abatement? Review of Economics and Statistics 67:702–706

Saito M, Tokutsu I (2001) An international comparison of the input—output structure: Europe, the U.S.A, and East Asia. Journal of Applied Input—Output Analysis 7:35–60

Tokutsu I (1994) Econometric analysis of the structure of production. Sobunsha, Tokyo

Welch E, Hibiki A (2003) An institutional framework for analysis of voluntary policy: the case of voluntary environmental agreements in Kita Kyushu, Japan. Journal of Environmental Planning and Management 46:523–543

West SE, Williams RC III (2004) Estimates from a consumer demand system: implications for the incidence of environmental taxes. Journal of Environmental Economics and Management 47:535–558

Yoshida F, Hata A, Tonegawa H (1999) Itai-itai disease and the countermeasures against cadmium pollution by the Kamioka Mine. Environmental Economics and Policy Studies 2:215–229

Author information

Authors and Affiliations

About this article

Cite this article

Fullerton, D., Heutel, G. Who bears the burden of a tax on carbon emissions in Japan?. Environ Econ Policy Stud 8, 255–270 (2007). https://doi.org/10.1007/BF03353960

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/BF03353960