Abstract

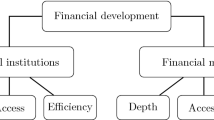

This paper uses a stochastic production frontier for panel data to investigate the effect of financial development on productive efficiency. Three panels of a number of countries in different stages of development are used along with eight alternative measures of financial development pertaining to the monetary sector, financial intermediaries, and equity markets. The results indicate that in general the more developed the financial intermediaries sector and equity markets, the higher the productive efficiency. In particular, financial deepening reduces productive inefficiency in both developed and developing countries, although the effect is larger in the former.

Similar content being viewed by others

References

Atje, R., and B. Jovanovic. 1993. “Stock Markets and Development.”European Economic Review 37: 632–640.

Barro, R. J. 1991. “Economic Growth in a Cross Section of Countries.”Quarterly Journal of Economics 106: 407–443.

Barro, R. J., and X. Sala-i-Martin. 1997. “Technological Diffusion, Convergence, and Growth.”Journal of Economic Growth 2: 1–26.

Benhabib, J., and M. M. Spiegel. 1994. “The Role of Human Capital in Economic Development: Evidence from Aggregate Cross-Country Data.”Journal of Monetary Economics 34: 143–173.

Battese, G. E., and T. J. Coelli. 1995. “A Model for Technical Inefficiency Effects in a Stochastic Production Frontier for Panel Data.”Empirical Economics 20: 325–32.

Beck, T., Levine, R., and N. Loayza. 2000. “Finance and the Sources of Growth.”Journal of Financial Economics 58: 261–300.

Berthelemy, J. C., and A. Varoudakis. 1996a. “Models of Financial Development and Growth: A Survey of Recent Literature.” InFinancial Development and Economic Growth: Theory and Experiences from Developing Countries, edited by N. Hermes and R. Lensink.Studies in Development Economics, vol. 6. London and New York: Routledge, 7–34.

—. 1996b. “Financial Development, Policy and Economic Growth” InFinancial Development and Economic Growth: Theory and Experiences from Developing Countries, edited by N. Hermes and R. Lensink.Studies in Development Economics, vol. 6. London and New York: Routledge, 7–34.

Coelli, Tim J. 1996. “A Guide to FRONTIER Version 4.1: A Computer Program for Stochastic Production and Cost Function Estimation.” Centre for Efficiency and Productivity Analysis, University of New England, Armidale, NSW, Australia, working paper 96/07.

De Gregorio, J., and P. E. Guidotti. 1995. “Financial Development and Economic Growth.”World Development 23: 433–448.

Demetriades, P. O., and K. A. Hussein. 1996. “Does Financial Development Cause Economic Growth? Time-Series Evidence from Sixteen Countries.”Journal of Development Economics 51.

Demirguc-Kunt, A., and V. Maksimovic. 1998. “Law, Finance, and Firm Growth.”Journal of Finance 53: 2107–2137.

Easterly, W., and R. Levine. 2001. “It's Not Factor Accumulation: Stylized Facts and Growth Models.”World Bank Economic Review 15: 177–219.

Harris, R. D. F. 1997. “Stock Markets and Development: A Re-assessment.”European Economic Review 41: 139–146.

Hodrick, R. J., and E. C. Prescott. 1997. “Postwar U.S. Business Cycles: An Empirical Investigation.”Journal of Money, Credit, and Banking 29: 1–16.

Jayaratne, J., and P. E. Strahan 1996. “The Finance-Growth Nexus: Evidence from Bank Branch Deregulation.”Quarterly Journal of Economics 111: 639–670.

Jung, W. S. 1986. “Financial Development and Economic Growth: International Evidence.”Economic Development and Cultural Change 34: 333–346.

King, R. G., and R. Levine. 1993a. “Finance and Growth: Schumpeter Might Be Right.”Quarterly Journal of Economics 108: 717–737.

—. 1993b. “Finance, Entrepreneurship, and Growth: Theory and Evidence.”Journal of Monetary Economics 32: 513–542.

Koop, G., Osiewalski, J, and M. F. J. Steel. 2000. “Modeling the Sources of Output Growth in a Panel of Countries.”Journal of Business and Economic Statistics 18: 284–299.

Levine, R. 1997. “Financial Development and Economic Growth: Views and Agenda.”Journal of Economic Literature 35: 688–726.

Levine, R., Loayza, N., and T. Beck. 2000. “Financial Intermediation and Growth: Causality and Causes.”Journal of Monetary Economics 46: 31–77.

Levine, R., and S. Zervos. 1998. “Stock Markets, Banks, and Economic Growth.”American Economic Review 88: 537–558.

Lucas, R. J. 1988. “On the Mechanics of Economic Development.”Journal of Monetary Economics 22: 3–42.

Mankiw, N. G., Romer, D., and D. Weil. 1992. “A Contribution to the Empirics of Economic Growth.”Quarterly Journal of Economics 107: 407–437.

Moroney, J. R., and C. A. K. Lovell. 1997. “The Relative Efficiencies of Market and Planned Economies.”Southern Economic Journal 63: 1084–1093.

Rousseau, P. L., and P. Wachtel. 2000. “Equity Markets and Growth: Cross-Country Evidence on Timing and Outcomes, 1980–1995.”Journal of Banking and Finance 24: 1933–1957.

Rajan, R. G., and L. Zingales. 1998. “Financial Dependence and Growth.”American Economic Review 88: 559–586.

Robinson, J. 1952.The Rate of Interest and Other Essays. London: McMillan.

Romer, P. M. 1986. “Increasing Returns and Long-Run Growth.”Journal of Political Economy 94: 1002–1037.

Schumpeter, Joseph. 1912.Theorie der Wirtschaftlichen Entwicklug (The Theory of Economic Development), 1934 translated ed. Cambridge, Massachusetts: Harvard University Press.

Wurgler, J. 2000. “Financial Markets and the Allocation of Capital.”Journal of Financial Economics 58: 187–214.

Author information

Authors and Affiliations

Additional information

The author wishes to thank three anonymous referees for their many helpful comments on an earlier version of this paper. All remaining errors are the author's responsibility. A slightly different version of this paper was presented at the 50th annual conference of the International Atlantic Economic Society, Charleston, South Carolina, October 2000. This research is partially funded by a Marquette University College of Business Administration Faculty Research Grant from the Miles Fund and a grant from Marquette University Institute for International Economic Affairs.

Rights and permissions

About this article

Cite this article

Nourzad, F. Financial development and productive efficiency: A panel study of developed and developing countries. J Econ Finan 26, 138–148 (2002). https://doi.org/10.1007/BF02755981

Issue Date:

DOI: https://doi.org/10.1007/BF02755981