Abstract

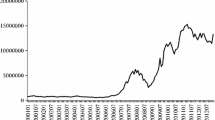

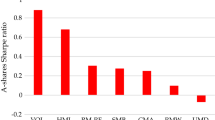

We identify a unique phenomenon in the Central Provident Fund (CPF) stocks where stock prices increase in the absence of fundamental changes in firm value. CPF stocks are stocks endorsed by the Central Provident Fund Board in Singapore as approved investment for its members. CPF stocks offer significant price appreciation and value preservation as well as abnormal returns in the bull market before the October 1987 market crash. We find evidence of noise trading in bull markets and price pressure effects that persist through bearish market conditions.

Similar content being viewed by others

References

Lam, S S and K C Tsui, (1991), Price and volume effects for stocks traded under the CPF Approved Investment Scheme,Security Industry Review 17, April, 13–24.

Tsui, K C and S S Lam, (1991), Price and volume effects associated with shifts in the demand for securities: New evidence for price pressures,International Journal of Finance 3, Spring, 56–76.

Koh, W, S S Lam and K C Tsui, (1992), Asset pricing and investors' expectations: Theory and evidence, Working Paper.

Additional information

The authors are from the Department of Finance and Banking, National University of Singapore.

Rights and permissions

About this article

Cite this article

Lam, SS., Tsui, KC. CPF stocks: Prices, returns and volatility. Asia Pacific J Manage 9, 243–251 (1992). https://doi.org/10.1007/BF01732899

Issue Date:

DOI: https://doi.org/10.1007/BF01732899