Abstract

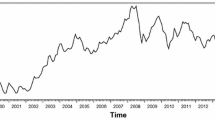

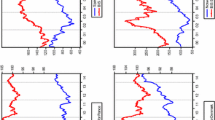

The transmission mechanism between the Asian dollar and Eurodollar markets is investigated for the period 1981–1989 using a cointegration analysis and error correction model. Results indicate the absence of reverse causality in the Asian dollar market throughout the 1980s. In the Eurodollar market, reverse causality exists in the first half, but disappears in the second half of the decade. Both markets are evolving into rapid incorporation of prior interest rate information into current rates. These results are likely to be due to reduced market regulation, expansion of futures trading, more sophisticated telecommunications and 24-hour trading practices.

Similar content being viewed by others

References

Ahkong, A, (1982), Financial transactions: Taxation and tax planning techniques,East Asian Executive Reports 8, 17–20.

Akaike, H, (1974), A new look at the statistical model identification,IEEE Transactions on Automatic Control, 714–723.

Aliber, R Z, (1978), The integration of national financial markets: A review of theory and findings,Weltwirtschaftliches Archiv, 448–480.

Amemiya, T, (1980), Selection of regressors,International Economic Review, 331–352.

Bhoocha-oom, A and S Stansell, (1990), A study of international financial market integration: An examination of the US, Hong Kong and Singapore markets,Journal of Business Finance and Accounting, 193–212.

Dickey, D A and W A Fuller, (1979), Distribution of the estimators for autoregressive time series with a unit root,Journal of American Statistical Association, 427–431.

Dufey, G and J H Giddy, (1978),The International Money Market, Englewood Cliffs, NJ: Prentice Hall.

Engle, R F and C W J Granger, (1987), Co-integration and error correction: Representation, estimation, and testing,Econometrica, 251–276.

Fuller, W A, (1976),Introduction to Statistical Time Series, New York: John Wiley and Sons.

Fung, H G and C J Lie, (1990), Stock market and economic activities, in S G Rhee and R P Chang, eds:Pacific-Basin Capital Markets Research, North Holland.

Fung, H G and S Isberg, (1992), The international transmission of Eurodollar and US interest rates: A cointegration analysis,Journal of Banking and Finance 16, forthcoming.

Geweke, J and R Meese, (1981), Estimating regression models of finite but unknown order,International Economic Review, 55–70.

Giddy, I, G Dufey and S Min, (1979), Interest rates in the US and Eurodollar markets,Weltwirtschaftliches Archiv, 51–67.

Granger, C W J, (1986), Developments in the study of cointegrated economic variables,Oxford Bulletin of Economics and Statistics, 213–228.

Hsiao, C, (1981), Autoregressive modelling and money-income causality detection,Journal of Monetary Economics, 85–105.

Kaen, F R and G A Hachey, (1983), Eurocurrency and national money market interest rates,Journal of Money, Credit and Banking, 327–338.

Levin, J, (1974), The Eurodollar market and the international transmission of interest rates,Canadian Journal of Economics, 205–224.

Maddala, G S, (1977),Econometrics, McGraw Hill Company.

Mallows, C L, (1974), Some comments on Cp,Technometrics, 579–590.

Parzen, E, (1977), Multiple time series: Determining the order of approximating autoregressive schemes, in P Krishnaiah, ed:Multivariate Analysis, IV, Amsterdam: North Holland.

Schnitzel, P, (1983), Testing for the direction of causality between the domestic monetary base and the Eurodollar system,Weltwirtschaftliches Archiv, 616–629.

Swanson, P E, (1988), The international transmission of interest rates: A note on causal relationships between short-term external and domestic US dollar returns,Journal of Banking and Finance, 563–573.

Author information

Authors and Affiliations

Additional information

The authors wish to thank Zoltan Acs and Elizabeth Cooperman for helpful comments and suggestions. Invaluable assistance in data collection and entry was provided by Brett Salazar. Any errors remain our own.

Rights and permissions

About this article

Cite this article

Fung, HG., Isberg, S.C. & Leung, W.K. A cointegration analysis of the Asian dollar and Eurodollar interest rate transmission mechanism. Asia Pacific J Manage 9, 167–177 (1992). https://doi.org/10.1007/BF01732894

Issue Date:

DOI: https://doi.org/10.1007/BF01732894