Abstract

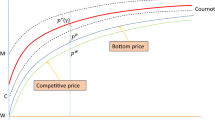

Pricing policy in a regulated monopoly industry is usually based on maximizing welfare or some other measure of utility level of return on investment. Previously, the Ramsey pricing policy which states that the percentage deviation of quasi-optimal price from marginal cost for each product must be inversely proportional to its price elasticity of demand, has been developed for a static market. The Ramsey framework assumes instantaneous demand response to price changes; empirical evidence suggests demand changes occur dynamically through time.

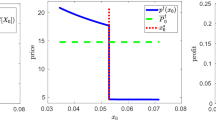

In this paper an optimum pricing rule for a profit maximizing firm based on a general time varying demand model in a dynamic market is obtained assuming a single price change at the beginning of the planning period. A dynamic market equivalent of the well known inverse elasticity law of the static market is developed. Defining the concept of average price elasticity for dynamic markets we show that the inverse elasticity law of static markets takes an inequality form in dynamic markets. For demand functions which decrease, increase or are constant with time the optimum price markups are greater than, less than, or equal to the inverse of the average price elasticity, respectively.

The results are then generalized to the case of a constrained welfare maximizing firm. This leads to the development of a dynamic market generalization of the well known Ramsey pricing rule. A simple rule for making quantitative arguments about the relative size of the optimum price in static and dynamic markets is also derived.

Similar content being viewed by others

References

Baumol WJ (1975) Scale economics, average cost and the profitability of marginal cost pricing. In: Gresson RE (ed) Essays in urban economics and public finance. Lexington, Massachusetts

Panzar JC, Willig RD (1977) Economies of scale in multi-output production. Quarterly Journal of Economics 91:481–494

Ramsey E (1927) A contribution to the theory of taxation. Economic Journal 37:47–61

Baumol WJ, Bradford DF (1970) Optimal departures from marginal cost pricing. American Economic Review 60:265–283

Mitchell BM (1981) Local telephone cost and the design of rate structures. Presented at Telecommunications in Canada: Economic Analysis of the Industry, March 4–6

Taylor LD (1980) The demand for telephone service, a survey and critique of the literature. Ballinger, Cambridge, Massachusetts

Bensoussan A, Gerald Hurst F Jr, Naslund (1974) Management applications of modern control theory. North-Holland Publishing Company

Franklin F (1885) Proof of a theorem of Tschebyscheff's on definite integrals. American Journal of Mathematics 7:377–379

Hardy GH, Littlewood JE, Polya G (1934) Inequalities. Cambridge University Press, London, p 43

Aminzadeh F (1981) Optimum pricing policy for dynamic markets — I: monopoly case. IEEE CS-M 1/4:18–24

Ho YC, Kastner MP (1978) Market signaling: An example of a two person decision problem with a dynamic information structure. IEEE Transactions and Automatic Control AC-23: 350–361

Littlechild SC (1970) A game theoretic approach to public utility pricing. Western Economic Journal 7:162–166

Koenigsberg E (1980) Uncertainty, capacity, and market share in oligopoly: A stochastic theory of production quality. Journal of Business 53:151–164

Feldstein MS (1972) Distributional equity and the optimal structure of public prices. The American Economic Review 62:32–36

Wenders JT (ed) (1977) Pricing in regulated industries theory and application. The Mountain States Telephone and Telegraph Company, Denver

Pressman I (1970) A mathematical formulation of the peak-load pricing problem. The Bell Journal of Economics and Management Science, pp 304–326

Fama EF (1970) Multiperiod consumption-investment decisions. The American Economic Reviw 60:163–174

Fenton CG, Stone RF (1979) Optimal and subsidy-free prices in the telephone industry. Presented at the seventh Annual Telecommunications Policy Research Conference. Skytop, Pennsylvania, April 29–May 1

Waverman L (1974) Demand for Telephone Services in Great Britain, Canada and Sweden. Presented at the Birmingham International Conference in Telecommunications Economics, Birmingham, England, May 1974

Vogesland I, Finsinger J (1979) A regulatory adjustment process for optimal pricing by multi-product monopoly firms. Bell Journal of Economics, pp 157–171

Aminzadeh F (1987) Application of a dynamic market inverse elasticity law with linear and log-linear demand models. ZOR-B 31

Rheaume GC (1981) Welfare optimal subsidy-free prices under a regulated monopoly. Presented at Telecommunications in Canada; Economic Analysis of the Industry, March 4–6

Aminzadeh F (1987) Parameter identification of a linear dynamic model (a state space approach). ZOR-B 31

Author information

Authors and Affiliations

Additional information

This work was completed when the author was with Bell Laboratories, USA.

Rights and permissions

About this article

Cite this article

Aminzadeh, F. Pricing policy in dynamic markets and a generalization of the Ramsey rule. Zeitschrift für Operations Research 31, B1–B29 (1987). https://doi.org/10.1007/BF01272653

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01272653