Abstract

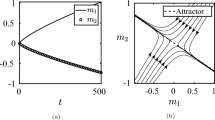

Dynamic pricing of new products has been extensively studied in monopolistic and oligopolistic markets. But, the optimal control and differential game tools used to investigate pricing behavior on markets with a number of firms are not well-suited to model competitive markets with a large number of firms. Using a mean-field game approach, this article develops a setting where numerous firms optimize prices for a new product. We analyze a framework à la Bass with product diffusion and experience effects. The analytical contribution of the paper is to prove the existence and uniqueness of a mean-field game equilibrium, further characterized in terms of mean tendencies and market heterogeneity. We also demonstrate the possible emergence of one or more groups of firms with regards to their pricing strategy. Numerical simulations illustrate how differences in firm experience translate into market heterogeneity in sales and profits. We show that, on a market where the absolute price effect is stronger than the relative price effect, we observe the emergence of two groups of firms, characterized by different prices, sales, and profits. Heterogeneity in firms’ prices and profits is thus compatible with competitive markets.

Similar content being viewed by others

Notes

Weintraub et al. [82, p. 1377] affirm that “most industries contain more than 20 firms, but it would require more than 20 million gigabytes of computer memory to store the policy function for an industry with just 20 firms and 40 states.”

Technically, an MFG equilibrium approximates a Nash equilibrium with a finite but large number of players. The approximation process is the following. First is the optimization of the game with a finite number of players; second is the passage to the limit. Note that the steps are not commutative.

Technically, modeling rational anticipation is achieved with the forward/backward structure of the mean-field game.

Stochastic analyses are also frequent in the dynamic pricing literature [15, 16, 36, 71, 72]. A difference between the deterministic and stochastic analyses is that the deterministic setting gives information about the mean tendencies, while the stochastic setting also provides information about the deviations from the mean. While the main results are expected to be similar in the two settings, the stochastic approach complexifies the analysis which is already computationally complex with MFG.

Note that inequality \({\overline{X}}_t \le N_0\) is only true in average and does not imply \(x_t \le N_0\). This means that a particular firm may sell more than \(N_0\) units. However, if some firms sell more than \(N_0\), some other firms sell necessarily less to compensate at market level.

The reciprocal is also true: given the price distribution \(P_t\), if the price distribution \(p_t\) is optimal and any moment of \(p_t\) and \(P_t\) coincide, then we have an equilibrium.

Note that the condition of mean equality (i.e., \({\mathbb E}[p_t]={\mathbb E}[P_t]\)) is necessary for the equilibrium, but not sufficient. If only the means coincide one cannot conclude to a MFG equilibrium because this condition alone does not ensure that the distribution \(P_t\) of prices observed on the market coincides with the distribution \(p_t\) of prices announced by the firms.

A more general formulation of the type \(\mathrm{d}x_t/\mathrm{d}t = h(x_t,p_t;\mu _t ,P_t )\) is also possible. It corresponds to the case where the firms have more information about the mean-field distributions of cumulative demands and prices.

See the official interest rates of the European Central Bank. www.ecb.europa.eu/stats/policy_and_exchange_rates/key_ecb_interest_rates/html/index.en.html.

Indeed, when the price of each firm is a time-dependent curve, the difficulty comes from the fact that the MFG will be a Nash equilibrium between an infinity of curves (whose mean values \({\overline{X}}_t\) and \({\overline{P}}_t\) represent the mean-fields). The following fixed point procedure is used: Starting with the mean-fields \({\overline{X}}_t\) and \({\overline{P}}_t\), we compute the (optimal) price of any firm through the critical point equations. By averaging, we obtain the novel mean-fields which should coincide with the initial datum \({\overline{X}}_t\) and \({\overline{P}}_t\). The result by Kakutani–Glicksberg–Fan guarantees that a fixed point exists if the space of curves is regular enough (the required mathematical concept is the compactness).

A log-normal (or Gibrat) distribution accounts for the multiplicative product of numerous independent and identically distributed variables, which are additive on a log scale.

The definition of the mapping \({\mathscr {E}}\) appears in the proof of point 1 from Theorem 5.6 in “Appendix B”.

Recall that \(\Pi ^\dagger (x_0):=J^*(x_0,Z^\dagger )\), with \(J^*\) defined in Eq. (B.6) in “Appendix B.”

Abbreviations

- t :

-

Time

- \(p_{t}\) :

-

Price of the firm at time t (decision variable)

- \(x_t\) :

-

Cumulative demand of the firm at time t (state variable)

- \(x^{\tau ,y}_t\) :

-

Cumulative demand at time t of the firm with cumulative demand y at time \(\tau \)

- \(\mathrm{d}x_t/\mathrm{d}t\) :

-

Current demand of the firm at time t

- \(X_t\) :

-

The variable capturing the distribution of cumulative demands of all firms at time t

- \(P_t\) :

-

The variable capturing the distribution of prices of all firms at time t

- \({\overline{X}}_t\) :

-

Average (mean-field) market cumulative demand at time t

- \({\overline{P}}_t\) :

-

Average (mean-field) market price at time t

- r :

-

Discount rate

- c(.):

-

Unit production cost

- \(\Pi (.)\) :

-

Profit of the firm

- \(^*\) :

-

Superscript notation for the optimal strategy

- \(^\dagger \) :

-

Superscript notation for the equilibrium

- \(N_0\) :

-

Average market potential per firm

References

Adlakha S, Johari R (2013) Mean field equilibrium in dynamic games with strategic complementarities. Oper Res 61(4):971–989

Adlakha S, Johari R, Weintraub GY (2015) Equilibria of dynamic games with many players: existence, approximation, and market structure. J Econ Theory 156:269–316

Alasseur C, Taher IB, Matoussi A (2020) An extended mean field game for storage in smart grids. J Optim Theory Appl 184(2):644–670

Babonneau F, Foguen R, Haurie A, Malhamé R (2020) Coupling a power dispatch model with a wardrop or mean-field-game equilibrium model. In: Haurie A, Zaccour G (eds) Dynamic games and applications. Springer, Berlin, pp 1–25

Bardi M, Capuzzo-Dolcetta I (1997) Optimal control and viscosity solutions of Hamilton–Jacobi–Bellman equations. Systems and control: foundations and applications. Birkhäuser, Boston. With appendices by Maurizio Falcone and Pierpaolo Soravia

Bass F (1969) A new product growth for model consumer durables. Manag Sci 15(5):215–227

Bensoussan A, Frehse J, Yam P et al (2013) Mean field games and mean field type control theory, vol 101. Springer, Berlin

Bressan A, Piccoli B (2007) Introduction to the mathematical theory of control. Volume 2 of AIMS series on applied mathematics. American Institute of Mathematical Sciences (AIMS), Springfield

Calvano E, Calzolari G, Denicolò V, Pastorello S (2019) Algorithmic pricing what implications for competition policy? Rev Ind Organ 55(1):155–171

Carmona R, Delarue F (2017, 2018) Probabilistic theory of mean field games with applications I–II. Springer, Berlin

Chan P, Sircar R (2015) Bertrand and Cournot mean field games. Appl Math Optim 71(3):533–569

Chan P, Sircar R (2017) Fracking, renewables, and mean field games. SIAM Rev 59(3):588–615

Chatterjee R (2009) Strategic pricing of new product and services. In: Rao V (ed) Handbook of pricing research in marketing. Edward Elgar Publishing, Cheltenham, pp 169–215

Chen M, Chen Z-L (2015) Recent developments in dynamic pricing research: multiple products, competition, and limited demand information. Prod Oper Manag 24(5):704–731

Chen X, Hu P, Shum S, Zhang Y (2016) Dynamic stochastic inventory management with reference price effects. Oper Res 64(6):1529–1536

Chen X, Hu Z-Y, Zhang Y-H (2019) Dynamic pricing with stochastic reference price effect. J Oper Res Soc China 7(1):107–125

Chen Y-M, Jain DC (1992) Dynamic monopoly pricing under a Poisson-type uncertain demand. J Bus 65(4):593–614

Chenavaz R (2012) Dynamic pricing, product and process innovation. Eur J Oper Res 222(3):553–557

Chenavaz R (2017) Better product quality may lead to lower product price. BE J Theor Econ 17(1):1–22

Chenavaz R, Drouard J, Escobar OR, Karoubi B (2018) Convenience pricing in online retailing: evidence from Amazon.com. Econ Model 70:127–139

Chenavaz R, Paraschiv C (2018) Dynamic pricing for inventories with reference price effects. Econ Open Access Open Assess E J 12(2018–64):1–16

Chenavaz RY, Feichtinger G, Hartl RF, Kort PM (2020) Modeling the impact of product quality on dynamic pricing and advertising policies. Eur J Op Res 284(3):990–1001

Chutani A, Sethi SP (2012) Optimal advertising and pricing in a dynamic durable goods supply chain. J Optim Theory Appl 154(2):615–643

Clarke FH, Darrough MN, Heineke JM (1982) Optimal pricing policy in the presence of experience effects. J Bus 55(4):517–530

Couillet R, Perlaza SM, Tembine H, Debbah M (2012) Electrical vehicles in the smart grid: a mean field game analysis. IEEE J Sel Areas Commun 30(6):1086–1096

Crandall MG, Lions P-L (1983) Viscosity solutions of Hamilton–Jacobi equations. Trans Amer Math Soc 277(1):1–42

Danaher PJ, Hardie BG, Putsis WP Jr (2001) Marketing-mix variables and the diffusion of successive generations of a technological innovation. J Mark Res 38(4):501–514

Delarue F, Lacker D, Ramanan K (2019) From the master equation to mean field game limit theory: a central limit theorem. Electron J Probab 24(51):1–54

Den Boer AV (2015a) Dynamic pricing and learning: historical origins, current research, and new directions. Surv Oper Res Manag Sci 20(1):1–18

Den Boer AV (2015b) Tracking the market: dynamic pricing and learning in a changing environment. Eur J Oper Res 247(3):914–927

Dockner E, Jørgensen S (1988) Optimal pricing strategies for new products in dynamic oligopolies. Mark Sci 7(4):315–334

Dockner E, Jorgenssen S, Long VN, Gerhard S (2000) Differential games in economics and management science. Cambridge University Press, Cambridge

Fruchter G (2009) Signaling quality: dynamic price-advertising model. J Optim Theory Appl 143(3):479–496

Fruchter GE, Van den Bulte C (2011) Why the generalized Bass model leads to odd optimal advertising policies. Int J Res Mark 28(3):218–230

Fudenberg D, Tirole J (1991) Game theory. MIT Press, Cambridge

Gallego G, Van Ryzin G (1994) Optimal dynamic pricing of inventories with stochastic demand over finite horizons. Manag Sci 40(8):999–1020

Gini C (1921) Measurement of inequality of income. Econ J 31:22–43

Gomes D, J. a. Saúde, (2014) Mean field games models a brief survey. Dyn Games Appl 4(2):110–154

Gomes DA, Saúde J (2020) A mean-field game approach to price formation. Dyn Games Appl. https://doi.org/10.1007/s13235-020-00348-x

Guéant O, Lasry J-M, Lions P-L (2011) Mean field games and applications. In: Carmona R, Çınlar E, Ekeland I, Jouini E, Scheinkman JA, Touzi N (eds) Paris-Princeton lectures on mathematical finance 2010. Springer, Berlin, pp 205–266

Gutierrez GJ, He X (2011) Life-cycle channel coordination issues in launching an innovative durable product. Prod Oper Manag 20(2):268–279

Helmes K, Schlosser R (2015) Oligopoly pricing and advertising in isoelastic adoption models. Dyn Games Appl 5(3):334–360

Helmes K, Schlosser R, Weber M (2013) Optimal advertising and pricing in a class of general new-product adoption models. Eur J Oper Res 229(2):433–443

Huang M, Caines PE, Malhamé RP (2007) Large-population cost-coupled LQG problems with nonuniform agents: individual-mass behavior and decentralized \(\varepsilon \)-Nash equilibria. IEEE Trans Autom Control 52(9):1560–1571

Huang M, Malhamé RP, Caines PE (2005) Nash equilibria for large-population linear stochastic systems of weakly coupled agents. In: Boukas El-Kébir, Malhamé Roland P (eds) Analysis, control and optimization of complex dynamic systems. Springer, Berlin, pp 215–252

Huang M, Malhamé RP, Caines PE et al (2006) Large population stochastic dynamic games: closed-loop McKean–Vlasov systems and the Nash certainty equivalence principle. Commun Inform Syst 6(3):221–252

Iyer K, Johari R, Sundararajan M (2014) Mean field equilibria of dynamic auctions with learning. Manag Sci 60(12):2949–2970

Jeong M, Kim B-I, Gang K (2017) Competition, product line length, and firm survival: evidence from the US printer industry. Technol Anal Strateg Manag 29(7):762–774

Jiang Z, Jain DC (2012) A generalized Norton–Bass model for multigeneration diffusion. Manag Sci 58(10):1887–1897

Jing B (2011) Social learning and dynamic pricing of durable goods. Mark Sci 30(5):851–865

Jorgensen S, Kort PM (2002) Autonomous and induced learning: an optimal control approach. Int J Technol Manag 23(7–8):655–674

Jørgensen S, Kort PM, Zaccour G (1999) Production, inventory, and pricing under cost and demand learning effects. Eur J Oper Res 117(2):382–395

Jørgensen S, Zaccour G (2004) Differential games in marketing. Springer, Berlin

Kalish S (1983) Monopolist pricing with dynamic demand and production cost. Mark Sci 2(2):135–159

Karray S, Martín-Herrán G (2009) A dynamic model for advertising and pricing competition between national and store brands. Eur J Oper Res 193(2):451–467

Kiesling E, Günther M, Stummer C, Wakolbinger LM (2012) Agent-based simulation of innovation diffusion: a review. CEJOR 20(2):183–230

Kizilkale AC, Salhab R, Malhamé RP (2019) An integral control formulation of mean field game based large scale coordination of loads in smart grids. Automatica 100:312–322

Kogan K, El Ouardighi F (2019) Autonomous and induced production learning under price and quality competition. Appl Math Model 67:74–84

Krishnan TV, Bass FM, Jain DC (1999) Optimal pricing strategy for new products. Manag Sci 45(12):1650–1663

Larsen J (2017) The making of a pro-cycling city: social practices and bicycle mobilities. Environ Plan A 49(4):876–892

Lasry J-M, Lions P-L (2006a) Jeux à champ moyen. I: Le cas stationnaire. C R Math Acad Sci Paris 343(9):619–625

Lasry J-M, Lions P-L (2006b) Jeux à champ moyen. II: horizon fini et contrôle optimal. C R Math Acad Sci Paris 343(10):679–684

Lasry J-M, Lions P-L (2007) Mean field games. Jpn J Math 2(1):229–260

Leduc MV, Jackson MO, Johari R (2017) Pricing and referrals in diffusion on networks. Games Econ Behav 104:568–594

Li G, Rajagopalan S (1998) Process improvement, quality, and learning effects. Manag Sci 44(11–part–1):1517–1532

Lorenz MO (1905) Methods of measuring the concentration of wealth. Publ Am Stat Assoc 9(70):209–219

Moon J, Başar T (2019) Risk-sensitive mean field games via the stochastic maximum principle. Dyn Games Appl 9(4):1100–1125

Raman K, Chatterjee R (1995) Optimal monopolist pricing under demand uncertainty in dynamic markets. Manag Sci 41(1):144–162

Robinson B, Lakhani C (1975) Dynamic price models for new-product planning. Manag Sci 21(10):1113–1122

Rubel O (2013) Stochastic competitive entries and dynamic pricing. Eur J Oper Res 231(2):381–392

Schlosser R (2017) Stochastic dynamic pricing and advertising in isoelastic oligopoly models. Eur J Oper Res 259(3):1144–1155

Schlosser R (2020) Stochastic dynamic pricing with waiting and forward-looking consumers. Springer, Berlin, pp 1–23

Schmeidler D (1973) Equilibrium points of nonatomic games. J Stat Phys 7(4):295–300

Selcuk C, Gokpinar B (2018) Fixed versus flexible pricing in a competitive market. Manag Sci 64(12):5584–5598

Shokri M, Kebriaei H (2018) Mean field optimal energy management of plug-in hybrid electric vehicles. IEEE Trans Veh Technol 68(1):113–120

Sultan F, Farley JU, Lehmann DR (1990) A meta-analysis of applications of diffusion models. J Mark Res 27(1):70–77

Tchuendom RF, Malhamé R, Caines P (2019) A quantilized mean field game approach to energy pricing with application to fleets of plug-in electric vehicles. In: 2019 IEEE 58th conference on decision and control (CDC). IEEE, pp 299–304

Vörös J (2006) The dynamics of price, quality and productivity improvement decisions. Eur J Oper Res 170(3):809–823

Vörös J (2019) An analysis of the dynamic price-quality relationship. Eur J Oper Res 277(3):1037–1045

Wang B, Huang M (2015) Dynamic production output adjustment with sticky prices: a mean field game approach. In: 2015 IEEE 54th annual conference on decision and control (CDC). IEEE, pp 4438–4443

Wang B, Huang M (2019) Mean field production output control with sticky prices: nash and social solutions. Automatica 100:90–98

Weintraub GY, Benkard CL, Van Roy B (2008) Markov perfect industry dynamics with many firms. Econometrica 76(6):1375–1411

Wiszniewska-Matyszkiel A (2002) Static and dynamic equilibria in games with continuum of players. Positivity 6(4):433–453

Wiszniewska-Matyszkiel A (2014) Open and closed loop Nash equilibria in games with a continuum of players. J Optim Theory Appl 160(1):280–301

Xie J, Sirbu M (1995) Price competition and compatibility in the presence of positive demand externalities. Manag Sci 41(5):909–926

Yang J, Xia Y (2013) A nonatomic-game approach to dynamic pricing under competition. Prod Oper Manag 22(1):88–103

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Proof of Lemma 5.4

Proof

General considerations When the overall dynamics \({\overline{X}}_t\) and \({\overline{P}}_t\) is given, the situation enters, formally, the setting of Kalish [54, bottom of page 141] and Clarke et al. [24, Proposition 2 page 523]. Consider the function

Since \({\mathscr {L}}'(p)= 2- \frac{g(p) g''(p)}{(g'(p))^2}\) and hypothesis (H1) holds, we obtain \({\mathscr {L}}'(p)>0\). \({\mathscr {L}}\) is thus a strictly increasing function. Its image is \([\frac{g(0)}{g'(0)},\infty [\). Since \(g\ge 0\) and \(g'(p)\le 0\), we get \(\frac{g(0)}{g'(0)} \le 0\). Thus, the image of \({\mathscr {L}}\) contains \({\mathbb R}_+\).

P

Proof of points 2 and 3

For \(r>0\), the optimum price \(p^*\) satisfies as in Kalish [54] and Clarke et al. [24]:

which together with hypothesis (H1) provide the point 2 of the conclusion.

For \(r=0\), one obtains \(\frac{d p^*_t}{\mathrm{d}t} {\mathscr {L}}'(p^*_t) =0\) thus \(p^*_t\) is constant (point 3 of the conclusion).

Proof of point 1

We introduce the Hamiltonian

The optimal price \(p^*\) will maximize H with respect to p when \(\lambda \) is the adjoint state \(\lambda ^*\); recalling that at the optimal solution, \(\lambda ^*(t) = \partial _x \Pi ^*(t,x_t)\).

With the market conditions given, the maximization of (A.3) is related to the maximization of \(p \mapsto (p-\beta )g(p)\) (with the particular case of interest \(\beta =c(x) -\lambda \)). Its derivative is \(g(p) + (p-\beta )g'(p)\) which is positive when \(\beta \ge {\mathscr {L}}(p) \) or, equivalently, \( {\mathscr {L}}^{-1}(\beta ) \ge p\) (for \(\beta \) in the domain of \({\mathscr {L}}\)). Thus \((p-\beta )g(p)\) increases and then decreases; it has a unique maximum attained at \({\mathscr {L}}^{-1}(\beta )\). Going back to the maximization of Eq. (A.3) it results that the optimal price satisfies \(p^*_t = {\mathscr {L}}^{-1}(c(x_t) - \lambda _t ) = {\mathscr {L}}^{-1} \left( c(x_t) - \partial _x \Pi ^*(t,x_t) \right) \), which shows that the optimal price is unique when \(\Pi ^*(t,x)\) is differentiable with respect to x everywhere (and not necessarily so otherwise).

Proof of point 4

Intuitively the profit \(\Pi ^*\) is increasing with respect to x because a firm with higher initial sales can use the same strategy as a firm with lower initial sales, but its cost will be lower, which allows for higher profit. The rigorous transcription of this idea is as follows: consider two firms with initial sales \(x_0^1\) and \(x_0^2\), with \(x_0^1 \le x_0^2\), p some pricing strategy as in (3.3) and \(x^{\tau ,x_0^1}_t\) and \(x^{\tau ,x_0^2}_t\) the sales of the firms using the strategy p. Then \(\frac{d}{\mathrm{d}t}x^{\tau ,x_0^2}_t = \frac{d}{\mathrm{d}t} x^{\tau ,x_0^1}_t\) and thus \(x^{\tau ,x_0^2}_t \ge x^{\tau ,x_0^1}_t\) for any \(t\ge \tau \) which shows that \(c(x^{\tau ,x_0^2}_t) \le c(x^{\tau ,x_0^1}_t)\) for any \(t\ge \tau \). But then, recalling definition (4.3), \(\Pi (\tau ,x_0^2,p) \ge \Pi (\tau ,x_0^1,p) \). Taking now the supremum with respect to p and using (3.3) it follows that

proving the first part of point 4.

Denote \({\mathscr {H}}(\beta )= \max _{p\ge 0} (p-\beta ) g(p)\). The optimal profit \(\Pi ^*\) is the unique viscosity solution (see Crandall and Lions [26], Bressan and Piccoli [8] and Bardi and Capuzzo-Dolcetta [5] for more details) of the following Hamilton–Jacobi–Bellman equation:

In addition, at any point \(x_t\) where \(\partial _x \Pi ^*(t,x_t)\) exists the optimal price \(p^*_t\) of a firm with cumulative sales \(x_t\) at time t only depends on t and \(x_t\) and satisfies:

Thus, hypothesis (H2) and (H3) allow bounding the profit for \(x_0\rightarrow \infty \). For \(x_0 \rightarrow 0\) the optimal price can be unbound (since \(c(x_0)\) may tend to \(\infty \) for \(x_0\rightarrow 0\)) but the profit will certainly be finite (being inferior to any profit for fixed \(x_0 > 0\)), which proves the second part of point 4 of the conclusion. \(\square \)

Appendix B: Proof of Theorem 5.6

Proof

General considerations

Point 3 of Lemma 5.4 gives that for \(r=0\), the optimal price \(p^*\) of a representative firm is constant. Given \({\overline{X}}_t\), \({\overline{P}}_t\) (not necessarily at equilibrium) the (constant) optimal price \(p^*\) of a firm maximizes the profit [obtained from Eq. (4.3) with p constant using (4.1)] :

where \(I_c(\cdot )\) refers to a primitive of the cost function c; that is, \(I_c'(y)= c(y)\), for any \(y> 0\).

Using the definition of \(Z=Z_{{\overline{X}}_t,{\overline{P}}_t}\), which is fixed and integrating (4.1) with respect to time, yields \(x_\infty = x_0 + Z g(p)\). To determine the optimal price \(p^*=p^{Z,*}(x_0) \) that maximizes Eq. (B.1), we define the profit function J:

Note that J is increasing with respect to \(x_0\). By differentiating J with respect to p, we obtain \( Z(p^*g'(p^*)+ g(p^*)) = c(x_0 + Z g(p^*)) Z g'(p^*)\). Divide now both terms by \(Z g'(p^*)\), to obtain \(p^*+ g(p^*)/g'(p^*) = c(x_0 + Z g(p^*))\), which can also be written as \({\mathscr {L}}(p^*)= c(x_0 + Z g(p^*))\). Hence, after inverting the function \({\mathscr {L}}\) and indicating the explicit dependence on \(x_0\), we obtain:

Note that at this time \(p^{Z,*}(x_0)\) is not necessarily unique. However, we can show that \(p^{Z,*}(x_0)\) is decreasing with respect to \(x_0\); indeed consider \(x_0^1 < x_0^2\). The optimum price being constant means that we must have for any \(t \ge 0\)

Otherwise, some point \(\bar{t}\) exists with \(x_{\bar{t}}^{x_0^1,*} = x_{\bar{t}}^{x_0^2,*}\), and thus, a non-constant price can be constructed that is optimal for the firm starting in \(x_0^2\). However, (B.4) implies \(x_\infty ^{x_0^1,*} \le x_\infty ^{x_0^2,*}\), which also implies

A closer analysis reveals that \(p^{Z,*}(x_0)\) is in fact strictly monotonic. Thus \(p^{Z,*}(x_0)\) is strictly decreasing with respect to \(x_0\), has left and right limits (which are optimums) and any other (optimal) value is between these limits.

On the other hand, the function

is Lipschitz thus differentiable almost everywhere with respect to \(x_0\); in any point of differentiability of \(J^*(x_0,Z)\) we have that \(p^{Z,*}(x_0)\) is uniquely given by [compare with formula (A.7)]

Let us now inquire about the variation of \(p^{Z,*}(x_0)\) with respect to Z: consider \(Z_2 > Z_1\) and the optimal dynamics \(x_t^{x_0,*}\) of a firm starting in \(x_0\); at time \(t=0\) the price \(p^{Z_2,*}(x_0)\) represents a maximum of the profit \(J(x_0,Z_2=\int _0^\infty f({\overline{X}}_t,{\overline{P}}_t) \mathrm{d}t,p)\) with respect to p, while at a later time \(t\ge 0\) it will also be an optimum of \(J(x_0,\int _t^\infty f({\overline{X}}_t,{\overline{P}}_t) \mathrm{d}t,p)\). Choosing the time t for which \(Z_1= \int _t^\infty f({\overline{X}}_t,{\overline{P}}_t) \mathrm{d}t\) we obtain \(p^{Z_2,*}(x_0) = p^{Z_1,*}(x_t^{x_0}) < p^{Z_1,*}(x_0)\), where we used the monotonicity of \(p^{Z,*}(x_0)\) with respect to \(x_0\); thus, we obtain that \(p^{Z,*}(x_0)\) is strictly decreasing with respect to Z.

In summary, \(x_0 \mapsto p^{Z,*}(x_0)\) is strictly decreasing; thus, although it is not continuous, the set of discountinuity points is at most countable. The same holds for \(Z \mapsto p^{Z,*}(x_0)\).

To avoid lengthy technical developments, we will only present the reminder of the proof for the situation when \(\mu _0\) admits a density \(\rho _0(x_0)\), i.e., \(\mu _0 = \rho _0(x_0) d x_0\).

When \(\mu _0\) does not admit a density, then it may occur that for a set A (with \(\mu _0(A)> 0\)) of firms \(\omega \in A\), the price p is not necessarily unique, which means that two firms starting from the same \(x_0\) can choose different prices. In mathematical terms, p depends not only on the cumulative sales \(X_0(\omega )\) of the firm \(\omega \) but also on the firm \(\omega \) itself: \(p=p(\omega ,X_0(\omega ))\); in this case \({\mathscr {E}}(\cdot )\) is a set-valued map and the proof has to use more general fixed point theorems (see Remark 5.10).

Moreover, to avoid degenerate settings, we also assume that the cost function \(c(\cdot )\) is always strictly positive.

Proof of point 2a

Since each firm has constant optimal price, the equilibrium mean price \({\overline{P}}^\dagger _t\) will also be constant:

In addition, hypothesis (H4) ensures that \({\overline{X}}^\dagger _t \in [0,N_0]\) and \({\overline{X}}^\dagger _t\rightarrow N_0\) for \(t\rightarrow \infty \).P

Proof of point 1

The proof of existence relies on the remark that to each possible \({\overline{X}}_t\) and \({\overline{P}}_t\) a number Z corresponds. We will find the Z that gives an equilibrium. Note first that any equilibrium Z can be bounded by some universal constant \(Z_{max}^{\mu _0} := \frac{N_0- {\overline{X}}_0}{ {\mathbb E}\left[ g({\mathscr {L}}^{-1}\left( c(X_0 )\right) ) \right] }\); thus, it is enough to look for an equilibrium in the interval \([0, Z_{max}^{\mu _0}]\). Let \(Z \in [0, Z_{max}^{\mu _0}]\); then one can associate to it the optimal price \(p^{Z,*}(x_0)\) maximizing \(J(p,x_0,Z)\) (with respect to p). This price is unique for almost all \(x_0\); for \(Z_n \rightarrow Z\) any accumulation point of \(\{ p^{Z_n,*}(x_0), n\ge 1 \}\) is necessarily an optimum for \(J(p,x_0,Z)\), thus by uniqueness \(p^{Z,*}(x_0) = \lim \limits _{n\rightarrow \infty } p^{Z_n,*}(x_0)\) a.e. in \(x_0\). The mapping \(Z \in [0, Z_{max}^{\mu _0}] \mapsto {\mathscr {E}}(Z) = \frac{N_0-{\overline{X}}_0}{ {\mathbb E}\left[ g(p^{Z,*}(X_0)) \right] } \in [0, Z_{max}^{\mu _0}]\) is thus well defined and continuous; it must have a fixed point (according to Brower’s theorem) that corresponds to an equilibrium.

Also note that \({\mathscr {E}}(Z) \ge \frac{N_0-{\overline{X}}_0}{g(0)} > 0\). The strict monotony of \(p^{Z,*}(x_0)\) with respect to Z implies that \({\mathscr {E}}(Z) \) is decreasing with respect to Z and thus the fixed point is unique.

Proof of point 2b

Now take \(Z^{\dagger }\) as the equilibrium value and \(p^\dagger (\cdot )= p^{Z^\dagger ,*}(\cdot )\); note that

To prove that \({\mathbb V}(X_t)\) is increasing with respect to t, we will use an alternative formula for the variance of a random variable Y:

Or, formula (B.9) and the monotonicity of \(p^{Z,*}(x_0)\) with respect to \(x_0\) show that for any \(y_1 = X_0(\omega _1),y_2=X_0(\omega _1) \ge 0\):

which implies, using (B.10), that \({\mathbb V}(X_t) \ge {\mathbb V}(X_0)\).

Proof of point 2c

We now analyze the past cumulative revenue \({\mathbb V}\left[ \int _{0}^{t} P^\dagger _s \dot{X}^\dagger _s ds \right] \). Recalling that with firm’s price being constant in time, the past cumulative revenue is simply \(P^\dagger _0(X_t^\dagger -X_0)\); equation (B.9) shows that \({\mathbb V}(P^\dagger _0(X_t^\dagger -X_0)) = {\mathbb V}\left[ P^\dagger _0 g(P^\dagger _0) \right] \frac{ ({\overline{X}}^\dagger _t-{\overline{X}}_0)^2}{ {\mathbb E}\left[ g(p^\dagger (X_0)) \right] ^2 }\) which is increasing because \({\overline{X}}^\dagger _t-{\overline{X}}_0\) is positive increasing. The conclusion on the Lorenz curve follows from the remark that cumulative revenue \(P^\dagger _0 (X^\dagger _t-X_0)\) is the product of a time-dependent real constant \({\overline{X}}^\dagger _t-{\overline{X}}_0\) and a time-independent random variable \( \frac{ P^\dagger _0 g(P^\dagger _0) }{ {\mathbb E}\left[ g(P^\dagger _0) \right] }\).

Proof of point 2d

Recall that the Gini coefficient of a real variable B is

Thus

But since \(y_1-y_2\) and \( g(p^\dagger (y_1)) -g(p^\dagger (y_2))\) have the same sign and \( \frac{{\overline{X}}^\dagger _t-{\overline{X}}_0}{ {\mathbb E}\left[ g(P^\dagger _0) \right] } >0\) we obtain:

and after some computations,

hence the conclusion follows. \(\square \)

Appendix C: Proof of Corollaries

Proof of Corollary 5.7

Proof

The proof of Corollary 5.7 uses the same arguments as those developed in “Appendix B” to prove that the variance of cumulative demand \({\mathbb V}(X_t^\dagger )\) increases over time (point 2b of Theorem 5.6). Formula (B.9) and the monotony of \({\overline{X}}^\dagger _t-{\overline{X}}_0\) and \({\overline{X}}^\dagger _\infty -{\overline{X}}_t^\dagger \), respectively guarantee that the variance of past cumulative demand \({\mathbb V}(X_t^\dagger -X_0)\) increases over time, while the variance of future cumulative demand \({\mathbb V}(X_\infty ^\dagger -X_t^\dagger )\) decreases over time. \(\square \)

Proof of Corollary 5.8

Proof

The proof of Corollary 5.8 is similar to that of Point 3 of Theorem 5.6 in “Appendix B.” \(\square \)

Proof of Corollary 5.9

Proof

In the General considerations of the proof of Theorem 5.6, we shown that the optimal equilibrium price \(p^\dagger (x_0)\) is strictly decreasing with respect to \(x_0\), has left and right limits (which are optimums). The monotonicity of \(p^\dagger (\cdot )\) implies (by the Darboux–Froda theorem) that it can only have at most a countable number of discontinuities. Each such discontinuity corresponds to a non-differentiability point of \(\Pi ^\dagger (\cdot )\), which proves the claims of the Corollary. \(\square \)

Rights and permissions

About this article

Cite this article

Chenavaz, R., Paraschiv, C. & Turinici, G. Dynamic Pricing of New Products in Competitive Markets: A Mean-Field Game Approach. Dyn Games Appl 11, 463–490 (2021). https://doi.org/10.1007/s13235-020-00369-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-020-00369-6