Abstract

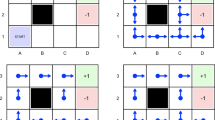

This paper is designed to combine the game-theoretic investigation of the static or equilibrium properties of large strategic market games together with the investigation of some very simple dynamics, which nevertheless are sufficient to show differences between two related games, one with only trade and one in which both borrowing from an outside bank and trade take place. The role of banking reserves emerges as relevant and sensitive to the transient state dynamics.

Several 100,000 player games are simulated and the behavior is compared with the analytical prediction for the games with a continuum of agents.

The dynamics considered here is so simple that it does not show adaptive learning. A natural extension calls for updating via a learning program such as a genetic algorithm.

Similar content being viewed by others

References

Bond, G., Liu, J., and Shubik, M. (1994): “Dynamic Solutions to a Strategic Market Game: Analysis, Programming and a Genetic Algorithm Approach.” InBrainware, edited by Stender and Hillebrand. Amsterdam: IOS (forthcoming).

Feldman, M., and Giles, C. (1985): “An Expository Note on Individual Risk Without Aggregate Uncertainty.”Journal of Economic Theory 35: 26–32.

Holland, J., and Miller, J. (1991): “Artificial Adaptive Agents in Economic Theory.”American Economic Review 81,Papers and Proceedings: 365–370.

Karatzas, I., Shubik, M., and Sudderth, W. D. (1992): “Construction of Stationary Markov Equilibria in a Strategic Market Game.” Santa Fe Institute, Santa Fe, NM, 92-05-022.

Karatzas, I., Shubik, M., and Sudderth, W. D. (1994): “Construction of Stationary Markov Equilibria in a Strategic Market Game.”Mathematics of Operations Research (forthcoming).

Keynes, J. M. (1957):The General Theory of Employment, Interest and Money. London: Macmillan. [First printing 1936.]

Maitra, A. (1968): “Discounted Dynamic Programming on Compact Metric Spaces.”Sankhya A. 30: 211–216.

Shapley, L. S., and Shubik, M. (1977): “Trade Using One Commodity as a Means of Payment.”Journal of Political Economy 85: 937–968.

Shubik, M., and Thompson, G. L. (1959): “Games of Economic Survival.”Naval Logistics Research Quarterly 6: 111–123.

Shubik, M., and Whitt, W. (1973): “Fiat Money in an Economy with One Non-durable Good and No Credit (A Noncooperative Sequential Game).” InTopics in Differential Games, edited by A. Blaquiere. Amsterdam: North-Holland.

Stokey, N. L., and Lucas, R. E. (1989):Recursive Methods in Economic Dynamics. Cambridge. Harvard University Press.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Miller, H.H., Shubik, M. Some dynamics of a strategic market game with a large number of agents. Zeitschr. f. Nationalökonomie 60, 1–28 (1994). https://doi.org/10.1007/BF01228023

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01228023