Conclusion

This paper has focused on the extent to which the traditional tools of macroeconomic management in the United States, monetary and fiscal policy, have contributed to a political business cycle. Regardless of whether politicians can successfully influence real economic variables to their own ends, the evidence presented here suggests that they tried, and that they enjoyed some at least indirect aid from their ‘independent’ monetary authorities in doing so. Several major conclusions emerge.

-

(1)

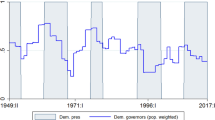

Over the years 1960 to 1976 in the United States a cyclically adjusted Federal deficit was related to the Presidential electoral cycle. We find that roughly half of the high employment deficit was ultimately monetized, in the sense that an addition of one dollar to the deficit was associated with an increase in M1 of almost .50 cents.

-

(2)

Monetary policy responded systematically to this deficit in addition to other basic factors in the management of the money supply. The high employment deficit is in fact more important than any of the other variables included in the monetary reaction function estimated here.

-

(3)

When a political component of the high-employment deficit is isolated by observing the relationship of the electoral cycle to the deficit, the monetary authority may have responded even more to this component than to the residual deficit, although the politically induced deficit component as measured here is small relative to the total deficit.

Similar content being viewed by others

References

Abrams, R. K., Froyen, R., and Waud, R. N. (1980). Monetary policy reaction functions consistent expectations and the burns era. Journal of Money, Credit, and Banking, February.

Addison, J. T., Burton, J., and Torrance, T. S. (1980). On the causation of inflation. The Manchester School of Economics and Social Studies, June.

Barro, R. J. (1977). Unanticipated money growth and unemployment in the United States. American Economic Review, March.

Barro, R. J. (1978a). Unanticipated money, output and the price level in the United States. Journal of Political Economy, August.

Barro, R. J. (1978b). Comment from an unreconstructed Ricardian. Journal of Monetary Economics, August.

Bazdarich, M. (1980). Money, inflation and causality in the United States, 1959–79. Federal Reserve Bank of San Francisco. Economic Review, Spring.

Berman, P.I. (1978). Inflation and the money supply in the United States, 1956–1977. Lexington, Mass.: D.C. Health, Lexington Books.

Buchanan, J.M., and Wagner, R.E. (1977). Democracy in deficit: The political legacy of Lord Keynes. New York: Academic Press.

Frey, B. S. (1978). Politico-economic models and cycles. Journal of Public Economics 9.

Gordon, R. J. (1975). The demand for and supply of inflation. Journal of Law and Economics, December.

Gordon, R. J. (1977). World inflation and monetary accommodation in eight countries. Brookings Papers on Economic Activity 2.

Hamburger, M. J., and Zwick, B. (1981). Deficits, money, and inflation. Journal of Monetary Economics, January.

Havrilesky, T.M., Sapp, R.H., and Schweitzer, R.L. (1976). Test of the Federal Reserve's reaction to the state of the economy: 1964–74. In T.M. Havrilesky and J.T. Boorman, Current issues in monetary theory and policy. Arlington Heights, Illinois: AHM Publishing Company.

Kane, E. J. (1980). Politics and Fed policymaking: The more things change the more they remain the same. Journal of Monetary Economics, April.

Kane, E.J. (1982). External pressures and the operations of the Fed. In R. Lombra and W. Witte (Eds.), The political economy of national and international monetary policy. Ames, Iowa: Iowa State University Press.

Luckett, D. G., and Potts, G. T. (1980). Monetary policy and partisan politics. Journal of Money, Credit, and Banking, August.

Maisel, S. (1973). Managing the dollar. New York: Norton.

McCallum, B. T. (1978). The political business cycle: An empirical test. Southern Economic Journal, January.

McMillin, W. D. (1981). A dynamic analysis of the impact of fiscal policy on the money supply. Journal of Money, Credit, and Banking, May.

McMillin, W. D., and Beard, T. R. (1980). The short-run impact of fiscal policy on the money supply. Southern Economic Journal, July.

Moore, B. J. (1979). The endogenous money stock. Journal of Post Keynesian Economics, Fall.

Niskanen, W. A. (1978). Deficits, government spending, and inflation: What is the evidence. Journal of Monetary Economics, August.

Nordhaus, W. D. (1975). The political business cycle. Review of Economic Studies, April.

Sims, C. A. (1972). Money, income, and causality. American Economic Review, September.

Stigler, G. J. (1973). General economic conditions and national elections. American Economic Review Papers and Proceedings, May.

Tufte, E.R. (1978). Political control of the economy. Princeton: Princeton University Press.

Weintraub, R. E. (1978). Congressional supervision of monetary policy. Journal of Monetary Economics, April.

Willett, T. D., and Laney, L. O. (1978). Monetarism, budget deficits, and wage push inflation: The cases of Italy and the United Kingdom. Banca Nazionale del Lavoro Quarterly Review, December.

Willett, T.D., and Mullen, J. (1982). The effects of alternative international monetary systems on macroeconomic discipline and the political business cycle. In R. Lombra and W. Witte (Eds.), The political economy of national and international monetary policy. Ames, Iowa: Iowa State University Press.

Federal fiscal policy, 1965–72. Federal Reserve Bulletin (1973), June.

The federal budget in the 1970s. Federal Reserve Bulletin (1978), September.

Author information

Authors and Affiliations

Additional information

Horton Professor of Economics, Claremont Graduate School and Claremont Men's College, and Research Associate, Center of the Study of Law Structures. (Conclusions are those of the authors and should not be attributed to any of the above institutions. We would like to thank colleagues at Claremont and the Federal Reserve Bank of Dallas, as well as Raymond Lombra, Herbert Stein, and Edward Tower, for helpful comments, without implying they agree with conclusions reached.)

Rights and permissions

About this article

Cite this article

Laney, L.O., Willett, T.D. Presidential politics, budget deficits, and monetary policy in the United States; 1960–1976. Public Choice 40, 53–69 (1983). https://doi.org/10.1007/BF00174996

Issue Date:

DOI: https://doi.org/10.1007/BF00174996