Abstract

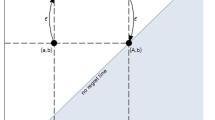

Many real-world decisions entail choices between information on either probabilities or payoffs (i.e., prizes). Simplified versions of such decisions are examined to gain insight into preferences for different types of information as a function of risk-attitudes. General and simple decision rules are derived for cases where the utility function is concave (or convex) over the relevant payoff interval.

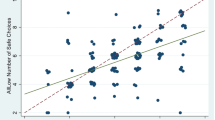

The article further describes several experiments to test business students' intuitions concerning these optimal decision rules. In general, risk-taking attitudes did not correlate significantly with subjects' preferences for information, in violation of theorems regarding mean-preserving spreads of risk. Other tests, e.g., narrowing certain probability ranges, also resulted in preferences contrary to expected utility (EU) theory.

Behavioral and economic explanations are examined for people's limited insights into the value of information. The main experimental results are proved to be counter to subjective expected utility (SEU) theory as well as EU. Subjects appear to use heuristics in which probability is not treated linearly, second-order probability matters, and nonmultiplicative integration occurs with prizes.

Similar content being viewed by others

References

ArrowKenneth. (1971). Essays in the Theory of Risk-Bearing. Chicago: Markham Publishing Co.

Chew, Soo Hong and Kenneth MacCrimmon. (1979). “Alpha-nu Choice Theory: A Generalization of Expected Utility Theory,” Working paper No. 669, Faculty of Commerce and Business Administration, University of British Columbia.

ChewSoo Hong, EdiKarni, and ZviSafra. (1987). “Risk-Aversion in the Theory of Expected Utility with Rank-Dependent Probabilities,” Journal of Economic Theory 42, 370–381.

DebreuGerard. (1959). Theory of Value. New York: Wiley.

DiamondPeter and MichaelRothschild. (1978). Uncertainty in Economics. New York: Academic Press.

Ehrlich, Isaac and Gary Becker. (1972). “Market Insurance, Self-Insurance and Self-Protection.” Journal of Political Economy 80, July-August.

EllsbergDaniel. (1961). “Risk, Ambiguity and the Savage Axioms,” Quarterly Journal of Economics 75, 643–669.

EpsteinLarry and StephenTanny. (1980). “Increasing Generalized Correlation: A Definition and Some Economic Consequences,” Canadian Journal of Economics 13, 16–34.

Fishburn, Peter and Raymond Vickson. (1978). “Theoretical Foundations of Stochastic Dominace.” In G. A. Whitmore and M. C. Findlay (eds.), Stochastic Dominance. Lexington Books, D. C. Heath and Company.

FriedmanMilton. (1935). Essays in Positive Economics. Chicago: The University of Chicago Press, 3–43.

GouldJohn. (1974). “Risk, Stochastic Preference and the Value of Information,” Journal of Economic Theory 8, 64–84.

GretherDavid and CharlesPlott. (1979). “Economic Theory of Choice and the Preference Reversal Phenomenon,” American Economic Review, 69, 623–38.

HadarJoseph and WilliamRussell. (1969). “Rules for Ordering Uncertain Prospects,” American Economic Review 59, 25–34.

HeyJohn. (1982). “Search for Search Rules,” Journal of Economic Behavior and Organization 3, 65–81.

HersheyJohn and PaulSchoemaker. (1980). “Risk Taking and Problem context in the Domain of Losses: An Expected Utility Analysis,” The Journal of Risk and Insurance 47, 111–32.

HirshleiferJack and JohnRiley. (1979). “The Analytics of Uncertainty and Information: An Expository Survey,” Journal of Economic Literature 17, 1375–1421.

HogarthRobin. (1981). “Beyond Discrete Biases: Functional and Dysfunctional Aspects of Judgmental Heuristics,” Psychological Bulletin 90, 197–217.

KahnemanDaniel and AmosTversky. (1979). “Prospect Theory: An Analysis of Decision Under Risk,” Econometrica 47, 2, 263–291.

LaValleIrving. (1968). “On Cash Equivalents and Information Evaluation in Decision Under Uncertainty, Part I: Basic Theory,” Journal of the American Statistical Association 63, 252–276.

LichtensteinSarah and PaulSlovic. (1971). “Reversals of Preferences between Bids and Choices in Gambling Decisions,” Journal of Experimental Psychology 89, 46–55.

LichtensteinSarah and PaulSlovic. (1973). “Response-Induced Reversals of Preference in Gambling: An Extended Replication in Las Vegas,” Journal of Experimental Psychology 101, 16–20.

LippmanS. and JohnMcCall. (1981). “The Economics of Uncertainty: Selected Topics and Probabilistic Methods.” In K.Arrow and M. D.Intrilligator (eds.), Handbook of Mathematical Economics. New York: North Holland.

MarchJames and ZurShapira. (1987). “Managerial Perspectives on Risk and Risk Taking,” Management Science 33, 11, 1404–1418.

MacCrimmonKenneth and DonaldWehrung. (1986). Taking Risks: The Management of Uncertainty. New York: Free Press.

MachinaMark. (1982). “’Expected Utility Analysis’ Without the Independence Axiom,” Econometrica 50, 277–323.

Machina, Mark. (1987). “Decision Making in the Presence of Risk,” Science, 537–543.

MachlupFritz. (1967). “Theories of the Firm: Marginalist, Behavioral, Managerial,” The American Economic Review 57, 1.

MassyW. F. (1965). “On Methods: Discriminant Analysis of Audience Characteristics,” Journal of Advertising Research 5, 39–48.

MeyerJack. (1977). “Choice Among Distributions,” Journal of Economic Theory 14, 326–336.

PayneJohn. (1973). “Alternative Approaches to Decision Making Under Risk: Moments vs. Risk Dimensions,” Psychological Bulletin 80, 6, 493–553.

PrattJohn, DavidWise, and RichardZeckhauser. (1979). “Price Differences in Almost Competitive Markets,” Quarterly Journal of Economics 93, 189–211.

QuigginJohn. (1982). “A Theory of Anticipated Utility,” Journal of Economic Behavior and Organization 3, 323–343.

RothschildMichael and JosephStiglitz. (1970). J. E. “Increasing Risk: I. A Definition,” Journal of Economic Theory 2, 225–243.

SchoemakerPaul. (1979). “The Role of Statistical Knowledge in Gambling Decisions: Moment vs. Risk Dimension Approaches,” Organizational Behavior and Human Performance 24, 1–17.

Schoemaker, Paul. (1980). Experiments on Decisions Under Risk: The Expected Utility Hypothesis. Kluwer-Nijhoff Publishing, 45–65.

SchoemakerPaul. (1982). “The Expected Utility Model: Its Variants, Purposes, Evidence and Limitations,” Journal of Economic Literature 20, 529–563.

Schoemaker, Paul. (1988). “Are Risk-Attitudes Related Across Domains and Response Modes?” Working Paper, Center for Decision Research, University of Chicago.

Segal, Uzzi. (1987). “Two-Stage Lotteries without the Reduction Axiom,” Working Paper, Department of Economics, University of Toronto.

SlovicPaul. (1969). “Differential Effects of Real Versus Hypothetical Payoffs on Choices Among Gambles,” Journal of Experimental Psychology 80, 434–437.

Slovic, Paul and Sarah Lichtenstein. (1968). “The Relative Importance of Probabilities and Payoffs in Risk Taking,” Journal of Experimental Psychology 78.

StiglerGeorge. (1961). “The Economics of Information”, Journal of Political Economy 69, 213–225.

VonNeumannJohn and OskarMorgenstern. (1947). Theory of Games and Economic Behavior. Princeton: Princeton University Press (2-nd ed.).

Additional information

University of Chicago

Rights and permissions

About this article

Cite this article

Schoemaker, P.J.H. Preferences for information on probabilities versus prizes: The role of risk-taking attitudes. J Risk Uncertainty 2, 37–60 (1989). https://doi.org/10.1007/BF00055710

Issue Date:

DOI: https://doi.org/10.1007/BF00055710