Abstract

This paper explores regional variation in the effects of publicly sponsored R&D grants on SME performance. The results suggest that there is no guarantee that the grants will impact firm growth, either positive or negative. Positive growth effects are most likely to be found for publicly sponsored R&D grants targeting SMEs located in regions abundant with skilled labor, whereas the opposite is found for SMEs located in regions with a limited supply of skilled labor.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The importance of innovation as a key driver of long-run economic growth is well established. However, although the link between innovation and growth is recognized, there is no consensus regarding the best policy through which to achieve innovation and growth. Interestingly, Veugelers (2015) shows that innovation policies deployed in EU member states seem, to a great extent, to apply similar combinations of instruments, regardless of their innovation capacity. In this vein, direct R&D grants and support through tax incentives are two commonly applied measures. Sweden, however, is somewhat of an outlier in this area, as it has a strong focus on direct government funding through R&D grants and a low reliance on R&D tax-incentives (OECD, Organization for Economic Co-operation and Development 2015a).

Apart from having innovation and growth as desired outcomes, many growth-oriented government programs tend to focus their efforts on supporting small- and medium-sized enterprises (SMEs). New ventures and innovative SMEs account for a large share of net job-creation and productivity growth. These capabilities are well documented, but due to a lack of financial resources or competitive elements in the industry, many new firms are not able to survive their first year(s) of business (Shane 2009; Nightingale and Coad 2014). As a response to these complications, governments have—in the last couple of decades—been implementing various policies that aim to increase SME survival rates and innovation. One channel through which governments support private enterprises is via “targeted R&D grants.” However, even though there is a history of targeted R&D grants, surprisingly little is known about the actual effects of such policies (Edler et al. 2013).Footnote 1

In summarizing studies that analyze the impact of various R&D grants and subventions, it is clear that results vary. Bronzini and Iachini (2014) assessed the effects of receiving an investment grant on R&D in northern Italy. They found that such grants had positive effects on R&D for small enterprises, whereas large companies did not seem to be affected by the grants. Cin et al. (2017) found R&D subsidies to enhance the performance of Korean SMEs. For Finland, Koski and Pajarinen (2013) showed that R&D support seemed to lead to an increase in the number of employees as long as support was given to the firm, but these results did not persist after the funding ended. Similar results with a lack of long-lasting effects were also found by Cappelen et al. (2016) for Norway. Zúñiga-Vicente et al. (2014) summarize the results of 77 studies on different R&D support schemes. They uncovered three fairly stable patters: (i) The amount of crowding-out is closely related to the financial restrictions facing the companies, (ii) the growth effects vary across basic- and applied research, and (iii) the impact of a grant is larger for smaller firms. The finding that the impact of a grant seems to be largest for smaller firms is further supported by Gonzalez et al. (2005), Criscuolo et al. (2012), Heshmati and Lööf (2005), and Gustafsson et al. (2016). There are also indications of start-ups being more innovative than established firms (Acs and Audretsch 1988).

One area in which there seems to be a relative large lack of knowledge is connected to the regional dimension. In some regions, innovation and growth targeted programs may work better than in others. It is well-established that finding skilled labor can be both problematic and a factor limiting growth among many innovative and R&D-intensive firms (for an international outlook on this matter see Rutkowski (2007) and OECD, Organization for Economic Co-operation and Development (2015b), and for Sweden see Tillväxtverket (2011)). It has also been shown that the most important factor determining firms’ localization decision is access to qualified workers (UNCTAD 1997).

Hence, the local supply of skilled labor can be seen as a critical factor for the growth prospect of innovative and R&D-intensive firms, and we cannot exclude the possibility that the impact of innovation grants will be dependent on the local supply of skilled labor. Our question is, therefore, are there any regional differences in the growth effects of publicly sponsored innovation and growth targeting grants, and what role does human capital have?

A few studies have taken a regional perspective on how subsidies impact firm performance. Banno et al. (2013) and Herrera and Nieto (2008) both found that R&D subsidies had stronger growth effects in central regions than in remote regions. Similar results were found by Piekkola (2007), whereas Doloreux (2004), in a Canadian study, did not find evidence for a significant difference across regions. Overall, these results suggest that regional characteristics matter for the impact of R&D subsidies, but the source of the heterogeneity remains unknown.

We contribute to this literature by explicitly focusing on the role of the local supply of human capital in shaping the impact of R&D grants. This route is motivated by the close link between innovation and human capital, as well as by a lack of knowledge of the role of the regional dimension in this area. Using information on the size of the grants combined with detailed firm and individual characteristics, we analyze the link between R&D grants and regional characteristics. From a policy and efficiency perspective, the regional dimension may be critical in order to understand the outcome of an intervention.

A main result of this study is that, in most cases, the R&D grants have no significant impact on firm growth, though the likelihood of finding a positive effect increases as the regional supply of skilled labor increases. Hence, the results suggest a positive connection between growth effects of the R&D grants and the regional supply of skilled labor.

The remainder of this paper is organized as follows. Section 2 discusses the background. Section 3 surveys empirical studies on the impact of innovation grants and subsidies with a focus on the regional dimension. Section 4 provides information about data and matching. The models are described in Sect. 5, and the results are outlined in Sect. 6. Finally, Sect. 7 summarizes the paper.

2 Background

There is a well-funded belief of innovation and R&D as a driver of long run economic growth (Schumpeter 1911; Solow 1957; Romer 1986; Lucas 1988; Aghion and Howitt 1998). The view of R&D as the solution to many pressing challenges spurred the development of innovation policies, wherein public R&D subsidies and grants constitute an important part of the package (OECD, Organization for Economic Co-operation and Development 2015a). One central aspect of R&D is its close connection to knowledge spillovers and its dependency of skilled labor (Akerlof 1970; Stiglitz and Weiss 1981).

As early as in the beginning of the twentieth century, Marshall (1920) argued for three factors affecting the localization decision of a firm. In short, Marshall argued for (i) access to labor and a reasonable maximum commuting distance for workers, (ii) input and output links, and (iii) spillovers that are “in the air.” The first argument is related to both the size of the local labor market and its content. What type of labor is accessible? It is well known that the comparative advantage of a region depends on the regional supply of production factors. In regard to innovation and R&D, local access to a well-educated labor force is instrumental (Dosi 1988; Feldman 1994a; Fujita et al. 1999), suggesting that the geographical distribution of innovative activities is interdependent with the distribution of skilled labor. The close connection between the prospects of successful R&D and the local supply of skilled labor is further supported by questionnaires, where the typical result is that one of the most important factors determining firms’ localization decisions is access to qualified workers (UNCTAD 1997).

The importance of the local environment is further strengthened when we consider the influence of input-output linkages. Today, the interplay between input-output linkages, transportation costs, and scale effects, as vehicles for clustering and agglomeration, is formalized in the new economic geography (Fujita et al. 1999; Krugman 1991). Innovative firms are dependent on new knowledge, and most knowledge has a geographical dimension that makes it easier to transport between individuals and firms who are physically close. Dosi (1988) presents “five stylized facts” that help explain why knowledge spillovers are geographically bounded. Dosi’s arguments have been further developed by Feldman (1994a, b) and Baptista and Swann (1998). Marjolein (2000) contributes to this literature with both theoretical arguments and an empirical overview regarding the local nature of knowledge. Hence, it is widely accepted that knowledge will spread, whether the owner wants it to or not, and that geographical closeness eases knowledge transfers. In summary, this branch of literature suggests that firms in knowledge-intensive industries benefit from a locally abundant supply of skilled labor and from the spillovers effects associated with innovative activities.

The system approach provides us with an additional explanation of why regions matter for innovation. This line of thinking stresses the importance of cooperation and of links between industry, government, and academia. Today, we lack an exact and commonly agreed upon definition of what a regional innovation system really is, but it can be said to be a collection of organizations, institutions, firms, and individuals among whom the creation, use, and distribution of new knowledge occur (Cooke 2004). Regardless of which definition we choose, the regional innovation system comprises all clusters of firms, as well as the institutional structures and rules that surround them. Within the system perspective, several arguments can be found to support the use of an active innovation policy (Asheim et al. 2011; Asheim and Gertler 2006; Cooke 2001; Cooke 2004; Doloreux and Parto 2005; Tödtling and Trippl 2005). A key component here is the central role played by skilled labor. That is, for innovation to take place, access to skilled labor is essential. Given this, surprisingly few studies have analyzed the relation between the outcome of selective R&D incentives and the local supply of skilled labor.

With the system perspective in mind, it becomes relevant to discuss possible interaction effects between the impact and efficiency of innovation grants and the local environment. We suggest that the likelihood that a R&D grant will generate positive growth effects is positively correlated with the local pool of skilled labor. That is, a larger local pool of skilled labor increases the possibility of finding the skills required by the firm, and also increases the related spillover effects.Footnote 2 To determine whether this suggestion is supported by real-world data, we will in subsequent chapters perform a difference-in-differences analysis in order to analyze the linkages between the growth effects of R&D grants and the relative size of the local labor pool that has tertiary education. One may note that while agglomeration factors generate clustering of skilled labor we do not intend to analyze drivers of agglomeration but rather take the local supply of skilled labor as given.Footnote 3

3 Empirical studies with a regional focus

The aim of this study is to, with special attention to the local supply of human capital, determine whether the effects of innovation grants differ among regions. Even though the role of the local supply of human capital has not been in focus in the mass of previous studies on innovation subsidies, regional variation per se has been studied in a series of papers, suggesting a number of interesting observations. To be precise, there are two sets of studies with a regional focus, one larger set dealing with regional grants which often has investment and employment in focus rather than innovation, and one smaller set of papers with a regional innovation focus. We hope to contribute to the latter.

In an influential paper, Baptista and Swann (1998) show that firms located in strong clusters tend to innovate more, where the strength of a cluster is measured in own-sector employment. Moreover, there is a number of studies indicating that the quality of the regional innovation system affects both the probability of innovation within firms and knowledge transfers across firms (Asheim et al. 2011; Cooke 2004; Doloreux and Parto 2005; Tödtling and Trippl 2005; Srholec 2010). This line of reasoning is consistent with the finding that in Finland, half of all R&D is conducted in the capital city, Helsinki, and that four regions are responsible for almost 80% of all R&D in Finland. A similar pattern holds true for the USA, where ten areas contribute to two thirds of all R&D activity in the country (Georghiou et al. 2003). It is, therefore, interesting to note that just as R&D activities, innovation subsidies and grants are not distributed evenly across regions. The probability of receiving innovation support is larger for a firm located in a central area compared to a peripheral area (Czarnitzki and Fier 2002; Gonzalez et al. 2005; Herrera and Nieto 2008). Moreover, based on the argument that technology is path-dependent, evolutionary economic geographers argue that the pre-existing routines and competences of institutions, firms, and labor in well-developed regions determine what kind of innovations they generate (Boschma and Martin 2007). In addition to this, the probability that a new industry enters a region increases with the number of pre-existing related industries in the region (Hidalgo et al. 2007; Neffke et al. 2011; Boschma et al. 2013; Boschma et al. 2015).Footnote 4

A limited number of studies have investigated regional variations in the effects of innovation subsidies. For Italy, Banno et al. (2013) find that policies intended to stimulate R&D generate larger economic profits in regions that are relatively more internationalized than in remote regions. Similarly, Herrera and Nieto (2008) divide Spain into central and peripheral regions. Their analysis shows that the effects of R&D subsidies are larger in two out of three central regions compared to the rest of the country. Focusing on the importance of knowledge capital, Piekkola (2007) finds that growth from R&D subsidies is concentrated in regions that have a high level of knowledge capital to begin with.

Although it may seem like regions have a vital impact on the innovative activities of firms, some studies argue against this. One such example is Doloreux (2004), who conducts telephone interviews with small- and medium-sized Canadian firms. The results indicate that the R&D patterns within firms are the same across several Canadian regions. Moreover, most firms stated that they use national and global knowledge sources when innovating, and they downplayed the importance of the regional structure. Isaksen and Onsager (2010) reach a similar conclusion in their study of Norway, where they find that rural areas and smaller cities have a larger proportion of innovating firms compared to larger cities. This finding contradicts earlier research in this field. To explain their results, Isaksen and Onsager (2010) stress that innovation subsidies in Norway are aimed at firms in smaller cities and rural areas, as a part of Norway’s overarching policy to develop the whole country. The over-representation of targeted firm located in remote regions is therefore likely to be driven by political decisions.

In short, most empirical evidence indicates that there are differences in regard to the distribution and the effects of R&D subsidies and grants. This suggests that there are reasons to take location into consideration when forming policies around the distribution of selective public R&D subsidies and grants.

4 Data and matching

4.1 Data

Firm level data on public grants and subsidies in Sweden is collected and stored in the MISS database by the Swedish Agency for Growth Policy Analysis. The MISS database comprises information about the grant distributor and receiver, the size of the grant, and when the firm receives the payments. We link these data with yearly register data provided by Statistics Sweden (SCB) containing information on firms’ input and output, covering all firms in the economy. Hence, information about both the treated and the non-treated firms is collected from these sources.

In addition to firm level data, individual level data on workers’ education, wages, gender, and age is aggregated to the firm level and linked to firm data. Firm level and aggregated individual level data contains information on production, sales, employment, value added, investments, physical capital, profits, industry affiliation, educational attainment of the labor force, geographic location, etc., spanning the period 1997–2011. All datasets are linked using unique individual firm-year ID codes.

Out of the two analyzed programs “Win Now” and “Research & Growth,” Win Now is the smaller program directed at start-ups (firms younger than 1 year at the time of application), and its funds can be granted to SMEs that have developed a new product, method, or service that has not yet reached the market. The aim is to give start-ups a chance to survive in the market by providing financial aid during the commercialization process, which is intended to attract external capital and make the business successful in the future. Hence, future growth is one of the main purposes of the grant. However, the timeframe for achieving growth is not specified. Half of the granted amount should be allocated to business development, while the other half can be used for R&D activities. A total of 1309 firms applied for Win Now, and approximately 10% received support. Win Now has been granted 125 times during the period under study (2002–2010), and the average grant was 164,847 SEK ($18,458). A firm is only granted the subsidy once, and the maximum amount awarded is 300,000 SEK ($33,592). Win Now can also be seen as a springboard to its sister program Research & Growth, targeting slightly older firms.Footnote 5

The subsidy program Research & Growth targets small- and medium-sized innovative firms supporting developing projects, but support may also be awarded to pilot studies. Approximately 20% of the applicants were granted support, and the recipients consist mostly of SMEs that are already on the market. The purpose of Research & Growth is to support and promote innovation-driven growth within the subsidized firms. In all, the program provided 546 grants during the studied period (2005–2010), with an average grant of 543,321 SEK ($60,836). The project time is normally between 6 and 18 months.

Earlier empirical studies of the two programs Win Now and Research & Growth have produced mixed results. Some studies have found that they yield growth in employment and sales, while others have found negative outcome in, for example, employment, and productivity (Söderblom et al. 2015; Daunfeldt et al. 2016; Vinnova 2014). The different outcomes in these studies may be due to differences in empirical strategy, discussed in Daunfeldt et al. (2016).

The innovation grants analyzed here are distributed to firms in cities as well as rural areas. In Table 1, all Swedish regions and municipalities are divided into three different groups: Big Cities, Support Areas A&B, and Other Areas. This division is only used to provide an overview of the regional division of the grant sums. When carrying out the empirical analysis, the regions considered are the 60 Swedish functional labor market regions. The idea with the functional labor market regions is that most of the home-to-work commuting takes place within the region rather than across the borders. In addition, the labor market region should not be larger than it should be possible to, on a daily basis, commute between any two points within the region. For descriptive purposes, we choose to characterize Sweden in three dimensions, from dense city regions to rural areas. The first category, Big Cities, contains the three largest cities in Sweden: Stockholm, Gothenburg, and Malmo. The second category, Support Areas A&B, includes particularly vulnerable regions in Sweden. Vulnerable areas are those that have the right to apply for regional support.Footnote 6 The third and final group, Other Areas, comprises the remaining in-between regions in Sweden.

As seen in Table 1, both the size of the average grant and funding per employee is largest in the Big Cities. There is a tendency to give more grants to firms in large cities compared to other firms, which is consistent with the internationally observed pattern regarding the distribution of R&D grants.

As noted above, the supply of skilled workers is a key component of innovation and growth. To measure the regional supply of high-skilled labor empirically, we construct a regional index. This index-variable is constructed as a revealed comparative advantage index (RCA-index), where a value above one indicates that a region is above the country average and vice versa. To simplify the interpretation of our regression variables, this index will be centered around zero in our analysis, and thus, a value above (below) zero will indicate that a region is above (below) the country average.Footnote 7 The measure of the relative supply of high-skilled labor is as follows:

where the first term describes the share of high-skilled labor in the region, and the second term describes the share of high-skilled labor in the country. The use of RCA-indices is common within the international trade literature, starting with Balassa (1965). In our setting, we might note that the RCA-index captures the relative concentration of skilled labor rather than factors behind this clustering. That is, from the governmental project coordinator perspective, when allocating grants, the spatial distribution of firms and human capital is taken as given.Footnote 8

Table 2 reveals a clear picture of the distribution of skilled labor across regions in Sweden: skilled labor is concentrated in the large cities, whereas the opposite is true for the (rural) areas granted regional support measures. The RCA-index (based on 60 labor market regions) and firm level variables, sources, mean values, and standard deviations are described in Table 3.

4.2 Matching

As noted above, the R&D grants have both a specific purpose and are targeting a specific population of firms; hence, grants are not randomly distributed across firms. This, in turn, leads to the question of how to create a control group of similar firms. To handle this selection problem, we use coarsened exact matching (CEM) to create a control group of non-treated firms that, in all relevant aspects, are as similar as possible to the firms receiving grants. As shown by Coberly et al. (2011), CEM matching usually outperforms both propensity score matching (PSM) and Mhalanobis distance matching (MDM) in terms of reducing the imbalance between the treatment and control group. The combination of its intuitive approach, good statistical properties, and easy-to-use has made CEM matching increasing popular in applied empirical work. For recent applications of this matching method, see Croce et al. (2013), Cumming et al. (2017), and Grilli and Murtinu (2014).Footnote 9

The matching is based on variables that are relevant for both program participation and program outcomes, and the key idea is that all matching variables should be as similar as possible between the control and treatment groups. Unlike PSM, CEM does not estimate the probability of being treated, but instead it coarsens variables into strata and puts different weights on the control firms depending on how close they are to the treated firms (Iacus et al. 2011, 2012). Detailed descriptions of CEM can be found in Blackwell et al. (2009) and Iacus et al. (2011, 2012). The matching performed in this paper is a so-called one-to-one matching, which yields one control firm for each treated firm. Consequently, we do not need to take matching weights into consideration to adjust for differences in the number of observations between the treated and control groups. For each of the treated firms, we match on firm properties 1 year before the treatment, (t − 1), with t being the year a firm receives a grant (Caliendo and Kopeinig 2008). Firms receiving multiple R&D subsidies have been removed from the sample.

Results from the matching are presented in Table 4. As noted by Iacus et al. (2011, 2012), the value of the imbalance test is subordinate to the change in imbalance as given by matching. As shown in Table 4, matching reduces the imbalance for all variables, suggesting that matching leads to a control group that is more similar to the treatment group than to the collection of all non-treated firms.

Table 5 displays the matching results when the region of the treated firm is added as an (exact) matching variable, forcing the control firm to be in the same region as the treated firm. This creates a perfect balance between the treatment group and the control group on the regional variable. Having the “twin” firm located in the same region as the treated firm removes the possibility that subsequent changes in the development of the treated and control firms is due to location. We may also note that matching results from this matching strategy correspond strongly to the matching results presented in Table 4, where no geographical concern was included in the matching. However, forcing the control firm to be located in the same region as the treated firm reduces the number of matched pairs, which is seen when comparing the lower panels of Tables 4 and 5.

Finally, Table 6 provides the mean values of our outcome variables—employment, sales, and labor productivity—divided into six categories. The outcome variables are reported for all firms, treated firms, treated firms before treatment, treated firms after treatment, firms in the control group (original match), and firms in the control group when we include region as a matching variable. Here, we note that subsidized firms have slightly different mean outcome values before and after treatment and that there are some initial differences in the mean outcomes comparing the subsidized and control firms.

5 Models

5.1 Model specifications

As noted above, a main purpose of the analyzed grants is to promote growth and competitiveness in targeted firms, whereas the type of growth desired is less clear. To tackle this problem, we analyze the effects of the R&D grants on a set of outcome variables capturing various aspects of firm growth and competitiveness. More specifically, we will analyze how the grants impact employment, sales, and labor productivity. As pointed out by Delmar et al. (2003), employment represents an input variable and a measure of growth in resources, while sales represents an output variable and a measure of the acceptance of the product or service in the market. Combined these measures are closely related to labor productivity making it interesting to analyze these aspects of competitiveness.Footnote 10

In the analysis, we estimate matched differences-in-differences (DID) regressions and, as a robustness test, we employ fixed-effects (FE) regressions on treated firms only. Hence, while the first method seeks to analyze the performance of the treatment group vs. a set of similar firms that did not receive any R&D grants, the latter method seeks to detect trend breaks in firm development at the time of or after receiving the grants. The model specifications are chosen based on the existing literature in each respective area. Because the choice of model is central to the analysis, we will present each model in more detail.

5.2 Labor demand

The labor market literature is relatively clear on the specification of the employment model. A firm’s demand for labor is derived from the production function where firms, for a given set of factor prices, decide on the combination of input factors that are consistent with profit maximization (Hijzen and Swaim 2008). Furthermore, we allow for the adjustment costs of the labor force. Adjustment costs are handled by including a dynamic lag of the number of employees as an explanatory variable (Cahuc and Zylberberg 2004), thus shifting the analysis toward a dynamic panel data model specification (Angrist and Pischke 2008). To handle the endogeneity problem associated with a lagged dependent variable as an explanatory variable, we apply Han and Phillips’ (2010) dynamic panel estimator. Compared to the commonly used GMM-estimators that rely on the absence of second order autocorrelation in the residual and a properly specified instrument matrix (Arrelano and Bond 1991; Blundell and Bond 1998), the Han and Phillips (2010) estimator tackles the endogeneity problem through its differencing design. The Han and Phillips (2010) estimator is known for having good short panel properties and avoiding much of the weak moment condition problem that is known to affect conventional GMM estimation when the autoregressive coefficient is near unity. Thus, to evaluate the effects of public R&D grants on employment, we estimate the following augmented labor demand model:

where βl reflects the effect from the number of employees in the previous period (lit − 1) and implicitly depends on the size of the adjustment costs, wit is wage in firm i and year t, and y is value added, treatment is a dummy for the year the firm receives the grant, whereas post captures the post treatment period. Regional differences in the supply of skilled labor are captured by the RCA-index RCA, where a value above zero indicates that a region has a relative abundance of skilled labor. Hence, the interaction between the regional supply of skilled labor and the treatment indicators captures asymmetric effects in how the grants impact firm performance in different regions. To control for firm-specific human capital and profitability (variables that may impact innovation, firm performance, and the likelihood of receiving support), the model is augmented with firms’ profit ratio π and the share of the labor force with tertiary education (skill-share); firm- and -year fixed effects are captured by υi and γt, respectively, and finally, εit is the error term.

5.3 Sales

Two commonly used measures when analyzing firm growth are number of employees and sales. Number of employees represents an input variable and a measure of growth in resources, while sales represents an output variable and a measure of the acceptance of the product or service in the market (Delmar et al. 2003). For input variables, it is reasonable to expect positive effects for firms receiving a grant. However, the effect on output variables is unclear (Gustafsson et al. 2016). How sales are affected by the R&D grants can also be influenced by the fact that the subsidy program descriptions state future sales growth as a relevant key variable. Hence, following the commonly applied Cobb-Douglas production function approach, the augmented sales model takes the following form (Felipe and Gerard Adams 2005):

where we have the same set of fix-effect, regional-, and treatment indicators as in Eq. (2), but note that the dependent variable here, sales, is represented by Sit, K is the firm capital stock, L is the employment, and finally, R&D is the firm level R&D-intensity.

5.4 Labor productivity

As a complementary measure to employment and sales, we look at labor productivity, which can be seen as a combination of the relative impact of the grants on employment and production. To study labor productivity effects, we follow Griliches (1986) to obtain the following augmented labor productivity (Lp) model:

where βk/l is a measure of the productivity elasticity with respect to the capital intensity in the firm. The coefficient for number of employees, βl, is a scale indicator; if βl = 0, this is a sign of constant returns to scale, βl > 0 and (βl < 0) signal increasing (decreasing) returns to scale, respectively.Footnote 11

6 Results

6.1 Overview of results

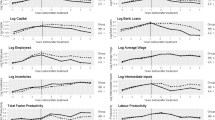

An overview of the sign and significance of the treatment and post-treatment effects is depicted in Table 7, and a corresponding overview of the results from our robustness checks can be found in Table 8. Table 9 in the Appendix contains the basic results on how the R&D grants impact our three outcome variables: employment, sales, and labor productivity and shows the effects from both matched DID estimations and FE estimations on treated firms only. In this paper, our focus will be on the DID results because these can be considered more precise, but as we will observe, the results from the DID estimations and the more naive fixed effects estimations are rather similar, which we interpret as a sign of robustness of the results. The key results are depicted in Figs. 1, 2, and 3 and summarized in Table 7, where the treatment period corresponds to periods when the grant is paid out to the receiving firm, and the post-treatment period corresponds to the period after which the firm no longer receives support. We may also note that the first set of CEM matched regression results presented is based on a matching where we are not forcing the “twin” firm to be located in the same labor market region as the treated firm.Footnote 12 Hence, in these first estimates, we cannot exclude the possibility that a part of the treatment effect can be influenced by regional differences in the location of treated and control firms. In subsequent regressions, this matter will be examined in more detail.Footnote 13

Marginal effects on employment. Notes: All figures are constructed with non-clustered standard errors. The confidence intervals regarding the employment effects are only correct for RCA-index = 0. The figures are based on CEM matched DID estimations from Table 9

Marginal effects on sales. Notes: All figures are constructed with non-clustered standard errors. The figures are based on CEM matched DID estimations from Table 9. Due to technical limitations in retrieving marginal effects at different percentiles when using clustered standard errors, estimates, depicted in Figs. 2 and 3, are based on non-clustered standard errors.

Marginal effects on labor productivity. Notes: All figures are constructed with non-clustered standard errors. The figures are based on CEM matched DID estimations from Table 9

6.2 Effects on employment

A goal prioritized by the government is to generate new jobs. Hence, employment is one of the analyzed outcome variables. However, as shown in Table 7, there are no statistically significant employment effects of the analyzed grants. That is, we do not find evidence of a direct employment effect of the grants at the time of the payment, nor in the post-treatment period. What should be noted is that the estimated direct effect represents the average effect across all regions. To uncover the potential heterogeneity of the impact of the R&D grants, we turn to the interaction between the received grant and regional characteristics. Studying the regional interaction, the first thing to note is that the estimate is positive but not statistically significant, suggesting a positive relation between employment that is not significant at the midpoint of our sample (RCA-index = 0), as illustrated in Fig. 1 and given by the estimates in Table 9.

When interpreting the above result, we note that the estimated coefficient reflects the mid-point estimate and does not reveal the marginal effect of the grants at the endpoints of the distribution. The full cross-regional variation in the impact of the R&D grants is illustrated in Fig. 1, suggesting a varying effect across our 60 labor market regions that goes from a negative and significant effect in regions at the low end of the human capital supply ranking to a positive and significant effect in the regions with the most abundant human capital (during the period when the grant is paid out). For the post-treatment effect, however, the estimate never becomes positive and significant as we move toward more skill-abundant regions. This spread in marginal effects is an example of how information can be hidden behind the average effect. We also note that the results discussed here are based on CEM-matching without forcing the treated and control firm to be located in the same region. Hence, if there are systematic differences in the locations of treated and control firms, not controlling for location may impact the estimates of the treatment effect. In subsequent regressions, we will analyze whether controlling for location upsets the results.

6.3 Effects on sales

Together with employment, sales are a commonly applied indicator of firm growth. If firms are able to increase their efficiency, sales can be increased without a matched increase in the labor force. The results from the sales regressions are given in columns 2 and 5 in Table 9, and the regional distribution of the marginal effect (matched DID estimates) is depicted in Fig. 2. Figure 2 reveals a series of interesting observations. First, at the time of the treatment, there is a tendency of a negative drift in sales, and the negative effect is largest in regions with abundant human capital. One possible explanation for this result is that the grant triggers investment, which leads to a temporary reallocation of productive resources from production to investment activities; this effect may be largest in human capital-abundant regions. However, when we move from the period of treatment to the post-treatment period, the picture is reversed. After the treatment period (after which the grant has been paid out), we find a negative and significant effect on sales for firms in regions with a relatively small share of high-skilled workers and a positive but not significant effect for firms in regions with an abundance of high-skilled workers. We may note that this post-treatment pattern is consistent with the hypothesis that the largest investments take place in firms located in human capital-abundant regions, leading to more positive sales development in subsequent years.

6.4 Effects on productivity

The impact of the grants on productivity can be seen as a weighted employment and sales effect. As noted above, the effect of the grants on employment and sales was negative during the treatment period, although not significant for employment. Hence, expectations for labor productivity are not obvious. Looking at the DID results in Table 9, the direct effect of the grants is negative but not significant, both during and after the treatment.

The regional spread in labor productivity effects is illustrated in Fig. 3, which indicates no significant treatment effects in any type of region during the treatment. However, for the post-treatment period, we note that in line with the findings for sales and employment, a more positive (or less negative) productivity effect is found in regions with an abundance of high-skilled workers. To be precise, as we move from the least to the most skill-abundant region, the post-treatment effect on labor productivity goes from negative and significant to barely positive and significant in the most skill-abundant regions. Hence, the probability of a positive post-treatment effect on sales, employment, and productivity is highest in skill-abundant regions. These results are, to some extent, consistent with earlier studies that found the most positive effects of similar grants in central rather than rural regions (Banno et al. 2013; Herrera and Nieto 2008; Piekkola 2007). This result allows us to speculate whether it may be the lack of high-skilled workers that puts growth restrictions on innovative SMEs in regions with a low RCA-skill index. However, because firm location is not included as a matching variable in these regressions, we at this stage cannot rule out the possibility that these results may be driven by a systematic difference in location between treated firms and the control group. In the subsequent section, we will take a closer look at the robustness of these results when controlling for firm location.

6.5 Robustness checks

The analysis above does not guarantee a complete separation of the effect of being localized in a specific labor market region from the effect of the grant. To rule out the possibility of location-driven bias, we redo our matching and include regions as an exact matching variable, forcing the control firm to be localized in the same labor market region as the treated firm. Hence, any differences in results between Tables 9 and 10 signal a locational selection bias in Table 9 where we do not force the matched firm to be located in the same labor market region as its matched twin firm.

Studying the summarized results Table 8, we find that the results before and after matching on region are quite similar; when there is a significant effect in Table 8, we always find a corresponding effect in Table 7 in both sign and (approximately) size. Consequently, forcing the control firm to be located in the same local labor market region as the subsidized firm does not significantly alter the results. These observations lead us to two noteworthy results. First, matching on location does not impact the overall instantaneous effect or the post-treatment effect. The grants have, considered over all regions, no significant post-treatment effect on employment, sales, or productivity. However, an immediate dip in sales and labor productivity can be found. Secondly, turning to the regional dimension, starting with the regional distribution of the instantaneous effect, we find no significant midpoint interaction effects. For the post-treatment period, however, we find a positive interaction between the regional supply of skilled labor and receiving a grant on sales and productivity. This significant interaction suggests that grants have a more positive post-treatment effect on firms located in human capital-abundant regions than in other regions. Given that the treated and control firms are in the same region, this asymmetry can occur if the agency administrating the grants is systematically targeting more successful firms in human capital-abundant regions compared to other regions.

We may also consider the possibility that receiving a grant generates a temporary competitive advantage. Given that the prospects of growth for innovative SMEs are likely to be better in human capital-abundant regions than in other regions, the marginal return is also likely to be higher in human capital-abundant regions. Hence, given that we ignore distributional issues and potential distortions caused by the grants and focus on growth in targeted firms, the results suggest that if firm growth is the primary goal of the program, R&D grants focused on innovative SMEs tend to generate the largest growth effects when they are given to firms located in human capital-abundant regions.

As an additional robustness test, we re-estimate the models in columns 1–3 in Table 9 using spell-fixed post-treatment periods. The results from these additional robustness checks are presented in Table 11 and fixed to 2 respectively 3 years after treatment. The estimated effects almost exactly correspond to the estimated post-treatment effects in Table 9. Hence, we conclude that following the treated firms for a fixed post-treatment period, in comparison to following each treated firm for all available post-treatment years, yields similar results for all outcome variables. This further strengthens our belief in the results found above.

7 Conclusions

The central question discussed in this paper is whether the effects of public innovation grants to private firms vary depending on firm location and the surrounding environment. Why regions matter for the success of different industries has been discussed by, for example, Marshall (1920), Asheim et al. (2011), Cooke (2001), and Tödtling and Trippl (2005). A common feature of these studies is that they all agree that regional context matters for firm location and growth; i.e., there is interdependence between firm performance and the surrounding environment. In this vein, it is well known that access to skilled labor is crucial for the innovation and development of innovative SMEs, or, as noted by Kunz (2014) regarding the US situation: “A common complaint from 21st century manufacturers is having access to a skilled workforce, …, Currently, nine out of ten manufacturers are having difficulty finding skilled workers, and they say this is directly hurting the bottom line.”

This paper analyzes one dimension of how the regional supply of skilled labor influences the prospects of firm growth by examining local abundance of skilled labor and regional variation in relation to the impact of public R&D grants targeting innovative SMEs. Specifically, we analyze the effects of two R&D subsidy programs on firms’ employment, sales, and labor productivity and how the impact of these grants co-varies with the regional relative supply of skilled labor. Hence, potential drivers behind the clustering of human capital are not analyzed.

We divide the results into the impact during and after the treatment. During the treatment period when the firms are receiving financial support, we find a significant and negative effect on sales and a non-significant treatment effect on firm employment and labor productivity. The negative effect on sales in the treatment period could be associated with within firm reallocation effects when the R&D grant is received. One can, for example, consider an investment that for a transitional period of time leads to a reallocation of resources from production to investment related activities. After the treatment period has ended, there is no evidence of any significant effects on sales, employment, and labor productivity.

Adding the regional dimension to the analysis, we find that the effect of the grants differs across regions. In the treatment period, the employment effect goes from negative and significant to positive and significant whereas sales develop in the opposite direction. For labor productivity, the effect is non-significant for all type of regions. In the post-treatment period, the pattern is clear. For both sales and productivity, we find a positive drift as we move from the least to the most skill-abundant labor market region. To be precise, the marginal effect of the grant goes from negative and significant to positive and significant as we move from the least to the most skill-abundant region. For employment, there is a less clear positive trend with mostly insignificant employment effects.

In conclusion, the treatment effect of the analyzed innovation grants can be negative for firms in some regions, not significant in others, and significantly positive for firms in the most human capital-abundant regions. Hence, the findings of this paper indicate that the better regional surroundings a firm faces, in terms of human capital-abundance, the higher is the probability that the recipient of an R&D grant will show positive growth effects after receiving a grant. Accordingly, with the firm growth focus of this paper in mind, these results yield the following policy implication. If the aim is to maximize the growth effects of public R&D grants, it can be counterproductive to distribute R&D grants too evenly across regions. However, the policy-maker may have other reasons for distributing R&D grants than to maximize the growth effects that justify an equal spread of grants across regions. One may also note that regions have different comparative advantages, implying that regions less suited for R&D-intensive activities may be better suited for other type of activities.

Overall, our finding that better regional surroundings in terms of human capital-abundance increase the probability of positive growth effects from publicly founded R&D and innovation grants makes intuitive sense and is also consistent with findings of earlier literature suggesting that R&D grants generate larger effects in central rather than rural regions (Banno et al. 2013; Herrera and Nieto 2008; Piekkola 2007).

Notes

The relative richness of micro-level data and strong focus on grants rather than R&D subventions makes Sweden a proper instrument for analyzing growth effects from publicly sponsored innovation targeted grants.

That is, we take the local supply of skilled labor as given. To change the local supply of skilled labor is a question more connected to education policies than the allocation of public R&D grants targeting SMEs.

The reason for this approach is that when allocating grants, the local industrial structure can be seen as predetermined and externally given.

The strategic package relation between “Win Now” and “Research & Growth” is one reason for why these programs are jointly evaluated. In addition, these programs have also been analyzed, jointly as well as individually in Daunfeldt et al. (2016) suggesting that they to some extent can be seen as a package. Finally, at the time for this analysis, these programs were probably the most innovation and growth focused public support programs in Sweden.

For information on the Swedish regions eligible to apply for regional support, see: http://www.tillvaxtverket.se.

With centralized interaction variables, we can evaluate the direct effect of a grant as what happens when the RCA-index is zero, that is, when we evaluate the effect at the mean.

The RCA-index is, however, not unproblematic. For example, Hinloopen and Van Marrewijk (2001) observed that the average value for the RCA-index typically was greater than one and that this result is an outcome of the chosen specification of the index. Hoen and Oosterhaven (2006) suggest an additive RCA index, centered around zero. Additional attempts to characterize comparative advantages includes Michelaye index that range from − -1 to 1. In the econometric analysis, we re-balance the RCA-index to be centered around zero, which to some extent also deals with the average value problem discussed above. We may also note that the RCA-index has been criticized by Yeats (1985), who found that the index was not reliable as a cardinal or ordinal index in a cross-country comparison. Further attempts to modify the RCA-index have been carried out by, for example, Hoen and Oosterhaven (2006), Yu et al. (2009), and Bebek (2011).

Two critical assumptions behind the matching is unconfoundedness, which in essence means that after the matching process, assignment to treatment can be seen as random, and ignorability that presumes that the treatment variable is independent of the potential outcomes Tiv{Yi(0), Yi(1)}Xj. In non-experimental set-ups, these assumptions cannot be directly tested, but researchers have instead developed sensitivity analyses to assess their plausibility (Luna and Lundin 2009; Imbens 2004; Rosenbaum 2002). We note that both assumptions hinges on access to detailed information on the objects of concern. In this vein, we note that the dataset used here is fairly rich, allowing us to apply the relevant matching variables. In addition, the analysis is based on FE-estimations eliminating time invariant unobserved fixed effects. Lastly, as a robustness test, we in subsequent regressions estimate models using different matching set-ups as well as FE-models on treated only (ATT), resulting in similar results. This is interpreted as an indication that the results are robust w.r.t. the method of choice.

Hence our focus is more a real side analysis than a study of the financial aspects, which we leave for future research.

The reason for not using a dynamic model specification is that the non-dynamic formulation is more frequently used when labor productivity is evaluated (Chansarn 2010).

There is a total of 60 labor market regions, defined such that most of the work-home commuting takes place within the region and that it is possible to commute between “any two points” in each region.

We also note that the RCA-index captures relative local supply of human capital, whereas potential drivers behind this clustering are left aside. An interesting route for future research is therefore to continue and analyze drivers of the clustering of human capital.

References

Acs, Z. J., & Audretsch, D. B. (1988). Innovation in large and small firms: an empirical analysis. American Economic Review, 78, 678–690.

Aghion, P., & Howitt, P. (1998). Endogenous growth theory. Cambridge: MIT Press.

Akerlof, G. A. (1970). The market for “lemons”: quality uncertainty and the market mechanism. Quarterly Journal of Economics, 84, 488–500.

Angrist, J. D., & Pischke, J.-S. (2008). Mostly harmless econometrics: an empiricist’s companion. Princeton: Princeton University Press.

Arrelano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Econometric Studies, 58, 277–297. https://doi.org/10.2307/2297968.

Asheim, B. T., & Gertler, M. (2006). The geography of innovations: regional innovation systems. In J. Fagerberg & D. C. Mowery (Eds.), The Oxford handbook of innovation (pp. 291–317). Oxford: Oxford University Press. https://doi.org/10.1093/oxfordhb/9780199286805.003.0011.

Asheim, B. T., Lawton Smith, H., & Oughton, C. (2011). Regional innovation systems: theory, empirics and policy. Regional Studies, 45(7), 875–891. https://doi.org/10.1080/00343404.2011.596701.

Balassa, B. (1965). Trade liberalisation and ‘revealed’ comparative advantage. The Manchester School, 33(2), 99–123. https://doi.org/10.1111/j.1467-9957.1965.tb00050.x.

Banno, M., Morandi, V., & Amorim, C. (2013). Public policy for innovation and internationalization: are they worth it? Applied Economic Letters, 20(10), 927–930. https://doi.org/10.1080/13504851.2013.765535.

Baptista, R., & Swann, P. (1998). Do firms in clusters innovate more? Research Policy, 27, 525–540. https://doi.org/10.1016/s0048-7333(98)00065-1.

Bebek, U. G. (2011). Consistency of the proposed additive measures of revealed comparative advantage. Economics Bulletin, 31(3), 2491–2499.

Blackwell, M., Iacus, S. M., King, G., & Porro, G. (2009). CEM: coarsened exact matching in Stata. Stata Journal, 9(4), 524.546.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 11–143. https://doi.org/10.1016/s0304-4076(98)00009-8.

Boschma, R., & Martin, R. (2007). Editorial: constructing an evolutionary economic geography. Journal of Economic Geography, 7(5), 537–548. https://doi.org/10.1093/jeg/lbm021.

Boschma, R., Minondo, A., & Navarro, M. (2013). The emergence of new industries at the regional level in Spain: a proximity approach based on product relatedness. Economic Geography, 89(1), 29–51. https://doi.org/10.1111/j.1944-8287.2012.01170.x.

Boschma, R. A., Balland, P. A., & Kogler, D. F. (2015). Relatedness and technological change in cities: the rise and fall of technological knowledge in US metropolitan areas from 1981 to 2010. Industry and Corporate Change, 24(1), 223–250. https://doi.org/10.1093/icc/dtu012.

Bronzini, R., & Iachini, E. (2014). Are incentives for R&D effective? Evidence from a regression discontinuity approach. American Economic Journal: Economic Policy, 6(4), 100–134. https://doi.org/10.1257/pol.6.4.100.

Cahuc, P., & Zylberberg, A. (2004). Labour economics. MIT-press.

Caliendo, M., & Kopeinig, S. (2008). Some practical guidance for the implementations of propensity score matching. Journal of Economic Surveys, 22(1), 33–72. https://doi.org/10.1111/j.1467-6419.2007.00527.x.

Cappelen, Å., Fjærli, E., Iancu, D.-C., Klemetsen, M., Moxnes, A., Nilsen, Ø. A., Rakneru, A., & Rybalka, M. (2016). Innovasjons- og verdiskapningseffekter av utvalgtenaeringpolitiske virkemidler, report 2016/12. Statistics: Norway.

Chansarn, S. (2010). Labor productivity growth, education, health and technological progress: a cross-country analysis. Economic Analysis & Policy, 40(2), 249–261. https://doi.org/10.1016/s0313-5926(10)50027-4.

Cin, B. C., Kim, Y. J., & Vonortas, N. S. (2017). The impact of public R&D subsidy on small firm productivity: evidence from Korean SMEs. Small Business Economics, 48, 345–360. https://doi.org/10.1007/s11187-016-9786-x.

Coberly, C., King, G., Nielsen, R., Pope, J. E., & Wells A. (2011). Comparative effectiveness of matching methods for causal inference, Mimeo, Copy at http://j.mp/2nydGlv

Cooke, P. (2001). Regional innovation systems, clusters, and the knowledge economy. Industrial and Corporate Change, 10(4), 945–974. https://doi.org/10.1093/icc/10.4.945.

Cooke, P. (2004). Evolution of regional innovation systems: emergence, theory, challenge for action. In: Cooke, P., Heidenreich, M., Braczyk, H-J (Eds) (2004). Regional innovation systems: the role of governances in a globalized world, 1–18. London: Routledge.

Criscuolo, C., Martin, F., Overman, H., & Van Reenen, J. (2012). The causal effects of an industrial policy. IZA DP, No. 6323. https://doi.org/10.3386/w17842.

Croce, A., Marti, J., & Murtinu, S. (2013). The impact of venture capital on the productivity growth of European entrepreneurial firms: ‘screening’ or ‘value added’effect? Journal of Business Venturing, 28(4), 489–510. https://doi.org/10.2139/ssrn.1705225.

Cumming, D., Grilli, L., & Murtinu, S. (2017). Governmental and independent venture capital investments in Europe: a firm-level analysis. Journal of Corporate Finance, 42, 439–459. https://doi.org/10.2139/ssrn.2294746.

Czarnitzki, D., & Fier, A. (2002). Do innovation subsidies crowd out private investment? Evidence from the German service sector. ZEW Discussion Papers, No. 02-04.

Daunfeldt, S.-O., Halvarsson, D., & Tingvall Gustavsson, P. (2016). Statliga innovationsstöd till små och medelstora företag – har de någon effekt? Ekonomisk Debatt, 44(1), 6–19.

Delmar, F., Davidsson, P., & Gartner, W. (2003). Arriving at the high-growth firm. Journal of Business Venturing, 18(2), 189–216. https://doi.org/10.1016/s0883-9026(02)00080-0.

Doloreux, D. (2004). Regional innovation systems in Canada: a comparative study. Regional Studies, 38(5), 479–492. https://doi.org/10.1080/0143116042000229267.

Doloreux, D., & Parto, S. (2005). Regional innovation systems: current discourse and unresolved issues. Technology in Society, 27, 133–153. https://doi.org/10.1016/j.techsoc.2005.01.002.

Dosi, G. (1988). The nature of the innovative process. In G. Dosi et al. (Eds.), Technical change and economic theory. London: Pinter Publishers. https://doi.org/10.1177/017084069001100116.

Edler, J., Cunningham, P., Gök, A., & Shapira, P. (2013). Impacts of innovation policy: synthesis and conclusions—compendium of evidence on the effectiveness of innovation policy intervention project. Nesta, 2013, June. UK.

Ellison, G., Kerr, W. R., & Glaeser, E. (2010). What causes industry agglomeration? Evidence from coagglomeration patterns. American Economic Review, 100(3), 1195–1213. https://doi.org/10.3386/w13068.

Feldman, M. P. (1994a). The geography of innovation. Boston: Kluwer Academic Press. https://doi.org/10.1007/978-94-017-3333-5.

Feldman, M. P. (1994b). Knowledge complementarity and innovation. Small Business Economics, 6, 363–372. https://doi.org/10.1007/bf01065139.

Felipe, J., & Gerard Adams, F. (2005). “A theory of production” the estimation of the Cobb-Douglas function: a retrospective view. Eastern Economic Journal, 31(3), 427–445.

Fujita, M., Krugman, P., & Venables, A. J. (1999). The spatial economy, cities, region and international trade. Cambridge, Massachusetts: MIT Press.

Georghiou, L., Smith, K., Tojvanen, O., & Ylä-Anttila, P. (2003). Evaluation of the Finnish innovation support system. 5/2013. Helsinki: Ministry of Trade and Industry.

Glaeser, E. (2008). Cities, agglomeration and spatial equilibrium. Oxford: Oxford University Press.

Gonzalez, X., Jaumandreu, J., & Pazo, C. (2005). Barriers to innovation and subsidy effectiveness. RAND Journal of Economics, 36(4), 930–949.

Griliches, Z. (1986). Productivity, R&D and basic research at the firm level in the 1970’s. American Economic Review, 76(1), 141–167.

Grilli, L., & Murtinu, S. (2014). Government, venture capital and the growth of European high-tech entrepreneurial firms. Research Policy, 43(9), 1523–1543. https://doi.org/10.1016/j.respol.2014.04.002.

Gustafsson, A., Hallman, A., Karlsson, N., & Stephan, A. (2016). The “sugar rush” from innovation subsidies: a robust political economy perspective. Empirica, 43(4), 729–756. https://doi.org/10.1007/s10663-016-9350-6.

Han, C., & Phillips, P. C. B. (2010). GMM estimation for dynamic panels with fixed effects and strong instruments at unity. Econometric Theory, 26, 119–151. https://doi.org/10.1017/s026646660909063x.

Herrera, L., & Nieto, M. (2008). The national innovation policy effect according to firm location. Technovation, 28, 540–550. https://doi.org/10.1016/j.technovation.2008.02.009.

Heshmati, A., & Lööf, H. (2005). The impact of public funds on private R&D investment: new evidence from a firm level innovation study. In Discussion papers 11862. MTT Agrifood Research: Finland.

Hidalgo, C. A., Klinger, B., Barabasi, A., & Hausmann, R. (2007). The product space conditions the development of nations. Science, 317(5837), 482–487. https://doi.org/10.1126/science.1144581.

Hijzen, A., & Swaim, P. (2008). Offshoring, labour market institutions and the elasticity of labour demand. The University of Nottingham, Research paper series, No. 2008/05.

Hinloopen, J., &Van Marrewijk, C. (2001). On the empirical distribution of the Balassa index. Welwirtschaftliches Archiv, Heft 137, Vol. 1, 1–35. https://doi.org/10.1007/bf02707598.

Hoen, A. R., & Oosterhaven, J. (2006). On the measurement of comparative advantage. The Annals of Regional Science, 40(3), 677–691. https://doi.org/10.1007/s00168-006-0076-4.

Iacus, S. M., King, G., & Porro, G. (2011). Multivariate matching methods that are monotonic imbalance bounding. Journal of the American Statistical Associations, 106(493), 345–361. https://doi.org/10.1198/jasa.2011.tm09599.

Iacus, S. M., King, G., & Porro, G. (2012). Causal inference without balance checking: coarsened exact matching. Political Analysis, 20(1), 1–24. https://doi.org/10.1093/pan/mpr013.

Imbens, G. W. (2004). Nonparametric estimation of average treatment effects under exogeneity: a review. Review of Economics and Statistics, 86(1), 4–29. https://doi.org/10.1162/003465304323023651.

Isaksen, A., & Onsager, K. (2010). Regions, networks and innovative performance: the case of knowledge-intensive industries in Norway. European Urban and Regional Studies, 17(3), 227–243. https://doi.org/10.1177/0969776409356217.

Koski, H., & Pajarinen, M. (2013). The role of business subsidies in job creation of start-ups, gazelles and incumbents. Small Business Economics, 41(1), 195–214. https://doi.org/10.1007/s11187-012-9420-5.

Krugman, P. (1991). Geography and trade. Cambridge, Massachusetts: MIT Press.

Kunz, J. (2014). SME speaks: lack of skilled workers challenges manufactures. Manufacturing Engineering Magazine, 2014, 17–18.

Lucas, R. E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22, 3–42. https://doi.org/10.1016/0304-3932(88)90168-7.

Luna, X., & Lundin, M. (2009). Sensitivity analysis of the unconfoundedness assumption in observational studies. IFAU WP, No. 2009:12.

Marjolein, C.J.C. (2000). Knowledge spillovers and economic growth. Edward Elgar: Cheltenham, UK. Northampton, MA, USA.

Marshall, A. (1920). Principles of economics (8th ed.). London: Macmillan.

Neffke, F., Henning, M. S., & Boschma, R. (2011). How do regions diversify over time? Industry relatedness and the development of new growth paths in regions. Economic Geography, 87(3), 237–265. https://doi.org/10.1111/j.1944-8287.2011.01121.x.

Nightingale, P., & Coad, A. (2014). Muppets and gazelles: political and methodological bias in entrepreneurship research. Industrial and Corporate Change, 23(1), 113–143. https://doi.org/10.1093/icc/dtt057.

OECD, Organization for Economic Co-operation and Development. (2015a). Evaluation of industrial policy: methodological issues and policy lessons, DSTI/IND(2014)3/Final. Paris: OECD.

OECD, Organization for Economic Co-operation and Development. (2015b). Labour market mismatch and labour productivity: evidence from PIAAC data. In ECO/WKP(2015)27. Paris: OECD.

Piekkola, H. (2007). Public funding of R&D and growth: firm-level evidence from Finland. Economics of Innovation and New Technology, 16(3), 195–210. https://doi.org/10.1080/10438590600661897.

Romer, P. M. (1986). Increasing returns and long-run growth. Journal of Political Economy, 94, 1002.

Rosenbaum, P.R. (2002). Observational studies, 2nd ed. Springer: New York.

Rutkowski, J. (2007). From the shortage of jobs to the shortage of skilled workers: labor markets in the EU new member states. IZA DP. 3202.

Schumpeter, J. (1911). Theorie der wirtschaftlichen Entwicklung, Redvers Opie (1934). The theory of economic development. Cambridge: Harvard University Press.

Shane, S. (2009). Why encouraging more people to become entrepreneurs is bad public policy. Small Business Economics, 33(2), 141–149. https://doi.org/10.1007/s11187-009-9215-5.

Solow, R. M. (1957). Technical change and the aggregate production function. Review of Economics and Statistics, 39(3), 312–320.

Srholec, M. (2010). A multilevel approach to geography of innovation. Regional Studies, 44(9), 1207–1220. https://doi.org/10.1080/00343400903365094.

Stiglitz, J., & Weiss, A. (1981). Credit rationing in markets with imperfect information. American Economic Review, 71(3), 393–410.

Söderblom, A., Samuelsson, M., Wiklund, J., & Sandberg, R. (2015). Inside the black box of outcome additionality: effects of early-stage government subsidies on resource accumulation and new venture performance. Research Policy, 44(8), 1501–1512. https://doi.org/10.1016/j.respol.2015.05.009.

Tillväxtverket. (2011). In Swedish: Tillväxtmöjligheter och tillväxthinder för svenska små och medelstora företag. Företagens villkor och verklighet 2011. Tillväxtverket: Stockholm.

Tödtling, F., & Trippl, M. (2005). One size fits all? Towards a differentiated regional innovation policy approach. Research Policy, 34(8), 1203–1219. https://doi.org/10.1016/j.respol.2005.01.018.

UNCTAD. (1997). Invest in France mission: DATAR and Artur Andersen. International investment: toward the year 2001. OECD, Paris 1997.

Veugelers, R. (2015). Mixing and matching research and innovation policies in EU countries. Bruegel Working Paper 2015/16, Dec 2015.

Vinnova. (2014). In Swedish: Effektanalys av Vinnovas finansiering av Innovativa SMF.

Yeats, A. J. (1985). On the appropriate interpretation of the revealed comparative advantage index: implications of a methodology based on industry sector analysis. Weltwirtschaftliches Archiv, 121(1), 61–73. https://doi.org/10.1007/bf02705840.

Yu, R., Cai, J., & Leung, P. S. (2009). The normalized revealed comparative advantage index. The Annals of Regional Science, 43(1), 267–282. https://doi.org/10.1007/s00168-008-0213-3.

Zúñiga-Vicente, J. A., Alonso-Borrego, C., Forcadell, F. J., & Galán-ZazoJ.I. (2014). Assessing the effect of public subsidies on firm R&D investment: a survey. Journal of Economic Surveys, 28(1), 36–67. https://doi.org/10.1111/j.1467-6419.2012.00738.x.

Funding

Financial support from the Swedish competition authority, the Swedish Retail and Wholesale Development Council, and the Foundation for Baltic and Eastern European Studies is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Tingvall, P.G., Videnord, J. Regional differences in effects of publicly sponsored R&D grants on SME performance. Small Bus Econ 54, 951–969 (2020). https://doi.org/10.1007/s11187-018-0085-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-018-0085-6