Abstract

Although some firms use dynamic pricing to respond to demand fluctuations, other firms claim that fairness concerns prevent them from raising prices during periods when demand exceeds capacity. This paper explores conditions in which fairness concerns can or cannot cause shortages. In our model, a firm announces a price policy that states its prices during high and low demand, and customers must travel to a venue to learn the current price. We show that the interaction of fairness concerns with travel costs can cause the firm to set stable prices, which leads to shortages during high demand. However, if the firm is able to inform customers about the current price before they incur any travel costs, then dynamic pricing with no shortages is optimal even with strong fairness concerns.

Similar content being viewed by others

Notes

Prices are available at https://disneyland.disney.go.com/tickets/. As another example, Uber sometimes warns customers about periods with unusually high surge prices. On New Year’s Eve of 2016, Uber released this statement: “On this busy night, fares will be the highest between midnight and 3am as people head home for the night” (Haydu 2016).

We interviewed a Disneyland executive who said that stores in their theme park often have stockouts of umbrellas when it rains. He said they would not consider raising the price of umbrellas when it is raining because of the potential backlash from customers who would consider such price increases unfair.

The CEO of the Coca Cola Company once proposed vending machines that would automatically raise the price of drinks when the temperature was hot. After complaints that this price policy would represent “gouging” and “exploitation” of customers, the company canceled its plans to vary prices based on temperature (Leonhardt 2005).

In our base model in Section 3.1, price is always equal to one of the firm’s announced prices, PL or PH, but the model extension in Section 3.3 allows the firm to set different prices. We assume customers derive utility vi − c − Pt from purchasing at price Pt < min(PL,PH), although the firm never has an incentive to deviate to a price below its minimum announced price.

The model of inequity aversion by Fehr and Schmidt (1999) implies that price dispersion would also decrease the utility of customers in the low price condition who feel bad about inequity, whereas the model of transaction utility by Thaler (1985) implies price dispersion would increase the utility of those in the low price condition who feel good about receiving a favorable deal. However, both models imply that the effect on customers in the high price condition is greater in absolute value than the effect on those in the low price condition. In the interest of parsimony, and similar to the model by Li and Jain (2016), we include only the effect on those in the high price condition.

We have stated this condition, and the following derivations of customer behavior, for the case in which PH ≥ PL, which is true in equilibrium. In principle, our model also allows PL > PH, in which case an analogous condition must be satisfied for a customer with valuation vi to learn demand.

Profit-maximizing prices must induce customers with the highest valuation to travel if the success probability is one. In particular, prices must satisfy (2) for vi = V, SH = 1, and SL = 1, or no customers would travel.

Another feasible strategy would be to set prices that vary across periods, with rationing during high demand. However, we show in the proof of Lemma 2 that this strategy is always dominated by one of the other strategies.

If there were not a capacity constraint, the firm would set prices \(P_{H} = P_{L} = \frac {V-c}{2}\), and customers with valuations greater than \(\frac {V+c}{2}\) would always travel and purchase.

The conditions of Proposition 3 are sufficient, but not necessary, for rationing to occur. Lemma 2 shows that Condition 2 ensures setting constant prices is optimal for the entire range of possible values of v∗ derived in Lemma 1, which may be a stronger condition than necessary for rationing.

As explained by Fehr and Schmidt (1999), a player with α = 4 would be willing to reduce his own payoff by $1.00 in order to reduce the payoff of another player, who receives a larger payoff, by $1.25, and thus reduce the payoff gap by $0.25.

For simplicity, we assume, when the period ends, all potential customers learn about any deviation from the firm’s price policy. For example, customers might learn about deviations through news stories or word of mouth. If only customers who traveled in the current period observed deviations, then our conditions for sustaining a fixed price policy would need to be modified, but results similar in spirit would still hold.

In this section, we assume the price policy announcement is binding, but in principle we could allow for endogenous price commitment as in the previous section.

Under this alternative assumption, rationing could occur at the search stage as customers who search learn whether they can purchase in the current period, or rationing could occur at the the venue itself as customers with high valuations would travel directly to the venue without searching if the success probability were sufficiently high.

If we assumed customers who search could observe both the price and the demand state, then in some cases, customers might want to search even with a policy of constant prices, in order to avoid travel during high-demand periods with rationing. However, this alternative assumption allowing customers who search to learn the demand state would not affect our results. All customers who travel in the fixed-price equilibrium derived in this section gain greater expected utility from traveling directly to the venue than they would from searching and traveling only when demand is low.

As in the previous sections, these derivations focus on policies for which PL ≤ PH, which is true in equilibrium.

Formally, by deriving the minimum values of vi that make (12) and (14) positive, we find there is a segment of customers who search only if \(P_{L} + [c_{1}/(1-\widehat {H})+c_{2})]/S_{L} < P_{H} + \alpha (P_{H} - P_{L}) + [-c_{1}/\widehat {H}+c_{2})]/S_{H}\), in which case there is a range of valuations for which (12) is positive but (14) is negative.

For a given value of \(v^{*}_{1}\), a reduction in search costs (c1) has three effects on the profits from a variable price policy. First, reduced search costs allow the firm to increase PL while still attracting the same customers during low demand. Second, given fairness concerns, the resulting increase in PL implies, all else equal, the firm can increase PH while still providing the same amount of utility to customers during high demand. However, the third effect, which tends to offset the second, is that reduced search costs imply the firm must provide greater utility to customers during high demand to induce them to travel to the venue and purchase during both periods rather than searching and purchasing only during low demand. The conditions for rationing must account for all three effects when comparing the profits from variable versus fixed price policies.

In the parameter range for which the firm sets variable prices, a marginal reduction in search costs leads to strictly higher profits. In the parameter range for which the firm sets fixed prices, a marginal reduction in search costs has no effect on profits.

References

Anderson, E.T., & Simester, D.I. (2010). Price stickiness and customer antagonism. The Quarterly Journal of Economics, 125(2), 729–765.

Becker, G.S. (1991). A note on restaurant pricing and other examples of social influences on price. Journal of Political Economy, 99(5), 1109–1116.

Bolton, L.E., Warlop, L., Alba, J.W. (2003). Consumer perceptions of price (un)fairness. Journal of Consumer Research, 29(4), 474–491.

Camerer, C.F., & Thaler, R.H. (1995). Anomalies: Ultimatums, dictators and manners. Journal of Economic Perspectives, 9(2), 209–219.

Charlotin, R. (2010). Boston Red Sox need a new Fenway Park. Bleacher Report.

Chen, Y., Koenigsberg, O., Zhang, Z.J. (2017). Pay-as-you-wish pricing. Marketing Science, 36(5), 780–791.

Cui, T.H., Raju, J.S., Zhang, Z.J. (2007). Fairness and channel coordination. Management Science, 53(8), 1303–1314.

Drayer, J., Shapiro, S.L., Lee, S. (2012). Dynamic ticket pricing in sport: An agenda for research and practice. Sport Marketing Quarterly, 21(3), 184–194.

Economist. (2016). Disney discovers peak pricing. https://www.economist.com/blogs/freeexchange/2016/02/price-discrimination-land.

Englmaier, F., Gratz, L., Reisinger, M. (2012). Price discrimination and fairness concerns. Working paper.

Feeney, M. (2014). The economics of Uber’s surge pricing. Cato Institute. https://www.cato.org/blog/economics-uber-surge-pricing.

Fehr, E., & Schmidt, K.M. (1999). A theory of fairness, competition, and cooperation. The Quarterly Journal of Economics, 114(3), 817–868.

Fritz, B. (2016). Disney rolls out seasonal pricing for one-day park tickets. Wall Street Journal.

Gilbert, R.J., & Klemperer, P. (2000). An equilibrium theory of rationing. The RAND Journal of Economics, 31(1), 1–21.

Guo, L. (2015). Inequity aversion and fair selling. Journal of Marketing Research, 52(1), 77–89.

Guo, X., & Jiang, B. (2016). Signaling through price and quality to consumers with fairness concerns. Journal of Marketing Research, 53(6), 988–1000.

Haydu, S. (2016). New Year’s Eve ride guide. Uber Newsroom.

Hoffman, E., McCabe, K., Shachat, K., Smith, V. (1994). Preferences, property rights, and anonymity in bargaining games. Games and Economic Behavior, 7(3), 346–380.

Kahneman, D., Knetsch, J.L., Thaler, R. (1986). Fairness as a constraint on profit seeking: Entitlements in the market. The American Economic Review, 76 (4), 728–741.

Kosoff, M. (2015). Don’t complain about Uber’s surge pricing tonight. Business Insider.

Lefton, T., & Lombardo, J. (2003). Stern’s NBA shows its transition game. Street and Smith’s Sports Business Journal.

Leonhardt, D. (2005). Why variable pricing fails at the vending machine. New York Times.

Levy, D., Bergen, M., Dutta, S., Venable, R. (1997). The magnitude of menu costs: Direct evidence from large U.S. supermarket chains. The Quarterly Journal of Economics, 112(3), 791–824.

Li, K.J., & Jain, S. (2016). Behavior-based pricing: An analysis of the impact of peer-induced fairness. Management Science, 62(9), 2705–2721.

Liu, Q., & Shum, S. (2013). Pricing and capacity rationing with customer disappointment aversion. Production and Operations Management, 22(5), 1269–1286.

Martin, H. (2014). Disney parks on both coasts close temporarily on Christmas. Los Angeles Times.

Mohammed, R. (2015). Of course Disney should use surge pricing at its theme parks. Harvard Business Review.

Nasiry, J., & Popescu, I. (2012). Advance selling when consumers regret. Management Science, 58(6), 1160–1177.

Okada, T. (2014). Third-degree price discrimination with fairness-concerned consumers. The Manchester School, 82(6), 701–715.

Ozer, O., & Zheng, Y. (2016). Markdown or everyday low price? The role of behavioral motives. Management Science, 62(2), 326–346.

Rogers, J. (2016). LA tries to cope with rain in a place where rain is rare. Associated Press. https://www.businessinsider.com/ap-la-tries-to-cope-with-rain-in-a-place-where-rain-is-rare-2016-1.

Rotemberg, J.J. (2005). Customer anger at price increases, changes in the frequency of price adjustment and monetary policy. Journal of Monetary Economics, 52(4), 829–852.

Rovell, D. (2001). Jordan is just the ticket to boost NBA attendance. Espn.com. http://assets.espn.go.com/nba/s/2001/0925/1255329.html.

Shapiro, S.L., Drayer, J., Dwyer, B. (2016). Examining consumer perceptions of demand-based ticket pricing in sport. Sport Marketing Quarterly, 25(1), 34–46.

Su, X. (2010). Optimal pricing with speculators and strategic consumers. Management Science, 56(1), 25–40.

Thaler, R. (1985). Mental accounting and consumer choice. Marketing Science, 4(3), 199–214.

Vaux, R. (2010). Disney World compared to Disneyland. USA Today travel tips.

Weiner, J. (2014). Is Uber’s surge pricing fair? Washington Post. https://www.washingtonpost.com/blogs/she-the-people/wp/2014/12/22/is-ubers-surge-pricing-fair.

Wernerfelt, B. (1994). Selling formats for search goods. Marketing Science, 13 (3), 298–309.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Helpful comments were provided by Anthony Dukes, Jeanine Miklós-Thal, Daniel Mochon, Cristina Nistor, Mohammad Zia, and seminar participants at Chapman, Florida, UC Irvine, and the 2019 Marketing Theory Symposium. Peter Selove inspired me to work on this project.

Appendix: Proofs

Appendix: Proofs

Proof of Proposition 1

For any price policy that leads to rationing, we will show that, if α = 0, there is a profitable deviation, which implies that such a price policy cannot be optimal.

Suppose rationing occurs only during high demand. If PH < v∗ < PL, then the marginal customer with valuation v∗ buys only during high demand. In this case, a small increase in PH increases high-demand profits (PHK), without causing any sales reduction during low demand, despite the resulting marginal increase in v∗. Similarly, if PL < v∗≤ PH, then the marginal customer with valuation v∗ buys only during low demand. In this case, a small increase in PH increases high-demand profits, without causing any sales reduction during low demand, because this price change does not affect v∗. In both cases, a small increase in PH leads to greater total profits.

The only way a marginal increase in PH can reduce sales during low demand is if PH < v∗ and PL ≤ v∗, in which case such a price increase leads to a higher value of v∗ and reduces low-demand sales. When v∗ is weakly greater than the price for both demand states, prices must satisfy Eq. 5 as follows:

Suppose the firm increases PH by 𝜖 = v∗− PH. In order to induce customers with the same v∗ to continue traveling, it must decrease PL by \(\epsilon \frac {\widehat {H} S_{H}(v^{*})}{1 - \widehat {H}}\) so that Eq. 17 continues to hold. The net effect on expected profits of these price changes is:

Inserting \(\widehat {H} = \frac {H D_{H}}{H D_{H} + (1-H) D_{L}}\), \((1-\widehat {H}) = \frac {(1-H) D_{L}}{H D_{H} + (1-H) D_{L}}\), and \(S_{H}(v^{*}) = \frac {KV}{D_{H}(V-v^{*})}\) into this expression, we find that the net effect on expected profits is zero. Because we increased PH by 𝜖, where 𝜖 = v∗− PH, we now have PL < v∗ = PH. As shown above, further increases in PH increase profits during high demand without affecting sales during low demand. Therefore, the initial price policy with rationing only during high demand could not be optimal.

Similar analysis shows that a price policy with rationing only during low demand cannot be optimal. Finally, if rationing occurs during both demand states, then the firm always sells K units, and a small price increase leads to greater profits. Thus, if α = 0, the firm’s profit-maximizing price policy cannot involve rationing. QED

Proof of Proposition 2

If c = 0, then all customers always travel. Suppose a price policy leads to rationing during high demand. Increasing PH leads to greater profits during high demand without affecting travel behavior. If PH ≥ PL, this increase in PH does not affect sales during low demand. On the other hand, if PH < PL this increase in PH leads to weakly greater sales during low demand by reducing the effect of fairness concerns on low-demand sales. In either case, total expected profits increase. Therefore, rationing during high demand cannot be optimal. A similar argument shows that rationing during low demand cannot be optimal. QED

Proof of Lemma 1

We first show that any price strategy that leads to a minimum travel valuation of \(v^{*} > \overline {v}^{*}\) cannot be the firm’s profit-maximizing strategy. The upper bound \(\overline {v}^{*}\) was defined such that the firm always has excess capacity if \(v^{*} > \overline {v}^{*}\), so all purchase attempts succeed, and the Eq. 5 becomes:

We will show that, for any \(v^{*} > \overline {v}^{*}\), the most profitable way to induce customers with valuation v∗ to travel is by setting constant prices, PL = PH = v∗− c. Suppose the firm starts with these constant prices. Now suppose the firm increases PH by a small amount 𝜖. If customers have no fairness concerns, so α = 0, then in order for customers with the same valuation v∗ to continue traveling, the firm must reduce PL by \(\epsilon \frac {\widehat {H}}{(1 - \widehat {H})}\) so that Eq. 19 continues to hold. Therefore, the net effect on expected profits of these price changes is \(\epsilon H D_{H} \frac {V-v^{*}}{V} - \epsilon \frac {\widehat {H}}{(1 - \widehat {H})} (1-H)D_{L} \frac {V-v^{*}}{V}\). Note that \(\frac {\widehat {H}}{(1 - \widehat {H})} = \frac {H D_{H}}{(1 - H)D_{L}}\). Therefore, for α = 0 and a given value of v∗, the net effect on expected profits of this deviation from constant prices is \(H D_{H} \frac {V-v^{*}}{V}[\epsilon - \epsilon ] = 0\), so the firm is indifferent between constant prices and small deviations from constant prices. On the other hand, if α > 0, increasing PH by 𝜖 requires the firm to make an even larger reduction in PL in order for Eq. 19 to continue to hold for the same v∗, so that the net effect on expected profits is strictly negative. Similar derivation show that, starting with constant prices and a given value of v∗, the firm would not want to increase PL and reduce PH to induce the same value of v∗.

We also need to check non-local deviations. If the firm sets PH high enough that PH + α(PH − PL) > v∗, then customers with valuation v∗ no longer purchase during high demand, even if PL decreases enough that these customers continue to travel and purchase during low demand. The firm’s profits during each high demand period become \(\frac {D_{H} P_{H} [V-P_{H} - \alpha (P_{H} - P_{L})]}{V}\). Taking the first derivative of these profits with respect to PH, we have \(\frac {D_{H} [V-2P_{H} - \alpha (2P_{H} - P_{L})]}{V}\). Under Condition 1, this derivative is negative for PH > v∗, so the firm could increase its profits by reducing its price. Therefore, this non-local deviation from constant prices is not optimal. Similar analysis shows that a large (non-local) increase PL cannot be optimal, and therefore constant prices are the profit-maximizing way to induce customer travel for any \(v^{*} > \overline {v}^{*}\).

With constant prices, the firm’s expected profits as a function of v∗ are:

Taking the first derivative, we have:

Condition 1 guarantees \(\overline {v}^{*} > \frac {V + c}{2}\). Therefore, this derivative is negative for any \(v^{*} > \overline {v}^{*}\), and prices that lead to any such v∗ cannot be optimal because the firm could increase its profits by reducing its prices.

We next show that any price strategy that leads to a minimum travel valuation of \(v^{*} < \underline {v}^{*}\) cannot be the firm’s profit-maximizing strategy. For any such v∗, we will show that the firm could increase its profits by raising prices during one or both demand states. We need to consider three cases.

First, suppose the firm sets a price policy with PL < PH, and v∗ is such that PL < v∗ < PH + α(PH − PL). In this case, customers with valuation v∗ makes purchase attempts only during low demand periods. If the firm has excess demand even during low-demand periods, then profits during low demand are PLK. In this case, a small increase in PL leads to greater profits during low demand. On the other hand, if the firm can satisfy all customers during low demand, then its profits during low demand are \(P_{L} D_{L} \frac {V - v^{*}}{V}\), where price PL must satisfy Eq. 5:

Solving for price, we have \(P_{L} = v^{*} - \frac {c}{1 - \widehat {H}}\), which implies profits during low demand periods are:

Taking the first derivative, we have:

This derivative is positive for all \(v^{*} < \underline {v}^{*}\). Therefore, increasing PL would increase profits during low demand, and would also weakly increase profits during high demand by reducing the effect of fairness concerns on high-demand profits.

Next, suppose the firm sets a price policy with PH < PL, and v∗ is such that PH < v∗ < PL + α(PL − PH). Given \(v^{*}< \underline {v}^{*}\), the firm has excess demand during high demand periods, during which it generates profits PHK. A similar argument to the one above shows that increasing PH leads to greater profits.

Finally, suppose the firm sets a price policy such that PL < v∗ and PH < v∗, so that customers with valuation v∗ purchase during both demand states. A similar argument to the one described above (for \(v^{*} > \overline {v}^{*}\)) shows that constant prices (PH = PL) are the optimal way to induce such an outcome. In particular, for α = 0 and a given value of v∗, if the firm starts with constant prices and increases PH by 𝜖, it must decrease PL by \(\epsilon \frac {\widehat {H} S_{H}(v^{*})}{1 - \widehat {H}}\) to induce customers with the same v∗ to continue traveling. This deviation leads to zero effect on expected profits (see the proof of Proposition 1 for additional detail). However, if α > 0, the firm must make an even larger reduction in PL to maintain the same v∗, which leads to strictly lower expected profits. Therefore, constant prices are optimal for any policy in which customers with valuation v∗ purchase during both demand states.

Given PH = PL = P and \(v^{*} < \underline {v}^{*}\), if the firm has excess demand during both demand states, then a small price increase leads to greater profits. On the other hand, if the firm has excess demand during high demand periods but not during low demand, then prices must satisfy (5) as follows:

Solving for price, we have \(P = v^{*} - \frac {c}{1 - \widehat {H} + \widehat {H} S_{H}(v^{*})}\), which implies expected profits are:

Inserting \((1 - \widehat {H}) = \frac {(1 - H)D_{L}}{(1 - H) D_{L} + H D_{H}}\), \(\widehat {H} = \frac {H D_{H}}{(1 - H) D_{L} + H D_{H}}\), and \(S_{H}(v^{*}) = \frac {KV}{D_{H}(V - v^{*})}\) into the above equation, we have:

Rearranging terms, we have:

Taking the first derivative, we have:

This derivative is positive for all \(v^{*} < \underline {v}^{*}\). Therefore, increasing prices would increase profits. We have shown that, for any \(v^{*} < \underline {v}^{*}\), the firm can always increase profits by raising its price during one or both demand states, so any such v∗ cannot be optimal for the firm. QED

Proof of Lemma 2

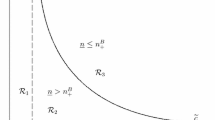

Lemma 1 shows that, under Condition 1, the minimum valuation of customers who travel is given by \(v^{*} \in [\underline {v}^{*},\overline {v}^{*}]\). For all v∗ in this range, Condition 1 ensures the firm has sufficient capacity to serve all customers who travel during low demand, but not during high demand. We will show that Condition 2 ensures setting constant prices is the profit-maximizing way to induce customers to travel for any v∗ in this range. We consider three cases. For all three cases, some of the derivations from the proof of Lemma 1 still apply.

First, suppose the firm sets a price policy with PH < PL, and v∗ is such that PH < v∗ < PL + α(PL − PH). During high demand, the firm generates profits PHK. The same argument as in the proof of Lemma 1 shows that increasing PH leads to greater profits. Therefore, any such price policy cannot be profit-maximizing, and the profit-maximizing policy must involve one of the following two cases.

Next, suppose the firm sets a price policy with PL < PH, and v∗ is such that PL < v∗ < PH + α(PH − PL). The same derivations as in the proof of Lemma 1 show that, for this type of price policy, the price during low demand must satisfy \(P_{L} = v^{*} - \frac {c}{1 - \widehat {H}}\). We still need to compute the optimal price during high demand. If \(P_{H} + \alpha (P_{H} - P_{L}) \leq \overline {v}^{*}\), the firm is at capacity and generates profits PHK during high demand, so profits increase as the price increases in this range. However, the same derivations as in the proof of Lemma 1 show the firm would not want to set prices high enough to have excess capacity during high demand. Therefore, the profit-maximizing price is such that capacity constraint holds with equality, with \(P_{H} = \frac {\overline {v}^{*} + \alpha P_{L}}{1 + \alpha }\). These prices imply that the firm’s expected profits are:

Finally, suppose the firm sets a price policy such that PL < v∗ and PH < v∗, so that customers with valuation v∗ purchase during both demand states. The same derivations as in the proof of Lemma 1 shows that, for any such policy, it is optimal to set constant prices, with \(P_{H} = P_{L} = v^{*} - \frac {c}{1 - \widehat {H} + \widehat {H} S_{H}(v^{*})}\), and the expected profits from this outcome are:

Therefore, the policy with constant prices generates greater profits than the policy with variable prices if the following condition holds:

Rearranging terms, this condition is equivalent to \(\overline {v}^{*} - v^{*} < \frac {\alpha c}{1 - \widehat {H}}\). Condition 2 ensures this inequality holds for all \(v^{*} \in [\underline {v}^{*},\overline {v}^{*}]\). QED

Proof of Proposition 3

Lemmas 1 and 2 show that, if Conditions 1 and 2 hold, then the minimum valuation of customers who travel is given by \(v^{*} \in [\underline {v}^{*},\overline {v}^{*}]\), and the firm sets constant prices. We will show that Condition 3 ensures the firm sets prices low enough that customers with valuations strictly below \(\overline {v}^{*}\) travel, and rationing occurs in equilibrium. In particular, we need to show that the derivative of profits with respect to v∗ is negative for \(v^{*} = \overline {v}^{*}\).

When the firm sets constant prices to induce travel for any \(v^{*} \in [\underline {v}^{*},\overline {v}^{*}]\), the derivative of profits with respect to v∗ are given by Eq. 29. Taking this derivative at \(\overline {v}^{*} = V \left (1 - \frac {K}{D_{H}}\right )\), we have:

This derivative is negative if the following inequality holds:

Rearringing term, this inequality is equivalent to the following:

This inequality is the same as Condition 3. Thus, the conditions of this proposition ensure the firm sets constant prices that lead to customer travel for a value of v∗ strictly less than \(\overline {v}^{*}\), which leads to rationing during high demand.

Because the derivative of Eq. 29 with respect to v∗ is strictly negative, the second derivative of the profit function is strictly negative, and the equilibrium is unique. QED

Proof of Proposition 4

The proofs of Lemma 1 and Proposition 3 shows that, under the conditions of the proposition, the minimum valuation of customers who travel is \(v^{*} \in [\underline {v}^{*},\overline {v}^{*}]\), prices are \(P_{L} = P_{H} = P \equiv v^{*} - \frac {c}{1 - \widehat {H} + \widehat {H} S_{H}(v^{*})}\), and expected profits are given by Eq. 26.

This outcome leads to rationing during high demand. During a high-demand period, the firm could deviate to a higher price \(\widetilde {P} = \frac {\overline {v}^{*} + \alpha P}{1+\alpha }\), so that the capacity constraint binds with equality and there is no rationing. This price deviation would increase profits for the period by \((\widetilde {P} - P) K = \left (\frac {\overline {v}^{*} - P}{1 + \alpha } \right )K\).

By setting \(v^{*} = \underline {v}^{*}\), the left side of Condition 4 is an upper bound on the profits from deviating, and the right side of Condition 4 is a lower bound on the expected discounted value of future profits if the firm maintains its optimal policy with constant prices. Therefore, if this condition holds, the optimal strategy with constant prices and rationing is sustainable. QED

Proof of Proposition 5

The same derivations as in the proof of Lemma 1, with slight modifications to account for separate search and travel costs, show that Condition 5 guarantees it cannot be optimal to set prices such that \(v^{*}_{1} > \overline {v}^{*}_{1}\). For any such prices, the firm would have excess capacity during both periods, and reducing one or both prices would lead to greater profits. Derivations similar to those for Lemma 1 also show it cannot be optimal to set prices such that \(v^{*}_{1} < \underline {v}^{*}_{1}\), as the firm could increase profits by increasing one or both prices.

We now show that, for any \(v^{*}_{1} \in [\underline {v}^{*}_{1},\overline {v}^{*}_{1}]\), Condition 6 guarantees the optimal way to induce customers with valuation greater than \(v^{*}_{1}\) to purchase is by setting constant prices rather than variable prices. Under variable pricing, to induce customers with valuation \(v^{*}_{1}\) to search and then travel during low demand, the firm must set \(P_{L} = v^{*}_{1} - c_{2} - \frac {c_{1}}{1 - \widehat {H}}\). We then compute the maximum high-demand price that induces customers with valuation \(\overline {v}^{*}_{1}\) to travel directly to the venue, so the firm is exactly at capacity during high demand. We find this value of PH by setting expression (14) equal to zero and inserting \(v_{i} = \overline {v}^{*}_{1}\) and SH = 1:

Rearranging terms, we derive the following price during high demand:

Therefore, given these prices, the firm’s expected profits under variable pricing are:

Rearranging terms, the profits from variable pricing are equal to:

As \(c_{1} \to \widehat {H} c_{2}\), the profits from variable pricing converge to the following value, which is analogous to the expression for profits from variable pricing in Lemma 2.

For a given value of \(v^{*}_{1}\), we now compute the profits from fixed prices. The same derivations as in the proof of Lemma 2 show that, if the firm sets constant prices, with \(P_{H} = P_{L} = v^{*}_{1} - \frac {c_{2}}{1 - \widehat {H} + \widehat {H} S_{H}(v^{*}_{1})}\), then expression (13) is positive for \(v_{i} > v^{*}_{1}\), so customers with valuations greater than \(v^{*}_{1}\) derive positive utility from traveling to the venue. The firm then generates the following expected profits:

The general condition in which fixed prices generate greater profits than variable prices for all \(v^{*}_{1} \in [\underline {v}^{*}_{1},\overline {v}^{*}_{1}]\) is that the profits in Eq. 41 are greater than in Eq. 39 for \(v^{*}_{1} = \underline {v}^{*}_{1}\). As \(c_{1} \to \widehat {H} c_{2}\), we need that the profits in Eq. 41 are greater than in Eq. 40, and the same analysis as in Lemma 2 shows that this inequality holds under Condition 6.

Finally, the same derivations as in the proof of Proposition 3 show that, under Condition 7, if the firm sets constant prices and customers travel directly to the venue, then it is optimal to set prices such that \(v^{*}_{1} = v^{*}_{2} < \overline {v}^{*}_{1}\), which implies there is rationing during high demand. As in the proof of Proposition 3, the second derivative of profits with respect to \(v^{*}_{1}\) is strictly negative, which ensures the equilibrium is unique. QED

Proof of Proposition 6

Suppose a price policy leads to rationing during high demand and \(v^{*}_{1} < v^{*}_{2}\), so the marginal customer during low demand periods does not purchase during high demand. In this case, a small increase in PH increases profits during high demand and does not affect profits during low demand.

On the other hand, suppose there is rationing during high demand and \(v^{*}_{1} = v^{*}_{2}\), so the marginal customer during low demand also purchases during high demand. Given α = 0, the same argument as in the proof of Proposition 1 shows the firm can increase profits by increasing PH while reducing PL in a way that holds profits constant while keeping the same marginal customer, and then by increasing PH further after prices reach the point at which this marginal customer purchases only during low demand. In both cases, there is a profitable deviation.

Similar analysis shows that a price policy with rationing only during low demand or both demand states cannot be optimal. QED

Proof of Proposition 7

If travel costs are zero (c2 = 0), this model extension is equivalent to the original version of the model with no search costs, and Proposition 2 ensures there is no rationing.

If search costs are zero (c1 = 0), then customers can learn the current price at no cost. Therefore, the optimal strategy for a customer with valuation vi is to travel to the venue during low-demand periods if and only if the following condition holds:

Similarly, the customer will travel to the venue during high demand if an only if:

Suppose a price policy leads to rationing during high demand. A small increase in PH leads to greater profits during high demand, and it either has no effect on profits during low demand (if PH ≥ PL) or it weakly increases profits during low demand (if PH < PL). In either case, total expected profits increase. Therefore, rationing during high demand cannot be optimal. A similar argument shows that rationing during low demand cannot be optimal. QED

Proof of Proposition 8

We first present the proof for the case in which Condition 5 holds. In this case, if the firm sets fixed prices, profits for a given \(v^{*}_{1}\) are stated by Eq. 41, which does not depend on c1.

If the firm sets variable prices, profits for a given \(v^{*}_{1}\) are stated by Eq. 39. Taking the derivative with respect to c1, we have:

For any α ≥ 0, the first expression in parentheses is weakly less than \(\frac {1}{\widehat {H}}\), which implies:

Because Condition 5 ensures the capacity constraint binds during high demand, we have \(K < D_{H} (\frac {V-v^{*}_{1}}{V})\), which implies:

Inserting the expression for \(\widehat {H}\) from Eq. 1 shows the right side of this inequality equals zero. Therefore, the derivative of profits with respect to c1 is negative, which implies that a decrease in search costs leads to strictly greater profits under variable pricing.

The preceding analysis applies if Condition 5 holds, in which case the capacity constraint binds during high demand but not during low demand. If the capacity constraint does not bind during either demand state, the firm can implement the solution from a standard monopoly pricing problem with linear demand curves by setting \(P_{H} = P_{L} = \frac {V-c_{2}}{2}\), and c1 has no effect on equilibrium profits.

We now address the case in which the capacity constraint binds during both demand states. If the firm sets constant prices, then a reduction in c1 has no effect on profits. If the firm sets variable prices, then the capacity constraint must bind with equality in each demand state, or the firm could increase profits by raising one or both prices. Following a reduction in c1 by a small amount 𝜖, the firm can continue to sell at capacity during both demand states by increasing PL by \(\frac {\epsilon }{1 - \widehat {H}}\) so that Eq. 12 is still positive for the same set of customers, and decreasing PH by \(\frac {\epsilon }{\widehat {H}}\) so that Eq. 14 is also positive for at least the same customers. The net effect on profits is \(\epsilon K (\frac {1-H}{1 - \widehat {H}} - \frac {H}{\widehat {H}})\), and inserting the expression for \(\widehat {H}\) from Eq. 1 shows this profit change is strictly positive.

We have shown that, for any equilibrium value of \(v^{*}_{1}\), a reduction in search costs implies the firm can generate the same or greater profits. QED

Rights and permissions

About this article

Cite this article

Selove, M. Dynamic pricing with fairness concerns and a capacity constraint. Quant Mark Econ 17, 385–413 (2019). https://doi.org/10.1007/s11129-019-09212-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-019-09212-8