Abstract

A sensitivity analysis of the impact of cumulative prospect theory (CPT) parameters on a Mean/Risk efficient frontier is performed through a simulation procedure, assuming a Multivariate Variance Gamma distribution for log-returns. The optimal investment problem for an agent with CPT preferences is then investigated empirically, by considering different parameters’ combinations for the CPT utility function. Three different portfolios, one hedge fund and two equity portfolios are considered in this study, where the Modified Herfindahl index is used as a measure of portfolio diversification, while the Omega ratio and the Information ratio are used as measures of performance.

Similar content being viewed by others

Notes

One of the main assumptions of EU theory is the independence axiom, which states that the intrinsic value that an individual places on any particular outcome in a gamble will not be influenced by the other possible outcomes (either within that gamble or within other gambles to which the gamble is being compared), or by the size of the probability of the outcome occurring. The axiom requires that, when comparing gambles, all common outcomes that have the same probability of occurring will be viewed by the individual as irrelevant. In a famous criticism of EU, Maurice Allais argued that under certain conditions individuals will systematically violate independence. Allais proposition is known as the Allais paradox (or the common consequence effect), and has been empirically supported in subsequent analysis [see, among the others (Morrison 1967; MacCrimmon and Larsson 1979; Kahneman and Tversky 1979; Camerer and Kunreuther 1989)].

Omega Ratio is defined by:

$$\begin{aligned} \varOmega =\frac{\mathbb {E}\left( R_P-\tau \right) ^+}{\mathbb {E}\left( \tau -R_P\right) ^+}, \end{aligned}$$where \(R_P\) denotes the return of the portfolio and \(\tau \) is a specified threshold. \(\varOmega \) ratio is very sensitive to \(\tau \), which can be different from investor to investor. In the empirical analysis \(\tau \) is set equal to 0. For a given threshold, a higher ratio indicates that the portfolio provides more expected gains than expected losses and so it would be preferred by an investor.

In case of mean-variance portfolio the considered risk aversion parameter is one.

For more information on the Global Search algorithm see. http://it.mathworks.com/help/gads/how-globalsearch-and-multistart-work.html.

The finer the grid is, the more precise the solution is, and the longer the computation time will be.

Given the first four moments of each asset and the corresponding correlation matrix, we implement an algorithm able to estimate the parameters of the MVG distribution (see Hitaj and Mercuri 2013a, b). We then simulate a sample of \(10^4\) observations for the log-returns by means of the MVG r.v. with the desired parameters. The reason for using the MVG to simulate assets’ returns is related to the fact that this distribution can capture some of the stylized facts of assets’ returns (see Hitaj and Mercuri 2013b and the references therein).

Loss aversion implies, for example, that one who loses one hundred dollars will lose more satisfaction than that gained from one hundred dollars windfall.

The greater \(\beta \in (0,1)\), the lower the attitude to risk in losses.

The data set is taken from www.hedgefundresearch.com.

The data set for the second and third portfolios is downloaded from Bloomberg.

We refer to the in-sample period also as 1 year (or 6 months).

We refer to the out-of-sample period also as 1 week (or 1 month).

More details about the results concerning the JB test for sub-samples are omitted for space constraints, but they are available upon request for the interested reader.

The fact the MV portfolio is concentrated is due to the value of the risk aversion, which is fixed at 1. The level of risk aversion has an important impact on the portfolio (see Hitaj and Zambruno (2016) where a detailed analysis has been performed in case of a CARA utility function). Considering different levels of risk aversion goes beyond the objective of this paper.

For space constraints the results obtained for the two equity portfolios are not reported, but are available upon author request.

Of course each portfolio manager has his own reference portfolio. The reason for choosing the \(\textit{GMV}\) is that, when dealing with \(\mu /\sigma \) efficient frontier, it exhibits the minimum risk (\(\sigma \)).

We point out that \(\varOmega \) ratio is very sensitive to \(\tau \) which can be different from investor to investor. In this analysis \(\tau \) is set equal to 0.

Rolling window ‘1 year—1 week’ means that the in-sample period is 1 year and the out-of-sample period is 1 week.

For space constraints the results obtained in case of the other three rolling window strategies are not reported, but can be obtained from the authors upon request.

References

Allais M (1953) Le Comportement de l’Homme Rationnel devant le Risque: Critique des Postulats et Axiomes de l’Ecole Americaine. Econometrica 21(4):503–546

Barberis NC (2013) Thirty years of prospect theory in economics: a review and assessment. J Econ Perspect 27(1):173–195

Barberis N, Huang M (2008) Stocks as lotteries: the implications of probability weighting for security prices. Am Econ Rev 98(5):2066–2100

Bernard C, Ghossoub M (2010) Static portfolio choice under cumulative prospect theory. Math Financ Econ 2:277–306

Camerer CF, Kunreuther H (1989) Decision processes for low probability events: policy implications. J Policy Anal Manag 8(4):565–592

De Giorgi E, Hens T, Mayer J (2007) Computational aspects of prospect theory with asset pricing applications. Comput Econ 29(3):267–281

Goodwin TH (1998) The information ratio. Financ Anal J 54(4):34–43

Grüne L, Semmler W (2004) Solving asset pricing models with stochastic dynamic programming. Technical report, CEM working paper

He XD, Zhou XY (2011) Portfolio choice under cumulative prospect theory: an analytical treatment. Manag Sci 57(2):315–331

Hens T, Mayer J (2014) Cumulative prospect theory and mean variance analysis: a rigorous comparison. Technical report 14–23, Swiss Finance Institute Research paper series

Hitaj A, Mercuri L (2013a) Portfolio allocation using multivariate variance gamma models. Financ Mark Portf Manag 27(1):65–99

Hitaj A, Mercuri L (2013b) Advances in financial risk management: corporates, intermediaries and portfolios. Palgrave Macmillan, Basingstoke

Hitaj A, Zambruno G (2016) Are smart beta strategies suitable for hedge funds portfolios? Rev Financ Econ 29:37–51

Hitaj A, Zambruno G (2018) Portfolio optimization using modified Herfindahl constraint. In: Consigli G, Stefani S, Zambruno G (eds) Recent advances in comodity and financial modeling: quantitative methods in banking, finance, insurance, energy and commodity markets. Springers International series in operations research and management science. Springer, Berlin

Hitaj A, Martellini L, Zambruno G (2012) Optimal hedge fund allocation with improved estimates for coskewness and cokurtosis parameters. J Altern Invest 14(3):6–16

Jondeau E, Rockinger M (2006) Optimal portfolio allocation under higher moments. Eur Financ Manag 12(01):29–55

Jondeau E, Poon SH, Rockinger M (2007) Financial modeling under non-Gaussian distributions. Springer, Berlin

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):263–91

MacCrimmon KR, Larsson S (1979) Utility theory: axioms versus paradoxes. In: Allais M, Hagen O (eds) Expected utility hypotheses and the Allais paradox. Springer, Berlin, pp 333–409

Mantegna RN, Stanley HE (2000) An introduction to econophysics: correlations and complexity in finance. Cambridge University Press, Cambridge

Markowitz H, Selection P (1959) Efficient diversification of investments, vol 12. Wiley, New York, pp 26–31

Martellini L, Ziemann V (2010) Improved estimates of higher-order comoments and implications for portfolio selection. Rev Financ Stud 23(4):1467–1502

Mastrogiacomo E, Gianin ER (2015) Optimal pareto allocation under quasiconvex risk measures. Math Financ Econ 9(2):149–167

Mayer J, Hens T (2013) Theory matters for financial advice! NCCR FINRISK Working Paper, p 25

Morrison DG (1967) On the consistency of preferences in allais’ paradox. Syst Res Behav Sci 12(5):373–383

Muliere P, Parmigiani G (1993) Utility and means in the 1930s. Stat Sci 8:421–432

Müller A (2007) Certainty equivalents as risk measures. Braz J Probab Stat 21:1–12

Patton AJ (2004) On the out-of-sample importance of skewness and asymmetric dependence for asset allocation. J Financ Econ 2(1):130–168

Pirvu T, Kwak M (2014) Cumulative prospect theory with skewed return distribution

Pirvu TA, Schulze K (2012) Multi-stock portfolio optimization under prospect theory. Math Financ Econ 6(4):337–362

Potaptchik M, Tunçel L, Wolkowicz H (2008) Large scale portfolio optimization with piecewise linear transaction costs. Optim Methods Softw 23(6):929–952

Quiggin J (1993) Testing between alternative models of choice under uncertainty-comment. J Risk Uncertain 6(2):161–164

Roy AD (1952) Safety first and the holding of assets. Econ J Econ Soc 20:431–449

Tversky A, Kahneman D (1992) Advances in prospect theory: cumulative representation of uncertainty. J Risk Uncertain 5(4):297–323

Xiong JX, Idzorek TM (2011) The impact of skewness and fat tails on the asset allocation decision. Financ Anal J 67(2):23–35

Yaari ME (1987) The dual theory of choice under risk. Econ J Econ Soc 55:95–115

Acknowledgements

The authors would like to thank the Editor and the anonymous Referees for their helpful comments. All remaining errors are responsibility of the authors. Asmerilda Hitaj and Elisa Mastrogiacomo want to acknowledge GNAPMA for the financial support of the project ’Levy processes, stochastic control and portfolio optimization’.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

In the following the results obtained for the two equity portfolios under analysis are reported.

1.1 Equity portfolio 1 results

See Tables 3, 4 and Figs. 6, 7.

Equity portfolio 1 in case of rolling-window 1 year (250 days)—1 week (5 days). The figure is divided in 6 sectors, one for each level of \(\alpha \). On the x-axis the value of \(\beta \) is indicated; each point in the figure is associated with a number that indicates the value of \(\lambda \). On the y-axis the value of the average out-of-sample Information Ratio (with respect to the GMV portfolio) for a particular combination of parameters is reported. It is evident that the Information Ratio in the majority of the cases under consideration is less than zero meaning that, in an out-of-sample perspective, the CPT portfolios lead to a loss with respect to the GMV one

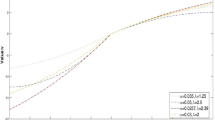

Equity portfolio 1; Rolling-window 1 year—1 week. The figure is divided in 6 parts, one for each level of \(\alpha \). On the x-axis the value of \(\beta \) is indicated; each point in the figure is associated with a number that indicates the value of \(\lambda \). On the y-axis the value of the average out-of-sample monthly Omega Ratio for different levels of \(\alpha \), \(\beta \) and \(\lambda \) is reported. The point labelled \(\textit{MV}\) indicates the result obtained from the Mean Variance model and the one labeled \(\textit{GMV}\) indicates the result obtained using the Global Minimum Variance

1.2 Equity portfolio 2 results

See Tables 5, 6 and Figs. 8, 9.

Equity portfolio 2: rolling-window 1 year (250 days)—1 week (5 days). The figure is divided in 6 parts, one for each level of \(\alpha \). On the x-axis the value of \(\beta \) is indicated; each point in the figure is associated with a number that indicates the value of \(\lambda \). On the y-axis the value of the average out-of-sample Information Ratio (with respect to the GMV portfolio) for a particular combination of parameters is reported. Having always an Information Ratio greater than zero means that, in an out-of-sample perspective, the CPT model leads to a gain with respect to the GMV

Equity portfolio 2: rolling-window 1 year—1 week. The figure is divided in 6 parts, one for each level of \(\alpha \). On the x-axis the value of \(\beta \) is indicated; each point in the figure is associated with a number that indicates the value of \(\lambda \). On the y-axis the value of the average out-of-sample monthly Omega Ratio for different levels of \(\alpha \), \(\beta \) and \(\lambda \) is reported. The point labeled \(\textit{MV}\) indicates the result obtained from the Mean Variance model and the one labeled \(\textit{GMV}\) indicates the result obtained using the Global Minimum Variance. It is evident that in an out-of-sample the majority of the CPT portfolios lead to gains, in terms of Omega Ratio, with respect to the GMV and to the MV ones

Rights and permissions

About this article

Cite this article

Consigli, G., Hitaj, A. & Mastrogiacomo, E. Portfolio choice under cumulative prospect theory: sensitivity analysis and an empirical study. Comput Manag Sci 16, 129–154 (2019). https://doi.org/10.1007/s10287-018-0333-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10287-018-0333-x