Abstract

Background

Fossil fuel utilization is the biggest contributor to the emissions of greenhouse gases which are the main reason for global warming. Solar energy photovoltaic (PV) technology is one of the most rapidly rising technologies and is a sturdy candidate to replace fossil fuels due to its versatility. Egypt receives high solar intensity which makes it a perfect place for utilizing this technology. However, for the past years, the focus in Egypt was on using solar energy for residential applications, henceforth a research gap was identified in studying the feasibility of using solar energy for industrial applications in Egypt. To ensure the sustainability of this application, this feasibility study addresses technical, economic, environmental, and social aspects.

Results

A case study is investigated for utilizing solar PV panels for energy generation in Egypt at an industrial site. A food factory was studied under three scenarios. Scenario 1 is the baseline case for the other scenarios with fixed tilted PV panels and no storage, Scenario 2 is the same as Scenario 1 with difference in is the model of the PV panels with no tracking or storage system. Scenario 3 has a vertical axis tracking system. Software was used to simulate the performance of the three scenarios for 25 years. Results have shown that Scenario 1 and Scenario 2 had close values of the annual energy production. However, Scenario 3 produces 2047 MWh annually which is considerably higher. Finally, a sensitivity analysis is carried out to test the effect of some economic parameters on the financial feasibility.

Conclusions

All the three scenarios are found to be feasible. Scenario 1 has the shortest discounted payback period with a net present value of 414,110.12 USD, a nominal levelized cost of energy of 0.022 USD/kWh, and avoided CO2 emissions of 14,898.993 tons. Although Scenario 3 has higher costs, it has higher energy production and better impact on the environment with 18,891.435 tons of avoided CO2 emissions. The paper concluded that a generalization could be done about using solar PV systems in Egypt for energy generation to be sustainable and feasible technically, economically, and environmentally.

Similar content being viewed by others

Background

Renewable energy and global demand

Energy resources can be classified into two main categories: renewable energy and non-renewable energy. Non-renewable energy resources, such as natural gas, coal, oil, and nuclear, have limited supplies due to the long time it takes for them to be replaced [1]. On the other hand, renewable energy resources, such as solar, wind, hydro, biomass, and geothermal, are replenished by natural means [2]. However, they are limited in their supply at any given time [3].

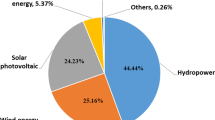

Global energy demand is estimated to increase by 50% by 2050. Moreover, by the end of 2021, the world energy demand has risen by 4.6% compared to 2020 [4]. Conventional energy resources are getting depleted rapidly, eventually this will result in an energy crisis with not enough resources to produce energy that satisfies the global demand. In the present day, non-renewable energy is the dominant by far in the energy sector. According to [5], oil counts for 33.06%, coal 27.04%, natural gas 24.23%, and nuclear 4.27% of the global energy consumption; this shows that non-renewable energy represents 88.6% of the market while all the renewable energy sources combined accounts for 11.4% [5, 6]. According to [7], if the emissions continued at the same rate, the atmosphere would warm up to 1.5o C above the pre-industrial levels by 2040. Incomplete combustion of the fossil fuels can result in emitting carbon monoxide, of which high concentrations can cause reduction in the amount of oxygen delivered to the body tissues, respiratory health issues, and dangerous impacts on cardiovascular and central nervous systems. Additionally, prices of fossil fuels are rising through the years. This makes it clear that fossil fuels are not a sustainable resource of energy. The tendency of the world is slowly but surely moving towards renewable energy as it provides cleaner, more sustainable, and cheaper sources of energy.

Solar technologies are used to capture the radiation from the sun and convert it to the desired form of energy. Solar energy upper limit is around 120,000 TW of power that is being delivered to Earth [8]. The intensity of the solar radiation differs from one location to another [9]. There are two main categories of solar technologies that are used to harness energy: photovoltaic, which is used for electricity production [10], and solar thermal systems, which are used for heat generation [11]. Due to the increasing investments, the solar PV technology has experienced a large decrease in the prices by 82% between 2010 and 2019 [12]. In 2023, prices for solar PV modules have declined by 50% year-on-year, with manufacturing capacity tripled 2021 levels [13]. In 2022, global consumption of non-power thermal coal and lignite rose by 7%. Non-power uses accounted for 22% of overall consumption in that year [14]. Industrial heat demand is projected to expand by 16% globally by 2028, with China and India together accounting for more than 50% of the growth. Renewable heat developments are expected to represent just over 30% of additional heat demand [13]. Henceforth, it is important to integrate a sustainable resource of energy in the industrial sector to gradually decrease the gigantic consumption of fossil fuels in this sector.

Opportunities for Egypt

Having abundant land, sunny weather, and high wind speeds, Egypt is a perfect location for the usage of renewable energy resources; the East and West Nile areas have the potential to produce around 31,150 MW of wind power and 52,300 MW of solar [15]. Key aspect of Egypt’s future vision is sustainability; now the energy production exceeds the consumption. According to [16], in 2021, Egypt has reached 4.16 quadrillion British thermal units (Btu) of total energy production against 3.81 quadrillion Btu of total energy consumption. The energy sector in Egypt is dominated by fossil fuels with a total of 94.4% in 2021[17]. Most of the energy is produced using natural gas with 55.1% followed by oil with 36.9%, then coal consumption with 2.4%. On the other hand, renewables in Egypt have a low share of 11.5% from the total energy consumed in 2021. However, the energy produced by renewables in Egypt has increased by 242.4% in 2022 compared to 2020 [18]. Egypt plans to generate 42% of its needed electricity through renewable energy by 2035; 22% of that to be generated by photovoltaic panels (PVs) and 14% through wind energy [19]. With the decrease in its costs, solar energy has become the most cost-effective resource of energy in 2020 [20], while in 2024, Egypt ranks number 41 among emerging markets and number 68 in the global power ranking with a power score of 1.87 [21]. According to [22], industry absorbs 29% of the total energy consumption in Egypt, with little research addressing this sector. As recommended by [12], feasibility studies should be conducted in Egypt for the following projects:

-

Solar-thermal power plants for both electricity generation and water desalination.

-

Solar-thermal power plants for industrial purposes.

-

Designing a technical–financial mechanism to promote the use of solar water heaters in Egypt’s residential sector.

-

Local manufacturing of renewable energy equipment.

PV systems can be either on-grid or off-grid. On-grid systems are connected directly to the nearest power grid to feed the energy generated into it; thus, the system does not need any type of batteries to store the energy. On the other hand, off-grid systems are not connected to the power grid. They use the electricity generated by the PV system to directly power up the different applications which they are intended for. The off-grid systems are mostly utilized with batteries to store the excess energy for future usage. Regarding the industrial sector in Egypt, most of the utilized PV systems are connected on-grid since it is not practical to power up the industrial applications directly by the PVs. This can be justified by the low return on investment due to high costs and quick deterioration rates of batteries in harsh environment like that of Egypt, in addition to the negative environmental impact and footprint of batteries [23]. In Egypt, the electricity prices for the industrial sector are even higher than those for the residential sector [24]. Hence, an increasing number of factories are considering the feasibility of using solar PV systems, which agrees with the recommendations by [12].

In this paper, a feasibility study of investing in using solar energy for power generation at industrial sites in Egypt is developed, hence addressing the first two suggested topics by the International Trade Administration. This study discusses the possibility of achieving sustainability and decreasing emissions. Thus, environmental and health hazards created from fossil fuels decrease. The remainder of this paper is structured as follows: first previous works on performing feasibility studies on using solar PV panels in industrial applications are reviewed. Second, methods of performing the economic, technical, and environmental studies are described. Third, results for three different scenarios are given with comparing key indicators, sensitivity analysis, and sustainability impact. Last, risks, limitations, and conclusions are given for the study.

Previous feasibility studies on using solar PV panels in industrial applications

A feasibility study addresses many factors that can lead to success or failure of a project; these factors may be technical, market, legal, and most importantly economic; each makes a huge impact on the results of the study. This section addresses some studies that took into consideration all or some of these factors. Since this paper is concerned with sustainability as well, previous studies that considered the environmental impact were reviewed. Based on the literature review, the research gaps were identified, and contributions of this work are highlighted.

Throughout the past years, several research works were dedicated to study the application of solar PV panels for energy generation, however, most of those works were oriented towards using it for residential applications. Since the scope of this work is the industrial sector, only works on such applications were considered. In [25], the possibility of using solar energy at the copper mining industrial facilities in Chile was studied; three different solar technologies at four different locations were investigated, considering the detailed economic and technical aspects of each case. Nine important economic tools were used to assess the financial feasibility of the systems: benefits-to-costs ratio (BCR), modified internal rate of return (MIRR), simple payback (SPB), net present value (NPV), nominal levelized cost of energy (LCOE), discounted payback period (DPP), internal rate of return (IRR), and total life cycle cost (TLCC). In [26], the financial feasibility of utilizing solar PV systems was investigated on the rooftop of commercial and industrial facilities at Tamil Nadu, India. The results yielded a payback period of 4.46 and 3.72 years for the commercial and the industrial facilities, respectively, with IRR for equity of 31.78% and 35.57% for the commercial and the industrial facility, respectively. Finally, the study concluded that the PV systems are financially feasible for both facilities. In [27], the potential of using solar energy in three selected sites in the Gaza strip, Palestine, was evaluated as a roadmap to address the ongoing electricity crisis with testing two different scenarios. However, the authors elaborated on the uncertainty of the meteorological data.

In [28], the possibility of integrating solar energy into the natural gas process facilities in Qatar was investigated. Economical and technical studies were conducted to reduce the emissions and to be less dependent on the power grid. Two types of systems were tested and studied for this purpose. The first system consists of regular PV panels with batteries, and the second type is a PV system integrated with solid oxide fuel cells. The plant total consumption is 65 MW; however, the required power to be generated by the PV system is around 33.5 MW. The system can directly feed 10 MW of power to the plant for the 8 h of daytime, while the backup system will be used during the 16 h of nighttime. Furthermore, the expected lifetime of both systems is around 25 years. The results have shown that the PV–fuel cell system has a lower LCOE which makes it a better option. However, both scenarios have a negative NPV which made the project not feasible economically. A sensitivity analysis was used to study the effect of parameters including the gas price and the lifetime of the systems on the LCOE for both systems. In [29], the economic feasibility of solar PV investment in Durban, South Africa was studied. Furthermore, the impact of applying new policies and incentives that support renewable energy investments in South Africa was investigated. Simulation results showed that the 1 MW PV system will produce around 1699.563 MWh annually for 30 years, which is the system’s lifespan. The results show that the installed PV system for the bulk consumers is feasible with the lowest LCOE and a payback period of 5 to 6 years.

In [30], the economic feasibility of applying solar PV panels for three manufacturing facilities in the United States was studied. System Advisor Model (SAM) was used to analyze and simulate data. The system is fixed with two-axis sun tracking and degradation rate of 0.36%; such systems are usually more expensive and require more maintenance. Six scenarios were studied and compared. The paper concluded that the system was feasible for industrial use at three locations, and that the location policies and financial support both play important roles in making the renewable projects more feasible. In [31], the possibility of using either solar PV systems or PV system integrated with green roofs at the OSTIM industrial zone in Turkey was analyzed. PVWatts software was used to calculate the total price of the system which was around $99,396. The results showed that the PV system has a payback period of 7.22 years, while the green roof integrated with the PV system has a longer payback period of 10.46 years. Finally, it was concluded that although the PV system alone has a lower payback period, the green roof-based PV system has more environmental benefits.

The economic feasibility of using PV system to power up factories in the industrial cities in KSA was investigated in [32]. The PV system is intended to provide 100% of the factory required power, it was concluded for this case that it is better to power up the factory directly by the PV system as the primary energy source and by the power grid as the backup source. Consequently, the excess electrical energy will be exported to the grid. Moreover, the PVs have an efficiency of 16.7% at a cost around $175,597 including commissioning and installing for lifetime of 25 years with a degradation rate of 1%, which is considered conservative value. Furthermore, the outcome of the analyses shows a payback period of 15.4 years and a NPV of $-1,079. The negative value indicates that the project is not economically feasible. To study the uncertain parameters that significantly led to this result, sensitivity analysis was performed for the values of the uncertain parameters. In [33], the economic and technical feasibility of utilizing different renewable energy resources was addressed for a food factory in China. Solar PVs, wind turbines (WT), and PV–WT systems were considered, in addition to fuel cells and batteries as a storage system. A two-stage optimization approach was proposed to minimize costs by utilizing HOMER software. The results showed that the proposed systems are all feasible, but the PV–WT combined system always gives a better result than any of the other two systems separated. However, this case is not applicable if solar or wind energy are not abundant in that location. In [34], the economic feasibility and the environmental impact of installing solar PV system at a company headquarters in Australia was investigated. The total power output of the system is around 100 kW, which is about 24% of the building total power consumption. The study results showed a payback period of 3.1 years, 10-year NPV of $240,300, and annual savings of $45,300. In addition to, a reduction of 127 tons of the emitted CO2 annually.

In [35], a feasibility study was conducted for a factory in UAE with total available space of 31,500 m2. PV panels can be mounted on the available area which can produce up to 4.89 MW; around 20% of the total power required by the factory. These calculations were done using SAM software. Prices were assumed to have an annual increasing rate of 5%. To evaluate the technical and economic aspects of this study, five scenarios were compared for installing the PV system with different funding models. For the power storage, a stack of lead acid-flooded batteries is considered which will be able to store only 50% of the total system capacity. The paper concluded that the PV investment is currently feasible for all the studied scenarios, and advised to avoid storage systems if possible. In [36], the possibility of reducing power costs by installing PV system at a steel facility in the United States was investigated. The PV systems have an average life span of 25 years and were installed at the rooftops of each building with a total power output of 81.6 kW. Furthermore, the results of the study showed a payback period of 3.8 years and net savings over 25 years of about $338,883. In [37], the cost reduction and the environmental impact of utilizing solar PV system at a facility in the US was investigated. The total output power of the PV system is around 312 kW, which is around 34% of the facility total required power. The study results showed that the PV system would save $33,397 annually. On top of that, the company is estimated to generate $176,000 of revenue annually due to gaining about 312 Solar Renewable Energy Credits (SRECs). Regarding the environmental impact of the system, the project would result in a decrease in CO2 emissions by 215 tons annually. Other papers addressed different sectors such as agriculture or seawater desalination [38,39,40]. Table 1 compares the recent works covered on the feasibility of using solar PVs for industrial applications to assess their covering of those three sustainability dimensions.

Research gap and contributions

Traditionally, feasibility studies for new projects tend to give the most concern to economic performance with less concern regarding the environmental performance [41]. From Table 1, it is observed that the main concern of most of the works was the economic dimension. However, to provide a sustainable solution, various dimensions should be considered [42]. Henceforth, lies the gap which this work aims to cover. With the global shift towards green energy, a real opportunity lies in such studies. Especially within the scope of Egypt Vision 2030 which sets a target to reduce greenhouse gases (GHGs) by 10% from the energy sector, including oil and gas, by 2030 compared to 2016 [4, 43, 44]. From the literature review, it was found that there is a lack of case studies in this field for the industrial applications in Egypt. Therefore, this paper is addressing this gap by investigating the feasibility of using solar panels for power generation a large food factory in Egypt with real data and results.

The contribution of this paper is to analyze the feasibility of different scenarios for using solar energy for industrial applications in Egypt with considering the environmental dimension. This is done by studying the possibility of decreasing emissions, hence decreasing the environmental impact. To include this dimension, this study will calculate the amount of GHG measured in the equivalent reduced amount of CO2 resulting from utilizing the solar PV system in the plant. In total, seven key indicators are calculated for each scenario to reflect the technical, economic, and environmental performance; those indicators include: the system total energy production, space required, ratio of the factory consumption, avoided CO2 emissions, net present value, discounted payback period, and the nominal levelized cost of energy.

Methods

The objective of this work is to develop a feasibility study for using solar energy in industrial applications in Egypt, with considering the sustainability goals. Nevertheless, the power output of the PV system will be used to export electricity to the grid and the government will grant a discount on the electricity bill as a financial investment. The methodology adopted in this paper consists of four phases; the first phase, is the market study, and it is completely done prior to this work as a part of the pre-feasibility study. This phase was done to make an initial assessment of the project to decide whether it should be initiated, redesigned, or totally declined [45]. Thus, this phase is an input of the study addressed by this work.

The second phase is the technical study which involves technological specific hardware data, geolocational data, space requirements, maintenance costs, solar radiation amount, and the generated power for each scenario. After the technical study is done, economic study is performed as the third phase. This phase consists of three components: financial study, non-financial considerations, and sensitivity analysis. The last phase is conducting an environmental study to determine the expected impact on the environment resulting from implementing this project and assessing the sustainability impact.

Technical study

The technical study starts with data collection and analysis for the whole PV system, the factory geographical and climatic features throughout the whole year, the daily solar radiation intensity, the available area for installation, shading of the area, the total power consumption, and the governmental energy laws. To perform the technical study, Pvsyst modeling software [46] was used to evaluate the total output power of the system over 25 years which is the expected planning horizon of the project.

Economic study

The economic study should take into consideration both financial and non-financial considerations to assess whether the project can meet its objectives [47]. Pvsyst modeling software was used to model the financial features of the PV system. Furthermore, three indicators were used to determine whether the model is financially feasible: net present value (NPV), levelized cost of energy (LCOE), and economic payback period (EPP). All the revenue expected to be generated from the system as well as the costs associated with the system are considered, such as initial costs, operations and maintenance, installation costs, and balance of the systems (BOS).

The methodology for calculating the financial feasibility will be elaborated in detail in the case study and results section. The non-financial part considered is the acceptance (fact) and acceptability (value) of this project which are further shown in the extended acceptability model [48]. The extended technology acceptance model is a modification of the original technology acceptance model (TAM) designed especially for renewable energy (Fig. 1); it considers not only the perceived usefulness, perceived ease of use, and the effect of one factor over another in the project, which are used in the original TAM, but also the perceived affordability and environmental awareness and their effect on both the attitude and the intention to use it [49]. In the solar PV case for industrial applications, the acceptance is surely rising with time as proven by the rising number of investments in Egypt in this direction, yet it is still not at the desired level.

Environmental study

Generating large amounts of electricity using sustainable resources, such as the sun is considered as an immense contribution to the environment [50, 51]. This study will calculate the amount of CO2 emission reduced by utilizing the solar PV system in the plant. The CO2 reduction amount will be calculated for the three scenarios over the course of the 25 years. Furthermore, Pvsyst will be used as the modeling tool to calculate the environmental benefits of this project.

Results

The case study used is from food industry. Egypt has about 80,000 food factories; the food section contributes by about 5% of the country’s GDP and employs more than 570,000 people [52]. Energy consumption for industrial purposes is generally used for processes, steam and cogeneration, heating and cooling, lighting, and air conditioning. It is estimated that the food industry consumes 8% of the total energy consumption in the industrial sector [52]. According to [52], it is estimated that energy saving measures implemented in the food sector in Egypt could achieve a reduction between 25% and 60% of the energy consumption, which makes it highly important for companies to implement energy efficiency strategies.

A case study is addressed for a food factory located in northeastern Egypt. As the management of the factory was looking into investing in solar energy, they approached the university to make a feasibility study to validate such investment. This was considered for two reasons; the first is participation of the factory into the country’s orientation towards renewable energy achieving Egypt Vision 2030. The second reason is making use of the large untilted roofs of the factory’s buildings. In this case study, it has been decided to use the PV system to feed the power generated directly to the grid and get feed-in tariff system as a financial incentive for the factory owner. The factory is located at latitude of 30.3°, longitude of 31.7°, and has an altitude of 115 m above the sea level with a total average annual irradiance of 305 W/m2. The daylight length is around 14.1 h for the longest summer day and 10.1 h for the shortest winter day as obtained from the software database. The two buildings of the factory have an available roof space of 7000 m2 for building A and 2800 m2 for building B. The plant consumption is around 2,328,000 kWh/year of electrical energy. The regulations in Egypt puts a net metering cap system on the amount of electrical energy that can be supplied to the grid per station not to exceed 500 kW. Since the factory has two certified stations, it can generate up to 1000 kW from the PV system. This means that the PV system will be designed based on the 1000 kW limit. To ensure not exceeding the limit, all the designs will be set to 975 kW to accommodate variations in the insolation intensity. Finally, the PV system has a life expectancy of 25 years which will be the planning horizon for this study.

All the system parameters will be optimized and analyzed by using Pvsyst software. The system values are obtained from the data sheet and the database of the Pvsyst software, the losses are calculated considering all the deviations, and they will be illustrated for each scenario. Three indicators are used for financial analysis: NPV, DPP, and LCOE. For an investment to be financially feasible, the internal rate of return (IRR) should surpass the minimum attractive rate of return (MARR). The MARR value is dependent on two factors: opportunity cost of money which represents the investments risks and the cost of investment capital that can be represented by the weighted average cost of capital (WACC). MARR of 12% will be used for this study as estimated by the Central Bank of Egypt [53]. To perform the feasibility study, three scenarios are analyzed. The first scenario (S1) is the baseline case for the other scenarios. In S1, vertex 550W TSM-DE19 fixed tilted PV panels are considered with no storage. The second scenario (S2) is basically the same as S1, the only difference is the model of the PV panels where a 530W ZXM7-SPLD is considered in S2. In the third scenario (S3), the model that gives the best results from the first two scenarios is considered with vertical one axis tracking.

Scenario 1

The PV module used for S1 is a monocrystalline module with rated power of 550 W, 27 V, and 21.2% maximum efficiency. The inverter utilized is Huawei-SUN2000-60KTL-M0 400Vac with capacity up to 60 kW, efficiency up to 98.8%, and 6 maximum point power tracking (MPPT). These selections have been made by consulting multiple PV solar panels providers based on components’ availability and performance. The orientation of the PV panels is set to have a plane tilt angle of 29° and azimuth angle of 0° which means it is directed exactly to the south. This orientation was concluded to maximize the outcome after trying different tilt angles between 28° and 32o by trial-and-error method, the optimal outcome was found at tilt angle of 29°. This maximizes the annual irradiation yield for a fixed PV system in this location by optimizing the orientation between the summer and winter values. A high annual irradiation yield of 2056 kWh/m2 is obtained. The angles and orientation were obtained by the simulation software, according to [54] this is the orientation that led to the best results in Egypt.

The system design, which is based on the planned output power of 975 kW, requires 1771 PV panels with an area of 4627 m2 which is almost half of the area available. According to the model, the optimum total power for the inverters required is 722.4 kW. This means that 13 inverters are needed with Pnom ratio of 1.25 which is recommended by the software. The Pnom ratio is the ratio of the installed PV power (nominal at STC) with respect to the Pnom(ac) of the inverter (PVSyst) according to the STC assumptions. A nominal AC power of 780 kW will be obtained from the system that consists of 77 strings (arrays), each with 23 PV modules in series. A total of 621 V is generated from each array through utilizing the lower and higher voltage limits of the MPPT (Fig. 2), to determine the number of modules in series. Since it is required to reach a power output of 975 kW with the minimum number of modules, a nominal value of 600 V needs to be obtained from each array to reach the required output. The software utilized the array required power to determine the number of strings in parallel as shown in Fig. 3.

The effect of solar radiation and temperature is important parameters that need to be considered. Furthermore, past studies have shown that with increasing solar radiation, the current and voltage increase. On the other hand, with the increase of the cell surface temperature, the voltage decreases which leads to a decrease in the output power (Fig. 4) [55, 56].

The effect of changing temperature and solar radiation [55]

Based on the given data, the software was used to simulate the losses which were estimated to be around 0.07 kWh/kWp/day for the system and 0.94 kWh/kWp/day for the array. A detailed breakdown of the losses is given in Fig. 5. However, it is worth noting that based on the geographical terrain inputs and PV system properties, the highest loss is one caused due to temperature effect on the PV panels which is estimated to be around 9%.

After accounting for all the losses, the PVsyst model results in producing 1634 MWh/year, which is the amount of electrical energy exported to the grid, with a specific production of 1677 kWh/kWp/day, and an average performance ratio (PR) of 82%. Figure 6a shows the monthly normalized production, the collection, and the system losses associated with it. Moreover, the average of normalized production is 4.6 kWh/kWp/day. Table 2 gives the main inputs and outputs of Scenario 1. GlobHor is Global horizontal irradiation, DiffHor is the horizontal diffuse irradiation, T_Amb is the ambient temperature, GlobInc is the global incident in collection plane, GlobEff is the effective global, corr for shading, and EArray is the effective output energy from the array. The E_Grid is equivalent to 1,633,811 kWh, because it represents the actual energy for which the feed-in tariff system is charged. Furthermore, the distribution of the power injected to the grid throughout the whole year is illustrated in Fig. 6b. The generated power in S1 out of the PV system represents 72.8% of the total power used by the factory.

Since the PV panels for this scenario are fixed, the main point of the tilt angle is to get the maximum output over the year, not specifically during equinox or spring, by having minimal losses of the solar irradiation throughout the year [57].

To perform a financial study for S1, a cash flow of all the expenses and the revenues is constructed. To obtain accurate data, prices were obtained from quotations provided by solar companies in Egypt. The total initial cost for this scenario is estimated to be 271,245.29 USD calculated by summing up the system components costs as shown in Table 3.

The project’s revenue comes from exporting electricity to the grid under the feed-in tariff system. The feed-in tariff price in Egypt is equivalent to 0.044 USD/kWh [24] and is estimated to increase annually by the government to attract investors [58]; consequently, it will be represented as a geometric series with average 3% as expected by service providers. The total electricity exported from the PV system to the grid is 1,633,811 kWh annually. The first-year revenue can be calculated as 71,509.95 USD. The annual running costs for this project; like cleaning and maintenance, are expected to be 972.64 USD with an expected increase of 64.84 USD each year, so it will be represented on the flow diagram as a gradient series. Cleaning and maintenance are crucial to future operations of the PV system since poor cleaning leads to a decrease of the output power from the system by at least 30% [59]. Finally, the salvage value for the whole project is estimated by the manufacturer to be 12,968.53 USD after 25 years. The cash flow inputs are given in Table 4 and the cash flow is graphed in Fig. 7.

The net present value (NPV) is a method to turn all cash flows into the present to answer the question of “how much is it worth now?” The NPV method is used as a ranking method to rank the alternatives. NPV = 400,000 × \(\left(\frac{P}{F}, i=12\%, n=25\right)\) − 2000 × \(\left(\frac{P}{G}, i=12\%, n=25\right)\) + 2,205,645 × \(\left(\frac{1-{\left(1+g\right)}^{n}*{\left(1+i\right)}^{-n}}{i-g}\right)\) − 8,633,260.

NPV = 400,000 × (0.0588) − 8,633,260 − 2000 × (53.105) + 2,205,645 × (9.7426) = 12,772,767 EGP.

NPV = 414,110.12 USD.

The discounted payback period (DPP) is the period a project will take to start making positive cumulative NPV. Simply, it is the time a project will take to start making profit [60]. Table 5 gives the DPP calculations. The discounted payback period is 5.711 years. Considering the 25 years lifespan of the system, this relatively low DPP shows that this project can be considered as a suitable investment. The discounted generated power through the 25 years.

The NPV value for the total costs can be obtained by deducting the revenue as well as the salvage value from the NPV [62].

Total costs NPV = 12,772,767 − 2,205,645 × (9.7426) − 400,000 * (0.0588) = − 8,739,469 EGP = − 283,345.23 USD.

The NPV of the generated power in 25 years is calculated as shown in Table 6. The total discounted power = 12,814,143 kWh.

Levelized cost of energy (LCOE), is a measure for the average present cost of energy. It can be defined as the cost of 1 kWh of energy [61]. It can be calculated using the following formula:

The LCOE for the PV system for S1 is almost half the current cost of energy charged in Egypt. Regarding the environmental impact, it should be clear that even though the PV system is not feeding the factory directly, it is feeding the grid; this will result in replacing the same amount of energy in the grid. To get the actual environmental impact of this PV system, the total amounts of CO2 emissions required for the system’s installation need to be calculated and compared [63]. The system installation emissions calculated through the software are shown in Table 7. The total installation emissions are calculated to be = 1,668,275 + 54,102 + 3934 = 1726.31 tCO2. Regarding the replaced emissions, the model used conservative value for the degradation rate of 1% annually. By generating 1633.81 MWh annually, the PV system will replace a total of 16,682.1 tCO2. This value was calculated by the software using predefined values in its database obtained from [12]. The avoided CO2 emissions were calculated by getting the difference of the total replaced emissions and the installations emissions that is 14,898.993 tCO2. The ratio of the avoided emissions over the total replaced emissions is 89.3% which is a considerable contribution towards global warming action and lowering greenhouse gases emissions. Therefore, the avoided CO2 emission factor can be calculated by dividing the avoided CO2 emissions by the power produced annually [64], yielding a factor of 10.21 TCO2/MWh.

Scenario 2

S2, is basically the same as S1, also does not have storage or tracking system. Nevertheless, a different model of PV modules and inverters were utilized for this scenario to check which give the best environmental and economic results in terms of inverters’ saving and CO2 emissions. A ZXM7-SPLD144 PV module and a SUN2000-100KTL-INM0-480Vac inverter were used for S2. The PV module is double glass monocrystalline module with rated power of 530 W, Voltage of 35 V, efficiency of 20.6%, and annual degradation rate of 0.45% for 30 years. The utilized inverter has a capacity up to 100 kW, efficiency up to 98.8%, nominal input voltage of 480 V, and 10 MPPT. Finally, the AC and the DC cables will be the same as S1. The orientation is also the same as S1 since it is the optimum condition for this geographical location with annual irradiation yield of 2056 kWh/m2.

The system design is based on the planned output power required of 975 kW. In S2, the sizing results showed that this can be achieved by utilizing 1,840 PV module, 4753m2 of space, and 8 inverters. The 8 inverters will result in obtaining a nominal AC power of 800 kW and a Pnom ratio of 1.22 which lies in the optimum range. The system will have 115 strings in parallel, each with 16 PV modules in series. The array sizing through I–V curve was studied, with respect to the lower and the higher voltage limits of the MPPT, to determine the number of modules in series. To determine the number of strings in parallel, the software utilized the array required power, Fig. 8a and b shows the power sizing and inverter output distribution comparison between S1 and S2, respectively. The losses are estimated by the software to be around 0.09 kWh/kWp/day for the system and 0.94 for the array.

After considering the losses, the PVsyst results are as follows: the total generated power exported to the grid is 1626 MWH/year, the specific production is around 1676 kWh/kWp/day with an average annual PR of 81.5%. Figure 9a shows the monthly normalized production; the total annual generated power that will be exported to the grid in S2 is 1,625,848 kWh. Figure 9b shows the monthly values of the E_grid to estimate the monthly output of the PV system. Note that the generated power in case of S2 represents 70% of the total power consumption for the factory.

To perform a financial study for S2, a cash flow of all the expenses and the revenues is constructed using the same method as S1. The total initial cost for this scenario is estimated to be 307,309.03 USD with same running costs as S1. The power exported to the grid by S2 is 1,625,848 kWh, consequently, the first-year revenue is 71,161.42 USD. Nevertheless, the project salvage value for this scenario is different from that of S1 due to the different life span guaranteed by the manufacturer. The salvage value at the end of the 25 years planning horizon is different, and it is estimated to be around 41,823.52 USD. The NPV is calculated to be 385,003.97 USD and the DPP is 5.988 years. The PV system LCOE is slightly more than half current cost of the energy charge in Egypt which is equivalent to 0.024. The total amount of installation emissions is 1728.88 tCO2. Regarding the replaced emissions, the model used conservative value for the annual degradation rate of 0.5%. Generating 1625.59 MWh annually, the PV system will replace a total of 17,536 tCO2. The avoided CO2 emissions are calculated to be 15,808.960 tCO2. The ratio of the avoided emissions to the replaced emissions is 84.9% which is less than S1.

Scenario 3

In S3, the PV system has one axis vertical tracking system and no storage. The PV modules and the inverters models are selected based on which of the two first scenarios, S1 and S2 gives the better results. S1 was selected as it has the better financial and technical results. Hence, all the components used in S3 are the same as the components utilized in S1. Nevertheless, the orientation for the vertical axis tracking modules will differ from the tilted fixed ones. The azimuth angle has a rotation limitation starting from -120° up to 120o with respect to south. However, the tilt angle will be fixed at the same value of 29°. The system design is still based on the required output power of 975 kW. The sizing for this scenario will lead to the same results as the sizing of S1 since the tracking has no impact on the amount of the generated power as it does not depend on the exposure time but rather the maximal intensity of the solar radiation.

The tracking system increases the amount of time the PV panel is highly exposed to the solar radiation which in return increases the energy generated (kWh). The number of PV modules to be utilized is 1,771 on an area of 4627 m2. 13 inverters are used providing a Pnom ratio of 1.25, which lies in the optimum range, and a nominal AC power of 780 kW. The system consists exactly of 77 strings, each with 23 PV modules in series. Note that the sizing process is the same as S1 which is 1000 kw as per the governmental regulations of the net metering cap on the amount of electrical energy that can be supplied to the grid per station The losses in this scenario are estimated to be around 0.09 kWh/kWp/day for the system and 0.90 kWh/kWp/day for the array. After considering all the losses, PVsyst model results yield 2047 MWh/year, a specific production of 2102 kWh/kWp/day, and an average performance ratio (PR) of 85.3%. Figure 10a shows the monthly normalized production. The E_Grid of this system is 2,047,425 kWh annually which is a big difference from the fixed model in S1 regarding the amount of energy exported to the grid. Figure 10b shows the distribution of the energy generated annually by the system. Note that, the generated energy in S3 represents 87.94% of the factory total electrical consumption.

Regarding the financial study, all the items utilized for S1 will be used in S3 as well as the tracking system components. The total initial cost for this scenario is 390,793.25 USD. The revenue for the first year is 89,613.31 USD where 2,047,425 kWh is the amount of electrical energy exported to the grid annually. The running costs for this system will be double those ofS1. The reason for this is that the S3 tracking system has much higher complexity. Consequently, the running costs are expected to increase by 129.69 USD annually and can be represented as a gradient series. The salvage value is estimated to be around 19,452.80 USD at the end of the 25th year. Thus, the NPV is calculated as 476,530.23 USD and the DPP is calculated as 6.139 years. The PV system LCOE is more than half current cost of the energy charge in Egypt which is calculated as 0.025. To measure the environmental impact, the total installation’s emissions were calculated to be 1942.72 tCO2. The model uses conservative value for the annual degradation rate of 0.5%, generating 2047.43 MWh annually, the PV system will replace a total of 20,834.155 tCO2. The avoided emissions are 18,891.435 tCO2. The ratio of the replaced emissions over the avoided emissions is 90.6%. Table 8 summarizes the results for the three scenarios.

Discussion

Key indicators’ comparison

The three scenarios are compared against the three addressed aspects: technical, environmental, and financial. Table 9 shows the different values for key indicators for the three scenarios. Although S1 provides the best indicators in terms of the discounted payback period and the levelized cost of energy, S3 may be a better choice with higher net present value, relatively short payback period, and better environmental performance. Therefore, if the investor prioritizes LCOE and the DPP, then the best alternative is S1; on the other hand, if the investor prioritizes the net present value and the environmental impact, then S3 is the best alternative.

Sensitivity analysis

Sensitivity analysis is performed to test the effect of changing some parameters on the NPV and the LCOE for certain scenarios. S1 and S3 were chosen for this analysis as they are the most promising scenarios in this study. The first important parameter to be analyzed is the discount rate of the project due to the recent fluctuations in the world economy and the increasing inflation in Egypt. Figure 11a shows that NPV for both scenarios S1 and S3 is dependent on the discount rate, and that with increasing the discount rate the NPV decreases for both scenarios. The break-even occurs at discount rate of 18.63%, after this point NPV of S1 is higher than that of S3. Figure 11b shows that the LCOE of energy is also dependent on the discount rate value. It is shown that with increasing the discount rate the LCOE continuously increases for both scenarios. It is seen that the break-even occurs almost at 0 discount rate which is unlikely to occur in Egypt according to the economic situation and forecasts, hence, S1 is expected to keep having lower LCOE.

Furthermore, the initial investment, operating and maintenance costs, salvage value, and annual revenue are analyzed to study their effect on the NPV. It was found that the NPV is clearly inversely dependent on the initial investment. The increases in operating and maintenance costs and the salvage value have a very small effect on the NPV relative to the other parameters. Finally, the annual revenue is the parameter with the highest direct proportional effect on the NPV. Nevertheless, the controllable parameter that can be changed from one system to another, regarding the annual revenue, is the system annual production, not the feed-in tariff price for the electricity.

Finally, it can be concluded that the PV project will not be financially feasible if the discount rate continuously increased while the other parameters did not change, which is unlikely since the other parameters change with the change in the discount rate. Hence, it can be said that further increasing the discount rate will have negative impact on the financial feasibility of the project.

Sustainability impact

From the past sections, the economic, technical, and environmental aspects were addressed, however, to achieve full sustainability, the social aspect should be considered as well. Since all the aspects are connected, it is agreed upon that improvement in economic and environmental dimensions reflect on the social status of a community in terms of the wealth and well-being of the people. To be more specific, in terms of the food industry, United Kingdom and Europe markets have a high potential as export destinations, however, they have high environmental standards. Increasing the energy efficiency and following sustainable approaches will give the Egyptian products a competitive edge added to the relatively low prices. For example, Tesco’s ‘Nature’s Choice’ standard is an example of the increasing interest in products that were produced following sustainable standards [52]. By moving towards sustainable production, the company can export more leading to better revenues that will enable future investments specially in a growing sector as the processed meat and poultry industry. This would have a positive impact on social aspects such as local employment, job opportunities, better life standards, better health, and community development [65]. Consequently, such projects, besides achieving feasibility, also achieves sustainability and can be easily mapped to the United Nations Sustainable Development Goals (UN SDGs). A direct impact will be for SDG 3 (Good health and well-being), SDG 7 (Affordable and clean energy), SDG 8 (Decent work and economic growth), SDG 9 (Industry, innovation, and infrastructure), SDG 11 (Sustainable cities and communities), SDG 12 (Responsible consumption and production), and SDG 13 (Climate action).

Risks and limitations

Every project has certain risks and limitations that must be considered to have the full picture of the project opportunities and threats. This section will elaborate on the risks for the solar PVs for the industrial applications in Egypt.

Risks

-

The unpredictable changes of the weather which will lead to fluctuations in the power output [66].

-

Sandstorms and dust accumulations on the PV panels that can cause the output power to decrease until the panels are cleaned.

-

Fluctuations in the economy and the associated inflation and interest rate changes [67].

Limitations

-

Restriction on the maximum power output to be exported to 500 kW by station enforced by the Egyptian regulations.

-

The average value of the solar radiation in Egypt led to high number of PV panels.

-

The relatively high costs associated with this project will limit the number of investments specially for smaller factories.

Conclusions

This study investigates the feasibility of the usage of solar energy for industrial applications in Egypt specifically solar PV panels. To ensure the sustainability of this application, the feasibility study has considered technical, economic, and environmental analysis. Three scenarios have been investigated; the first two scenarios differ in the model of the PV panels used as well as the inverter’s type. The third scenario utilizes a vertical axis solar tracking system using the model with the best results from the first two scenarios. Also, non-financial considerations were considered, such as the acceptance and the acceptability. For the financial study, three financial indicators were utilized to determine whether the different PV systems are feasible and which scenario is preferred.

The results have shown that the PV module with vertical tracking will produce the highest amount of energy with 2047 MWh which represents 87.94% of the factory’s consumption. However, it had the longest DPP of around 6.139 years out of 25 years life span of the PV system which is still considered good investment. The third scenario had the highest NPV among the three scenarios calculated as 476,530.23 USD. The first scenario had the lowest LCOE of around 0.022 USD/kWh, which is considered almost half of the current energy price in Egypt as set by the government. The third scenario will have the highest positive impact on the environment with 18,891.435 tons of avoided CO2 emissions. Moreover, sensitivity analysis was carried out to test the effect of changing the discount rate on the NPV and the LCOE. The results of the feasibility-sustainability study have shown that utilizing the PV system for power generation at industrial sites is feasible and sustainable in every aspect for the three scenarios. Consequently, a generalization can be made which is the PV systems in Egypt are feasible for the industrial sector and make a very good investment choice with a positive environmental impact.

Based on the study conducted and its results the following recommendations can be concluded:

-

it is recommended to use the on-grid option by utilizing the solar system as a financial investment instead of using it as a source of direct power to the factory to avoid the environmental and economic issues related to batteries’ installation and usage.

-

Based on the results of this case study, it is preferable to use one axis sun tracking instead of fixed angle PV panels in Egypt. It is worth noting that after consulting with multiple service providers in Egypt, it was decided that two-axis system will not be utilized in this study as it is not commonly used in Egypt, making its maintenance and spare parts not easily available

-

Based on the performed sensitivity analysis, the investment in PVs is not recommended when the discount rate highly increases, since the LCOE of the system will be higher than the incentive paid by the government.

Future work can be done to study the effect of the change in the feed-in tariff on the feasibility of such systems. Studying the effect of temperature on the output power is another interesting research direction. Furthermore, Egypt’s future vision is also focusing on wind energy, thus, a feasibility-sustainability study for wind energy usage for residential or industrial application is considered as an important topic with a solar–wind hybrid plant to be studied.

Availability of data and materials

Not applicable due to confidentiality.

Abbreviations

- BCR:

-

Benefits-to-costs ratio

- BOS:

-

Balance of the systems

- Btu:

-

British thermal units

- CSP:

-

Concentrating solar power

- DPP:

-

Discounted payback period

- GHGs:

-

Greenhouse gases

- IRR:

-

Internal rate of return

- kWh:

-

Kilowatt hour

- kWp:

-

Kilowatt peak

- LCOE:

-

Nominal levelized cost of energy

- MIRR:

-

Modified internal rate of return

- MPPT:

-

Maximum point power tracking

- MW:

-

Megawatt hour

- NPV:

-

Net present value

- PR:

-

Performance ratio

- PVs:

-

Photovoltaic panels

- SRECs:

-

Solar renewable energy credits

- SPB:

-

Simple payback

- STC:

-

Standard test conditions

- TAM:

-

Technology acceptance model

- TCO2 :

-

Ton of carbon dioxide

- TLCC:

-

Total life cycle cost

- UN SDGs:

-

United Nations Sustainable Development Goals

- WACC:

-

Weighted average cost of capital

- WT:

-

Wind turbines

References

KQED (2014) Nonrenewable and Renewable Energy Resources. https://www.kqed.org/quest/64341/nonrenewable-and-renewable-energy-resources-2. Accessed 13 May 2021

US Energy Information Administration EIA (2023) Renewable energy explained. https://www.eia.gov/energyexplained/renewable-sources/ Accessed 20 May 2021

Al-Rawashdeh H, Al-Khashman OA, Al Bdour JT, Gomaa MR, Rezk H, Marashli A, Arrfou LM, Louzazni M (2023) Performance analysis of a hybrid renewable-energy system for green buildings to improve efficiency and reduce GHG emissions with multiple scenarios. Sustainability-Basel 15:7529. https://doi.org/10.3390/su15097529

IEA (2021) Global Energy Review 2021. https://www.iea.org/reports/global-energy-review-2021?mode=overview. Accessed 20 April 2022

Ritchie H, Roser M. (2020) Energy mix. https://ourworldindata.org/energy-mix?country=#energy-mix-what-sources-do-we-get-our-energy-from. Accessed 6 April 2022

European Environment Agency EEA (2021) Environmental impact of energy. https://www.eea.europa.eu/help/glossary/eea-glossary/environmental-impact-of-energy. Accessed 1 December 2021

IPCC (2018) Summary for Policymakers. In: Global warming of 1.5°C. https://www.ipcc.ch/sr15/. Accessed 8 June 2021

Herron S. (2010) Solar Irradiation and Energy from Deserts. http://large.stanford.edu/courses/2010/ph240/herron2/. Accessed 20 November 2021

Carra E, Ballestrín J, Monterreal R, Enrique R, Polo J, Fernández-Reche J, Barbero J, Marzo A, Alonso-Montesinos J, López G, Díaz B (2021) Interannual variation of measured atmospheric solar radiation extinction levels. Sustain Energy Technol 51:101991. https://doi.org/10.1016/j.seta.2022.101991

Awad H, Nassar YF, Hafez A, Sherbiny MK, Ali AFM (2022) Optimal design and economic feasibility of rooftop photovoltaic energy system for Assuit University, Egypt. Ain Shams Eng J 13(3):101599. https://doi.org/10.1016/j.asej.2021.09.026

Nassar YF, Alsadi SY, Miskeen GM, El-Khozondar HJ, Abuhamoud NM (2022) Mapping of PV Solar Module Technologies Across Libyan Territory. Iraqi International Conference on Communication and Information Technologies (IICCIT), 7–8 September 2022, Basrah, Iraq, pp 227–232, https://doi.org/10.1109/IICCIT55816.2022.10010476

International Energy Agency IEA (2020) Final consumption. https://www.iea.org/reports/renewables-2020. Accessed 20 November 2021

International Energy Agency (2024) Renewables 2023. https://www.iea.org/reports/renewables-2023. Accessed 16 March 2024

International Energy Agency (2023) Coal 2023. https://www.iea.org/reports/coal-2023. Accessed 16 March 2024

Fayad MF, Sabri S, Elmahdy M, Kasem A (2020) Managing of renewable energy transformations in Egypt. Int J Sci Res Sustain Dev 3(2):1–18

Knoema, Egypt (2020) Total primary energy consumption. https://knoema.com/atlas/Egypt/Primary-energy-production. Accessed 5 May 2021

Ritchie H, Roser M. (2020) Egypt: Energy Country Profile. https://ourworldindata.org/energy/country/egypt#citation. Accessed 10 May 2021

International Energy Agency (2023) Egypt. https://www.iea.org/countries/egypt. Accessed 13 May 2021

Informa Markets (2023) North Africa Energy Overview Report 2023. https://www.egypt-energy.com/en/forms/north-africa-energy-report.html. Accessed 10 March 2024

Stanek B, Wang W, Bartela L (2023) A potential solution in reducing the parabolic trough based solar industrial process heat system cost by partially replacing absorbers coatings with non-selective ones in initial loop sections. Appl Energy 331:120472. https://doi.org/10.1016/j.apenergy.2022.120472

ClimateScope (2024) Egypt. https://www.global-climatescope.org/markets/eg/. Accessed 12 March 2024

Informa Markets (2022) Egypt Energy Sector: Market Report 2022. https://www.egypt-energy.com/en/forms/africa-outlook-report.html Accessed 20 May 2023

Ouyang D, Weng J, Chen M, Wang J (2020) Impact of high-temperature environment on the optimal cycle rate of lithium-ion battery. J Energy Storage 28:101242. https://doi.org/10.1016/j.est.2020.101242

Ali M (2021) New tariffs in Egypt. https://gate.ahram.org.eg/News/2843722.aspx. Accessed 10 May 2021

Behar O, Sbarbaro D, Moran L (2020) Which is the most competitive solar power technology for integration into the existing copper mining plants: photovoltaic (PV), concentrating solar power (CSP), or hybrid PV-CSP? J Clean Prod 287:125455. https://doi.org/10.1016/j.jclepro.2020.125455

Kumar M (2020) Social, economic, and environmental impacts of renewable energy resources. Wind Solar Hybrid Renewable Energy Syst. https://doi.org/10.5772/intechopen.89494

Nassar YF, Alsadi SY (2019) Assessment of solar energy potential in Gaza Strip-Palestine. Sustain Energy Techn 31:318–328. https://doi.org/10.1016/j.seta.2018.12.010

Al-Khori K, Bicer Y, Koç M (2021) Comparative techno-economic assessment of integrated PV-SOFC and. Energy 222:119923. https://doi.org/10.1016/j.energy.2021.119923

Sewchurran S, Davidson IE (2021) Technical and financial analysis of large-scale solar-PV in eThekwini Municipality: residential, business and bulk customers. Energy Rep 7:4961–4976. https://doi.org/10.1016/j.egyr.2021.07.134

Namin AT, Kamarthi S, Eckelman MJ, Isaacs JA (2019) Comparison of U.S. Manufacturing Locations for Solar PVs. Procedia CIRP 434–439. https://doi.org/10.1016/J.PROCIR.2019.01.094

Catalbas MC, Kocak B, Yenipınar B (2021) Analysis of photovoltaic-green roofs in OSTIM industrial zone. Int J Hydrogen Energy 46(27):14844–14856. https://doi.org/10.1016/j.ijhydene.2021.01.205

Azzam YA, Ibrahim N (2018) A feasibility study of the use of solar PV energy in Saudi Arabia: a case study. J Sol Energy-T ASME 140(4):140–172. https://doi.org/10.1115/1.4039551

Li X, Gao J, You S, Zheng Y, Zhang Y, Du Q, Min X, Qin Y (2022) Optimal design and techno-economic analysis of renewable-based multi-carrier energy systems for industries: a case study of a food factory in China. Energy 244:123174. https://doi.org/10.1016/j.energy.2022.123174

Infinite Energy Corporation (2016) Index case study. https://www.infiniteenergy.com.au/commercial/case-studies-2/manufacturer/imdex100kw/. Accessed 6 April 2022

Hussain MN, Qamar SB, Janajreh I, Zamzam S (2017) Solar PV implementation in industrial buildings: economic study. International Renewable and Sustainable Energy Conference (IRSEC), 4–7 December 2017, Tangier, Morocco, pp. 1–5. https://doi.org/10.1109/IRSEC.2017.8477355

SunPower Corporation (2019) Texas Manufacturing Business Runs 100% on Solar. https://us.sunpower.com/sites/default/files/media-library/case-studies/cs-rehme-steel.pdf. Accessed 6 May 2022

Solar Energy World corporation (2020) Metuchen Sportsplex 2020. https://www.solarenergyworld.com/case-study/metuchen-sportsplex/. Accessed 2 November 2021

Ghasemi-Mobtaker H, Mostashari-Rad F, Saber Z, Chau K-W, Nabavi-Pelesaraei A (2020) Application of photovoltaic system to modify energy use, environmental damages and cumulative exergy demand of two irrigation systems-a case study: Barley production of Iran. Renew Energy 160:1316–1334. https://doi.org/10.1016/j.renene.2020.07.047

Gomaa MR, Al-Bawwat AK, Al-Dhaifallah M, Rezk H, Ahmed M (2023) Optimal design and economic analysis of a hybrid renewable energy system for powering and desalinating seawater. Energy Rep 9:2473–2493. https://doi.org/10.1016/j.egyr.2023.01.087

Al-Rawashdeh H, Rezk H, Al-Khashman OA, Shalby M, Arrfou LM, Al Bdour JT, Gomaa MR, Louzazni M (2023) Different scenarios for reducing carbon emissions, optimal sizing, and design of a stand-alone hybrid renewable energy system for irrigation purposes. Int J Energ Res. https://doi.org/10.1155/2023/6338448

Shen L, Tam VWY, Tam L, Ji Y (2010) Project feasibility study: the key to successful implementation of sustainable and socially responsible construction management practice. J Clean Prod 18(3):254–259. https://doi.org/10.1016/j.jclepro.2009.10.014

Mostafa N, Grida M, Park J, Ramadan HSM (2022) A sustainable user-centered application for residential energy consumption saving. Sustain Energy Technol 53D:102754. https://doi.org/10.1016/j.seta.2022.102754

Mentes M (2023) Sustainable development economy and the development of green economy in the European Union. Energy Sustain Soc 13:32. https://doi.org/10.1186/s13705-023-00410-7

International Trade Administration (2022) Electricity and Renewable Energy. https://www.trade.gov/country-commercial-guides/egypt-electricity-and-renewable-energy

Mesly O (2017) Project Feasibility: tools for uncovering points of vulnerability. CRC Press, Boca Raton

PVsyst modelling software. https://www.pvsyst.com/

Gruneberg SL (1997) Construction economics an introduction. MACMILLAN, London

Mitcham C, Bocong L, Baichun Z (2018) Philosophy of engineering, East and West. Springer, Boston

Yang L, Danwana SB, Yassaanah IF-I (2021) An empirical study of renewable energy technology. Sustainability-Basel 13(19):10791. https://doi.org/10.3390/su131910791

Nassar Y, Mangir I, Hafez A, El-Khozondar H, Salem M, Awad H (2023) Feasibility of innovative topography-based hybrid renewable electrical power system: a case study. Cleaner Eng Technol 14:100650. https://doi.org/10.1016/j.clet.2023.100650

Elmariami A, El-Osta W, Nassar Y, Khalifa Y, Elfleet M (2023) Life cycle assessment of 20 MW wind farm in Libya. Appl Solar Energy 59:64–78. https://doi.org/10.3103/S0003701X22601557

UNIDO (2017) Integration of Energy Efficiency into Food Manufacturing Sector Strategy. https://ieeegypt.org/wp-content/uploads/2016/04/Food-IEE-strategy.pdf

Central Bank of Egypt, https://www.cbe.org.eg/en/Pages/default.aspx. Accessed 13 June 2022

El Abagy A, Emeara M, AbdelGawad A (2021) Orientation-optimization simulation for solar photovoltaic plant of Cairo international airport. Egypt Int J Eng Sci Technol 33:45–68. https://doi.org/10.21608/eijest.2021.56964.1035

Nassar YF, Salem AA (2007) The reliability of the photovoltaic utilization in southern cities of Libya. Desalination 209(1–3):86–90. https://doi.org/10.1016/j.desal.2007.04.013

Ssenyimba S, Kiggundu N, Banadda N (2020) Designing a solar and wind hybrid system for small-scale irrigation: a case study for Kalangala district in Uganda. Energy Sustain Soc 10:6. https://doi.org/10.1186/s13705-020-0240-1

Kochmarev KO, Malozyomov BV, Kuznetsova SY, Ignatev IV (2020) Theory and practice of positioning a solar panel to obtain peak power points at weather stations. J Phys: Conf Ser 1661:012098. https://doi.org/10.1088/1742-6596/1661/1/012098

Alternative Policy Solutions (2022) Renewable Energy Policies in Egypt: An Overview and Analysis. https://aps.aucegypt.edu/en/articles/807/renewable-energy-policies-in-egypt-an-overview-and-analysis. Accessed 16 March 2024

Chandler DL (2022) How to clean solar panels without water. MIT News

Nassar YF, Abdunnabi MJ, Sbeta MN, Hafez AA, Amer KA, Ahmed AY (2021) Dynamic analysis and sizing optimization of a pumped hydroelectric storage-integrated hybrid PV/Wind system: a case study. Energy Convers Manage 229:113744. https://doi.org/10.1016/j.enconman.2020.113744

Mohammed S, Nassar Y, El-Osta W, El-Khozondar HJ, Miskeen A, Basha A (2023) Carbon and energy life cycle analysis of wind energy industry in Libya. Solar Energy Sustain Dev 12(1):50–70

Hafez AA, Nassar YF, Hammdan MI, Alsadi SY (2020) Technical and economic feasibility of utility-scale solar energy conversion systems in Saudi Arabia. Iran J Sci Technol Trans Electr Eng 44:213–225. https://doi.org/10.1007/s40998-019-00233-3

Mokhtara C, Negrou B, Settou N, Bouferrouk A, Yao Y (2021) Optimal design of grid-connected rooftop PV systems: an overview and a new approach with application to educational buildings in arid climates. Sustain Energy Technol 47:101468. https://doi.org/10.1016/j.seta.2021.101468

Abdunnabi M, Etiab N, Nassar YF, El-Khozondar HJ, Khargotra R (2023) Energy savings strategy for the residential sector in Libya and its impacts on the global environment and the nation economy. Adv Build Energy Res 17(4):379–411. https://doi.org/10.1080/17512549.2023.2209094

Kumar HS (2021) Rooftop Solar for C&I Consumers in Tamil Nadu. https://settn.energy/events/rooftop-solar-for-ci-consumers-in-tamil-nadu. Accessed 20 November 2021

Nassar YF, Alsadi SY, El-Khozondar HJ, Ismail MS (2022) Design of an isolated renewable hybrid energy system: a case study. Mater Renew Sustain 11:225–240. https://doi.org/10.1007/s40243-022-00216-1

El-Khozondar HJ, El-batta F, El-Khozondar RJ, Nassar Y, Alramlawi M, Alsadi S (2022) Standalone hybrid PV/wind/diesel-electric generator system for a COVID-19 quarantine center. Environ Prog Sustain 42(3):e14049. https://doi.org/10.1002/ep.14049

Acknowledgements

We would like to express our gratitude for English Language Unit at The British University in Egypt for their efforts in editing and proofreading the manuscript.

Funding

Open access funding provided by The Science, Technology & Innovation Funding Authority (STDF) in cooperation with The Egyptian Knowledge Bank (EKB).

Author information

Authors and Affiliations

Contributions

N.A.M.: conceptualization, methodology, supervision, investigation, validation, writing—reviewing and editing. A.A.: software, data curation, visualization, investigation, writing—original.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

This study has no human or animal studies.

Consent for publication

The authors comply with the publication and conditions of the journal.

Competing interests

There are no financial and personal relationships with other people or organizations that could inappropriately influence this work.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/. The Creative Commons Public Domain Dedication waiver (http://creativecommons.org/publicdomain/zero/1.0/) applies to the data made available in this article, unless otherwise stated in a credit line to the data.

About this article

Cite this article

Mostafa, N.A., Aboelezz, A. Feasibility-sustainability study of power generation using solar energy at an industrial site: a case study from Egypt. Energ Sustain Soc 14, 36 (2024). https://doi.org/10.1186/s13705-024-00460-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s13705-024-00460-5