Abstract

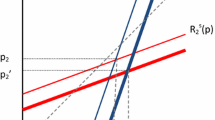

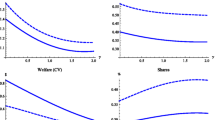

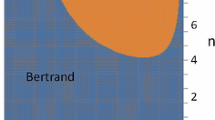

We examine the effects of switching costs in a two-period Hotelling-type model where a profit-maximising private firm competes with a welfare-maximising public firm. We show that, in contrast with the case in which both firms are private, where switching costs raise prices in both periods, in the mixed duopoly they raise prices in the second period but reduce them in the first period. Moreover, the first-period price reduction is of such magnitude that switching costs reduce firms’ profits and raise consumer welfare. We also find that switching costs affect the consequences of privatisation in favour of firms and against consumers.

Similar content being viewed by others

References

Burguet, R., R. Caminal and C. Matutes (2002) “Golden Cages for Showy Birds: Optimal Switching Costs in Labor Contracts”, European Economic Review, Vol. 46, No. 7, pp. 1153–1185.

Caminal, R. and C. Matutes (1990) “Endogenous Switching Costs in a Duopoly Model”, International Journal of Industrial Organization, Vol. 8, No. 3, pp. 353–373.

Chen, Y. (1997) “Paying Customers to Switch”, Journal of Economics and Management Strategy, Vol. 6, No. 4, pp. 877–897.

Dadpay, A. and J. S. Heywood (2006) “Mixed Oligopoly in a Single International Market”, Australian Economic Papers, Vol. 45, No. 4, pp. 269–280.

Dong, Q. and J. C. Bárcena-Ruiz (2017) “Privatization and Entry with Switching Costs”, Manchester School, Vol. 85, No. 4, pp. 491–510.

Farrell, J. and P. Klemperer (2007) “Coordination and Lock-in: Competition with Switching Costs and Network Effects”, in M. Armstrong and R. Porter eds, Handbook of Industrial Organization, vol. 3, Amsterdam: North-Holland, pp. 1967–2072.

Fernández-Ruiz, J. (2009) “Managerial Delegation in a Mixed Duopoly with a Foreign Competitor”, Economics Bulletin, Vol. 29, No. 1, pp. 90–99.

——— (2017) Online Appendix to “A Mixed Duopoly with Switching Costs”, mimeo., El Colegio de México. Available from URL: http://jorgefernandez.webstarts.com/.

Fjell, K. and J. S. Heywood (2002) “Public Stackelberg Leadership in a Mixed Oligopoly with Foreign Firms”, Australian Economic Papers, Vol. 41, No. 3, pp. 267–281.

——— and D. Pal (1996) “A Mixed Oligopoly in the Presence of Foreign Private Firms”, Canadian Journal of Economics, Vol. 29, No. 3, pp. 737–743.

Grzybowski, L. and P. Pereira (2011) “Subscription Choices and Switching Costs in Mobile Telephony”, Review of Industrial Organization, Vol. 38, No. 1, pp. 23–42.

Heywood, J. S. and G. Ye (2009) “Mixed Oligopoly and Spatial Price Discrimination with Foreign Firms”, Regional Science and Urban Economics, Vol. 39, No. 5, pp. 592–601.

Ishibashi, K. and T. Kaneko (2008) “Partial Privatization in Mixed Duopoly with Price and Quality Competition”, Journal of Economics Vol. 95, No. 3, pp. 213–231.

Kikuchi, T. (2007) “Switching Costs and the Impact of Trade Liberalization”, Economics Bulletin, Vol. 6, No. 6, pp. 1–7.

Kim, M., D. Kliger and B. Vale (2003) “Estimating Switching Costs: The Case of Banking”, Journal of Financial Intermediation, Vol. 12, No. 1, pp. 25–56.

Kitahara, M. and T. Matsumura (2013) “Mixed Duopoly, Product Differentiation and Competition”, The Manchester School, Vol. 81, No. 5, pp. 730–744.

Klemperer, P. (1987) “The Competitiveness of Markets with Switching Costs”, Rand Journal of Economics, Vol. 18, No. 1, pp. 138–150.

Klemperer, P. (1995) “Competition when Consumers Have Switching Costs: An Overview with Applications to Industrial Organization, Macroeconomics, and International Trade”, The Review of Economic Studies, Vol. 62, No. 4, pp. 515–539.

Kraft, J. and E. Salies (2008) “The Diffusion of ADSL and Costs of Switching Internet Providers in the Broadband Industry”, Research Policy, Vol. 37, No. 4, pp. 706–719.

Lee, S. H., L. Xu and Z. Chen (2013) “Competitive Privatization and Tariff Policies in an International Mixed Duopoly”, The Manchester School, Vol. 81, No 5, pp. 763–779.

Lin, M. H. and T. Matsumura (2012) “Presence of Foreign Investors in Privatized Firms and Privatization Policy”, Journal of Economics, Vol. 107, No. 1, pp. 71–80.

Lu, Y. and S. Poddar (2007) “Firm Ownership, Product Differentiation and Welfare”, The Manchester School, Vol. 75, No. 2, pp. 210–217.

Matsumura, T. and N. Matsushima (2003) “Mixed Duopoly with Product Differentiation: Sequential Choice of Location”, Australian Economic Papers, Vol. 42, No. 1, pp. 18–34.

———, ——— and I. Ishibashi. (2009) “Privatization and Entries of Foreign Enterprises in a Differentiated Industry”, Journal of Economics, Vol. 98, No. 3, pp. 203–219.

Ohnishi, K. (2010) “A Three-stage International Mixed Duopoly with a Wage-rise Contract as a Strategic Commitment”, The Manchester School, Vol. 78, No. 4, pp. 279–289.

Ogawa, H. and Y. Sanjo (2007) “Location of Public Firm in the Presence of Multinational Firm: A Mixed Duopoly Approach”, Australian Economic Papers, Vol. 46, No. 2, pp. 191–203.

Osborne, M. (2011) “Consumer Learning, Switching Costs, and Heterogeneity: A Structural Examination”, Quantitative Marketing and Economics, Vol. 9, No. 1, pp. 25–70.

Sanjo, Y. (2009) “Bertrand Competition in a Mixed Duopoly Market”, The Manchester School, Vol. 77, No. 3, pp. 373–397.

Shy, O. (2002) “A Quick-and-Easy Method for Estimating Switching Costs”, International Journal of Industrial Organization, Vol. 20, No. 1, pp. 71–87.

To, T. (1994) “Export Subsidies and Oligopoly with Switching Costs”, Journal of International Economics, Vol. 37, No. 1, pp. 97–110.

Wang, L. F. and T. L. Chen (2011) “Mixed Oligopoly, Optimal Privatization, and Foreign Penetration”, Economic Modelling, Vol. 28, No. 4, pp. 1465–1470.

———, Y. C. Wang and L. Zhao (2009) “Privatization and Efficiency Gain in an International Mixed Oligopoly with Asymmetric Costs”, Japanese Economic Review, Vol. 60, No. 4, pp. 539–559.