Abstract

To analyse the impact of the free trade zone (FTZ) policy on firms’ innovation performance, this study conducted a quasi-natural experiment involving FTZ promotion, matched information on the establishment of China’s FTZs with patent data for listed companies from 2012 to 2020, and applied identification, estimation and inference processes to identify the effects of FTZs using a time-varying difference-in-differences model. The validity of the findings was confirmed using the parallel trend test, the placebo test and a high-dimensional fixed effects estimation, and the mediating roles of financing constraints and industrial agglomeration on firms’ innovation performance were analysed. To address the endogeneity issue and eliminate regression bias resulting from non-random selection, an instrumental variable regression and propensity score matching were employed. In addition, the policy effects were further explored by analysing the moderating effects of contextual factors and firm heterogeneity. The results showed that the FTZ policy has considerably enhanced the innovation performance of enterprises in the pilot areas, increasing the innovation level of enterprises by alleviating financing constraints and enhancing industrial agglomeration. The level of economic development and the degree of government involvement have also influenced the effect of the FTZ policy on enterprises’ innovation performance. Firm heterogeneity, including factors such as size, ownership, industry affiliation and location, influences the policy effects. In an effort to accelerate the implementation of the policy, an in-depth analysis of the underlying mechanism of the FTZ policy and its effects on enterprise innovation performance was provided, thereby providing a realistic basis for the expansion of the FTZ policy.

Similar content being viewed by others

Introduction

With the ongoing deepening of global economic integration, free trade is of considerable importance in reducing unemployment rates, expanding markets and business opportunities and fostering international cooperation and stability (Sun and Cao, 2021). It offers opportunities for greater economic prosperity and accelerates the realisation of the United Nations’ Sustainable Development Goals (SDGs) (Leite, 2019b). However, free trade also poses numerous challenges. Due to the varying positions of countries in the global value chain and their roles in the international division of industries, there is an imbalance in the industrial structure and distribution of benefits (Leite, 2019a). Therefore, to ensure the self-interests of trading parties and the fairness and inclusiveness of free trade, free trade zones (FTZs) have emerged (Yue, 2022).

In simple terms, a FTZ is a trade agreement voluntarily established by a group of countries or regions. Its purpose is to promote trade liberalisation between the countries through mutual reductions in trade barriers and eliminating or reducing tariffs and non-tariff barriers (Qin et al., 2022). Members of the FTZ enjoy favourable trade conditions and low transaction costs within the region, facilitating convenient exchange and flow of goods and services. FTZs facilitate the deepening of economic cooperation through mechanisms such as policy coordination and investment collaboration (Hao, 2023). Hence, FTZs have a substantial impact on improving the business environment, enhancing resource allocation efficiency and boosting consumer welfare. The establishment of FTZs can take different forms, including customs unions, tariff quota systems and common markets (Barros and Martínez-Zarzoso, 2022). Globally renowned FTZs include the European Free Trade Association (EFTA), the North American Free Trade Agreement (NAFTA) and the free trade area established among the member countries of the Association of Southeast Asian Nations (ASEAN), known as the ASEAN Free Trade Area (AFTA). EFTA is composed of seven European countries, including the United Kingdom, Norway and Switzerland. Member countries have eliminated tariffs among themselves and maintain an open trade policy in the field of trade. NAFTA consists of the United States, Canada and Mexico and aims to foster economic integration in the North American region. AFTA aims to expand the market size in Southeast Asia and promote trade prosperity in the Asia–Pacific region (Tritto and Camba, 2023).

Currently, Chinese society is undergoing an important period of economic transformation. Numerous factors such as inadequate resource endowment and financing constraints have led to the slow development of some enterprises and there is an urgent need to improve enterprises’ level of innovation (Tsang, 2023). China hopes to further expand its level of openness to the outside world through the Belt and Road concept, promote industrial structure upgrading and enterprise technological innovation and ultimately achieve the SDGs (Su and Li, 2023). The Chinese government has formulated an FTZ policy and established FTZ pilot areas as a key initiative in its push to establish a high-quality, open system aimed at addressing the problems of restricted access to finance and weak innovation capabilities. Research suggests that FTZs can reduce transaction costs and thus increase corporate investment in research and development (R&D). However, some scholars suggest that the establishment of FTZs will mean that Chinese companies are directly involved in global competition, which increases the pressure on the growth of such enterprises (Camba, 2022). Therefore, the effect of the FTZ policy on the innovation performance of enterprises should be clarified in an effort to enhance the high-quality development of Chinese enterprises.

To accurately explore the effects of establishing FTZs on firms’ innovation performance, we conducted a quasi-natural experiment that involved establishing groups of Chinese FTZs as an entry point. We matched patent data for Chinese listed companies for the period from 2012 to 2020 with related data on the pilot FTZs and estimated the effect of FTZs on firms’ innovation performance using a time-varying difference-in-differences (DID) model. The findings of this study provide a novel way of thinking about the construction of FTZs and the high-quality innovation of firms. The academic contributions of the study are as follows.

(1) In this study, we construct an analytical framework based on dynamic capability theory and competitive advantage theory and explore the strategic impact of FTZs on enterprise innovation, providing empirical evidence that supports the implementation and promotion of the FTZ policy. (2) Using a time-varying DID model, we conduct a robustness test of our baseline results regarding the effect of FTZs on the innovation performance of listed companies, thereby increasing our knowledge of policy and corporate innovation. (3) We analyse the mechanism by which the FTZ policy influences the innovation performance of enterprises, including the mediating roles of financing constraints and industrial agglomeration, and provide a reliable basis for enterprises to enhance their research capabilities. (4) We address endogeneity, and utilise instrumental variables (IVs) and propensity score matching (PSM) to mitigate bias arising from non-random selection. In addition, we analyse moderating effects and firm heterogeneity.

Background review

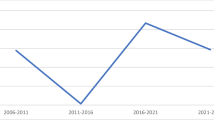

In 2008, in the aftermath of the global economic crisis, China faced several problems, including strong downward pressure on the economy and difficulties in transforming traditional industries. Thus, the Chinese government implemented the strategic plan of establishing FTZs with the aim of expanding the scale of foreign trade and promoting the upgrading and development of the regional economy and business entities (Wang et al., 2022b). Since the establishment of China’s first FTZ in Shanghai in 2013, the Chinese State Council has approved 21 FTZs in six phases. As shown in Fig. 1, in addition to Shanghai, the FTZs are Guangdong, Tianjin and Fujian in 2015; Liaoning, Zhejiang, Henan, Hubei, Chongqing, Sichuan and Shaanxi in 2017; Hainan in 2018; Shandong, Jiangsu, Guangxi, Hebei, Yunnan and Heilongjiang in 2019; and Beijing, Hunan and Anhui in 2020. China’s provincial-level administrative divisions are divided into ‘provinces, municipalities directly under the central government (municipalities) and autonomous regions’, which are equivalent to the states in the United States. Among the 21 pilot FTZs, Beijing, Tianjin, Shanghai and Chongqing are municipalities, whereas the others are provinces.

Over the past decade, the Chinese government has implemented continuous reforms and innovations using FTZs, replicated over 3400 reform measures nationwide and accomplished remarkable achievements (Chen et al., 2022). These achievements include the liberalisation and facilitation of investment and trade, providing financial services to the real economy, and exploring innovative management models. China’s FTZs are distributed across various provinces, and each have their own characteristics in terms of strategic positioning, functional setting, development planning and other aspects. Table 1 provides details on the locations and features of some FTZs. These FTZs cover over 90% of the areas where Chinese enterprises are located and they coordinate the new pattern of reform and opening up in coastal, inland and border areas. China has established a well-developed policy framework for FTZs and the dividends of its institutional innovation continue to benefit the world, making substantial contributions to promoting an open global economy.

FTZ policy has facilitated cooperation between Chinese enterprises and the global economy, and other countries have begun to attach importance to opportunities for cooperation with China. Foreign companies hope to transform policy dividends into development opportunities, thereby deepening exchanges with Chinese enterprises and collaborating in the field of technological innovation (Chen et al., 2021). Hence, this raises the question that we will primarily investigate in this study, namely: how should the policy advantages of FTZs be leveraged to enhance the innovation performance of enterprises? A review of the literature indicates three key advantages of the FTZ policy, as it: (i) expands trade between areas and attracts more foreign enterprises, thereby enhancing market competition; (ii) achieves concentrations of capital and technology in a short period of time, providing a quality business environment for high-tech enterprises; and (iii) possesses policy flexibility and space for innovative mechanisms, expediting the marketisation process in pilot areas.

Nevertheless, some deficiencies and gaps remain in the literature. (1) First, the enterprises, as the main source of national technological innovation, are important for regional R&D capacity enhancement and high-quality economic development. However, studies largely focus on the promotion and macro impact of FTZs, with few examining the role of FTZs in driving firms’ technological innovation. Therefore, whether FTZs can enhance the scale and quality of R&D outcomes through enterprise innovation needs to be explored. (2) Second, because China’s FTZs have been established in phases or lots over time and the benefits reaped by various firms have occurred at different points in time, directly measuring the effect of the FTZ policy on firm innovation is difficult. Therefore, assessing the effects over time, while controlling for firm-year fixed effects, is important in an effort to enhance the credibility of our findings. (3) Third, the FTZs improve the business environment in the pilot areas by promoting institutional innovation, thereby creating a synergistic effect among industries and innovation spillover effects among enterprises. However, this process may be constrained by various mediators, such as industrial agglomeration and financing constraints. Therefore, clarifying the mediation mechanism by which the construction of FTZs affects firms’ innovation performance is important. (4) Finally, we acknowledge that external factors, including the economic development level and government subsidies of FTZ areas, as well as firm features, such as size, ownership and location, may influence the impact of FTZ policy on firm innovation. However, studies have not thoroughly addressed these aspects. Thus, there is a need to broaden the research scope and specifically investigate both moderating effects and heterogeneity.

On the basis of the above analysis and in response to the shortcomings in the literature, we explore the following four aspects of the effect of FTZs on enterprise innovation.

-

First, to address the question of whether FTZs can enhance the enterprises’ innovation performance, we measure the scale and quality of innovation performance using the total number of patent applications and the number of invention patent applications, respectively, of Chinese listed companies. Then, we estimate whether the FTZ policy has expanded the scale of their technological innovation and enhanced the quality of the enterprises’ innovation.

-

Second, to address issues with study designs and methodological choices in the literature, we utilise a quasi-natural experiment to measure the effects of FTZs on enterprise innovation by means of a time-varying DID model, thereby avoiding interference from external factors.

-

Third, to examine mediation mechanisms, we analyse how financing constraints and industrial agglomeration indirectly affect the impact of FTZs on enterprise innovation performance from the theoretical perspectives of dynamic capabilities and competitive advantages.

-

Fourth, to mitigate the endogeneity issue arising from the non-randomness of policy, we utilise the IV method and a PSM regression. In addition, we thoroughly investigate the causal relationship, considering the development levels and firm heterogeneity of the FTZ areas.

The remainder of this paper is organised as follows. Section “Theoretical analysis and research hypothesis” presents our theoretical analysis and research hypotheses regarding the effect of the FTZ policy on firms’ innovation performance. Section “Data and methodology” presents the data and methodology, including the data sources, the time-varying DID model and descriptive statistics. Section “Empirical results” presents the empirical results of the baseline regressions and robustness tests using various approaches, including parallel trend and placebo tests. Section “Mediation mechanism” presents our estimation of the mediating effects of financing constraints and industrial agglomeration, and analyses the mechanism underlying the impact of FTZs on firms’ innovation performance. Section “Endogeneity issues” addresses the endogeneity problem using IV and PSM. Section “Further study” further studies potential moderating effects and firm heterogeneity. Section “Conclusions” presents our findings and implications. Figure 2 shows the analytical framework for our study.

Theoretical analysis and research hypothesis

Theoretical analysis

The innovation capability, as an important element of a company’s overall dynamic capabilities, is the key to generating new driving forces by integrating and using effective resources (Forliano et al., 2022). Evidence shows that firms with greater innovation capabilities possess a substantial competitive advantage in the market. The establishment of an FTZ quickly increases the number of firms in the pilot area, with the fierce competitive environment forcing firms to continuously engage in innovative behaviours. The theory of dynamic capabilities states that the ability to innovate is an important factor in determining a company’s growth prospects (Cenamor, 2021). The two forms of corporate innovation are explorative innovation, or the ‘technological revolution’, and exploitative innovation, or ‘knowledge spillover’. In a knowledge-based economy, intellectual property rights, represented by patents, which are highly valuable intangible assets, are a direct reflection of an enterprise’s innovation capabilities (Dong et al., 2020). Innovation is a long-term process fraught with uncertainty that cannot be effectively pursued without the support of national strategies. Sound policies and institutions can deliver ‘innovation incentives’ to firms, thereby providing strong help for their R&D innovation. Thus, in this study, we propose and test three hypotheses regarding the effect of the FTZ policy on firms’ innovation.

Direct effects

Direct Effects of the FTZ Policy on Firms’ Innovation Performance. China’s FTZ policy has enabled foreign companies to enter the Chinese capital and product markets and increased the intensity of competition within various industries. To protect and expand their market share, local enterprises must continually increase their investment in technological R&D to maintain their competitiveness (Akbari et al., 2019). Local governments provide financial support for technological R&D through tax breaks and financial subsidies to promote the construction of FTZs, thereby encouraging increased research and rapid improvement in innovation performance. In addition, as a testing ground for institutional innovation, an FTZ generates institutional dividends that not only have a profound impact on the pilot areas but also expand the level of openness and financing of the neighbouring regions, thereby fully stimulating the market dynamics of the areas surrounding the FTZ (Jiang et al., 2021). Therefore, a positive process of ‘FTZ establishment → external capital injection → industrial structure refinement → improvement of enterprise innovation performance’ is generated. It can be deduced from this mechanism that the FTZ policy influences the innovation performance and research outputs of enterprises. However, whether the FTZ policy can improve the quality of innovation performance based on expanding the scale of enterprises’ innovation performance is debatable. Thus, we propose the following hypothesis:

H1: Listed companies located in FTZs display considerably better innovation performance in terms of scale and quality than listed companies located outside FTZs.

Mediating roles

An important question that we explore in this study is how the FTZ policy affects enterprises’ innovation performance through the mediating effects of financing constraints and industrial agglomeration. We conduct a detailed analysis of these two mediating effects. The theoretical model is shown in Fig. 3.

Mediating roles of financing constraints

Financing constraints are one of the main factors that affect the innovation performance of enterprises (Yu et al., 2021). An FTZ can alleviate the financing constraints of enterprises through both capital and spillover effects, thereby laying the foundation for technological innovation. First, the institutional dividend offered by the FTZ can provide continuous financial support for enterprise innovation. The capital effect reduces the financing constraints on enterprises, and the open financial system makes the internal financing mechanism of the FTZ more effective. The broadening of financing channels has enabled enterprises to overcome the problem of insufficient R&D funding, especially for start-ups, and thus increased investment in technological innovation. Furthermore, the establishment of an FTZ organically combines new financing channels with traditional sources of capital, which reduces the financing constraints on enterprises. The resulting spillover effect breaks down the liquidity barriers of traditional capital, turning the FTZ into a more open gathering place for capital. The abundant external capital provides an economic basis for enterprises to innovate and conduct R&D, and simultaneously reducing financing constraints and technology costs, providing favourable conditions for enterprises to continuously enhance their innovation performance (Arora et al., 2021). Thus, we propose the following hypothesis:

H2: The FTZ policy alleviates the financing constraints on enterprises in the pilot FTZ areas, which in turn improves the scale and quality of their innovation performance.

Mediating roles of industrial agglomeration

Industrial agglomeration is an equally important factor influencing enterprise innovation (Liu and Zhang, 2021). The construction of an FTZ can enhance industrial agglomeration in the area through two effects, the synergistic effect and the peer effect, thereby improving enterprise innovation. FTZs attract a large number of enterprises from outside the pilot areas, increasing the complexity of the industrial structure in these areas. The resulting synergistic effect makes the division of labour between enterprises more logical, and shifts the industrial structure from traditional industries to medium- and high-tech industries (Li et al., 2021). Furthermore, increased industrial agglomeration within an FTZ not only increases the opportunities for enterprises to exchange ideas and learn from each other but also promotes the efficient flow of information and other resources. The synergies obtained can accelerate changes in supply and demand within traditional industries, thereby stimulating the learning efficiency and innovation ability of enterprises. Meanwhile, in terms of the peer effect, the high-quality business environment and low trade barriers in the FTZ will inevitably attract new enterprises, which will continue to engage in technological innovation in an effort to improve production efficiency and maximise revenue. Thus, we propose the following hypothesis:

H3: The FTZ policy enhances industrial agglomeration in the pilot areas, which in turn improves the scale and quality of innovation performance.

Data and methodology

Data sources

In 2013, the Chinese government implemented the General Scheme of the Pilot Free Trade Zones, with Shanghai Pudong as the first pilot area, thereby commencing the pilot FTZ reform. To date, China has approved the establishment of 21 pilot FTZs (Lin et al., 2023). For this study, we collect and compile valid patent data for listed companies from the China National Intellectual Property Administration and China Stock Market & Accounting Research Database (CSMAR). In addition, company financial data are obtained from the CSMAR and WIND databases, and data on cities and provinces are obtained from the China Statistical Yearbook series. Next, we match the data of the listed companies (including patents, finance and other data) with related data on the pilot FTZs, according to the ‘city-province’ of companies’ official registration location. The data cover the period from 2012 to 2020, and we successfully merge a total of 17,667 data entries.

To ensure the validity of our sample, we screen the data and exclude: (i) listed financial companies such as banks and securities and insurance companies; (ii) listed companies in the ST (Special treatment) and *ST categories. (In the Chinese stock market, when the financial conditions of a listed company become abnormal or it violates listing regulations, its stock is labelled ‘ST’; if a company receives the ‘ST’ designation for 3 consecutive years, it is upgraded to ‘*ST’, indicating higher trading risks for the listed company); (iii) outliers in relation to key variables; and (iv) data with missing key variables. To improve the representativeness of the sample, we filtered out 6,862 data records, ensuring the reliability of the regression results. Ultimately, this yields 10,805 valid firm-year observations for listed companies spanning the period from 2012 to 2020. Moreover, to eliminate the effect of outliers, we conduct a two-sided 1% tail reduction on the main continuous variables, which are winsorised at the 1st and 99th percentiles. To address potential cross-sectional issues and increase robustness, we utilise cluster-robust standard errors with clustering adjustments based on ‘provinces’ and ‘industries’ in all regressions. We use the Stata V17.0 software package to conduct the regression analyses.

Model construction

The rapid introduction of the FTZ policy has resulted in strong external policy impacts on the pilot areas and firms. As the FTZs were rolled out incrementally over a number of years, this enables us to analyse how FTZs affect firms’ innovation performance using a time-varying DID model. Following the literature (Callaway and Sant’Anna, 2021), we construct the two-way fixed effects model to estimate the impact of FTZs on firms’ innovation performance:

Variable definitions

The dependent variable Innovation represents the innovation performance of the firm (Ponta et al., 2021). In the literature, variables used to measure the innovation performance of companies include: intellectual property indicators, such as the scale and quality of patents (Zhang and Shan, 2023); R&D input indicators, such as R&D costs, R&D expenditure ratio and total factor productivity (TFP) (König et al., 2022); and organisational innovation indicators, such as executives’ educational background, and innovation management mechanisms. This study employs the most widely used intellectual property indicator, patent data, as a proxy variable for measuring the innovation performance of companies. China’s patent law divides patents into inventions, utility models and designs. Of these, invention patents are the most innovative and have the greatest impact on business development, whereas utility models are less innovative, and designs are the least innovative form of patents.

The patent application process is lengthy, with the duration from application to patent grant typically ranging from 12 to 18 months. Patents granted to companies in a particular year are potentially the result of R&D work from one year earlier. Hence, utilising the number of patent applications as a metric for measuring a company’s innovative performance is a more scientific approach than using patents granted. We use the total number of patent applications as a proxy for the scale of corporate innovation (Patent) and the number of invention patent applications as a proxy for the quality of corporate innovations (Invent) and perform separate baseline regression analyses. Because there is a thick tail in the distribution of the number of patents, we use the logarithm of the total number of patent applications plus 1 and the logarithm of the number of invention patent applications plus 1 to measure the scale and quality, respectively, of a company’s innovation performance. Moreover, based on the previous analysis, the R&D process prior to patent applications requires a considerable amount of time. This indicates a certain degree of delay between patent applications and actual innovative development (Li, 2023). Thus, to prevent potential reverse causality and mitigate any endogeneity issues, we use the number of patent applications lagged by one term as the dependent variable (Yuan et al., 2023). To check the validity of the results, we conduct robustness tests using enterprises’ R&D expenditure ratio and TFP as proxies for innovation performance.

The independent variable FTZ represents the cross-multiplication term between two dummy variables, reflecting the fact that the enterprise is located in an FTZ and the time of establishment of the FTZ. If the listed company is located in an FTZ, the variable takes a value of 1 in the year when the FTZ was implemented and all subsequent years, otherwise it takes a value of 0. If the area in which the listed company is located has never implemented an FTZ, FTZ takes a value of 0 in all cases. For example, Xiamen in Fujian Province established an FTZ in 2015 and thus the FTZ value for listed companies located in the Fujian FTZ is 1 in 2015 and beyond, and 0 before 2015; Nanchang in Jiangxi Province has not established an FTZ, and thus the FTZ value of listed companies located in the Jiangxi Province is 0 in all years.

Control variables include firm and area-specific variables that can affect corporate innovation, including the firm’s return on assets (ROA), total asset growth (Growth), proportion of tangible assets (Tangible), debt to asset ratio (Leverage) and cash flow (Cashflow), as well as the per capita disposable income (Perwage), local fiscal revenue (Revenue), foreign direct investment (FDI) and telecom development index (Telecom). The details of the variables are presented in Table 2. In addition, β0 is a constant term, β1 is used to estimate the rate of increase in firm innovation performance in the experimental group compared with the control group, with the sign expected to be positive; subscripts i and j denote individual and time. The model includes dummy variables for company (Cid), year (Year), industry (Ind) and province (Prov) to mitigate the fixed effects generated by these factors. Finally, εij represents the random disturbance term to control for bias as a result of unobserved factors.

Descriptive statistics

Descriptive statistics are obtained for the main variables and control variables (see Table 3). The difference between the maximum and minimum values of the number of patents used to measure a company’s innovation performance is significant, indicating a relatively wide range among companies in terms of their innovation levels. In particular, the mean value of invention patents is greater than the median, with a right-skewed distribution, indicating that only a few companies are achieving high-quality inventions. Most companies only lodge utility model and design patents, and thus the overall quality of innovation is not high. In addition, the mean value of FTZ is 0.1717, indicating that companies located within FTZs account for 17.17% of the total sample.

Empirical results

Baseline regression

The results of the baseline regressions of the effects of the FTZ policy on enterprises’ innovation performance are shown in Table 4. The results in columns (1) and (4) use the total number of patent applications (Patent) and the number of invention patent applications (Invent), respectively, as proxies for enterprise innovation performance and demonstrate positive and significant correlations at the 1% level. Columns (2), (3), (5) and (6) show the regression results after adding the company and area control variables. The baseline regression coefficient change slightly, but remain significant at the 1% level. Furthermore, the results show that the total number of patent applications and the number of invention patent applications of enterprises within the FTZ increase by 9.2% and 12.2%, respectively, compared with enterprises outside the FTZ. The coefficient of the number of invention patent applications is significantly higher than that of the total number of patent applications, indicating that the FTZ policy not only enhances the scale of the firms’ innovation performance but also has a positive impact on the quality of the innovation performance, providing support for H1. In addition, Table 4 shows that local fiscal revenue and FDI provide financial support for companies, thereby improving their technological level and innovation performance.

Robustness tests

To check the robustness of the time-varying DID model and the baseline regression results, we conduct the following tests.

Parallel trend test

The most important check of a time-varying DID model is the parallel trend test to determine whether there were parallel trends between the treatment group and the control group before the implementation of the FTZ policy. The results of parallel trends test are crucial for validating the adequacy of the time-varying DID model and assessing the effectiveness of causal inference. We base our parallel trend test is based on existing literature (Chan and Kwok, 2022). The results are shown in Fig. 4, with the horizontal axis indicating the years before and after the implementation of the policy and the vertical axis indicating the change in firms’ innovation performance of the experimental and control groups. Figure 4a, b shows the dynamic parallel trend of the FTZ policy on the total number of patent applications and the number of invention patent applications, respectively. Before the implementation of the FTZ policy, the confidence interval fluctuates around 0 and the coefficient is insignificant. This indicates that the treatment group and the control group had parallel trends before the intervention, meaning that there were no systematic differences among the areas before the introduction of the FTZ policy. After the establishment of the FTZ, there is at least one period where the confidence interval of the coefficient lies above 0. This indicates that the policy intervention altered the parallel trends and implies that establishing the FTZs had a significant positive impact on the innovation performance of enterprises. To facilitate result reproducibility, we have uploaded the data and code for this study as ‘Supplementary information’, and it can also be accessed through https://github.com/ws8228/FTZ.

Placebo test

The placebo test evaluates whether there are significant statistical differences between the treatment group and the control group during periods outside the intervention. Its purpose is to eliminate result biases caused by other factors and validate the effectiveness of the time-varying DID model. To support our argument that firms’ innovation performance is promoted by the FTZ policy rather than being the result of other factors, we conduct a placebo test based on existing literature (Eggers et al., 2023). We randomly select firms with equal values located in the FTZ during the period of 2012–2020 as the experimental group and the other firms as the control group and repeat the time-varying DID regression on the total number of patent applications and the number of invention patent applications of the randomly selected firms. The kernel density distribution of the coefficients was obtained after 3000 random non-relaxed draws and regression tests (see Fig. 5). Figure 5a, b shows the placebo test of the FTZ policy on the total number of patent applications and the number of invention patent applications, respectively. Their shape roughly overlaps the normal distribution, with most of the estimated coefficient values of the core independent variables being less than the baseline regression coefficients. This indicates that during the periods outside the intervention, there are no significant differences between the treatment group and the control group, implying that our model design is reasonable, and that the results are not influenced by other factors. This confirms that the improvement in the firms’ innovation performance was the result of the implementation of the FTZ policy rather than other factors.

High-dimensional and iterative fixed effects

Cumulative fixed effects, including time, individual, industry and province fixed effects, are introduced in an attempt to control for industry- and province-specific factors. However, real-world economies often face multi-factor shocks and the extent to which different individuals react to such shocks varies. In real-world analyses, the introduction of time-industry and time-province interaction terms and the use of principal component iterations provide better control when using panel data. Therefore, in an effort to rule out any spurious associations between FTZs and firms’ innovation performance and to consider the fact that industry and province characteristics can change over time, we conduct robustness tests using high-dimensional and iterative regressions. The results are shown in Table 5. Panel A of Table 5 shows positive and significant coefficients after the inclusion of the high-dimensional fixed effects of year × industry and year × province, and Panel B shows positive and significant coefficients after the iterative regression at the 1% significance level. This suggests that the results of the FTZ policy aimed at improving firms’ scale and quality of innovation performance remain robust even after adding more realistic multi-dimensional shocks to the model and conducting multiple iterations of the regression.

Excluding interference from other policies

To encourage enterprises to engage in R&D and technological innovation in key projects supported by the government, eligible enterprises can be recognised as high-tech enterprises and enjoy income tax incentives from the year of approval, such as prepayment rebates or a transitional 15% tax rate. The 2016 edition of China’s ‘Measures for the Administration of High and New Technology Enterprise Recognition’ states that the eligibility requirement for these incentives is either one invention patent or six utility model patents. Thus, instead of applying for as many patents as possible, some enterprises only applied for sufficient patents to enjoy the abovementioned tax incentives. Therefore, in an effort to avoid bias, data for firms with no more than one invention patent or no more than six utility model patents are excluded from the sample, and the robustness tests are repeated. The results are shown in columns (1) and (2) of Panel A in Table 6. After excluding the effects of the ‘high-tech enterprise recognition’ policy, the effect of establishing FTZs on the enterprises’ scale and quality of innovation performance remains positive and significant at the 1% level.

Substitution of dependent variables

The number of patent applications reflects the level of innovation output of enterprises. However, the FTZ policy can also have an impact on the levels of enterprises’ innovation input and efficiency. To conduct robustness checks of the baseline regression results, we use the ratio of R&D expenditure to operating revenue as a proxy for the R&D expenditure ratio (RD-ratio) and calculate TFP using the ‘Levinsohn and Petrin’ method to measure the innovation efficiency of enterprises (Wang et al., 2022a). The regression results are shown in columns (3) and (4) of Panel B in Table 6. Although the sample size is reduced as a result of non-disclosure of R&D expenditure ratio and TFP data by some enterprises, the results show a significant and positive effect, indicating that the establishment of the FTZ enhanced the innovation performance of enterprises, consistent with the findings of the baseline regression.

Application of multiple regression models

The data for listed companies includes a large number of zero values and exhibits broken-tail characteristics. Therefore, we use the Tobit model to test the impact of the establishment of the FTZ on the innovation performance of enterprises. The number of corporate patents has the characteristics of a count variable and the Poisson distribution can properly regress this type of data; thus, we use the Poisson model for our regression. The results of the Median model are more robust in response to extreme values and require few hypothetical conditions regarding the error term to estimate the effect of FTZ policy on the median number of patent applications. The regression results are shown in Table 7, with columns (1), (2) and (3) showing the results of regressing the total number of patent applications using the Tobit, Poisson and Median models, respectively. Columns (4), (5) and (6) show the results of regressing the number of invention patent applications for each of the three models. The FTZ coefficient remains positive and significant at the 1% level across all models, indicating that the FTZ policy made a positive and significant contribution to the enterprises’ scale and quality of innovation performance, confirming the results of the baseline regression.

These robustness tests confirmed that the implementation of the FTZ policy enhanced the research output and innovation performance of firms in the pilot areas after considering the influence of multiple complex factors and confirm the validity of the baseline regression analysis.

Mediation mechanism

Mediating effects of financing constraints

Most companies find it difficult to finance R&D solely using internal funding and thus external funding is necessary to ensure the sustainability of research projects. However, the high initial investment, long benefit cycle, information asymmetry and high regulatory costs involved in research and innovation present significant challenges for companies seeking external financing (Khan et al., 2021). When companies face unreliable funding sources or severe financing constraints, they tend to reduce their R&D investment, thereby inhibiting their innovation performance. However, the introduction of the FTZ policy has reduced capital controls and increased the flexibility of the financial market in the pilot areas, resulting in an increase in the scale of FDI and attracting a steady flow of capital into enterprises for research and innovation activities.

To address the endogeneity problem, we use the SA index to measure the degree of financing constraints (FC) on firms (Mun and Jang, 2019). The SA index is constructed using two exogenous and relatively robust indicators, firm age and firm size, and is calculated as follows:

The SA index is negative and, as the absolute value increases, the firm’s FC also increases. To analyse the mediation mechanism of the FTZ policy regarding the weakening of FC and to investigate whether the establishment of FTZs enhances firms’ innovation performance by alleviating external FC, we first use stepwise regression to analyse the mediating effect using Eq. (3). Then, we apply the Sobel test for robustness testing using Eq. (4):

If β11 and β22 are significant, there is a mediating effect. If β21 is significant, there is a partial mediating effect, whereas if β21 is not significant, there is a full mediating effect. The robustness testing procedure is as follows. First, regression analysis of the effects of the FTZ on the FC is performed using Eq. (3). Second, we add the FC to Eq. (1) to investigate the effect of the FTZ policy and the mediating variable FC on the innovation performance of enterprises. Finally, to avoid the Type II error of mediating effects that exist but are not shown, a secondary test is conducted using the Sobel test.

The results are shown in Table 8. Column (1) shows the regression results using Eq. (3). The coefficient β11 is negative and significant at the 1% level, indicating that the establishment of the FTZ alleviated the FC of enterprises. Columns (2) and (3) show the regression results using Eq. (4), which tests the direct effect of the FTZ policy on the total number of patent applications and the number of invention patent applications by enterprises (β21) and the intermediary effect of FC (β22). The coefficients of both β21 and β22 are significant, confirming the existence of a partial intermediary effect. Columns (4) and (5) show the results of our robustness test of the mediating effect using the Sobel test. It is evident that the results are consistent, confirming that the FTZ policy enhanced the enterprises’ scale and quality of innovation performance in the pilot area by reducing FC. Thus, H2 is supported.

Mediating effects of industrial agglomeration

Industrial agglomeration is an important external factor affecting the innovation performance of enterprises, and it plays a leading role in their internal governance. The unique institutional advantages offered by FTZs have attracted numerous leading and emerging enterprises, both domestic and foreign, to form industrial clusters. Industrial agglomeration clarifies the division of labour among enterprises in an FTZ and enhances collaboration, not only increasing labour productivity, but also promoting the sharing of technology and other resources. To some extent, this compensates for the government’s inadequate allocation of resources and improves the innovation performance of enterprises by enhancing the industrial structure (Peng et al., 2022). FTZ policy has increased industry agglomeration and enterprises competition in the pilot areas.

We use Herfindahl–Hirschman Index (HHI) values as a proxy for the degree of industrial agglomeration. The HHI is a commonly used measure of industrial agglomeration based on the sum of the squares of the percentage of total industry revenue or total assets of each industrial agglomerate within an industry and is mainly used to measure changes in market share (Spiegel, 2021). A lower HHI value indicates more intense competition. HHI values are calculated as follows:

Given the low efficiency of the stepwise regression test and the fact that Type II errors sometimes occur, we directly use the mediating factor test and the Sobel test to analyse the mediating effect of industrial agglomeration. The results are shown in Table 9.

Column (1) in Table 9 shows the regression results using Eq. (3), which measures the effect of the FTZ policy on industrial agglomeration. The coefficient is negative and significant, indicating that the establishment of FTZs lowers the HHI values, reflecting an increased level of industrial agglomeration. Columns (2) and (3) show the results of using the Sobel test to analyse the effect of the FTZ policy on the total number of patent applications and the number of invention patent applications, as well as the mediating effect of industrial agglomeration. Both coefficients are significant, indicating the existence of a partial mediating effect. Therefore, the FTZ policy improved the enterprises’ scale and quality of innovation performance in the pilot area by increasing industrial agglomeration, and thus H3 is supported.

Endogeneity issues

When formulating policies, governments inevitably introduce a certain level of subjectivity and intentionality. For instance, during the initial site selection for policy pilot areas, there was a tendency toward areas with prominent locational advantages and strong competitiveness. Policy formulation necessitates careful deliberation as policies are crafted to capitalise on strengths or rectify weaknesses, and their implementation incurs substantial costs. But this non-random selection may introduce endogeneity issues to causal inference (Goodman-Bacon, 2021). In the baseline regression, we employed the time-varying DID model to effectively control for individual and time fixed effects, and we clustered the data by ‘industry’ and ‘province’ to mitigate potential biases arising from non-random selection. The time-varying DID model tackles endogeneity issues by controlling for differences between the treatment and control groups, assuming random assignment of FTZ pilot areas. However, in reality, the selection of FTZs may be influenced by non-random factors such as economic and locational considerations, which can perturb the accuracy of policy evaluation results. Thus, we utilise a quasi-experimental framework and employ the IV method and PSM to minimise estimation biases arising from endogeneity issues as much as possible.

Additionally, most enterprises in the sample went public before the implementation of the FTZ policy. Hence, the impact of ‘enterprises consciously setting up their registration in the FTZs prior to entering the A-share market’ is minimal on our estimation results.

Instrumental variable method

Unobserved factors that may be correlated with FTZ policy could have a simultaneous impact on firm innovation performance, resulting in potential bias in the estimation of the time-varying DID model. The IV method can effectively mitigate the endogeneity problem caused by omitted variables and measurement errors. Its goal is to leverage the random nature of IVs for causal inference and obtain more precise estimates of the impact of FTZ policy on firm innovation. The selection of IVs follows scientific principles and requires the satisfaction of two conditions: relevance and exogeneity. The IV should be relevant to the endogenous independent variable and irrelevant to the random error term. Based on this, we leverage existing findings that the level of urban area construction and development was the primary factor considered in the selection of national FTZ locations (Atanasov and Black, 2021). We utilise industrial sulphur dioxide emissions (SO2) and length of urban sewage pipes (Pipe) as our IVs. The rationale for selecting these IVs is that the infrastructure construction and development level of an area are inherently correlated, satisfying the assumption of relevance to the independent variable. Moreover, these IVs do not directly impact firm innovation performance, thereby meeting the exogeneity assumption.

We employ a two-stage least squares estimation, with the results shown in Table 10. The goal of the first-stage regression is to assess the effectiveness of the IVs and derive the predicted values for the endogenous independent variable. In the second-stage regression, the predicted values from the first stage are used as independent variables and regressed against firm innovation performance. This approach enables us to accurately estimate the causal effects without being influenced by endogeneity bias (Miklin et al., 2022). In column (1), the regression results from the first stage reveal a significant negative correlation between SO2 and the FTZ development at a 1% significance level, while Pipe exhibits a significant positive correlation with the FTZ development at a 1% significance level. This demonstrates that FTZ policy have curtailed SO2 emissions, and facilitated the development of urban infrastructure such as sewage pipes. Columns (2) and (3) display the results of the second-stage regressions for firm innovation scale and quality, respectively. This demonstrates that after considering the potential endogeneity between the establishment of the FTZ and firm innovation performance, the FTZ coefficient remains positive and significant at the 1% level. In addition, we conducted an overidentification test on the IVs and calculate a p-value of 0.36 (exceeding 0.05), which indicates that the original hypothesis that both IVs are exogenous is not rejected. We also performed a weak instrumental variable test and obtained an F-statistic of 129.19 (exceeding 10), indicating the absence of weak instrumental variables. In summary, after accounting for potential endogeneity issues, the establishment of FTZs significantly enhances firms’ scale and quality of innovation performance, confirming the validity of our findings.

Propensity score matching estimation

To address selection bias and endogeneity issues in policy pilot areas, we utilise the PSM method based on whether a specific region has implemented an FTZ to assess the ‘treatment effect’ of this policy on the innovation performance of local businesses (Ferman, 2021). Before conducting a PSM regression estimation, it is essential to conduct a pre-matching balance test. The results of this test reveal that post-matching, the standardised biases of all variables are below 10%, and all t-test results do not reject the null hypothesis of no systematic differences between the treatment and control groups. Compared with the pre-matching results, the standardised biases of all variables are substantially reduced, indicating successful balance across all variables. This indicates that after PSM, the area differences between FTZs and non-FTZs are reduced significantly, with a minimal loss of samples in the matching process. Next, we utilise nearest neighbour, calliper, kernel and Mahalanobis matching methods to perform the PSM regression estimation of the impact of FTZ policy on the scale and quality of firm innovation. The results of the PSM regression are presented in Table 11. ATT represents the average treatment effect on innovation for firms within FTZs, which is the primary focus of this study. ATE represents the matching results considering the entire sample and ATU represents the matching results considering only non-FTZ firms. In Table 11, all coefficients of the matching results are positive. Furthermore, apart from the two coefficients in ATU regarding the firm innovation quality, which are significant at the 5% level, all other coefficients (particularly ATT) are significant at the 1% level. The PSM estimation results closely align with the baseline regression, reaffirming our conclusions and providing strong evidence that the FTZ policy effectively enhances firm innovation performance.

Further study

To further mitigate the impact of endogeneity on the research results, we conduct an in-depth analysis of the moderating effects of contextual factors and enterprise heterogeneity. This provides a more comprehensive understanding of the logic behind the influence of the FTZ policy on firm innovation performance (De Chaisemartin and D’Haultfoeuille, 2023).

Moderating effects of contextual factors

Using regression results from a time-varying DID model and various robustness tests, we have established that the FTZ policy significantly increased the innovation performance of firms in the pilot area. However, whether any other factors also influence the baseline regressions requires an investigation of the moderating effects of contextual factors. Some scholars argue that a range of factors, such as the level of economic development and government support, might also influence the effect of the FTZ policy on innovation by firms in different areas. First, the level of economic development affects firms’ internal technological innovation decisions, with the demand for new technologies and inventions being stronger in more economically developed areas (Lou et al., 2022). Following the establishment of an FTZ, enterprises have increased access to research funding, and the cost of finance approval and supervision is relatively low. This provides enterprises with a greater incentive to engage in innovation activities, which in turn enhances the effect of the FTZ policy on their innovation performance. Second, direct subsidies from local governments help to alleviate the pressure of raising funds for R&D and support in the form of various types of research subsidies and special funding varies depending on the level of importance that local governments attach to technological R&D (Shi et al., 2023). Following the implementation of the FTZ policy, the variety of projects funded by the government and the abundance of financial subsidies significantly eased the pressure on R&D funding in pilot areas. However, the question of whether the level of economic development and government subsidies can truly contribute to an increase in the scale and quality of corporate innovation following the implementation of the FTZ policy remains to be answered.

To accurately assess the moderating effects of the level of economic development and government support on the baseline regression, we use the area GDP per capita and government subsidies as proxies for the level of economic development and government support, respectively. Equations (6) and (7) are constructed by adding the interaction terms of area GDP per capita and government subsidies to Eq. (1) as follows:

PerGDP denotes the area GDP per capita, and Subsidy denotes the amount of subsidies provided to enterprises by the government. The results are shown in Table 12. The coefficients of the interaction terms of PerGDP × FTZ and Subsidy × FTZ are both positive at the 1% significance level, indicating that the higher the levels of GDP per capita and government subsidies in the pilot areas, the more the FTZ policy stimulated the innovation performance of enterprises. The coefficient of the interaction term in columns (2) and (4) is greater than those in columns (1) and (3), and the rate of increase in the number of invention patent applications is higher than the rate of increase in the total number of patent applications. This indicates that the implementation of the FTZ policy in economically developed areas is more conducive to improving the quality of enterprises’ research and innovation. Thus, it can be inferred that the higher the economic level of the area and the higher the government subsidies, the more significant is the effect of the FTZ policy on the firms’ scale and quality of innovation performance.

Heterogeneity analysis

To address potential cross-sectional issues, we conduct a heterogeneity analysis from four perspectives: size, ownership, industry and geographic location of the companies. This provides a comprehensive analysis of whether causal relationships differ because of individual features or environmental conditions (Sun and Abraham, 2021).

Cross-sectional test of enterprise size

The size of an enterprise reflects the stage of its lifecycle. Different stages of development entail varying strategic objectives and market constraints for the enterprise (Pahnke et al., 2023). To obtain high-quality resources and competitive advantages, enterprises need to continuously engage in technological innovation. However, innovation is a costly long-term activity, and companies face high R&D costs. Small and medium-sized enterprises (SME) have a short development period and limited risk-bearing capacity, which prevents them from allocating substantial funds for research and innovation. Conversely, larger-sized enterprises (LE) are in the mature stage of development, and their objective is to establish a stable market share. Patents and new technologies can enhance industry barriers and help companies solidify their existing market positions. Therefore, LE are willing to invest more capital in innovation than SMEs. Because of the significant differences in enterprise sizes across different industries, we categorise enterprises into LE and SME based on the median enterprise size within each industry category. The regression results for size heterogeneity are presented in Table 13. The coefficients in columns (1) and (2) are significant at the 5% level, whereas those in columns (3) and (4) are significant at the 1% level. This indicates that the FTZ policy has a significant positive impact on the technological R&D levels of enterprises of different sizes. However, the policy’s influence on the quality of innovation is higher than its impact on the scale of innovation. Moreover, the coefficients in columns (1) and (3) are higher than those in columns (2) and (4), respectively, indicating that the innovation performance coefficients of LE are higher than those of SME. This suggests that the FTZ policy has a greater impact on improving the innovation output of large enterprises compared with SMEs.

Cross-sectional test of company’s ownership

The basic economic system in China is characterised by the predominance of public ownership and the simultaneous development of diverse forms of ownership economy. Moreover, the private economy is an important foundation for China’s high-quality development, and the Chinese government strongly supports its growth. Therefore, in this study, companies are categorised by the ownership attributes into state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs). Heterogeneity analysis of ownership contributes to understanding the actions taken by companies of different ownership types in response to the FTZ policy. The regression results of company ownership heterogeneity are presented in Table 14. The coefficients in columns (1) and (3) are significant at the 5% level, and the coefficients in columns (2) and (4) are significant at the 1% level. The results indicate that the FTZ policy has indeed enhanced the innovation scale and quality of enterprises with different ownership types, but the positive impact on innovation performance is more pronounced for non-SOEs than for SOEs. This indicates that non-SOEs are more capable of leveraging FTZ policy to continuously enhance their innovation performance than SOEs. It also demonstrates that this policy has contributed to the development of the non-public sector of the economy.

Cross-sectional test of the industry

The business field and R&D innovation of an enterprise are often closely related to its industry. Non-technology-intensive enterprises, such as the agriculture, wholesale and retail industries, do not rely on new product development and have a lower tendency toward technological innovation. However, even if they do not engage in research activities, this will not affect their normal production and operations. In contrast, high-tech enterprises or knowledge-intensive industries place greater emphasis on R&D in specialised fields. The design, development and sales of new products need to be completed within short timeframes. With diverse and rapidly evolving products, these companies must continuously engage in R&D and innovation to maintain their market share amid fierce competition. To examine the heterogeneity of innovation effects across different industries regarding the FTZ policy, we classify technology-intensive (Tech) and non-technology-intensive enterprises (non-Tech) based on the Chinese Economic Industry Classification Standard (GB/T 4754). The regression results of industry heterogeneity are presented in Table 15. The coefficients in columns (1) and (3) are significant at the 1% level, whereas the coefficients in columns (2) and (4) are not significant. The results show that the FTZ policy has a more pronounced promotion effect on the innovation performance of Tech, whereas its impact non-Tech is not significant. This demonstrates that the policy has accelerated the R&D innovation of technology-intensive industries.

Cross-sectional test of regional location

Natural geographical factors have divided China into four major regions, with the modernisation development in the eastern region far surpassing that of the western, central and northeastern regions (Yue et al., 2023). Therefore, China has formulated the regional coordinated development strategy of ‘Eastern Region Leading, Western Region Development, Central Region Rising and Northeast Region Revitalisation’. Based on this, we divide the geographic location of companies into the eastern region (including Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong and Hainan provinces and municipalities) and other regions and conduct a heterogeneity analysis of the impact of FTZ policy on innovation among enterprises in different regions. The regression results are presented in Table 16. The coefficient in column (1) and (3) is significant at the 1% level, whereas the coefficient in column (2) and (4) is significant at the 5% level. This indicates that the FTZ policy has substantially improved the innovation performance in Eastern enterprises. This is also a result of the clear locational advantages and higher-level economic development of the coastal provinces in eastern China, which makes it easier to attract high-quality technology companies (such as Tesla) for innovative R&D exchanges.

Conclusions

Findings

In this study, we focused on the effects of China’s FTZ policy on enterprise innovation. Using data for Chinese A-share listed companies and data on FTZs from 2012 to 2020, as well as the total number of patent applications and the number of invention patent applications as proxies for enterprise innovation performance, a time-varying DID model was used to investigate the effects of the FTZ policy on enterprise innovation performance. The findings are as follows.

(1) First, after baseline regression analysis and various robustness tests such as the parallel trend test and the placebo test, the exclusion of other factors and the use of IVs to address the endogeneity problem, we found that the FTZ policy substantially enhanced the firms’ scale and quality of innovation performance in the pilot areas. (2) Second, we found that financing constraints and industry agglomeration mediated the effects of the FTZ policy on firms’ innovation performance. The establishment of FTZs has attracted foreign capital, thereby reducing firms’ financing constraints and enhanced industry agglomeration has resulted in a more refined division of labour and more intense competition among firms, leading to an improvement in firms’ innovation performance. (3) Third, from an innovation-driven perspective, differences in the moderating variables for the economic development level and government subsidies were used to explore the innovation level of enterprises, with the results confirming that as the level of economic development and government subsidies in the pilot FTZs increased, the innovation level of enterprises also increased. (4) Fourth, we employed an IV regression and PSM to effectively address the issue of non-randomness in policy evaluation. In addition, we conducted further research on the variation in the innovation impact of FTZs on enterprises with distinct characteristics, including size, ownership, industry and location.

Implications

To better promote the development of FTZs and enhance the research and innovation performance of enterprises, we put forward the following policy implications.

(1) Governments in the pilot areas should promote the implementation of the FTZ policy in an orderly manner. The pilot areas have accumulated considerable experience in relation to the construction of FTZs and thus should promote the FTZ experience, expand China’s opening up to the outside world in an orderly manner, and cement the construction of FTZs as a long-term policy for area reform. (2) Enterprises within the FTZ pilot areas should deepen their knowledge of technological innovation. The pilot FTZs should prioritise the development of a high-end intelligent industrial system and focus on supporting high-tech enterprises with their own brands. Firms will be able to attract more high-level talent with a high-quality platform and complete industrial chain to raise the level of competition in the FTZs. (3) Administrative agencies at all levels should strengthen the identification of the innovation achievements of enterprises. The government should identify enterprises with strong innovation performance and help them to obtain government subsidies. For SMEs with a low level of innovation, the government should stimulate their innovation efforts by providing guidance and assistance.

Prospects

Given the importance of the FTZ policy to the innovation performance of enterprises, we conducted a precise policy evaluation from various angles, including a baseline regression, robustness checks, a mediation analysis, an exploration of moderating effects and discussions of endogeneity. As the pilot scope of FTZ expands, it is essential to continue learning and discussing the latest research findings. In the future, we will utilise novel approaches to measure firm innovation performance and examine the relationship between FTZ policy and the SDGs.

Data availability

Data sets generated and analyzed during the current study are available in the GitHub repository, https://github.com/ws8228/FTZ, and also are available from the corresponding author on reasonable request.

References

Akbari M, Azbari ME, Chaijani MH (2019) Performance of the firms in a free-trade zone: the role of institutional factors and resources. Eur Manag Rev 16(2):363–378. https://doi.org/10.1111/emre.12163

Arora A, Belenzon S, Sheer L (2021) Knowledge spillovers and corporate investment in scientific research. Am Econ Rev 111(3):871–898. https://doi.org/10.1257/aer.20171742

Atanasov V, Black B (2021) The trouble with instruments: the need for pretreatment balance in shock-based instrumental variable designs. Manag Sci 67(2):34. https://doi.org/10.1287/mnsc.2019.3510

Barros L, Martínez-Zarzoso I (2022) Systematic literature review on trade liberalization and sustainable development. Sustain Prod Consum 33:921–931. https://doi.org/10.1016/j.spc.2022.08.012

Callaway B, Sant’Anna PHC (2021) Difference-in-differences with multiple time periods. J Econ 225(2):200–230. https://doi.org/10.1016/j.jeconom.2020.12.001

Camba A (2022) How Chinese firms approach investment risk: strong leaders, cancellation, and pushback. Rev Int Polit Econ 29(6):2010–2035. https://doi.org/10.1080/09692290.2021.1947345

Cenamor J (2021) Complementor competitive advantage: a framework for strategic decisions. J Bus Res 122:335–343. https://doi.org/10.1016/j.jbusres.2020.09.016

Chan MK, Kwok SS (2022) The PCDID approach: difference-in-differences when trends are potentially unparallel and stochastic. J Bus Econ Stat 40(3):1216–1233. https://doi.org/10.1080/07350015.2021.1914636

Chen H, Yuan B, Cui Q (2021) Does the pilot free trade zone policy attract the entering of foreign-invested enterprises? The evidence from China. Appl Econ Lett 28(14):1162–1168. https://doi.org/10.1080/13504851.2020.1803482

Chen WL, Hu Y, Liu B, Wang H, Zheng MB (2022) Does the establishment of Pilot Free Trade Test Zones promote the transformation and upgradation of trade patterns? Econ Anal Policy 76:114–128. https://doi.org/10.1016/j.eap.2022.07.012

De Chaisemartin C, D’Haultfoeuille X (2023) Two-way fixed effects and differences-in-differences with heterogeneous treatment effects: a survey. Econ J 26(3):C1–C30. https://doi.org/10.1093/ectj/utac017

Dong Q, Wang AM, He KK, Zhu K (2020) Impact of government incentives on the innovation output of high-tech enterprises from the perspective of the free trade zone: a case study of China. Transform Bus Econ 19(3C):462–485

Eggers AC, Tuñón G, Dafoe A (2023) Placebo Tests for Causal Inference. Am J Polit Sci 16 https://doi.org/10.1111/ajps.12818

Ferman B (2021) Matching estimators with few treated and many control observations. J Econ 225(2):295–307. https://doi.org/10.1016/j.jeconom.2021.07.005

Forliano C, Ferraris A, Bivona E, Couturier J (2022) Pouring new wine into old bottles: a dynamic perspective of the interplay among environmental dynamism, capabilities development, and performance. J Bus Res 142:448–463. https://doi.org/10.1016/j.jbusres.2021.12.065

Goodman-Bacon A (2021) Difference-in-differences with variation in treatment timing. J Econ 225(2):254–277. https://doi.org/10.1016/j.jeconom.2021.03.014

Hao YY (2023) The dynamic relationship between trade openness, foreign direct investment, capital formation, and industrial economic growth in China: new evidence from ARDL bounds testing approach. Hum Soc Sci Commun 10(1):11. https://doi.org/10.1057/s41599-023-01660-8

Jiang YF, Wang HY, Liu ZK (2021) The impact of the free trade zone on green total factor productivity -evidence from the Shanghai pilot free trade zone. Energy Policy 148:11. https://doi.org/10.1016/j.enpol.2020.112000

Khan SU, Shah A, Rizwan MF (2021) Do financing constraints matter for technological and non-technological innovation? A (re)examination of Developing Markets. Emerg Mark Financ Trade 57(9):2739–2766. https://doi.org/10.1080/1540496x.2019.1695593

König M, Storesletten K, Song Z, Zilibotti F (2022) From Imitation to Innovation: Where is all that Chinese R&D going? Econometrica 90(4):1615–1654. https://doi.org/10.3982/ecta18586

Leite ACC (2019a) China and global value chains: globalization and the information and communications technology sector. Reg Stud 53(1):156–157. https://doi.org/10.1080/00343404.2018.1540114

Leite ACC (2019b) Understanding mega free trade agreements: the political and economic governance of new cross-regionalism. Int Aff 95(4):941–942. https://doi.org/10.1093/ia/iiz113

Li H (2023) Innovation and financial performance: an assessment of patenting strategies of Chinese listed firms. Int J Financ Econ 28(2):1693–1712. https://doi.org/10.1002/ijfe.2501

Li X, Lai XD, Zhang FC (2021) Research on green innovation effect of industrial agglomeration from perspective of environmental regulation: evidence in China. J Clean Prod 288:12. https://doi.org/10.1016/j.jclepro.2020.125583

Lin X, Leng LP, Qiu Y (2023) Research on the policy effect of Free Trade Zone on regional innovation capability: evidence from China. Appl Econ Lett 30(5):689–694. https://doi.org/10.1080/13504851.2021.2011101

Liu XP, Zhang XL (2021) Industrial agglomeration, technological innovation and carbon productivity: Evidence from China. Resour Conserv Recycl 166 https://doi.org/10.1016/j.resconrec.2020.105330

Lou ZK, Chen SY, Yin WW, Zhang C, Yu XY (2022) Economic policy uncertainty and firm innovation: evidence from a risk-taking perspective. Int Rev Econ Financ 77:78–96. https://doi.org/10.1016/j.iref.2021.09.014

Miklin N, Gachechiladze M, Moreno G, Chaves R (2022) Causal inference with imperfect instrumental variables. J Causal Inference 10(1):45–63. https://doi.org/10.1515/jci-2021-0065

Mun SG, Jang S (2019) Indicating restaurant firms’ financial constraints: a new composite index. Int J Contemp Hosp Manag 31(4):2014–2031. https://doi.org/10.1108/ijchm-06-2018-0466

Pahnke A, Welter F, Audretsch DB (2023) In the eye of the beholder? Differentiating between SMEs and Mittelstand. Small Bus Econ Group 60(2):729–743. https://doi.org/10.1007/s11187-022-00612-x

Peng C, Elahi E, Fan BB, Li ZH (2022) Effect of high-tech manufacturing co-agglomeration and producer service industry on regional innovation efficiency. Front Environ Sci 10:12. https://doi.org/10.3389/fenvs.2022.942057

Ponta L, Puliga G, Manzini R (2021) A measure of innovation performance: the Innovation Patent Index. Manag Decis 59(13):73–98. https://doi.org/10.1108/md-05-2020-0545

Qin B, Zeng DM, Gao AG (2022) Convergence effect of the Belt and Road Initiative on income disparity: evidence from China. Hum Soc Sci Commun 9(1):16. https://doi.org/10.1057/s41599-022-01315-0

Shi JG, Sadowski BM, Zeng XR (2023) Picking winners in strategic emerging industries using government subsidies in China: the role of market power. Hum Soc Sci Commun 10(1):8. https://doi.org/10.1057/s41599-023-01910-9

Spiegel Y (2021) The Herfindahl-Hirschman index and the distribution of social surplus. J Ind Econ 69(3):561–594. https://doi.org/10.1111/joie.12253

Su X, Li FF (2023) The impact of digital transformation on ESG performance based on the mediating effect of dynamic capabilities. Sustainability 15(18):22. https://doi.org/10.3390/su151813506

Sun LY, Abraham S (2021) Estimating dynamic treatment effects in event studies with heterogeneous treatment effects. J Econ 225(2):175–199. https://doi.org/10.1016/j.jeconom.2020.09.006

Sun YT, Cao C (2021) Planning for science: China’s “grand experiment” and global implications. Hum Soc Sci Commun 8(1):9. https://doi.org/10.1057/s41599-021-00895-7

Tritto A, Camba A (2023) The Belt and Road Initiative in Southeast Asia: a mixed methods examination. J Contemp China 32(141):436–454. https://doi.org/10.1080/10670564.2022.2090099

Tsang S (2023) Getting China right. Survival 65(4):43–54. https://doi.org/10.1080/00396338.2023.2239057

Wang AP, Hu Y, Li YY, Rao SQ, Lin WF (2022a) Do pilot free trade zones improve the green total factor productivity? Evidence from a quasi-natural experiment in China. Environ Sci Pollut Res 29(50):75307–75321. https://doi.org/10.1007/s11356-022-21003-5

Wang HY, Zhang YH, Liu ZAK, Liu RK, Li KY (2022b) The impact and mechanisms of the Shanghai pilot free-trade zone on the green total factor productivity of the Yangtze River Delta Urban Agglomeration. Environ Sci Pollut Res 29(27):40997–41011. https://doi.org/10.1007/s11356-021-17758-y

Yu CH, Wu XQ, Zhang DY, Chen S, Zhao JS (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:13. https://doi.org/10.1016/j.enpol.2021.112255

Yuan F, Li MS, Sun XH, Zhai Y (2023) The impact of demand-pull and supply-push policies on technological innovation: does the type of policy matter? Int J Technol Manag 92(4):269–287. https://doi.org/10.1504/ijtm.2023.129563

Yue W (2022) Foreign direct investment and the innovation performance of local enterprises. Hum Soc Sci Commun 9(1):9. https://doi.org/10.1057/s41599-022-01274-6

Yue W, Lin QX, Xu SY (2023) Investment effect of regional trade agreements: an analysis from the perspective of heterogeneous agreement provisions. Hum Soc Sci Commun 10(1):13. https://doi.org/10.1057/s41599-023-01792-x

Zhang L, Shan XG (2023) The use of intellectual property right bundles and firm performance in China. Hum Soc Sci Commun 10(1):13. https://doi.org/10.1057/s41599-023-01712-z

Acknowledgements

This was supported by the National Social Science Fund of China (23BGL190), and Natural Science Foundation of Shandong Province (ZR2020MG046).

Author information

Authors and Affiliations

Contributions

XS conceptualized and structured the draft, wrote the introduction, conducted the background review, and supervised the work. SW conducted the theoretical and econometric analysis, dissected the empirical results, summarized the conclusions, and edited the entire draft. The authors read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Su, X., Wang, S. Impact of China’s free trade zones on the innovation performance of firms: evidence from a quasi-natural experiment. Humanit Soc Sci Commun 11, 17 (2024). https://doi.org/10.1057/s41599-023-02523-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-02523-y

- Springer Nature Limited

This article is cited by

-

The Impact of Free-Trade Zones on Total Factor Productivity: Evidence from China

Journal of the Knowledge Economy (2024)