Abstract

A common fallacy is that small and medium-sized enterprises (SMEs) are the translation for Mittelstand companies. Until today, no common, widely accepted, and consistently applied understanding of what constitutes the Mittelstand exists, and related international research is consequently less coherent as well as a strong evidence-base for policy makers lacking. Most empirical research has relied on data for SMEs, taking quantitative metrics on firm size as constituent features of Mittelstand companies. The paper challenges this simplified equation of Mittelstand and SMEs and provides a first comparison of different approaches to analyze Mittelstand companies. Focusing on the criteria owner-management, firm size, and a sense of belonging to the Mittelstand, we highlight systematic differences of these approaches. Consequently, we suggest a conceptualization of Mittelstand companies that paves the way for more comprehensive research by setting the distinctive company identity based on ownership and management at the core of what constitutes the Mittelstand.

Plain English Summary

Research on Mittelstand companies is faced with a dilemma. On the one hand, Germany’s Mittelstand companies have attracted increased attention in the entrepreneurship literature as well as from policy makers and media at an international level. On the other hand, there is no common, widely accepted and consistently applied understanding of what constitutes the Mittelstand. As a result, research on the Mittelstand is less coherent causing confusion in media, politics, and academia. The paper addresses this ambiguity of the term Mittelstand prevalent throughout the literature and compares different approaches to measuring, identifying, and classifying the Mittelstand. Highlighting their systematic differences, we finally suggest that research, policy makers, and practitioners should set the unity of ownership and management at the core of the Mittelstand. In this way, a more comprehensive and unified understanding of the Mittelstand and its heterogeneity should emerge at all levels.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Germany’s Mittelstand companies have attracted increased attention in the entrepreneurship field as well as from policy makers and media at the international level. Although these companies play a more unique role for German economic development than in other countries, such as the USA or the UK (Audretsch & Elston, 1997), there is some interest in understanding and — to some extent — in emulating the German Mittelstand (e.g., Bod, 2014; Logue et al., 2015; Ross Range, 2012), also from policymakers worldwide (Pahnke & Welter, 2019). Not only is West Germany’s “economic miracle”, the Wirtschaftswunder of the 1950s and 1960s, along with the well-known brand “Made in (West) Germany” attributed to the Mittelstand (Berghoff, 2006; Muzyka et al., 1997) but also the resilient performance of the German economy in the wake of the financial crisis (e.g., Bruff & Horn, 2012; Lehrer & Schmid, 2015; Pichet & Lang, 2012). The Mittelstand is therefore frequently portrayed as the “backbone of the German economy” and as flagship of the country’s innovativeness and export success (Audretsch & Lehmann, 2016).

However, research on Mittelstand companies is faced with a dilemma: just as there exists no legal or a generally accepted definition (Becker & Ulrich, 2011; Krimphove & Tytko, 2002), there similarly is no broad understanding of what constitutes the Mittelstand. At least in German-speaking countries, a longstanding “[…] lively and quite controversial scientific discussion on the question how Mittelstand companies can be defined adequately” (Berlemann et al., 2021, p. 1) has emerged over the past 20 years (Berlemann et al., 2018; Wolter & Hauser, 2001). However, both in Germany and internationally, research frequently tends to simply consider and translate Mittelstand companies as small and medium-sized enterprises (SMEs) (Schenkenhofer, 2022), because official statistics usually do not contain information about business ownership, for example. Over time, therefore, a small or medium firm size was “[…] erroneously seen as constitutive characteristic of Mittelstand companies” (Wolter & Hauser, 2001, pp. 29, translated from German), leading to a large proportion of research on the German Mittelstand being in fact research on SMEs (Berlemann et al., 2018).

The practice of equating SMEs and Mittelstand has come under criticism, not least because broad measurement of Mittelstand companies is lacking and thus restricting the relevance of research for policy-makers (Cassel & Thomas, 2019), be that in Germany or elsewhere. The problem with this false equivalence between SMEs and the Mittelstand is that typical characteristics of a bona fide Mittelstand company are “[…] not the size of its workforce or the number on its balance sheets, but rather its corporate governance in a broad sense that encompasses both legal and sociocultural features” (Berghoff, 2006, p. 271). In fact, Welter et al. (2015) have identified a range of characteristics comprising the Mittelstand that vary between eight and 18, depending on the perspective and eye of the beholder, while Schenkenhofer (2022) lists a total of 10 (qualitative) key characteristics of Mittelstand companies. This ambiguity of what actually constitutes a bona fide Mittelstand company, combined with the intractability of measurement for some of the characteristics, such as the extent to which the company is embedded in the local community, has resulted in an inability to actually measure, and classify a company as belonging to the Mittelstand.

Our paper addresses this ambiguity arising from equating SMEs with Mittelstand companies. We first introduce an analytical framework that incorporates multiple characteristics associated with the Mittelstand. In light of the current discourse, we focus on owner-management (ownership criterion) and firm size (size criterion). A sense of belonging to the Mittelstand (identification criterion) is introduced as an additional dimension. Such self-assessment of “being part of the Mittelstand” has been posited as an important determinant of the success and sustainability of Mittelstand companies (e.g., Audretsch & Lehmann, 2016; Berghoff, 2006; Fear, 2014; Pahnke & Welter, 2019).

Taking these three dimensions together, we are able to explore different research approaches to measuring, identifying, and classifying the Mittelstand. We therefore challenge the widely applied empirical equivalence of Mittelstand with SMEs, instead providing a comparison of different approaches, which has been glaringly absent in the extant entrepreneurship literature. Highlighting their systematic differences, we finally suggest a conceptualization of Mittelstand companies that paves the way for more comprehensive approaches in research and facilitates international comparative studies by setting the distinctive company identity based on ownership and management at the core of what constitutes the Mittelstand.

2 Characterizing and defining the Mittelstand

2.1 The importance of owner-management

Owner-management, be that by a single entrepreneur or families, has been recognized as one important criterion distinguishing the Mittelstand (e.g., Berghoff, 2006; Berlemann et al., 2018; Lehrer & Celo, 2016; Lehrer & Schmid, 2015; Welter, 2018).Footnote 1 From the vantage point of agency theory, which deals with issues arising from the separation of firm ownership and management (Berle & Means, 1932), owner-managed firms can often circumvent or minimize agency problems — notwithstanding that owner-management may come with its own agency costs as has been shown for family-managed firms (De Massis, Audretsch, et al., 2018; De Massis, Kotlar, et al., 2018). Even though on a case-by-case basis, the actual composition of the management board is important, problems or inefficiencies in management related to principal agent-relationships with employed managers are less likely to occur in such companies (Jensen & Meckling, 1976). This is due to the fact that in owner-managed companies the long-term orientation of the owners is less likely to be opposed by a usually shorter optimization perspective of employed managers (Berlemann et al., 2021).

Moreover, since the unity of ownership and management reflects the legal, economic, and entrepreneurial independence of the owner-manager(s), these are able to better reconcile their personal and business goals (e.g., Chrisman et al., 2014). Owner-managers of Mittelstand companies in Germany have been shown to put high emphasis on the strategic preservation of their legal and economic independence (Pahnke et al., 2019) which can be considered as an important “side condition” (or restriction) for Mittelstand companies, too. For example, Mittelstand companies tend to maintain a high equity ratio and are generally not listed on capital markets what increases their autonomy with respect to capital supply and yields a certain independence from economic cycles (Audretsch & Lehmann, 2016; Berghoff, 2006; Welter et al., 2015), although such a financing strategy of the owner-manager will not necessarily exploit the full economic potential of its company (e.g., Hutchinson, 1995; Molly et al., 2019).

In conclusion, owner-managed companies are not solely driven by economic considerations (e.g., Berrone et al., 2012; Michiels & Molly, 2017; Molly et al., 2012; Romano et al., 2001). Personal values of their owner-managers also play an important role (Rau et al., 2019), while the emotional attachment to the company “[…] may also detract from the firm’s focus on economic goals” (Mustakallio et al., 2002, p. 205). Owner-managed businesses may overall have an advantage in that their owners also emotionally and personally invest in their companies. However, if not successful, owner-managers bear, in contrast to employed managers, the entrepreneurial risks and liabilities of these decisions so that economic success (of the company) and private wealth (of its owner-managers) are inseparable linked (Alchian & Demsetz, 1972).

2.2 Owner-management and firm size

In general, owner-managers have been shown to be more focused on the firm’s long-term prospects (Daily & Dollinger, 1993; Whisler, 1988) or the protection of “socio-emotional wealth” (Berrone et al., 2012; Gómez-Mejía et al., 2007) of the owner-family (Arregle et al., 2017) rather than firm growth and a large enterprise size.

Moreover, owners of small firms are also able to pursue their own interests by exerting indirect influence over other managers and employees through the informal organizational structure of such firms and the ambiguity given there (Goffee & Scase, 1985; Whisler, 1988). Owner-managed companies also seem to favor defensive, less growth-oriented strategies to sustain control and to protect their market position (Cromie et al., 1995; Ward, 1987). In contrast, employed managers concentrate more on their short-term personal goals which often results in a relatively larger firm size, as managerial remuneration is linked to company profit. Larger firms also provide better career opportunities for managers while their size helps to conceal ineffective decision-making at the same time (Daily & Dollinger, 1993).

Agency theory provides an additional argument for the smaller size of owner-managed companies. By splitting the decision process into the three elements — “decision management” (initiation and implementation of decisions), “decision control” (ratification and monitoring of decision), and (residual) risk bearing — Fama and Jensen (1983) argue that in small noncomplex organizations, the identity of ownership and management, reflected in decision management and decision control is more efficient. In these organizations, the detailed information which is required but costly to transfer among agents (specific knowledge) is concentrated in one or a few agents. Major decision makers are also the major (residual) risk bearers which allows owner-managers to bear a substantial share of the wealth effects of their decisions. However, as soon as (small) organizations grow, (additional) specific knowledge may become more important for and more diffuse within the firm. Therefore, in larger organizations, the separation of management, ownership and control contributes to efficiency and reduces agency costs (Fama & Jensen, 1983).

On the one hand, relatively small owner-managed companies may evolve over time to large companies, in which ownership and management are completely separate from each other, and the strategic influence of any single (majority) owner is no longer given. They may also become so-called owner- or family-controlled firms in which “[…] it is possible to own less than a majority of the shares and elect a board of directors that will support the controlling family’s goals” (Tagiuri & Davis, 1982, p. 200). For example, in the case of business succession (i.e., older, and larger companies), companies may start hiring external managers while retaining their ownership and thus a significant influence on strategic decisions. Despite such possibilities to maintain at least control of strategic decisions in larger companies, the growth of owner-managed companies is not automatic. It is ultimately driven and sometimes limited by the strategic posture of the owner-managers, their personal interests, and preferences as well as by their decision-making behavior (Daily & Thompson, 1994).

2.3 The Mittelstand mindset: a sense of belonging

The importance of owner-manager(s) in the Mittelstand, as well as of their preferences and goals, is also reflected in a certain sense of belonging or “Mittelstand mindset”. According to Ludwig Erhard (1956), who crafted Germany’s post-war economic miracle as minister of economic affairs, the German Mittelstand is less associated with quantitative than qualitative features reflecting a certain ethos and a fundamental disposition of how one acts and behaves in society. In other words, the term Mittelstand is associated with a certain “entrepreneurial spirit” in Germany (Parella & Hernández, 2018) and comes with a multitude of positive connotations (Fear, 2014) so that “[…] everybody wanted – and still wants – to belong to the Mittelstand […]” (Berghoff, 2006, p. 265).

While the existing literature stresses the importance of such an understanding of Mittelstand companies, exemplary referring to their long-term orientation and sustainability (Audretsch et al., 2018; De Massis, Audretsch, et al., 2018; De Massis, Kotlar, et al., 2018; Logue et al., 2015; Welter, 2018), there is, however, little empirical evidence (Ruf et al., 2021). Companies or owner-managers perceiving a sense of belonging to the Mittelstand are probably committed to corresponding social and entrepreneurial values (Berlemann et al., 2021), which can then spread or persist even beyond the boundaries of the Mittelstand company (Pahnke & Welter, 2019). In particular, long-established family businesses in manufacturing, as well as many larger (and older) enterprises, where the identity of ownership and management is no longer given, still perceive themselves as Mittelstand (Welter et al., 2015). Even the political discourse in Germany is based on an ownership- and value-driven understanding of the Mittelstand which explains why emotions, passion, and feelings of belonging play an additional as well as important role for understanding the (German) Mittelstand (Pahnke & Welter, 2019).

Such a “Mittelstand mindset” probably includes values which generally matter in shaping the behavior of an organization, its management, and its employees and their interaction with the environment (Agle & Caldwell, 1999; Donker et al., 2008; Schwartz, 2005). It affects in this way decision-making processes of all organizational members (Klenke, 2005) and could therefore yield or be considered as competitive advantage of the company (Deal & Kennedy, 1982; Donker et al., 2008). Again, owner-managers of Mittelstand companies are of particular importance in this regard: Given the general significance of values as guiding principles for individuals, it is reasonable to conclude that they actively shape the corporate values of their company (Anderson & Reeb, 2003; Schein, 1983).

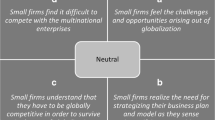

2.4 Analytical framework to demarcate the Mittelstand

We now bring together the elements outlined above in an analytical framework that allows — as depicted in Fig. 1 — a comparison of different approaches to the Mittelstand along the “ownership”, “size”, and “identification” criteria. The idea is to classify every company of a population along these three criteria. The size criterion does therefore not only refer to SMEs, but also to large enterprises for which no upper-limit regarding their total number of employees and/or annual turnover exists at the end. For the purpose of additional analyses within the group of SMEs, these can be further divided into micro, small, and medium-sized enterprises, according to the current definition of the European Commission (2003).

Within the category “ownership”, we distinguish between owner-managed companies, owner-controlled companies, and other businesses, because levels of ownership and management vary across companies so that corresponding effects on firms’ strategic decisions and on firm size are likely to differ, too (Chrisman et al., 2005; Melin & Nordqvist, 2007). Companies are owner-managed if (managing) owners are fully dependent on the business income, and fully bear the entrepreneurial risk. Regarding companies where ownership and management are generally separated, we further differentiate between owner-controlled companies, in which natural persons as majority owners are still able to exert significant influence on the strategic decisions of the company but are not concurrent members of its management board, and other businesses, for example, publicly listed firms without such a sufficient large majority ownership of a single shareholder or natural person, respectively.

Finally, the “sense of belonging to the Mittelstand” brings in a subjective element to our model. Combined with the attribute “owner-managed”, we then can distinguish four subgroups:

-

Owner-managed companies that also have a sense of belonging to the Mittelstand

-

Owner-managed companies that do not have a sense of belonging to the Mittelstand

-

Companies that are not owner-managed but have a sense of belonging to the Mittelstand

-

Companies that are neither owner-managed nor have a sense of belonging to the Mittelstand

Of course, a similar categorization of the “sense of belonging to the Mittelstand” is also possible in conjunction with the size criterion.

3 Data and key variables

For the empirical analyses based on our model, we rely on survey data for Germany from the Mittelstandsbefragung 2014. This (cross-sectional) survey, conducted by the Institut für Mittelstandsforschung (IfM) Bonn in 2014, provides detailed information on the ownership and governance structure of surveyed companies, their total number of employees, their annual total turnover, and their sense of belonging to the Mittelstand (Schlömer-Laufen & Schneck, 2020). The data therefore allow a definite assignment of every surveyed company according to our analytical framework shown in Fig. 1, while further information on firm characteristics can be used as control variables. The survey is based on a random sample which was drawn from an address database of Creditreform comprising 3.5 Mio. companies with headquarters in Germany and stratified by four industries and four categories of annual turnover. 541 properly completed questionnaires were returned from 14,397 contacted companies, and the response rate (of 3.8% in total) is uniformly distributed over firm sizes and industries (for details, see Welter et al., 2015, p. 67 ff.).

Each company is assigned to a size class based on the SME-definition of the European Commission (2003), which is widely used in the literature and sets ceilings for each category in employee headcount and annual turnover. In particular, micro enterprises are enterprises with up to 9 employees and up to 2 million euros annual turnover, small enterprises are enterprises with up to 49 employees and up to 10 million euros annual turnover (excluding microenterprises), while the threshold for medium-sized enterprises is up to 249 employees and up to 50 million euros annual turnover (excluding micro and small enterprises). Large enterprises exceed these thresholds.

Owner-managed companies are identified using the operationalization suggested by Wolter and Hauser (2001, p. 33): a company is owner-managed if (and only if) (i) up to two natural persons (and/or their close families) hold at least 50% of the voting shares of the company and (ii) these natural persons or families are, at the same time, members of the management board. Companies for which neither of the criteria holds are classified as not owner-managed. However, companies in which up to two natural persons hold at least 50% of the voting shares but are no concurrent members of the management board are categorized as owner-/family-controlled. The data allow us to assign each surveyed company to one of the ownership-categories of our analytical framework (Fig. 1) in two steps: Companies in the legal form of sole proprietorship were per se and according to German law classified as owner-managed. For the remaining cases, we additionally used information on the composition of the management and the ownership shares of concurrent members of the management board.Footnote 2 The classification with regard to a perceived “sense of belonging” to the Mittelstand is based on a self-assessment of the survey respondents (yes/no question), as has been applied in other studies also (e.g., Berlemann et al., 2021).

Consequently, we only use observations with complete information on the ownership and management structure, total number of employees, total annual turnover, and the self-assessment, i.e., the sense of belonging to the Mittelstand. Otherwise, it is not possible to assign each observation of the sample to a unique category of our model. As a result, the initial total sample size is reduced from 541 to 409 observations due to missing values for at least one of these key variables.

4 Empirical findings

4.1 Ownership and size

We first analyzed our model in terms of ownership and firm size. The majority, i.e., more than two-thirds of surveyed companies can be classified as owner-managed, 32% as non-owner-managed (Fig. 2). However, roughly every fourth non-owner-managed company (or 8.3% of all companies in the sample) is an owner-/family-controlled company. Consequently, 23.5% of the companies in our sample are neither owner-managed nor owner-controlled. Overall, the structure of our data is very similar to the much larger sample of Berlemann et al., (2021, Table 2) which contains 3989 owner-managed companies (67.4%) out of 5845 observations in total.Footnote 3

Next, we examined owner-managed companies combined with enterprise size (Fig. 3). Our data emphasize that the common classification equating owner-managed Mittelstand companies with SMEs is likely to result in large biases, less coherent and more ambiguities of research results; quite apart from the fact that there are very different approaches to defining SMEs in the literature too (e.g., Baker & Mazzarol, 2015; Berghoff, 2006). While in total 24.2% of all SMEs are not owner-managed in our sample, the overlap between owner-managed companies and SMEs is also decreasing with firm size. The proportion of owner-managed companies is 95.0% for micro enterprises, 74.5% for small enterprises, 58.3% for medium-sized enterprises, and 43.2% for large enterprises. In the light of those results, it is important to emphasize that while owner-managed companies are more prominent in the smallest size categories, there are also larger owner-managed companies. So, when SMEs are used as an approximation for owner-managed companies because of an “insufficient data situation”, for example, such an approach does not only — in view of our results — confound owner- and non-owner managed companies but also systematically exclude large owner-managed companies from the (empirical) analyses; as Handler (1989, p. 259) also concludes, “However, including family businesses in a small business file may serve to camouflage the unique ways family business differ from entrepreneurships and other closely held corporations, thereby making the development of family firm-specific models and frameworks difficult.” The same generally applies to research on the Mittelstand, although the severity of such inherent biases (or measurement errors) then depends on the particular research questions studied. Nonetheless, there is a noticeable impact on the comparability of research and its results.

We therefore took a closer look at the ownership structure. Table 1 illustrates that this varies (on average) not only across firm size but — not surprisingly — also between owner-managed and non-owner-managed companies. Admittedly, the proportion of the first two main shareholders should be relatively high because of the applied definition of owner-managed companies (50% threshold). The results still suggest that ownership and management of such companies mainly lie in one hand. The first main shareholder of an owner-managed company (by definition also the managing director) holds 93.6% of a micro, 80.9% of a small, 84.0% of a medium sized, and still 68.6% of a large enterprise with 250 and more employees. Another important result is that the ownership share of legal entities is very low (and almost meaningless) on average in owner-managed companies. These can therefore act very independently since they are rarely linked — via ownership shares — to other companies. The same applies to larger owner-managed companies where the ownership of other natural persons but not legal entities, gains importance. The ownership-structure in non-owner-managed companies is, again not only different (as expected because of our definition) but nearly the opposite of owner-managed companies: In every size class of the non-owner-managed companies, legal entities hold the largest proportion of company shares which is additionally increasing with firm size; from 40.0% in micro-enterprises to 80.1% in large enterprises. Hence, the ownership and management structures in both types of companies turn out very differently: while the owner-managed companies are — in accordance with the assessment of Berghoff (2006) — likely to be some kind of “one-person show”, non-owner-managed companies are much more integrated in (larger) corporate structures. Since these findings refer to all size classes, equating owner-managed companies with SMEs becomes even more challenging and problematic the more differences in decision-making or management in general are at the very center of research.

4.2 The sense of belonging to the Mittelstand

Turning to the sense of belonging, the data implies — again in line with comparable evaluations of Berlemann et al. (2021) — that there are actually more companies that perceive themselves as Mittelstand than there are Mittelstand companies as defined by the owner-management criterion (Fig. 4). However, this “surplus” is not only based on non-owner-managed companies that perceive themselves as part of the Mittelstand. There is actually a relatively large proportion of owner-managed companies that have no sense of belonging to the Mittelstand (18.1%) but also an even larger proportion of non-owner-managed companies doing so (26.1%).

Although nearly every third company with a sense of belonging to the Mittelstand is therefore not owner-managed, the majority of owner-managed companies still consider themselves as Mittelstand. In fact, 73.5% of all owner-managed, and 82.3% of the non-owner-managed companies do so. Because the sense of belonging to the Mittelstand tends to reflect a value-oriented business culture, this finding is important to better understand the impact of the Mittelstand, the “phenomenon Mittelstand”, on the German economy and society.

While the majority of entrepreneurs do not regard firm size as a constituent feature of the Mittelstand (May-Strobl & Welter, 2016), very small companies or micro enterprises are somewhat different. Although most of them are owner-managed, many of them do not perceive themselves as Mittelstand (Fig. 5). Similar to relatively larger non-owner-managed companies that regard themselves (still) as Mittelstand, it is, however, likely that these micro enterprises will develop a sense of belonging to the Mittelstand as they grow and hire their first or new employees.

4.3 Interdependencies between ownership, firm size, and the sense of belonging to the Mittelstand

In a final step of our analysis, we estimate several Probit-models in order to empirically test previously discussed interdependencies between our three criteria: owner-management, firm size as well as sense of belonging to the Mittelstand and thus validating our analytical model. We focus on the general differences between owner-managed and non-owner-managed companies and the characteristics of companies with a sense of belonging to the Mittelstand. Furthermore, we take a closer look at the characteristics of owner-managed companies that do not perceive themselves as Mittelstand by comparing them with owner-managed companies that do so. The same is done regarding non-owner-managed companies. In addition to firm size, the control variables now include firm age, the size of the managing board, an indicator for women-led firms (management boards that consist of more than 50% of women), the location of the head office, and industry. Information on the legal form of the companies and personal liability of the owners is not used because these are closely related to the actual identification of owner-managed companies.

In accordance with our previous findings, the comparison of owner-managed and non-owner-managed companies (columns 1a and 1b of Table 2) confirms that smaller enterprises are more likely to be owner-managed. Moreover, the size of the estimated (average) marginal effects reflects smaller proportions of Mittelstand companies in the larger size categories. These size effects are also robust with respect to the inclusion of additional control variables, such as firm age, size of the management board or industry, for example, in the estimation model.

Such a high consistency of descriptive and multivariate results can also be seen with respect to the sense of belonging to the Mittelstand (Fig. 4 vs. columns 2a and 2b of Table 2). In general, owner-managed companies are more likely to perceive themselves as Mittelstand. However, there is an additional and opposite effect of the firm size. The estimation results therefore confirm that especially owner-managed micro enterprises are less likely to express a sense of belonging to the Mittelstand. At the same time, medium-sized enterprises have (ceteris paribus) obviously the highest probability in doing so.

Ironically, this high level of identification with the Mittelstand in medium-sized enterprises is the exact reason why the whole size class had to be dropped from the subsample of all owner-managed companies that has been used to determine the characteristics of owner-managed companies which do not perceive themselves as Mittelstand. Nevertheless, the results confirm — again in line with descriptive findings (Fig. 5) — that smaller owner-managed companies tend not to associate themselves with the Mittelstand (column 3 of Table 2). With respect to the differences between non-owner-managed companies that regard themselves as Mittelstand and the remaining non-owner-managed companies (column 4 of Table 2), the estimation results demonstrate once more the robustness of the discussed size effects in relation to the affiliation to the Mittelstand. Even in this subsample micro and small enterprises are, once again, less likely to associate themselves with the Mittelstand while all other structural variables show no statistically significant effects. Regardless of the actual ownership structure, the sense of belonging to the Mittelstand is therefore the weaker the smaller the companies are.

5 Discussion and conclusions

To address the lack of a common understanding of the Mittelstand in the literature, this paper investigates and compares for the first time different approaches to measuring and analyzing Mittelstand companies by focusing on three distinct criteria that are commonly used to characterize the Mittelstand in (empirical) research: owner-management, firm size, and a sense of belonging to the Mittelstand. Our empirical analyses incorporating these three dimensions of Mittelstand companies first suggest that these are in themselves not congruent. In particular, equating owner-managed companies with SMEs, as has been prevalent in the existing literature, is problematic. Many but not all SMEs are owner-managed while there are also larger owner-managed enterprises. At the same time, there are owner-managed companies that do not perceive themselves as Mittelstand as well as companies that do so but are not owner-managed. Furthermore, (very) small enterprises generally do not have a sense of belonging to the Mittelstand, irrespective of their ownership structure.

Interestingly though, the unity of ownership and management prevailing in owner-managed companies is not only — as discussed in the paper — recognized as the most important criterion of Mittelstand companies but is also very likely related to their firm size and the sense of belonging to the Mittelstand. The unity of ownership and management “empowers” Mittelstand entrepreneurs to determine the growth of their company and to shape its corporate values. In other words, the three criteria, owner-management, firm size, and the sense of belonging to the Mittelstand, on which we focused in this paper, are not mutually exclusive but rather interconnected.

In the sense of a lowest common denominator, we therefore propose to set the unity of ownership and management at the core of the Mittelstand. In doing so, our analytical framework (Fig. 1) can also be understood as a “Mittelstand model” which allows for a more comprehensive demarcation of Mittelstand companies. Combining “owner-management” with the “sense of belonging to the Mittelstand”, for example, we can distinguish further between what we would call pure Mittelstand (owner-managed with a sense of belonging), hybrid Mittelstand (owner-managed without a sense of belonging), hybrid non-Mittelstand (non-owner-managed with a sense of belonging), and ultimately pure non-Mittelstand (non-owner-managed without a sense of belonging). Similarly, combining the status of owner-management and size would allow us to distinguish between smaller/owner-managed and larger/owner-controlled Mittelstand.

Admittedly, the related dichotomy of Mittelstand and non-Mittelstand is relatively rough still from an empirical point of view. However, it is theoretically of great importance. Such an understanding of the Mittelstand as first and foremost owner-managed companies is finally associated with the insight that it is quite heterogenous and not determined by a certain size or industry affiliation, for example. It should therefore pave the way for more comprehensive empirical analyses because effects emerging from this unique organizational structure can be separated from other effects of interest, which are — in the sense of an expansion of the proposed Mittelstand model — not limited to owner-management, firm size, and the sense of belonging to the Mittelstand.

An example might be a (conceptual) comparison of family businesses and Mittelstand companies in Germany which additionally takes the changing influence or importance of owner-families across firm size into account. Given the international attention for the German Mittelstand mentioned in the introduction, future research is particularly needed on the corporate and individual values in the Mittelstand. Further knowledge in this area is likely to improve our understanding of the Mittelstand in an international context: What is the “Mittelstand mindset” exactly and do German owner-managed companies differ from those in other countries with respect to corporate values and the attitudes of their owner-managers? How do economic and political institutions shaping the nature of entrepreneurship and SMEs (Dilli et al., 2018) interact with the Mittelstand mindset and its corresponding values? What are the starting points for policy makers who want to emulate the German Mittelstand in their country or wish to fine-tune their enterprise policies in this context?

The answer to why we need to distinguish between SMEs and Mittelstand is not only of interest for international comparative research, but also relevant for policy makers. Data limitations still prevent researchers from providing an appropriate evidence-base on the Mittelstand; and approximations of Mittelstand companies with other parts of the enterprise population are often inevitable. Hence, a precise terminology in research is needed. Research that deals with SMEs in general or certain parts of the Mittelstand population should be accordingly labeled and carefully distinguished in order to avoid further confusion and — more importantly — to obtain a better and more coherent picture of the Mittelstand. This would provide a great service to countries, where identifying and supporting their own Mittelstand has emerged as distinct policy priority.

Data availability

The datasets analyzed during the current study are available for non-commercial reasons upon request from the Institut für Mittelstandsforschung (IfM) Bonn, Germany. Detailed information are available on the internet: https://www.ifm-bonn.org/en/index/about-us/data-of-the-ifm-bonn-1

Code availability

Data analysis is based on STATA 16.1.

Notes

Apart from owner-management, the concepts of SMEs, Mittelstand companies, and family businesses can generally coincide in any constellation, but also appear separately without overlap (Schenkenhofer, 2022). For the purpose of the present paper, we focus on the relation of SMEs and Mittelstand companies only. With respect to the overlap of family businesses and Mittelstand companies in Germany see, for example, Lehrer and Schmid (2015) or Lehrer and Celo (2016).

The approach of Berlemann et al. (2021) for identifying owner-managed companies is different and refers to companies with a maximum of four managers of who at least one owns company shares.

References

Agle, B. R., & Caldwell, C. B. (1999). Understanding research on values in business: A level of analysis framework. Business & Society, 38(3), 326–387.

Alchian, A. A., & Demsetz, H. (1972). Production, information costs, and economic organization. The American Economic Review, 62(5), 777–795.

Anderson, R. C., & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. The Journal of Finance, 58(3), 1301–1328.

Arregle, J. L., Duran, P., Hitt, M. A., & Van Essen, M. (2017). Why is family firms’ internationalization unique? A meta–analysis. Entrepreneurship Theory and Practice, 41(5), 801–831.

Audretsch, D. B., & Elston, J. A. (1997). Financing the German Mittelstand. Small Business Economics, 9(2), 97–110.

Audretsch, D. B., & Lehmann, E. E. (2016). The seven secrets of Germany: Economic resilience in an era of global turbulence: Oxford University Press.

Audretsch, D. B., Lehmann, E. E., & Schenkenhofer, J. (2018). Internationalization strategies of hidden champions: Lessons from Germany. Multinational Business Review, 26(1), 2–24. https://doi.org/10.1108/MBR-01-2018-0006

Baker, S., & Mazzarol, T. (2015). The Australian manufacturing Mittelstand: An initial exploration. Paper presented at the 28th Annual SEAANZ Conference, Melbourne.

Becker, W., & Ulrich, P. (2011). Mittelstandsforschung: Begriffe, Relevanz und Konsequenzen. Kohlhammer.

Berghoff, H. (2006). The end of family business? The Mittelstand and German capitalism in transition, 1949–2000. The Business History Review, 80(2), 263–295.

Berle, A. A., & Means, G. C. (1932). The modern corporation and private property. The Macmillan Company.

Berlemann, M., Jahn, V., & Lehmann, R. (2018). Auswege aus dem Dilemma der empirischen Mittelstandsforschung. ifo Schnelldienst, 71(23), 22–28.

Berlemann, M., Jahn, V., & Lehmann, R. (2021). Is the German Mittelstand more resistant to crises? Small Business Economics. https://doi.org/10.1007/s11187-021-00573-7

Berrone, P., Cruz, C., & Gomez-Mejia, L. R. (2012). Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches, and agenda for future research. Family Business Review, 25(3), 258–279.

Bod, P. A. (2014). Whither Hungarian Mittelstand? Hungarian Review, (04), 16–24.

Bruff, I., & Horn, L. (2012). Varieties of capitalism in crisis? Competition & Change, 16(3), 161–168.

Cassel, S., & Thomas, T. (2019). Echte Mittelstandsforschung für Mittelstandspolitik nutzen. In ECONWATCH Policy Brief (Vol. 03/19). ECONWATCH Gesellschaft für Politikanalyse e.V.

Chrisman, J. J., Chua, J. H., & Sharma, P. (2005). Trends and directions in the development of a strategic management theory of the family firm. Entrepreneurship Theory and Practice, 29(5), 555–575.

Chrisman, J. J., Memili, E., & Misra, K. (2014). Nonfamily managers, family firms, and the winner’s curse: The influence of noneconomic goals and bounded rationality. Entrepreneurship Theory and Practice, 38(5), 1–25. https://doi.org/10.1111/etap.12014

Cromie, S., Stephenson, B., & Monteith, D. (1995). The management of family firms: An empirical investigation. International Small Business Journal, 13(4), 11–34.

Daily, C. M., & Dollinger, M. J. (1993). Alternative methodologies for identifying family-versus nonfamily-managed businesses. Journal of Small Business Management, 31(2), 79–90.

Daily, C. M., & Thompson, S. S. (1994). Ownership structure, strategic posture, and firm growth: An empirical examination. Family Business Review, 7(3), 237–249.

De Massis, A., Audretsch, D. B., Uhlaner, L., & Kammerlander, N. (2018a). Innovation with limited resources: Management lessons from the German Mittelstand. Journal of Product Innovation Management, 35(1), 125–146.

De Massis, A., Kotlar, J., Mazzola, P., Minola, T., & Sciascia, S. (2018b). Conflicting selves: Family owners’ multiple goals and self-control agency problems in private firms. Entrepreneurship Theory and Practice, 42(3), 362–389.

Deal, T. E., & Kennedy, A. A. (1982). Corporate cultures: The rites and rituals of corporate life. Addison-Wesley.

Dilli, S., Elert, N., & Herrmann, A. M. (2018). Varieties of entrepreneurship: Exploring the institutional foundations of different entrepreneurship types through ‘Varieties-of-Capitalism’ arguments. Small Business Economics, 51(2), 293–320. https://doi.org/10.1007/s11187-018-0002-z

Donker, H., Poff, D., & Zahir, S. (2008). Corporate values, codes of ethics, and firm performance: A look at the Canadian context. Journal of Business Ethics, 82(3), 527–537.

Erhard, L. (1956). Der mittelständische Unternehmer in der Sozialen Marktwirtschaft. In A. Rüstow, F. Böhm, H. Reif, J. Lang, & G. Schmölders (Eds.), Wortlaut der Vorträge auf der vierten Arbeitstagung der Aktionsgemeinschaft Soziale Marktwirtschaft e.V. am 17. November 1955 in Bad Godesberg (pp. 51–61). Ludwigsburg.

European Commission (2003). Commission recommodation on 6 May 2003 concerning the definition of micro, small and medium-sized enterprises (2003/361/EC). Official Journal of the European Union, L124, 36–41.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301–325.

Fear, J. (2014). The secret behind Germany’s thriving ‘Mittelstand’ businesses is all in the mindset. The Conversation. Retrieved from http://theconversation.com/the-secret-behind-germanys-thriving-mittelstand-businesses-is-all-in-the-mindset-25452

Goffee, R., & Scase, R. (1985). Proprietorial control in family firms: Some functions of ‘quasi-organic’ management systems. Journal of Management Studies, 22(1), 53–68.

Gómez-Mejía, L. R., Haynes, K. T., Núñez-Nickel, M., Jacobson, K. J., & Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Administrative Science Quarterly, 52(1), 106–137.

Handler, W. C. (1989). Methodological issues and considerations in studying family businesses. Family Business Review, 2(3), 257–276.

Hutchinson, R. W. (1995). The capital structure and investment decisions of the small owner-managed firm: Some exploratory issues. Small Business Economics, 7(3), 231–239.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Klenke, K. (2005). Corporate values as multi-level, multi-domain antecedents of leader behaviors. International Journal of Manpower, 26(1), 50–66.

Krimphove, D., & Tytko, D. (2002). Der Begriff “mittelständische Unternehmen” in betriebswirtschaftlicher und juristischer Diskussion. Praktiker-Handbuch Unternehmensfinanzierung: Kapitalbeschaffung und Rating für mittelständische Unternehmen (pp. 3–13). Schäffer-Poeschel Verlag.

Lehrer, M., & Celo, S. (2016). German family capitalism in the 21st century: Patient capital between bifurcation and symbiosis. Socio-Economic Review, 14(4), 729–750.

Lehrer, M., & Schmid, S. (2015). Germany’s industrial family firms: Prospering islands of social capital in a financialized world? Competition & Change, 19(4), 301–316.

Logue, D. M., Jarvis, W. P., Clegg, S., & Hermens, A. (2015). Translating models of organization: Can the Mittelstand move from Bavaria to Geelong? Journal of Management and Organization, 21(1), 17–36.

May-Strobl, E., & Welter, F. (2016). KMU, Mittelstand, Familienunternehmen: Eine Klarstellung. In H. H. Hinterhuber & H. K. Stahl (Eds.), Erfolgreich im Schatten der Großen. Wettbewerbsvorteile für kleine und mittlere Unternehmen (pp. 1–11). Erich Schmidt Verlag.

Melin, L., & Nordqvist, M. (2007). The reflexive dynamics of institutionalization: The case of the family business. Strategic Organization, 5(3), 321–333.

Michiels, A., & Molly, V. (2017). Financing decisions in family businesses: A review and suggestions for developing the field. Family Business Review, 30(4), 369–399.

Molly, V., Laveren, E., & Jorissen, A. (2012). Intergenerational differences in family firms: Impact on capital structure and growth behavior. Entrepreneurship Theory and Practice, 36(4), 703–725.

Molly, V., Uhlaner, L. M., De Massis, A., & Laveren, E. (2019). Family-centered goals, family board representation, and debt financing. Small Business Economics, 53(1), 269–286. https://doi.org/10.1007/s11187-018-0058-9

Mustakallio, M., Autio, E., & Zahra, S. A. (2002). Relational and contractual governance in family firms: Effects on strategic decision making. Family Business Review, 15(3), 205–222.

Muzyka, D., Breuninger, H., & Rossell, G. (1997). The secret of new growth in old German ‘Mittelstand’ companies. European Management Journal, 15(2), 147–157.

Pahnke, A., Holz, M., & Welter, F. (2019). Unternehmerische Zielsysteme: Unterscheiden sich mittelständische Unternehmen tatsächlich von anderen? In IfM-Materialien (Vol. 276). IfM Bonn.

Pahnke, A., & Welter, F. (2019). The German Mittelstand: Antithesis to Silicon Valley entrepreneurship? Small Business Economics, 52(2), 345–358.

Parella, J. F., & Hernández, G. C. (2018). The German business model: The role of the Mittelstand. Journal of Management Policies and Practices, 6(1), 10–16.

Pichet, E., & Lang, G. (2012). The German Mittelstand and its fiscal competitiveness: Lessons for France. La Revue de droit fiscal, (n°14), 46–55.

Rau, S. B., Schneider-Siebke, V., & Günther, C. (2019). Family firm values explaining family firm heterogeneity. Family Business Review, 32(2), 195–215.

Romano, C. A., Tanewski, G. A., & Smyrnios, K. X. (2001). Capital structure decision making: A model for family business. Journal of Business Venturing, 16(3), 285–310.

Ross Range, P. (2012). The German Model. Report. Handelsblatt. Retrieved from http://www.handelsblatt.com/politik/konjunktur/report-the-german-model/6966662.html

Ruf, P. J., Graffius, M., Wolff, S., Moog, P., & Felden, B. (2021). Back to the roots: Applying the concept of individual human values to understand family firm behavior. Family Business Review, 34(1), 48–70.

Schein, E. H. (1983). The role of the founder in creating organizational culture. Organizational Dynamics, 12(1), 13–28.

Schenkenhofer, J. (2022). Hidden champions: A review of the literature & future research avenues. Management Review Quarterly, 1–66.

Schlömer-Laufen, N., & Schneck, S. (2020). Data for Mittelstand companies in Germany at the IfM Bonn. Jahrbücher Für Nationalökonomie Und Statistik, 240(6), 849–859.

Schwartz, M. S. (2005). Universal moral values for corporate codes of ethics. Journal of Business Ethics, 59(1), 27–44.

Tagiuri, R., & Davis, J. (1982). Bivalent Attributes of the Family Firm. Reprinted in 1996. Family Business Review, 9(2), 199–208.

Ward, J. L. (1987). Keeping the family business healthy: How to plan for continuing growth, profitability, and family leadership. Jossey-Bass.

Welter, F. (2018). The Mittelstand: A specific entrepreneurial profile of the social market economy. Journal for Markets and Ethics, 6(1), 99–106.

Welter, F., May-Strobl, E., Holz, M., Pahnke, A., Schlepphorst, S., Wolter, H.-J., & Kranzusch, P. (2015). Mittelstand zwischen Fakten und Gefühl. In IfM-Materialien (Vol. 234). IfM Bonn.

Whisler, T. L. (1988). The role of the board in the threshold firm. Family Business Review, 1(3), 309–321.

Wolter, H.-J., & Hauser, H.-E. (2001). Die Bedeutung des Eigentümerunternehmens in Deutschland. Jahrbuch Zur Mittelstandsforschung, 1, 27–78.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Pahnke, A., Welter, F. & Audretsch, D.B. In the eye of the beholder? Differentiating between SMEs and Mittelstand. Small Bus Econ 60, 729–743 (2023). https://doi.org/10.1007/s11187-022-00612-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-022-00612-x