Abstract

This article addresses the historical evolution of sovereign debt trajectories since the beginning of the euro area up to the corresponding sovereign debt crisis, using certain key economic concepts previously proposed by the literature in connection to other historic sovereign debt events. It first recovers the concept of the sovereign debt Laffer curve, which efficiently addresses the non-linear relationship between economic output and public debt issuance. It then presents an important set of theoretic economic concepts that accurately describe the onset of debt vulnerabilities negatively impacting economic growth, therefore linking these fundamental but heterogeneous public debt-related concepts under the unifying concept of the said sovereign debt Laffer curve, which adequately encompasses these heterogeneous concepts. For example, fundamental concepts such as debt vulnerability, ‘debt overhang’, or ‘illiquidity vs. insolvency’ are adequately contextualized under the said Laffer curve. This innovative historical perspective might be useful in the analysis of subsequent sovereign debt crises, as well as in tackling future research in public debt sustainability, namely where the design and implementation of sustainable public debt policies in advanced economies is concerned.

Similar content being viewed by others

Introduction

The Euro Area Sovereign Debt Crisis (hereafter SDC) constitutes a most cumbersome epilogue to the Global Financial Crisis (hereafter GFC). Both crises have deeply scarred international financial markets and affected the performance of real economies globally. Whereas the GFC exposed a set of frailties in the global financial markets (most notably in the global banking industry), the SDC exposed idiosyncratic fiscal frailties associated with the implementation of a Euro Area-wide sovereign effort to countervail the impact of the negative sovereign debt shock on the fabric of Euro Area’s real economies. This is particularly visible where the pursuit of accommodative monetary and fiscal policies—the latter of which is essentially fueled by rising fiscal deficits and elevated public debt—that have ultimately endeared the public purse. The present document focuses on the Euro Area for the following reasons: (i) as the Euro Area expands its global economic relevance, the corresponding public debt levels in relation to its gross domestic product (GDP) have soared to approximately 100%, thus prompting a deep critical analysis surrounding the sustainability of its sovereign debt, especially in the context of future stress episodes in sovereign debt markets; (ii) existing post-Euro sovereign debt vulnerabilities seem to be related to historic pre-Euro vulnerabilities, highlighting the importance of the application of previously proposed concepts to the critical analysis of the Euro Area’s sovereign debt trajectories for each Member State; and (iii) the future of the Euro Area rests on the appropriate interplay between a centripetal monetary policy and a fractious/heterogeneous set of fiscal policies (the latter crucially dependent on public debt), thus underscoring the need to develop solutions based on the referred historic concepts.

Where the pursuit of accommodative fiscal policies is concerned, the financing burden has essentially fallen upon the sovereign debt policy instrument as the main financing tool. The said burden has been conspicuously noticeable in the feeble state of the public finances of Euro Area Member States in the aftermath of the GFC and SDC, most especially in the Euro Area’s Mediterranean States—the GIIPSFootnote 1 economiesFootnote 2. These Member States’ ensuing, but inevitable, breach of the Stability and Growth Pact in the wake of the GFC and SDC has exposed these economies to the potentially deleterious macroeconomic impact of excessive sovereign debt accumulation on Euro Area economic growth trajectories. Nevertheless, there are multiple root causes related to the said breach, namely (i) an incomplete treaty promoting a discrepancy between a centripetal monetary policy and multiple idiosyncratic and heterogenous fiscal policies (at the national level); (ii) the weak institutional enforcement of the original ‘Stability and Growth Pact’; and (iii) a non-optimal currency union that unevenly (but unwillingly) has fostered some macroeconomic imbalances among different Member States. The final dominant effect of all these root causes is still unknown, but the generally elevated levels of sovereign indebtedness across the Euro Area have nevertheless prompted a significant, enduring, and yet unresolved debate surrounding the sustainability of the said high levels of public debt at a national level. This is increasingly relevant in the context of the observed low economic growth rates during the recessionary stages of the business cycle. Given the centrality of this fiscal debate to the future of the Euro Area, the present survey should also provide a contribution to pinpoint existing vulnerabilities related to this important debate.

The present article mainly describes an important theoretical concept (the sovereign debt Laffer curve), a set of operational concepts (namely sovereign debt-related vulnerabilities), as well as some important empirical findings (e.g., the quantitative debt thresholds that have been estimated) that can collectively be used in policy formulation. This research design points to the need to promote sustainable debt management practices in the Euro Area. This is achieved by adequately contextualizing the macroeconomic impact associated with excessive sovereign debt accumulation and the need to promote adequate public debt policies in support thereof. This debate is quite important on two counts: (i) it historically contextualizes the latest Euro Area sovereign debt crisis, taking into consideration the existence of a set of proficient concepts that were developed throughout earlier sovereign stress-related episodes taking place before the actual formation of the Euro Area; (ii) it critically reviews the essential tenets of this complex historical episode, policy lessons for the future of fiscal Europe might be drawn in an attempt to build a more fiscally sustainable Euro Area. Both of these points take into consideration that the public debt instrument has been deeply strained in the aftermath of the SDC, thus compromising shock responsiveness in relation to future systemic episodes. The article focuses on the timeframe between 1998 (the first phase of the introduction of the Euro) up to 2014 (the year of the Greek rescheduling), thus encompassing the yield convergence process prior to the GFC and the subsequent yield divergence (during the SDC).

Accordingly, the present article fundamentally draws on the concept of the sovereign debt Laffer curveFootnote 3 for the Euro Area, which further encompasses a set of efficient tools that critically describe the state and impact of excessive sovereign debt on the macroeconomy and bond markets. The present article pays particular attention to the main debt-related stress period historically located between the GFC and the initial stages of the SDC, prior to the pursuit of accommodative European Central Bank (hereafter ECB) monetary policies targeting excessive public debt issues in the Euro AreaFootnote 4. This specific historical time frame has duly revealed the Euro Area’s sovereign frailties in the immediate aftermath of a systemic shock, as well as the Euro Area’s responsiveness to the twin systemic shocks (the GFC and the SDC), the critical study of which is fundamental to understand future policy design frameworks dealing with potential extreme financial stress episodes.

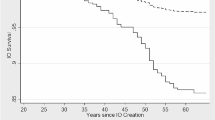

From a historic standpoint, this fundamental research topic is quite crucial to the fiscal analysis of the Euro Area on three counts. First, in the historical context preceding the implementation of the E.C.B.’s quantitative easing program in a post-GFC environment, the initial stages of the SDC had deeply shaken the belief in the Euro Area as an optimal currency area, by exposing idiosyncratic Member States’ fiscal frailties in the aftermath of the global systemic event (the GIIPS sub-set has been particularly exposed to negative bond market sentiment, visible through bond yield discrimination), as can be observed in Figs. 1 and 2.

Each sub-panel describes a given member state’s output-public debt scatterplot. Source: Bhimjee and Leão (2020).

Second, the SDC has also encumbered Euro Area Member States’ national accounts for the following decades and has impacted the corresponding economies quite heterogeneously, giving rise to a centrifugal and divisive two-speed Euro Area, most specifically where the performance of economic output is concernedFootnote 5. Third, the said Laffer framework quite aptly, but simplistically describes the process of encumbered Euro Area economic growth due to excessive sovereign debt accumulation in corresponding Member States, as well as presenting key sovereign stress-related conceptsFootnote 6.

In its research design, this document first draws on two types of literature strands: (i) the theoretical literature addressing key concepts in sovereign stress e.g., (e.g., debt vulnerability; ‘debt overhang’; ‘illiquidity vs. insolvency’; etc.); (ii) empirical fiscal sustainability studies mainly addressing sovereign stress in the Euro Area in the context of the SDC (as in the case of the GIIPS economies).

By using this specific research design, our contribution to the academic literature is twofold: (i) it first uses an interdisciplinary approach to address an important viewpoint on sovereign debt sustainability, by incorporating into the fold of our critical analysis various concepts that have been developed throughout pre- and post-Euro Area public debt crisis episodes, but were scattered across the academic literature; and (ii) it further binds several diverse and heterogeneous strands of academic literature that are presently critical to understand the need to develop more ‘federalist’ tools that might countervail future sovereign debt episodes, especially taking into consideration the interplay between fiscal and monetary policies.

Therefore, the main concepts associated with this article are useful in the critical analysis of future shock episodes of sovereign extraction, especially in those episodes where excessive private risks that have systemic implications (e.g., banking risks) spill over to the fiscal pillar of the Euro Area. This article is organized as follows: the following section first provides a succinct historical synopsis of recent excessive public debt trajectories in the European continent, in order to better contextualize the latest sovereign stress episode (section “A historical synopsis of excessive sovereign debt in Europe”); it then briefly addresses the sovereign debt vulnerabilities in the Euro Area and the ensuing financial market response to these sovereign frailties (section “Sovereign debt vulnerabilities in the euro area”). It subsequently introduces the theoretical concept of the sovereign debt Laffer curve, as an expression of the associative non-linear relationship involving public debt and economic growth in the immediate aftermath of this sovereign crisis (section “The sovereign debt Laffer curve”). It subsequently presents and expands on a specific set of fundamental concepts related to debt vulnerability, which can be viewed as an operational expression of sovereign vulnerabilities, ranging from initial debt vulnerabilities to serial default associated with the non-optimal (i.e., over-leveraged) section of the said Laffer (section “The sovereign debt-output growth nexus: the perilous journey from debt vulnerability to serial default”); the document then discusses the existence and role of sovereign thresholds as reference points to sovereign debt crises (section “Sovereign thresholds in the euro area in the aftermath of the sovereign debt crisis”), as well as summing up the main transmission channels associated with sovereign shocks (section “The sovereign debt Laffer curve: transmission channels”), before concluding (section “Conclusion”).

A historical synopsis of excessive sovereign debt in Europe

Public debt—as a key fiscal policy instrument of choice—has been particularly strained in the aftermath of the present GFC and SDC, in view of its strategic importance as an effective budgetary financing instrument. Intensive use of this fiscal instrument inevitably gave rise to upsetting sovereign financial stress affecting financial market soundness in the Euro Area in the aftermath of the GFC and the ensuing SDC Sovereign debt might nevertheless be susceptible to sovereign default risk, thus resulting in a loss (partial or total) of the underlying credit (i.e., the bond) as a result of this uncertainty.

More specifically, where the link between the GFC and the Euro Area SDC is concerned, Lane (2012) openly states that the GFC “triggered a major reassessment among investors of the sustainability of rapid credit growth and large external deficits. In turn, this took the form of significant private sector capital outflows, the tightening of credit conditions, and a shuddering halt in construction activity, with national banking systems grappling with the twin problems of rising estimates of loan losses and a liquidity squeeze in funding markets. In turn, the combined impact of domestic recessions, banking-sector distress, and the decline in risk appetite among international investors would fuel the conditions for a [Euro Area] sovereign debt crisis” (Lane, 2012, p. 54).

But, from a historical standpoint, is there a specific link between mounting sovereign debt and subsequent output growth in the context of the Euro Area? In the affirmative case, what are the main characteristics of this complex and dynamic relationship?

Typically, from a historical perspective, public debt soars in the aftermath of financial crises. In the specific case of banking crises, the cumulative percentage increase in public debt in the three years following systemic banking crises in selected post-World War II financial episodes indicates that increments in public debt average 86.3%. That is, the stock of public debt nearly doubles in the following three years after an extreme episode has taken place. In addition, gross central government debt as a percentage of GDP traditionally peaked in the aftermath of the World Wars and the Great Depression episodes. That is, the evolution of this ratio throughout these systemic episodes confirms that when output is traditionally retrenching, the public debt stock traditionally soars in order to mitigate the impact of the said episodes through fiscal deployment, especially taking into consideration that tax revenues traditionally decrease throughout crisis windows (Reinhart and Rogoff, 2009).

That is, from a historical standpoint, public debt constitutes a most dependable financing instrument for the implementation of countercyclical fiscal policy. By historical standards, and taking into account the recent performance of this ratio during the GFC and SDC present global financial turmoil, the said ratio is still peaking and has recently reached levels not recorded since the end of World War II. It has even surpassed previous historical peaks reached during World War I and the Great DepressionFootnote 7 (Reinhart and Rogoff, 2009).

This research essentially focuses on the period 1998–2014 due to the following reasons: (i) this specific period starts with the introduction of the Euro, whereby a more unique and centralized approach to monetary policy in the Euro Area is implemented; (ii) the end period approximately signals the end-year of the stressful episode related to the Euro Area Sovereign Debt Crisis.

Nevertheless, it should also be acknowledged that this Crisis has its historic roots in the pre-Euro yield convergence period, a process which most likely started in the 1960s. That is, during the slow evolution of the European integration process since the Treaty of Rome, an overall sovereign bond yield convergence among present-day Member States is first observed, reflecting bond markets’ earlier beliefs in the European Common Market until the onset of the GFC and the Euro Area SDC. This fiscally heterogenous set of countries individually possessed a unique fiscal profile and was faced with fiscal imbalances even before the onset of the GFC and SDC events. This was due to the fact that ‘cheap’ borrowing conditions—available through lenient sovereign debt markets—in a pre-Euro setting increased public debt profiles (especially those of the less advanced economies in Europe). This fiscal easing (i.e., public debt-related) was facilitated by financial market expectations that even the less fiscally disciplined countries were on a convergence path with Germany, notwithstanding the fact that economic fundamentals remained the same as before. For example, Southern European bond yields (such as Greek and Italian yields) were able to converge to the Euro Area benchmark (the German Bund) on three counts: (i) a Pareto sub-optimal design related to the Euro Area fiscal architecture which allowed non-core Member States to benefit from the sustainable public debt practices related to Germany’s public finances (the Euro Area’s solid benchmark); (ii) the significant development of sovereign bond markets across the Euro Area, which provided greater access to sovereign market funding; and (iii) the ‘Zero Lower Bound’ (conventional) monetary policy in the aftermath of the GFC event, and the development of (unconventional) ‘Quantitative Easing’ programs, which both expanded the depth of sovereign debt markets and instruments, while lowering bond yieldsFootnote 8.

Figure 2 displays the pre- and post-Euro convergence process and the post-crises divergence periods related to 10-year bond spreads related to the GIIPS economies vs. Germany, as well as the very recent trend to convergence. Nevertheless, GIIPS economies seem to have experienced a more sustained increase in the public debt-to-GDP ratios vis-à-vis Germany. In sum, a critical reflection about the vulnerabilities present in the public debt markets in a Euro environment has to take into account the ‘fiscal easing’ period that accommodated an earlier convergence that was actually disrupted by the GFC and SDC events.

Where the impact of the GFC in advanced economies is concerned, rising public indebtedness has been most striking in seven of the countries most affected by the latest financial crises: Greece, Iceland, Ireland, Portugal, Spain, the United Kingdom, and the USA, with public debt levels rising by an average of ~134%, thus exceeding by a considerable margin the 86.3% historical benchmark connected with prior financial crisis episodes within a larger set of countries (Reinhart and Rogoff, 2009). Typically, banking crises frequently either precede or coincide with sovereign debt crises, when banking and sovereign stress are rampant, and when the creditworthiness of public debt is seriously questioned by the financial markets. This reflects the fact that banking crises often constitute efficient predictors of sovereign debt crises. This link between banking and sovereign crises points to the existence of a fundamental research question in the sovereign debt–economic output nexus: is there an optimal level of public indebtedness beyond which output growth becomes encumbered by the sheer stock of existing public debt. That is, is there an optimal threshold level of public debt which does not restrain output growth? If so, is such a threshold quantifiable?

In the context of the latest sovereign debt crisis in the Euro Area, the debate addressing the existence of sovereign debt thresholds has been mired in some controversy. In a controversial study, Reinhart and Rogoff (2010a) find that when public debt-to-GDP ratios are >90%, the corresponding median economic growth rates fall by one percentage point and average growth rates fall almost by four percent, a result that is applicable to both advancedFootnote 9 and emerging market economies. Thus, according to this finding, the relationship between public debt and output growth would become deleterious when levels of public indebtedness are above 90% (Reinhart and Rogoff, 2010a, p. 7).

Notwithstanding, Irons and Bivens (2010) criticize the main findings associated with the line of research pursued by Reinhart and Rogoff (2010a), sustaining that the estimation of the 90% threshold is based on a simple correlation between high debt levels and slower growth. That is, the said threshold is endogenously determined in accordance with the initial groupings proposed by the former authors. More importantly, no particular evidence on causality between public debt and output growth has actually been provided (Irons and Bivens, 2010). More significantly, Herndon et al. (2014) later observe serious distortions and inconsistencies associated with the Reinhart and Rogoff 90% threshold findings which deeply question the existence of a unique threshold applicable to a disparaging set of countries across quite an extended timelineFootnote 10. Notwithstanding, and in the context of the present article, the major research question raised by this academic debate is importantly related to the advancement of the research hypothesis according to which a maximum (or ‘threshold’) might be potentially reached in the relationship between public debt and output growth. Furthermore, from a historical standpoint, the contemporary debate associated with public debt thresholds might be viewed as an offshoot of the sovereign debt sustainability literature, as initially proposed by Krugman (1988) and Sachs (1990), insofar as debt thresholds constitute a specific point (i.e., the maximum/optimal) in the Sovereign Debt Laffer curve architecture.

Sovereign default episodes in Europe have been quite persistent throughout history. First, there have been extensive periods where the historical nations encompassing present-day Euro Area Member States have been in either a default state or in a restructuring state. Essentially, there have been five pronounced global peaks or default cycles. The last two global defaults (in fact, the only two episodes of the last century) refer to the post-World War II and to the emerging market debt crises of the 1980s and 1990s. The historical incidence of default episodes is quite high (Reinhart and Rogoff, 2009).

Second, public debt traditionally follows a lengthy and repeated two-stage boom-and-bust cycle, the latter typically constituting the phase where a markedly higher incidence of sovereign debt crises takes place. In fact, these crises commonly occur in the wake of the peak of public indebtedness. Globally, public debts continue to rise after default has taken place, in light of the accumulation of debt arrears and subsequent sharp GDP contractions (Reinhart and Rogoff, 2010b).

Third, serial default is a most pervasive financial phenomenon, affecting both advanced and emerging market economies alike, across all continents (Reinhart and Rogoff, 2010b). In particular, the economies of the European continent have been, historically, quite affected by this phenomenon.

Where the European continent is concerned, serial default in medieval Europe during the period 1300–1799 was quite frequent, and thus, the latest sovereign financial turmoil in the Euro Area does not constitute a historic anomaly, in light of earlier sovereign default episodes taking place on this continent during the medieval period. During this latter period, France and Spain exhibited the greatest number of defaults (8 and 6, respectively) (Reinhart and Rogoff, 2009, p. 87, Table 6.1, column entitled ‘Number of defaults’).

Furthermore, during the nineteenth century, a majority of European sovereign default and restructuring episodes took place involving major world powers of European extraction, such as Austria-Hungary, France, and Germany (the latter considered a set of powerful regional states). Even a newly formed State, such as GreeceFootnote 11, defaulted four times during the nineteenth century since its independence date (in 1829) (Reinhart and Rogoff, 2009, p. 91, Table 6.2, entry ‘Europe’). Where the period comprising the twentieth century and up to 2008 is concerned, default and rescheduling episodes for the European continent are also unequivocally high, most of which clustered in the second and fourth quarters of the last century. The first cluster is mainly attributed to World War II-related financial strains, while the second cluster is mainly attributed to debt-related episodes in Central and Eastern European countries (Poland, Romania, Russia, and Turkey) (Reinhart and Rogoff, 2009, p. 96, Table 6.4, entry ‘Europe’).

Therefore, the main conclusion to be drawn from this historical synopsis refers to the high incidence of historical sovereign debt crises of varying severity across Europe, thus placing the latest Euro Area sovereign crisis in its proper historical context.

The cognitive dissonance arising from the latter differential contrasting rigorous historical analysis to entrenched misconceptions concerning the imperviousness of public indebtedness (specially within advanced economies) constitutes the very base of the ‘this time is different’ syndrome proposed by Reinhart and Rogoff (2009, 2010b).

The said syndrome essentially expresses a stringent collective belief (or rather, a collective misconception) that financial crises (including those episodes involving sovereign debt crises) do not happen to ‘us’, but solely to ‘other people’. That is, these shocks simply cannot happen to advanced economies, essentially due to one or several of the following reasons: (i) the said ‘advanced economies are immune to shocks’; (ii) ‘our collective learning curve allows us to quickly learn from past mistakes’; (iii) ‘the old rules of valuation no longer apply to the current boom’; or iv) simply because ‘the present boom is actually built on very sound fundamentals, contrary to past episodes’ (Reinhart and Rogoff, 2009, 2010b).

Focusing our attention on the origins of the Euro Area sovereign debt crisis, one of the misconceptions that fueled the underlying boom in debt instruments relates to the fact that increased global financial integration actually empowered global capital markets. This allowed countries to deepen their sovereign debt exposures on an unprecedented scale without, apparently, any consequent side-effects. Furthermore, the very buoyancy of a financial globalization process based on the innovative design of new financial instruments (e.g., securitized products)—but whose structural demerits were not duly scrutinized in the event of a massive financial shock—should not, ex ante, have constituted a source for subsequent worry (Reinhart and Rogoff, 2009, p. 214, 215).

Needless to say, the latter misconceptions were entirely shattered in the wake of the GFC and ensuing Euro Area SDC. Notwithstanding, the gist of this self-renovating cyclical syndrome possesses a very powerful and effective (albeit simplistic) explanatory power.

Sovereign debt vulnerabilities in the Euro area

Taking into account the case of the world’s most advanced economies (including the vast majority of the Euro Area’s economies), Cecchetti et al. (2010) address the post-crisis fiscal situation and short-term fiscal prospects of these economies. Their empirical findings confirm the rapid deterioration of fiscal positions, namely where the intricate correlation between the fiscal outlook and government debt is concerned, insofar as the rapid deterioration of the former is duly accompanied by mounting governmental indebtedness. For example, in the case of the German economy (as the Euro Area’s biggest economy), the fiscal balance deteriorated from a surplus of 0.2% of GDP in 2007 to a deficit of 4.6% in 2011. Analogously, government debt rose from 65% to 85% of GDP. This dual deterioration was also extensible to all of the Euro Area’s economies included in these authors’ research (Cecchetti et al., 2010, p. 3, Table 1).

Furthermore, and considering the long-term 30-year projections for the trajectory of the public debt-to-GDP ratio for a dozen advanced economies (including nine of the Euro Area’s economiesFootnote 12), the latter authors’ forecasts unequivocally point to an untenable public debt situation, even taking into account subsequent mitigating gradual (but not radical) fiscal consolidation plans (Cecchetti et al., 2010, p. 3, Graph 4).

Thus, one of the major risks posed by these long-term public debt forecasts is the ensuing higher risk premia demanded by investors for holding the corresponding public debt, particularly in the case of the most indebted economies of the Euro Area. This might reflect the fact that these economies’ public debt profiles are presently associated with the over-leveraged section of the sovereign debt Laffer curve, and are correspondingly set on unsustainable trajectories, thus increasing sovereign risk premia during extreme financial episodes.

When public debt trajectories are associated with the over-leveraged section of the Laffer curve, this potentially constitutes a menacing obstacle for the wholesome prosecution of the European project: as risk premia become higher than the benchmark (e.g., the German ‘Bund’) in view of unsustainable public debt trajectories, investor market differentiation among Euro Area Member States might originate, in subsequent sovereign shocks, the onset of episodic (but damaging) episodes of outright default on the corresponding national public debts. This extreme scenario is particularly applicable to the economies exhibiting a weaker fiscal outlook, thus prompting the need to a quicker return to conservative and sound fiscal and public debt trajectories over the long-term. As the 2012 Greek restructuring example clearly demonstrates, public debt trajectories might ultimately have to be corrected by strict curtailing measuresFootnote 13, especially in the context of prospective extreme financial events.

On the other hand, heterogeneous risk premia on Euro Area sovereign debt might constitute a forewarning as to the potential occurrence of an impending credit event (in the case of the Euro Area, a sovereign default in a specific sub-set of Member States), reflecting a given sovereign debtor’s increasing probability of non-compliance with contractual obligations previously agreed to under the pre-default terms of the debt contract. The said non-compliance may refer to the non-payment of principal and/or accrued interest payments. This is particularly relevant in the context of the descending phase of the sovereign debt Laffer curve, where structured debt vulnerabilities occur.

The level of sovereign debt typically reflects the accumulation of past government deficits. The time episode herein described (the Euro Area SDC) reflects the fiscal trajectories of individual Member States in a pre-Euro context, as well as the early stages related to the implementation of the Euro. Indeed, the first twenty years of the Euro have witnessed a significant build-up in public debt accumulation, which might also have a negative impact on economic growth through higher taxes and/or decreased investment over the long-run. Notwithstanding, this increase—supported by the sovereign bond markets—also reflects the impact of institutional changes in the global financial landscape, namely at the level of (i) the evolution of governance/regulatory institutions; and (ii) the more recent developments in global monetary policy. For example, in the aftermath of the GFC and SDC episodes, the public bailout of national banking industries led to the expansion of public debt, the growing size of which prompted the European Central Bank (ECB) to further develop unconventional monetary policy programs—known as ‘Quantitative Easing’ (QE)—to support market demand for the national debt. This is especially relevant in crisis periods (when market liquidity typically dries up) while lowering the yields for less sought-after bonds (i.e., those perceived to be riskier). A natural consequence of this monetary policy toolkit expansion was to change the tolerance associated with the concept of sovereign debt threshold. This means that a sovereign debt threshold is more manageable presently than it would have been 10 years back, as central banks (such as the ECB) have stepped in to become large-scale buyers of public debt in the secondary bond markets, through the said QE programs. For the purpose of this research, a major implication is that sovereign debt thresholds should be viewed as dynamic over time, as institutional and/or policy changes might actually change the quantitative level of sovereign thresholds and the underlying sovereign debt Laffer curves across the Euro Area.

The sovereign debt Laffer curve

The existence of a sovereign debt Laffer curve was initially advanced by Krugman (1988) and Sachs (1990), in the wake of the resounding debt crises episodes of the 1970s and 1980s. The latter episodes launched a stern debate concerning the effectiveness of debt reduction programs for over-indebted governments and respective economies (e.g., Asian economies). The main aim associated with these economic recovery programs was to allow these economies to re-gain financial creditworthiness and restore output growth.

As an economic instrument for critical analysis, the sovereign debt Laffer curve stipulates that the accumulation of sovereign debt leads to a diminishment of economic output above a certain given threshold, compromising a country’s debt repayment capabilities through encumbered economic output drag. This sovereign financial repayment stress is mainly attributed to the fact that in light of the disincentive to expand capital accumulation due to existing high levels of public indebtedness, the expected debt-servicing costs associated with an already significant level of public debt further discourage subsequent domestic and foreign investment. That is, above a certain threshold level, a typical adverse feedback loop becomes manifest, inhibiting economic growth, typically through reduced investment schedules. Strictly from a leveraging perspective, this line of reasoning sustains that the threshold represents a maximum point of public indebtedness that efficiently maximizes economic output.

According to Krugman (1988) and Sachs (1990), the public debt–output relationship resembles a concave function where the maximum point of this function represents, ceteris paribus, the maximum economic output attainable as a function of the level of public indebtedness. That is, below the threshold, adding public debt leverages economic output, while above the same threshold, adding public debt de-leverages economic output. This is essentially achieved through the said capital accumulation channel, notwithstanding the fact that other alternative channels might also play a concomitant and significant role (to be critically reviewed in the following sections).

From a theoretical standpoint, sovereign debt thresholds typically point to the existence of an optimal level of public debt in the sovereign debt Laffer curve architecture. From an empirical standpoint, threshold points for public debt might be estimated through the sovereign debt Laffer curve architecture, a framework that captures the existence of potential non-linearities in the relationship between public debt and economic output. Thresholds might typically refer to either a panel data setting or to specific (i.e., individual) countries. In the former case, thresholds are common to the chosen set of countries; while in the latter case, public debt thresholds are essentially country-specific, and might accordingly vary quite heterogeneously across the countries included in the chosen sample (this is due to the existence of idiosyncratic national fiscal policies, most specially in Euro Area Member States, each of which with its own fiscal policy traditions). In thresholds, the combination of economic output and public debt is thus optimized, but, beyond the corresponding threshold, debt vulnerabilities become manifest, which thus justifies the significant importance attributed to this structural concept in sustainable debt management.

Lastly, it should be observed that the sovereign debt Laffer curve constitutes an important framework as it encompasses a series of related sovereign stress-related concepts previously, but separately, advanced by the literature.

The sovereign debt–output growth nexus: the perilous journey from debt vulnerability to serial default

The sovereign debt Laffer curve constitutes a simple, but effective, economic concept that adequately encompasses several public debt vulnerability-related definitions. The sovereign debt Laffer curve is generally comprised of two quite distinctive sections. In the first section, public debt is a benign determinant of economic output, while in the second section, debt becomes a malign determinant of economic output. The SDC impacted the Euro Area’s sovereign debt markets in the aftermath of the GFC, through excessive public debt accumulation that ultimately ended up encumbering economic output at the height of the sovereign crisis.

There are essentially five (5) debt sustainability concepts that are encompassed by the sovereign debt Laffer curve architecture. The above-mentioned economic concepts are critical to understand whether public indebtedness trajectories in advanced economies in the aftermath of the GFC have been set on unsustainable trajectories, most notably taking into consideration the governmental recapitalization effort of ailing financial institutions and the introduction of costly macroeconomic fiscal stimulus packages, which have constrained public debt policy in the Euro Area in the aftermath of the GFC and the SDC. First, the over-leveraged section of the sovereign debt Laffer curve is thus implicitly associated with the concept of debt vulnerability, whereby the accumulation of debt beyond a given optimal threshold strongly reduces the incentives for complying with the underlying existing set of public debt liabilities. That is, the vulnerability concept relates to the possibility incurred by sovereign debtors of not complying (either willfully or otherwise) with the initial terms of the accrued debt agreements or contracts, and the increased probability of default. Nevertheless, there are several gradative distinctions before non-compliance (or, in the extreme case, default) occurs. That is, there are various degrees of non-compliance whereby the original debt contracts might be partially or fully breached. For example, debt vulnerability might ultimately lead to debt intolerance, debt overhang, and/or debt illiquidity/insolvency (these concepts will be introduced in the following sessions).

Second, whenever levels of public indebtedness surpass the optimal thresholds, a sovereign debtor might also be liable to suffer from the so-called ‘debt overhang’ paradox. Debt overhang is typically associated with the over-leveraged section of the sovereign debt Laffer curve, insofar as the corresponding over-indebtedness is equated with a debt service surcharge to the economy that typically undermines the expansion of economic output through distortionary channels. That is, as a greater share of output is needed to service mounting public debt repayment schedule, there is a reduced incentive for debtor nations to adopt structural reforms in order to correct their initial excessive dependency on public debt. This ultimately suggests the occurrence of a potent and vicious negative debt cycle—a sovereign adverse feedback loop, as a variant of the type of pricing mechanism initially proposed by Mishkin (2010)—whereby the quality of existing sovereign debt is seriously jeopardized by adding subsequent un-serviceable sovereign debt layers that might ultimately compromise the very solvency of underlying debtor nations. This implacable sovereign loop can only be reversed through a Pareto-improving debt consolidation process, thus restructuring the initial conditions under which the initial debt burden was agreed upon. More importantly, the said debt consolidation is Pareto-improving to both debtors and creditors alike, in view of the fact that it strengthens the incentives for debt repayment and avoids massive default-induced losses (Roubini, 2001).

Third, an important source of vulnerability stems from the ‘illiquidity vs. insolvency’ debate within the literature. Debt illiquidity refers to the specific episodic circumstances under which a given sovereign debtor’s short-term debt compliance schedule might become compromised by the onset of a liquidity crisis (e.g., as in the aftermath of a systemic financial crisis). Under these circumstances, the said schedule—which includes both the financing of interest payments and the potential rolling over of the accrued principal—is compromised by the debtor’s short-term inability to fund these schedules. That is, the said sovereign debtor is faced with a financial short-term debt repayment non-compliance but is otherwise fully willing and capable of financing the said schedule(s) in the long run (Reinhart and Rogoff, 2009).

On the other hand, debt insolvency stands in clear contrast to the preceding situation insofar as it reflects the market perception upheld by bond creditors that a given sovereign debtor is either unwilling or financially unable to honor its compromises over the long run. In these extreme circumstances, the trajectory of existing public debt is structurally unsustainable over a long time frame or is, at the very least, perceived to be so by financial market creditors (Reinhart and Rogoff, 2009).

In operational terms, it is often quite difficult to distinguish between the more temporary state of illiquidity from the more structural state of insolvency, insofar as both are inherently dynamic concepts and are typically associated with macroeconomic uncertainties. Ultimately, distinguishing illiquidity from insolvency constitutes an intricate and daunting economic task that requires a profound and complex analysis sustained by a very broad range of indicators, factors and assessments (Roubini, 2001). Furthermore, these two quite distinct states may require equally distinct conciliatory approaches to solving the underlying debt-related issues. Should a sovereign debtor be facing illiquidity issues, a process of debt rescheduling (equivalent to a very mild restructuring) might suffice to correct the temporary ailments and restore creditworthiness. In a more extreme scenario, should a sovereign debtor suffer from a more structural insolvency condition, the proper solution might come in the form of a thorough debt reduction program. In either case, both prescriptions are Pareto-improving, insofar as they reduce the incentives for debt profligacy and restore the necessary trust in the creditor–debtor relationship (Roubini, 2001).

From an operational standpoint, and considering the severity of this later insolvency state, there are, however, no simple rules for assessing whether a given sovereign debtor is insolvent or not. One of the approaches suggested by the literature states that a sovereign debtor’s solvency requires, for example, the discount value of its foreign (i.e., external) debt to be non-zero in the infinite limit of its inter-temporal budget constraint. Implicitly, the growth of its foreign debt must necessarily be inferior (or equal) to the underlying real interest rate paid on this debt. Accordingly, if a sovereign State is running primary deficits and has an initial stock of debt, this solvency constraint requires the said State to run primary surpluses somewhere over the (theoretically) infinite timeline. Notwithstanding, and taking into account the infinite trajectory paths that might ensure compliance with the inter-temporal solvency criterion and its infinite timeline budget constraint, the latter approach constitutes a very loose criterion in the assessment of a given country’s fiscal sustainability (Roubini, 2001).

In the aftermath of the SDC, quantitative fiscal rules are still needed in order to remind governments that there are limits to government budget policies, even if the rules associated with the Stability and Growth Pact were not complied with in the aftermath of the SDC (Beetsma, 2022). Pursuing this line of argumentation, and adopting a more operational standpoint, the public debt sustainability debate has brought about the onset of specific operational rules to ensure that Member States comply with a common set of rules where sovereign debt assessment procedures are concerned. For example, as of November 2022, the European Commission has started to implement some medium-to-long-term dynamic plans based on debt sustainability techniques that take into consideration the existing (high, medium, or low) sovereign debt profile of a given Member State. Under this recent framework, the metric net expenditure ceilings (measured on an annual basis) will replace the metric related to cyclically adjusted budgetary balances in the computed debt sustainability estimations. This will more closely link the financing side to the actual corresponding expenditure side for which the said debt should be used (European Commission, 2022). Moreover, ongoing research by the ECB has also focused on the need to promote broad-based debt sustainability assessment exercises that cross-check information from multiple sources. This constitutes a more encompassing exercise, with a view to deriving a robust debt sustainability assessment framework (Bouabdallah et al., 2017). Analogously, the I.M.F. has recently started to use the ‘Sovereign Risk and Debt Sustainability Framework’ (SRDSF), a framework comprising a more proficient set of debt-related metrics. The SRDSF has been presently promoted as the IMF’s main public debt assessment tool, allowing this institution to implement a more realistic and efficient set of metrics and procedures related to public debt sustainability (International Monetary Fund, 2022).

Fourth, the manifestations of sovereign default, as a non-compliance event, are as follows. Sovereign defaults may comprise an outright default or a rescheduling. In the former case, the sovereign debtor simply announces its intention to dishonor its existing public debt schedule and disengage itself from the correspondent contractual obligations. An outright default may be further classified as complete (when the sovereign debtor’s intentions extend to the totality of its debt commitments) or partial (when the said intentions comprise a fraction of its debt commitments) (Reinhart and Rogoff, 2009).

On the other hand, rescheduling should be contextualized within a more dynamical bargaining framework, whereby a sovereign debtor seeks to impose upon its creditors a longer repayment schedule and/or interest rate concessions (some rating agencies regard reschedulings as negotiated partial defaults). This is pursued in order to soften the profile/trajectory of existing cumbersome debt schedules.

In practice, most defaults are typically partial in nature and, accordingly, the ensuing bargaining equilibria typically involve partial re-negotiated repayment schedules most suited to the interested parties. This empirical bargaining framework quite often blurs the thin line between outright defaults and reschedulings (Reinhart and Rogoff, 2009).

Fifth, sovereign serial default constitutes the extreme scenario in non-compliance frameworks. The latter default refers to a sovereign debtor’s sovereign default(s) on either external or domestic debt (or both), regardless of the (higher or lower) default frequency associated with the historical incidence of the corresponding default episodes in question. On the other hand, serial default might also involve either wholesome default or partial default through rescheduling, regardless of the time needed to obtain the often negotiated partial exaction to creditors (Reinhart and Rogoff, 2009).

From a macroeconomic and legal standpoint, there are essentially three incentive mechanisms involved in sovereign default (serial or otherwise). First, and contrary to other non-sovereign issuers (e.g. private entities), sovereign debtors cannot be liquidated and there are neither national nor international judicial institutions capable of enforcing the original terms of a contractually agreed upon public debt contract which might ensure the forced transfer of assets from sovereign debtor to sovereign creditor. Second, defaults or restructurings enable sovereign debtors to reduce the volume of debt and/or lengthen the maturity of their repayments, with the intention of providing a temporary boost to current consumption expenditures, notwithstanding the fact that the latter increase might be obtained at the expense of future declining consumption expenditures (De Paoli et al., 2006). Third, should the financial costs of servicing existing sovereign debt within the originally agreed contractual terms exceed the financial costs associated with the restructuring of those very terms, a critical ‘default point’ might have been reached (Borensztein and Panizza, 2008). That is, once this critical point is surpassed, sovereign debtors have a strong incentive not to comply with the initial debt schedules and seek a bargaining equilibrium more suited to their vested interests. These three mechanisms are more liable to occur in countries facing the descending stage of the sovereign debt Laffer curve.

Nevertheless, these mechanisms entail several economic costs to those sovereign debtors engaging in default. Essentially, there are five types of impactful economic costs associated with sovereign default episodes. First, there are short-term reputational costs to corresponding credit ratings and interest rate spreads associated with the default-prone sovereign debtor. Second, there are international trade exclusion costs impacting more export-oriented economies. Third, there are short-term costs to domestic growth in the sovereign debtor’s economy through the financial repression of the corresponding banking systems. Fourth, there are significant political costs associated with sovereign debtor default to corresponding national governmentsFootnote 14 (Borensztein and Panizza, 2008). Fifth, sovereign debtors loose market access to borrowing from the financial markets, once a default decision is undertaken, although evidence on this is rather mixed (De Paoli et al., 2006).

A more critical analysis of both the GFC and the SDC should critically analyze the potential existence of major flaws in the European integration process, thus highlighting the significant relevance of the high debt-low economic growth nexus, as observed through the sovereign debt Laffer curve. For example, Bordo and James (2014) note that, contrary to the Gold Standard framework, the European integration process does not have a ‘safety valve’ that would allow Member States to more easily recoup from a low growth scenario associated with debt accumulation, because the said States cannot devalue their currencies in order to promote economic growth (contrary to what happened in the Gold Standard framework). Moreover, Bordo et al. (2009) further propose that the completion of the international financial architecture might require the adoption/incorporation of more stringent mechanisms, such as more transparent public debt restructuring mechanisms, thus more effectively easing the impact of negative shocks. This recommendation is particularly relevant in the context of a Monetary Union that still maintains idiosyncratic fiscal policies. This ‘safety valve’ would be quite useful in the context of the downward slope of the sovereign Laffer curve, as multilateral restructuring mechanisms would ease off tensions in the bond markets in the aftermath of sovereign crises, thus placing over-indebted economies on a more sustainable growth pathFootnote 15.

According to Kraüssl et al. (2017), since the onset of the GFC and SDC events, monetary policy has propelled the Zero Lower Bound debate to the forefront of fiscal policy, as the structural decline in the overall level of interest rates has brought about the need for financial investors to look for higher yields in alternative assets, i.e. in non-traditional asset classes. This has fueled significant economic/financial activity in new investment domains, by providing essential liquidity to new financial investment segments, thus allowing over-indebted economies to promote much-needed economic growth related to investments in these new asset classes.

Sovereign thresholds in the euro area in the aftermath of the sovereign debt crisis

In the specific case of the Euro Area, empirical findings pointing to the existence of noxious effects associated with excessive public debt above a given threshold have been documented by multiple authors, namely by Caner et al. (2010), Cecchetti et al. (2011), Checherita and Rother (2010), and Kumar and Woo (2010).

Caner et al. (2010) analyze a broad sample of 101 countries within the 1980–2008 period, employing a threshold least squares regression model involving real GDP growth and public debt variables. They identify a unique threshold level, namely the 77.1% threshold (of public debt-to-GDP ratio) for a sub-sample of 79 countries, a point beyond which public debt starts to impact negatively on economic growth. Each additional percentage point of sovereign debt-to-GDP ratio costs the economy 0.0174 percentage points in annual average real growth (Caner et al., 2010, p. 5)Footnote 16.

Cecchetti et al. (2011) also analyze the same research question using a database comprised of 18 OECD countries between 1980 and 2010. Their analysis acknowledges the massive rise in non-financial sector debt (which duly includes both government and private sector indebtedness) as a percentage of GDP for the countries included in their chosen sample. First, the authors also confirm that there is a negative impact of mounting public debt on output growth, insofar as a 10 percentage point increase in the public debt-to-GDP ratio is associated with a 17–18 basis point reduction in subsequent average annual growth (Cecchetti et al., 2011). Second, the authors conduct their research by dividing their sample into quartiles, and their findings suggest that high levels of debt impact output growth, most specially taking into account that when debt is augmented from the third to the fourth quartile, output growth is reduced (Cecchetti et al., 2011). Third, the authors’ findings suggest that public debt is deleterious for output growth when the public debt-to-GDP ratio is beyond the 80–100% range (specific thresholds vary according to their adopted model specifications) (Cecchetti et al., 2011). Fourth, the authors also strive to present some of the policy implications associated with their findings. They conclude that the advanced economies’ demographic profiles—namely where the existence of ageing populations is concerned—constitute a main driver for the structural deterioration of fiscal gaps, further straining fiscal policy instruments (including public debt). This fact reinforces the need for governments to substantially and aggressively reduce their mounting public debt exposure. Debt consolidation (or reduction) strategies targeting a level of public debt much lower than the calculated thresholds would enhance the corresponding economies’ ability to respond to future economic shocks of uncertain magnitude (Cecchetti et al., 2011), a critical issue for the future fiscal sustainability of the Euro Area.

Checherita and Rother (2010) directly assess the average impact of sovereign debt on per capita GDP growth in twelve Euro Area countries (collectively addressed) during the 1970–2011 period. For this purpose, these authors employ a quadratic econometric specification in debt. Their main findings suggest that there is a non-linear impact of public debt on growth, and this impact becomes pernicious after a given turning point has been reached. The authors unveil a concave (inverted U-shape) relationship between the variables, with a sovereign debt-to-GDP ratio turning-point between 90% and 100%. Nevertheless, the computation of confidence intervals for their estimations indicates that the initial effects of the referred deleterious impact become evident at much lower levels of 70–80%.

Kumar and Woo (2010) also establish a link between public debt and growth, by using a wide variety of econometric methods applied to a sample of data comprising the 1970–2007 period for several advanced and emerging market economies alike. The authors’ findings suggest the existence of a negative relationship between high public debt and subsequent real per capita GDP growth. On average, a 10 percentage point increase in the initial public debt-to-GDP ratio is associated with a subsequent gradual decrease of 0.2 percentage points in annual real per capita GDP growth, although the said impact is smaller when addressing the sub-set of advanced economies included in their sample, where the decrease is around 0.15. More fundamentally, the latter authors also observe the impact of non-linearities of mounting public debt on output growth. They conclude that the higher the level of initial public debt, the higher the negative impact on subsequent output growth. They also suggest that a given ratio increase has a significantly higher impact on the highest public debt-to-GDP ratio sub-set than in the remaining lower sub-sets. This fact suggests the presence of non-linear effects when the said ratio surpasses the 90% threshold (Kumar and Woo, 2010). On the other hand, this further re-enforces the policy recommendations proposed by Cecchetti et al. (2011), whereby public debt levels should be kept quite below the recommended threshold markings. According to these authors, this precautionary measure should be pursued in order to avoid incurring in the said non-linearities, once the potentially deleterious 90% threshold has been surpassed.

Nevertheless, it should be pointed out that sovereign debt thresholds are not static over time. That is, these thresholds might evolve over time according to the underlying economic conditions associated with sovereign debt markets and their determinants for any given country. For example, Japan’s secular stagnation has meant that this advanced economy has experienced a high public-debt-to-GDP ratio (around or above 200%Footnote 17) in more recent decades. However, Japan is not deemed by the financial markets to have a significant public debt problem. A potential explanation for this higher ‘debt tolerance’ might be associated with behavioral or psychological concepts. That is, sovereign debt markets might tolerate a higher public debt-to-GDP ratio because both Japanese households and corporates have a high savings rate that sustains the demand side of the high-volume Japanese sovereign debt market (Kyoji et al., 2015). This behavioral dimension might constitute an important lesson that can be replicated in the case of the Euro Area, insofar as the existence of a higher public debt-to-GDP ratio might prompt the need to implement national policies that increase the rate of savings in the said area, in order to uphold higher sovereign debt thresholds. This again reflects the dynamical nature of sovereign debt thresholds over time.

The sovereign debt Laffer curve: transmission channels

As the latter literature review points out, the impact of rising public indebtedness on output growth prompts a further question concerning the channels through which the said output growth might be diminished. A most simple connection between public debt and output growth links future debt sustainability to rising taxes. In view of the fact that, in the aftermath of financial crises, governments traditionally follow expansionary fiscal policies (thus expanding public debt-financed fiscal deficits), taxes will ultimately and inevitably end up being raised in the long-term. This will inevitably originate a subsequent distortionary impact on long-term output growth, ultimately straining the ensuing redemption of existing public debt (Reinhart and Rogoff, 2010a).

Kumar and Woo (2010) provide a more comprehensive review of other growth-distortionary channels established in the literature. Besides the simple (but quite effective) long-term distortionary taxation channel previously expounded, other major channels documented by previous literature include: (i) the adverse effect of public debt on capital accumulationFootnote 18 and growth (through higher long-term interest rates); (ii) the onset of future inflation corroding growth; (iii) the prospect of greater macroeconomic uncertainty affecting growth; (iv) the constraints imposed by high levels of debt on the scope of countercyclical fiscal policy; and (v) the ‘debt overhang’ channel (Kumar and Woo, 2010).

Checherita and Rother (2010) also conclude that there are multiple channels through which the impact of public debt on economic growth is conveyed. These authors observe the existence of the following channels: (i) private saving; (ii) public investment; (iii) total factor productivity, and (iv) long-term nominal and real interest rates.

Conclusion

The present article addresses the complex relationship linking sovereign indebtedness to economic growth in the Euro Area, a link that has greatly impacted the global sovereign debt landscape, most especially in the aftermath of the Euro Area Sovereign Debt Crisis.

The present article unites different literature strands pertaining to key economic concepts related to public debt sustainability, by encompassing these concepts under the architecture of the sovereign debt Laffer curve. The latter framework has been previously developed in connection to other historic sovereign debt episodes. These heterogeneous key economic concepts include public debt optimality and thresholds; distortionary channels; debt ‘overhang’; debt vulnerability; illiquidity vs. insolvency; rescheduling vs. restructuring; and (serial) default.

This document constitutes a preliminary attempt to map a mellifluous and unfolding episode, and thus connect the growing, but somewhat disparaging, sovereign debt-related literature, most notably where the impact thereof on advanced economies (namely in the Euro Area) is concerned. This article thus constitutes an innovative approximation to this highly complex historic event, by interconnecting and uniting quite relevant sovereign debt sustainability concepts under a common historic framework (the sovereign debt Laffer curve).

The implications of this research point to the fact that the importance of sovereign debt sustainability cannot be overestimated. This has become quite a central debate insofar as the current empirical literature addressing the state of sovereign debt trajectories in Euro Area Member States points to their potential deleterious impact on economic growth processes. This potentially leads to constrained fiscal integration processes and sub-optimal real economic growth trajectories, given the present high levels of sovereign debtFootnote 19. Given that monetary policy in the Euro Area cannot be used to fund Member States’ fiscal policies, sovereign debt vulnerabilities can have an impact on these States’ funding, especially in future shocks, where massive investor discrimination might again pose a challenge to the sustainability of the Euro Area’s public finances.

Concerning suggestions for future research, the lessons associated with this Euro Area Sovereign Debt Crisis point to the fact that idiosyncratic Member States’ public debt schedules need to be adequately curtailed (in line with some policy recommendations herein reviewed). This would allow public debt-to-GDP ratios to be appropriately brought under control, and economic output growth might sustainably resume their corresponding pre-crisis trajectories, in order to deal with the growing demographic issues pointed out by previous literature. In order to achieve this important sustainability goal, the continuity of the Euro Area warrants further research on the topic of a common European fiscal framework and its accruing benefits, and, more specifically, on the design of the most adequate sovereign financing instruments and policies that do not expose the referred Area and its individual constituents to encumbered growth in the aftermath of systemic financial episodes. For example, the ‘European Fiscal Compact’ (European Council, 2012) has constituted a major step in reigning in sovereign over-indebtedness and help restore confidence in the sovereign debt markets and stimulate economic growth. That is, should this over-indebtedness be properly dealt with, future systemic episodes where debt sustainability spins out of control might be more adequately curtailed, prompting a ‘soft landing’ in relation to prospective sovereign debt tensions, as the analysis of the historic period herein analyzed clearly demonstrates. Further plans to develop a more ‘federalist’ fiscal pillar to the Euro Area is also warranted, in line with the centralist monetary policy conducted by the ECB. Notwithstanding, it is important to recognize the fact that country-specific financing instruments are presently the prevailing mode of financing, and the task of designing/implementing an efficient financing instrument for the whole of the Euro Area nevertheless remains challenging.

Furthermore, these innovative sovereign financing mechanisms would dilute individual heterogeneous Member State frailties in the aftermath of the said shocks, making them (individually and collectively) more impervious to these sovereign shocks, under the tutelage of a solid common fiscal architecture. This common fiscal framework, along with its monetary sibling already in place, would hopefully ensure the much warranted wholesome stability and cohesion of a heretofore historically fiscally-divided Europe. It is hoped that the main assertions herein described might ultimately contribute (albeit modestly) to the cohesiveness and future prosperity of the Euro Area. The latter’s continuity crucially rests on the design of a common innovative fiscal policy response to present and future shocks of systemic magnitude, especially taking into consideration the implementation of effective principles of sustainable public debt management in the Euro Area.

Notes

This specific subset includes the following countries: Greece, Italy, Ireland, Portugal, and Spain, which were significantly impacted by the Euro Area Sovereign Debt Crisis event.

Although the present article does not address the multiple determinants of financial crises in the Euro Area, there might be some common determinants prompting the implementation of fiscal responses tailored to the severity of the underlying event. For example, current account imbalances have been a common determinant in Spain’s historic exposure to financial crises (Betrán and Pons, 2019), and they might also be common to other Member States.

The original Laffer curve—named after U.S. economist Arthur Laffer—constitutes a theoretical representation of government revenues as a function of the taxation rate (namely, as a percentage of taxable income) and suggests the existence of an optimal rate of taxation which maximizes government revenues in a non-linear concave relationship.

This includes both conventional and non-conventional monetary policy actions (Blanchard, 2009).

Notwithstanding the simplicity of this theoretical construct, the sovereign debt Laffer curve frequently leads to empirical implementation issues, especially in the context of the more recent Euro Area SDC, in view of the fact that this sovereign event is quite contemporary, as the case of Caner et al. (2010), and Checherita and Rother (2010) clearly illustrate.

As a general rule, it should be observed that, prior to World War II, the main driver for public indebtedness was mainly attributable to the cost of financing wars; while, during peacetime, the main driver for rising public debt is attributable to the onset of severe financial crises (Reinhart and Rogoff, 2009).

In the context of the legal backdrop, another potential explanation for macroeconomic differentials involving Germany and the GIIPS economies might also be related to a flawed design in the ‘Treaty on the Functioning of the European Union’ (TFEU), more specifically in Article 125, the critical analysis of which is nevertheless beyond the scope of the present document. We would like to thank an anonymous Referee for this suggestion.

The selected advanced economies portrayed by the authors are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Japan, the Netherlands, New Zeeland, Norway, Portugal, Spain Sweden, the United Kingdom and the USA (Reinhart and Rogoff, 2010a, p. 7).

There is also some ambiguity as to whether the proposed 90% threshold is country-specific or common to heterogeneous countries.

Greece has spent more than a century (expressed as a cumulative tally) since its independence in a state of default or rescheduling (Reinhart and Rogoff, 2009, p. 99, Table 6.6, entry ‘Europe’, first column).

This group includes Austria, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, and Spain.

The Stability and Growth Pact still constitutes an excellent historical reference point for the whole of the Euro Area. In fact, the Stability and Growth Pact tried to curb excessive budget deficits by imposing penalties to prospective profligate Member States, even taking into account the occurrence of recessionary states. That is, implicitly, the promotion of economic growth was already envisaged in the Pact—with public debt levels below the proposed 60% threshold—even taking into account a prospective post-crisis scenario. Rising public spending in the aftermath of a crisis might have constituted a powerful and forceful countercyclical instrument, should the Pact have been fully enforced in its intended original framework, which is especially relevant in the ascending phase of the sovereign debt Laffer curve.

The conventional wisdom linking the pursuit of expressive fiscal adjustments (e.g., profound budget reductions) to significant political costs to the political agents pursuing public debt default is nevertheless being challenged. Alesina et al. (2011) do not find supporting evidence to sustain this traditional perspective in the context of their research addressing 19 OECD countries within the 1975–2008 period.

Another major issue associated with sovereign crises fueled by foreign debt is related to the fact that any depreciation in the exchange rate could prominently increase sovereign risk should a given country be significantly exposed to foreign currency-denominated debt (Bordo et al., 2009). In the case of the Euro Area, this would constitute a suggestion for further research, which is nevertheless beyond the scope of the present article.

The threshold for the sub-set of developing countries is much lower (64%), confirming the presence of a lower ‘debt intolerance’ for this specific sub-set (Caner et al., 2010).

According to the CEIC database, available at https://www.ceicdata.com/en/indicator/japan/government-debt--of-nominal-gdp.

In a prior study conducted before the GFC, Pattillo et al. (2004) observe that the negative impact of high debt on output growth stems from a strong negative effect on both physical capital accumulation and total factor productivity growth; in addition, they also find that doubling debt reduces output growth by about 1%, through the reduction in both per capita physical capital and total factor productivity by almost as much; this thus highlights the importance of this channel of growth distortion (Pattillo et al., 2004).

A decade-long expansionary monetary policy pursued by the E.C.B. in the aftermath of the Global Financial Crisis essentially reflects a major concern regarding these feeble real growth trajectories following the said crisis.

References

Alesina AF, Carloni D, Lecce G (2011) The electoral consequences of large fiscal adjustments. National Bureau of Economic Research (NBER) Working Paper 17655

Beetsma R (2022) The economics of fiscal rules and debt sustainability. Intereconomics 57(1):11–15

Betrán C, Pons MA (2019) Understanding Spanish financial crises severity, 1850–2015. Eur Rev Economic Hist 23(2):175–192

Blanchard O (2009) The crisis: basic mechanisms, and appropriate policies. International Monetary Fund Working Paper WP/09/80, International Monetary Fund

Bordo M, James H (2014) The European crisis in the context of the history of previous financial crises. J Macroecon 39:275–284

Bordo M, Meissner C, Stuckler D (2009) Foreign currency debt, financial crises and economic growth: a long run view

Bordo M, Meissner C, Weidenmier M (2009) Identifying the effects of an exchange rate depreciation on country risk: evidence from a natural experiment. J Int Money Finance 28:1022–1044

Borensztein E, Panizza U (2008) The costs of sovereign default. International Monetary Fund Working Paper WP/08/238. International Monetary Fund

Bouabdallah O, Checherita-Westphal C, Warmedinger T, de Stefani R, Drudi F, Setzer R, Westphal A (2017) Debt sustainability analysis for euro area sovereigns: a methodological framework. European Central Bank Occasional Paper Series No 185

Caner M, Grennes T, Koehler-Geib F (2010) Finding the tipping point—when sovereign debt turns bad. Policy Research Working Paper 539. Economic Policy Sector, World Bank

Cecchetti SG, Mohanty MS, Zampolli F (2010) The future of public debt: prospects and implications. Bank of International Settlements Working Paper 300. Bank of International Settlements

Cecchetti SG, Mohanty MS, Zampolli F (2011) The real effects of debt. Draft dated August of 2011 prepared for The Federal Reserve Bank of Kansas City 2011 Economic Policy Symposium at Jackson Hole

Checherita C, Rother P (2010) The impact of high and growing government debt on economic growth. Working Paper 1237, Working Paper Series, European Central Bank

De Paoli B, Hoggarth G, Saporta V (2006) Costs of sovereign default. Financial Stability Paper no. 1, Bank of England

European Commission (2022) Communication from the Commission to the European Parliament, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions—Communication on Orientations for a Reform of the EU Economic Governance Framework. https://economy-finance.ec.europa.eu/system/files/2022-11/com_2022_583_1_en.pdf. Accessed 6 Jan 2023

European Council (2012) Treaty on stability, coordination and governance. European Council. https://www.consilium.europa.eu/media/20399/st00tscg26_en12.pdf. Accessed 25 Jul 2019

Herndon T, Ash M, Pollin R (2014) Does high public debt consistently stifle economic growth? A critique of Reinhart and Rogoff. Camb J Econ 38(Issue 2):257–279

International Monetary Fund (2022) Staff guidance note on the sovereign risk and debt sustainability framework for market access countries. https://www.imf.org/-/media/Files/Publications/PP/2022/English/PPEA2022039.ashx. Accessed 6 Jan 2023

Irons J, Bivens J (2010) Government debt and economic growth—overreaching claims of debt ‘threshold’ suffer from theoretical and empirical flaws. Briefing Paper 271, Economic Policy Institute

Kyoji F, Hyeog Ug K, Tatsuji M, Kenta I, Kim Y, Miho T (2015) Lessons from Japan’s secular stagnation. RIETI Discussion Paper Series 15-E-124

Krugman P (1988) Financing vs. forgiving a debt overhang. National Bureau of Economic Research (NBER) Working Paper 2486

Kumar MS, Woo J (2010) Public debt and growth. International Monetary Fund Working Paper WP/10/174, International Monetary Fund

Lane PR (2012) The European sovereign debt crisis. J Econ Perspect 26(3):49–68

Mishkin F (2010) Over the cliff: from the ‘subprime’ to the GFC. National Bureau of Economic Research (NBER) Working Paper 16609

Pattillo C, Poirson H, Ricci L (2004) What are the channels through which external debt affects growth. International Monetary Fund Working Paper WP/04/15, International Monetary Fund

Reinhart CM, Rogoff KS (2009) This time is different—eight centuries of financial folly. Princeton University Press

Reinhart CM, Rogoff KS (2010a) Growth in a Time of Debt. Draft dated the 7th of January, 2010, prepared for the American Economic Review Papers and Proceedings

Reinhart CM, Rogoff KS (2010b) From financial crash to debt crisis. National Bureau of Economic Research (NBER) Working Paper 15795

Roubini N (2001) Debt sustainability: how to assess whether a country is insolvent. Stern School of Business Working Paper, New York University

Sachs J (1990) A strategy for efficient debt reduction. J Econ Perspect 4(1):19–29

Kraüssl R, Lehnert T, Rinne K (2017) The Search for Yield: Implications to Alternative Investments. Journal of Empirical Finance 44: 237-236

Bhimjee DCP, Leão ER (2020) Public Debt, GDP and the Sovereign Debt Laffer Curve: A country-specific analysis for the Euro Area. Journal of International Studies, 13(Number 3): 280-295

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The author declares no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by the author.

Informed consent

This article does not contain any studies with human participants performed by the author.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article