Abstract

This paper investigates the primary push factors that constitute home country-specific characteristics of Brazil, Russia, India, China, and South Africa (BRICS) and enhance their abilities as emerging market economies to engage in outward foreign direct investments (OFDI). The motivation behind this study was the need to fill the gap in the existing literature on the push factors from BRICS. A panel autoregressive distributed lag model was employed on these countries from 2000 to 2018, followed by an impulse response function analysis using a unique data set from a productive capacity index (PCI) and a derived index obtained from each country’s political risk ranking. A robust relationship was detected between OFDI and all of its short- and long-term push factors. The results reveal the relative strength of the long-term impact of the productive capacity and political stability indices supported by the divergent effect of their shocks on OFDI. This substantial contribution highlights the policy implication of how governments should promote their productive capacity and political stability to sustain a healthy investment environment for firms to expand their investments abroad.

Similar content being viewed by others

Introduction

Pull factors are the specific characteristics of a host country that provide a motivation for a home country’s OFDI. In contrast, push factors, which are the focus of this study, are the country-specific characteristics of a home country that drive OFDI to destination economies. OFDI is argued to have a positive impact on home countries. It provides domestic firms with access to new markets, intermediate goods, and technology at a lower cost. Thus, a home country industry benefits from enhanced productivity, output growth, and competitiveness (Navaretti and Castellani, 2004; Desai et al., 2005). Knoerich (2017) described the crucial impact of OFDI on the emerging market economies of home countries. These economies benefit by acquiring assets and other market advantages. According to Sauvant (2008), the main domestic factors that drive OFDI in emerging market economies are liberalization, economic reform, and targeted competitiveness. Luo et al. (2010) and Lee et al. (2016) stated that firms are also motivated to engage in OFDI are seeking resources and attempting to diversify market risk. World (2018) noted that the escalating global growth rate and the increase in the prices of commodity exports are the main sources of finance that firms use to engage in OFDI.

According to the World Bank’s Global Investment Competitiveness Report (2018), the last decade has witnessed a surge in OFDI from firms in developing countries. Global OFDI flows increased from 4% in 1995 to 20% in 2015. The lion’s share (62%) of this increase was from BRICS countries.

Becker-Ritterspach et al. (2019) supported treating BRICS countries as having close home-country characteristics and explored the “home country measures” (HCM) that support domestic firms’ in making the decision to invest abroad. They argued that these HCM measures are more influential in developing countries and can vary significantly from one country to another. Further, they added that the influence of HCM varies in terms of their effect on specific industrial sectors rather than on all sectors. Similarly, Wladimir (2016) studied the country-specific characteristics of each BRICS country. The author argued that these countries—which share the characteristics of being emerging countries that are transitioning from communist to liberal economies—are characterized by common home-country push factors that affect their multinational firms’ decisions to invest abroad. Owing to the significant rise in OFDI from BRICS countries and its positive impact on their economies and because they are a group of countries that have unique characteristics, this current study explored these countries and studied their home-country push factors for OFDI to other countries.

Despite the presence of a few studies related to the OFDI push factors from emerging market economies, the literature does not address political stability and productive efficiency to the best of the authors’ knowledge. There have been limited attempts to study home country OFDI push factors using different methodologies and applications without reference to political stability and productive capacity in Kyrkilis and Pantelidis (2003), Tolentino (2010), and Roy and Narayanan (2020).

A few studies revealed that International Country Risk Guide (ICRG) political risk has a significant effect on inwards foreign direct investment as found by Jeutang and Kesse (2021). Similarly, productive capacity has a significant effect on all aspects of sustainable development in developing countries (Aizenman, 1994; Javorcik, 2004). These studies argue that the superior performance of countries in the PCI results in a more enhanced investment environment for promoting OFDI. Despite the proven impact on several economic aspects, these two variables are under studied, especially as home-country OFDI push factors. Accordingly, this study narrows the gap by empirically introducing these two innovative sets of variables. The study also contributes an index derivation for political stability, using 12 ICRG components for country ranking related to BRICS countries.

This study examines the home-country push factors that affect OFDI from BRICS as emerging market economies and their dynamic short- and long-term effects. A panel autoregressive distributed lag model (PARDL) and impulse response function (IRF) were employed to analyze the relationship between OFDI stocks and their economic and political push factors. Employing a PARDL model to analyze the relationship between OFDI and its unique push factors for this group of countries is a novel contribution to existing empirical studies. A single contribution by Roy and Narayanan (2020) used quantile panel regression to distinguish BRICS counties using a dummy variable in their push factors analysis to OFDI for developing in contrast to push factors for developed counties. The rest of the studies concentrated on analyzing these factors for a single country using or comparing two BRICS countries (Kalotay & Sulstarova, 2010; Morck et al., 2008; Hong & Kim, 2003; Tolentino, 2010; Nayyar, 2008).

The results confirmed the short- and long-term relationships between OFDI stocks and their push factor determinants. Further, the results highlighted the significant long-term relationships between the political stability index (PSI) and the productive capacity index in OFDI stock. The IRF confirms this relationship by revealing long term relationship.

This paper is organized as follows: section one, introduction; section two, literature review; section three, methodology; and section four, results and conclusion.

Literature review

Theoretical background

Dunning (1988) addressed the motivation for firms to participate in OFDI solely from a firm cost-benefit perspective. He summarized the main objectives of firms’ OFDI decisions in his “eclectic paradigm” or OLI model—ownership, location, and internationalization advantages. Later, Dunning and Lundan (2008, 2010) contributed the institution level as the main push factor for firms’ decisions to participate in OFDI. Dunning and Narula (1996) added the investment development path, which describes a five-stage development model for countries to turn from net FDI inflow to net FDI outflow. In each stage, the push and pull factors are determined. In summary, most variables—particularly in the third and fourth stages of economic development in which BRICS countries can be located—are market size, natural resources, type of FDI, and government policies. Desai et al. (2005) and Lipsey (1995) added that U.S. firms that have foreign direct operations in other countries promoted employment levels in the U.S labor market. This was also asserted by Navaretti and Castellani (2004), who found that Italian firms’ OFDI increases domestic output and productivity growth.

Some studies that focused on home-country conditions that promoted OFDI were conducted on individual countries—unlike this study, which is conducted on BRICS as a group of countries. Although these studies confirm the effect of institutional and political factors as OFDI push factors for firms, none of them applied their research on BRICS as a group of countries using a Panel ARDL model. Nor did they investigate the long-term shocks these factors have on OFDI. Kalotay and Sulstarova (2010) tackled OFDI push and pull motivational factors by introducing two sets of home- and host-country Russian OFDI determinants. They highlighted the fact that privately owned enterprises were pushed to invest abroad, escaping the domestic market’s restrictive regulations. The pull factors for both state owned and privately owned firms were mainly ownership and location. Their study was analytical and applied on a firm level rather than using macroeconomic factors in their analysis.

Similarly, Hong and Kim (2003) examined the OFDI determinants from China to European countries, using a logit model from 1986 to 1997. They found that China’s reform and liberalization policies were the main drivers of the surge in the country’s OFDIs. Morck et al. (2008) added that the Chinese institutional policy of encouraging firms to invest abroad, such as banks directing lending toward overseas investments, fewer government constraints, and government policies encouraging national savings, were key drivers of home-country OFDI. Another study on China’s motives for OFDI is the political orientation toward more open investments, especially in sectors that have a domestic labor surplus, such as the infrastructure and construction sectors. In addition to GDP growth in China, access to capital and credit, capital control policies, and expected fluctuations in the exchange rate of its domestic currency encourage OFDI (Yu et al., 2019). Regarding studies on India, Nayyar (2008) agreed that the same factors that prevailed in China—liberalized, free financial markets that enhance competitiveness—were the main home-country contributors to OFDI.

Recently, empirical perspectives that investigate OFDI push factors changed from firm-level factors to emerging market macroeconomic factors. Tolentino (2010), analyzed home-country motivational conditions for OFDI directed from China and India. He used macroeconomic home-country indicators to determine the effect on each country, separately. He used the real exchange rate, the GDP deflator, the real lending rate, and the sum of exports and imports as his main explanatory variables but encountered no institutional or political variables or factors of production efficiency—unlike this study. Roy and Narayanan (2020) used developing markets versus emerging markets to distinguish BRICS as a set of countries differentiated by a dummy variable in their quantile panel and investigated the home country-specific push factors for each group. Their results showed that OFDI push factors in home countries varied across their sample countries. Additionally, the level of income, technology, and global integration are positively associated with these countries’ OFDI. Moreover, the interest rate is found to be negatively associated with OFDI. Their study did not focus on BRICS countries as separate from emerging countries, although their results revealed that they are different. Moreover, they did not use the set of political risk and production capacity variables employed in this study despite the ICRG political risk’s significant effect on inward FDI as found by Jeutang & Kesse (2021). Productive capacity dimensions also have a significant effect of on all aspects of sustainable development in developing countries (Aizenman,1994).

Empirical support for variable selection

The following push factors can be classified into three groups as listed in Table 1.

The first group represents the economic openness and economic stability variables

The main hypothesis is that these variables are positively related to OFDI in BRICS. Dunning and Narula (1996), Kyrkilis and Pantelidis (2003), and Chang et al. (2022) asserted that macroeconomic indicators, such as income, exchange rate, interest rate, trade openness, and FDI inflows, are the main indicators that are positively associated with OFDI.

The second group of variables is PCI and technology

Although no empirical studies have been conducted that measure the direct impact of PCI on OFDI pushed from home countries, there are several that separately measure the impact of this index’ components. The variables included in this index; human resources, natural and energy resource abundance the studies of Lall (1980) and Clegg (1987) asserted their direct positive relationship OFDI. Additional technology advances are positively related to OFDI (Lall, 1980; Clegg 1987; Al-Sadig, 2013). To avoid spurious regressions, the main PCI index is used as an exogenous variable and a proxy for the other nine variables that make up this index.

The third group of variables is the PSI

These variables are also assumed to be a set of political stability push factors for OFDI. Given the existence of their high multicollinearity, a single index is created as a proxy for these variables using the ICRG political risk rating database. The main assumption is that better home-country conditions result in a more positive OFDI. Lucas (1990) argued that political risk is a key determinant of FDI flows. Political stability is positively related to FDI outflows from home countries, and it is negatively related to FDI inflow to host countries. By the same token, La Porta et al. (1999) asserted that higher political stability provides a healthy environment in which firms can conduct foreign direct and foreign portfolio investments.

Bulatov (2017) added that the Russian Federation and other BRICS economies have unfavorable business climates compared to leading developed economies, and this drives firms to escape the domestic market and invest in a more convenient international market. This argument was also supported by Buitrago, Camargo (2020), Ciesielska-Maciagowska and Koltuniak (2021), Becker-Ritterspach et al. (2019), and Tallman (1988). According to Miniesy and Elish (2017) and Ciesielska-Maciagowska and Koltuniak (2021), home-country institutional factors affect the scale of OFDI. They found that the government’s position in terms of property rights, rule of law, transparency, and an unbiased attitude toward minorities are positively associated with OFDI from these countries.

Data

All the variables’ data was extracted from the World Development Indicators and the United Nations Conference On Trade and Development (UNCTAD). The ICRG was first created in 1980 to serve investors who intend to invest in its member countries’ markets. It is an analysis on potential risk in these markets. Political risk rating is one of the areas on which the ICRG reports. It assesses the political stability of the countries surveyed by the ICRG on the basis of relative comparison. A range of political risk components and subcomponents are assigned risk points on Government Stability, Socioeconomic Conditions, Investment Profile, Internal Conflict, External Conflict, Corruption, Military in Politics, Religious Tensions, Law and Order, Ethnic Tensions, Democratic Accountability, and Bureaucracy Quality. A maximum of 100 points are given. Each component is assigned a minimum of zero points (highest risk rating) and a maximum number with an assigned fixed weight (lowest risk rating). The points are assigned based on a series of pre-set questions for each risk component. This ensures uniformity in collecting data for different countries and time periods and ensures consistency. The UNCTAD productive capacity index provides a framework for assessing developing countries’ productive capacity. It evaluates the country’s condition and areas where policies can be established to work on shortfalls and enhance the country’s sustainable development. It has eight main components, namely Human Capital, Natural Capital, ICTs, Structural Change, Transport, Institutions, and the Private Sector. The time span covered by PCI was from 2000 to 2018, which restricted the model to using the model during this period.

Methodology

To empirically examine the relationship between home-country push factors as explanatory variables and OFDI for the five BRICS emerging market economies, balanced panel data were used from 2000 to 2018. First, diagnostic tests checked multicollinearity and cross-section dependency (CSD). If both were excluded, a cointegration test for a long-term relationship was performed. The PARDL was then applied in the short- and long-runs. The ARDL has the advantage of applying a dynamic short- and long-run analysis simultaneously. It can work with different levels or a mixture of integration levels. In addition, it is able to accommodate various lag selections (Duasa, 2007; Pesaran et al., 2000). Finally, an IRF of a vector autoregression (VAR) model was created to determine the effect of shocks in any explanatory variable on the dependent variable under study and to picture its long-term effect.

Model specification

The independent variable used was OFDI stock. The model can be expressed as:

The natural logarithm for each variable was employed to avoid any potential multicollinearity between the explanatory variables that would complicate the model running smooth. The model was demonstrated as follows, where t represents time and i represents each country.

Political stability index

This study adopted ICRG political risk data to estimate the political stability effect on OFDI in BRICS countries. Running all 12 subcomponents at the same time created a definite multicollinearity problem and biased results. These were detected from the initial correlation matrix of 27 variables that exhibited a significant correlation between the explanatory variables. Therefore, this study used the Jeutan and Kessa (2021) method for creating a PSI using principal component analysis (PCA) estimation. This index was generated by first estimating the PCA for the 12 subcomponents in the ICRG. The eigenvalues for ICRG PCA were demonstrated in Fig. 1, which clearly shows that only the first four principal components (PCs) should be retained because their eigenvalues were greater than or equal to 1 and had a cumulative eigenvalue of 0.7520. However, using all ICRG PCs less than 1 in the PSI calculation is preferred, despite the trivial eigenvalues and their cumulative effects, to objectively view all aspects of the political stability effect on OFDI. Therefore, all PCs were retained.

Next, the retained PCs were assigned weights on the basis of their relative eigenvalue to the sum of the eigenvalues, as follows:

where Ei is the eigenvalue of all PCs, and Wi is the relative weighted eigenvalue.

The sum of each PC multiplied by its assigned weight was calculated to generate a sub-index score as follows:

where PCi represents each principal component.

The descriptive index statistics show a mean value of 2.1803, a minimum value of 1.99, a maximum value of 2.55, and a standard deviation of 0.1313.

Cross-section dependency test and the test for correlation

Using the CSD test was crucial to accessing the correlation among the cross-sections in the panel data, even if the standard unit root test indicated cross-sectional independency (Hsiao et al., 2011; Xu et al., 2016; Sahoo & Sethi, 2022). CSD tests were also required because of the dependency of existing common shocks and unobserved components between groups, This was part of the error term that leads to the likelihood that the panel data exhibited substantial cross-sectional dependency. An existing CSD indicated biased estimations. Therefore, in this study, the CSD tests employed were Lagrange multiplier tests—suitable in this study because N < T—formulated by Breusch and Pagan (1980), Pesaran (2015), and Pesaran (2004) for weak CSD.

The results are shown in Table 2.

Table 2 shows that all P-values were higher than 5%, which indicates that the null hypothesis is accepting the nonexistence of CSD or a weak CSD in the existing fixed panel regression.

Unit root tests

In order to detect long-term relationships between the dependent variable and the explanatory variables, panel cointegration tests should be performed to integrate the variables (Granger & Newbold, 1974). As a first step, evaluating the stationary properties of the variables was performed using the Im, Pesaran, and Shin (IPS), the Augmented Dickey Fuller, the Phillips-Perron, and the Levin–Lin–Chu (LLC) unit root tests (Im et al., 2003; Levin et al., 2002; Maddala & Wu, 1999). For each unit root test, the models were implemented with a deterministic trend and an intercept. The IPS, ADF-Fisher, and PP-Fisher unit root tests assumed a single unit root and changes in the autocorrelation coefficients for cross-sections; however, LLC allowed for a common unit root along cross-sections. Finally, the variance inflation factor test for all variables ranged from less than 10 and had a mean value of 5.8, which negated the presence of possible multicollinearity.

The tests revealed that some series did not have stationary natural logarithmic values at level. However, when the tests were applied at the first level, they all showed significance, which indicates that the null hypothesis of panel unit root nonstationary be rejected.

Panel cointegration test

As shown in Table 3, all series were stationary at first difference, which permitted the application of panel cointegration tests to determine the long-term relationships between the variables. Therefore, the tests used for this purpose were from Pedroni (1999), Kao (1999), and Westerlund (2007). The underlying idea was to test for the absence of cointegration by determining whether or not the individual panel members were error-correcting.

The outcome of the three-panel cointegration tests is summarized in Table 4, which indicates that all statistics are significant at the 1% level. This inference shows that the no cointegration null hypothesis for the model can be rejected. The Kao panel cointegration test for all models were found to be in line with those from the Pedroni panel cointegration and the Westerlund tests. Hence, all results confirmed the existence of a long-run cointegration relationship between the explanatory variables and the dependent variable.

Optimal lag selection

The optimal lag selection was established depending on the order in both the panel VAR specification and the moment condition (Andrews & Lu, 2001; Hansen, 1982). The proposed consistent model and moment selection criteria (MMSC) and Hansen J statistic of the recognized restrictions were similar to the other selection criteria, such as the Akaike information criteria (Akaike, 1969), the Bayesian information criteria (Schwarz, 1978; Rissanen, 1978), and the Hannan-Quinn information criteria (Hannan & Quinn, 1979). Additionally, the coefficient of determination captured the proportion of the variation explained by the panel model, with higher values preferable to lower ones. Table 5 leads to the conclusion that the optimal lag appropriate for this model is the first lag.

Results and discussion

PARDL model

The Mean Group (MG) estimation model was originally suggested by Pesaran, Shin and Smith (2000) to treat the bias resulting from the presence of heterogeneous slopes in dynamic panels. To treat this bias, the MG estimator provides the panel’s long-term parameters by taking the average of the long-term parameters in the PARDL models for individual countries. The estimator also separates regressions for each country and calculates the coefficients as the unweighted mean of the estimated coefficients for each country. Doing so permits all variable coefficients to be heterogeneously varying in the short and long terms. The MG estimator assumes all countries in the panel are different and share no common features, which might not be the case in the current group of countries.

The ARDL model is as follows:

For country i, where i = 1, 2, …. N, the long-term parameter θt for country i is:

The MG estimator for the entire panel is given by:

The Pooled Mean Group (PMG) estimator developed by Pesaran, Shin and Smith (1999) assumes that the long-term coefficients of the variables are the same in the long term but differ between groups in the sample in the short term.

The unrestricted specification for the PARDL system of equations for t = 1, 2, … , T, periods and i = 1, … ,N countries for the dependent variable Y is:

where \(x_{i,t - j}\) is the (k × 1) vector of the explanatory variables for group i, and \(\mu _i\)represents the fixed effects. The model can be reparametrized as a VECM system:

where the βi are the long-term parameters, and the θi are the error correction parameters. The PMG restriction is that all of the elements βi representing the estimators’ coefficients are the same across countries. Equation (9) was used to estimate the MG, PMG, and DEF models, where y is OFDIS, x is a set of independent variables identified in Table 1, β represents the long-term coefficients of θ—the coefficients of the speed of adjustments to the long-term status—and the subscripts i and t represent country and time, respectively.

The dynamic fixed effect (DFE) estimator was very close to the PMG estimator, except that it assumed that the coefficient of the cointegrating vector in the model was equal across all panels in the long term. However, DFE had the restriction of slowing the adjustment and short-term coefficients to make them both equal in the short term. DFE also calculated the standard error at the same time, allowing for intragroup correlation. One of the shortfalls of the DFE estimator was that the models faced simultaneous equation bias from the endogeneity between the error term and the lagged dependent variable (Baltagi et al., 2000).

A Hausman test was applied to check for the best estimator to predict the model and showed that the MG estimator was the best for predicting this PARDL model. The null hypothesis of this test was that the difference between the PMG and MG estimations was not significant. The P-value of the test was equal to 0.7755, indicating that the null hypothesis is rejected and that a significant difference exists between the MG and PMG estimators, and MG is the appropriate estimator for the PARDL model in this study.

However, the assumption of having short-term heterogeneity between BRICS countries also cannot be ignored. Therefore, the application of the other two estimators was necessary to ensure a holistic view of the model analysis. In addition, the time span of this study was only 28 years; in this case, the MG estimator did not have enough degrees of freedom to estimate the model without complete non-biasedness.

Table 6 confirms that the error correction term was negative and significant in the three model estimators and that any deviation between the dependent variable and the explanatory variables was corrected in the long term. A summary of the results follows.

Economic openness and stability

The results show that a positive and significant relationship between both LEIGDP and LFDI against LOFDIS occurred in the short and long terms. This finding confirms the assumption that the positive effect was more in trade and FDI relationships with other countries and in promoting countries’ ability to perform OFDI. Similarly, LGDP and LEXCH were positive and significant in relation to LOFDIS. The real interest rate indicated capital abundance. A low real interest rate indicated a lower cost of capital, which encourages firms to borrow and accumulate capital for exploring markets abroad. The results show that LRIR had a negative and significant effect on LOFDI in both terms. These results confirm the standard theoretical base originally developed by Dunning & Narula (1996) and Kyrkilis & Pantelidis (2003). The relationship direction and the significance compares to the same results as Roy and Narayanan (2020) on developing countries, including BRICS countries.

The productive capacity index (PCI) and technology

The model used the PCI as a proxy for the eight subcomponents. As shown in Table 6, LPCI was positive and significant, with a large coefficient in both terms relative to other explanatory variables in the model. Finally, the effect of technology, LTechno, was also an important determinant for OFDI, which had a positive and significant effect in the short and long terms. The results are also supported by Kyrkilis & Pantelidis (2003), who examined the effect of human resources, natural resources, technology, transportation, and the set of standard variables of economic openness and stability that I have already examined. The PCI that I am using includes more productivity dimensions and also revealed the same positive significant effect on OFDI.

The political stability index (PSI)

Table 6 shows a positive and significant effect of the Lindex on LOFDI in the short and long terms for all three estimators. However, the short-term Lindex coefficients demonstrated trivial effects compared with the other explanatory variables in the model. Alternatively, the Lindex long-term coefficient was considerably higher than the short-term coefficient and the relative coefficients of the other variables in the long term. This result confirms the main research hypothesis of the significant effect of political stability on the home country’s ability to establish OFDI (Buitrago & Camargo, 2020; Ciesielska-Maciagowska & Koltuniak, 2021; Becker-Ritterspach et al., 2019; Tallman, 1988). The results of the ARDL model initiated a deeper analysis of the impact of political stability shocks, in addition to the other explanatory variables, on OFDI in BRICS.

The impulse response function

The IRF detects the response of an endogenous variable to any shock to that variable and to every other endogenous variable. In addition, the IRF tracks the direction and magnitude of the variable’s’ response to a shock that spreads through the model.

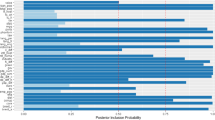

Figure 2 illustrates the IRF for 10 years by displaying the time path of the response of LOFDIS to shocks from each explanatory variable. The magnitude of the shock is one standard deviation of the residuals in the VAR model. Impulse responses can be considered significant if the confidence interval is higher than the zero line, thereby rejecting the null hypothesis of the nonexistence of the impulse response. In Fig. 2(a–e), the IRF shows the one standard deviation significant effect on LOFDIS. Accordingly, a shock on LOFDIS created a downward drift to itself starting in the second period. The significant effect of shocks was identified in the response of LOFDIS to Lindex, LPCI, LTechno, and LGDP. A shock in Lindex created a positive, significant effect from the fourth period and diverged higher than the zero line. Therefore, any improvement in political stability in terms of governance and political tension improved OFDI in the long term. This gives the same results as in Nazeer and Masih (2017), who used IRF to detect the same relationship in Malaysia from 1984 to 2013. A similar effect is also shown in the shock in LPCI that diverged from period 2, which indicated the major effect of a productive capacity improvement on OFDI from BRICS.

Technology and GDP improvements

Gross domestic product showed more or less similar positive effects on OLFDIS from the second period diverging toward the long term.

Robustness check

All steps starting from CSD, unit root test, panel cointegration, and lag selection were executed after replacing the control variable political stability index (Lindex), previously derived in The Political Stability Index subsection, with Governance Political Stability (GPS) sourced from the World Development Indicator, WB. View suplimentary information Tables 5 to 8 in Appendix A confirm similar results between both models. Table 9 demonstrates the PMG, MG, and DFE Model 1 (with Lindex) and Model 2 (with GPS) results. When the model was run again using GPS as an alternative control variable, all control variable coefficients demonstrated similar signs and significance in relation to the independent variable. It was noticeable, however, that the size of the long-run coefficient of Lindex compared to GPS is relatively larger. This confirms the results previously discussed and supports the creation of Lindex, which is more comprehensive and includes different aspects of political stability, rather than depending on a single variable.

Conclusion

This research study investigates the main push factors of OFDI in home countries—primarily in BRICS, which permit the undertaking of OFDI as emerging market economies. The PARDL and IRF models were used to investigate a set of push factors that fit into the categories of macroeconomic stability, openness, investment incentives, and political stability. The analysis revealed that significant short- and long-term relationships exist between OFDI and its push factors. The main determinants being political stability, productive capacity, technology, and GDP. The standard shocks of these factors revealed a major positive impact on BRICS countries’ capability to sustain and improve their OFDI. Policy implications derived from this study shed light on the importance of government efforts to enhance aspects of production efficiency by improving human resources, securing energy and natural resources, improving economic structure, and encouraging the private sector in BRICS countries. Additionally, governments should work on enhancing governmental, institutional, and political aspects that provide a healthy environment for firms to expand and invest abroad. This research area needs to be broadened to separately investigate the political stability components with other methodologies to overcome multicollinearity.

Data availability

The data that support part of the findings of this study are available from International Country Risk Guide available at https://www.prsgroup.com/explore-our-products/icrg/ but restrictions apply to the availability of these data, which were used under license for the current study, and so are not publicly available. Data are, however, available from the authors upon reasonable request and with permission of [International Country Risk Guide]. The rest of the data sources are freely accessed from UNCTAD available at https://unctadstat.unctad.org/EN/ and World Bank World Development Indicators available at https://databank.worldbank.org/source/world-development-indicators.

References

Aizenman J (1994) Monetary and real shocks, productive capacity and exchange rate regimes. Economica 61(244):407–434. https://doi.org/10.2307/2555031

Akaike H (1969) Fitting autoregressive models for prediction. Ann Inst Stat Math 21:243–247. https://doi.org/10.1007/BF02532251

Al-Sadig AJ (2013) Outward foreign direct investment and domestic investment: The case of developing countries. IMF Working Paper. WP/13/52, Washington DC

Andrews DWK, Lu B (2001) Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. J Econ 101:123–164. https://doi.org/10.1016/S0304-4076(00)00077-4

Baltagi BH, Griffin JM, Xiong W (2000) To pool or not to pool: Homogeneous versus heterogeneous estimations applied to cigarette demand. Rev Econ Stat 82:117–126. https://doi.org/10.1162/003465300558551

Becker-Ritterspach F, Allen ML, Lange K, Allen MMC (2019) Home-country measures to support outward foreign direct investment: Variation and consequences. Transnat Corp 26:61–85. https://doi.org/10.18356/a98759e5-en

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its application to model specifications in econometrics. Rev Econ Stud 47:239–253. https://doi.org/10.2307/2297111

Buitrago RRE, Camargo MIB (2020) Home country institutions and outward FDI: An exploratory analysis in emerging economies. Sustainability 12:10010. https://doi.org/10.3390/su122310010

Bulatov A (2017) Offshore orientation of Russian Federation FDI. Transnat Corp 24:71–89. https://doi.org/10.18356/ed298a0d-en

Ciesielska-Maciagowska D, Koltuniak M (2021) Foreign direct investments and home country’s institutions: the case of CEE countries. ERSJ 335–353. https://doi.org/10.35808/ersj/1965

Chang BH, Derindag OF, Hacievliyagil N et al. (2022) Exchange rate response to economic policy uncertainty: evidence beyond asymmetry. Humanit Soc Sci Commun 9:358. https://doi.org/10.1057/s41599-022-01372-5

Clegg J (1987) Multinational enterprises and world competition: a comparative study of the USA, Japan, the UK, Sweden and West Germany. Int Aff 64:278. https://doi.org/10.2307/2621871

Desai MA, Foley CF, Hines Jr JR (2005) Foreign direct investment and the domestic capital stock. Am Econ Rev 95:33–38

Duasa J (2007) Determinants of Malaysian trade balance: an ARDL bound testing approach. Globl Econ Rev 36(1):89–102. https://doi.org/10.1080/12265080701217405

Dunning JH (1988) The eclectic paradigm of international production: a restatement and some possible extensions. J Int Bus Stud 19:1–31. http://www.jstor.org/stable/154984. https://doi.org/10.1057/palgrave.jibs.8490372

Dunning JH, Lundan SM (2008) Institutions and the OLI paradigm of the multinational enterprise. Asia Pac J Manage 25:573–593. https://doi.org/10.1007/s10490-007-9074-z

Dunning JH, Lundan SM (2010) The institutional origins of dynamic capabilities in multinational enterprises. Ind Corp Change 19:1225–1246. https://ideas.repec.org/a/oup/indcch/v19y2010i4p1225-1246.html. https://doi.org/10.1093/icc/dtq029

Dunning JH, Narula R (1996) The investment development path revisited: some emerging issues. In: Dunning J, Narula R (eds.) Foreign direct investment and government, catalysts for economic restructuring. Routledge, London

Granger CWJ, Newbold P (1974) Spurious regressions in econometrics. J Econ 2:111–120. https://doi.org/10.1016/0304-4076(74)90034-7

Hannan EJ, Quinn BG (1979) The determination of the order of an autoregression. J R Stat Soc B (Methodol) 41:190–195. https://doi.org/10.1111/j.2517-6161.1979.tb01072.x

Hansen LP (1982) Large sample properties of generalized method of moments estimators. Econometrica 50:1029–1054. https://doi.org/10.2307/1912775

Hong S, Kim S (2003) Locational determinants of Korean manufacturing investments in the European Union. Hitotsubashi J Econ 44:91–103. http://www.jstor.org/stable/43296122

Hsiao C, Pesaran M, Rich A (2011) Diagnostic tests of cross-section independence for limited dependent variable panel data models. Oxf Bull Econ Stat 74:253–277. https://doi.org/10.1111/j.1468-0084.2011.00646.x

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115:53–74. https://doi.org/10.1016/S0304-4076(03)00092-7

Javorcik BS (2004) Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. Am Econ Rev 94:605–627. https://doi.org/10.1257/0002828041464605

Jeutang P, Kesse K (2021) A novel measure of political risk and foreign direct investment inflows. J Risk Financ Manag 14:482. https://doi.org/10.3390/jrfm14100482

Kalotay K, Sulstarova A (2010) Modelling Russian outward FDI. J Int Manag 16:131–142. https://doi.org/10.1016/j.intman.2010.03.004

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econ 90:1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Knoerich J (2017) How does outward foreign direct investment contribute to economic development in less advanced home countries? Oxf Dev Stud 45:443–459. https://doi.org/10.1080/13600818.2017.1283009

Kyrkilis D, Pantelidis P (2003) Macroeconomic determinants of outward foreign direct investment. Int J Soc Econ 30:827–836. https://doi.org/10.1108/03068290310478766

Lall S (1980) Monopolistic advantages and foreign involvement by U.S. manufacturing industry. Oxf Econ Pap 32:102–122. https://ideas.repec.org/a/oup/oxecpp/v32y1980i1p102-22.html. https://doi.org/10.1093/oxfordjournals.oep.a041464

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny R (1999) The quality of government. J Law Econ Org 15:222–279. https://EconPapers.repec.org/RePEc:oup:jleorg:v:15:y:1999:i:1:p:222-79

Lee C, Lee CG, Yeo M (2016) Determinants of Singapore’s outward FDI. J Southeast. Asian Econ 33:23–40. https://doi.org/10.1353/ase.2016.0012

Levin A, Lin C, James Chu C (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econ 108:1–24. https://doi.org/10.1016/S0304-4076(01)00098-7

Lipsey RE (1995) Outward direct investment and the U.S. economy NBER chapters. In: The effects of taxation on multinational corporations 7–42, National Bureau of Economic Research, Inc. https://ideas.repec.org/h/nbr/nberch/7738.html

Luo Y, Xue QZ, Han BJ (2010) How emerging market governments promote outward FDI: Experience from China. J World Bus 45:68–79. https://doi.org/10.1016/j.jwb.2009.04.003

Lucas RE (1990) Why doesn’t capital flow from rich to poor countries? Am Econ Rev 80(2):92–96. http://www.jstor.org/stable/2006549

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61:631–652. https://doi.org/10.1111/1468-0084.61.s1.13

Miniesy RS, Elish E (2017) Is Chinese outward FDI in MENA little? J Chin Econ Foreign Trade Stud 10:19–43. https://doi.org/10.1108/JCEFTS-09-2016-0026

Morck R, Yeung B, Zhao M (2008) Perspectives on China’s outward foreign direct investment. J Int Bus Stud 39:337–350. https://doi.org/10.1057/palgrave.jibs.8400366

Navaretti GB, Castellani B (2004) Investments abroad and performance at home: Evidence from Italian multinationals, No 4284, CEPR Discussion Papers, C.E.P.R. Discussion Papers. https://econpapers.repec.org/RePEc:tcb:wpaper:0805

Nayyar D (2008) The internationalization of firms from India: Investment, mergers and acquisitions. Oxf Dev Stud 36:111–131. https://doi.org/10.1080/13600810701848219

Nazeer AM, Masih M (2017) Impact of political instability on foreign direct investment and economic growth: evidence from Malaysia. University Library of Munich, Germany https://ideas.repec.org/p/pra/mprapa/79418

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple repressors. Oxf Bull Econ Stat 61:653–670. https://doi.org/10.1111/1468-0084.61.s1.14

Pesaran H (2015) Time series and panel data econometrics. OUP Oxford. Oxford, England

Pesaran M (2004) General diagnostic tests for cross section dependence in panels. Faculty of Economics, University of Cambridge. https://econpapers.repec.org/scripts/redir.pf?u=https%3A%2F%2Fdoi.org%2F10.1016%252Fj.enpol.2021.112184;h=repec:eee:enepol:v:151:y:2021:i:c:s0301421521000537

Pesaran MH, Shin Y, Smith RJ (2000) Structural analysis of vector error correction models with exogenous I(1) variables. J Econ 97:293–343. https://doi.org/10.1016/S0304-4076(99)00073-1

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94:621–634. https://doi.org/10.1080/01621459.1999.10474156

Rissanen J (1978) Modeling by shortest data description. Automatica 14:465–471. https://doi.org/10.1016/0005-1098(78)90005-5

Roy I, Narayanan K (2020) Push factors of outward FDI—A cross-country analysis of developed and developing countries. In: Siddharthan N, Narayanan K (eds.) FDI, Technology and Innovation. Springer, Singapore

Sahoo M, Sethi N (2022) The dynamic impact of urbanization, structural transformation, and technological innovation on ecological footprint and PM2.5: Evidence from newly industrialized countries. Environ Dev Sustain 24:4244–4277. https://doi.org/10.1007/s10668-021-01614-7

Sauvant KP (2008) The rise of transnational corporations from emerging markets: threat or opportunity? Edward Elgar Publishing, Cheltenham, UK

Tallman SB (1988) Home country political risk and foreign direct investment in the United States. J. Int. Bus. Stud 19:219–234. https://doi.org/10.1057/palgrave.jibs.8490856

Schwarz G (1978) Estimating the dimension of a model. Ann Statist 6:461–464. https://doi.org/10.1214/aos/1176344136

The PRS Group (2021) International country risk guide (ICRG) researcher’s datasets, abacus data network, V1. https://hdl.handle.net/11272.1/AB2/4V8VXQ. Accessed 11 Nov 2021

Tolentino PE (2010) Home country macroeconomic factors and outward FDI of China and India. J Int Manag 16:102–120. https://doi.org/10.1016/j.intman.2010.03.002

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69:709–748. https://doi.org/10.1111/j.1468-0084.2007.00477.x

Wladimir A (2016) Outward foreign direct investment from BRIC countries: Comparing strategies of Brazilian, Russian. Indian and Chinese multinational companies. J Comp Econ 12:79–131

World B (2018) Global investment competitiveness report 2017/2018: Foreign investor perspectives and policy implications. World Bank, Washington, DC. http://hdl.handle.net/10986/28493. Accessed 12 Jan 2022

Xu QH, Cai ZW, Fang Y (2016) Panel data models with cross-sectional dependence selective review. Appl Math J Chin Univ 31:127–147. https://doi.org/10.1007/s11766-016-3441-9

Yu S, Qian X, Liu T (2019) Belt and road initiatives and Chinese firm’ outward foreign direct investment. Emerg Mark Rev 41:100629. https://doi.org/10.1016/j.ememar.2019.100629

Acknowledgements

I would like to thank Dr Hossam Eldin Ahmed, Lecturer at the British University in Egypt for technical comments in the methodology that greatly improved the manuscript.

Funding

Open access funding provided by The Science, Technology & Innovation Funding Authority (STDF) in cooperation with The Egyptian Knowledge Bank (EKB).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The author declares no competing interests.

Ethical approval

This article does not contain any studies with human participants or animals performed by the author.

Informed consent

This article does not contain any studies with human participants or animals performed by the author.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Elish, E. Political and productive capacity characteristics as outward foreign direct investment push factors from BRICS countries. Humanit Soc Sci Commun 9, 432 (2022). https://doi.org/10.1057/s41599-022-01460-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-022-01460-6

- Springer Nature Limited