Abstract

Aggregate business investment is a major driver of long-term economic growth. It has been weak in many advanced economies over the last decade, partly due to cyclical demand-side effects. Nevertheless, a number of structural factors and policies interact with and have an effect on business investment. This paper provides a survey of the literature on the main policy drivers of business investment such as finance (including bank and market finance, venture capital and the debt bias in corporate taxation), tax policies, foreign direct investment, product and labour market and environmental regulations, the importance of an efficient insolvency regime, the negative impact of (regulatory) uncertainty and the role of infrastructure investment as a support for business investment.

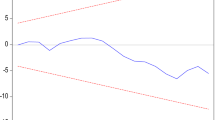

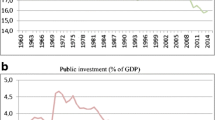

Source: Panel A: Author’s calculations using data drawn from the OECD Economic Outlook database; Panel B: Ollivaud et al. (2016)

Source: Author’s calculations based on data drawn from the OECD Economic Outlook database

Source: Author’s calculations based on data drawn from the OECD Economic Outlook database

Source: Sorbe and Johansson (2016)

Source: Calculations based on Égert and Gal (2016)

Source: Adalet McGowan and Andrews (2016)

Similar content being viewed by others

Notes

There are several alternative models, which help better understand the drivers of aggregate investment. They include the accelerator model, standard neoclassical models of investment, Tobin’s Q and the Euler equation. A systematic comparison of alternative models for the US economy indicates that the accelerator model tended to outperform other models until the early 1990s (Oliner et al. 1995).

References

Abiad, A., D. Furceri and P. Topalova. 2015. The macroeconomic effects of public investment: Evidence from advanced economies, IMF Working Papers No. 15/95.

Adalet McGowan, M. and D. Andrews (2016), Insolvency regimes and productivity growth: A framework for analysis, OECD Economics Department Working Papers No. 1309.

Adalet McGowan, M., D. Andrews and V. Millot (2017), The walking dead? Zombie firms and productivity performance in OECD countries, OECD Economics Department Working Papers No. 1372.

Ademmer, M., and N. Jannsen. 2018. Post-crisis business investment in the euro area and the role of monetary policy. Applied Economics 50: 34–35.

Agiomirgianakis, G.M., D. Asteriou, and K. Papathoma. 2003. The determinants of foreign direct investment: A panel data study for the OECD countries, (03/06). London, UK: Department of Economics, City University London.

Alesina, A., S. Ardagna, G. Nicoletti, and F. Schiantarelli. 2005. Regulation and investment. Journal of the European Economic Association 3(4): 791–825.

Alfaro, L., and A. Charlton. 2009. Intra-Industry Foreign Direct Investment. American Economic Review 99(5): 2096–2119.

Alves, J. 2019. The Impact of tax structure on investment: An empirical assessment for OECD countries. Public Sector Economics 43(3): 291–309.

Amador, J. and A.J. Nagengast. 2016. The effect of bank shocks on firm-level and aggregate investment, Deutsche Bundesbank Discussion Papers 20/2016.

Andrews, D. and A. de Serres. 2012. Intangible assets, resource allocation and growth: A framework for analysis, OECD Economics Department Working Papers No. 989.

Andrews, D. and C. Criscuolo. 2013. Knowledge-based capital, innovation and resource allocation, OECD Economics Department Working Papers No. 1046.

Araujo, S. 2011 Has deregulation increased investment in infrastructure?: Firm-level evidence from OECD countries, OECD Economics Department Working Paper No. 892.

Arnold, J. 2011. Raising investment in Brazil, OECD Economics Department Working Paper No. 990.

Arnold, J. 2017. Raising business investment in Portugal, OECD mimeo.

Arnold, J.M., B. Brys, C. Heady, A. Johanson, C. Schwellnus, and L. Vartia. 2011a. Tax policy for economic recovery and growth. Economic Journal 121(550): 59–80.

Arnold, J.M., B.S. Javorcik, and A. Mattoo. 2011b. Does services liberalisation benefit manufacturing firms? Journal of International Economics 85(1): 136–146.

Arnold, J.M., B.S. Javorcik, M. Lipscomb, and A. Mattoo. 2014. Services reform and manufacturing performance: Evidence from India. Economic Journal 126(590): 1–39.

Autor, D.H., W.R. Kerr, and A.D. Kugler. 2007. Does employment protection reduce productivity? Evidence from US States. Economic Journal 117(521): 189–217.

Baker, S.R., N. Bloom, and S.J. Davis. 2016. Measuring Economic Policy Uncertainty. Quarterly Journal of Economics 131(4): 1593–1636.

Baker, S.R., N. Bloom, B. Canes-Wrone, S.J. Davis, and J. Rodden. 2013. Why Has US Policy Uncertainty Risen Since 1960? American Economic Review, Papers & Proceedings 104(5): 56–60.

Banerjee, R.N., J. Kearns, and M.J. Lombardi. 2015. (Why) Is investment weak? BIS Quarterly Review Bank for International Settlements, March

Barkbu, B., S. P. Berkmen, P. Lukyantsau, S. Saksonovs and H. Schoelermann. 2015. Investment in the euro area: why has it been weak? IMF Working Papers No. 15/832.

Barry, C.B., and V.T. Mihov. 2015. Debt financing, venture capital, and the performance of initial public offerings. Journal of Banking & Finance 58: 144–165.

Blonigen, B.A., and J. Piger. 2014. Determinants of foreign direct investment. Canadian Journal of Economics 47(3): 775–812.

Blundell-Wignall, A., and C. Roulet. 2013. Long-term investment, the cost of capital and the dividend and buy-back puzzle. OECD Journal Financial Market Trends 1: 1–15.

Bond S., G. Rodano and N. Serrano-Velarde. 2015. Investment dynamics in Italy: Financing constraints, demand and uncertainty, Bank of Italy Occasional Papers No. 283.

Bond, S., and C. Meghir. 1994. Dynamic investment models and the firm’s financial policy. The Review of Economics Studies 61(2): 197–222.

Bruno, R., N. Campos and S. Estrin. 2017. The benefits from foreign direct investment in a cross-country context: A meta-analysis, CEPR Discussion Paper No. 11959.

Bruno, R., N. Campos, S. Estrin and M. Tian. 2016. Foreign direct investment and the relationship between the United Kingdom and the European Union, CEP Discussion Paper No. 1453.

Busetti, F., C. Giordano, and G. Zevi. 2016. The drivers of Italy’s investment slump during the double recession. Italian Economic Journal 2: 143–165.

Cambini, C and L. Rondi. 2011. Regulatory independence, investment and political inference: Evidence from the European Union, RSCAC Working Paper 2011/42, European University Institute.

Carruth, A., A. Dickerson, and A. Henley. 2000. What do we know about investment under uncertainty? Journal of Economic Surveys 14(2): 119–153.

Cette, G., J. Lopez and J. Mairesse. 2016. Labour market regulations and capital intensity, NBER Working Papers No. 22603.

Cezar, R., and O.R. Escobar. 2015. Institutional distance and foreign direct investment. Review of World Economics/Weltwirtschaftliches Archiv 151(4): 713–733.

Chirinko, R. 1993. Business fixed investment spending: Modelling strategies, empirical results, and policy implications. Journal of Economic Literature 31(4): 1875–1911.

Cingano, F., M. Leonardi, J. Messina, and G. Pica. 2010. The effect of employment protection legislation and financial market imperfections on investment: Evidence from a firm-level panel of EU countries. Economic Policy 25(61): 117–163.

Cingano, F., M. Leonardi, J. Messina, and G. Pica. 2015. Employment protection legislation, capital investment and access to credit: Evidence from Italy. Economic Journal 126(595): 1798–1822.

Cole, R., D.J. Cumming, and D. Li. 2016. Do banks or vcs spur small firm growth? Journal of International Financial Markets, Institutions, & Money 41: 60–72.

Conway, P., D. de Rosa, G. Nicoletti and F. Steiner. 2006. Productivity, competition and productivity convergence, OECD Economics Department Working Papers No. 509.

Cullmann, A., and M. Nieswand. 2016. Regulation and investment incentives in electricity distribution: An empirical assessment. Energy Economics 57: 192–203.

Davis, S.J. 2015. Regulatory Complexity and Policy Uncertainty: Headwinds of Our Own Making, Stanford University Hoover Institution Working Paper No. 15118.

Dellis, K. 2019. Financial system heterogeneity and FDI flows: evidence from OECD economies, Working Papers 269, Bank of Greece.

De Mooij, R. 2012. Tax Biases to Debt Finance: Assessing the Problem Finding Solutions. Fiscal Studies 33(4): 489–512.

Dlugosch, D. and T. Kozluk. 2017. Energy prices, environmental policies and investment: Evidence from listed firms, OECD Economics Department Working Papers No. 1378.

Economou, F., C. Hassapis, N. Philippas, C. Tsionas, N. Philippas, and M. Tsionas. 2017. Foreign direct investment in OECD and developing countries. Review of Development Economics 21(3): 527–542.

Égert, B., and P. Gal. 2016. The quantification of structural reforms in OECD countries: A new framework. OECD Journal: Economic Studies 2016(1): 91–108.

Égert, B. 2009. Infrastructure investment in network industries: The role of incentive regulation and regulatory independence, CESifo Working Paper Series No. 2642.

Égert, B. 2018. Regulation, institutions and aggregate investment: new evidence from OECD countries. Open Economies Review 29(2): 415–449.

Égert, B. 2020. The quantification of structural reforms: Taking stock of the results for OECD and non-OECD countries, CESifo Working Paper Series No. 8778.

Egger, P., and D.M. Radulescu. 2011. Labour taxation and foreign direct investment. Scandinavian Journal of Economics 113(3): 603–636.

Epstein, R.A. 2011. Design for Liberty: Private Property, Public Administration, and the Rule of Law. Harvard University Press.

European Central Bank. 2016. Business investment developments in the euro area since the crisis, Economic Bulletin.

European Central Bank. 2018. Business investment in EU countries, ECB Occasional Paper Series No. 215.

European Investment Bank. 2017. From recovery to sustainable growth, Investment Report 2017/2018

European Investment Bank. 2018. Retooling Europe’s economy, Investment Report 2018/2019

European Investment Bank. 2019. Accelerating Europe’s transformation, Investment Report 2019/2020

Fournier, J. 2015. The negative effect of regulatory divergence on foreign direct investment, OECD Economics Department Working Papers, No. 1268.

Fournier, J. 2016. The Positive Effect of Public Investment on Potential Growth, OECD Economics Department Working Papers 1347.

Fournier, J. and Å. Johansson. 2016. The Effect of the Size and the Mix of Public Spending on Growth and Inequality, OECD Economics Department Working Papers, No. 1344.

Fuentes Hutfilter, A., A. Kappeler, D. Schneider, G.M. Semeraro. 2016. Boosting investment performance in Germany, OECD Economics Department Working Paper No. 1326.

Gal, P. and A. Hijzen. 2016. The short-term impact of product market reforms: A cross-country firm-level analysis, OECD Economics Department Working Papers No. 1311.

Garsous, G. and T. Kozluk. 2017. Foreign direct investment and the pollution haven hypothesis: evidence from listed firms, OECD Economics Department Working Paper No. 1379.

Giordano C., M. Marinucci and A. Silvestrini. 2016. Investment and investment financing in Italy: some evidence at the macro level, Bank of Italy Occasional Papers No. 307.

Goujard, A. 2016. Improving transport and energy infrastructure investment in Poland, OECD Economics Department Working Papers No. 1302.

Greenaway, D., and R. Kneller. 2007. Firm Heterogeneity, Exporting and Foreign Direct Investment. Economic Journal 117(517): 134–161.

Harding T. and B. S. Javorcik. 2010. Roll out the red carpet and they will come: Investment promotion and FDI inflows, University of Warwick Working Paper Series No. 18.

Harding T. and B. S. Javorcik (2011), FDI and export upgrading, University of Oxford Department of Economics Discussion Paper Series No. 526.

Harding T. and B. S. Javorcik. 2012. Investment promotion and FDI flows: Quality matters, University of Oxford Department of Economics Discussion Paper Series No. 612.

Haugh, D. 2013. From bricks to brains: Increasing the contribution of knowledge-based capital to growth in Ireland, OECD Economics Department Working Papers No. 1094.

Haugh, D., M. Adalet McGowan, D. Andrews, A. Caldera Sánchez, G. Fülöp and P. Garia Perea. 2017. Fostering innovative business investment in Spain, OECD Economics Department Working Papers No. 1387.

Hubert, F. add N. Pain. 2000. Inward investment and technical progress in the UK manufacturing sector, OECD Economics Department Working Papers No. 268.

Javorcik, B.S., A.T. Turco, and D. Maggioni. 2017. New and improved: Does FDI boost production complexity in host countries? Economic Journal 128: 2507–2537.

Kerdrain, C., I. Koske and I. Wanner. 2010. The impact of structural policies on saving, investment and current accounts, OECD Economics Department Working Papers No. 815.

Kopp, E. 2018. Determinants of U.S. business investment, IMF Working Paper No. 18/139.

Kopp, E., D. Leigh, S. Mursula and S. Tambunlertrchai. 2019. U.S. investment since the Tax Cuts and Jobs Act of 2017, IMF Working Paper No. 19/119.

Leahy, J.V., and T.M. Whited. 1996. The effect of uncertainty on investment: Some stylized facts. Journal of Money, Credit and Banking 28(1): 64–83.

Lee, J. and P. Rabanal. 2010. “Forecasting U.S. investment”, IMF Working Papers No. 10/246.

Lewis, C., N. Pain, J. Stráský and F. Menkyna. 2014. Investment gaps after the crisis, OECD Economics Department Working Papers No. 1168

Millar, J. and D. Sutherland. 2016. Unleashing private sector productivity in the United States, OECD Economics Department Working Papers 1328.

Molnár, M., N. Pain, and D. Taglioni. 2008. Globalisation and employment in the OECD. OECD Economic Studies 34(3): 1–34.

Mourougane, A., J. Botev, J. Fournier, N. Pain, E. Rusticelli. 2016. Can an Increase in Public Investment Sustainably Lift Economic Growth?, OECD Economics Department Working Papers, No. 1351.

Mukherjee, A., and K. Suetrong. 2012. Unionisation structure and outward foreign direct investment. Journal of Institutional and Theoretical Economics 168(2): 266–279.

Nicoletti, G. and S. Scarpetta. 2005. Regulation and economic performance: product market reforms and productivity in the OECD, OECD Economics Department Working Papers No. 460

Nicoletti, G., S. Golub, D. Hajkova, D. Mirza and K-Y Yoo. 2003. Policies and international integration: influences on trade and foreign direct investment, OECD Economics Department Working Papers No. 359.

OECD. 2015. Lifting investment for higher sustainable growth, Chapter 3, OECD Economic Outlook 2015/1.

OECD. 2016. OECD Economic Survey of Hungary, Paris.

Oliner, S., G. Rudebusch, and D. Sichel. 1995. New and old models of business investment: a comparison of forecasting performance. Journal of Money, Credit and Banking 27(3): 806–826.

Ollivaud, P., Y. Guillemette and D. Turner. 2016. Links between weak investment and the slowdown in productivity and potential output growth across the OECD, OECD Economics Department Working Papers No. 1304.

Pelgrin, F., S. Schich, A. de Serres. 2002. Increases in business investment rates in OECD countries in the 1990s: How much can be explained by fundamentals? OECD Economics Department Working Papers No. 327.

Pisu, M. 2017. Promoting a private investment renaissance in Italy, OECD Economics Department Working Papers No. 1388.

Schwellnus, C. and J. Arnold. 2008. Do corporate taxes reduce productivity and investment at the firm level? Cross-country evidence from the Amadeus dataset, OECD Economics Department Working Papers No. 641.

Simmons-Süer, B. 2016. Cost of capital and US investment: Does financing matter after all? The Quarterly Review of Economics and Finance 60(C): 86–93.

Skeie, O. B. 2016. International differences in corporate taxation, foreign direct investment and tax revenue, OECD Economics Department Working Papers No. 1359.

Sorbe, S. and A. Johansson. 2016. International tax planning and fixed investment, OECD Economics Department Working Papers No. 1361.

Sutherland, D., S. Araujo, B. Égert, and T. Kozluk. 2011. Infrastructure Investment: Links to Growth and the Role of Public Policies. OECD Journal: Economic Studies 2011(1): 1–23.

Tevlin, S., and K. Whelan. 2003. Explaining the investment boom in the 1990s. Journal of Money, Credit and Banking 35(1): 1–22.

Vartia, L. 2008. How do taxes affect investment and productivity? – An industry-level analysis of OECD countries, OECD Economics Department Working Papers No. 656.

Vogelsang, I. 2010. Incentive regulation, investments and technological change, CESifo Working Paper Series No. 2964.

Warner, A.M. 2014. Public investment as an engine of growth, IMF Working Paper No. 14/148/

Westmore, B. 2013. R&D, patenting and growth: The role of public policy, OECD Economics Department Working Papers No. 1047.

Wisniewski, T.P., and S.K. Pathan. 2014. Political environment and foreign direct investment: Evidence from OECD countries. European Journal of Political Economy 36: 13–23.

Zwart, S. 2016., Enhancing private investment in the Netherlands, OECD Economics Department Working Papers No. 1305.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The author would like to thank an anonymous referee and colleagues at the OECD Economics Department for very useful comments and suggestions. The views expressed in the paper do not reflect the official view of the OECD and any other institution the author is affiliated with.

Rights and permissions

About this article

Cite this article

Égert, B. Investment in OECD Countries: a Primer. Comp Econ Stud 63, 200–223 (2021). https://doi.org/10.1057/s41294-021-00146-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41294-021-00146-3