Abstract

Drawing on the open innovation literature, we examine the relationship between alliances with science-based and market-based partners on the one hand, and impactful and lower-impact innovations, on the other hand. Specifically, we predict that alliances with science-based partners will boost impactful innovations while alliances with market-based partners will boost low-impact innovations. We also examine how the social capital of the Board of Directors moderates these relationships. We base our analyses on a large dataset of Chinese firms constructed from diverse sources and find strong support for our hypothesized relationships. We identify the theoretical and managerial implications of our study.

Similar content being viewed by others

Explore related subjects

Find the latest articles, discoveries, and news in related topics.Avoid common mistakes on your manuscript.

Introduction

Prior studies on managing open innovation have enhanced our understanding of how alliances with market-based and science-based partners impact financial performance (Du et al., 2014; Gretsch et al., 2019). But, as noted below, there are lacunae in the coverage of prior studies and our understanding of this important phenomenon. One lacuna is with regard to inadequate attention paid to innovation performance, and specifically to how alliances with two different types of partners (market-based and science-based) relate to high- versus low-impact innovations. This gap is surprising because a key goal of pursuing open innovation with different partners is to generate innovations (Belderbos et al., 2014; Wu, 2014), which can then be leveraged by partners to improve their financial performance. In other words, many prior studies have skipped an intermediate-level outcome (impactful versus non-impactful innovations) in terms of innovation performance and jumped to financial performance. Furthermore, even the few studies that have examined the effects of market-based alliances and science-based alliances on innovation performance have not explored the boundary conditions for those relationships—specifically the role of the top management, which plays a key role in strengthening, or weakening, the effects of science-based vs. market-based alliances on innovation (Gretsch et al., 2019; Lee, 1996; Mindruta, 2013). We address the aforementioned gaps.

Departing from the prior literature that relies on open innovation arguments (Chesbrough, 2003; Hagedoorn et al., 2000), we contend that partner profiles will influence the motivations behind forming the alliance, consistency (and compatibility) in the priority they place on the alliance, as well as their responses such as resource reallocation in response to evolutionary forces. We further submit that these will have important implications for the type of innovation resulting from the alliances, impactful or otherwise. Building on several prior studies that have concluded that the Board of directors (BOD) play an important role in forming alliances as well as in shaping their innovation performance (Hillman & Dalziel, 2003; Thornton et al., 2012; Wu et al., 2022), we examine how the social capital of BOD—specifically, their academic experience and their industrial interlocks, influences the alliances’ innovation performance. We hypothesize that the board’s academic experience will strengthen the effect of having science-based partners on producing impactful innovations, and the board’s industrial interlocks will strengthen the effect of having market-based partners on low-impact innovations.

The empirical context of our study, an emerging market, represents another point of departure versus many prior studies which have analyzed samples from developed country contexts (e.g., Faems et al., 2005; Kafouros et al., 2015; Lin et al., 2009). Alliance strategies of firms from emerging economies share some similarities with developed country contexts, but have key differences as well. Many emerging economy firms have lofty aspirations of catching up with their global rivals, especially in terms of innovation which was historically an area of weakness for them (e.g., Eun et al., 2006; Kafouros et al., 2015; Luo & Tung, 2007). The different aspirations and strategies of developing country firms would make an examination of the alliances-innovation relationship in a developing country context interesting in its own right. Spurred by the Chinese government which is placing innovation-driven development at the core of its national strategy, many Chinese firms are at the vanguard of this movement by emerging market firms towards developing global competitiveness. In fact, some Chinese firms such as Huawei, ByteDance, and Tencent enjoy global technological competitiveness in R&D-intensive industries. But, similar to other developing country contexts, many Chinese firms are lagging in innovation. This diverse context within China provides sufficient variation in terms of innovation strategies and performance across firms and hence a rich empirical context to test our key hypotheses.

The remainder of this paper is organized as follows. We start by discussing the conceptual foundations of our study and our key hypotheses. We include a discussion of the methodological aspects next, followed by a discussion of the results. We conclude the paper by discussing the key implications of our research and directions for future research.

Hypotheses development

Partner types and implications for the type of innovation

We distinguish between two different types of alliance partners: market-based (for-profit firms) versus science-based (Universities) and submit that these different types of partners are likely to have different goals and agendas, even as part of the same alliance. The primary goal of firms is to achieve higher profits from innovation, whereas many universities are founded as non-profit organizations with a mission of creating and disseminating knowledge. Since they are not required to produce profits, Universities can pursue innovations with high and long-term impact (Sappington & Sidak, 2003).

Firms and universities also have important differences in terms of their resources. Driven by profit maximization, private firms’ resources reside in their financial capital, market experience, management know-how, and product-development capability, and hence they often conduct practical research that leads to commercial products and, possibly, profits (George et al., 2002). On the other hand, since a key goal of universities is to engage in basic research that advances our understanding of the world, Universities excel in attracting research staff with a deep interest in and commitment to doing cutting-edge research, and have state-of-the-art research facilities and expertise in conducting research in diverse disciplines.

The abovementioned differences have important implications for the dynamics of alliances. A firm in an alliance with a science-based partner such as a University can pursue long-term goals because it doesn’t have a partner (e.g., another for-profit firm) that has a direct (and sometimes conflicting) interest in commercialization and near-term profits. Since the temptation of looking for quick wins in terms of low-impact innovations (Rossi et al., 2022) is absent, partners can think more widely and ambitiously, opening up the path for high-impact innovations.

Below, we develop hypotheses about the effect of a firm having science-based partners on producing impactful innovations and the effects of a firm having market-based partners on producing innovations with lower impact. The crux of our arguments is that the distinct cultures, interests, and associated resources of alliance partners will have strong implications for the kind of innovation that is likely to result from the alliance.

Science-based partners and impactful innovation

We submit that a firm that has science-based partners will tend to produce more impactful innovations than another firm without such partners for two reasons. First, impactful innovation is often a result of several years of accumulation of small technological progress and involves overcoming technological roadblocks that can seem daunting at that time. In the face of high uncertainty and distant returns, persistence is thus key (Wu et al., 2019) and, hence, impactful innovation is unlikely when partners have a short time horizon for earning returns on their innovation activities (Belderbos et al., 2014). As noted above, a science-based partner is likely to bring to the alliance a broad base of knowledge across multiple disciplines (Agarwal & Cockburn, 2003; Lowe & Ziedonis, 2006) and long-term orientation with a lower emphasis on the short-term as well as on commercial ramifications (Howells & Nedeva, 2003; Mansfield & Lee, 1996). Hence, a firm with science-based partners is better positioned to produce impactful innovations (Du et al., 2014).

Alliances with market-based partners, on the other hand, may be subject to shifting priorities of partners because of changes in leadership and middle management teams (Jiang et al., 2017; Reuer et al., 2002), leaving even an alliance with long-term goals (and good short-term performance) struggling because of resource reallocation and personnel turnover, among other factors (Carley, 1992; Pangarkar, 2009). Second, impactful innovations are less likely if the partners hold back resources or cooperation because of concerns that their advantages will be appropriated, concerns that are typically more salient in alliances with market-based partners because of overlapping goals and domains as well as competing interests. In fact, the desire of a firm to learn and acquire important and emerging technologies invented by scientists from its science-based partner which may be converted into commercial products and services at a later date is another factor helping collaboration (and reducing competition) in an alliance with a science-based partner (Gesing et al., 2015). These twin factors of lower appropriation concerns and the desire to learn the complementary knowledge of a science-based partner will reduce obstacles to sharing, and increase the likelihood of impactful innovations. Hence, we propose.

Hypothesis 1

Ceteris paribus, a firm with a portfolio of alliances with science-based partners will produce more high-impact innovations than a firm without a similar portfolio.

Market-based partners and low-impact innovations

A firm that has alliances with market-based partners is less likely to produce impactful innovations as argued below. First, in an alliance between two market-based firms, pursuit of private gains by each partner may result in conflicting interests among them and encourage opportunistic behaviors (Wu, 2012). In this regard, each partner may be guarded in terms of contributing its expertise and knowledge to the collaboration for fear of helping a present or future competitor (Wu, 2014). Moreover, as the partners in a market-based alliance are typically aiming for quick benefits, they are less likely to invest substantially in long-term projects that require sustained investments, thus reducing the likelihood of high-impact innovations (Gretsch et al., 2019). For these reasons, a firm with market-based alliance partners may be less likely to generate impactful innovations.

Alliances with market-based partners may be appropriate for achieving incremental innovations however, because the partners have: common goals in terms of coming up with successful commercial products (Ahuja, 2000; Wu, 2011); appropriate resources to achieve incremental innovations (Agarwal & Cockburn, 2003; Lowe & Ziedonis, 2006); and the opportunity to achieve scale economies because of overlapping domains. Concerns about sharing of intellectual property or leakage are also likely to be less salient because incremental innovations, by definition, do not build on radically different knowledge bases and the realization of profits may depend more on the possession of complementary assets by the partners than on the enforcement of property rights (Anton & Yao, 1994; Teece, 1986).

Hence, we propose the following hypothesis.

Hypothesis 2

Ceteris paribus, a firm with a portfolio of alliances with market-based partners will produce more low-impact innovations than a firm without a similar portfolio.

The moderating effects of board members’ academic experience and industrial interlock

The concept of BOD social capital was introduced by Hillman and Dalziel (2003) to capture the ability of the BOD to connect with the external environment and provide resources to the firm (Haynes & Hillman, 2010). Prior studies have highlighted the important role of the BOD’s social capital in improving financial performance through market-based and science-based alliances (Gesing et al., 2015). In the context of the present study, BODs’ social capital serves as a key channel to link with the external environment, leading to several benefits for their firms (Bendig et al., 2020; Chen et al., 2013; Han et al., 2015). Specifically, the BOD may offer advice and counsel to the firm on who to form alliances with and also facilitate the forging of the relationships by lending their personal connections and legitimacy (Salancik & Pfeffer, 1978). BOD may also help in smoothing out disagreements and conflicts. Hence, we submit that BOD’s social capital will serve as an important contingency for the relationship between market-based and science-based alliances on the one hand, and innovation performance on the other hand (Hillman & Dalziel, 2003; Sauerwald et al., 2016).

We consider two types of BOD social capital that are relevant to the relationship being examined in this paper: academic experience and industrial interlock (e.g., Richard et al., 2019; Wu et al., 2022). BOD academic experience refers to the (prior or current) academic experience and positions that Board members hold and we argue below that it will strengthen the effect of having science-based partners on impactful innovations. The synergistic possibilities arising out of academics serving on boards have begun to be recognized over the last couple of decades with the percentage of senior academics who serve on the boards of private firms steadily going up since the early 2000s (The New York Times, 2010). The trend is evident in emerging markets such as China, as well (Zhuang et al., 2018). Many senior Chinese academics serve on boards of companies and Chinese academics continue to be sought-after for their expertise and the connections they provide. Given the rich history of spinoffs based on technology from Chinese universities, many senior managers also have an academic background (Li, 2010).

Academic experience and linkages of the BOD can help a firm’s alliance with a science-based partner for several reasons. First, a Board with academic experience may be better able to help synergize the different resources of the firm and its science-based partner. For example, Board members with academic experience can guide the firm towards appropriate resources (such as university equipment or intellectual capital) as well as allocate the most qualified and experienced persons to the critical activities with the partner so as to maximize the performance of the collaboration. Personal connections of the BOD with science-based partners can be useful for tapping into the key resources of science-based partners (e.g., key University staff) which can be critical for innovation (Belliveau et al., 1996). BOD’s social capital (within and outside) can thus help to secure the most appropriate and/ or valuable human resources in the firm as well as the science-based partner to maximize impact (Chen et al., 2013).

Second, a BOD with academic experience can effectively alleviate any actual or potential conflicts between the goals and motivations of the firm and those of its science-based partner. Since the alliances between a firm and a science-based partner involve entities that may have different cultures and modes of operation, conflicts may arise during the tenure of the alliance—e.g., in matters such as communication, time horizon, and resource allocation. Under the leadership of a BOD with academic experience, such conflicts, and the fallouts arising from them, can be reduced, or even eliminated.

Essentially, when a BOD has academic experience, its connections with science-based partners (e.g., personal relationships with the administration as well as alumni) can build trust with those partners, in turn facilitating communication and improving the overall knowledge-sharing between the two parties. Since the support of the BOD and their academic experience together are likely to help in synergizing the resources of the partners in multiple ways as noted above, we propose the following hypothesis.

Hypothesis 3

The relationship posited in H1 will be strengthened by the academic experience of the directors of the board.

Board industrial interlocks refer to directorships that Board members hold at other for-profit firms (Salancik & Pfeffer, 1978; Stevenson & Radin, 2009; Tian et al., 2011). These interlocks function “as a conduit to disseminate ideas and innovations” (Galaskiewicz & Wasserman, 1989, p. 456), and the diffusion of practices through these interlocks enables a firm to become acquainted with the best industry practices (Shropshire, 2010) facilitating its incremental innovation by following and building on prior (successful) examples. In this regard, Srinivasan et al. (2018) conclude that board interlocks provide structural pathways for information flows across firms, thereby creating an alternative mechanism for knowledge flow and resulting in higher innovation through the launch of more new products, especially incrementally improved products. Specifically, industrial interlocks help reduce communication costs and conflicts between partners which are critical in market-based alliances where partners might have less tolerance for ambiguity, uncertainty, or delays. In the empirical context of our study (China), Board interlocks might also facilitate resource acquisition—e.g., a private firm with executives of top state-owned enterprises on its board may be able to access the latter’s resources (Peng & Luo, 2000) and avoid strategic errors such as overinvestment (Ying et al., 2013). Industrial interlocks thus facilitate both the leveraging of commonalities across partners as well as reconciling the differences between them to achieve greater incremental innovation. Hence, we propose the following hypothesis:

Hypothesis 4

Ceteris paribus, the relationship posited in H2 is strengthened by the industrial interlock of the directors of the board.

The research model for the study is shown in Fig. 1.

Data and methods

Data and sample

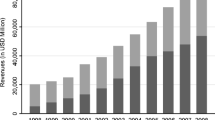

We tested our hypotheses on a dataset of listed Chinese firms spanning the years 2000 to 2010. We chose this sample period because most firm-level financial information is only available since the year 2000, and the data on the firm-university alliances, which was collected manually, was available until the year 2010. We believe that this time span gives a sufficiently large sample to test our hypothesized relationships.

Over the past two decades, many Chinese firms have been actively using alliances with other firms and universities to enhance their innovation performance and their BODs, armed with its social capital, have played an important role in this process (Luo, 2003; Wang et al., 2014). We constructed a longitudinal dataset for this study by drawing on multiple sources. First, we manually collected the data on the firm-university alliance from various sources, including the official websites of firms and universities as well information from secondary sources. Second, we extracted firm-level basic information (e.g., firm age, firm size) and financial information (e.g., return on assets, R&D intensity) from the China Stock Market Accounting Research (CSMAR) Corporate Financial Statements sub-database and Corporate Financial Index Analysis sub-database, respectively. Third, we obtained information on the BOD (e.g., Board interlocks and Board academic experience) and other data (e.g., firm ownership) of each publicly listed Chinese company from CSMAR’s Corporate Stockholder sub-database and the Corporate Characters Features sub-database, respectively. We then linked these datasets by unique company names. After deleting missing observations, we had an unbalanced panel data constructed with 10,001 observations covering 1507 firms. Finally, we also obtained information on these companies’ technological alliances and innovation performance from the State Intellectual Property Office (SIPO). We then merged the data from different sources to assemble a comprehensive dataset consisting of 3608 firm-year observations on 664 firms.

Measures

Dependent variables

Similar to several prior studies, we identify impactful innovations based on the citations received by patents, specifically citation-weighted patent counts (Ahuja & Morris Lampert, 2001; Brem et al., 2016; Dahlin & Behrens, 2005). Patent citations have been shown to be good measures of the quality of innovation by prior studies (Carpenter et al., 1981; Trajtenberg, 1990; Wu et al., 2019).

We obtained data on patents spanning the period 1983–2014 from the State Intellectual Property Office (SIPO), People’s Republic of China, which provides detailed information about the patent application number, patent grant number, assignees, as well as the reference of each patent, among other types of information. Following prior studies using patent citation methodologies (Hall et al., 2001; Trajtenberg, 1990), we first identified the yearly counts of patents that each sampled firm was granted. Secondly, we computed the yearly number of citations received by each patent while excluding self-citations (i.e., forward citations by year). Then, we summed up the yearly number of citations received by each patent for the six years prior to the observation year. Recent studies have suggested that (a) the most heavily cited patents are the most valuable (Trajtenberg, 1990), and (b) the value distribution of patents is highly skewed as a few patents are very valuable, while most patents have relatively low values (Griliches, 1990). We used the top 3% of values for citation-weighted patent counts to distinguish between high-impact vs. low-impact innovations (Ahuja & Morris Lampert, 2001; Dahlin & Behrens, 2005).

Patents with citation-weight patent counts above the threshold value (4601 patents) were classified as high-impact innovations, while patents with citation-weight patent counts below the threshold value (202,223 patents) were classified as low-impact innovations. We then computed firm-year level counts of the patents in each of the categories—high-impact and low-impact to arrive at values of the innovations variables.

Predictor variables

We measured the science-based alliances variable by the number of technology alliances that a focal firm formed with universities. It is noteworthy that almost all universities in China were publicly funded for the time period covered by our study, thus providing a strong justification for treating universities as employing an institutional logic (science-based organizations) that is clearly distinct from the private firms’ market logic. The mean value of science-based innovation alliances was 0.597.

We operationalized the market-based alliances variable by counting the number of alliances a focal firm had with other firms for R&D activities (Hagedoorn, 1993; Mowery et al., 1998). The mean value of market-based alliances was 7.285. Thus, market-based alliances were more frequent than science-based alliances, which was not surprising. In terms of sheer numbers, the population of firms is larger and hence a firm can form multiple alliances with other firms to pursue specific, sometimes narrowly defined, projects. These relationships can be formed quickly and disbanded quickly as well. Relationships with universities, which are fewer in number, are likely to take longer to form, and hence less frequent.

Moderator variables

Following prior studies, we operationalized Board industrial interlocks by counting the number of directorships that Board members held at other for-profit corporations (Haynes & Hillman, 2010; Wu et al., 2022). The mean value of Board industrial interlocks was 0.340. On the other hand, we operationalized Board academic experience by counting the number of academic positions that BOD held in various universities. The mean value of the BOD academic experience was 0.018. Board industrial interlocks thus occur far more frequently than BOD academic experience, possibly because directors in any firm are more likely to know directors in other firms rather than academics. Also, directors are likely to have industrial and commercial expertise that is more useful to other firms and, from a purely probabilistic perspective, firms are more numerous than universities.

Control variables

We controlled for several alternative explanations for the variation in the dependent variable. First, we included firm age, measured as the number of years from the firm’s original establishment (George et al., 2002; Mindruta, 2013). Second, prior studies have suggested that firm size matters with respect to both the types of relationships that firms have with universities as well as their strategic implications (Ettlie et al., 1984; Rothaermel & Thursby, 2005; Santoro & Chakrabarti, 2002). Hence, we included firm size, measured as the log of total assets, as a control variable. Third, we controlled for a firm’s R&D intensity, which we measured by the ratio of R&D expenditure to its total sales. Fourth, we accounted for a firm’s performance, proxied by its return on assets (Ahuja & Morris Lampert, 2001). We also controlled for firm ownership by including two variables: State ownership, which we measured by the equity stake owned by the State, and foreign ownership, which we measured by the equity stake owned by foreign investors. In addition, since the sample firms were from multiple industries, we included dummy variables for different industries. Finally, we also included year dummy variables in the regressions.

Econometric modeling

Because our dependent variable was measured by the number of high-impact/low-impact patents granted to a firm, a linear regression model was not appropriate and would have led to biased and inconsistent coefficient estimates. Therefore, we chose the categorical data regression model (Agresti, 2002). One key concern with categorical data regression models is that the variance may exceed the mean. Poisson regression is often employed to deal with the problems associated with the use of count data for dependent variables, but its limitation lies in the assumption that the variance of the dependent variable must equal the mean. To overcome this limitation, we used negative binomial regression estimation which allows the mean of the dependent variable to vary. It is written as

where X is a set of explanatory variables, β is the coefficient, and e is the random error. We specified the distribution of \(\delta\) with the parameter k and wrote the probability density function of \(\delta\) as g(δ), specified as:

Negative binomial distribution models the probability mass function as:

with the distribution mean of \(E(Y^{t} ) = u\) and a variance of \(VAR(Y^{t} ) = u + \frac{{u^{2} }}{k}\). With equations nos (2) and (3) specified, the maximum likelihood method could be applied to estimate the final regression model.

Results

Table 1 provides the descriptive statistics and the correlation matrix. It is evident that all the key variables in our dataset exhibit significant variation. We investigated potential multicollinearity issues by using variance inflation factors (VIFs). The maximum VIF was 1.32, which was deemed to be acceptable (Johnston et al., 2018; Li et al., 2007; Ryan, 1997). Regardless, we mean- centred all independent variables before calculating interaction terms (Aiken & West, 1991).

Table 2 presents the results of the panel data regressions for high-impact innovation (Models 1–3) and low-impact innovation (Models 4–6). Models 1 and 4 only included the control variables. Models 2 and 5 added the main effects of the predictors, respectively. Model 3 added the interaction term, Science-based partners * Board academic experience. Model 6 added the interaction term, Market-based partners * Board industrial interlocks. The Log-likelihood ratio and AIC statistics show that the inclusion of additional variables improved the fit of the baseline models (i.e., Models 1 and 4).

Hypothesis 1 predicts that a firm with a more extensive portfolio of alliances with science-based partners will have more innovations with high-impact than a firm without ssuch a portfolio. In Table 2, the coefficient for the main effect of the science-based alliances is positive and highly significant (i.e., β = 0.090, p = 0.009 in Model 2). Hence, Hypothesis 1 was supported. On the other hand, Hypothesis 2 predicts that a firm with a more extensive portfolio of alliances with market-based partners will have more innovations with low-impact than firms without such a portfolio. In Table 2, the coefficient for the main effect of the science-based alliance is positive and highly significant (i.e., β = 0.073, p = 0.000 in Model 5), supporting Hypothesis 2.

Hypothesis 3 predicts that the academic experience of the directors of the board will strengthen the positive effect of science-based alliances on impactful innovations. The coefficient for the interactive term, Science-based * Board academic experience, is positive and insignificant (i.e., β = 3.207, p = 0.036 in Model 3), suggesting that the positive effect of science-based alliances on producing innovations with high-impact is enhanced when the level of academic experience of the Board members is higher. To better understand the above relationship, we plotted Fig. 2 where both lines have a positive slope, but the dotted line representing firms with BOD academic experience is much steeper than the solid line that represents firms whose BOD have low academic experience. Figure 2, thus, supports the conclusion from the regression analysis that BOD academic experience significantly strengthens the positive effect of science-based partners on high-impact innovation. Therefore, Hypothesis 3 was supported.

Hypothesis 4 predicts that the industrial interlock of the Board members will strengthen the positive effect of market-based alliances on innovations with low-impact. The coefficient for the interactive term, Market-based partners * Board industrial interlock in Table 2, was positive and significant (i.e., β = 0.119, p = 0.075 in Model 6). To better understand the relationship, we plotted Fig. 3 where the solid line represents firms with low-level board industrial interlock. In Fig. 3, while both the lines have a positive slope, the dotted line that represents firms with Board industrial interlocks is steeper than the solid line representing firms without Board industrial interlocks, supporting the conclusion from regression analysis that Board industrial interlocks significantly strengthen the positive effect of market-based partners on innovations with low-impact. Therefore, Hypothesis 4 was supported.

Robustness analyses

Endogeneity is a common concern in regression and may lead to biased coefficient estimates. For example, some omitted variables at the firm level may simultaneously affect firms’ decisions to form R&D alliances and their innovation performance. Hence, if endogeneity is not accounted for, the regression results will not be causally interpretable because the effects on innovation performance due to the unobservable variables will be attributed to endogenous variables. We used a two-stage, least-squared (2SLS) model with instrumental variables to address this potential endogeneity problem. Following prior research (Robin & Schubert, 2013; Storz et al., 2022), we used the total number of universities in the province where the firm was headquartered divided by the total population of that province as the Instrumental Variable (IV). The rationale is that the IV will directly affect the firms’ decisions about forming R&D alliances with a university or firm, but is unlikely to influence firms’ innovation performance directly. We first tested the validity of the instrumental variable. The Cragg-Donald Wald F statistics with a value of 81.653 was statistically significant with a p-value well below 10% since the Stock-Yogo weak ID test critical value in the 10% maximal IV size was 16.38, indicating that the IV is an exogenous one. The Anderson canonical correlation LM statistics was 80.255, statistically significant (at p = 0.000), indicating that the number of IVs was sufficient. Taken together, these results suggest that the instrumental variable is good and sufficient. We further took the logarithm of the dependent variable and re-ran the analysis in Table 2 using the instrumental method. The results of these robustness analyses are shown in Table 3.

As shown in Table 3, the coefficient for Science-based partners was positive and significant (i.e., β = 0.097, p = 0.070 in Model 2), which supports Hypothesis 1. The coefficient for Science-based alliance was also positive and significant (i.e., β = 0.662, p = 0.013 in Model 5), supporting Hypothesis 2. Moreover, the coefficient for the interactive term, Science-based partners * Board academic experience was positive and significant (i.e., β = 1.087, p = 0.094 in Model 3). Hence, Hypothesis 3 was supported. The coefficient for the interactive term, Market-based partners * Board industrial interlock in Table 2 was also positive and significant (i.e., β = 0.012, p = 0.033 in Model 6). Hence, Hypothesis 4 was also supported. These results lend further support to all four hypotheses.

As noted in the “Introduction” section, prior studies on this topic have varied approaches and findings. Du et al. (2014) examined the implications of having market-based and science-based partners on financial performance. Ettlie et al. (1984) found that different internal strategies (e.g., concentration of technical specialists or centralization of decision-making) are required for radical versus incremental innovation. Based on analyses of data from China, Cao et al. (2023) found that basic science by Universities has a U-shaped relationship with firm-level innovation under specific contingencies (e.g., location in a few Chinese provinces and in special economic zones). It is evident that with a different research question and a rigorous modeling approach, our study has enhanced the literature on this important topic.

Discussion and conclusion

Implications for theory

To our knowledge, this study is the first in the open innovation literature to systematically investigate the relationship between alliances with different types of partners and innovation performance, as well as the boundary conditions for these relationships. Our rigorous analyses of a comprehensive dataset show that alliances with science-based partners lead to impactful innovations and this relationship is strengthened by the academic experience of the Board of directors. On the other hand, a firm with market-based partners tends to produce low-impact innovations, which is strengthened by the industrial interlock of the Board of directors. As discussed below, the findings of this study help us make important contributions to the open innovation literature.

First, as noted in the “Introduction” section, this study fills a lacuna in the literature. Though there are a few studies on managing open innovation with market-based and science-based partners (e.g., Belderbos et al., 2014; Du et al., 2014; Gretsch et al., 2019), inadequate efforts have been devoted to clarifying the theoretical rationale behind why alliances with market-based and science-based partners lead to distinct innovation outcomes and also the boundary conditions for the relationships between the different types of alliances and innovation outcomes. We adopted a comprehensive approach that drew on multiple theoretical perspectives and included both internal and external factors to examine the key relationships of interest to us.

Specifically, we identified alignment across partners in terms of their goals, priorities, and skills as the key factors driving the relationship between the type of alliance and the type of innovation outcome. We also accounted for boundary conditions for this relationship in the form of the BOD’s social capital, addressing another gap in the prior studies. For instance, while a few prior studies have identified the BOD’s social capital as a key contingent factor (Gretsch et al., 2019; Hillman & Dalziel, 2003), they have examined it briefly (Thornton et al., 2012; Wu, 2014). Our study has thus enriched the literature by exploring how BOD social capital moderates the relationships between market-based and science-based alliances on the one hand, and innovation performance on the other hand. Our analyses suggest that a more accurate and complete understanding of managing open innovation with market-based or science-based partners requires the integration of both external (partner characteristics) and internal (BOD) viewpoints because innovation is a multifaceted phenomenon that can benefit from varied inputs from different stakeholders (Dahlander & Gann, 2010).

Third, this study contributes to the literature by extending existing studies to emerging markets. While there are important findings on the relationships between managing open innovation with market-based and science-based partners and innovation performance, prior analyses of this relationship have largely been limited to developed economies (Belderbos et al., 2014; Srivastava & Gnyawali, 2011). We address this blind spot by shifting the attention from developed economies to China. In addition to being one of the largest emerging economies, China also represents a context where a few indigenous firms have successfully developed many innovative products with high-impact. Our approach, grounded in sound conceptual arguments and rigorous empirical analyses, thus complements the existing literature on open innovation, specifically on the types of alliances and the types of innovation as well as the boundary conditions for the relationships between the different types of alliances and different types of innovation.

Implications for practice

This study has several practical implications. First, a key message for firms is that firms and managers should align their alliance strategy with their innovation goals while paying attention to the implications of similar or different logic of partners on innovations resulting from the alliances. In this regard, partnering with local Chinese universities may offer ripe opportunities to Chinese firms since many Chinese universities receive substantial funding from the Chinese government and hence are able to have the long-term orientation that can help them develop impactful innovations.

Second, our findings on the social capital of the Board of directors can help firms fill gaps in their strategy. Firms aiming for impactful innovations might consider recruiting board members with academic linkages which can open up possibilities of collaborations with universities. Firms more focused on lower-impact commercial innovations, on the other hand, may look to recruit board members who serve on boards of other for-profit firms.

Moreover, while our empirical analyses were based on data from China, the insights learned could be leveraged in a wider range of firms and contexts. Many developing countries and their firms are also aiming to boost their innovation capability as their access to technologies from traditional sources (e.g., developed country firms or institutions such as Universities) becomes uncertain and also because the firms and their home countries are looking to offer higher value-added products. In this regard, our study suggests that developing country governments should encourage firms to partner with universities in order to generate more innovations with high-impact. In their desire to quickly catch up with their developed country rivals, firms may not view Universities as current or potential partners. But, if firms create synergistic collaborations with Universities, they may be able to come up with more impactful innovations (Doblinger et al., 2019). Emerging market firms can also forge alliances with market-based partners to improve their chances of producing low-impact innovations that can provide quicker returns, and possibly support their long-term orientation. In other words, developing country firms can pursue a portfolio of alliances with different types of partners to achieve different types of innovation.

Limitations

We acknowledge two limitations of our study. First, while patent citations have been frequently used to distinguish between high-impact versus low-impact citations, they have their limitations, specifically for commercial innovations since the value of one patent may be dramatically different depending on the industry and the context. Second, while we used a rich dataset for our analyses, it consists of firms from only China. Future studies may address this limitation by replicating our study in other countries, especially other developing countries.

Concluding remarks

This study investigated the different effects of managing open innovation with market-based partners and science-based partners on innovation performance and the boundary conditions for these relationships. The key idea for this study was that factors internal to partners (specifically the social capital of their boards) combined with the profiles of the partners (e.g., market-based versus science-based) leads to a more complete understanding of the the outcome in terms of low-impact versus high-impact innovations. We believe these findings will stimulate more research on this important topic.

Data availability

The author team affirms that the data can be obtained upon request.

References

Agarwal, A., & Cockburn, I. (2003). The anchor tenant hypothesis: Exploring the role of large, local, R&D-intensive firms in regional innovation systems. International Journal of Industrial Organization, 21(9), 1227–1253.

Agresti, A. (2002). Categorical data analysis. Hoboken.

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly, 45(3), 425–455.

Ahuja, G., & Morris Lampert, C. (2001). Entrepreneurship in the large corporation: A longitudinal study of how established firms create breakthrough inventions. Strategic Management Journal, 22(6–7), 521–543.

Aiken, L. S., & West, S. G. (1991). Multiple regression: Testing and interpreting interactions. Sage Publications Inc.

Anton, J. J., & Yao, D. A. (1994). Expropriation and inventions: Appropriable rents in the absence of property rights. The American Economic Review, 190–209.

Belderbos, R., Cassiman, B., Faems, D., Leten, B., & Van Looy, B. (2014). Co-ownership of intellectual property: Exploring the value-appropriation and value-creation implications of co-patenting with different partners. Research Policy, 43(5), 841–852.

Belliveau, M. A., O’Reilly, C. A., III., & Wade, J. B. (1996). Social capital at the top: Effects of social similarity and status on CEO compensation. Academy of Management Journal, 39(6), 1568–1593.

Bendig, D., Foege, N., Endriß, S., & Brettel, M. (2020). The effect of family involvement on innovation outcomes: The moderating role of board social capital. Journal of Product Innovation Management, 37(3), 249–272.

Brem, A., Nylund, P. A., & Schuster, G. (2016). Innovation and de facto standardization: The influence of dominant design on innovative performance, radical innovation, and process innovation. Technovation, 50, 79–88.

Cao, Q., Li, Y., & Peng, H. (2023). From university basic research to firm innovation: Diffusion mechanism and boundary conditions under a U-shaped relationship. Technovation, 123, 102718.

Carley, K. (1992). Organizational learning and personnel turnover. Organization Science, 3(1), 20–46.

Carpenter, M. P., Narin, F., & Woolf, P. (1981). Citation rates to technologically important patents. World Patent Information, 3(4), 160–163.

Chen, H. L., Ho, M. H. C., & Hsu, W. T. (2013). Does board social capital influence chief executive officers’ investment decisions in research and development? R&D Management, 43(4), 381–393.

Chesbrough, H. W. (2003). Open innovation: The new imperative for creating and profiting from technology. Harvard Business Press.

Dahlander, L., & Gann, D. M. (2010). How open is innovation? Research Policy, 39(6), 699–709.

Dahlin, K. B., & Behrens, D. M. (2005). When is an invention really radical? Defining and measuring technological radicalness. Research Policy, 34(5), 717–737.

Doblinger, C., Surana, K., & Anadon, L. D. (2019). Governments as partners: The role of alliances in US cleantech startup innovation. Research Policy, 48(6), 1458–1475.

Du, J., Leten, B., & Vanhaverbeke, W. (2014). Managing open innovation projects with science-based and market-based partners. Research Policy, 43(5), 828–840.

Ettlie, J. E., Bridges, W. P., & O’keefe, R. D. (1984). Organization strategy and structural differences for radical versus incremental innovation. Management Science, 30(6), 682–695.

Eun, J.-H., Lee, K., & Wu, G. (2006). Explaining the “University-run enterprises” in China: A theoretical framework for university-industry relationship in developing countries and its application to China. Research Policy, 35(9), 1329–1346.

Faems, D., Van Looy, B., & Debackere, K. (2005). Interorganiztaional collarboration and innovation: Toward a portfolio approach. Journal of Product Innovation Management, 22(3), 238–250.

Galaskiewicz, J., & Wasserman, S. (1989). Mimetic processes within an interorganizational field: An empirical test. Administrative Science Quarterly, 454–479.

George, G., Zahra, S. A., & Wood, D. R. (2002). The effects of business–university alliances on innovative output and financial performance: A study of publicly traded biotechnology companies. Journal of Business Venturing, 17(6), 577–609.

Gesing, J., Antons, D., Piening, E. P., Rese, M., & Salge, T. O. (2015). Joining forces or going it alone? On the interplay among external collaboration partner types, interfirm governance modes, and internal R&D. Journal of Product Innovation Management, 32(3), 424–440.

Gretsch, O., Salzmann, E. C., & Kock, A. (2019). University-industry collaboration and front-end success: The moderating effects of innovativeness and parallel cross-firm collaboration. R&D Management, 49(5), 835–849.

Griliches, Z. (1990). Patent statistics as economic indicators: A survey. Journal of Economic Literature, 28, 1661–1707.

Hagedoorn, J. (1993). Understanding the rationale of strategic technology partnering: Interorganizational modes of cooperation and sectoral differences. Strategic Management Journal, 14(5), 371–385.

Hagedoorn, J., Link, A. N., & Vonortas, N. S. (2000). Research partnerships. Research Policy, 29(4–5), 567–586.

Hall, B. H., Jaffe, A. B., & Trajtenberg, M. (2001). The NBER patent citation data file: Lessons, insights and methodological tools. Working paper no. 8498. National Bureau of Economic Research.

Han, J., Bose, I., Hu, N., Qi, B., & Tian, G. (2015). Does director interlock impact corporate R&D investment? Decision Support Systems, 71, 28–36.

Haynes, K. T., & Hillman, A. (2010). The effect of board capital and CEO power on strategic change. Strategic Management Journal, 31(11), 1145–1163.

Hillman, A. J., & Dalziel, T. (2003). Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Academy of Management Review, 28(3), 383–396.

Howells, J., & Nedeva, M. (2003). The international dimension to industry-academic link. International Journal of Technology Management, 25(1–2), 5–17.

Jiang, X., Jiang, F., Arino, A., & Peng, M. (2017). Uncertainty, adaptation and alliance performance. IEEE Transactions on Engineering Management, 64(4), 606–616.

Johnston, R., Jones, K., & Manley, D. (2018). Confounding and collinearity in regression analysis: A cautionary tale and an alternative procedure, illustrated by studies of British voting behavior. Quality and Quantity, 52(4), 1957–1976.

Kafouros, M., Wang, C., Piperopoulos, P., & Zhang, M. (2015). Academic collaborations and firm innovation performance in China: The role of region-specific institutions. Research Policy, 44(3), 803–817.

Lee, Y. S. (1996). Technology transfer and the research university: A search for the boundaries of university-industry collaboration. Research Policy, 25(6), 843–863.

Li, J. (2010). Global R&D alliances in China: Collaborations with universities and research institutes. IEEE Transactions on Engineering Management, 57(1), 78–87.

Li, J., Yang, J. Y., & Yue, D. R. (2007). Identity, community, and audience: How wholly owned foreign subsidiaries gain legitimacy in China. Academy of Management Journal, 50(1), 175–190.

Lin, Z., Peng, M. W., Yang, H., & Sun, S. L. (2009). How do networks and learning drive M&As? An institutional comparison between China and the United States. Strategic Management Journal, 30(10), 1113–1132.

Lowe, R. A., & Ziedonis, A. A. (2006). Overoptimism and the performance of entrepreneurial firms. Management Science, 52(2), 173–186.

Luo, Y., & Tung, L. (2007). International expansion of emerging market enterprises: A springboard perspective. Journal of International Business Studies, 38, 481–498.

Luo, Y. D. (2003). Industrial dynamics and managerial networking in an emerging market: The case of China. Strategic Management Journal, 24(13), 1315–1327.

Mansfield, E., & Lee, J.-Y. (1996). The modern university: Contributor to industrial innovation and recipient of industrial R&D support. Research Policy, 25(7), 1047–1058.

Mindruta, D. (2013). Value creation in university-firm research collaborations: A matching approach. Strategic Management Journal, 34(6), 644–665.

Mowery, D. C., Oxley, J. E., & Silverman, B. S. (1998). Technological overlap and interfirm cooperation: Implications for the resource–based view of the firm. Research Policy, 27(5), 507–523.

Pangarkar, N. (2009). Do firms learn from alliance terminations: An empirical examination. Journal of Management Studies, 46(6), 982–1004.

Peng, M. W., & Luo, Y. (2000). Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Academy of Management Journal, 43(3), 486–501.

Reuer, J. J., Zollo, M., & Singh, H. (2002). Post-formation dynamics in strategic alliances. Strategic Management Journal, 23(2), 135–151.

Richard, O., Wu, J., Markoczy, L., & Chung, Y. (2019). Top management team demographic-faultline strength and strategic change: What role does environmental dynamism play? Strategic Management Journal, 40(6), 987–1009.

Robin, S., & Schubert, T. (2013). Cooperation with public research institutions and success in innovation: Evidence from France and Germany. Research Policy, 42(1), 149–166.

Rossi, F., De Silva, M., Baines, N., & Rosli, A. (2022). Long-term innovation outcomes of university-industry collaborations: The role of bridging vs blurring boundary-spanning practices. British Journal of Management, 33(1), 478–501.

Rothaermel, F. T., & Thursby, M. (2005). University-incubator firm knowledge flows: Assessing their impact on incubator firm performance. Research Policy, 34(3), 305–320.

Ryan, T. Y. (1997). Modern regression analysis. Wiley.

Salancik, G. R., & Pfeffer, J. (1978). A social information processing approach to job attitudes and task design. Administrative Science Quarterly, 224–253.

Santoro, M. D., & Chakrabarti, A. K. (2002). Firm size and technology centrality in industry–university interactions. Research Policy, 31(7), 1163–1180.

Sappington, D. E., & Sidak, J. G. (2003). Incentives for anticompetitive behavior by public enterprises. Review of Industrial Organization, 22, 183–206.

Sauerwald, S., Lin, Z., & Peng, M. W. (2016). Board social capital and excess CEO returns. Strategic Management Journal, 37(3), 498–520.

Shropshire, C. (2010). The role of the interlocking director and board receptivity in the diffusion of practices. Academy of Management Review, 35(2), 246–264.

Srinivasan, R., Wuyts, S., & Mallapragada, G. (2018). Corporate board interlocks and new product introductions. Journal of Marketing, 82(1), 132–148.

Srivastava, M. K., & Gnyawali, D. R. (2011). When do relational resources matter? Leveraging portfolio technological resources for breakthrough innovation. Academy of Management Journal, 54(4), 797–810.

Stevenson, W. B., & Radin, R. F. (2009). Social capital and social influence on the board of directors. Journal of Management Studies, 46(1), 16–44.

Storz, C., ten Brink, T., & Zou, N. (2022). Innovation in emerging economies: How do university-industry linkages and public procurement matter for small businesses? Asia Pacific Journal of Management, 39(4), 1439–1480.

Teece, D. J. (1986). Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Research Policy, 15(6), 285–305.

The New York Times. (2010). Neoliberalism and the Academic-Industrial Complex. Retrieved from https://truthout.org/articles/neoliberalism-and-the-academicindustrial-complex/

Thornton, P. H., Ocasio, W., & Lounsbury, M. (2012). The institutional logics perspective: A new approach to culture, structure and process. Oxford University Press.

Tian, J., Haleblian, J., & Rajagopalan, N. (2011). The effects of board human and social capital on investor reactions to new CEO selection. Strategic Management Journal, 32(7), 731–747.

Trajtenberg, M. (1990). A penny for your quotes: Patent citations and the value of innovations. The Rand Journal of Economics, 21, 172–187.

Wang, C., Rodan, S., Fruin, M., & Xu, X. (2014). Knowledge networks, collaboration networks, and exploratory innovation. Academy of Management Journal, 57(2), 484–514.

Wu, J. (2011). The asymmetric roles of business ties and political ties in product innovation. Journal of Business Research, 64(11), 1151–1156.

Wu, J. (2012). Technological collaboration in product innovation: The role of market competition and sectoral technological intensity. Research Policy, 41(2), 489–496.

Wu, J. (2014). The effect of external knowledge search and CEO tenure on product innovation: Evidence from Chinese firms. Industrial and Corporate Change, 23(1), 65–89.

Wu, J., Harrigan, K. R., Ang, S. H., & Wu, Z. (2019). The impact of imitation strategy and R&D resources on incremental and radical innovation: Evidence from Chinese manufacturing firms. The Journal of Technology Transfer, 44, 210–230.

Wu, J., Richard, O. C., Triana, M. D. C., & Zhang, X. (2022). The performance impact of gender diversity in the top management team and board of directors: A multiteam systems approach. Human Resource Management, 61(2), 157–180.

Ying, Q., Luo, D., & Wu, L. (2013). Bank credit lines and overinvestment: Evidence from China. The International Journal of Business and Finance Research, 7(2), 43–52.

Zhuang, Y., Chang, X., & Lee, Y. (2018). Board composition and corporate social responsibility performance: evidence from chinese public firms. Sustainability, 10(8), 2752.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wu, J., Pangarkar, N., Shi, X. et al. Managing open innovation with science-based vs. market-based partners: board of directors as a contingency. Asian Bus Manage (2024). https://doi.org/10.1057/s41291-023-00261-2

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41291-023-00261-2