Abstract

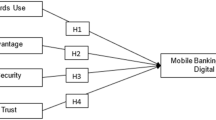

The Indian banking sector can take advantage of the proliferation of smartphones as well as the government’s encouragement of cashless transactions to accelerate the use of mobile and online banking. The purpose of this study is to understand the initial acceptance of mobile banking by existing online banking users. Few studies have focused on online banking users’ behavioural intention to use similar services (such as mobile banking) in India. To this end, a theoretical model was developed using the technology acceptance model, which was extended to cover the adoption factors that influence users of online banking to use mobile banking. These adoption factors comprise perceived ease of use, perceived security, mobile self-efficacy, social influence and customer support. The dependent variable is customers’ behavioural intention to use mobile banking. A partial least squares structural equation modelling analysis was used to test the theoretical model with sample data from 420 online banking customers of various public, private, foreign and co-operative banks in India. The study found that the adoption factors had a significant impact on customers’ behavioural intention to use mobile banking. The findings of this study provide insight into digital banking channels, contribute to existing research on digital banking adoption and will educate banks and financial institutions on the adoption of mobile banking in India.

Similar content being viewed by others

References

Alalwan, A., Y. Dwivedi, N. Rana, B. Lal, and M. Williams. 2015. Consumer adoption of Internet banking in Jordan: Examining the role of hedonic motivation, habit, self-efficacy and trust. Journal of Financial Services Marketing 20(2): 145–157.

Baabdullah, A.M., A.A. Alalwan, N.P. Rana, P. Patil, and Y.K. Dwivedi. 2019. An integrated model for m-banking adoption in Saudi Arabia. International Journal of Bank Marketing 37(2): 452–478.

Bandura, A. 1977. Self-efficacy: Toward a unifying theory of behavioral change. Psychological Review 84(2): 191–215.

Bandura, A. 1986. Social foundations of thought and action. Upper Saddle River, NJ: Prentice-Hall.

Barnes, S., and B. Corbitt. 2003. Mobile banking: Concept and potential. International Journal of Mobile Communications 1(3): 273.

BCG. 2019. Encashing on Digital: Financial services in 2020. The Boston Consulting Group, Facebook.

Bharti, M. 2016. Impact of dimensions of mobile banking on user satisfaction. The Journal of Internet Banking and Commerce 21(1): 1–22.

Bhatt, A., and S. Bhatt. 2016. Factors affecting customers adoption of mobile banking services. The Journal of Internet Banking and Commerce 21(1): 161.

Chen, L. 2008. A model of consumer acceptance of mobile payment. International Journal of Mobile Communications 6(1): 32.

Cheng, T., D. Lam, and A. Yeung. 2006. Adoption of internet banking: An empirical study in Hong Kong. Decision Support Systems 42(3): 1558–1572.

Chiu, J.L., N.C. Bool, and C.L. Chiu. 2017. Challenges and factors influencing initial trust and behavioral intention to use mobile banking services in the Philippines. Asia Pacific Journal of Innovation and Entrepreneurship 11(2): 246–278.

Compeau, D., and C. Higgins. 1995. Computer self-efficacy: Development of a measure and initial test. MIS Quarterly 9(2): 189.

Cruz, P., L.B.F. Neto, P. Munoz-Gallego, and T. Laukkanen. 2010. Mobile banking rollout in emerging markets: Evidence from Brazil. The International Journal of Bank Marketing 28(5): 342–371.

Danyali, A.A. 2018. Factors influencing customers’ change of behaviors from online banking to mobile banking in Tejarat Bank, Iran. Journal of Organizational Change Management 31(6): 1226–1233.

Davis, F.D. 1989. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly 13: 319–340.

De Leon, M.V. 2019. Factors influencing behavioural intention to use mobile banking among retail banking clients. Jurnal Studi Komunikasi 3(2): 118–137.

Fornell, C., and D.F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50.

Garland, R. 1991. The mid-point on a rating scale: Is it desirable. Marketing Bulletin 2(1): 66–70.

Geisser, S. 1974. A predictive approach to the random effect model. Biometrika 61(1): 101–107.

Ghani, M.A., S. Rahi, N.M. Yasin, and F.M. Alnaser. 2017. Adoption of internet banking: extending the role of technology acceptance model (TAM) with e-customer service and customer satisfaction. World Applied Sciences Journal 35(9): 1918–1929.

Giovanis, A., P. Athanasopoulou, C. Assimakopoulos, and C. Sarmaniotis. 2019. Adoption of mobile banking services. International Journal of Bank Marketing 37(5): 1165–1189.

Hair, J.F., R. Anderson, R. Tatham, and W. Black. 2006. Multivariate data analysis. 6th ed. Upper Saddle River, NJ: Prentice Hall.

Hair, J., C. Ringle, and M. Sarstedt. 2011. PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice 19(2): 139–152.

Hair, J.F., C.M. Ringle, and M. Sarstedt. 2013. Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Planning 46(1–2): 1–12.

Hamidi, H., and M. Safareeyeh. 2019. A model to analyze the effect of mobile banking adoption on customer interaction and satisfaction: A case study of m-banking in Iran. Telematics and Informatics 38: 166–181.

Hanafizadeh, P., M. Behboudi, A. Abedini Koshksaray, and M. Jalilvand ShirkhaniTabar. 2014. Mobile-banking adoption by Iranian bank clients. Telematics and Informatics 31(1): 62–78.

Harris, M., K.C. Cox, C.F. Musgrove, and K.W. Ernstberger. 2016. Consumer preferences for banking technologies by age groups. International Journal of Bank Marketing 34(4): 587–602.

Hassan, H.E., and V.R. Wood. 2020. Does country culture influence consumers’ perceptions toward mobile banking? A comparison between Egypt and the United States. Telematics and Informatics 46: 1–14.

Hinkin, T. 1998. A brief tutorial on the development of measures for use in survey questionnaires. Organizational Research Methods 1(1): 104–121.

Hong, S., and K. Tam. 2006. Understanding the adoption of multipurpose information appliances: The case of mobile data services. Information Systems Research 17(2): 162–179.

IBEF. 2019. Banking. India Brand Equity Foundation.

InMobi. 2019. The changing face of the Indian mobile user 2019 Mobile Marketing Handbook, Inmobi.

Jayawardhena, C. 2004. Measurement of service quality in internet banking: The development of an instrument. Journal of Marketing Management 20(1/2): 185–207.

Jeong, B.K., and T.E. Yoon. 2013. An empirical investigation on consumer acceptance of mobile banking services. Business and Management Research 2(1): 31–40.

Juniperresearch.com. 2019. Mobile banking users to exceed 1.75 billion by 2019, representing 32% of the global adult population. [online] https://www.juniperresearch.com/press-release/digital-banking-pr1. Accessed 20 March 2019.

Khalifa, M., and K.N. Shen. 2008. Drivers for transactional B2C m-commerce adoption: Extended theory of planned behavior. Journal of Computer Information Systems 48(3): 111.

Khan, M.S., and S.S. Mahapatra. 2009. Service quality evaluation in internet banking: an empirical study in India. International Journal of Indian Culture and Business Management 2(1): 30–46.

Khasawneh, M.H.A. 2015. A mobile banking adoption model in the jordanian market: An integration of TAM with perceived risks and perceived benefits. Journal of Internet Banking and Commerce 20: 128.

Koksal, M. 2016. The intentions of Lebanese consumers to adopt mobile banking. International Journal of Bank Marketing 34(3): 327–346.

KPMG. 2019. Fintech in India—Powering mobile payments. KPMG.

Laforet, S., and X. Li. 2005. Consumers’ attitudes towards online and mobile banking in China. International Journal of Bank Marketing 23(5): 362–380.

Laukkanen, Tommi, and Pasanen Mika. 2008. Mobile banking innovators and early adopters: How they differ from other online users? Journal of Financial Services Marketing 13(2): 86–94.

Lin, H.F. 2013. Determining the relative importance of mobile banking quality factors. Computer Standards and Interfaces 35(2): 195–204.

Luarn, P., and H.H. Lin. 2005. Toward an understanding of the behavioral intention to use mobile banking. Computers in Human Behavior 21(6): 873–891.

McKnight, D., V. Choudhury, and C. Kacmar. 2002. Developing and validating trust measures for e-commerce: An integrative typology. Information Systems Research 13(3): 334–359.

Mortimer, G., L. Neale, S. Hasan, and B. Dunphy. 2015. Investigating the factors influencing the adoption of m-banking: A cross cultural study. International Journal of Bank Marketing 33(4): 545–570.

Mutahar, A., N. Daud, R. Thurasamy, O. Isaac, and R. Abdulsalam. 2018. The mediating of perceived usefulness and perceived ease of use. International Journal of Technology Diffusion 9(2): 21–40.

Nunnally, J. 1978. Psychometric theory. New York, NY: McGraw-Hill.

Oruç, Ö.E., and Ç. Tatar. 2017. An investigation of factors that affect internet banking usage based on structural equation modeling. Computers in Human Behavior 66: 232–235.

Pikkarainen, T., K. Pikkarainen, H. Karjaluoto, and S. Pahnila. 2004. Consumer acceptance of online banking: An extension of the technology acceptance model. Internet Research 14(3): 224–235.

Podsakoff, P., S. MacKenzie, J. Lee, and N. Podsakoff. 2003. Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology 88(5): 879–903.

Püschel, J., J. Afonso Mazzon, C. Mauro, and J. Hernandez. 2010. Mobile banking: proposition of an integrated adoption intention framework. International Journal of Bank Marketing 28(5): 389–409.

Rahi, S., and M.A. Ghani. 2019. Investigating the role of UTAUT and e-service quality in internet banking adoption setting. The TQM Journal 31(3): 491–506.

Ringle, C., S. Wende, and J. Becker. 2015. SmartPLS 3 (Version 3.2. 3). Boenningstedt: SmartPLS GmbH.

Santos, J. 2003. E-service quality: a model of virtual service quality dimensions. Managing Service Quality: An International Journal 13(3): 233–246.

Sathye, M. 1999. Adoption of Internet banking by Australian consumers: An empirical investigation. International Journal of Bank Marketing 17(7): 324–334.

Shankar, A., C. Jebarajakirthy, and M. Ashaduzzaman. 2020. How do electronic word of mouth practices contribute to mobile banking adoption? Journal of Retailing and Consumer Services 52: 101920.

Shankar, A., and P. Kumari. 2016. Factors affecting mobile banking adoption behavior in India. The Journal of Internet Banking and Commerce 21(1).

Stone, M. 1974. Cross-validatory choice and assessment of statistical predictions. Journal of the Royal Statistical Society. Series B (Methodological) 36(2): 111–133.

Tan, E., and J.L. Lau. 2016. Behavioural intention to adopt mobile banking among the millennial generation. Young Consumers 17(1): 18–31.

Tarhini, A., M. El-Masri, M. Ali, and A. Serrano. 2016. Extending the UTAUT model to understand the customers’ acceptance and use of internet banking in Lebanon. Information Technology and People 29(4): 830–849.

Tran, H.T.T., and J. Corner. 2016. The impact of communication channels on mobile banking adoption. International Journal of Bank Marketing 34(1): 78–109.

Venkatesh, V., and F. Davis. 1996. A model of the antecedents of perceived ease of use: Development and test. Decision Sciences 27(3): 451–481.

Venkatesh, V., and F.D. Davis. 2000. A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science 46(2): 186.

Venkatesh, V., M. Morris, G. Davis, and F. Davis. 2003. User acceptance of information technology: Toward a unified view. MIS Quarterly 27(3): 425–478.

Wang, Y.S., Y.M. Wang, H.H. Lin, and T.I. Tang. 2003. Determinants of user acceptance of internet banking: an empirical study. International Journal of Service Industry Management 14(5): 501–519.

White, H., and F. Nteli. 2004. Internet banking in the UK: Why are there not more customers? Journal of Financial Services Marketing 9(1): 49–56.

Zeithaml, V.A., A. Parasuraman, and A. Malhotra. 2002. Service quality delivery through web sites: A critical review of extant knowledge. Journal of the Academy of Marketing Science 30(4): 362–375.

Zhang, T., C. Lu, and M. Kizildag. 2018. Banking “on-the-go”: Examining consumers’ adoption of mobile banking services. International Journal of Quality and Service Sciences 10(3): 279–295.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Singh, S., Srivastava, R.K. Understanding the intention to use mobile banking by existing online banking customers: an empirical study. J Financ Serv Mark 25, 86–96 (2020). https://doi.org/10.1057/s41264-020-00074-w

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41264-020-00074-w