Abstract

Motivated by the increasing demand for alternative assets that can contribute to reducing portfolio risk, this paper examines the volatility spillovers between collateralized loan obligations (CLOs) and various in-demand investment instruments, including equities, bonds, crude oil, commodities, gold, bitcoin, shipping and real estate. The applied methodology comprehends the time-varying parameter vector autoregressive (TVP-VAR) modification of the classical spillover approach, for the period from January 1, 2012, to August 31, 2023. The empirical findings show moderate levels of dynamic connectedness; albeit several external shocks strengthened the interconnection among the assets. Moreover, we compare the ability of CLOs for hedging, during the overall sample period and multiple subperiods, by estimating hedge ratios and optimal portfolio weights, in order to inform investors about feasible portfolio adjustments. Our results indicate that CLOs constitute an effective hedging tool, irrespective of the period covered, as the short position in their volatility provides high hedging effectiveness for investors holding long positions in the volatility of all the remaining assets.

Similar content being viewed by others

1 Introduction

The integrity of the global financial system has been endangered by a number of external shocks to the economy over the past 20 years, underscoring the necessity for proper portfolio diversification to safeguard investors from negative market conditions. More recently, collateralized loan obligations (hereafter CLOs) have come to surface as a fast-expanding alternative investment vehicle. CLOs have witnessed remarkable growth since their emergence in the late 1990s, with approximately $900 billion outstanding as of 2021 according to the Bank of America Global Research. Not surprisingly, the main factor making CLOs seem resilient in the face of future economic downturns is not new. The flexibility of the CLO structure was frequently acknowledged as a feature that may help to reduce the systemic risk posed by CLOs in the case of a crisis, even as worries about skyrocketing corporate debt and subpar credit quality grew in the years preceding 2020. The annual sales of new US CLOs hit a record during 2022,Footnote 1 as the value of new issuance reached approximately $129.3 billion, surpassing the previous high set in 2019. As of September 2023, the CLO market has grown over $1 trillion, according to data from the Bank of America, with the floating-rate coupon, and the solid past credit performance drawing in a large number of new investors. Forecasts about the future development of CLOs report that the global collateralized loan obligation market is anticipated to grow at a compound annual growth rate (CAGR) of 9.26%Footnote 2 by 2028, placing the CLO market in the forefront of the economic agenda worldwide.

A CLO is a single security backed by a pool of debt. It constitutes a diverse basket of bank loans given to enterprises with credit ratings below investment grade. First-lien loans, which have priority in the event of bankruptcy, are included in this pool, but second-lien loans and unsecured debts may also be allowed in some CLO portfolios. CLOs are initially sold to a manager who then sells investors shares in the CLO through a structure known as tranches. The funding for CLOs derives from the issuance of equity and debt, which is divided into tranches with various risk and return profiles based on the priority of the distribution of its cash flows and the risk of capital loss from the pool of loans (Abakah et al. 2022; Castillo et al. 2018). CLOs can offer investors a variety of benefits. The pool of loans and their tranches within it are less sensitive to changes in interest rates due to the floating-rate nature of the instrument, which is priced with a spread above an interbank rate such as LIBOR (Vink et al. 2021; Loumioti and Vasvari 2019). Therefore, under inflationary environments accompanied by low interest rates, CLOs will fluctuate less than their fixed-rate peers, providing advantages in dealing with the adverse effects of inflation. Furthermore, CLOs can aid in portfolio diversification, as investors are exposed to a range of industries and credit ratings. Thus, with CLOs, the risk of an individual loan or borrower defaulting is mitigated. In contrast to the illiquid nature of other types of fixed-income investments, CLOs are structured to provide liquidity, as investors are able to sell their shares in the CLO before it matures. The unprecedented increase in new deals makes evident that the higher yields provided for investors compared to their fixed-income counterparts and the floating-rate nature of CLOs have boosted their appeal over the last years.

The interlinkages among financial assets have recently become a remarkably pertinent issue and have been under investigation by the literature, since the volatility occurring in a specific market can be transmitted to other markets as well, provoking financial instabilities in the global economic environment. The majority of the literature points out equities as the major contributor of spillover effects to other markets (Papathanasiou et al. 2022; Zhang et al. 2021, 2019; Elsayed et al. 2020; Mandaci et al. 2020; Zhang 2017; Wang et al. 2016; Duncan and Kabundi 2013). Also frequently cited as a net transmitter of spillovers is bitcoin (Elsayed et al. 2022; Yousaf and Yarovaya 2022; Adekoya and Oliyide 2021). Conversely, the empirical results of many studies indicate that bonds (Tiwari et al. 2018; Duncan and Kabundi 2013), commodities (Zhang et al. 2019; Wang et al. 2016), shipping (Papathanasiou et al. 2023b; Samitas et al. 2022b) and real estate (Liow et al. 2018; Liow 2015) constitute the recipients of the diffused spillovers. The inferences concerning oil and gold are contradictory; Samitas et al. (2022b), Mensi et al. (2019) and Maghyereh et al. (2016) find evidence of the aforementioned assets being senders of volatility shocks within the transmission channel. On the other hand, Zeng et al. (2020) and Kang and Lee (2019) document that these assets mainly absorb the spread shocks. However, CLOs have received little attention by the literature and have never been tested within a VAR spillover framework. Thus, we intend to fill this gap, by monitoring the interactions of CLOs with other assets and shed light to the possibility that this alternative financial product can be used as a tool to mitigate the risk deriving from volatility transmission.

In this paper, we investigate the connectedness between CLOs and a set of high-demand investment instruments such as equities, bonds, crude oil, commodities, gold, bitcoin, shipping and real estate. Our dataset covers the period 1/1/2012–8/31/2023, and the implemented framework utilizes the Antonakakis et al. (2020) approach, which enhances the classical Diebold and Yilmaz (2012) methodology. We include in our research an extended sample of assets in order to examine the level of their interconnection. In addition, we also evaluate the hedging ability of CLOs within a portfolio containing the aforementioned assets. To do so, we calculate hedge ratios and optimal portfolio weights, by using conditional variance estimations (DCC-GARCH). As several extraneous shocks occurring the last decade may have had grave repercussions on asset price volatilities, we report changes in the capacity of CLOs to perform as a hedging instrument for the overall sample period and during diverse subperiods. The incentive behind this process is to provide investors with distinct investment schemes for an efficient diversification to be accomplished under different regimes.

The objective of our analysis is to provide sufficient proof to address the following research questions:

RQ1 Are CLOs interconnected with other major financial assets such as stocks, bonds, crude oil, commodities, gold, bitcoin, shipping and real estate? If so, to what degree?

RQ2 Has dynamic connectedness strengthened during periods of stress?

RQ3 What diversification advantages do CLOs provide when combined in an investment portfolio with traditional assets?

RQ4 How did the hedging ability of CLOs fluctuate during different subperiods defined by the most massive exogenous shocks taking place in the economic landscape?

We show that the connectedness among the assets under consideration ranges at moderate levels. Equities and commodities are proved to be the strongest net transmitters of spillover effects, followed by gold, bitcoin and real estate. Contrarily, bonds and shipping form the largest net volatility spillover receivers, followed by crude oil. CLOs exhibit minimal net shock reception within the channel, being simultaneously among the highest senders and recipients of spillovers. It is worth mentioning that connectedness intensified during economic turbulences, such as the fall in oil prices, the US–China cold war, the outbreak of COVID-19 pandemic and the period of rising inflation as an aftermath of the Russia–Ukrainian war. The hedging strategy analysis reveals that CLOs offer a high level of risk reduction benefit for investors holding long-positions in the volatility of all assets included and, thus, can be used as a tool for portfolio hedging. In general, CLOs preserved their ability to hedge against the risk deriving from volatility transmission during all the subperiods under investigation. We demonstrate that a long position in the volatility of bitcoin and shipping and a short position in the volatility of CLOs provide the optimal level of hedging efficacy, regardless of time period.

Our study contributes to the body of financial literature in two ways. Firstly, we intend to include a new asset class, CLOs, by analyzing for the first time its connectedness amongst a basket of other assets and their significance for portfolio diversification. Our initiative is motivated by the incessant quest for financial assets that will protect investors from volatility diffusion under unstable market conditions. Secondly, we show that CLOs are effective at hedging when combined with a variety of assets that investors commonly prefer to include in their portfolios. The investigation of assets that could improve the effectiveness of portfolio hedging is vital, particularly given the current global uncertain environment brought on by COVID-19 and the Russian–Ukrainian war.

Insightful conclusions are drawn from the examination of volatility spillovers among the selected assets that can help regulators, central banks and governments to establish appropriate financial frameworks to ensure financial stability. In particular, the size and direction of volatility spillovers from each asset class are crucial factors to consider when allocating capital within a portfolio or choosing hedging techniques.

Finally, our work makes recommendations for the ideal weights that minimize risk when CLOs are combined with other assets within a portfolio.

The remainder of the paper is structured as follows. Section 2 describes the empirical framework used in this study. Section 3 provides a description of the data sample and presents the preliminary analysis. The empirical findings are discussed in Sect. 4 and Sect. 5 concludes.

2 Methodology

2.1 The time-varying parameter vector autoregressive (TVP-VAR) model

We examine the intensity of volatility spillovers among the sampled markets by carrying out the Antonakakis et al. (2020) methodology, stemming from the connectedness framework of Diebold and Yilmaz (2012). In accordance with Forsberg and Ghysels (2007), we consider price volatility as the absolute returnFootnote 3\(V_{it} = \left| {\ln P_{it} {-}\ln P_{it - 1} } \right|\), where Pit is the daily closing price on day t. The TVP-VAR model addresses certain limitations of the fundamental framework; it permits variances to change over time, minimizes the negative impacts of outliers and yields more precise parameters as a result. Moreover, because a rolling window size setting is not a prerequisite, the entire data sample is utilized.

The time-varying parameter vector autoregressive (TVP-VAR) approach of Antonakakis et al. (2020) is formulated on the following equations:

where \(\Omega_{t - 1}\) is the amount of information obtainable at t − 1, \(z_{t - 1}\) is a lagged vector of yt, \({\text{Vec}}\left( {A_{t} } \right)\) is a N × Np matrix of time-varying coefficients, εt and ξt are N × 1 vectors of residuals and Σt and Ξt are Np × Np time-varying variance–covariance matrices of the residuals εt and ξt, respectively.

Considering the above formulas, we compute the H-step-ahead generalized forecast error variance decompositionsFootnote 4 denoted by \(\tilde{\theta }_{ij,t}^{g} \left( H \right)\), following Koop et al. (1996) and Perasan and Shin (1998):

with \(\psi_{ij,t}^{2,g} \left( H \right) = \Sigma_{ij,t}^{{ - \frac{1}{2}}}\) \(A_{h,t} \Sigma_{t} \varepsilon_{ij,t}\), \(\Sigma_{t}\) the covariance matrix for the error \(\varepsilon_{i,j,t}\), and \(\sum\nolimits_{j = 1}^{N} {\tilde{\theta }_{ij,t}^{g} \left( H \right)} = 1,\quad \sum\nolimits_{i,j = 1}^{N} {\tilde{\theta }_{ij,t}^{N} \left( H \right) = N.}\)

The following equation provides the total connectedness index:

The volatility spillovers market i transmits to all other markets j and vice versa (market i receives from markets j), can be approximated respectively as:

and

Ultimately, the net total directional connectedness is measured as the subtraction of (5)–(6), i.e.:

2.2 Hedge ratios, optimal portfolio weights and hedging effectiveness

By constructing optimal hedge ratios and portfolio weights using conditional variance estimations (DCC-GARCH), we extend our empirical findings and assess the CLOs' ability for hedging within a portfolio of other assets. The hedge ratio for a $1 long position in CLOs and a $1 short position in the remaining assets is defined as follows:

where β is the hedge ratio, hCLOs, assets,t is the conditional covariance between CLOs and the other asset in the bivariate portfolio and hassets, assets,t the conditional variance of the other asset’s returns. We estimate the hedge ratio for a $1 long position in conventional assets and a $1 short position in CLOs by substituting hassets, assets,t for hCLOs, CLOs,t, where the latter represents the conditional variance of CLOs.

We determine the optimal portfolio weights using Kroner and Ng’s formula (1998):

where hCLOs, assets,t, hassets, assets,t, hCLOs, CLOs,t are defined as above, wCLOs, assets,t is the weight of CLOs and 1 − wij,t is the weight of each conventional asset in the portfolio.

Finally, the following metric is used to measure the hedging effectiveness (HE) of a bivariate portfolio that includes CLOs and another asset:

where hunhedged is the variance of the unhedged position, hhedged is the variance of the optimally weighted portfolio strategy and HE is the percentage reduction in the unhedged position’s variance.

3 Data and preliminary analysis

3.1 Data

An appropriate proxy for CLOs is a critical issue, as they constitute a complex structured financial product that carry a range of diverse risks. Kundu (2021) argues that the existence of covenants in debt markets can lead to spillovers and liquidations of loans in the CLO portfolios. When the oil industry experiences a negative shock, CLOs exposed to such loans sell unrelated loans in the secondary market to attenuate these restrictions, dispersing shocks through capital markets and real economic activity. Thus, the high correlation of CLO exposures and the sectoral and geographic concentration of their portfolios are matters that should be carefully addressed. To overcome such limitations, we choose S&P/LSTA US Leveraged Loan 100 Index as the representative index for CLOs, since it provides a large exposure to leveraged loans from different sectors and numbers among the largest in market capitalization. The Index is one of the oldest operating in the market, as it was launched on October 20, 2008, with a market value exceeding $320 billion. The Index is fully investable and designed to track the market-weighted performance of the 100 largest loan facilities in the leveraged loan market, reflecting the most liquid side of the market. The constituents of the index are subjected to a 2% weight cap of the total index weight by market capitalization for a single lending facility. Each loan's interest is calculated upon on a base rate. The base rate is the average of the one-month synthetic USD LIBOR, three-month synthetic USD LIBOR, 1-month Term SOFR and three-month Term SOFR contracted rates on institutional loans according to the Markit WSO Database. The loan interest rate for each loan included in the Index is comprised of the base rate plus the spread for each loan. The market-value-weighted average of all loan interest rates in the Index is the loan interest rate at index level. The Index is calculated on a daily basis in US dollarsFootnote 5 and uses S&P Global Ratings' public facility level ratings. The Index is reconstructed on a semi-annual basis and is weekly rebalanced.

As widely used in the literature, we take into consideration S&P 500, 10-year US Government Bonds, West Texas Intermediate (WTI), Gold futures and Bitcoin as proxies for equities, bonds, crude oil, gold and cryptocurrency, respectively. As concerns the remaining assets, we use the Thomson Reuters CRB Commodity Index, the Baltic Exchange Dry Index (BDI) and the Dow Jones Equity All REIT Index as representative indices for commodities, shipping and real estate, respectively. The advantage of Thomson Reuters CRB Commodity Index is that it is calculated as the arithmetic average of 19 commodity futures prices from 4 sectors (energy, agriculture, precious metals, base/industrial metals), surpassing in this way the exposure to a specific group of commodities. The BDI gauges the price of moving via more than 20 marine routes of diverse raw materials. The Index is perceived by people as a predictor of future economic activity, as changes in the index stand for changes in the demand/supply for industrial materials. Finally, the Dow Jones Equity All REIT Index measures the performance of all publicly traded real estate investment trusts (REITs) listed on the Dow Jones US equity universe. A description of the chosen indices used in our study is given in Table 1.

We use daily observations, converted to returns, since high frequency data deliver more robust results compared to low-frequency data (Samitas et al. 2021; Yousaf and Ali 2020; Luo and Ji 2018). Our sample period covers the period from 1/1/2012 to 8/31/2023. We decide to explore the connectedness during the last decade, as the majority of the global market indices endured extreme fluctuations due to several economic and other crucial events taking place in the worldwide economic landscape. Our dataset comprises 2910 observations, retrieved from Bloomberg and Thomson Reuters Datastream.

3.2 Preliminary analysis

The descriptive statistics for the sample's daily return series are shown in Table 2.

As expected, bitcoin achieves the highest average daily return (0.00378), being in parallel the most volatile (0.04952) as measured by the standard deviation. On the other hand, CLOs deliver a relatively sufficient average daily return (0.00012) with quite a low risk (0.00222), showing indications of safe-haven properties that they may possess. Furthermore, the majority of the skewness coefficients are negative and, along with the high kurtosis values, denote that there is a strong likelihood that the distributions will be left-skewed and leptokurtic. The null hypothesis that the time series match a normal distribution is rejected according to the Jarque and Bera (1980) test at 1% level. In addition, the null hypothesis of unit root being present is also rejected at 1% level according to the Augmented Dickey and Fuller (1979) test, and, thus, we can infer that the series are stationary.

4 Empirical results

4.1 Volatility spillover analysis

In a time span of over 10 years, we use the Bai and Perron (2003) process to examine the evolution of volatility spillovers and identify potential structural changes and time variations in the connectedness among our sampled assets. Bai (1997) describes the distribution function applied for breakpoint confidence intervals. The procedure for monitoring structural breaks is based on the minimization of the residual sum of squares over all partitions. In our test, the null hypothesis for the time series of total volatility spillovers is that no structural break occurs. The sample is divided into subsamples according to the break dates if the null hypothesis is rejected. The process is repeated until the null hypothesis is accepted.Footnote 6 The Bai and Perron (2003) methodology has been vastly incorporated by numerous studies (Samitas et al. 2022a; Guhathakurta et al. 2020; Weideman et al. 2017). Table 3 presents the estimated break points and the subsequent subsample periods.

As it is observed, four break points in total volatility spillovers are documented for the period 1/1/2012–8/31/2023 and, therefore, five subsample periods. We also suggest potential events that might be responsible for these breaks.

The coefficients of the average dynamic connectedness determined by the TVP-VAR model of Antonakakis et al. (2020) are shown in Table 4. We employ the Schwarz Information Criterion in order to obtain the optimal lag length, which equals 2, with a 10-day forecast horizon.Footnote 7

Our analysis shows moderate volatility spillovers among the assets under consideration, as total connectedness reaches 37.44%. CLOs are proved to be the highest contributor of spillovers to crude oil (13%). This can be ascribed to the fact that CLO funding firms are intimately connected to the usage of crude oil. Therefore, shocks diffused from CLOs to crude oil are expected to a certain degree. By extension, a large pairwise directional connectedness from CLOs to shipping is documented (10%), whereas the opposite directional connectedness is also high (7%), indicating that the CLOs and shipping markets are tightly correlated. As shipping plays an indispensable role in business operations via the transport of goods, the aforementioned intense bidirectional volatility spillovers are not surprising. Furthermore, large volatility spillovers from CLOs to US Treasury bonds are reported (11%), probably attributable to the fact that bonds are affected by floating rate bonds such as CLOs. On the other hand, CLOs are prone to fluctuations deriving from commodities (12%). In agreement with Samitas et al. (2022a), the shocks transmitted from commodities have a crucial impact on equities (11%) and bonds (10%) also. Other high pairwise directional connectedness includes the ones from crude oil to shipping (13%) and from equities to crude oil (11%). When oil prices soar, profits are reduced for shipping companies, as fuel costs represent a large percentage of the overall operating costs; the same applies in the case of equities, since a rise in oil prices entails a rise in the enterprise’s production cost, causing profit margins to shrink, which in turn can affect the stock price of the company. The remaining values of directional connectedness are less than 10% and could be regarded as inconsequential.

The final row of Table 4 displays the net directional connectedness of each asset. Equities are found to be the largest net contributor of volatility spillovers (18%), followed by commodities (16%), gold (6%), bitcoin (3%) and real estate (2%). Conversely, bonds (− 20%), shipping (− 17%) and crude oil (− 7%) act as net receivers of the volatility diffusion from other assets. Our results are aligned with the conclusions of other studies documenting equities (Papathanasiou et al. 2022; Zhang et al. 2021, 2019; Elsayed et al. 2020; Mandaci et al. 2020; Zhang 2017; Wang et al. 2016; Duncan and Kabundi 2013) and gold (Samitas et al. 2022b; Mensi et al. 2019) as net senders of spillover effects to other assets. On the contrary, our findings contract the findings of studies reporting commodities (Zhang et al. 2019; Wang et al. 2016), bitcoin (Elsayed et al. 2022; Yousaf and Yarovaya 2022; Adekoya and Oliyide 2021) and real estate (Liow et al. 2018; Liow 2015) as net recipients of the diffused shocks within the transmission channel. Obviously, our results are differentiated due to disparities concerning the assets included in the sample and the time period under examination. CLOs exhibit comparatively neutral behavior within the mechanism, absorbing marginally the shocks transmitted by other markets (− 1%), as they influence the network approximately to the same extent as they are influenced by it. These results suggest possible diversification benefits for investors that include CLOs in their portfolios.

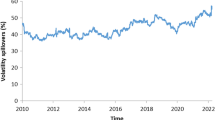

Figure 1 presents the plot for the total dynamic connectedness among the sampled assets for the period between 1/1/2012 and 8/31/2023.

As shown, total dynamic connectedness ranges between 24 and 48%. Volatilities remained at relatively high levels (30–35%) during 2012, as the aftermath of the European Sovereign Debt Crisis and the problems southern European countries were facing to finance their budget deficits. After the launch of the second economic adjustment program for Greece and the agreement of Private Sector Involvement (PSI), the prospect of a potential Grexit wandered away and resulted in the attenuation of volatility spillovers during 2013. At the beginning of 2014, the unprecedented fall in prices the oil market experienced, along with the enforcement of capital controls in Greece in order for a collapse of the banking system to be avoided, sparked off volatilities again, which fluctuated to a range of 35–42% for the biennium 2014–15. The quantitative easing programs executed by the European Central Bank, including the Covered Bond Purchase Program (CBPP3) and the Public Sector Purchase Program (PSPP), kept the volatilities in the markets relatively stable for almost two years (Papathanasiou et al. 2020). Due to the start of the US–China trade war and the ratification process for Brexit, there was a sharp rise in total connectedness in the beginning of 2018, which peaked at its highest level (47.90%) at the end of the year. During 2019, markets seemed to recover from the earlier volatility spikes, as spillovers were gradually reduced to 33% within a year. However, another steep increase in the levels of total dynamic connectedness (from 33 to 41%) is observed during the first period of the COVID-19 pandemic and its Omicron variant at the end of 2021 (from 36 to 44%). Finally, the outbreak of the Russia–Ukrainian war, along with the subsequent increase in inflation rates brought on by the conflict, retained the markets volatile, with spillovers varying from 41 to 47% until the end of the sample period. These findings are in accordance with the findings of numerous studies indicating that spillover effects intensify during periods characterized by unstable market conditions (Yousaf and Yarovaya 2022; Arif et al. 2021; Balcilar et al. 2021; Zhang et al. 2021; Umar et al. 2020).

In Figs. 2, 3 and 4, we illustrate the directional dynamic connectedness for each asset class (to, from, net).

Total directional connectedness “to” others. Note: In the figure above, the total directional connectedness “to” others is plotted for collateralized loan obligations, equities, bonds, crude oil, commodities, gold, bitcoin, shipping and real estate for the period 1/1/2012–8/31/2023. Y-axis denotes directional volatility spillovers to other markets and X-axis time

Total directional connectedness “from” others. Note: In the figure above, the total directional connectedness “from” others is plotted for collateralized loan obligations, equities, bonds, crude oil, commodities, gold, bitcoin, shipping and real estate for the period 1/1/2012–8/31/2023. Y-axis denotes directional volatility spillovers from other markets and X-axis time

“Net” total directional connectedness. Note: In the figure above, the net total directional connectedness is plotted for collateralized loan obligations, equities, bonds, crude oil, commodities, gold, bitcoin, shipping and real estate for the period 1/1/2012–8/31/2023. Y-axis denotes net directional volatility spillovers and X-axis time

As shown in Fig. 4, during the great plummet in oil prices, the contribution of oil, commodities and bitcoin to the transmission of volatility spillovers to other markets was expanded. Moreover, equities played an essential role during the US–China trade war, as increased volatility spillovers from equities within the channel are reported. During the unstable period of the coronavirus pandemic, shocks spread from commodities, gold and bitcoin were, for the most part, responsible for the high levels of dynamic connectedness. On the other hand, we observe CLOs, along with gold, transform from net recipients to major net transmitters of volatility diffusion amidst inflationary pressures. These results indicate that during economic turbulences, investors seek alternative assets acting like safe-havens in their attempt to safeguard their investments, as cited by the literature (Papathanasiou et al. 2023a; Akhtaruzzaman et al. 2021; Bouri et al. 2020; Shahzad et al. 2019; Conlon et al. 2018; Lucey and Li 2015; Ciner et al. 2013; Baur and Lucey 2010).

4.2 Portfolio implications

We proceed with our empirical results by examining the ability of CLOs to hedge against risk when combined with other investment instruments within a portfolio. In Table 5, we present the hedging effectiveness, optimal portfolio weights and hedge ratios for all possible combinations between CLOs and the other assets considered in our analysis for the whole sample period. Panel A (Panel B) displays the estimates for a hedging strategy of holding a long position in the volatility of CLOs (other assets) and a short position in the volatility of other assets (CLOs).

As it is evident, every asset included in the sample is a cheap hedge, in general, for the volatility of CLOs, as hedge ratios vary from 0.01 to 0.22. Bitcoin and shipping are the cheapest to hedge for a $1 long position in the volatility of CLOs, since both require a 1-cent investment. The most expensive hedging tool for the same strategy are equities ($0.22), followed by commodities ($0.17) and real estate ($0.17). This means that it needs a $0.22 short position investment in the volatility of equities and a $0.17 short position investment in the volatility of commodities and real estate, respectively, to hedge against the volatility of CLOs. However, the hedging effectiveness provided by the aforementioned portfolio weighting strategies is limited to a range of 1%-10%. This indicates that none of the sampled assets can perform effectively as a hedging tool for long-position CLO investors, since the risk-reduction benefits are extremely confined.

Results radically change when the mirror portfolios are considered. Hedging costs are increased and range from 0.48 (with gold) to 5.29 (with crude oil). The computed optimal portfolio weights suggest that gold, equities, real estate and commodities require higher investments in comparison to bitcoin, shipping, bonds and crude oil. The lowest weight (0.01) is reported in a portfolio consisting of bitcoin and CLOs, denoting that an investor who allocates 1 cent in the volatility of bitcoin and 99 cents in the volatility of CLOs can cut off his portfolio risk by 99%. The same applies in the case of shipping, as hedging effectiveness also reaches 99%. However, the hedge ratios, which represent the cost of hedging, imply that shipping is a cheaper hedge ($3.96) than bitcoin ($4.90), ensuring in parallel the same proportion of portfolio effectiveness. All in all, our empirical findings show that the short position in the volatility of CLOs is proven an effective tool for providing the potential of high diversification benefits in the examined portfolios, since hedging effectiveness varies from 90 to 99% in every possible combination.

In Appendices, 1–4 we provide the portfolio hedging strategies for all the subperiods defined by the breaks.Footnote 8 As shown, no significant differences are documented in comparison to the previous analysis. The main disparities can be summarized to the following: (a) hedging costs were higher for the period after the second economic adjustment program for Greece (1/1/2012–12/23/2013) and lower during the US–China trade conflict (1/7/2018–1/9/2020); (b) the hedging effectiveness of CLOs was slightly curtailed during COVID-19; and (c) CLOs was a cheap (expensive) hedge for bitcoin during the US–China trade war (the second economic adjustment program for Greece). Of utmost concern though, is to analyze the hedge ratios and optimal weights when the period after the recent rise in inflation is taken into consideration, as we do in Table 6.

Results do not utterly alter when the long position in the volatility of CLOs is taken into account (Panel A), as hedge ratios range from 0.02 to 0.17. The short position in the volatility of equities still constitutes the most expensive hedging strategy ($0.17) for long-position CLO investors amidst inflation. On the contrary, shipping (and crude oil) needs a 2-cent investment to hedge against the volatility of CLOs. The contrarian hedging strategy, though, remains ineffective, as only gold can lower risk for investors holding long positions in CLOs by 17%.

By taking a long position in the remaining assets (Panel B), we observe that hedging costs in most cases rose, as they vary from 0.71 (with gold) to 9.85 (with shipping), showing that investors need more money to hedge against the risk originating from asset price volatilities. The capacity of CLOs to hedge against the volatility of bitcoin, shipping and bonds is maintained at the same levels compared to the overall period, whereas they became a better hedging tool in the case of equities, crude oil and real estate. Although the hedging effectiveness provided for investors holding long-position in the volatility of commodities and gold decreased in comparison to the whole sample period, it still fluctuates at sufficient levels (91% and 84%, respectively). As a result, we may conclude that CLOs continued to function well as a hedging instrument during inflationary pressures.

Overall, the empirical findings revealed that CLOs demonstrate low net susceptibility to shocks within the channel. However, they constitute both prominent sources and targets of spillover effects. These findings indicate potential diversification gains for investors that add CLOs in their portfolios. Amidst the heightened inflation, the relatively attractive yields offered by CLOs compared to their fixed-income counterparts, coupled with the benefits of their floating-rate structure, are likely to have induced a shift in their network position from net recipients to net senders. The bivariate portfolio analysis showed that the hedging effectiveness of CLOs does not depend on the timeframe considered, as they perform well within a portfolio over time, ensuring sufficient risk-reduction gains. The short position in the volatility of CLOs can reduce the risk entailed in the volatility of all the sampled assets, especially for bitcoin, shipping and fixed income portfolios. CLOs are also proven to be an effective hedging technique at the investors’ disposal to manage risk under intensified inflationary pressures, despite being a costlier strategy compared to normal times.

5 Conclusions

Guided by the advanced demand for assets that aid in portfolio diversification, we investigate the capability of collateralized loan obligations (CLOs) to offset the adverse effects of volatility diffusion within a transmission mechanism containing other popular investment instruments. Specifically, we investigate the spillover effects among CLOs, equities, bonds, crude oil, commodities, gold, bitcoin, shipping and real estate for the period 1/1/2012–8/31/2023, by implementing the enhanced modification of the Diebold and Yilmaz (2012) approach. We conclude that spillovers among the assets considered in our analysis are moderate, with equities and commodities exhibiting the highest net directional connectedness, followed by gold, bitcoin and real estate. On the other hand, bonds, shipping, crude oil and CLOs receive the transmitted shocks, with the latter demonstrating a rather neutral behavior within the system as they constitute a marginal recipient. We display that the highest levels of connectedness occurred during economic turmoils, such as the collapse in oil prices, the US–China cold war, the burst of the COVID-19 pandemic and the inflation growth. Our empirical results comply with other results highlighting equities (Papathanasiou et al. 2022; Zhang et al. 2021, 2019; Elsayed et al. 2020; Mandaci et al. 2020; Zhang 2017; Wang et al. 2016; Duncan and Kabundi 2013) and gold (Samitas et al. 2022b; Mensi et al. 2019) as the primary sources of volatility spillovers within the channel. On the contrary, our findings are in contrast with the findings of studies denoting that commodities (Zhang et al. 2019; Wang et al. 2016), bitcoin (Elsayed et al. 2022; Yousaf and Yarovaya 2022; Adekoya and Oliyide 2021) and real estate (Liow et al. 2018; Liow 2015) form net receivers of spillover effects. To further assess the hedging ability of CLOs, we construct hedging strategies during the overall sample period and diverse subperiods in order to instruct investors in allocating their portfolio weights accordingly. We show that CLOs offer great potential to hedge against risk, irrespective of time span, as the short position in their volatility provides sufficient portfolio diversification for investors possessing long-positions in all the remaining assets.

This paper contributes to the literature by including CLOs, along with a battery of financial assets, in a TVP-VAR spillover framework in order to verify their dynamic interactions. We apply a contemporary methodology (Antonakakis et al. 2020), the advanced modification of the Diebold and Yilmaz (2012) approach, to document the volatility spillovers among the markets and record which assets perform as net contributors/receivers within the channel. The advantage of this model is that it deals with a number of limitations that pertain to the original framework. In addition, by evaluating the hedging ability of CLOs, we provide new evidence for alternative assets that can be used to reduce risk deriving from the dispersion of volatility.

Our investigation concludes the following findings. First, as our empirical results showed, equities and commodities are the main conduits for the spread of contagion to other assets. Regulators' efforts to develop appropriate frameworks to surmount financial instabilities benefit from the identification of senders of volatility spillovers resulting from the interaction of multiple important global markets. Second, investors holding assets that are vastly affected within the system should react promptly and allocate portfolio weights by using the best hedging techniques. Our empirical analysis points out bonds, shipping and crude oil as markets that mainly absorb the transmitted spillovers. Since CLOs offer high hedging effectiveness for the aforementioned portfolios, investors should use them as a hedging tool with long-short trading strategies to reduce risk and to protect their investments from adverse movements of the markets. These conclusions have also significance for a wide spectrum of investors who decide to invest in bitcoin, since it had been one of the most volatile in history. Lastly, market participants should re-evaluate their hedging strategies after the onset of inflation by adjusting their portfolio weights, as they are affected to some extent. The most substantial change observed refers to the ability of CLOs to hedge against the volatility of commodities and gold which was reduced; however, the cost of hedging commodities with the usage of CLOs also decreased, making the latter a cheaper hedging instrument for commodity futures.

Notes

For more details see: https://www.spglobal.com/_assets/documents/ratings/research/101572430.pdf.

More information can be found on: https://webonise.com/collateralized-loan-obligations-clo-market-2023-24-outlook-and-how-ai-and-tech-solutions-are-helping-managers/.

Forsberg and Ghysels (2007) described the advantages of adopting the absolute return as a measure of volatility.

For H = 1,2,…,.

The Index is also calculated on additional currency variants.

In our study, the forecast horizon was set to 10, 20, 50 and 100 days and up to four lags were examined.

Except the last subperiod determined by breakpoint 4.

References

Abakah EJA, Gil-Alana LA, Arthur EK, Tiwari AK (2022) Measuring volatility persistence in leveraged loan markets in the presence of structural breaks. Int Rev Econ Finance 78:141–152. https://doi.org/10.1016/j.iref.2021.11.016

Adekoya OB, Oliyide JA (2021) How COVID-19 drives connectedness among commodity and financial markets: evidence from TVP-VAR and causality-in-quantiles techniques. Res Policy 70:101898

Akhtaruzzaman Md, Boubaker S, Lucey BM, Sensoy A (2021) Is gold a hedge or a safe-haven asset in the COVID-19 crisis? Econ Model 102:105588. https://doi.org/10.1016/j.econmod.2021.105588

Antonakakis N, Chatziantoniou I, Gabauer D (2020) Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. J Risk Financ Manag 13:84. https://doi.org/10.3390/jrfm13040084

Arif M, Hasan M, Alawi SM, Naeem MA (2021) COVID-19 and time-frequency connectedness between green and conventional financial markets. Glob Finance J 49:100650. https://doi.org/10.1016/j.gfj.2021.100650

Bai J (1997) Estimation of a change point in multiple regression models. Rev Econ Stat 79:551–563

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Econom 18:1–22. https://doi.org/10.1002/jae.659

Balcilar M, Gabauer D, Umar Z (2021) Crude oil futures contracts and commodity markets: new evidence from a TVP-VAR extended joint connectedness approach. Res Policy 73:102219. https://doi.org/10.1016/j.resourpol.2021.102219

Baur DG, Lucey B (2010) Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financ Rev 45:217–229. https://doi.org/10.1111/j.1540-6288.2010.00244.x

Bouri E, Shahzad SJH, Roubaud D, Kristoufek L, Lucey B (2020) Bitcoin, gold, and commodities as safe havens for stocks: new insight through wavelet analysis. Q Rev Econ Finance 77:156–164. https://doi.org/10.1016/j.qref.2020.03.004

Castillo JA, Mora-Valencia A, Perote J (2018) Moral hazard and default risk of SMEs with collateralized loans. Finance Res Lett 26:95–99. https://doi.org/10.1016/j.frl.2017.12.010

Ciner C, Gurdgiev C, Lucey BM (2013) Hedges and safe havens: an examination of stocks, bonds, gold, oil and exchange rates. Int Rev Financ Anal 29:202–211. https://doi.org/10.1016/j.irfa.2012.12.001

Conlon T, Lucey BM, Uddin GS (2018) Is gold a hedge against inflation? A wavelet time-scale perspective. Rev Quant Finance Acc 51:317–345. https://doi.org/10.1007/s11156-017-0672-7

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431. https://doi.org/10.2307/2286348

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28:57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006

Duncan AS, Kabundi A (2013) Domestic and foreign sources of volatility spillover to South African asset classes. Econ Model 31:566–573. https://doi.org/10.1016/j.econmod.2012.11.016

Elsayed AH, Nasreen S, Tiwari AK (2020) Time-varying co-movements between energy market and global financial markets: implication for portfolio diversifications and hedging strategies. Energy Econ 90:104847. https://doi.org/10.1016/j.eneco.2020.104847

Elsayed AH, Gozgor G, Lau CKM (2022) Risk transmissions between bitcoin and traditional financial assets during the COVID-19 era: the role of global uncertainties. Int Rev Financ Anal 81:102069. https://doi.org/10.1016/j.irfa.2022.102069

Forsberg L, Ghysels E (2007) Why do absolute returns predict volatility so well? J Financ Econom 5:31–67. https://doi.org/10.1093/jjfinec/nbl010

Guhathakurta K, Dash SR, Maitra D (2020) Period specific volatility spillover based connectedness between oil and other commodity prices and their portfolio implications. Energy Econ 85:104566. https://doi.org/10.1016/j.eneco.2019.104566

Jarque CM, Bera AK (1980) Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ Lett 6:255–259. https://doi.org/10.1016/0165-1765(80)90024-5

Kang SH, Lee JW (2019) The network connectedness of volatility spillovers across global futures markets. Phys A 526:120756. https://doi.org/10.1016/j.physa.2019.03.121

Koop G, Perasan MH, Potter SM (1996) Impulse response analysis in nonlinear multivariate models. J Econom 74:119–147. https://doi.org/10.1016/0304-4076(95)01753-4

Kroner KF, Ng VK (1998) Modeling asymmetric comovements of asset returns. Rev Financ Stud 11:817–844. https://doi.org/10.1093/rfs/11.4.817

Kundu S (2021) The externalities of fire sales: Evidence from collateralized loan obligations. Available at SSRN: https://doi.org/10.2139/ssrn.3735645

Liow KH (2015) Volatility spillover dynamics and relationship across G7 financial markets. N Am J Econ Finance 33:328–365. https://doi.org/10.1016/j.najef.2015.06.003

Liow KH, Liao W-C, Huang Y (2018) Dynamics of international spillovers and interaction: evidence from financial market stress and economic policy uncertainty. Econ Model 68:96–116. https://doi.org/10.1016/j.econmod.2017.06.012

Loumioti M, Vasvari FP (2019) Portfolio performance manipulation in collateralized loan obligations. J Account Econ 67:438–462. https://doi.org/10.1016/j.jacceco.2018.09.003

Lucey B, Li S (2015) What precious metals act as safe havens, and when? Some US evidence. Appl Econ Lett 22:35–45. https://doi.org/10.1080/13504851.2014.920471

Luo J, Ji Q (2018) High-frequency volatility connectedness between the US crude oil market and China’s agricultural commodity markets. Energy Econ 76:424–438. https://doi.org/10.1016/j.eneco.2018.10.031

Maghyereh AI, Awartani B, Bouri E (2016) The directional volatility connectedness between crude oil and equity markets: new evidence from implied volatility indexes. Energy Econ 57:78–93. https://doi.org/10.1016/j.eneco.2016.04.010

Mandaci PE, Cagli EC, Taskin D (2020) Dynamic connectedness and portfolio strategies: energy and metal markets. Resour Policy 68:101778. https://doi.org/10.1016/j.resourpol.2020.101778

Mensi W, Hammoudeh S, Al-Jarrah IMW, Al-Yahyaee KH, Kang SH (2019) Risk spillovers and hedging effectiveness between major commodities, and Islamic and conventional GCC banks. J Int Financ Mark Inst Money 60:68–88. https://doi.org/10.1016/j.intfin.2018.12.011

Papathanasiou S, Koutsokostas D, Pergeris G (2022) Novel alternative assets within a transmission mechanism of volatility spillovers: the role of SPACs. Finance Res Lett 47:102602. https://doi.org/10.1016/j.frl.2021.102602

Papathanasiou S, Kenourgios D, Koutsokostas D, Pergeris G (2023a) Can treasury inflation-protected securities safeguard investors from outward risk spillovers? A portfolio hedging strategy through the prism of COVID-19. J Asset Manag 24:198–211. https://doi.org/10.1057/s41260-022-00292-y

Papathanasiou S, Vasiliou D, Magoutas A, Koutsokostas D (2023b) The dynamic connectedness between private equities and other high-demand financial assets: a portfolio hedging strategy during COVID-19. Aus J Manag. https://doi.org/10.1177/031289622311846. (Forthcoming)

Papathanasiou S, Papanastasopoulos A, Koutsokostas D (2020) The impact of unconventional monetary policies on unique alternative investments: The case of fine wine and rare coins. In: Recent Advances and Applications in Alternative Investments (Chapter 6). IGI Global, pp 120–142. https://doi.org/10.4018/978-1-7998-2436-7

Perasan HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58:17–29. https://doi.org/10.1016/S0165-1765(97)00214-0

Samitas A, Papathanasiou S, Koutsokostas D (2021) The connectedness between Sukuk and conventional bonds markets and the implications for investors. Int J Islamic Middle East Finance Manag 14:928–949. https://doi.org/10.1108/IMEFM-04-2020-0161

Samitas A, Papathanasiou S, Koutsokostas D, Kampouris E (2022a) Volatility spillovers between fine wine and major global markets during COVID-19: a portfolio hedging strategy for investors. Int Rev Econ Finance 78:629–642. https://doi.org/10.1016/j.iref.2022.01.009

Samitas A, Papathanasiou S, Koutsokostas D, Kampouris E (2022b) Are timber and water investments safe-havens? A volatility spillover approach and portfolio hedging strategies for investors. Finance Res Lett 47:102657. https://doi.org/10.1016/j.frl.2021.102657

Shahzad SJH, Bouri E, Roubaud D, Kristoufek L, Lucey B (2019) Is Bitcoin a better safe-haven investment than gold and commodities? Int Rev Financ Anal 63:322–330. https://doi.org/10.1016/j.irfa.2019.01.002

Tiwari AK, Cunado J, Gupta R, Wohar ME (2018) Volatility spillovers across global asset classes: evidence from time and frequency domains. Q Rev Econ Finance 70:194–202. https://doi.org/10.1016/j.qref.2018.05.001

Umar Z, Kenourgios D, Papathanasiou S (2020) The static and dynamic connectedness of environmental, social, and governance investments: international evidence. Econ Model 93:112–124. https://doi.org/10.1016/j.econmod.2020.08.007

Vink D, Nawas M, van Breemen V (2021) Security design and credit rating risk in the CLO market. J Int Financ Mark Inst Money 72:101305. https://doi.org/10.1016/j.intfin.2021.101305

Wang G-J, Xie C, Jiang Z-Q, Stanley HE (2016) Who are the net senders and recipients of volatility spillovers in China’s financial markets? Finance Res Lett 18:255–262. https://doi.org/10.1016/j.frl.2016.04.025

Weideman J, Inglesi-Lotz R, van Heerden J (2017) Structural breaks in renewable energy in South Africa: a Bai & Perron break test application. Renew Sustain Energy Rev 78:945–954. https://doi.org/10.1016/j.rser.2017.04.106

Yousaf I, Ali S (2020) The COVID-19 outbreak and high frequency information transmission between major cryptocurrencies: evidence from the VAR-DCC-GARCH approach. Borsa Istanbul Rev 20:S1–S10. https://doi.org/10.1016/j.bir.2020.10.003

Yousaf I, Yarovaya L (2022) Static and dynamic connectedness between NFTs, Defi, and other assets: Portfolio implication. Glob Finance J. https://doi.org/10.1016/j.gfj.2022.100719

Zeng T, Yang M, Shen Y (2020) Fancy Bitcoin and conventional financial assets: measuring market integration based on connectedness networks. Econ Model 90:209–220. https://doi.org/10.1016/j.econmod.2020.05.003

Zhang D (2017) Oil shocks and stock markets revisited: measuring connectedness from a global perspective. Energy Econ 62:323–333. https://doi.org/10.1016/j.eneco.2017.01.009

Zhang D, Lei L, Ji Q, Kutan AM (2019) Economic policy uncertainty in the US and China and their impact on the global markets. Econ Modelling 79(June):47–56. https://doi.org/10.1016/j.econmod.2018.09.028

Zhang H, Chen J, Shao L (2021) Dynamic spillovers between energy and stock markets and their implications in the context of COVID-19. Int Rev Financ Anal 77:101828. https://doi.org/10.1016/j.irfa.2021.101828

Funding

Open access funding provided by HEAL-Link Greece.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1. Hedge ratios and optimal portfolio weighting strategies with collateralized loan obligations (CLOs) for the period after the second economic adjustment program for Greece (1/1/2012–12/23/2013)

Pairs | Hedge ratios | Optimal portfolio weights | HE |

|---|---|---|---|

Panel A: Long position in CLOs and short position in other assets | |||

CLOs/Equities | 0.21 | 0.92 | 0.10 |

CLOs/Bonds | 0.01 | 0.95 | 0.07 |

CLOs/Crude oil | 0.05 | 0.98 | 0.02 |

CLOs/Commodities | 0.15 | 0.94 | 0.09 |

CLOs/Gold | 0.11 | 0.97 | 0.04 |

CLOs/Bitcoin | 0.01 | 0.99 | 0.01 |

CLOs/Shipping | 0.01 | 0.99 | 0.01 |

CLOs/Real estate | 0.13 | 0.96 | 0.06 |

Panel B: Long position in other assets and short position in CLOs | |||

Equities/CLOs | 2.39 | 0.08 | 0.90 |

Bonds/CLOs | 0.20 | 0.05 | 0.94 |

Crude oil/CLOs | 2.98 | 0.02 | 0.98 |

Commodities/CLOs | 2.78 | 0.06 | 0.92 |

Gold/CLOs | 4.46 | 0.03 | 0.96 |

Bitcoin/CLOs | 9.87 | 0.01 | 0.99 |

Shipping/CLOs | 6.79 | 0.01 | 0.99 |

Real estate/CLOs | 2.76 | 0.04 | 0.95 |

Appendix 2. Hedge ratios and optimal portfolio weighting strategies with collateralized loan obligations (CLOs) for the period after the oil price crash (12/24/2013–1/6/2018)

Pairs | Hedge ratios | Optimal portfolio weights | HE |

|---|---|---|---|

Panel A: Long position in CLOs and short position in other assets | |||

CLOs/Equities | 0.17 | 0.91 | 0.11 |

CLOs/Bonds | 0.02 | 0.98 | 0.02 |

CLOs/Crude oil | 0.05 | 0.99 | 0.01 |

CLOs/Commodities | 0.11 | 0.96 | 0.05 |

CLOs/Gold | 0.01 | 0.95 | 0.06 |

CLOs/Bitcoin | 0.01 | 0.99 | 0.01 |

CLOs/Shipping | 0.01 | 0.99 | 0.01 |

CLOs/Real estate | 0.06 | 0.94 | 0.08 |

Panel B: Long position in other assets and short position in CLOs | |||

Equities/CLOs | 1.70 | 0.09 | 0.91 |

Bonds/CLOs | 1.59 | 0.02 | 0.98 |

Crude oil/CLOs | 5.92 | 0.01 | 0.99 |

Commodities/CLOs | 2.54 | 0.04 | 0.95 |

Gold/CLOs | 0.20 | 0.05 | 0.94 |

Bitcoin/CLOs | 2.80 | 0.01 | 0.99 |

Shipping/CLOs | 6.10 | 0.01 | 0.99 |

Real estate/CLOs | 1.15 | 0.06 | 0.93 |

Appendix 3. Hedge ratios and optimal portfolio weighting strategies with collateralized loan obligations (CLOs) during the US–China trade war (1/7/2018–1/9/2020)

Pairs | Hedge ratios | Optimal portfolio weights | HE |

|---|---|---|---|

Panel A: Long position in CLOs and short position in other assets | |||

CLOs/Equities | 0.21 | 0.92 | 0.10 |

CLOs/Bonds | 0.07 | 0.98 | 0.02 |

CLOs/Crude oil | 0.09 | 0.98 | 0.03 |

CLOs/Commodities | 0.29 | 0.86 | 0.17 |

CLOs/Gold | 0.06 | 0.87 | 0.16 |

CLOs/Bitcoin | 0.01 | 0.98 | 0.02 |

CLOs/Shipping | 0.01 | 0.99 | 0.01 |

CLOs/Real estate | 0.14 | 0.91 | 0.11 |

Panel B: Long position in other assets and short position in CLOs | |||

Equities/CLOs | 2.35 | 0.08 | 0.92 |

Bonds/CLOs | 3.28 | 0.02 | 0.98 |

Crude oil/CLOs | 5.04 | 0.02 | 0.97 |

Commodities/CLOs | 1.81 | 0.14 | 0.82 |

Gold/CLOs | 0.41 | 0.13 | 0.85 |

Bitcoin/CLOs | 0.55 | 0.02 | 0.98 |

Shipping/CLOs | 3.22 | 0.01 | 0.99 |

Real estate/CLOs | 1.37 | 0.09 | 0.90 |

Appendix 4. Hedge ratios and optimal portfolio weighting strategies with collateralized loan obligations (CLOs) during the outbreak of COVID-19 (1/10/2020–10/5/2021)

Pairs | Hedge ratios | Optimal portfolio weights | HE |

|---|---|---|---|

Panel A: Long position in CLOs and short position in other assets | |||

CLOs/Equities | 0.31 | 0.86 | 0.16 |

CLOs/Bonds | 0.06 | 0.98 | 0.02 |

CLOs/Crude oil | 0.07 | 0.98 | 0.02 |

CLOs/Commodities | 0.25 | 0.91 | 0.10 |

CLOs/Gold | 0.07 | 0.79 | 0.24 |

CLOs/Bitcoin | 0.05 | 0.98 | 0.03 |

CLOs/Shipping | 0.01 | 0.99 | 0.01 |

CLOs/Real estate | 0.29 | 0.88 | 0.14 |

Panel B: Long position in other assets and short position in CLOs | |||

Equities/CLOs | 1.98 | 0.14 | 0.82 |

Bonds/CLOs | 3.56 | 0.02 | 0.98 |

Crude oil/CLOs | 5.57 | 0.02 | 0.98 |

Commodities/CLOs | 2.67 | 0.09 | 0.89 |

Gold/CLOs | 0.27 | 0.21 | 0.75 |

Bitcoin/CLOs | 4.51 | 0.02 | 0.97 |

Shipping/CLOs | 3.31 | 0.01 | 0.99 |

Real estate/CLOs | 2.12 | 0.12 | 0.85 |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Papathanasiou, S., Kenourgios, D., Koutsokostas, D. et al. The dynamic connectedness between collateralized loan obligations and major asset classes: a TVP-VAR approach and portfolio hedging strategies for investors. Empir Econ (2024). https://doi.org/10.1007/s00181-024-02583-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s00181-024-02583-2