Abstract

Reputation Quotients (RQs®) produced by Harris Interactive, Inc. are a presumed credible measure of corporate reputation that assesses corporate reputations employing six drivers, which are correlated with 20 attributes. Reputations appear to be an important characteristic of a firm, which transcends a company’s current production and financial statements to set a path for future performance. Although many years and multiple factors go into creating a reputation, this study found that past share price performance was unrelated to company reputation. However, reputation does appear to provide insight into future firm performance. Firms with the worst reputations often seem to have trouble providing a return sufficient to cover risk, especially in the absence of dividends. By comparison, firms with the best reputations tend to have lower risk, whether measured in terms of systematic risk or total risk, and therefore generate significantly higher risk-adjusted rates of return.

Similar content being viewed by others

References

Abraham, S.E., Friedman, B.A., Khan, R.H. and Skolnik, S.J. (2008) ‘Is publication of the reputation quotient (RQ) sufficient to move stock prices?’ Corporate Reputation Review, 11 (4), 308–319.

Black, E., Carnes, T. and Richardson, V. (2000) ‘The market valuation of corporate reputation’, Corporate Reputation Review, 3 (1), 31–42.

Brown, B. and Perry, S. (1994) ‘Removing the financial performance halo from Fortune’s ‘Most Admired’ companies’, Academy of Management Journal, 17 (1), 1347–1359.

Cahan, S., Chen, C., Chen, L. and Nguyen, N. (2014) ‘The business press and corporate social responsibility: Reputation, cost of capital and firm value’, American Accounting Association Annual Meeting Session, Atlanta, GA. 5 August, 2014. https://www2.aaahq.org/AM2014/abstract.cfm?submissionID=1250, accessed 1 September, 2015.

Cho, C.H., Guidry, R.P., Hageman, A.M. and Patten, D.M. (2012) ‘Do actions speak loader than words? An empirical investigation of corporate environmental reputation’, Accounting, Organizations and Society, 37 (1), 14–25.

Filbeck, G. and Krueger, T. (2002) ‘Investment merits of the world’s most admired firms’, Journal of Investing, 11 (1), 45–54.

Fombrun, C. (2001) ‘Corporate reputations as economic assets’, in, M. Hitt, R. Freeman and J. Harrison (eds.), Handbook of Strategic Management, Blackwell, Oxford, UK.

Grinvalde, G. and Dovladbekova, I. (2013) ‘Reputation as one of the most valuable intangible assets and the impact of the reputation on the financial stability in aviation sector’, Collection of Scientific Papers, Rigas Stradina University (Latvia).

Jones, G., Jones, B. and Little, P. (2000) ‘Reputation as reservoir: Buffering against loss in times of economic crisis’, Corporate Reputation Review, 3 (1), 21–29.

Kim, J. and Cha, H. (2013) ‘The effect of public relations and corporate reputation on return on investment’, Asia Pacific Public Relations Journal, 14 (1 & 2), 107–130.

Krueger, T.M. and Wrolstad, M.A. (2007) ‘Corporate reputation and investment value’, Journal of Contemporary Business Issues, 15 (1), 37–45.

Krueger, T.M. and Wrolstad, M.A. (2009) ‘Do Changes in Corporate Performance Impact Share Price Performance’, Journal of the Academy of Finance, 7 (1&2), 176–185.

Krueger, T.M., Wrolstad, M.A. and Van Dalsem, S. (2010) ‘Contemporaneous relationship between corporate reputation and return’, Managerial Finance, 36 (6), 482–490.

MacMillan, K., Money, K., Downing, S. and Hillenbrand, C. (2005) ‘Reputation in relationships: Measuring experiences, emotions and behaviors’, Corporate Reputation Review, 8 (3), 214–232.

Money, K. and Hillenbrand, C. (2006) ‘Beyond reputation measurement: Using reputation to create value’, Henley Business School, University of Reading White Paper, Oxfordshire, UK.

Odlyzko, A. (2010) ‘Bubbles, gullibility, and other challenges for economics, psychology, sociology, and information sciences’, First Monday, 15(9), 1–48, online publication, 6 September, doi: 10.2139/ssrn.1668130.

Paulos, J.A. (2003) A Mathematician Plays the Stock Market, Basic Books, New York.

Pfarrer, M.D., Pollock, T.G. and Rindova, V.P. (2010) ‘A tale of two assets: The effects of firm reputation and celebrity on earnings surprises and investors’ reactions’, Academy of Management Journal, 53 (5), 1131–1152.

Porritt, D. (2005) ‘The reputational failure of financial success: The bottom line backlash effect’, Corporate Reputation Review, 8 (3), 198–213.

Shamma, H. (2012) ‘Toward a comprehensive understanding of corporate reputation: Concept, measurement, and implications’, International Journal of Business and Management, 7 (16), 151–169.

Sohn, Y. and Lariscy, R. (2012) ‘A ‘buffer’ or ‘boomerang?’ The role of corporate reputation in bad times’, Communication Research, 20 (10), 1–23.

Tomak, S. (2014) ‘Corporate reputation and financial performance of firms in Turkey’, Academic Review of Economics and Administrative Sciences, 7 (1), 289–309.

Author information

Authors and Affiliations

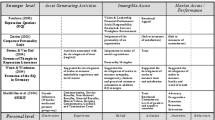

APPENDIX

Rights and permissions

About this article

Cite this article

Krueger, T., Wrolstad, M. Impact of the Reputation Quotient® on Investment Performance. Corp Reputation Rev 19, 140–151 (2016). https://doi.org/10.1057/crr.2016.5

Published:

Issue Date:

DOI: https://doi.org/10.1057/crr.2016.5