Abstract

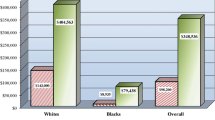

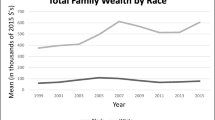

Using data on household balance sheets from the Survey of Consumer Finances and data on macroeconomic rates of return from Jordà et al. (Q J Econ. 134(3):1225–1298, 2019) we construct two alternative series for household rates of return by race from 1989 to 2016. Our estimates suggest a persistent racial gap in the rate of return on assets between 1 and 4 percentage points. The gap in returns remains even after conditioning on demographic factors, labor market factors, credit history, portfolio composition, household attitudes toward savings, financial literacy, and inheritance—suggestive of a role for discrimination. Recentered influence function (RIF) decompositions indicate between 40 and 53%—1.2 to 1.6 percentage points—of the difference in median returns between Black and White households is unexplained by observable characteristics. A standard Oaxaca-Blinder decomposition suggests that differential rates of return can explain up to 14% of the racial wealth gap at the mean. Finally, our data on differential rates of return allow us to effectively rule out explanations for the racial wealth gap based on myopia or excessive time preference. Given observed series for consumption and rates of return, a standard lifecycle model requires Black households to discount the future less than White households in order to match the data.

Similar content being viewed by others

Notes

Blau and Graham’s (1990) approach differs from ours, in that they are looking at the ability of differentials in the rate of return to explain differences in the “income coefficient” in an expression relating net worth to permanent income. However, they do not estimate the impact of differential returns on net worth directly.

As is common practice in the racial wealth gap literature (Hamilton and Darity 2010; 2017; Williams 2017; Darity and Mullen 2020) we use “wealth” and “net worth” interchangeably, with the understanding that the racial wealth gap and racial gap in net worth are synonymous. Any reference to wealth in the paper should be interpreted as referring to net worth.

Because data on inheritances are not included in the summary extract public data, we make use of the full public survey data to construct inheritance estimates.

Addressed by application of appropriate sample weights.

Racial differences in net worth may in fact be understated in the SCF. Steinbaum (2019) points out that individuals experiencing housing instability, incarceration, cohabitation without economic dependence, or any number of “non-traditional” living arrangements are excluded from SCF households, and therefore absent from estimates of the racial wealth gap.

We also exclude observations for which the implied value of the “Direct” rate of return measure exceeds 10, a total of 8 observations.

The questions are the following: (1) “Do you think that the following statement is true or false: Buying a single company’s stock usually provides a safer return than a stock mutual fund?” (2) “Suppose you had $100 in a savings account and the interest rate was 2 percent per year. After five years, how much do you think you would have in the account if you left the money to grow?” and (3) “Imagine that the interest rate on your savings account was 1 percent per year and inflation was 2 percent per year. After one year, would you be able to buy.” The first question is true/false, the second and third question are multiple choice with options more than/exactly/less than a given amount.

Appendix A2.6 offers further details on the liabilities side of household balance sheets.

For a similar application, see Ederer et al. (2020), who use the JST data to construct estimates of rates of return across the wealth distribution for a cross section of European countries.

The value of assets in the denominator does not include the value of capital income, so the estimated return is a true rate of return, rather than a share.

E.g., if the reported value of unrealized capital gains on a respondent’s primary residence was $100,000, and the respondent had owned the residence for 10 years, the annualized value of unrealized capital gains would be $10,000. If the respondent also owned other real estate worth $70,000, and they had owned this for 10 years, the annualized value of unrealized capital gains on that asset would be $7,000. The total annualized value of unrealized capital gains for the respondent would be the sum of unrealized gains on the primary residence ($10,000) and other real estate ($7000).

Although these historical differences will at least be indirectly reflected through inter-generational wealth transfers that show up on household balance sheets, including in the form of measured inheritances.

The assumed functional form is the one associated with the “asinh” command in Stata 16. In particular: Inverse Hyperbolic Sine(x) = \(ln \{ x + (x \times x + 1)^{\frac {1}{2}} \} \).

The savings indicator variable is not available in the 1989 wave of the SCF. The results presented here are therefore for 1992 onward. Dropping the savings variable and including the 1989 wave in the decomposition makes little difference to our results.

In a model explicitly including production with intensive production function y = f(k) with the usual properties, the planner would choose an allocation of capital across households \(\{k_{j}\}_{j=1}^{N}\) taking into account that \(r=f^{\prime }(k_{j})\) and \(w_{j}= f(k_{j})-f^{\prime }(k_{j})k_{j}\), which delivers equal amounts of capital for every household \(k_{j} =\bar k \forall j\), equal rates of return, and equal wages.

E.g., for the years 1990 and 1991 we assume a linear trend between the rates of return observed in 1989 and 1992.

We adopt a smoothing parameter of 100, commonly used in annual data.

Note that, while the data plot that features stochastic variation, the plots for the Euler equation are purely deterministic. These plots showcase the highly exponential nature of the solution to the Euler equation, which explains the strongly convex shape of the corresponding curve.

We omit simulations with zero gap in rates of return because they either would deliver a zero wealth gap (under identical time preference) or a counterfactually negative wealth gap (under Blacks being more patient than Whites, as implied by the orange line in Fig. 9). Observe further that the simulations are deterministic.

E.g., Shertzer et al. (2016) show that when comprehensive zoning was implemented in Chicago, industrial use zoning was disproportionately allocated to neighborhoods populated by racial and ethnic minorities.

In this case, winsorization involves replacing values above the 90th percentile or values below the 10th percentile value with the values corresponding to either the 90th or 10th percentile.

It is worth drawing attention to the fact that the largest variation occurs in the decompositions of the Hispanic-White rate of return gap using the direct measure. In particular, the fraction of the gap that remains unexplained is diminished (or even positive) when controls for portfolio composition are included in the decomposition (although the Black-White return differential shows a similar pattern when portfolio composition controls are included). As in the main text, we do not believe that this result rules out differences in returns due to discrimination. Rather, it simply begs the question of what is causing the differences in portfolio composition to arise (these differences themselves possibly the result of discrimination) that are leading to differences in rates of return?

References

Adams, S. 2009. Putting race explicitly into the CRA. Revisiting the CRA: perspectives on the future of the community reinvestment act, 167–169. https://www.frbsf.org/community-development/files/putting_race_explicitly_cra.pdf.

Aliprantis, D, Carroll D. 2019. What is behind the persistence of the racial wealth gap. Federal Reserve Bank of Cleveland, Economic Commentary. https://doi.org/10.26509/frbc-ec-201903.

Altonji, J, Doraszelski U. The role of permanent income and demographics in black/white differences in wealth. J Human Resour 2005;40(1):1–30.

Banzhaf, S, Ma L, Timmins C. Environmental justice: the economics of race, place, and pollution. J Econ Perspect 2019;33(1):185–208.

Barclays. 2016. UK equity and gilt study.

Bayer, P, Charles KK. Divergent paths: a new perspective on earnings differences between black and white men since 1940. Q J Econ 2018;133(3):1459–1501.

Blanchflower, D, Levine P, Zimmerman D. Discrimination in the small-business credit market. Rev Econ Stat 2003;85(4):930–943.

Blau, F, Graham J. Black-white differences in wealth and asset composition. Q J Econ 1990; 105(2):321–339.

Bogin, A, Nguyen-Hoang P. Property left behind: an unintended consequence of a no-child left behind ‘failing’ school designation. J Reg Sci 2014;54(5):788–805.

Boshara, R, Emmons W, Noeth B. 2015. The demographics of wealth, how age, education, and race separate thrivers from strugglers in today’s economy. Federal Reserve Bank of St. Louis.

Butler, A, Mayer E, Weston J. 2020. Racial Discrimination in the auto loan market. Working Paper. https://doi.org/10.2139/ssrn.3301009.

Charles, KK, Hurst E. The transition to home ownership and the black-white wealth gap. Rev Econ Stat 2002;84(2):281–297.

Chiteji, N, Hamilton D. Family connections and the black-white wealth gap among the middle class. Rev Black Polit Econ 2002;30(1):9–27.

Dal Borgo, M. Ethnic and racial disparities in saving behavior. J Econ Inequal 2019;17:253–283.

Darity, W Jr, Frank D. The economics of reparations. Am Econ Rev 2003;93(2):326–329.

Darity Jr., W. Forty acres and a mule in the 21st Century. Soc Sci Q 2008;89(3):656–664.

Darity, W Jr, Hamilton D. Bold policies for economic justice. Rev Black Polit Econ 2010;39 (1):79–85.

Darity, W Jr, Hamilton D, Stewart J. A tour de force in understanding intergroup inequality: an introduction to stratification economics. Rev Black Polit Econ 2015;41(1-2):1–6.

Darity, W Jr, Mullen K. From here to equality: reparations for black americans in the twenty-first century. Chapel Hill: University of North Carolina Press; 2020.

Dettling, L, Hsu J, Jacobs L, Moore K, Thompson J, Llanes E. 2017. Recent trends in wealth-holding by race and ethnicity: evidence from the survey of consumer finances FEDS notes. Washington, Board of Governors of the Federal Reserve System.

Dymski, G, Hernandez J, Mohanty L. Race, gender, power, and the US subprime mortgage and foreclosure crisis: a meso analysis. Fem Econ 2013;19(3):124–151.

Ederer, S, Mayerhofer M, Rehm M. 2020. Rich and ever richer: differential returns across socio-economic groups. J Post Keynes Econ. https://doi.org/10.1080/01603477.2020.1794902.

Fagereng, A, Guiso L, Malacrino D, Pistaferri L. Heterogeneity and persistence in returns to wealth. Econometrica 2020;88(1):115–170.

Firpo, S, Fortin N, Lemieux T. Unconditional quantile regressions. Econometrica 2009;77: 953–973.

Firpo, S. Identifying and measuring economic discrimination. IZA World of Labor 2017;2017:347. https://doi.org/10.15185/izawol.347.

Firpo, S, Fortin N, Lemieux T. Decomposing wage distributions using recentered influence function regressions. Econometrics 2018;6:28.

Ganong, P, Jones D, Noel P, Farrell D, Greig F, Wheat C. 2020. Wealth, race, and consumption smoothing of typical income shocks. Becker Friedman Institute Working Paper. NO. 2020-49. https://bfi.uchicago.edu/wp-content/uploads/BFI_WP_202049.pdf.

Gittleman, M, Wolff E. Racial differences in patterns of wealth accumulation. J Human Resour 2004;39(1):193–227.

Hamilton, J. Testing for environmental racism: prejudice, profits, and power? J Policy Anal Manage 1995;14(1):107–132.

Hamilton, D, Darity W Jr. Can ‘baby bonds’ eliminate the racial wealth gap in putative post-racial america? Rev Black Polit Econ 2010;37:207–216.

Hamilton, D, Darity W Jr. The political economy of education, financial literacy, and the racial wealth gap. Fed Reserve Bank St Louis Rev 2017;99(1):59–76. First Quarter.

Hendricks, L. 2002. Accounting for patterns of wealth inequality. ASU Department of economics working paper. No 8/02.

Hudson, C, Young J, Anong S, Hudson E, Davis E. African American Financial Socialization. Rev Black Polit Econ 2017;44:285– 302.

Jordà, Ò, Knoll K, Kuvshinov D, Schularick M, Taylor M. The rate of return on everything, 1870-2015. Q J Econ 2019;134(3):1225–1298.

Kakar, V, Daniels G, Petrovska O. Does student loan debt contribute to racial wealth gaps? a decomposition analysis. J Consum Aff 2019;53(4):1920–1947.

Katznelson, I. When affirmative action was white. New York: W.W. Norton; 2005.

Knoll. 2017. Our Home in days gone by: housing markets in advanced economies in historical perspective. Ph.D. thesis, Free University of Berlin. Chapter 3. As Volatile As Houses: Return Predictability in International Housing Markets, 1870–2015.

Knoll, K, Schularick M, Steger T. No price like home: global house prices, 1870-2012. Am Econ Rev 2017;107(2):331–352.

Menchik, P, Jianakoplos N. Black-white wealth inequality: is inheritance the reason? Econ Inq 1997;35(2):428–442.

Modigliani, M, Brumberg R. Utility analysis and the consumption function: an interpretation of cross-section data. Post-keynesian economics. In: Kurihara, editors. New Brunswick: Rutgers University Press; 1954. p. 388–436.

Munnell, AH, Tootell GH, Browne LE, McEneaney J. Mortgage lending in Boston: interpreting HDMA data. Am Econ Rev 1996;86(1):25–53.

Neumark, D. Employers’ discriminatory behavior and the estimation of wage discrimination. J Human Resour 1988;23:279–295.

Oliver, M, Shapiro T. Black wealth/white wealth, 2nd ed. New York: Routledge; 2006.

Pfeffer, F, Schoeni B, Kennickell A, Andreski P. 2015. Measuring wealth and wealth inequality: comparing Two U.S. Surveys. PSID Technical Series Paper # 14–03.

Pulido, L. Rethinking environmental racism: white privilege and urban development in southern california. Ann Assoc Am Geogr 2000;90(1):12–40.

Rios-Avila, F. Recentered influence functions (RIFs) in Stata: RIF regression and RIF decomposition. Stata J 2020;20(1):51– 94.

Rothstein, R. The color of law: a forgotten history of how our government segregated america. New York: W.W. Norton; 2017.

Saphir, A, Marte J. 2020. Fed’s Powell puts spotlight on unequal. U.S. Economy, Citing ‘Pain of Racial Injustice.’ Reuters.

Saez, E, Zucman G. Wealth inequality in the United States since 1913: evidence from capitalized income tax data. Q J Econ 2016;131(2):519–578.

Scholz, JK, Levine K. US black-white wealth inequality. Social inequality. In: Neckerman K, editors. Russel Sage Foundation; 2004. p. 895–929.

Shertzer, A, Twinam T, Walsh R. Race, ethnicity, and discriminatory zoning. Am Econ J Appl Econ 2016;8(3):217–246.

Shiller, R. Irrational exuberance. Princeton: Princeton University Press; 2000.

Skagerlund, K, Lind T, Strömbäck C, Tinghög G, Västfjäll D. Financial literacy and the role of numeracy—how individual’s attitude and affinity with numbers influence financial literacy. J Behav Exp Econ 2018;74:18–25.

Small, M, Pager D. Sociological Perspectives on Racial Discrimination. J Econ Perspect 2020; 34(2):49–67.

Steinbaum, M. 2019. Student debt and racial wealth inequality. Jain family institute working paper. https://phenomenalworld.org/media/pages/analysis/student-debt-racial-wealth-inequality/55155716-1577199400/marshall_steinbaum_student_debt_and_racial_wealth_inequality_final_8-7-19.pdf.

Stewart, J. Racial identity production dynamics and persisting wealth differentials: integrating neo-institutionalist perspectives into stratification economics. Rev Black Polit Econ 2010;37(3-4):217–222.

Survey of Consumer Finances. 2016. Board of governors of the federal reserve system.

Thompson, J, Suarez G. 2015. Updating the racial wealth gap. Federal Reserve Board FEDS Working Paper, 2015–76.

Williams, R. Wealth Privilege and the Racial Wealth Gap: A Case Study in Economic Stratification. Rev Black Polit Econ 2017;44:303–325.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix: 1. JST-SCF crosswalk

Table 9 presents the crosswalk between the JST and SCF data for the main asset categories in the SCF. For other assets, including vehicles, life insurance, transaction accounts (including checking accounts, savings accounts, and money market mutual funds), gold, silver, jewelry, antiques, future proceeds from lawsuits, mineral investments, and other miscellaneous sources of financial and non-financial wealth we assign a zero rate of return.

Appendix: 2. Additional results and sensitivity analysis

A2.1 Additional summary statistics

Table 10 presents additional summary statistics of detailed portfolio composition variables for the full sample and separately for Blacks, Hispanics, and Whites.

A2.2 Additional estimates of conditional differences in return using single-year and three-year averages of the matched balance sheet approach

Figure 10 presents time-series plots for the average rate of return across households, using different values of the Jordà et al. (2019) series to construct rates of return estimates using the matched balance sheet approach. In particular, while the in-text matched balance sheet series uses a five-year rolling average of each of the Jordà et al. (2019) rates when constructing each \(R^{Matched}_{it}\) observation, Figure 10 includes values of \(R^{Matched}_{it}\) constructed using 3-year rolling averages of each Jordà et al. (2019) rate, as well as values of \(R^{Matched}_{it}\) constructed using single-year values for each Jordà et al. (2019) rate, matched to each year in the SCF. The triennial nature of the SCF means the time-series using the single-year values of the Jordà et al. (2019) rates in Fig. 10 does not capture variation in rates of return in years between SCF surveys. Figure 10 also presents a comparison of the 3-year rolling average matched estimate and the direct approach estimate of the rate of return.

Matched balance sheet approach, different averages of Jordà et al. (2019) rates

Table 11 presents results from regressions estimating the conditional difference in returns—identical to the regressions in “Conditional Differences in the Rate of Return”—using the matched balance sheet series for returns with both 3-year rolling average values of the Jordà et al. (2019) rates and 1-year values of the Jordà et al. (2019) rates. In every case there remains a statistically significant gap in rates of return between White and Black households and White and Hispanic households close in magnitude to the estimates presented in the body of the paper. These results suggest that neither the use of a rolling average, nor the length of the window selected, are driving our main results.

A2.3 Full rate of return decomposition results

Tables 12 and 13 present the full results for the contribution of control variables to the explained portion of the Black-White gap in rates of return from the RIF decompositions in “Decomposition Analysis”. Significant contributors to the gap in returns in Table 12 include the variables capturing credit history, inheritance, and income. Table 13 indicates the importance of portfolio composition in explaining differences in returns: observed differences in homeownership, the ownership of equity in stocks and pooled investment funds, and business wealth explain a significant portion of the observed difference in returns.

Tables 14 and 15 present the full results for the contribution of control variables to the explained portion of the Hispanic-White gap in rates of return from the RIF decompositions in “Decomposition Analysis”. The results suggest similar factors—credit history, income, inheritance, home ownership, share of assets in stocks and pooled investment funds, and business wealth—are important contributors to the explained portion of the Hispanic-White gap in rates of return. For both the Black-White gap in rates of return and the Hispanic-White gap in rates of return, differences in portfolio composition appear to have the biggest effect at the top of the distribution of returns—consistent with the discussion in the body of the paper. Additionally, credit history (in the form of either being denied credit or reporting having feared being denied credit) appears to be a significant explanatory factor of differences in returns only at or below the mean.

A2.4 Additional estimates of racial wealth gap decomposition

Decomposition estimates using the direct rate of return series

Table 16 presents results from additional wealth gap decompositions that do not exclude the top and bottom 5% of the distribution of RDirect. In every specification rates of return continue to explain a statistically significant portion of the racial wealth gap for both Black and Hispanics, albeit with an attenuated magnitude in some cases.

Decomposition estimates from 2016 sample including financial literacy control

Tables 17 and 18 present results from decompositions using only the 2016 SCF sample to allow for the inclusion of a control for financial literacy. The primary results of the paper remain unchanged, with the fraction of the racial wealth gap explained by differential rates of return actually increasing in some cases. In contrast, in no specification does financial literacy explain a statistically significant fraction of the Black-White wealth gap or the Hispanic-White wealth gap.

A2.5 Winsorization

Tables 19 through 21 present results from our main specifications with both the rate of return and net worth winsorized at the 90th and 10th percentile.Footnote 22 Intuitively, winsorization should minimize the influence of outliers (in either rates of return or net worth) on the results of decompositions at the mean. While there are small differences in the magnitude of the estimates using winsorized values, the results remain qualitatively similar to those in the body of the paper.

A2.6 Household debt

An important consideration not explicitly addressed in the main text is the role of household debt—both as a factor influencing differential returns, and as a factor contributing to the racial wealth gap. For instance, Fagereng et al. (2020) argue that consideration of debt when measuring the returns to net worth can result in negative measured returns. Further, debt-constrained households may be limited in their investment options (or may have limited liquidity with which to invest), in such as a way as to exacerbate existing differences in access to high-return assets.

Table 22 presents summary statistics for the debt-to-income ratio and liability shares for households with debt. The average debt-to-income ratio is largest for Black households and smallest for Hispanic households. In terms of differences across race, mortgage debt accounts for the largest share of total debt for White and Hispanic households (although the share is larger for White households). In contrast, installment debt (student loan debt, auto loan debt, other revolving debt payments) accounts for the largest share of total debt for Black households. Credit card debt makes up a larger share of overall debt for Black and Hispanic households, compared to Whites.

To assess the role of household debt, we repeat estimates for (A) conditional differences in returns, (B) decompositions of the rate of return at the median, and (C) Oaxaca-Blinder decompositions of the racial wealth gap. Tables 23 through 25 present these results. The central results from the main text are unaltered. There remains a substantial gap in rates of return even after conditioning on household debt, a significant portion of differences in rates of return remain unexplained at the median, and rates of return explain a significant portion of the racial wealth gap—even after accounting for household debt explicitly.

A2.7 Additional rate of return decompositions

This section presents results for our rate of return decompositions on each rate of return measure separately, rather than taking the average of the two measures as in the main text. The decompositions are contained in Tables 26 through 29. As in “2 2”, we exclude portfolio composition controls from specifications where the matched-balance sheet rate of return is the dependent variable, given the way it is constructed. Although there is variation in the fraction of the difference in returns left unexplained across Black and Hispanic groups and percentiles of the distribution of returns, the results remain qualitatively similar to those obtained when using the average of the matched balance sheet and direct returns.Footnote 23 In fact, the results presented here illustrate the usefulness of taking the average of the two measures of the rate of return in previous decompositions, in that taking the average potentially mitigates bias or interpretative error caused by focusing on a single rate of return measure.

A2.8 Wealth gap decompositions without portfolio composition

Tables 30 and 31 contain decompositions of the racial wealth gap excluding portfolio composition controls. In nearly every specification the unexplained portion of the wealth gap is increased, relative to the results presented in the main text, as is the fraction explained by the rate of return.

Rights and permissions

About this article

Cite this article

Petach, L., Tavani, D. Differential Rates of Return and Racial Wealth Inequality. J Econ Race Policy 4, 115–165 (2021). https://doi.org/10.1007/s41996-021-00085-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41996-021-00085-2