Abstract

The paper provides fresh evidence on the dynamics of public expenditure multipliers and the factors explaining them. The findings of this paper may facilitate the policymakers in effectively framing fiscal policy to expedite economic stabilisation and uplift economic growth. The paper proceeds with computing the time-varying public expenditure multipliers by employing the time-varying parameter–vector autoregressive (TVP–VAR) model on the Indian quarterly data set between 1997Q1 and 2019Q4. It then examines the role of structural factors in explaining the time variation in public expenditure multipliers. The empirical investigation reveals the heterogeneity in time-varying transmission and effectiveness of revenue capital and total expenditure shocks. The study further finds the adverse effects of fiscal instability and trade openness on public expenditure multipliers. The financial development and propensity to consume augment the public expenditure multiplier values. The findings also provide insights into the periodic impact of expenditure multipliers, which is relevant for policymakers.

Similar content being viewed by others

Data availability

The data used in study is publlicaly available at RBI Handbook of Indian Economy, CEIC database, and Bank for International Settlements.

References

Aiyagari, S. R., Christiano, L. J., & Eichenbaum, M. (1992). The output, employment, and interest rate effects of government consumption. Journal of Monetary Economics, 30(1), 73–86. https://doi.org/10.1016/0304-3932(92)90045-4

Gelman, A., Carlin, J. B., Stern, H. S., & Rubin, D. B. (1995). Bayesian Data Analysis. New York: Chapman and Hall/CRC. https://doi.org/10.1201/9780429258411

Auerbach, A. J., & Gorodnichenko, Y. (2012). Measuring the output responses to fiscal policy. American Economic Journal: Economic Policy, 4(2), 1–27. https://doi.org/10.1257/pol.4.2.1

Batini, N., Eyraud, L., Forni, L., & Weber, A. (2014). Fiscal multipliers: Size, determinants and use in macroeconomic projections. International monetary fund.

Baxter, M., & King, R. G. (1993, June). Fiscal Policy in General Equilibrium. The American Economic Review, 83(3), 315–334. Retrieved from https://www.jstor.org/stable/2117521#metadata_info_tab_contents

Berg, T. O. (2016). Time varying fiscal multipliers in Germany. Review of Economics, 66(1), 13–46. https://doi.org/10.1515/roe-2015-0103

Blanchard, O., & Perotti, R. (2002). An empirical characterization of the dynamic effects of changes in government spending and taxes on output. The Quarterly Journal of Economics, 117(4), 1329–1368. https://doi.org/10.1162/003355302320935043

Borsi, M. T. (2018). Fiscal multipliers across the credit cycle. Journal of Macroeconomics, 56, 135–151. https://doi.org/10.1016/j.jmacro.2018.01.004

Broner, F., Clancy, D., Erce, A., & Martin, A. (2022). Fiscal multipliers and foreign holdings of public debt. The Review of Economic Studies, 89(3), 1155–1204. https://doi.org/10.1093/restud/rdab055

Canova, F., & Ciccarelli, M. (2009). Estimating multi-country VAR models. International Economic Review, 50(3), 929–959. https://doi.org/10.1111/j.1468-2354.2009.00554.x

Carter, C. K., & Kohn, R. (1994). On gibbs sampling of state space models. Biometrika, 81(3), 541–553. https://doi.org/10.1093/biomet/81.3.541

Cogley, T., & Sargent, T. J. (2001). Evolving post-world war II US inflation dynamics. NBER Macroeconomics Annual. https://doi.org/10.1086/654451

Edelberg, W., Eichenbaum, M., & Fisher, J. D. (1999). Understanding the effects of a shock to government purchases. Review of Economic Dynamics, 2(1), 166–206. https://doi.org/10.1006/redy.1998.0036

Gali, J., & Gambetti, L. (2015). The effects of monetary policy on: Stock market bubbles some evidence. American Economic Journal: Macroeconomics, 7(1), 233–257. https://doi.org/10.1257/mac.20140003

Ghatak, A., & Ghatak, S. (1996). Budgetary deficits and Ricardian equivalence: the case of India. Journal of Public Economics, 60(2), 267–282. https://doi.org/10.1016/0047-2727(95)01551-5

Glocker, C., Sestieri, G., & Towbin, P. (2019). Time-varying fiscal spending multipliers in the UK. Journal of Macroeconomics, 60, 180–197. https://doi.org/10.1016/j.jmacro.2019.02.003

Gupta, S., Clements, B., Baldacci, E., & Granados, C. M. (2005). Fiscal policy, expenditure composition, and growth in low-income countries. Journal of International Money and Finance, 24(3), 441–463. https://doi.org/10.1016/j.jimonfin.2005.01.004

Hory, M. P. (2016). Fiscal multipliers in emerging market economies: Can we learn something from advanced economies? International Economics, 146, 59–84. https://doi.org/10.1016/j.inteco.2015.11.002

Huidrom, R., Kose, M. A., & Lim, J. J. (2020). Why do fiscal multipliers depend on fiscal positions? Journal of Monetary Economics, 114, 109–125. https://doi.org/10.1016/j.jmoneco.2019.03.004

Ilzetzki, E., Mendoza, E. G., & Végh, C. A. (2013). How big (small?) are fiscal multipliers? Journal of Monetary Economics, 60(2), 239–254. https://doi.org/10.1016/j.jmoneco.2012.10.011

Khalid, A. M. (1996). Ricardian equivalence: Empirical Evidence from developing economies. Journal of Development Economics, 51(2), 413–432. https://doi.org/10.1016/S0304-3878(96)00422-1

Kim, S., Shephard, N., & Chib, S. (1998). stochastic volatility: likelihood inference and comparison with ARCH. Review of Economic Studies, 65(3), 361–393. https://doi.org/10.1111/1467-937X.00050

Kirchner, M., Cimadomo, J., & Hauptmeier, S. (2010). Transmission of government spending in euro area time variation and driving forces. European central Bank Working Paper, (1219). Retrieved from https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1219.pdf

Koh, W. C. (2017). Fiscal multipliers: New evidence from a large panel of countries. Oxford Economic Papers. https://doi.org/10.1093/oep/gpw066

McManus, R., Ozkan, F. G., & Trzeciakiewicz, D. (2021). Why are fiscal multipliers asymmetric? The role of credit constraints. Economica, 88(349), 32–69. https://doi.org/10.1111/ecca.12340

Perotti, R. (1999). Fiscal policy in good times and Bad. The Quarterly Journal of Economics, 114(4), 1399–1436. Retrieved from https://www.jstor.org/stable/2586967#metadata_info_tab_contents

Priftis, R., & Zimic, S. (2021). Sources of borrowing and fiscal multipliers. The Economic Journal. https://doi.org/10.1093/ej/ueaa051

Primiceri, G. E. (2005). Time-varying structural vector autoregressions and monetary policy. The Review of Economic Studies. https://doi.org/10.1111/j.1467-937X.2005.00353.x

Singh, T. (2017). Ricardian equivalence and the public and private saving nexus in India. Applied Economics, 49(36), 3579–3598. https://doi.org/10.1080/00036846.2016.1265072

Stock, J. H., & Watson, M. W. (1996). Evidence on structural instability in macroeconomic time series relations. Journal of Business and Economic Statistics, 14(1), 11–30. https://doi.org/10.1080/07350015.1996.10524626

Sutherland, A. (1997). Fiscal crises and aggregate demand: Can high public debt reverse the effects of fiscal policy? Journal of Public Economics, 65(2), 147–162. https://doi.org/10.1016/S0047-2727(97)00027-3

Takyi, P. O., & Leon-Gonzalez, R. (2020). Macroeconomic impact of fiscal policy in ghana: Analysis of an estimated DSGE model with financial exclusion. Economic Analysis and Policy, 67, 239–260. https://doi.org/10.1016/j.eap.2020.07.007

Acknowledgements

The short version of this paper will appear as a commentary in the Economic and Political Weekly titled “On the Dynamics of Time-varying Fiscal Multipliers.”

Author information

Authors and Affiliations

Contributions

PS: conceptualization, methodology, resources, writing—original draft, writing—review and editing, WA: conceptualization, methodology, investigation, writing—review and editing. NRB: conceptualization, writing—review and editing.

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

1.1 Gibbs sampling procedure

See Table 7.

The TVP–VAR model equations are as follows:

The Gibbs procedure for sampling parameter draws is as follows.

Step 1: Initialize \({X}_{t}, {\Theta }^{T}, {\phi }^{T},\Omega ,\Xi ,\Psi , {\mathrm{and }s}^{T}\) based on OLS estimates of linear VAR.

Step 2: The Gibbs sample procedure proceeds by drawing \({\upsigma }_{\mathrm{t}}\) using the Kim et al. (1998) algorithm. The TVP–VAR model in Eq. (1) can be rewritten as

Here \({X}_{t}^{**}\) equals \({F}_{t}^{-1}\) (\({X}_{t}- {A}_{0,t}+{A}_{1,\mathrm{t}}{X}_{t-1}+{A}_{2,t}{X}_{t-2}+ \dots \dots +{A}_{P,t}{X}_{t-P})\). Given \({\Theta }_{t}\) and \({F}_{t}^{-1}\), \({X}_{t}^{**}\) becomes observable. Equations (9) and (7) form the non-linear state-space model. Hence, we transform it into a linear state-space system by squaring the fifth equation and then taking the log.

Here \({X}_{t}^{***}\) = \(\mathrm{log}{{X}_{t}^{**}}^{2}\) \({h}_{t}=\mathrm{ log}{\sigma }_{t}\) and \({e}_{t}^{*}\) = log (\({e}_{t}^{2}\)). Equations (7) and (10) form the linear state-space model. However, \({e}_{\mathrm{t}}^{*}\) now follows the log chi-square distribution. Therefore, we approximate the log chi-square distribution by the mixture of seven normal distributions to convert the system into a gaussian linear state-space system. This strategy has been discussed in Kim et al. (1998). The details about the mixture of seven normal distributions with component probabilities \({\mathrm{q}}_{\mathrm{j}}\) mean \({\mathrm{m}}_{\mathrm{j}}\) − 1.2704, and variance \({\mathrm{v}}_{\mathrm{j}}^{2}\) is given in Table 7.

Let \({s}^{T}\)= [\({s}_{1}\), …, \({s}_{T}\)]′ be the vector of indicator variable choosing a distribution from the mixture of seven normal distributions. Given the value of \({s}_{t}=j\), Carter and Kohn, (1994) algorithm used to draw \({\mathrm{h}}_{\mathrm{t}}\) from the distribution of \(({e}_{t}^{*}|{s}_{t}=\mathrm{j}\)). Here, \({e}_{t}^{*}|{s}_{t}=j\sim N({\mathrm{m}}_{\mathrm{j}}\) − 1.2704, \({v}_{j}^{2}\)). More precisely \({h}_{t}\) is drawn from \(N({h}_{t|t+1}\),\({H}_{t|t+1}\)). Here, \({h}_{t|t+1}=E\left( {h}_{t}\right|{h}_{t+1}, {X}_{t}, {\Theta }^{T}, {\upphi }^{T},\Omega ,\Xi ,\Psi , {s}^{T})\) and \({H}_{t|t+1}=\mathrm{VAR}\left( {h}_{t}\right|{h}_{t+1}, {X}_{t}, {\Theta }^{T}, {\upphi }^{T},\Omega ,\Xi ,\Psi , {s}^{T})\) are the conditional mean and variance obtained from the backward recursion equations.

Step 3: In the third step, the Gibbs sampler draws \({\upphi }^{T}\). We can rewrite Eq. 5 as

Here \({X}_{t}^{*}\) equals (\({X}_{t}- {A}_{0,t}+{A}_{1,t}{X}_{t-1}+{A}_{2,t}{X}_{t-2}+ \dots \dots +{A}_{P,t}{X}_{t-P})\). Since \({F}_{t}^{-1}\) is a lower triangular matrix with one on the diagonal. The system of equations in A.7 can be written as

Here \({\sigma }_{i,t,} {e}_{i,t}\) are the ith element of \({\sigma }_{t }\mathrm{and }{e}_{t}\). \({X}_{[1,i],t}^{*}\) is the row vector [\({X}_{1,t}^{*}\),…… \({X}_{i,t}^{*}\)]. Given \({\Theta }^{T}\) and \({\sigma }^{T}\), \({X}_{t}^{*}\) becomes observable, and Eqs. 12 and 8 form the Gaussian linear state-space model, where states are \({\phi }_{i,t}.\) Since \({\phi }_{i,t}\) and \({\phi }_{j,t}\) are independent of each other, the Carter and Kohn, (1994) algorithm applied to draw \({\phi }_{i,t}\) from \(N({\upphi }_{i,t|t+1}\),\({\Phi }_{i,t|t+1}\)). Here, \({\phi }_{i,t|t+1}\) = \(E\left( {\phi }_{i,t}\right|{\phi }_{\mathrm{i},t+1}, {X}_{t}, {\Theta }^{T}, {\sigma }^{T},\Omega ,\Xi ,\Psi )\) and \({\Phi }_{i,t|t+1}\)= \(\mathrm{VAR}\left( {\phi }_{i,t}\right|{\phi }_{i,t+1}, {X}_{t}, {\Theta }^{T}, {\sigma }^{T},\Omega ,\Xi ,\Psi )\).

Step 4: In this step, we draw the regression coefficients \({\Theta }^{T}.\) Given \({F}_{\mathrm{t}}^{-1}\), \({D}_{t}\), \(\Omega\), \(\Xi\) and \({\Psi }_{\mathrm{i}}\), Eqs. (5) and (6) form the linear state-space model. Kalman filter and backward recursion, as given in Carter and Kohn, (1994), are used to draw \({\Theta }_{t}\). \({\Theta }_{t}\) is drawn from \(N({\Theta }_{t|t+1}\),\({P}_{t|t+1}\)), where \({\Theta }_{t|t+1}=E\left( {\Theta }_{t}\right|{\Theta }_{t+1}, {X}_{t}, {\sigma }^{T}, {\phi }^{T},\Omega ,\Xi ,\Psi )\) and \({P}_{t|t+1}=\mathrm{VAR}\left( {\Theta }_{t}\right|{\Theta }_{t+1}, {X}_{t}, {\sigma }^{T}, {\phi }^{T},\Omega ,\Xi ,\Psi ).\)

Step 5: In this step, we draw parameters \(\Omega ,\Xi ,\Psi\) from their distributions \(p(\Omega\)|\({X}_{t}, {\Theta }^{T}, {\phi }^{T},{\sigma }^{T})\), \(p(\Xi\)|\({X}_{t}, {\Theta }^{T}, {\phi }^{T},{\sigma }^{T})\), and \(p(\Psi\)|\({X}_{t}, {\Theta }^{T}, {\phi }^{T},{\sigma }^{T})\) respectively. Given \({X}_{t}, {\Theta }^{T}, {\phi }^{T},{\mathrm{and }\sigma }^{T}\) the parameters \(\Omega ,\Xi ,\Psi ,\) have Inverse Wishart distribution from which draws are obtained directly (Gelman et al. (1995).

Step 6: This step draws \({s}^{T}\). We sample \({s}_{i,t}\) from discrete density \(p({s}_{i,t}=j\)|\({X}_{i,t}^{***}, {\sigma }_{i,t}\)) \(\propto {q}_{j}{f}_{N}({X}_{i,t}^{***}|2{\sigma }_{i,t}+{m}_{j}\)−1.2704, \({v}_{j}^{2}).\)

Step 7: Go to step 2.

1.2 Convergence diagnostics

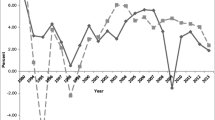

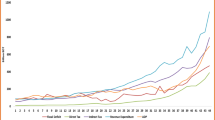

See Figs. 5, 6, 7, 8, 9, 10, 11, 12, 13, 14.

1.3 Robustness of regression results

See Tables 8, 9, 10, 11, 12, 13.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sachdeva, P., Ahmad, W. & Bhanumurthy, N.R. Uncovering time variation in public expenditure multipliers: new evidence. Ind. Econ. Rev. 58 (Suppl 2), 445–483 (2023). https://doi.org/10.1007/s41775-023-00175-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41775-023-00175-y